EXPLAINING RE-OWNERSHIP VS COURAGE CALLS

EDUCATIONAL AUDIO

(Sorry for no normal update today as we are traveling for a funeral. We will have a normal update sent in the morning)*

Re-ownership vs courage calls

What is the difference?

When & why should you use each of them

Explaining different scenarios

How each of these work in marketing

What NOT to do

How to utilize an inverse or carry

Those who have hard time pulling the trigger to make sales on weather scares

Beans hold must hold support (Chart below)*

Corn bounces right at 200-day MA (Chart below)*

Listen to today’s audio below

CHARTS

May Corn 🌽

Perfectly held the 61.8% retracement of the entire rally.

No concerns as long as corn holds the big red box. That is the must hold level.

It is 61.8% of the entire rally and also old key resistance (circled in red). We found resistance there 3 straight months in a row. It is now support.

To the upside, the next objective is $4.80

That is the 50% retracement of this sell off.

It is also that old key support (marked need to hold). We broke that support, so it is now resistantance.

If we can hold above that level, then the funds and algos probably step back in. But until then, it is resistance.

(We also bounced right at the 200-day MA. Scroll the view that chart)

The 200-day MA was resistance. It kept a lid on corn futures since 2023. (red arrows)

Then when after we broke above it in December, it then turned into support. (green arrows)

So this is a big support level bulls want to hold. We perfectly bounced off of it yesterday.

Finding a bottom at the 200-day MA makes sense.

If we break below, it would cause another leg lower.

Dec Corn 🌽

Finding support right at the 61.8% level of the entire rally. Finding a bottom here would make sense.

This level was also past resistance, now support.

Short term upside target is $4.60

That is 50% of the sell off.

It is also that old resistance where we topped out a few times (reference green box)

May Beans 🌱

Still holding that must hold support (red box).

This has been major support since August.

A break below here and there is no support until the contract lows.

Pretty much 2 things to watch:

1) A break below this support, we get a leg lower.

2) A break above the 100-day MA, means we probably found a bottom and go up to test the 200-day MA.

The 100-day MA has been key resistance several times. So breaking above it, should result in a leg higher.

An example of this would be that Jan rally (green circle). We busted above it, then turned it into support before heading up to that 200-day MA.

Nothing between this key support and the 100-day MA matters.

Nov Beans 🌱

Exact same set up in Nov as May beans. So no need to explain.

Also holding that key support. Need above the 100-day MA to call a bottom.

May Chicago 🌾

Not much to update.

Simply trapped int his channel.

Bouncing right where we should.

Next big resistance is the top of the channel.

May KC 🌾

Bounced right at key support.

Next big resistance is those old highs.

As we are simply trapped in a massive sideways range.

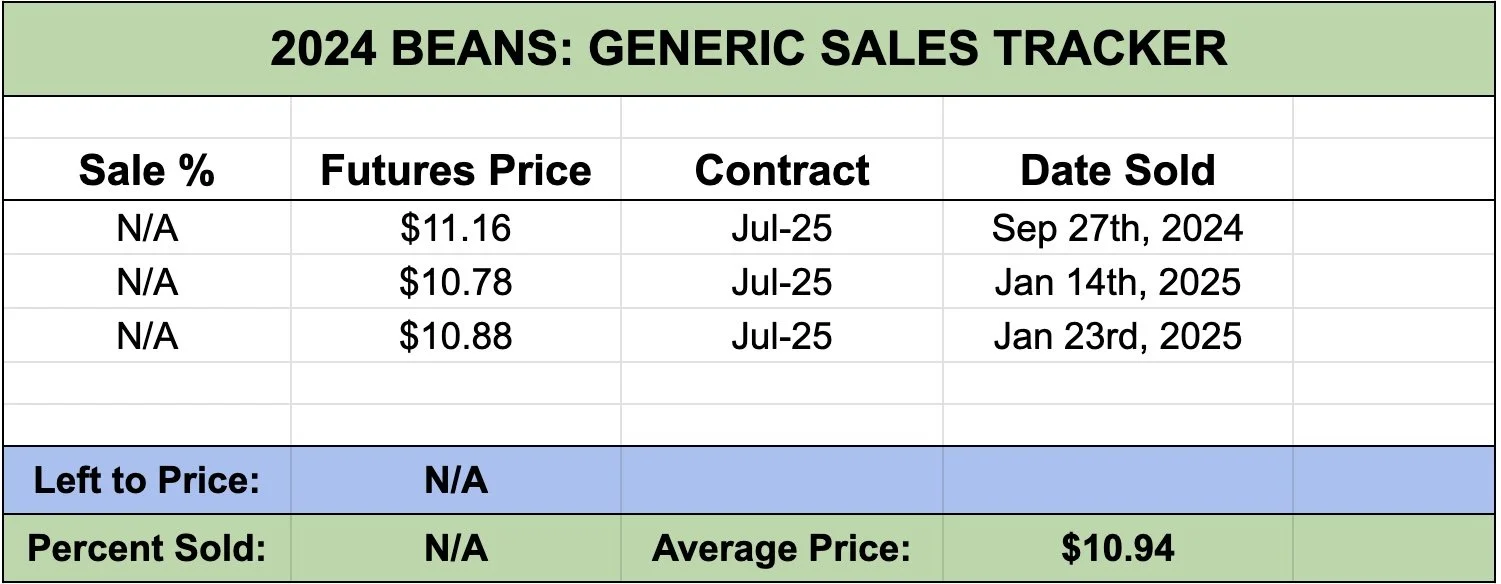

Generic Cash Sales Tracker

Due to requests here is our generic cash sales trackers.

