GRAINS TAKE A STEP BACK

MARKET UPDATE

I'm still getting used to making the video updates, so bare with me. Let me know if I should continue to make these or if you guys prefer the normal written versions.

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

(Chart Breakdowns Start at 7:50 min)

Futures Prices Close

Overview

Grains lower across the board as the funds take a pause.

We've had a phenomenal rally.

Corn is 50 cents off it's lows, and both beans & wheat are nearly $1.00 of theirs.

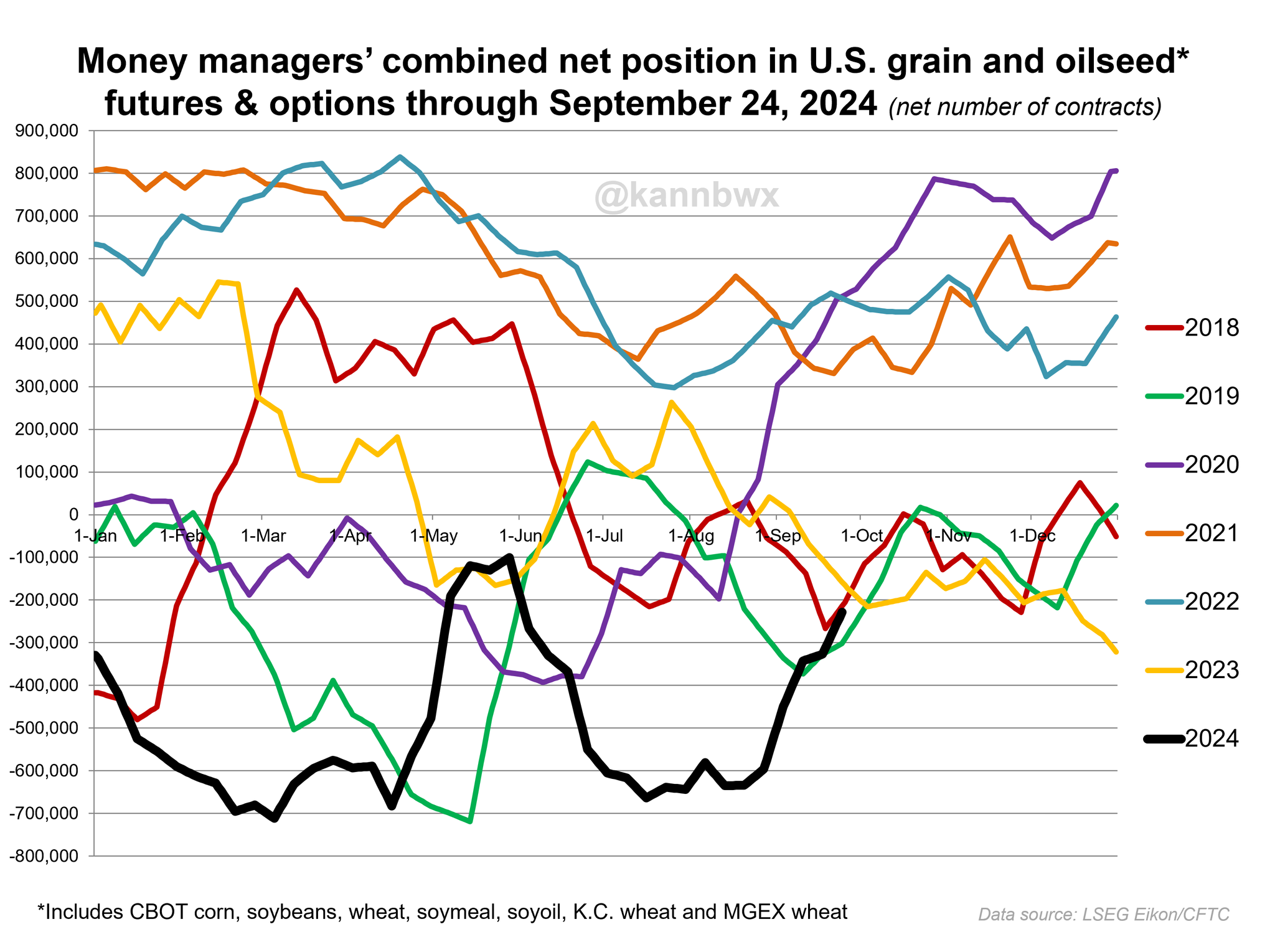

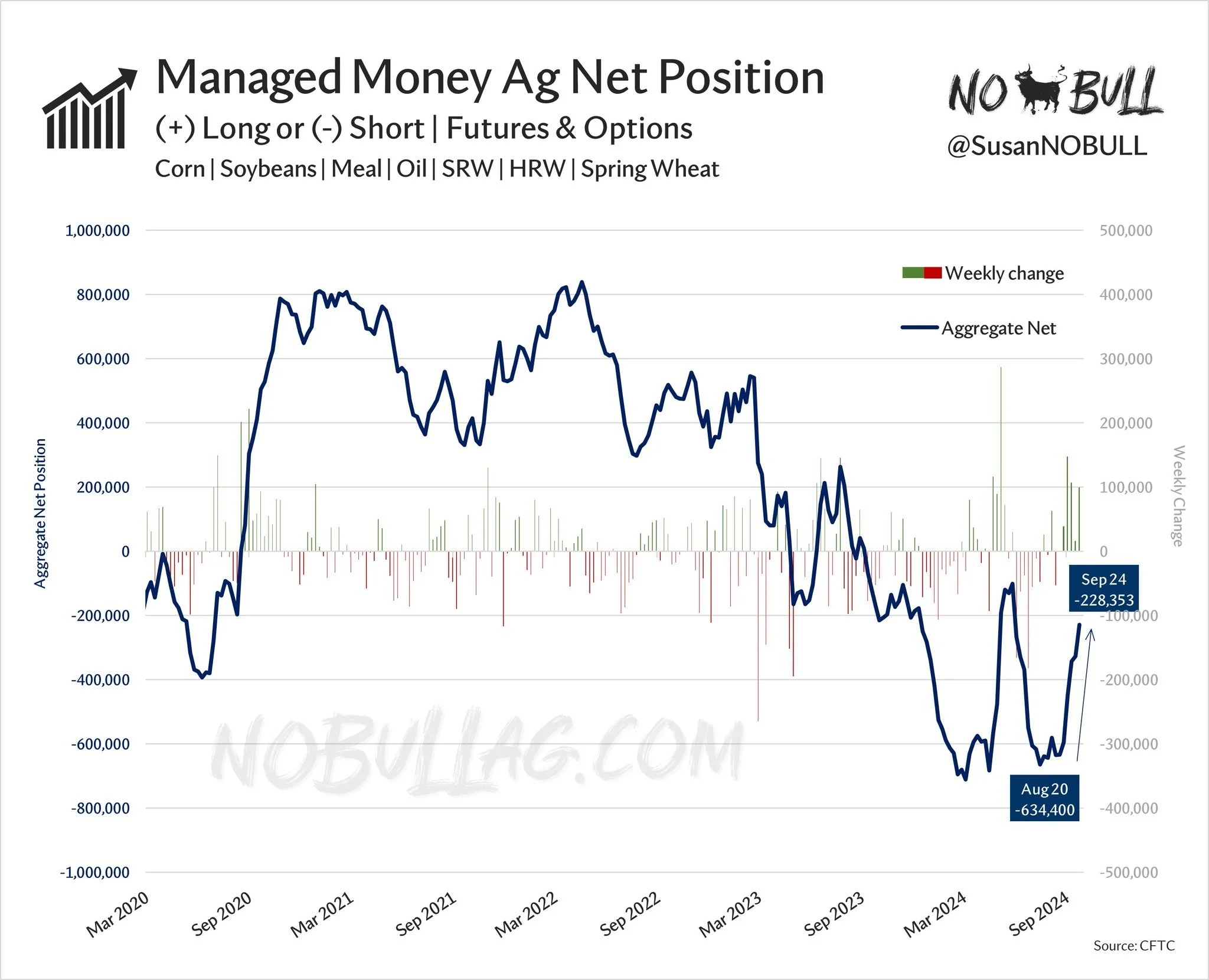

Private analysts suggest the funds are now only short around 50k contracts of corn. They were short a record 356k back in July.

So the funds are nearly back to even, with not many reasons to necessarily get long. Hence they are potentially taking a pause with all of the unknowns out there.

Why have we rallied in harvest?

The number #1 reason we have rallied is the funds.

We are definitely seeing farmer selling on this rally, but the fund short covering has more than offsetting that selling.

The funds held record shorts not too long ago, but ran out of reasons to stay that short.

Now they are nearly even on their positions, looking like they could soon be waiting for a factor to push them one way or the other.

Fun Fact:

The funds have never not got long corn during a year. They have still yet to get long. Will they finally do so?

Chart from Karen Braun

Chart from Susan of NoBull Ag

