MOTHER NATURE & BLACK SWANS

WEEKLY GRAIN NEWSLETTER

Some not so fearless comments for www.dailymarketminute.com

Things we know, things we don’t know, along with the things we believe we know that we might not actually and a couple extremely different colored Swans.

Grain markets, as well as basically any tradable vehicle often have prices driven by expectations versus reality. Some of which we know ahead of time, some of which is a major surprise, and other times it is like the storm that comes up in just a few minutes as Mother Nature does whatever however she would like for as long as she desires.

Unexpected headlines are often referred to as Black (Pink) Swan events, we have had a few that have hit both the Wall Street Casino along with the commodity markets the past several years. The biggest one the past few months have been the SVB Bank Failure, which started our current “banking crisis”.

As for the grain markets the biggest Black Swan Event has been Mother Nature as she destroys or blesses various areas that attempt to help feed the world. She left Argentina with the worst drought in over 60 years which has made an interesting story for the soybean and corn markets. (Not to mention she left them with ½ of a wheat crop early.)

Interest Rates, next stop and final destination?

A couple weeks ago after the FED spoke we had a market that knew it was going to see interest rates increase by 50 points in the near future.

But all of the sudden this Pink Swan shows up, panic sets in at SVB which is the first domino helping the mass panic that some in the banking industry are facing.

This opens the door to some very smart individuals calling for the FED to lower rates by the end of the year.

Now all of the sudden we have some news, some expectations, along with changing expectations all of which are waiting to see other economic data along with failures before deciding what the solution is.

This leaves some of the big money rather nervous so some pull funds. This helps panic set in and accelerate.

Take Credit Suisse, it was a 7 billion dollar company last week. Today UBS Bank owns them for a little over 2 billion dollars. That would hurt a little bit, but all of the bonds that other investors had last week are now worthless.

I would like to be straight with you guys, I am not going to be able to outsmart what the FED will do, nor how committed they might not actually be, how deep the quicksand could be, nor what Big Money will do or how they might react. I can read and listen to smart minds and utilize my mind to come up with what I think is the possible outcome most likely to happen, but the reality is that sometimes the world gets so complicated that it can be impossible to outguess life.

Impact?

This is where things can get even more complicated when trying to determine what the possible impact is to soybean, corn, wheat, prices based on a Silicon Valley Bank. Herein lies the risk as well as possible opportunity the grain markets find themselves presently in.

The risk is that the funds or Big Money as I like to refer to them as deciding to panic, and exit taking funds out of investment vehicles such as commodities. I.E. The Pink and Black Swan events give us a risk off atmosphere. Short term that would help markets such as the wheat market where the funds are short a sizeable amount.

Another possible outcome is that all the scary headlines give us a reaction that leads to lower interest rates and even higher inflation. Something like this happening could be the start of the Grain Market Mania as we soar to new all time high prices, behind Mother Nature impacts and scares, demand growth, and a story that Big Money wants to use to get richer.

I do think that our markets have plenty of cards in the deck that help us get to new all time highs just on our normal seasonal rally that we get provided the funds don't decide to stash the cash under the mattresses so to speak. But if the funds decide to panic, the grain markets will struggle no matter what our fundamentals are. As the biggest fundamental factor has always been money flow. Our carryouts, supply, and demand help determine prices, but most of that can be accomplished via basis, and future spreads.

Now my bias remains that Big Money will end up jumping back into grains big time because of increased demand, tight fundamentals, Mother Nature scaring and eliminating possible supply, and because of an inflation play. Gold was up nearly 200 per ounce at one time last week. I think our grains will see those types of price movements in the near future.

Here are some of the bullish factors that I see:

Corn demand has increased with China having 4 announcements last week in the daily exports. We can not continue this trend without having to adjust our exports back higher.

