MORE DROUGHT & USDA REPORT TOMORROW

Overview

Grains end the day mixed with corn seeing yet another day of red.

The markets were actually trading higher overnight but surcame to the pressure as the rains started to roll in across areas of the corn belt.

From what I can see all over social media, the driest areas that got rain today came with high winds and hail. As it looks like plenty of areas hit by the storm received damage in areas of Illinois, Iowa, Nebraska, and Missouri. Typically when areas get hit by hail and wind, it is beneficial to everyone around them besides them. So there was likely some needed rainfall in those areas.

Tomorrow we get the USDA report. My thoughts and preview is below. If you scroll to the end of today’s write up I also include a great write up from Farms.com and their thoughts going into tomorrow.

Pro Farmer tweeted,

"Historically, tomorrow’s report is the most volatile day of the year."

Markets will be open Sunday night and Monday, but will be closed Tuesday for the 4th of July.

***

In case you missed it, listen to this morning's audio

What's Next For The Grains? - Listen Here

USDA Preview

Tomorrow we get the USDA which will include the acreage numbers and quarterly stocks.

Farms.com Risk Management said,

"USDA's end of June reports on grain stocks and acreage are usually market movers. In the last 5 years it's moved corn futures up or down 7%, and soybean futures by 4%. A surprise could send corn and soybean futures limit up or down by 45 cents or 70 cents respectively."

The trade is expecting a slight decrease to corn acres, with a slight bump in both beans and wheat.

I have no idea what the USDA will decide to do here. They like to throw surprises.

However, there are a few things I could see playing out. Firstly, there isn’t much if any talk about an increase in corn acres. No, the trade isn't expecting any major changes to acres. So I could see a surprise either way. But I could actually see acres possibly coming in slightly higher than the trade has simply due to the fast planting we had. So that is a possibility we need to be prepared for. If this happens, we could see corn futures take it on the chin again as the trade isn’t expecting this.

Additionally, the trade is expecting some pretty big decreases to our stock numbers. Means how there aren’t major changes expected for acres, the trade is expecting the moves to be made here. Now with that expected large cut comes the risk that we don’t see stocks cut by quiet as much. Which would also be negative for futures. Now I am hoping it doesn't play out this way, but that is a risk we need to be aware of.

One thing to keep in mind is that basis has been firm and as have the spreads, which indicates that stocks are tight and perhaps we see something similar to that of January and March where we came in below estimates. Those were the last two reports we had, so the trend is to be below estimates.

Now if we do get a bearish report, there is one more scenario. If we get bearish news and the markets actually start to reverse and trade higher it would be a great signal of a reversal to the upside going into July.

Today's Main Takeaways

Corn

Corn futures lower yet again. Despite the drought monitors showing that drought has worsened and not improved. Why is this? First we have the forecasts. Secondly, the funds are looking to reduce exposure ahead of the report.

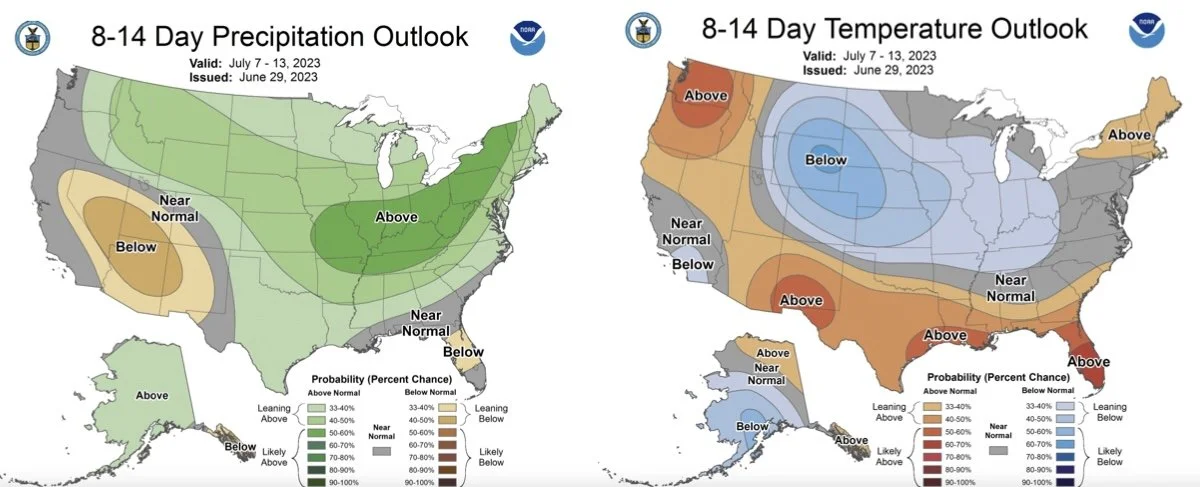

We actually traded higher over night but we broke as some rains came through Illinois. The forecasts are showing pretty good rains for the areas that have needed it the most. As Illinois and other parts of the corn belt are getting some rain. However, from it does appear that a lot of these rains seem to be spotty, but there was definitely some good rains across plenty of dry areas.