Could they continue to cover? Absolutely possible. They still have a little room to go until they even.

If they continue to cover, it will probably be more technical driven rather than fundamental driven unless something changes.

We have break outs on the charts. We are at our highest price levels since June, so that means that short position is red since June.

Fundamentally there isn’t any one factor driving us higher.

Yes we have some war news.

Yes the USDA report Monday was friendly corn.

The river levels are back to normal with the hurricane rains. So this helps logistics & exports.

But we still have expectations of record crops.

The talk is that soybean yields are more disappointing than expected, while corn yield continues to be great.

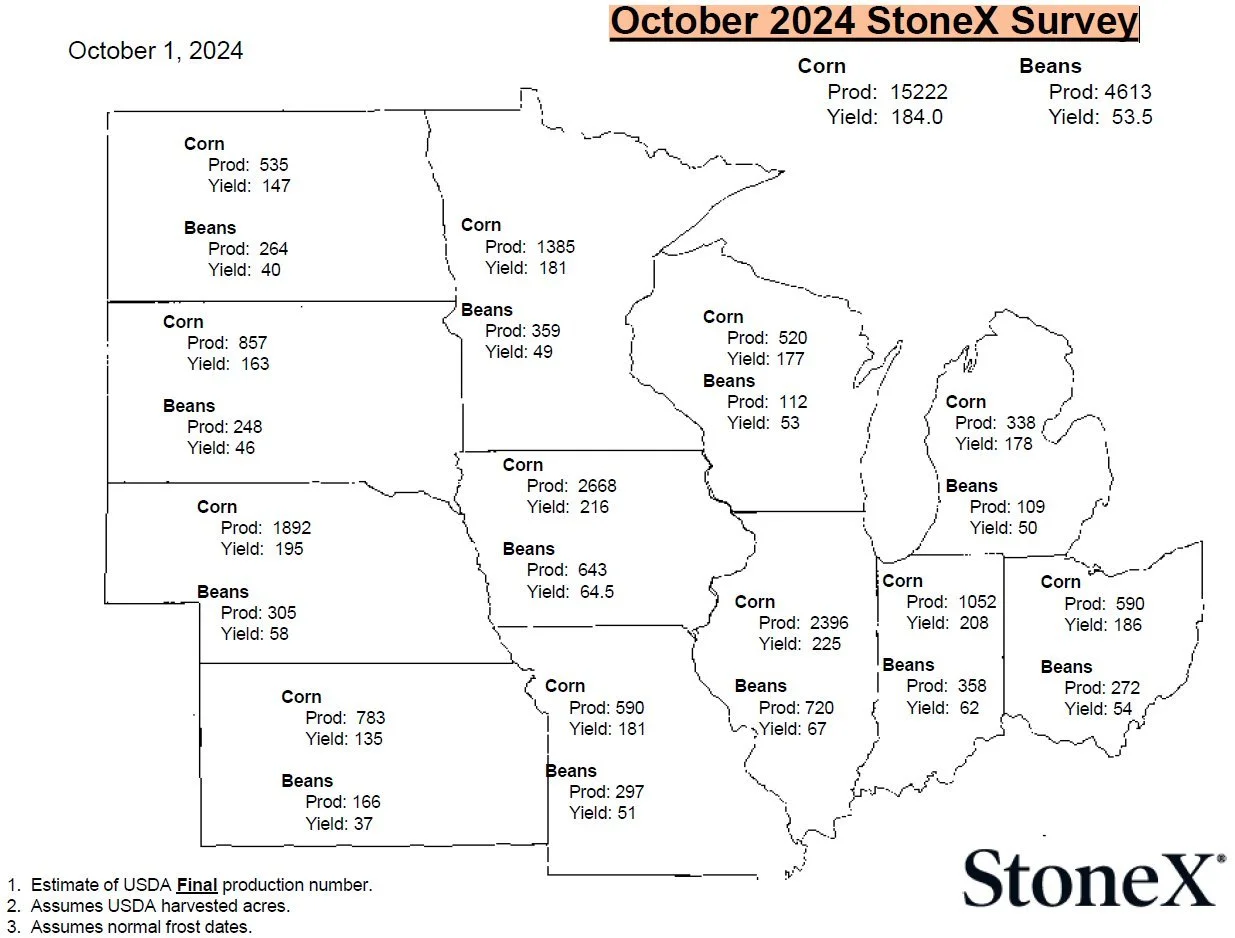

StoneX released their newest estimates and they actually have the crop bigger than the USDA does. As they raised their estimates from last month. This is a customer based survey.

StoneX Corn: 184.0 (182.9 last month)

USDA Corn: 183.6

StoneX Beans: 53.5 (53.0 last month)

USDA Beans: 53.2

So perhaps the funds take a wait and see approach here sometime soon.

If they pause, it will likely result in a correction. As that farmer selling & hedge pressure won’t be bought with fund buying.

They still have room to cover their short, but it just seems unlikely that they flip long given all of the unknowns. It is possible, but would likely require a bullish factor such as yield falling, demand increasing, or a Brazil scare.

What could make them flip long?

The first is Brazil.