Low prices helped cure low prices

Mother Nature

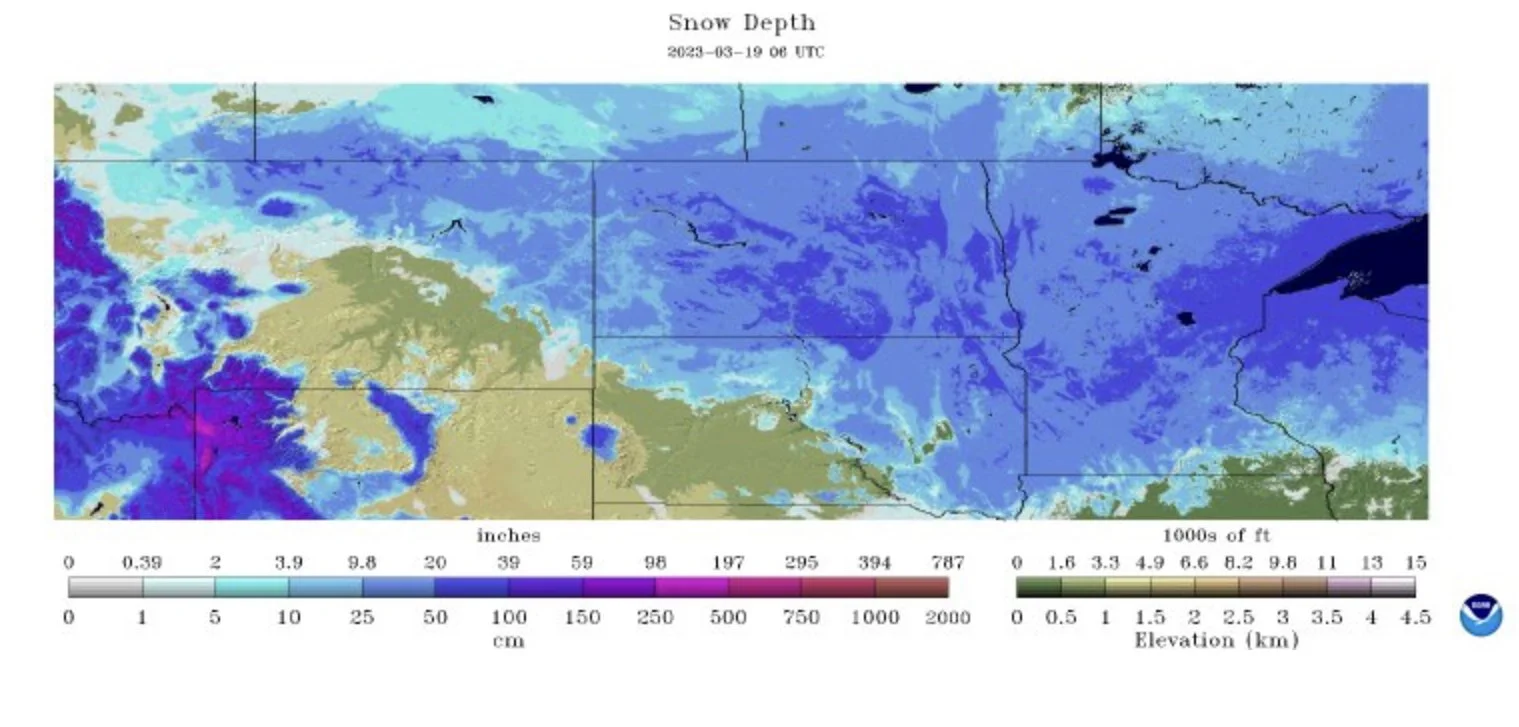

Snow in ND may shave spring wheat acres

Heat in India likely leads to export ban extension

Argentina when all is said and done it might be wheat, corn, and beans all only ⅔ to ½ of what was expected.

Brazil 2nd corn crop has plenty of Risk

Dry weather forecasts continued to KS and other wheat growing areas

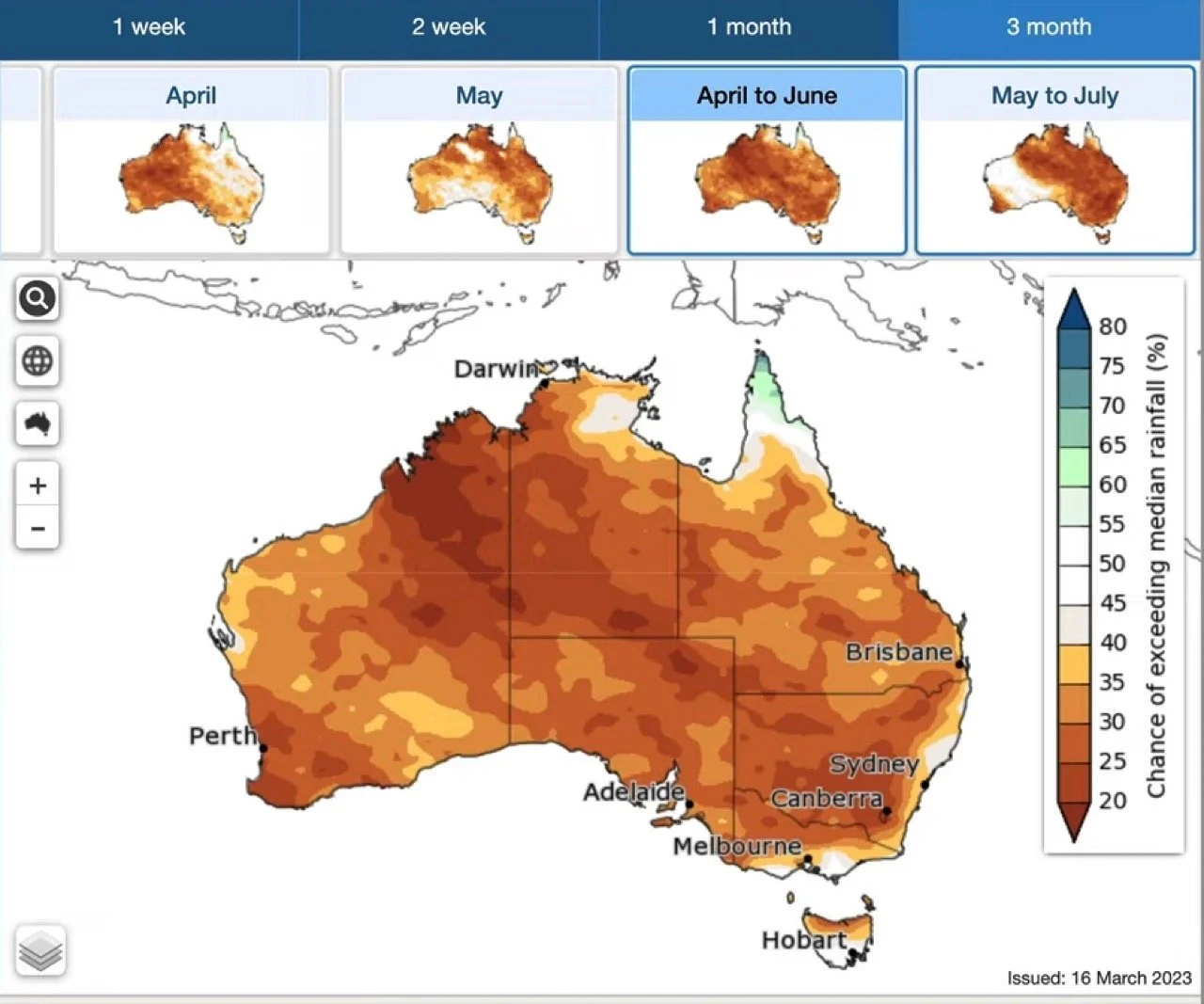

Australia wheat crop is already forecasts at ⅓ or so less then last years crop

How hot and dry and where next?

Corn Belt in 2023?