One thing to keep in mind is that a lot of these rains are all already mostly priced into the market. So if these future rains do not develop, or come up short, I think the bulls could see another rally.

Bulls make the argument that we have far over done this thing to the downside. Which I would have to agree. But ultimately it comes down to how weather shakes out. Bears on the other hand point at demand concerns coupled with the rain in the forecasts. As they think demand isn't strong enough to support this market without a massive weather scare. Both sides might be somewhat right.

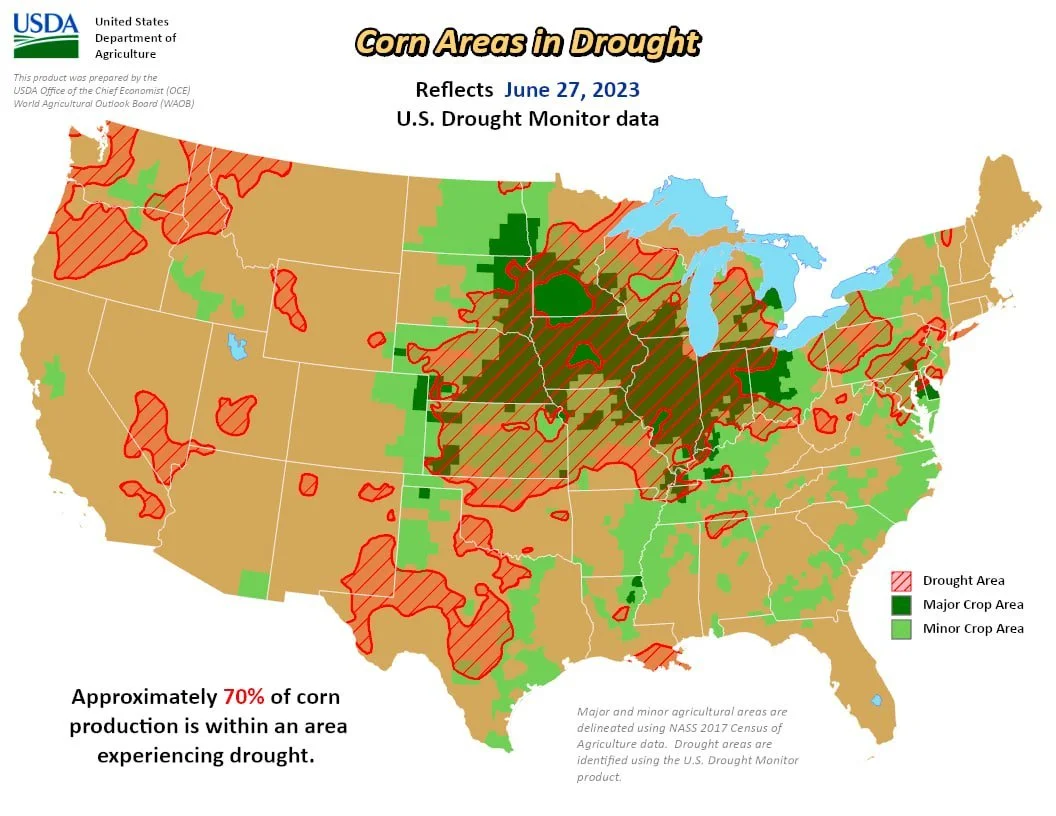

First things first I want to look at the newest drought monitors that were updated this morning.