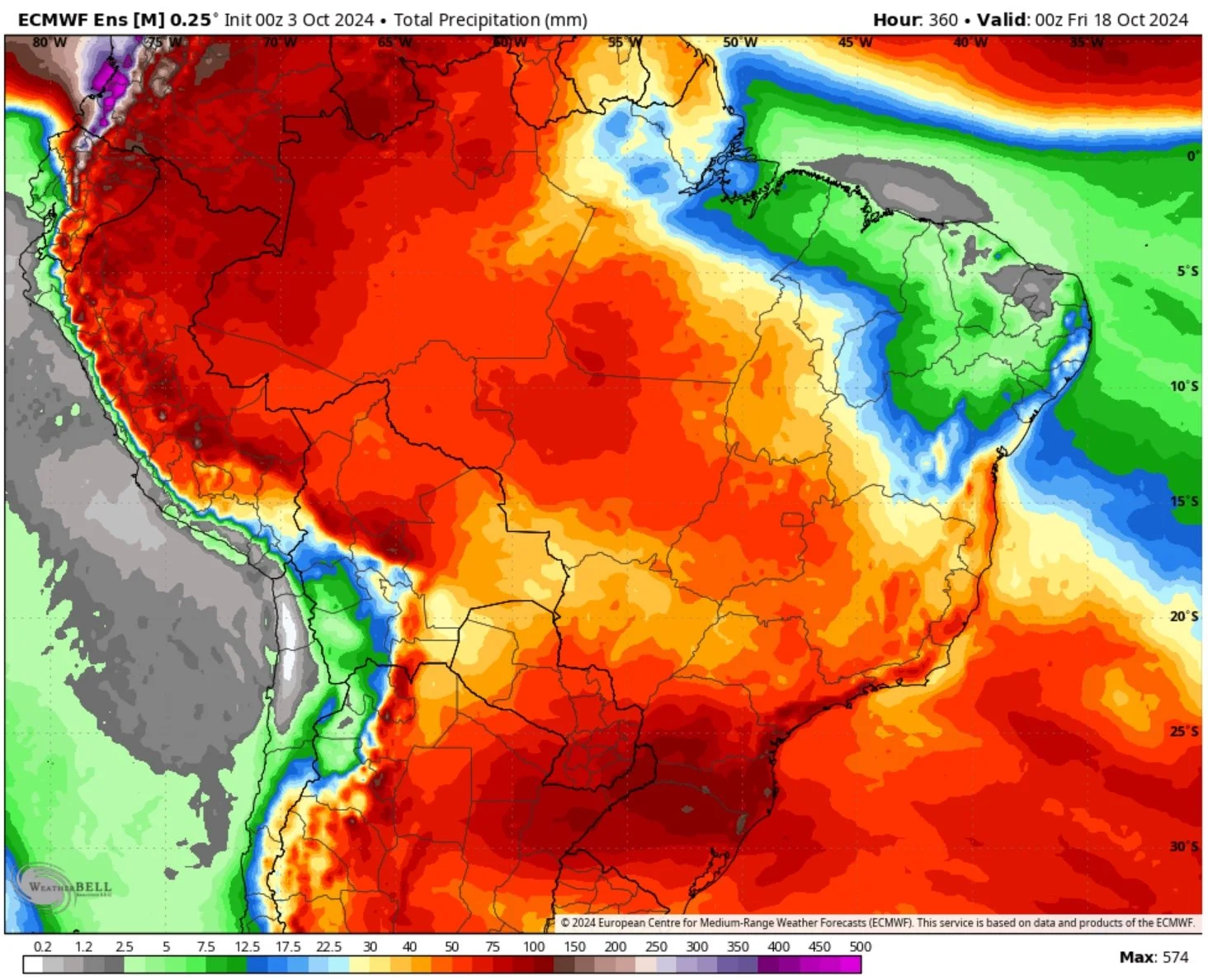

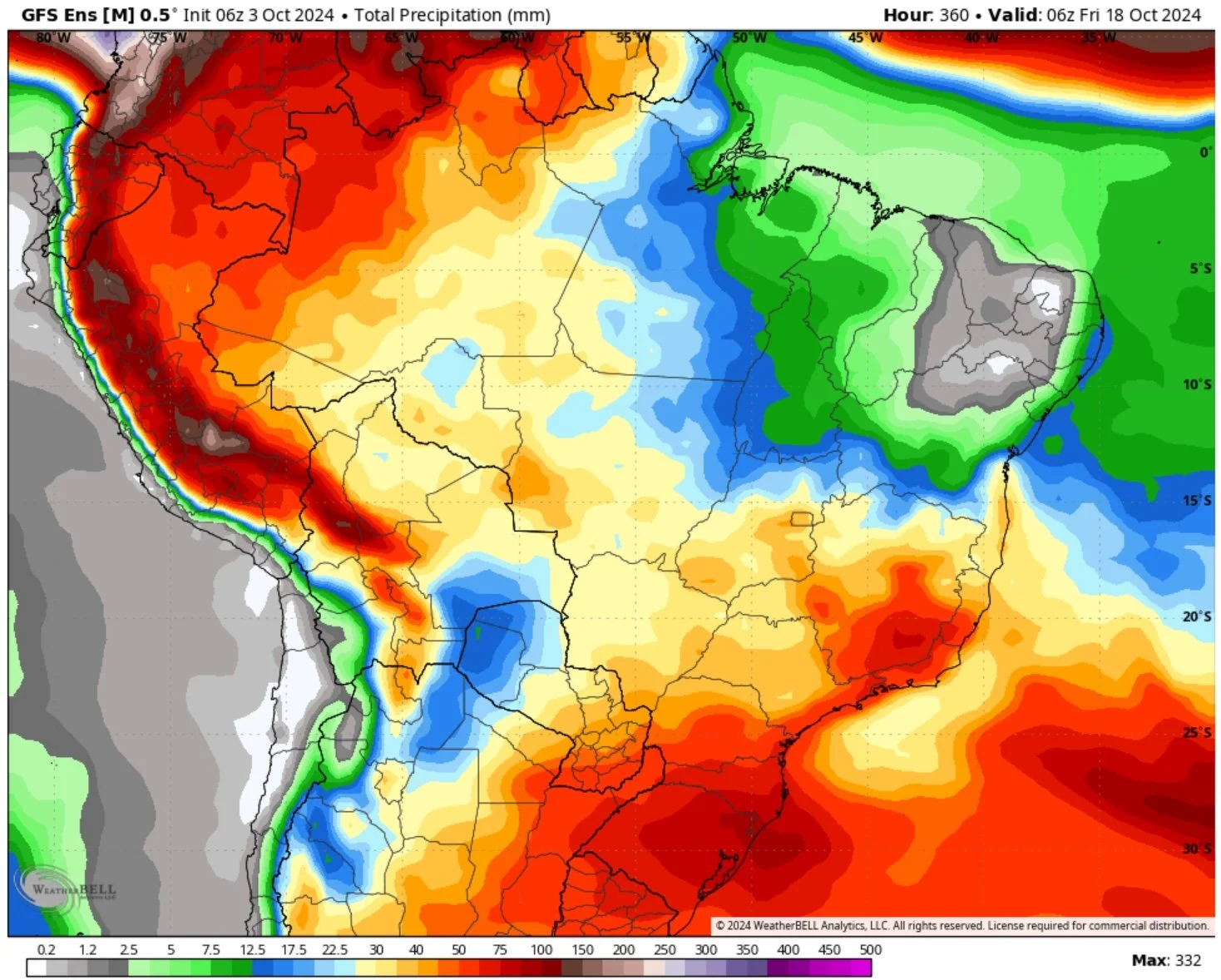

Almost every forecast calls for rain mid-October.