Supply not in the regions that have the demand

Not enough supply period to meet demand

Chart targets which can be self fulfilling

Ukraine Russia War impacts should be felt more

History repeating it self

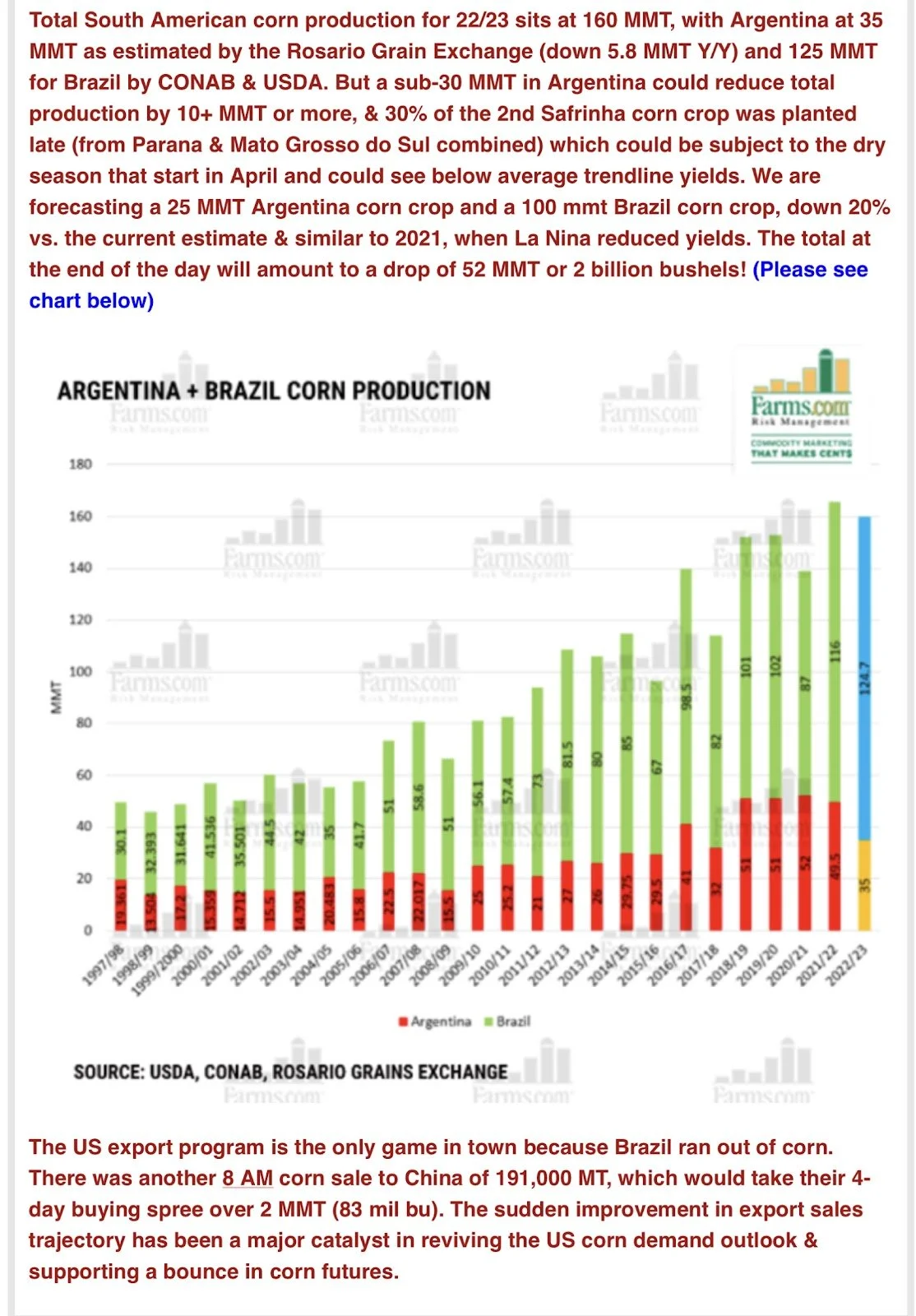

Here are a few tidbits that align with some of the above factors. This first is from Farms.com Risk Mangagement.

Here is Snow deep in ND. Keep in mind Spring Wheat farmers lack a price incentive also. Acre War going to start again?

Note the Austrian Crop Projection

Note drought expectations in Southern Plains.

How high could grains go if the stars align?

I will just say that more money could be lost from selling early and we could see elevators and others that hedge go broke from margin pressure.

A Grain Market Mania where prices go parabolic probably needs a couple things to happen on this list.

Chinese demand increases and grows

2012 type drought hits corn belt

89 year drought

Mother Nature remains wicked in her ways,

Too Hot

Too Wet

Too Dry

Too Cold

Headlines talk about inflation and we see decreased interest rates leading the money buying grains

Ukraine Russia war continues

Farmers heavily pre-sold because of fear of lower prices, i.e. the big ag corps scare them into pre-selling more than what they should

Margins remain strong and get stronger for those buying commodities

If our buyers make money we can go much higher

Price setbacks that scare farmers into panic selling while creating more demand from lower prices

2023 Acre War

Political leaders and their national Food Security continues to be something written in lots of countries as they report supply and demand forecasts.

Production Issues in other Countries

No Global Recession

Prices for our grain markets have basically been falling for some time. Last week wheat had a bounce, but prices are still horrible in comparison to where it was. Even the soybean market took it on the chin recently.

I strongly believe that the lower prices we have had recently have helped increase the odds that we see higher prices later this spring/summer. The market's job is to scare farmers into selling, that has happened, plus we have seen demand pick up, to go along with production issues that are huge such as Argentina.

Bottom line is that we don't have enough supply, at least in the right areas, to meet the demand. With farmers heavily sold, we have lost our natural sellers and both buyers and the funds could go into panic mode once they wake up and realize the situation could develop if Mother Nature determines she wants to play that card, and even if she plays nice we still might not have the supply to meet the demand. No sellers, buyers panic buying, and the funds trying to run prices up to print more money could be our future.

Here is a Tech update form the Tech Guy at Wright on the Market.