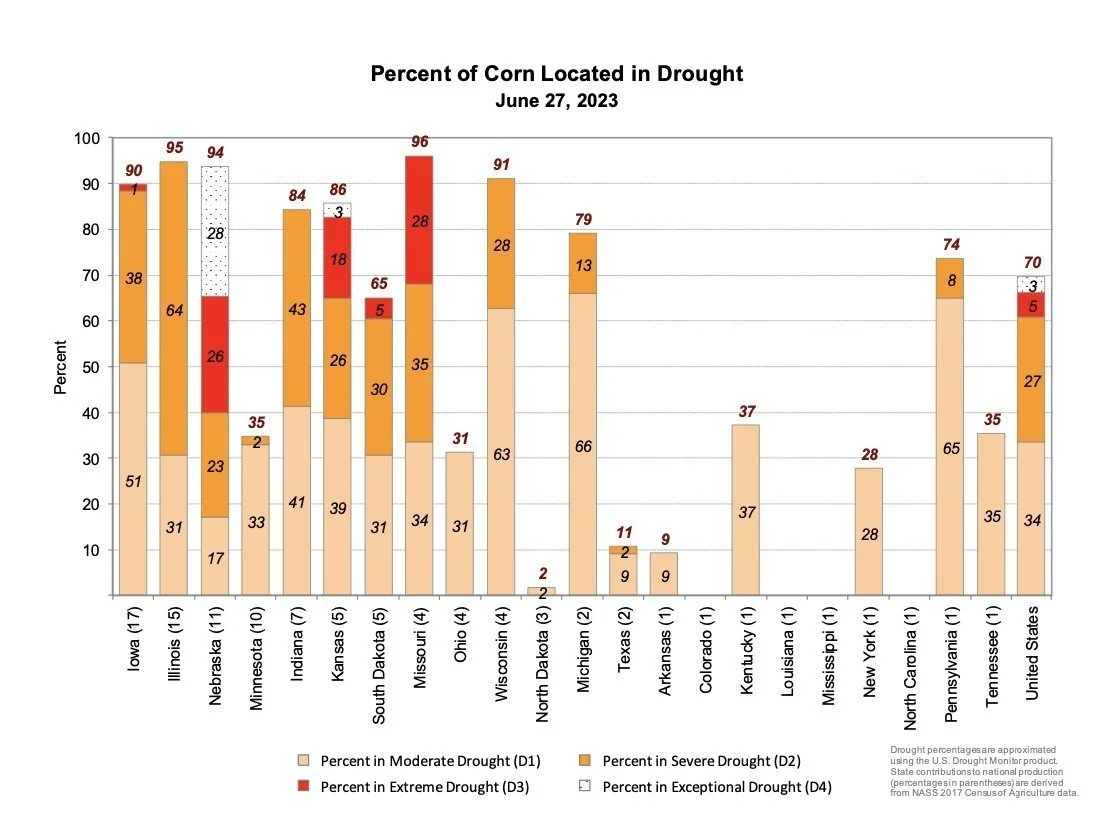

Corn areas suffering from drought yet again took another steep jump. Jumping +6% from last week, to now 70% of corn areas in drought. However, the trade mostly ignored this today and thinks that the current forecasts will fix this problem.

Here is a state by state breakdown.