It looks like rain will come. But the only question is how much rain?

When these rains come, soybeans will likely take a little hit. This is likely part of the reason for the weakness the past few days. As the market is removing some of that weather premium.

Even with these rains, it does not mean that we "can’t" get a weather scare later in the year. Because we still can if it turns drier later this year. Still a long growing season ahead of us. We got one in November last year.

Both the Euro and GFS show rain, but they disagree on the amount. The Euro shows a lot more rain than the GFS does.

14-Day Euro

14-Day GFS

The second is China (aka demand).

China is artificially boosting their economy.

This "could" lead to greater export demand.

Not only could it lead to export demand. It could be a reason for the funds to want to buy.

Remember what happened in 2020?

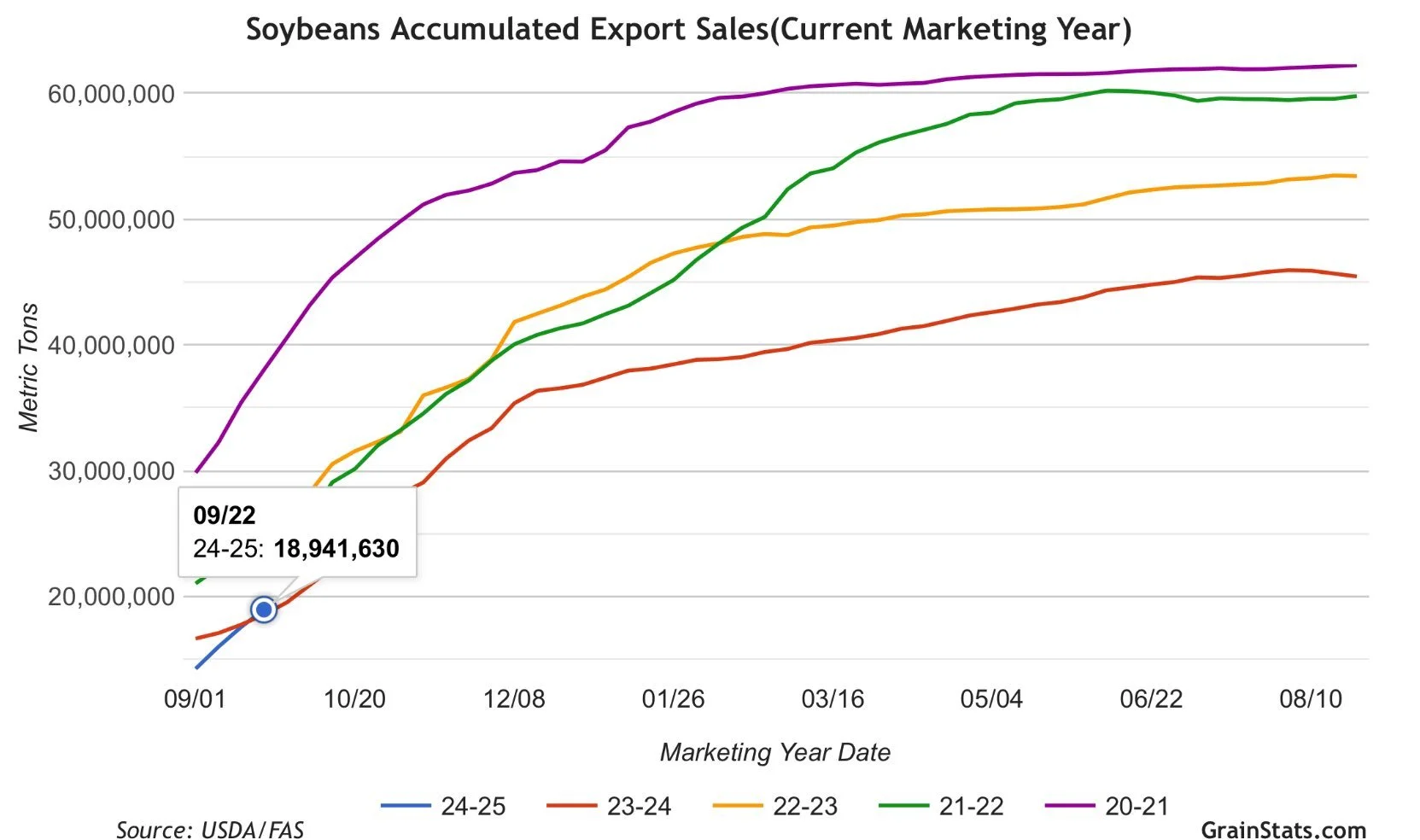

Not too long ago China had zero new crop bean sales on their books.

Now US export sales are actually already above last year.

