WHEAT CONTINUES RALLY & BEANS BOUNCE BACK

Overview

Grains continue to do what they have essentially done the past week.

Wheat continues to run higher with their 6th green day in a row, led by purchases from China and fund short covering. Corn continues to follow behind wheat, slightly higher with short covering. While the soybean market continues to take it on the chin with fund repositioning amongst Brazil weather uncertainty as well as uncertainty ahead of Friday's USDA report.

However, beans did get a solid bounce today after initially trading a dime lower, closing nearly unchanged.

How have prices changed on this shift?

The wheat market is a massive +75 cents off of it's contract lows from exactly a week ago.

Corn is +20 cents off it's lows from last week, while soybeans are down -45 cents the past 4 days.

So why have prices done what they’ve done?

Most of this is fund repositioning. However, the wheat market has gotten a nice boost from purchases from China.

Yesterday they announced the largest purchase of wheat in over a decade. Today it was then announced they bought another near 200k tons. Bringing the weekly total to 638k.

We touched on this yesterday, but if China is buying. I’m not selling.

More on this later in today's update as well.

Beans have been getting hit because of Brazil weather uncertainty. Currently the forecasts are mixed. But our markets do NOT like uncertainty. Which can often lead to the funds positioning themselves in a place where they see the least risk.

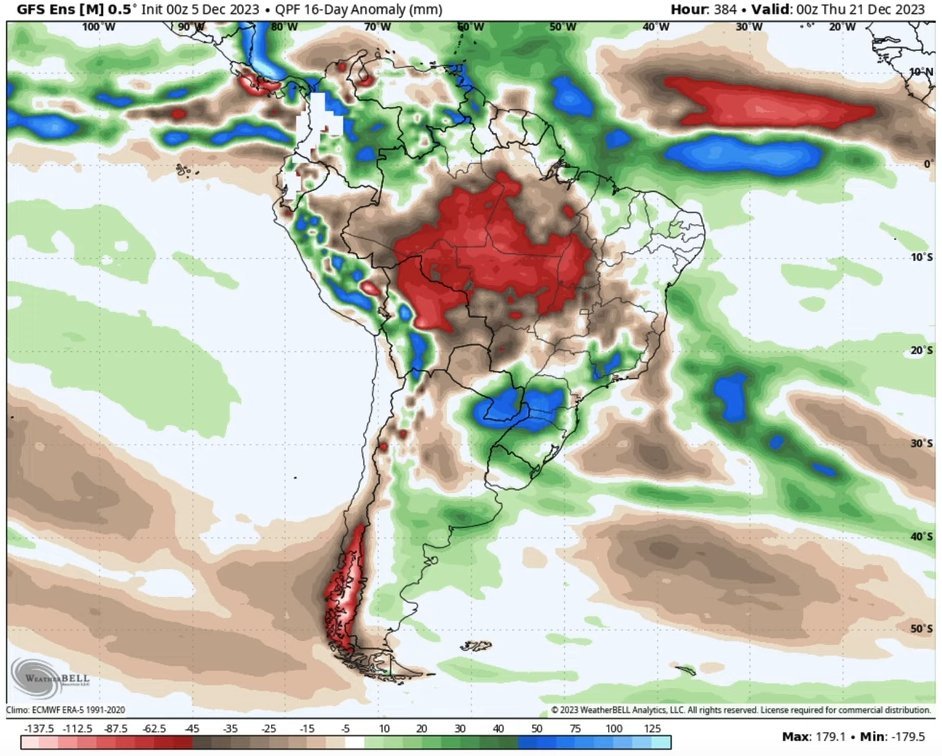

What does the Brazil outlook look like?

Still caught between two models. One is a lot drier than the other. Perhaps we will get something in the middle of these two, but neither look extremely promising in my opinion.

We also have the WASDE report on Friday, so perhaps the funds want to relieve some exposure ahead of the report in case we get some surprises.

Currently, the funds are still short nearly 200k contracts of corn and nearly 80k wheat. They are now only long around 30k to 40k beans but still long over 100k contracts of meal.

Until the report, there is a possibility that the funds continue to mitigate their risk and even out their positions.

Overall, aside from the China purchases there hasn’t been any real fresh news. So the next 2 days could largely be dictated by what the funds decide to do here.

Let's jump into today's update...

Diego Meuer, Brazil Producer:

"The largest group in Brazil announced it will replant 19 thousand hectare of soybeans, only then can you imagine the size of the problem in Mato Grosso, which the media and consultancies avoid showing."

Jason Britt, President of Central States Commodities:

The market just keeps kicking the can down the road. Reminds me of Argentina's situation last year and that didn’t turn out so good... (Talking about Brazil).

Mark Gold of Top Third:

"I think we are going to start seeing a continuation of lower Brazilian soybean production."