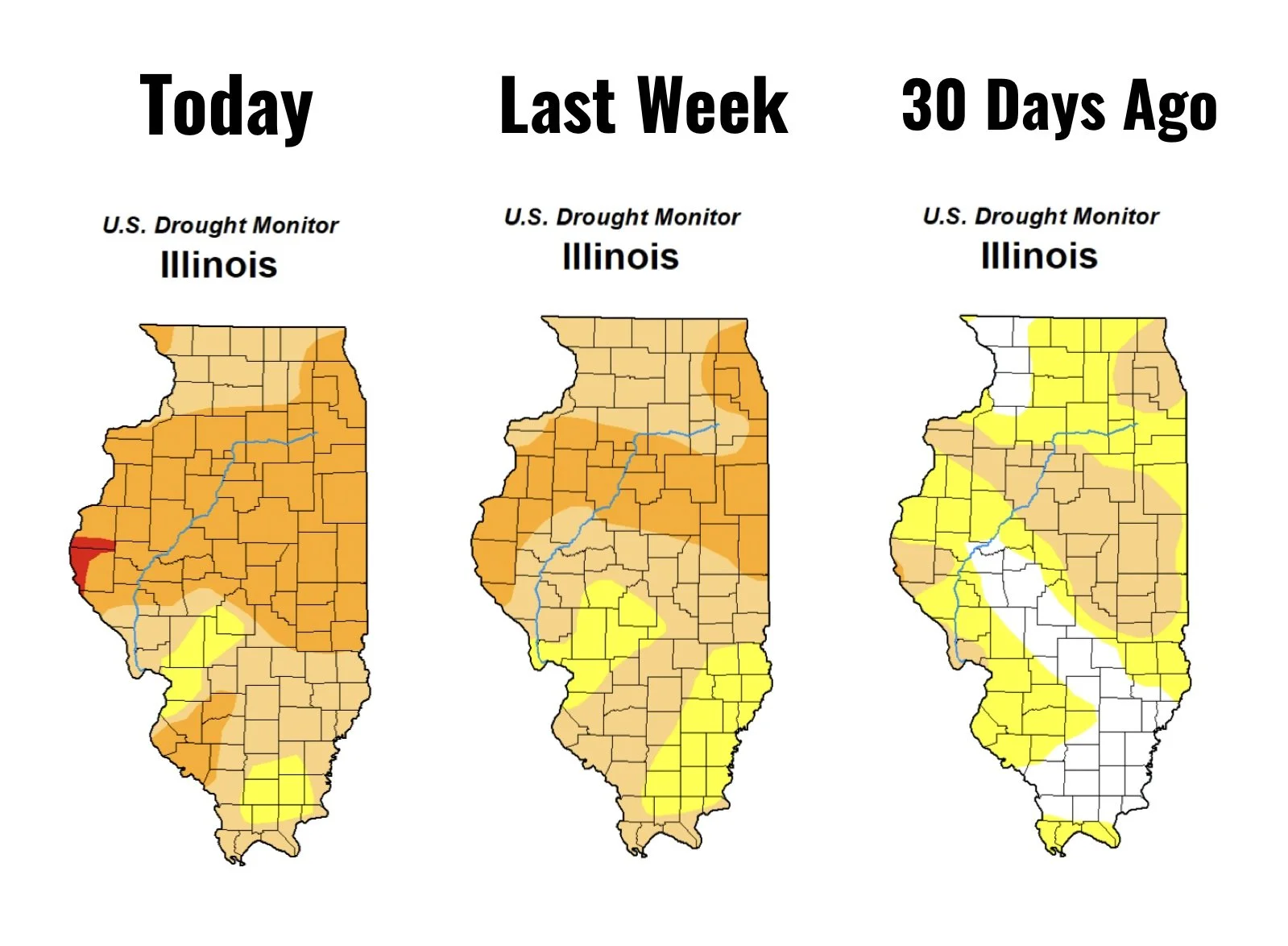

First let’s take a look at Illinois. The drought has continued to expand. Now Illinois did get some rain today. So this could change. But we can’t ignore the obvious concerns if a good portion of these rains miss.

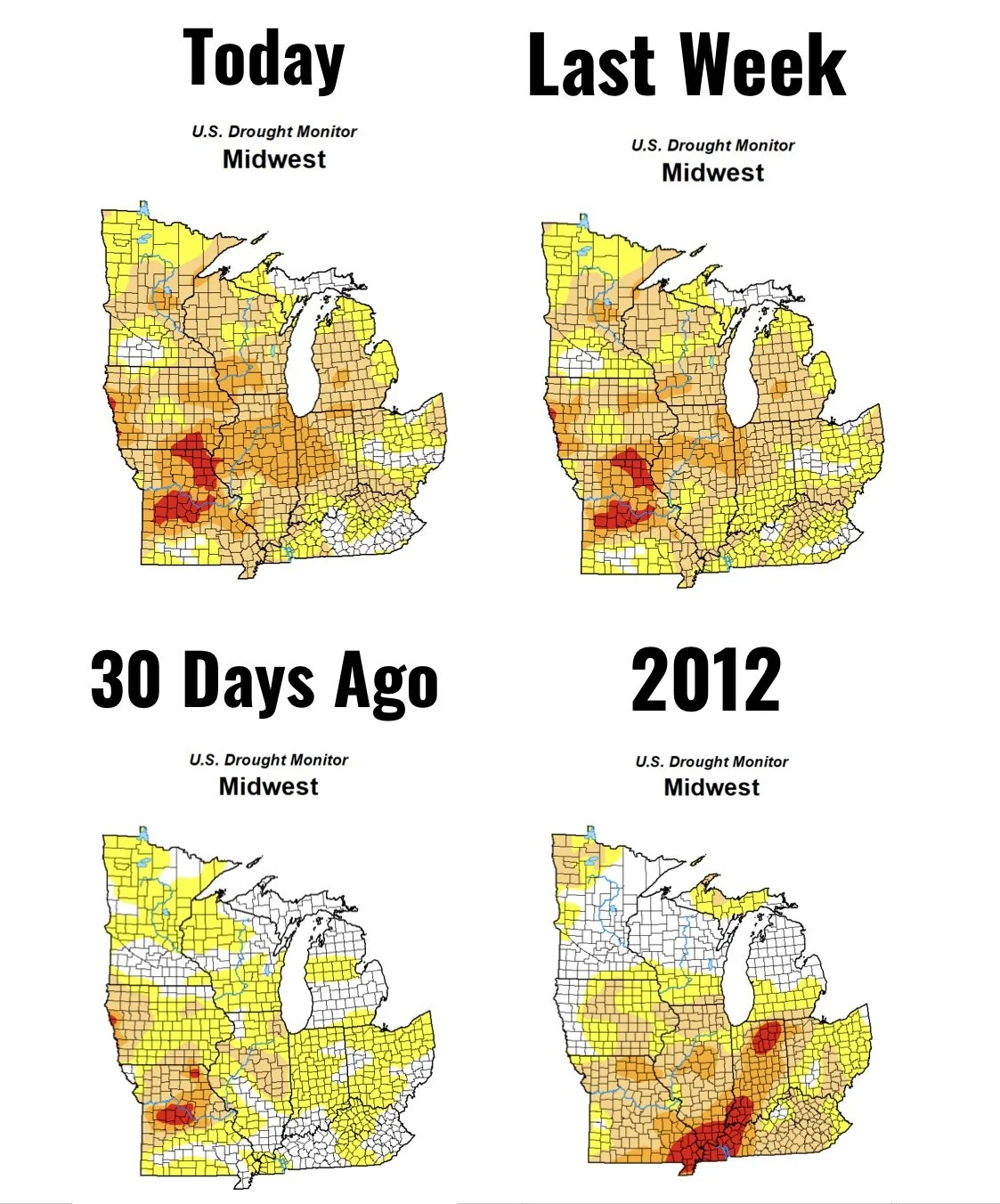

Now let's take a look at the midwest. Just 9% of the midwest remains drought free. Just for comparison, this number was 28% in 2012. Areas sitting in severe to exceptional drought (Class D2 to D4) is almost 25%. Much higher than the 15% in 2012.