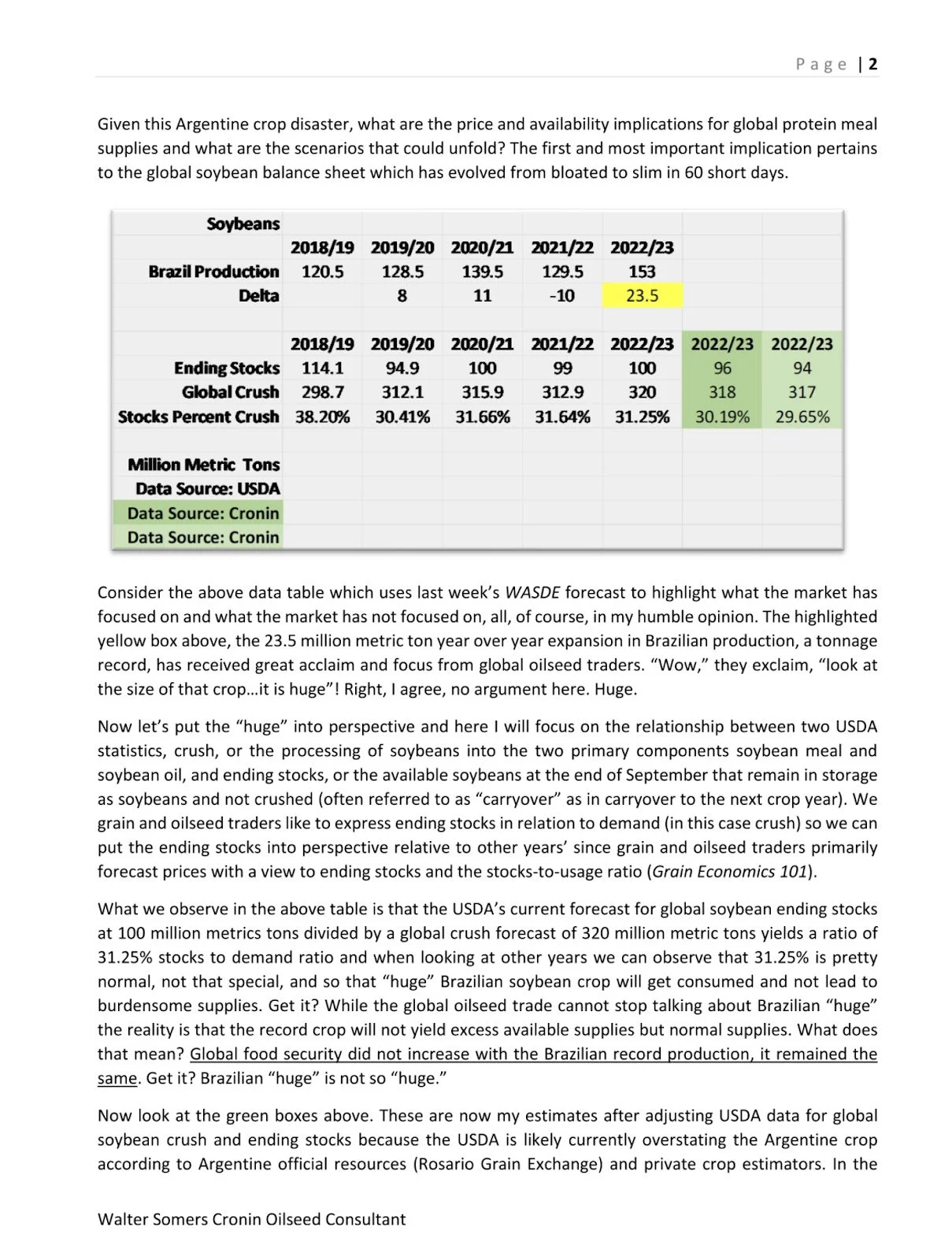

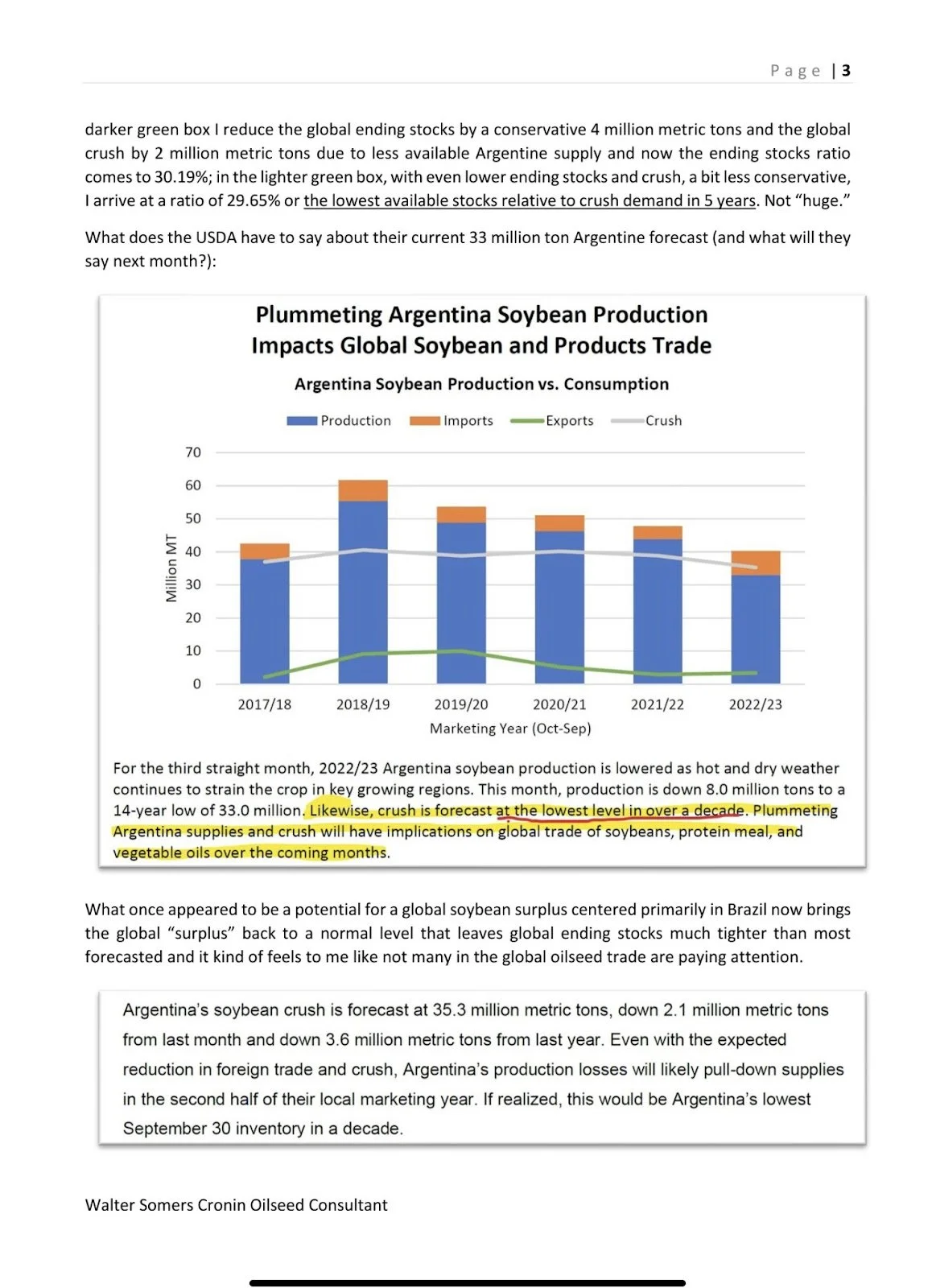

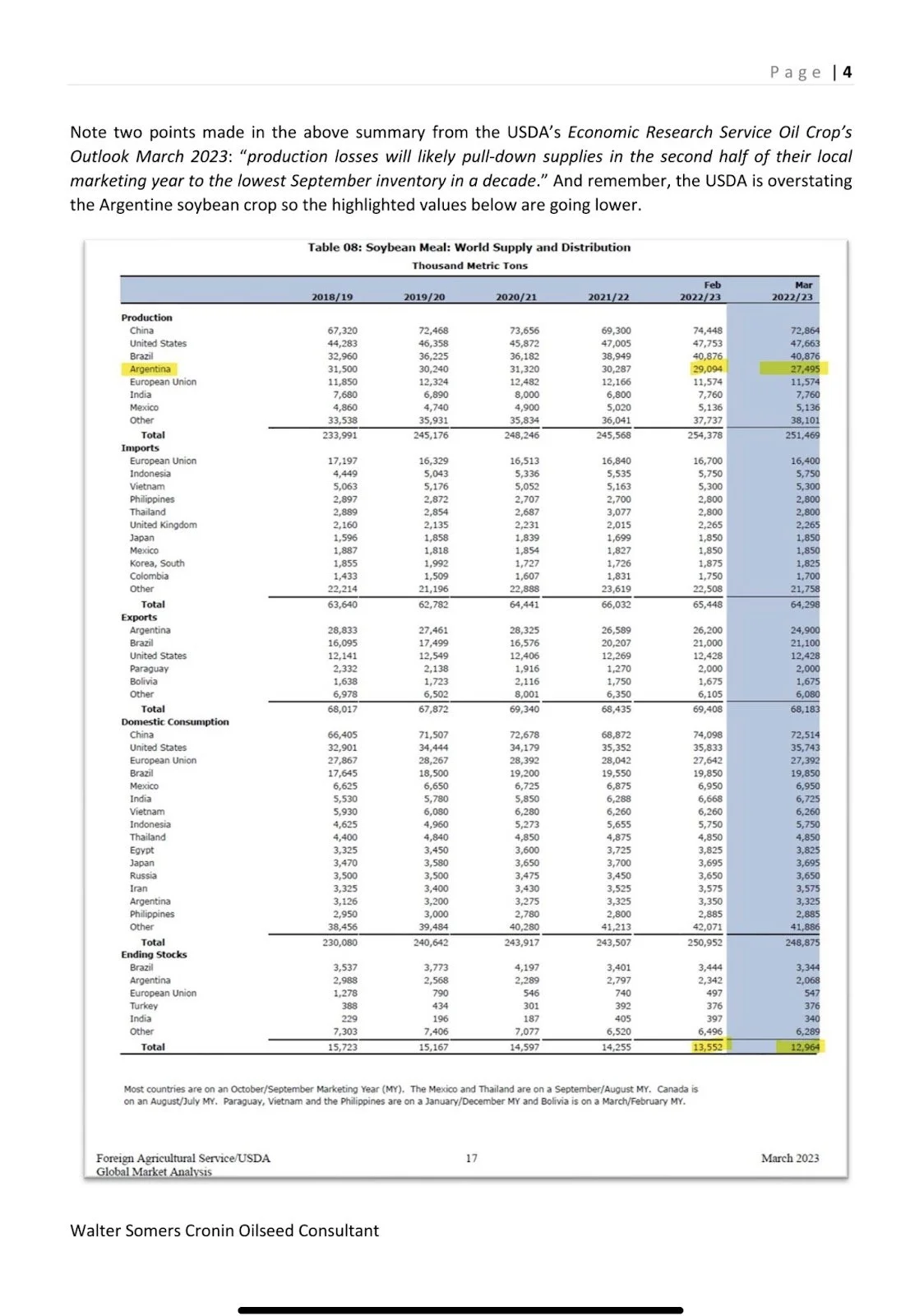

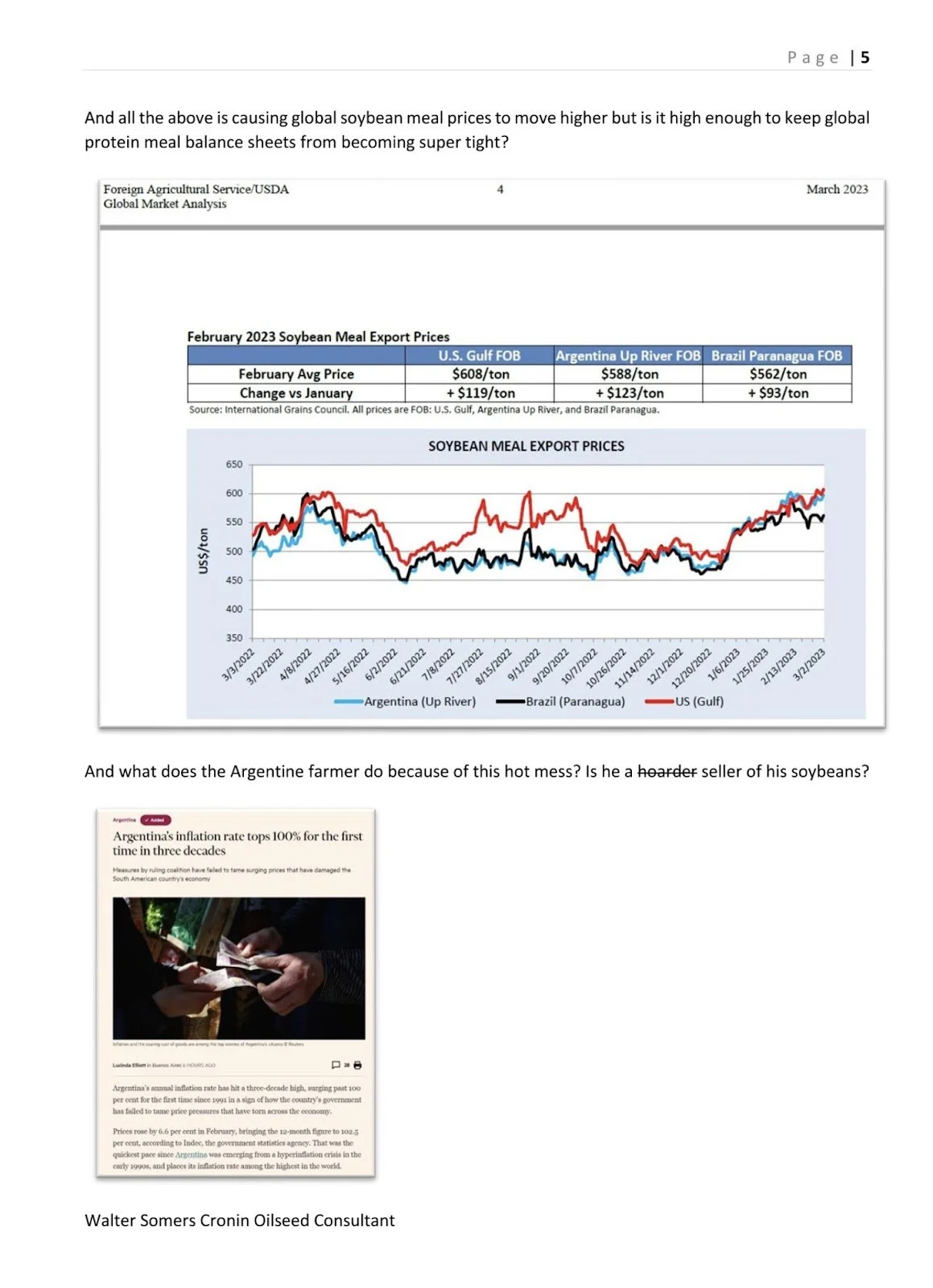

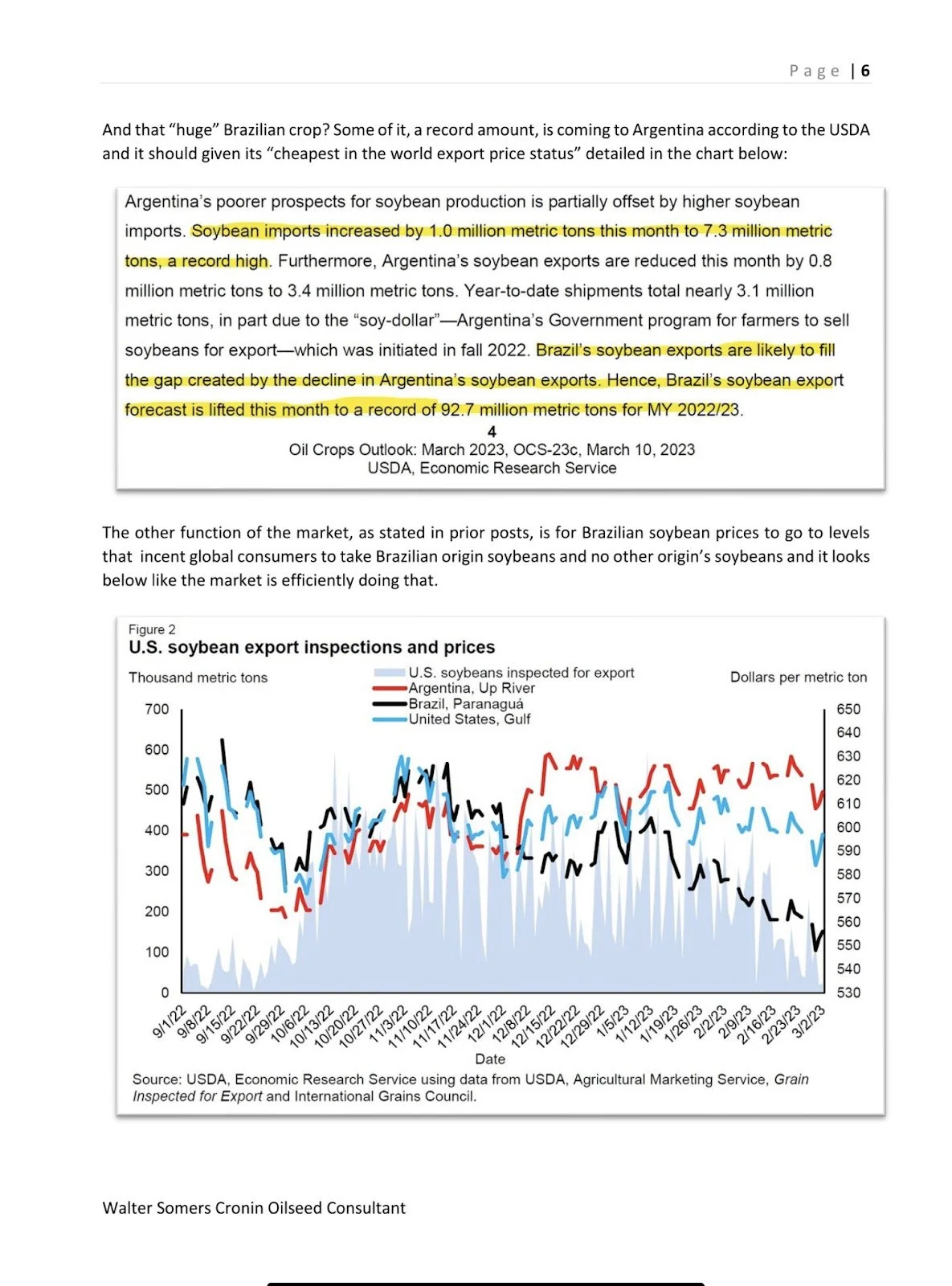

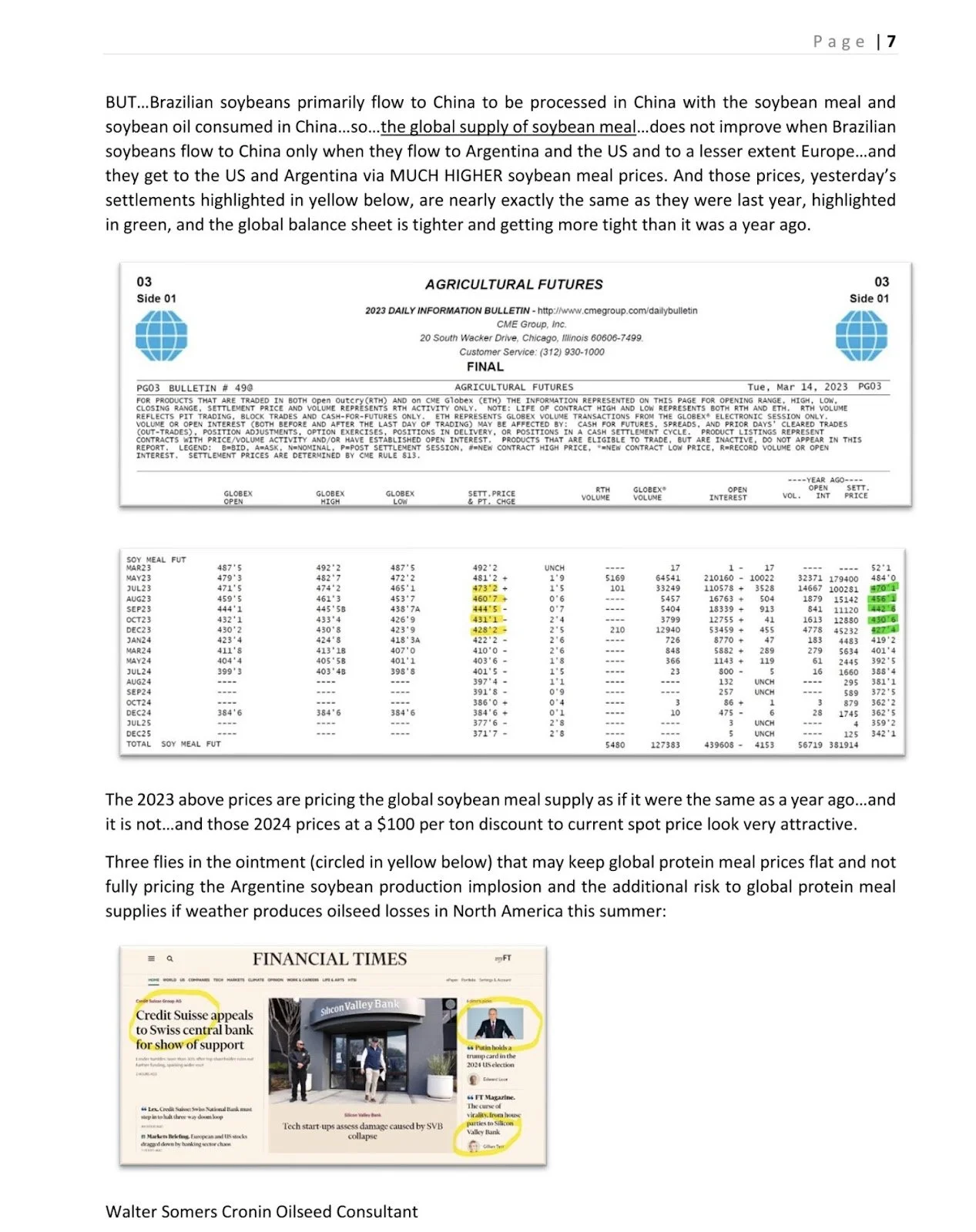

Below is from LinkedIn and Walter Cronin, it helps explain the supply not the right areas.