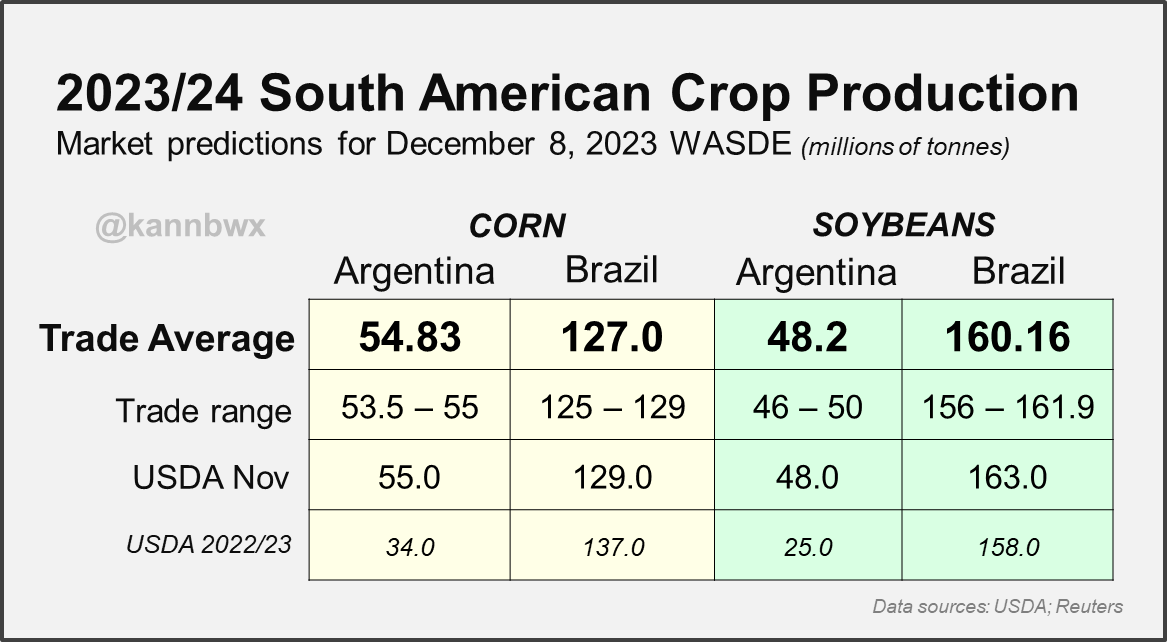

South America USDA Estimates:

We get the WASDE report Friday. Here is a chart from Karen Braun with the estimates.

The trade sees a lower Brazil corn and bean crop from last month, but bigger in comparison to last year.

Current Recommendations:

As far as marketing recommendations go,

Those who can wait until May, June, or July to sell, we don't recommend you do anything at this point.

For those of you who need cash flow or need to sell something in January, then you should have a plan in place and be more proactive. If you don't have a plan in place, one simple thing to do is to buy some cheap puts and put a floor under the market. Now is not a good time to spend a lot of money on puts as our markets are near the bottom of their ranges.

For wheat, something to note is that some of our competitors have been making sales on this rally. We don't necessarily like that, but that is under the assumption that we don't need to sell wheat until late spring or early summer next year. For those of you who are undersold there is nothing wrong with rewarding the rally.

Anyone who needs to price grain in the next 30 to 60 days should have a plan. If you don't have a plan, consider having protection in place.

For beans, now would not be a bad time to consider courage calls. Keep in mind in marketing, we do not want to be chasing. We want to be buying calls before a rally and puts after a rally.

We realize every operation is different. If you have questions or want tailored advice shoot us a text or call at (605)295-3100.

Today's Main Takeaways

Corn

Corn continues to trickle higher following in wheat's footsteps. Now +20 cents off of it's lows from last week.

Overall, the charts are actually starting to shift somewhat strong. Last week we posted a reversal on the weekly charts.

Dr. Cordonnier cut his Brazil corn production by 3 million metric tons to 118 million. Stating that "all indications point to a smaller safrinha corn acreage."

This is a factor that is flying under the radar when looking at corn long term. Yes our situation here in the US is far from bullish with our large carry out and may make a major rally more difficult, to go along with the fact that the Brazil situation will have a much greater initial effect on beans rather than corn.

But Brazil is not going to have much of a second corn crop. The rainy season was completely late for the bean crops. The first crop will always be the beans.

We will just be looking at a lot less acreage from Brazil corn the next few months.

Brazil overtook the US as the worlds leading exporter last summer. So a potential big set back would go a very long ways in helping the price of corn futures.

This would also lead to much greater demand and help push business to the US. It is a tad early to get super excited about this, but it is definitely something I will be keeping a very close eye on moving forward. I look for this to get a lot more traction towards January.