Now is this year still a repeat of 2012? With the current forecasts, it is highly unlikely. But does that mean we can’t still see a significant rally? Of course not. The potential is still there.

2023 may not be an exact replicate of 2012, but I don’t see this year being a same story to that of 1992 either. Where we start off and have these awful crop conditions, than all of the sudden we have record good conditions. We can’t discount the damage that has already been done.

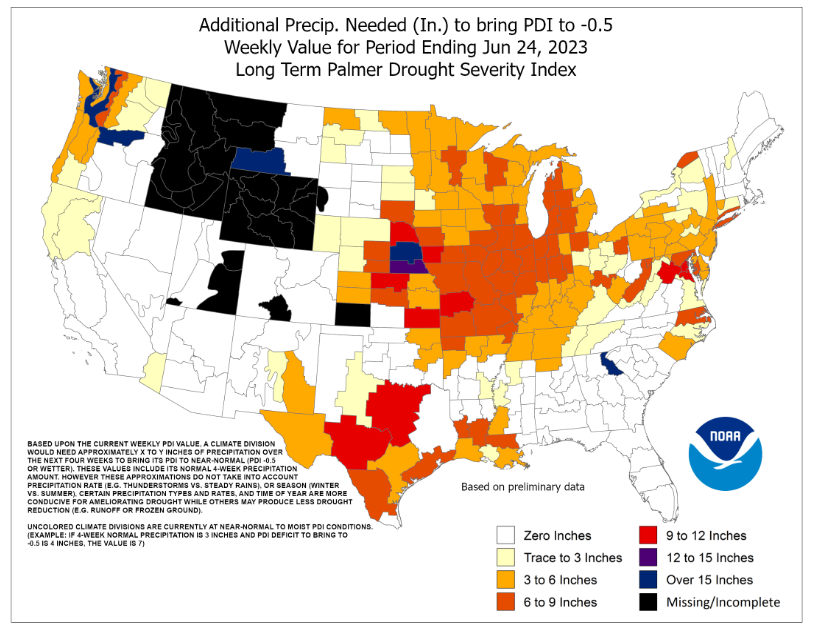

For the areas that are getting rain, yes there is definitely going to be improvement. But the crops still aren’t made. I included this chart Tuesday, but I again wanted to include it as it showcases just how much rain some of these areas need. A large portion need anywhere from 3 to 9 inches.

The markets are trading like these rains are going to save the crop and make a trendline yield. Now is that possible? Sure I suppose. Do I think it’s probable. No, not a chance. I just don’t see a world where we 8 bushels higher than last year, let alone even touch last years 173 bushel per acre.

Mark Gold from Top Third said,

"I just find it hard to believe this one rain is going to make a crop. There is talk about more rains over the weekend., if that happens maybe we see better yields than expected. Right now they are expecting 174-176, if we get more rains Saturday and Sunday maybe they bump it up to 177-178 but I still don't see us getting near the USDA 181.5 when its all said and done"

Going forward, it all comes down to tomorrow’s USDA report, weather, and demand. Do we get a bullish or bearish surprise? How much rain falls? No one has the answer. Either way it shakes out, there is definitely still some risk to see some more downside. Especially if we do get a bearish report, we could take another leg lower. That is something we need to be aware of.

But then again, if a lot of these rains wind up missing or coming up short and a week or two from now it is still dry, we could add all of this weather premium back and come screaming higher.

Every operation is different. If you want help managing your risk or to go over anything, you can always give Jeremey a call at (605)295-3100 completely free of charge.

Here is the July 7th to July 13th outlook. There is definitely some risk here if these come to fruition.

Corn Dec-23

Soybeans

Soybeans manage to close green today, but finished well off the highs as some rains started rolling in across some key growing regions.