Chart from GrainStats

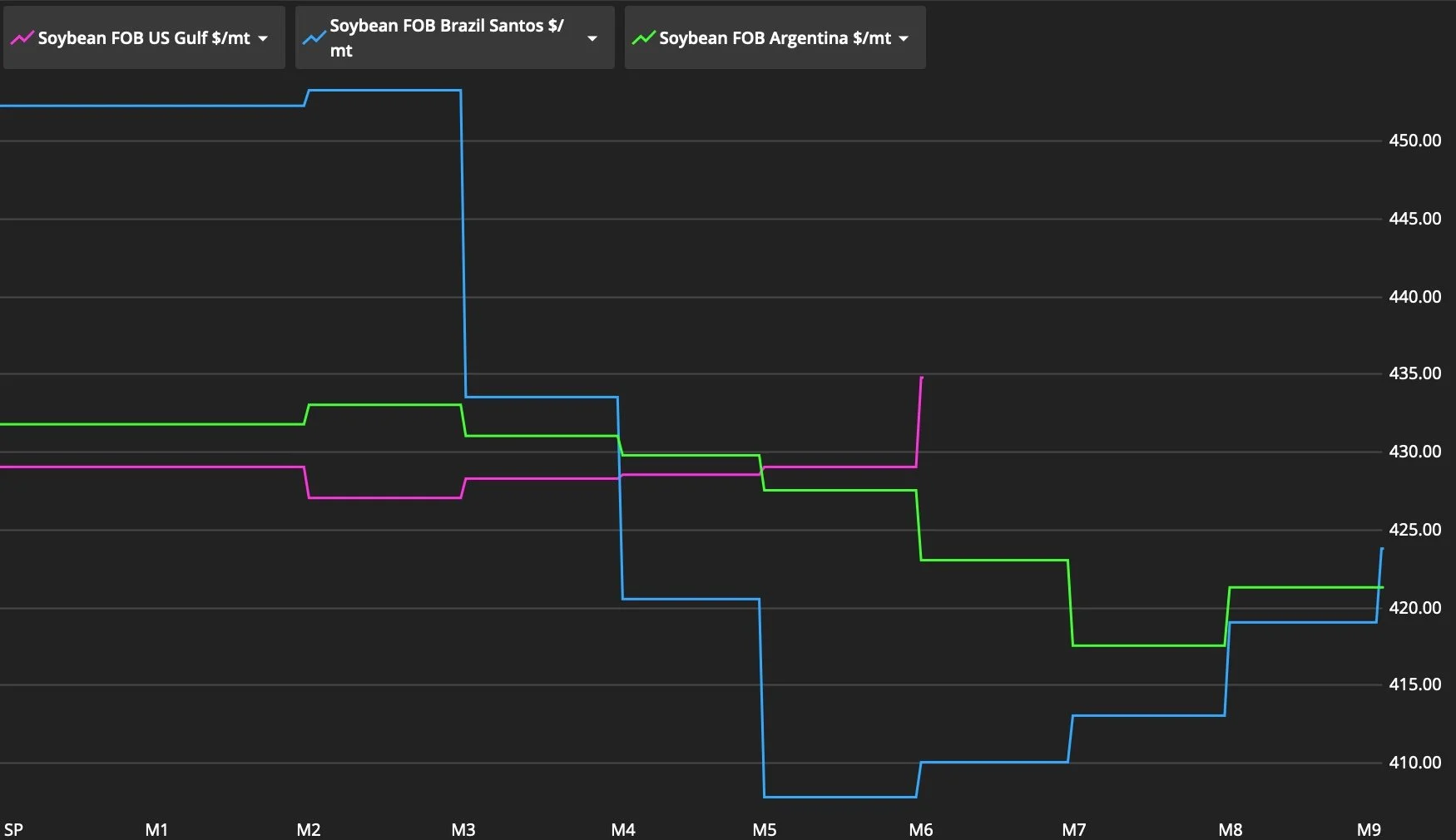

If China wants soybeans, US beans off the Gulf are still the cheapest in the world.

And will remain so until February.

This factor somewhat goes hand in hand with Brazil. If Brazil has production issues it will lead to greater demand.

Outright FOB Comparison: from Darrin Fessler

FOB Forward Price Curves: from Darrin Fessler

Lastly the US crop.

Right now the talk is a bumper corn crop. Maybe a little smaller bean crop than the USDA currently has us pegged at.