This does not include any hedge recommendations etc. Simply cash.

This is futures prices.

For old crop there is no percentages as we only recently started tracking our generic sell signals. Future new crop sales will have percentages as we continue to make sales.

This will be included at the bottom of every update.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

3/12/25

TARIFF FEARS. EU, CANADA, & ETHANOL

3/11/25

USDA SNOOZE. RECORD FUND SELLING A CONCERN?

3/10/25

USDA TOMORROW. GETTING COMFORTABLE IN MARKETING

3/7/25

HOW TIGHT IS THE WORLD & US SITUATION?

3/6/25

TARIFFS PUSHED BACK. FUTURE OPPORTUNITIES?

3/5/25

IS GRAINS BIGGEST RISK WEAK CRUDE & DEFLATION?

3/4/25

TRADE WAR BEGINS. 8TH DAY OF PAIN FOR GRAINS

3/3/25

TARIFFS ON TOMORROW. BUY SIGNAL

3/3/25

BUY SIGNAL

2/28/25

WHEN WILL THE BLEEDING STOP?

2/27/25

CORN AT CRITICAL SPOT. USDA ACRE REPORT. WAY TOO EARLY DROUGHT TALK

2/26/25

HISTORY SUGGESTS CORN TOP ISN’T IN? ACRE OUTLOOK TOMORROW

2/25/25

POSITIVE CLOSE. WHAT TO KNOW ABOUT USDA OUTLOOK

2/24/25

USDA OUTLOOK, FIRST NOTICE DAY & BRAZIL

2/21/25

WHAT TO EXPECT MOVING FORWARD IN GRAINS

2/20/25

FIRST NOTICE DAY CONCERNS. MASSIVE CORN ACRES OR NOT?

2/19/25

HOW TIGHT IS THE CORN SITUATION?

2/18/25

MORE DETAILS ON TODAYS SELL SIGNAL

2/18/25

OLD CROP KC WHEAT & CORN SELL SIGNAL

2/14/25

WHEAT BREAKING OUT ON WEATHER RISK. TECHNICALS & FUNDAMENTALS

2/12/25

GLOBAL GRAIN SITUATION, ACRE TALK, CHARTS & MORE

2/11/25

USDA: NOT A BEARISH REPORT. DISAPPOINTING PRICE ACTION

2/10/25

USDA TOMORROW. LONG TERM PATH FOR SUB 10% CORN STOCKS TO USE?

2/7/25

WHY WOULD THE FUNDS EXIT THEIR LONGS?

2/6/25

WHEAT FINALLY CATCHING A BID

2/5/25

COMPLETE THOUGHTS ON MARKETS: BACK & FORTH DISCUSSION

2/4/25

STRONG JANUARY LEAD TO STRONG YEAR? TARIFFS, CHARTS & MORE

2/3/25

TARIFFS PUSHED BACK

1/31/25

TARIFF NEWS ALL OVER THE PLACE. ARE YOU PREPARED FOR POSSIBILITIES?

1/30/25

WHEAT BULL ARGUMENT. TRUMP ADDS TARIFFS

1/29/25

CORN APPROACHES $5.00

1/28/25

TARIFFS, CORN FUNDS, SOUTH AMERICA & MORE

1/27/25

HEALTHY CORRECTION WE TALKED ABOUT & TARIFF NEWS

1/24/25

GRAINS DUE FOR SHORT TERM CORRECTION?

1/23/25

OUR ENTIRE NEW CROP SALES THOUGHTS & OLD CROP SELL SIGNAL

1/22/25

GRAINS TAKE A BREATHER. IS CORN IN A BULL OR BEAR MARKET?

1/21/25

HUGE DAY IN GRAINS. WHAT TO DO WITH OLD CROP VS NEW CROP

Read More

1/20/25

VIDEO CHART UPDATE

1/17/25

TRUMP, CHINA, ARGY & USING THE SPREADS INVERSE

1/16/25

OLD CROP LEADS US LOWER. MARKETING THOUGHTS

1/15/25

SIGNAL & HEDGE ALERT QUESTIONS EXPLAINED. IS $6 CORN EVEN POSSIBLE?

1/14/25

MORE DETAILS ON TODAYS HEDGE ALERT & SELL SIGNAL

1/14/25

CORN & SOYBEANS HEDGE ALERT/SELL SIGNAL

1/13/25

USDA GAME CHANGER OR NOT?

1/10/25

BULLISH USDA FOR CORN & BEANS

1/9/25

USDA OUT TOMORROW

1/8/25

2 DAYS UNTIL USDA. BE PREPARED

1/7/25

THE HISTORY OF THE JAN USDA & MORE

1/6/25

MAJOR USDA REPORT FRIDAY

Read More

1/3/25

UGLY DAY ACROSS THE GRAINS

1/2/25