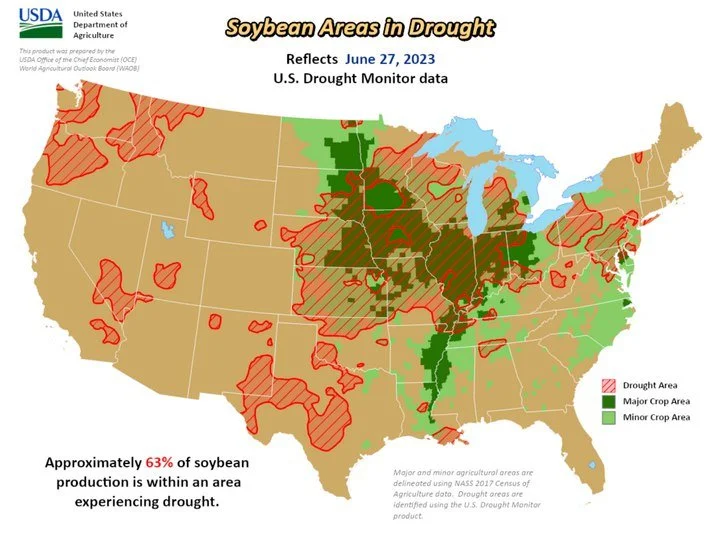

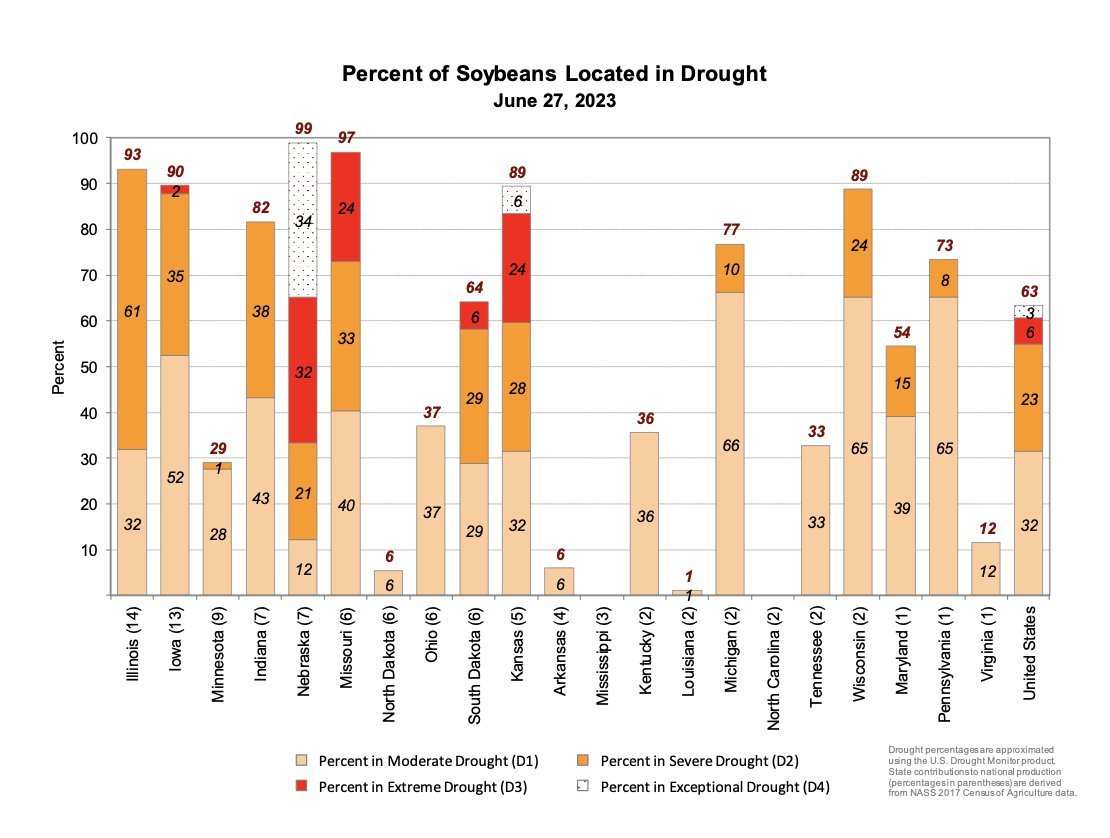

Similar to corn, soybean areas experiencing drought came in higher yet again. As soybeans saw a +6% increase to now 63% of areas experiencing drought.

Here is a quick state by state look of areas experiencing drought. As you can see, our top two growers are sitting at both +90% in drought.

Who knows exactly how much rain will hit the ground. We saw some good rains in key growing regions today. So of course you could imagine that if we continue to get rain in the forecasts and they do materialize we could take another leg lower, despite our markets being significantly oversold here.

The question is just how much of these rains were already priced in. I would assume a good amount has already been factored in, but that doesn’t mean we still won’t see some additional downside.

As for the demand side of the equation. Bulls do make the argument that we have a better demand story going for beans in comparison to corn. I would have to agree that I think we do have a demand story developing and our long term fundamentals are still very bullish.

Soybeans Nov-23

Wheat

Wheat futures end the day mixed with Minneapolis 7 cents higher and Chicago and KC 2 to 5 cents lower.

The newest drought monitors were a mixed bag for wheat.

On one hand, the areas experiencing drought for spring wheat stabilized over the week. Staying at just 15% experiencing drought.