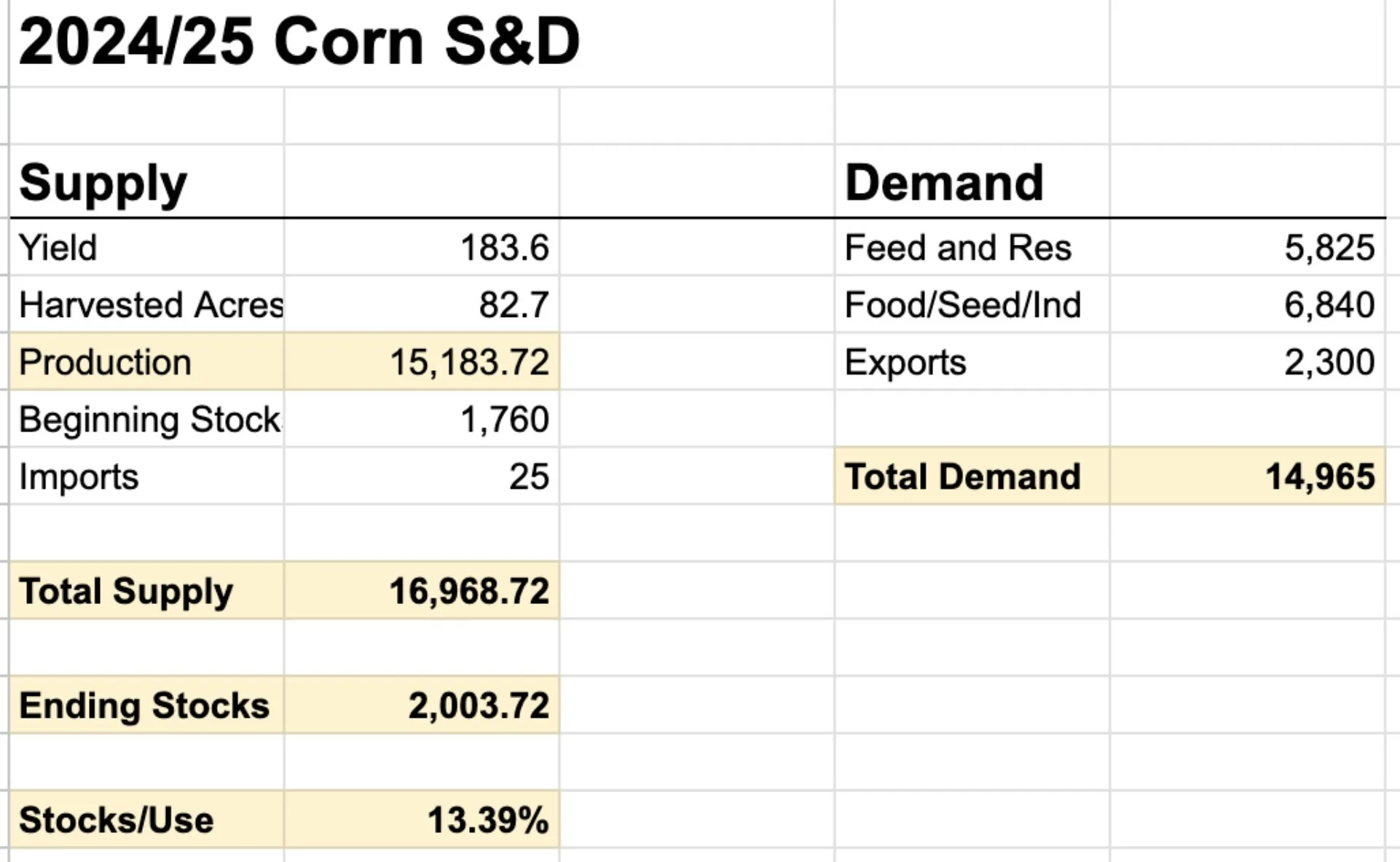

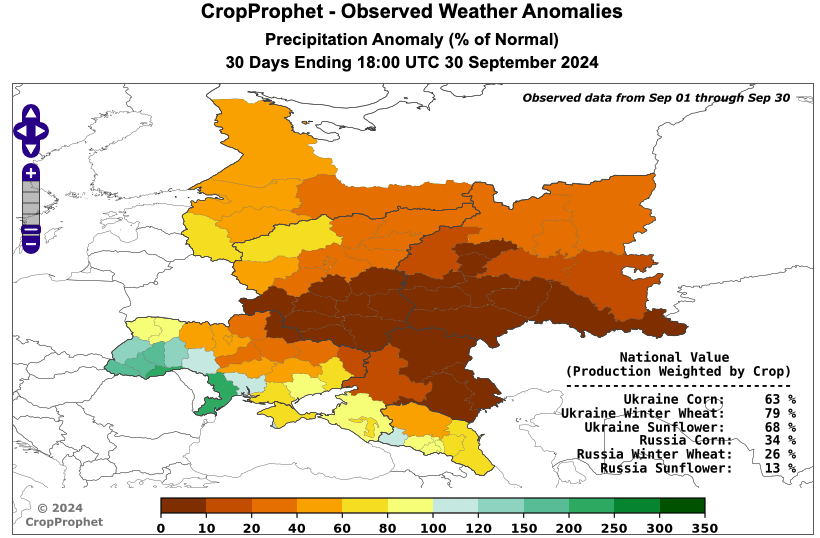

IF corn yield drops closer to 180, our carryout falls below 2 billion.

Then if you add the fact that the USDA was wrong about our feed & residual use for last year's crop.. there is the potential for them to be wrong about this years & boost this years. Which would add demand to the balance sheet.

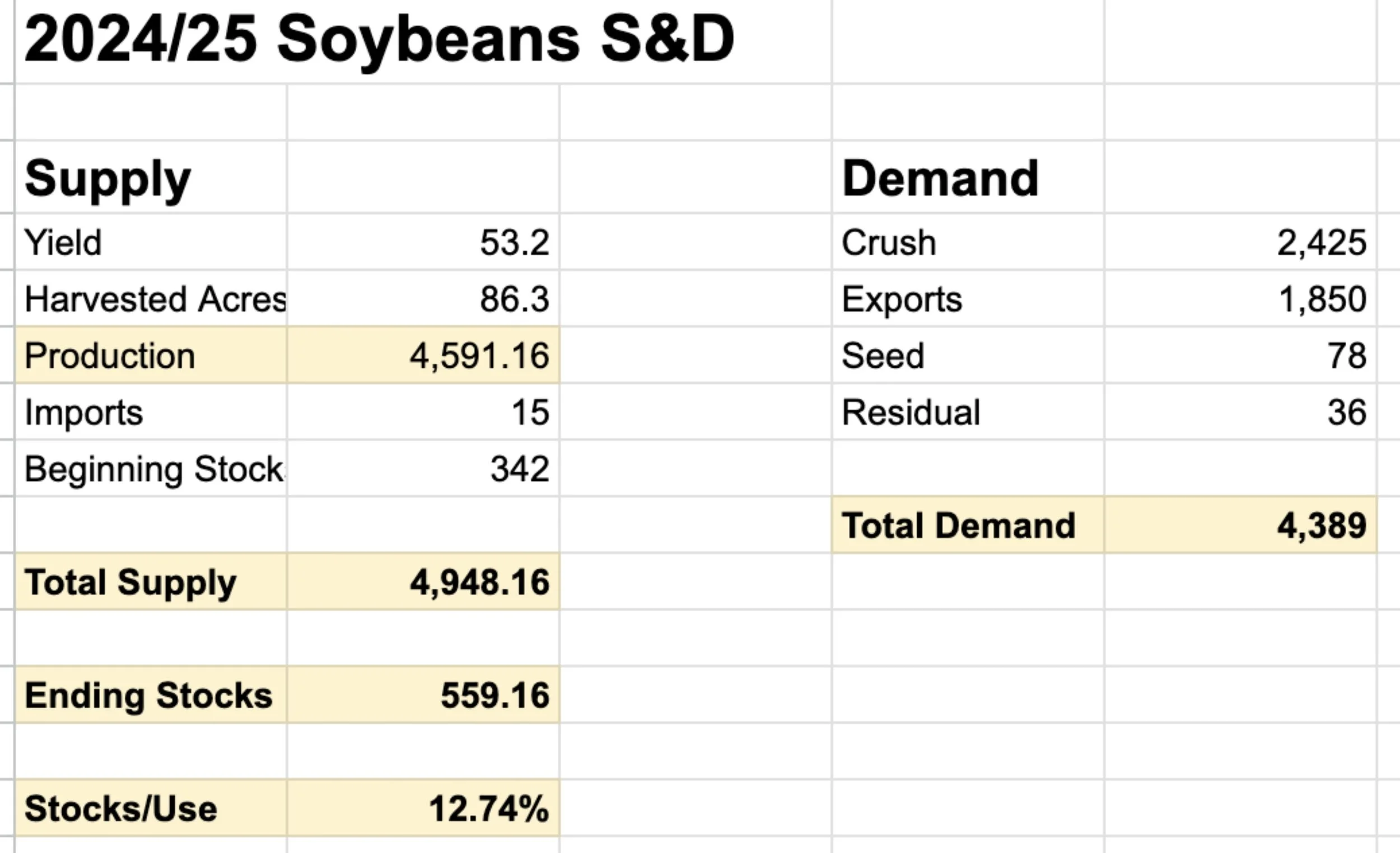

Current Balance Sheet

Balance Sheet 181 Yield

Now for soybeans, it is slightly harder to make this balance sheet look more friendly.

We have one of the bigger carryouts we've ever had in the past decade.

The last time our stocks to use ratio was this high, beans were $9.

Many think our export demand is already overstated, so it is hard to argue that export demand is what eats into this carryout. But it is very possible IF we see China step up here. Maybe the stimulus situation leads to this. But that's an unknown.

So it looks like the more likely way we see this carryout shrink is IF yield drops a few bushels.

Which is possible given most are talking about beans being good but not quiet as good as originally expected.

Current Balance Sheet

Balance Sheet 51 Yield

Spreads: Slightly Concerning Factor

The spreads is a slightly concering factor when looking at this rally.

Typically in a "bull market" type of rally, you see the spreads firm.

We have got a $1.00 rally in soybeans, yet the spreads haven’t flinched.

This is just something I want you to be aware of.

This doesn’t mean we can’t go higher, but this isn’t usually something you see on a bull rally that is going to continue.

Nov24-Mar25 Bean Spread

Bottom Line:

It is hard to know what is simply a "natural correction" or what is a change in the trend when you have all of these factors such as Brazil and US harvest.

It makes a guy nervous. That is why you need to be proactive when given the chance like we have been given.

From a technical standpoint, I would like to think we can go higher and that the funds continue to cover. None of the charts are broken.

From a fundamental standpoint, there isn’t anything screaming "we have to go higher".

A lot will be riding on what the USDA shows in the next report. If corn yield comes up, prices will probably go down. If yield shrinks, then we likely have more upside.

So my personal opinion is that we could get more upside and that the funds look to cover a little more. I wouldn't be surprised to see us take a breather here short term, then continue higher for another few weeks before the funds get more "risk off". But as a producer, your risk is lower. That is why we have issued several protection or sell signals the past few days.