Bottom line, we see higher prices. It may not be an easy path higher, but the upside is there. Seasonally we go higher. Now is not the best time for sales, we want to be making those in spring and summer typically.

From Grain Stats:

When discussing targets: "The $5 cash wall is going to be the one to watch, then futures."

We potentially got a break above that downward trend line, this could potentially lead to the funds looking to cover more of their shortest position in 5 years. A break above $4.96 could also spark some more short covering.

Corn March-23

Soybeans

Soybeans barely lower today. At one point they were down over a dime but rallied all the way back to nearly unchanged.

Even though Brazil forecasts have been the culprit for lower beans, we continue to see everyone lower their estimates for Brazil's beans.

First we had Ag Rural cut their production, lowering their estimate to 159 million metric tons. Now this is still a record crop by 1 million, but lower than the USDA's current 163.

We also saw StoneX lower theirs by 3.1 million to 161.9 million.

Lastly we saw Dr. Cordonnier lower his another 1 million, having the lowest of these estimates at 157 million. He said that these recent rains came too late for a full recovery on the planted beans.

Bottom line, we will have to see what the report holds on Friday. The trade is expecting Brazil's bean crop to come in at 160 vs last month's 163 and last year's 158.

I have been hearing numbers thrown out in the 155 MMT range and I believe when it is all said and done that is the range we will be closer to or below, but we will have to see. Nobody truly knows how this report will shake out.

Here is a breakdown of the current estimates:

Nov. USDA - 163

WASDE Est - 160.16

StoneX - 161.9

Ag Rural - 159

Dr. Cordonnier - 157

2022/23 Crop - 158

As mentioned in yesterday’s audio, yesterday we saw the spreads get smacked, yet basis firmed up by 5 to 10 cents. This does not make sense and is one reason why we believe beans will bounce out of here.

Shorter term, yes I could see us making another leg lower. I wouldn’t count out the possibility of us testing that $12.70 level if we get a bearish report or anything else.

However, longer term there are still so many potential factors that could push beans higher.

We could definitely see some choppiness or perhaps lower action ahead of the report or until we get a more clear picture of the Brazil situation.

Longer term, the upside for beans is there and there are plenty of factors that could push us higher. Demand isn’t going away and the balance sheets are still tight.

Overall a pretty solid day on the charts for beans in my opinion. Printing a doji candle on the chart as we found support above the 50% retracement to the downside from our $3 rally from May to July ($12.91 which is a big support) and we crawled back above $13.05. Bulls want a break above $13.26 to see more upside.

Soybeans Jan-23

Wheat

Wheat futures rally for the 6th consecutive day as we now sit +75 cents off those contract lows from last week.

We have now clawed back over 25% of the sell off from July.

As mentioned, most of this strength is stemming from two things. The funds and China.

The funds have finally said enough pushing wheat into the ground.

China came out and made their largest purchase in a decade as mentioned, and again added on to those purchases as they bought yet more again today.

Why is this important and why did we say "If China is buying, I'm not selling"?

Because when China is buying it means that they look at the current price of wheat and see it as a bargain. Meaning they foresee higher prices and want to lock in these lower prices before they are gone.

China typically does NOT buy a lot of our wheat. This is why this is so significant.

Bottom line, we have been saying wheat is a sleeper for a long time. Perhaps this is finally the start of the upside we have been saying is possible.

Short term perhaps we see this rally take a breather, but long term we still see higher prices.

We got that break above $6.22 I have been talking about for weeks that could lead to more upside. I still believe this could open the door higher but would like another solid day to fully break out of this range.

We touched that 100-day MA for the first time since August.

The chart is starting to look promising.. My next upside targets are $6.38 then $6.53.

Chicago March-23

KC March-23

Check Out Our Price Maker Program

Become a price maker and take your marketing to the next level.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Past Updates

12/4/23

IF CHINA IS BUYING, I’M NOT SELLING

Read More

12/1/23

BRAZIL, CHINA, FUNDS & SEASONALS

11/30/23

LOWS FINALLY IN OR ANOTHER SELLING OPPORTUNITY?

11/29/23

RISK & UPSIDE FACTORS

11/28/23

WHAT COULD CAUSE THE FUNDS TO COVER?

11/27/23

WHAT IS CORN BASIS CONTRACT DILEMMA TEACHING US?

11/24/23

POST THANKSGIVING MELT DOWN

11/22/23

WHAT’S THE BRAZIL STORY?

11/21/23

WHAT TO DO WITH YOUR CORN BASIS CONTRACTS

11/20/23

ARE YOU UTILIZING THE RIGHT STRATEGIES OR GETTING TAKEN ADVANTAGE OF?

11/17/23