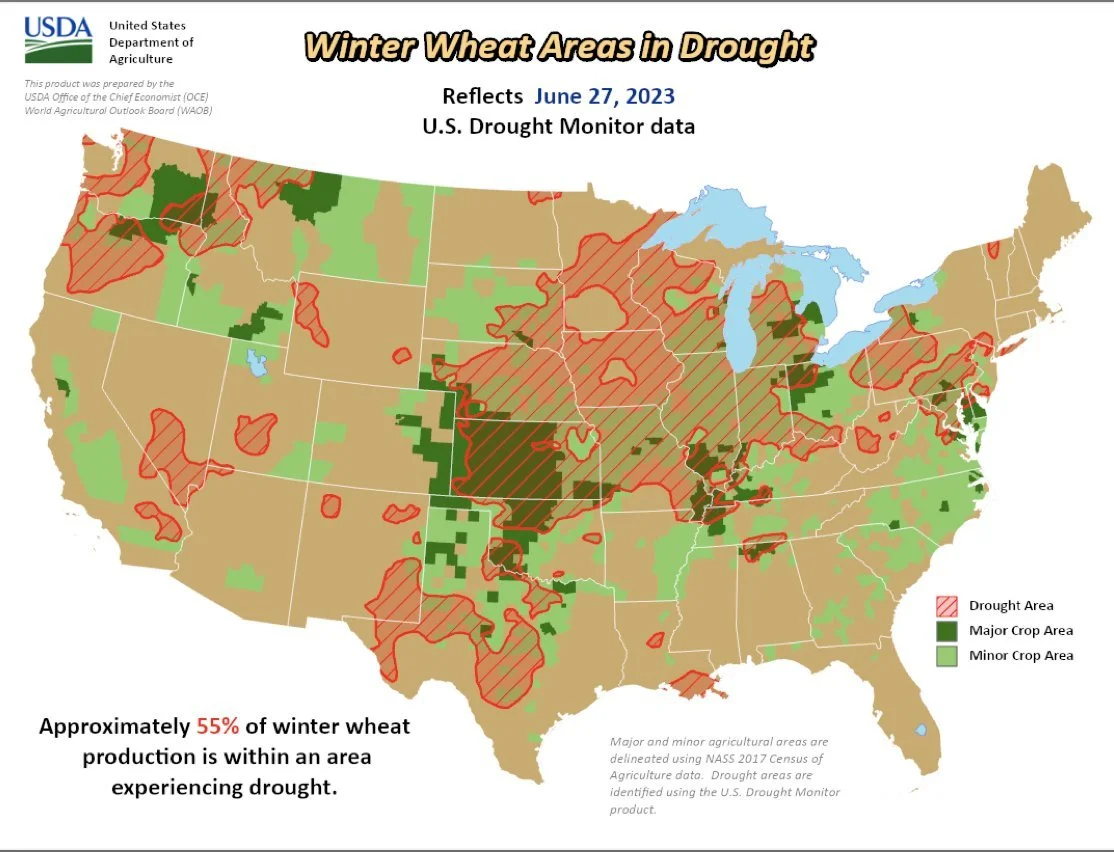

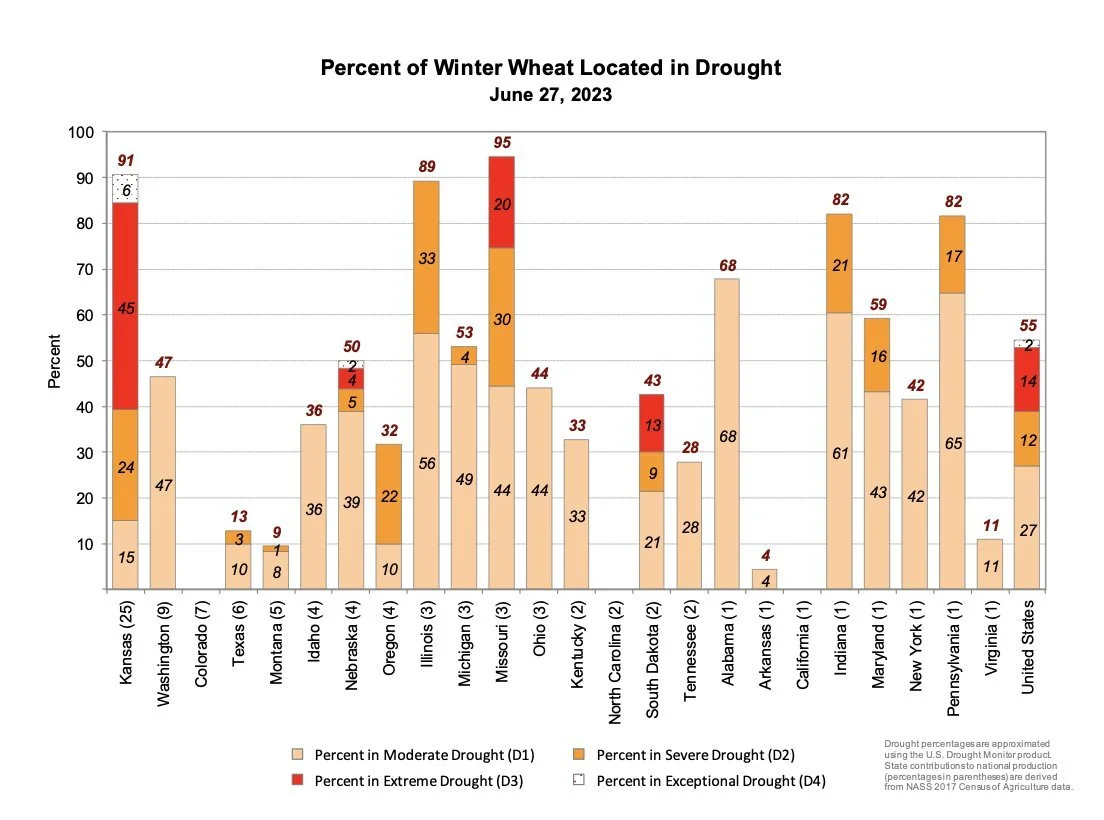

On the other hand, winter wheat followed the path of corn and beans. As winter wheat areas experiencing drought jumped another +5% to 55%.