It isn't about outguessing the market. It's called hedging, not guessing.

Today's Main Takeaways

Corn

The first chart I want to look at is a corn vs wheat chart.

As you can see they are been nearly identical in price action.

So if wheat struggles, corn also has the potential to struggle.

Something to be aware of.

We are running into resistance at the upper end of this channel.

I do still think we have a decent chance at seeing $4.41 to $4.46 as that is our next real point of resistance.

($4.41 is the 50% retracement to the May highs) ($4.46 is our Feb lows.)

But just like we advised earlier this week when we hit the $4.26 target, we want to make sure we are keeping puts under grain that we have to move off the combine.

It makes sense to spend a few cents to protect a 50 cent rally.

If you are storing your corn, utilizing puts might also be something to consider. But I do not want to overspend on puts for corn you are storing.

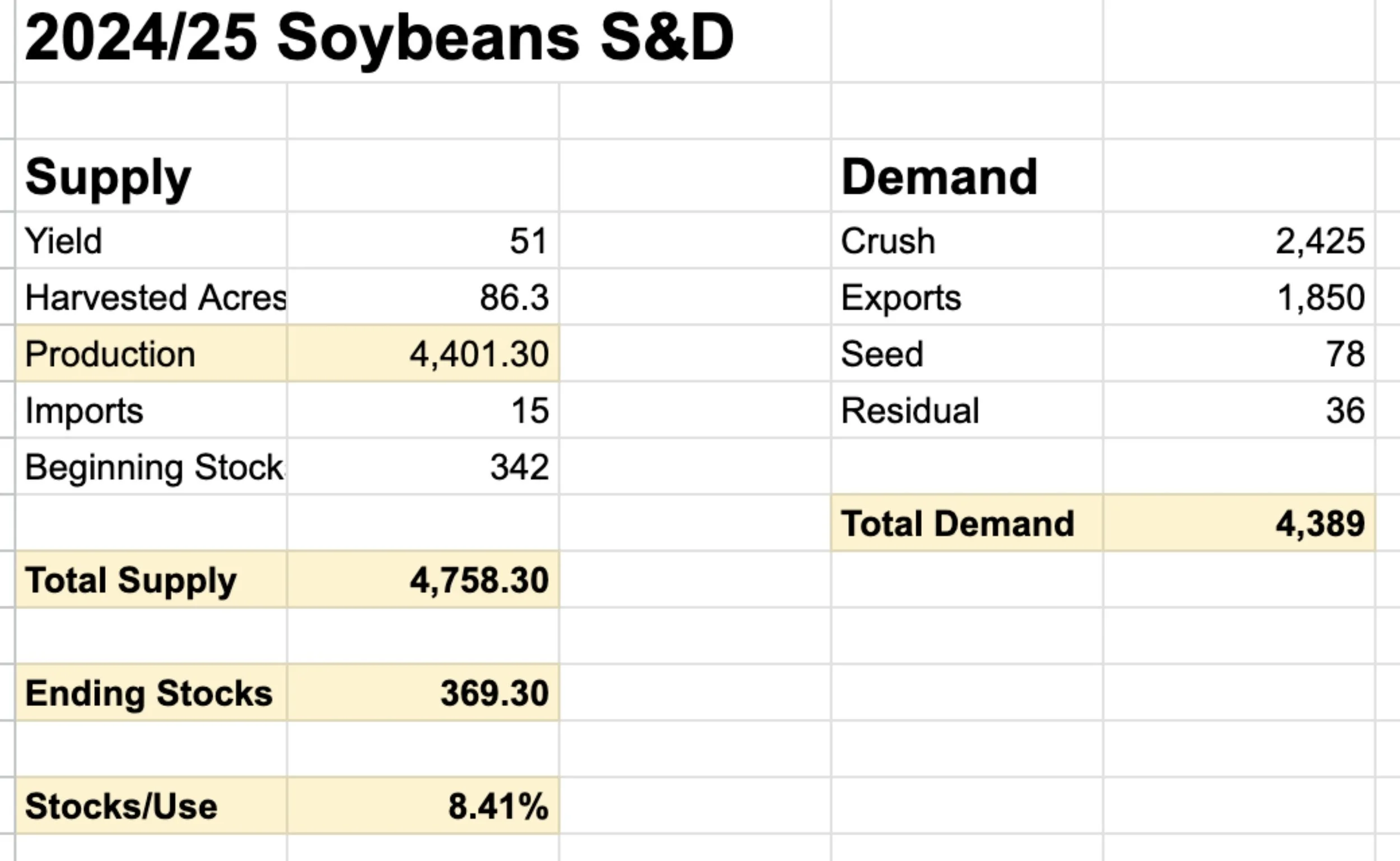

Why $4.60 is my longer term target

I have mentioned this in my past few updates.

But my 2nd longer term target after $4.41 to $4.46 is still $4.60.

This does NOT mean we will for sure see $4.60. There are many reasons on the charts why we could. But it will come down to fundamental factors such as our US balance sheet & Brazil.

Reason #1

We found support there in March, April, May, & June. (Old support turned new resistance)

Reason #2

We also still have a volume gap up to $4.60 on the weekly chart.

Reason #3

$4.60 is also our seasonal 5 year average for our fall high.

We have followed this seasonal to an absolute tea thus far.

Soybeans

We continue to find support at this $10.42 level. This was our late July highs. A break below and we could see $10.31. I would really like to see us hold $10.31

We are ran into resistance right where I thought we probably would at $10.65 to $10.80. That green box is a big resistance area.

We also have the upper end of this channel providing resistance.

$10.97 is still the next target if we break the $10.65 to $10.80 range.

Altough it does feel like soybeans kind of want to go lower.

One "potentially" friendly set up we do have is another bull flag.

The implied move for this takes us right above $11.00

The last bull flag played out pretty much exact as you can see here.

Wheat

War is of course playing a role in the rally.

War rallies are often sold, which makes me slightly hesitant if this rally will continue higher.

Although we do have potential other factors that could drive us higher.