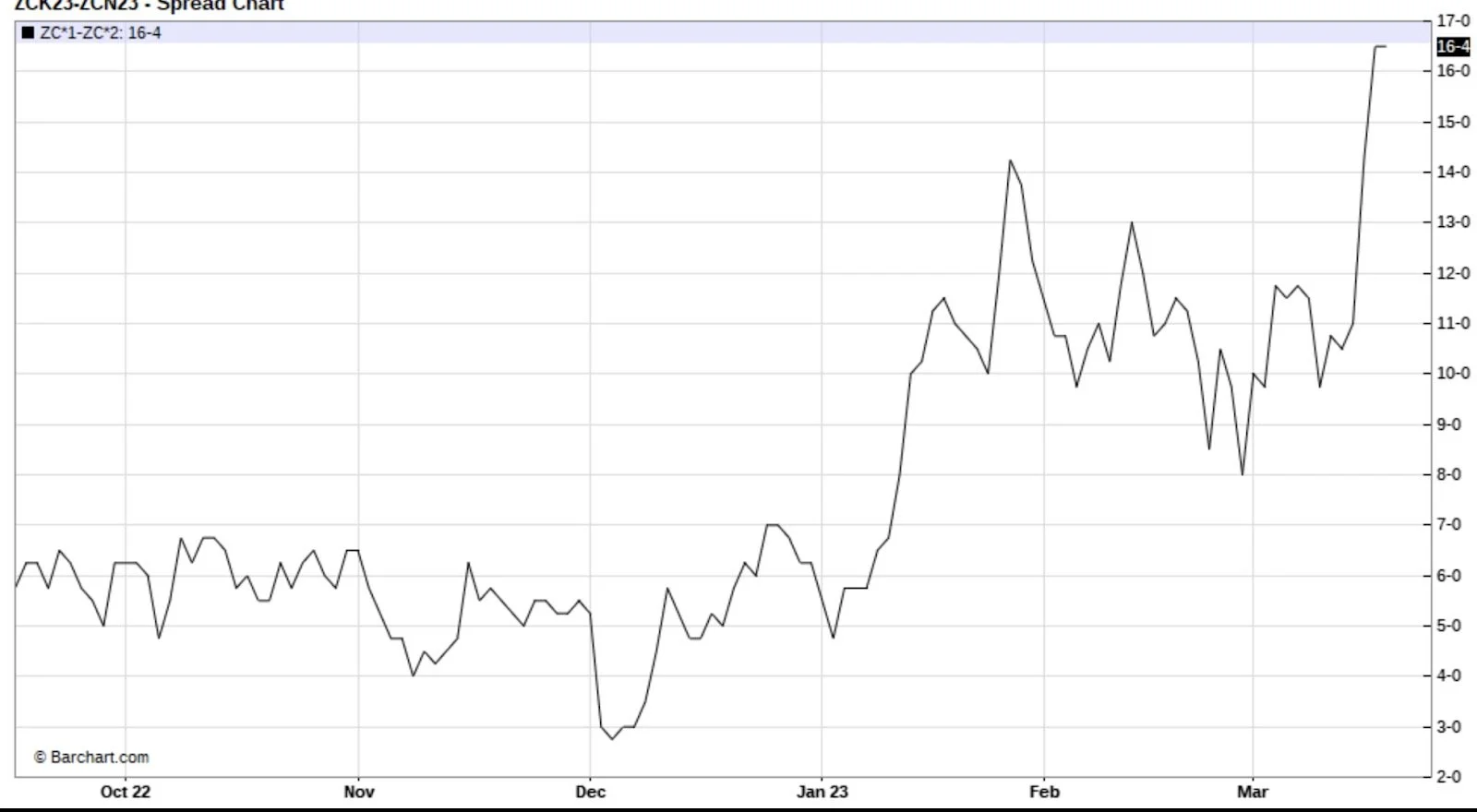

Here is the May - July corn spread chart, notice this shows strong demand with the inverse growing

Bottom Line

Bottom line remains to be patient making grain sales. But the number one rule for grain marketing is to be comfortable. So with some of the unknowns (acres, yield, demand, weather, etc.) out there like how the banking crisis will shake out as well as its impact, like always I have no issue for those that need to have some floors in for grains that they are growing. There is nothing wrong with making sales that make sense. But with the upside potential that we have along with the fact that we have more upside potential then downside risk. We strongly encourage putting in floors versus making grain sales. We don’t want to give supply away to buyers that are trying to make plenty of money. We want to sell when they are in panic mode so that supply won’t be there.