Here is a state by state breakdown for winter wheat areas in drought.

There isn’t a whole lot for the export demand story for wheat.

On one side there is some better rains and perhaps from better than expected yields coming out of the harvested fields. On the other hand, if we continue to see delays that could leave the crops exposed to potential wind or hail damage.

In other new, we got some updated numbers from Stat Canada that showed Canadian farmers planted their most wheat acres in over 20 years.

Global companies still remains one of the biggest things keeping a lid on wheat prices. As we still have the Russia and cheap export problem. It just doesn’t look like this problem is one that will solved the soonest.

The wheat market is still a global game. We have global problems that could look to support the wheat market. Going forward, these potential problems still make the wheat market a sleeper while most are focused on the weather in the corn belt.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

The Bottom Line

From Farms.com Risk Management,

Dry conditions dried up much of the U.S. Midwest this spring/summer but big changes vs. March intentions in the end-June reports are the exception. USDA can still surprise as the range of expectations are wide. In 2019, soybean acres plunged as farmers battled wet conditions, but corn seedings dropped in the following year after record March intentions and COVID decimated prices and ethanol demand expectations. In 2022, US soybean plantings dropped fell due to the northern Plains’ wet fields.

The figure to watch out for this year is prevent plant like last year. We may have lost as many as 300,000 – 400,000 acres in each corn & spring wheat, while soybeans likely gained 400,000 to 800,000 million acres from that region? Reports of farmers seeing more abandonment in the second planted soybean crop following the 2023 SRW wheat harvest in the ECB but that may not show up in this report.

USDA’s end of June reports on grain stocks and acreage are usually market-moving reports and in the last 5 years have moved corn futures by 7% up or down and soybean futures by 4%! On Friday a surprise could send corn and soybean futures limit up or down $0.45/bu and $0.70/bu respectively.

We are learning bullish as the funds overdid the topside last week and are now overdoing it to the downside this week on month and end of quarter selling!

We have never seen so much chaos and manipulation in the grain markets. The market and funds overdid it last week to the upside and now this week we are overdoing it to the downside.

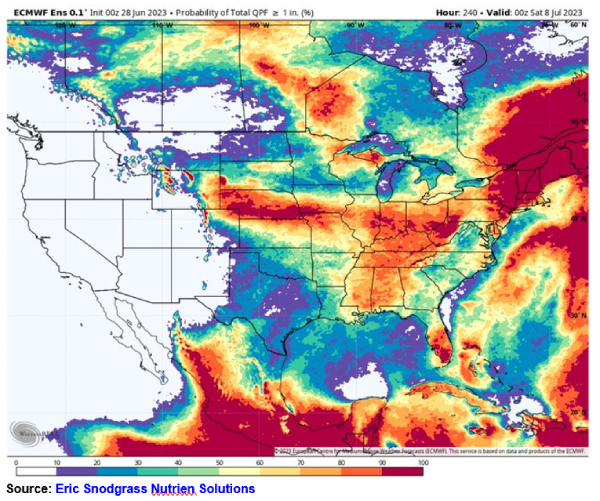

The beginning of the rainy forecast showed up on the radar with scattered storms rolling across portions of IA/MO/IL as well as N MN and N WI. Here's what the market is responding to - increasing odds of good rains greater than 1" across central and southern Midwest in next 10 days. The 1-week outlook rain is more erratic but the 2-week outlook for some areas is calling for 3-8 inches and the models are overdoing it. If it falls ½ to 1 inch it’s a relief for some during pollination but will it fall as advertised? If July rainfall is normal at 3.91 April-July would still be fourth driest since 1960 in the U.S. Midwest. (Please see map below)

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

6/29/23 - Audio

WHAT’S NEXT FOR THE GRAINS?

6/28/23 - Audio

FREE FALL CONTINUES. HOW WILL THIS PLAY OUT?

6/27/23 - Audio

GRAINS SMACKED DESPITE AWFUL CROP CONDITIONS

6/27/23 - Audio

DID WEATHER TREND CHANGE?

6/26/23 - Market Update

WERE THE RAINS ENOUGH?

6/23/23 - Market Update

HEALTHY CORRECTION OR END OF RALLY?

6/23/23 - Audio

EXTREME VOLATILITY & WEATHER MARKETS

6/22/23 - Market Update

BEANS PULLBACK & DROUGHT CONTINUES

6/22/23 - Audio