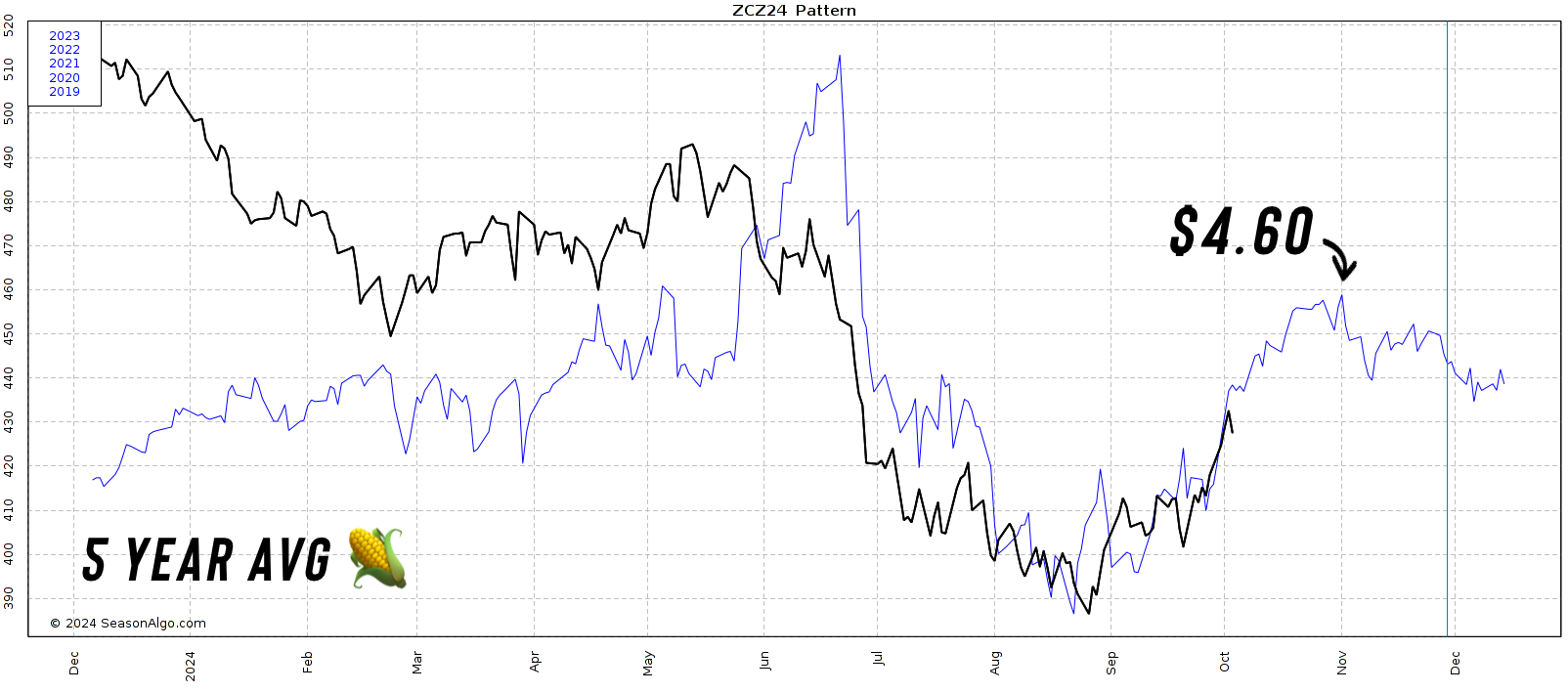

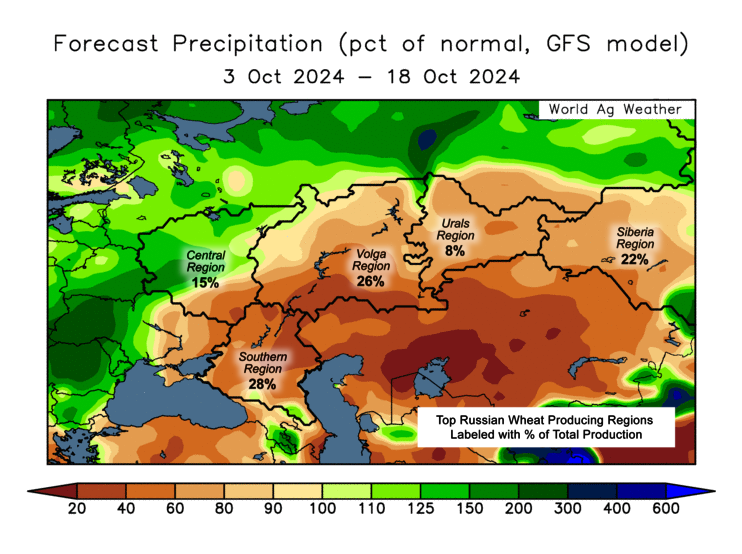

Such as Russia. Sovecon just dropped their Russian export estimates from 48.1 to 47.6 million (USDA has 48 million). That would be down -4.8 MMT from last year. A large -10% cut YOY.

They did so due to the dry weather. And Andrey Sizov of Sovecon stated that this Russian weather is priced in for now, but if it stays dry he sees the wheat market going higher.

It is still early, but Russia has only received 26% of normal rain the past month. Altough Ukraine has received 79% of normal rain.

Ukraine and Russia make up for 30% of global wheat exports. A big number.

A little early to jump on this story as they are just wrapping up planting, but definitely one to watch.

Chart from Standard Grain

Past 30 Days Rain

Next 2 Weeks Rain

There are quiet a few factors that could potentially lead to higher prices looking a little longer term.

Wheat isn't gaining acres here in the US. Global wheat stocks continue to fall year or year. There is production issues across the globe.

This rally may stall here, but I like our chances of higher prices looking long term.

Looking at the chart, we reached our first $6.12 target. This was that July high after the Russia rally sell off.

A great spot to consider taking some risk off the table if you have not yet. Hence our sell signal recently.

From a technical standpoint, the chart isn’t broken. So there is still reason to believe we could climb higher. If we can bust through this green box, the next target is $6.40 (our 50% retracement to the May highs).

Identical story for KC wheat.

A break above could bring $6.50, but still great spot to take risk off if you haven’t.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24

BULLISH USDA FOR CORN: RECOMMENDATION

9/27/24

UP-TOBER? SELL SIGNAL, TARGETS, & FACTORS

9/27/24

BEAN SELL SIGNAL

9/26/24

NEW HIGHS BUT CONCERNING CLOSE

9/25/24

HIGHEST CLOSES SINCE JULY. UPSIDE & SALES CONSIDERATION

9/24/24

GREAT START TO THE DAY, AWFUL FINISH

9/23/24

MASSIVE DAY FOR THE GRAINS

9/22/24

EARLY YIELD TALK, DROUGHT, BRAZIL, SEASONAL LOWS & MORE

9/19/24

GRAINS SEE TECHNICAL SELLING

9/18/24

FED DROPS RATES, BRAZIL STORY, 2025 SALES?

9/17/24

TARGETS & WHAT TO DO IF YOU BOUGHT PROTECTION

9/16/24

WAS TODAY HEALTHY CORRECTION BEFORE GRAIN RALLY RESUMES?

9/13/24

CORN & WHEAT BREAK OUT: EVERYTHING YOU NEED TO KNOW

9/12/24

USDA RAISES YIELD BUT REPORT WASN’T ALL THAT BEARISH

9/11/24

USDA TOMORROW. MAKE OR BREAK SPOT ON CHARTS

9/10/24

USDA THURSDAY

9/9/24

LOWS ARE IN UNLESS SOMETHING FUNDAMENTALLY CHANGES?

9/6/24

GRAINS WEAK. OUTSIDE DOWN DAY ON CHARTS

9/5/24

GRAINS GET HEALTHY CORRECTION. GETTING READY TO PROTECT DOWNSIDE

9/4/24

GRAINS CONTINUE RUN. WAYS TO PLAY THE MARKET. WHAT’S YOUR SITUATION?

9/3/24