So those needing to put floors in, make sure you have a hedge account open and buy puts when that’s what gets you comfortable. Wait to make the sales when the market starts telling us to.

Charts

Corn 🌽

May corn is +28 cents off our lows from last Friday. Looking to test resistance at the $6.37 level. Bulls would like to see a close above the $6.37 and $6.40 range to justify a rally up to our 200-day moving average into the $6.60 area.

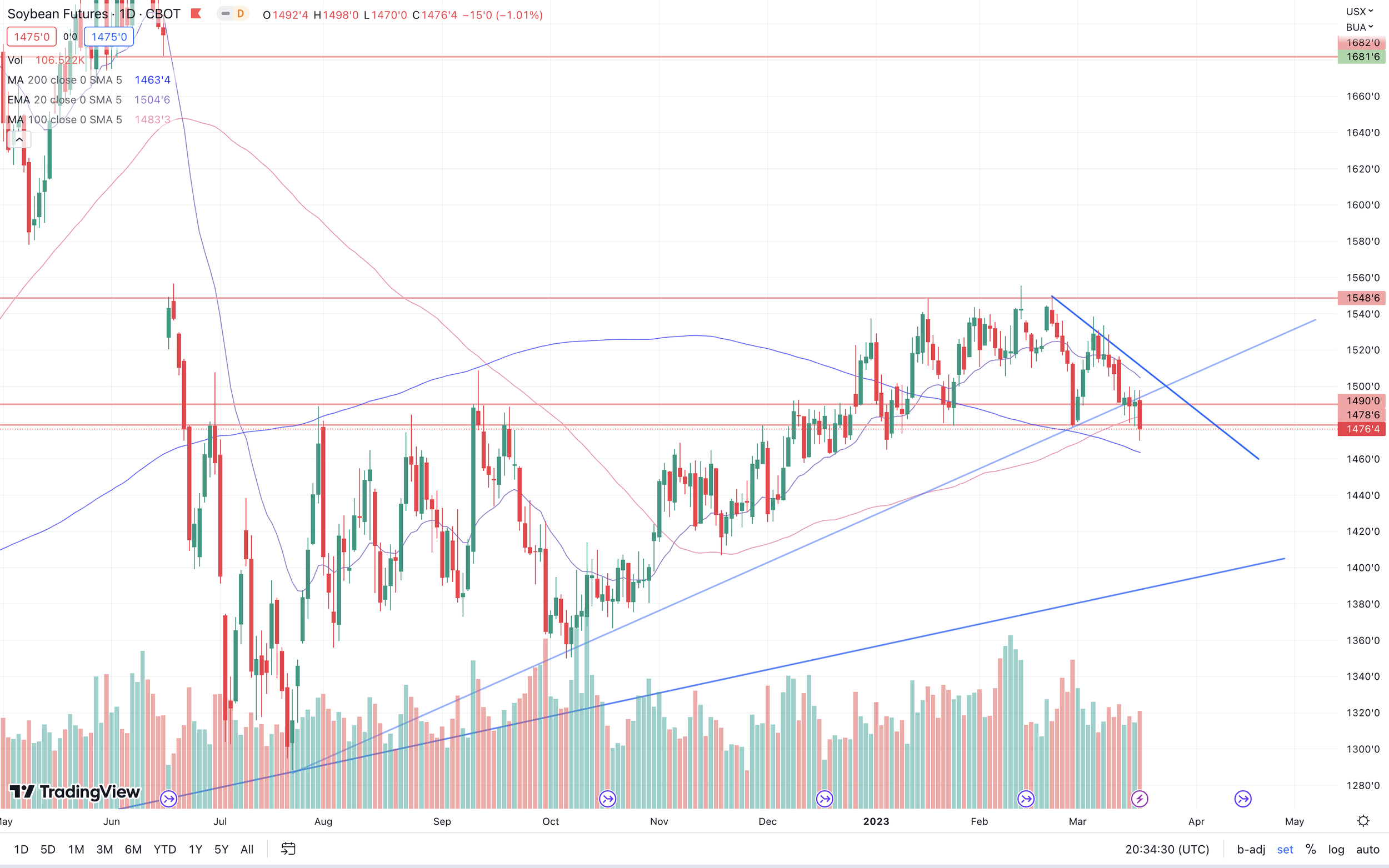

Beans 🌱

May beans have broke our long term uptrend and have now created a short term downtrend. We also broke our 100-day moving average. Bulls would like to stay above our 200-day moving average which is currently at $14.63.

Meal 🐮

Similar to beans, meal broke our uptrend from November, looking to test support right where we closed at the 4.66 level.

Chicago Wheat 🌾

Wheat continues its run, now nearly +50 cents off our lows just a week ago. I would like to see a close above $7.13 and our 20-day EMA to open the door to higher prices.

Crude Oil WTI 🛢

Crude continues its downfall, I wouldn’t be surprised to see us make another leg lower towards the $62 range or perhaps even lower into the $57 range before finding support. Check out yesterday’s market update for what another commodity technical analyst had to say about where he thinks the bottom is.

LAST WEEKS UPDATES

3/17/23 - Audio Commentary

Do We Have Enough Grain / Chinese Demand

3/16/23 - Market Update

Chinese Appetite Continues to Support Corn

3/15/23 - Market Update

Corn & Wheat Higher in Risk Off Day

3/14/23 - Audio Commentary

Will SVB Lead to Fund Buying in Grains

3/12/23 - Weekly Grain Newsletter