BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

Overview

Wheat rallied to new highs, up +20 cents at one point. Touching that target of $7.16 we had last week. However we failed to hold the gains, closing -26 cents off the highs at $6.93. The losses were mainly seen as profit taking, as the big money has been the main driver of this rally.

Corn and soybeans however remained strong, as soybeans nearly made a new high. Closing at $12.46. We haven’t closed above $12.50 since mid-January. A break above could open the door to higher prices.

Planting progress came in faster than expected Monday. Corn was 70% planted. Yet we are still higher.

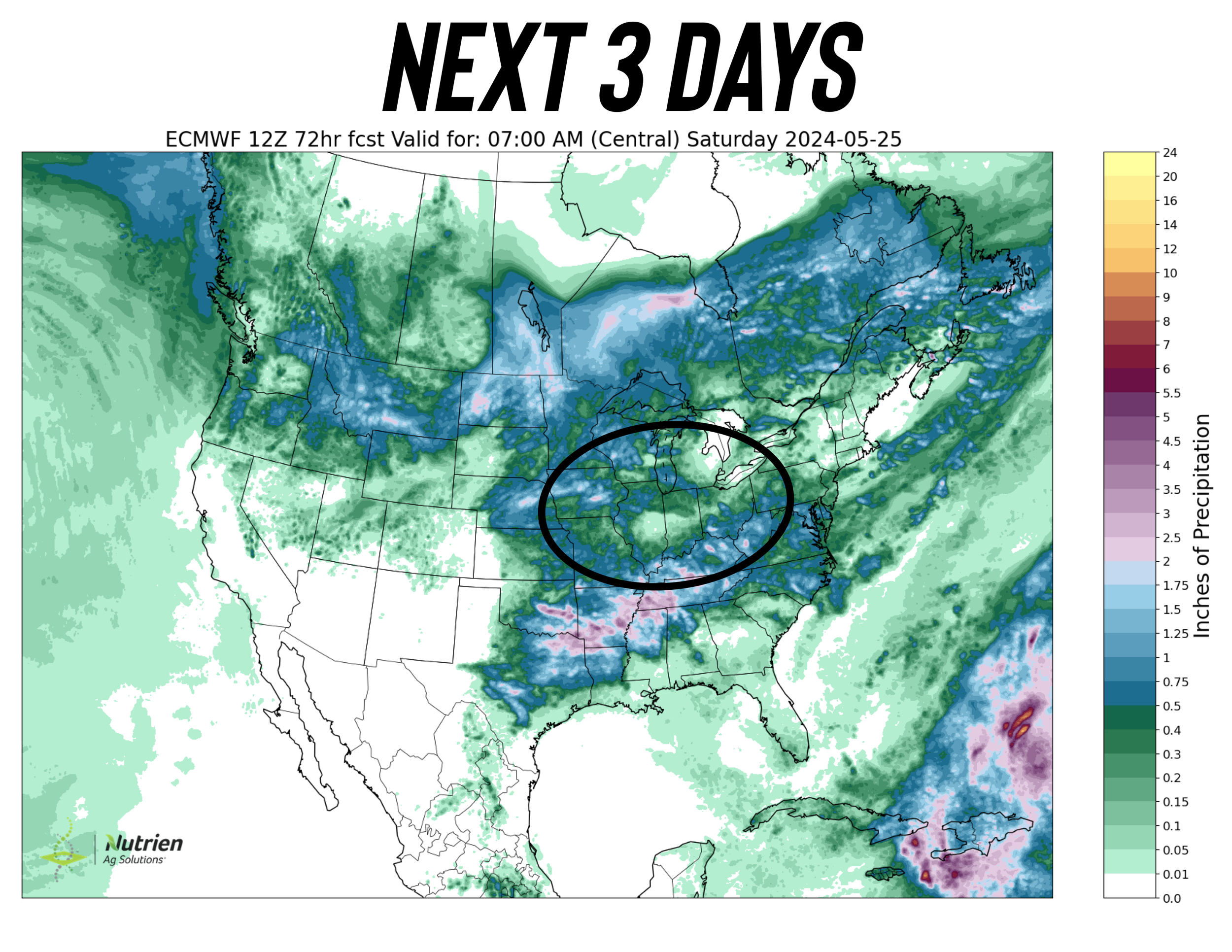

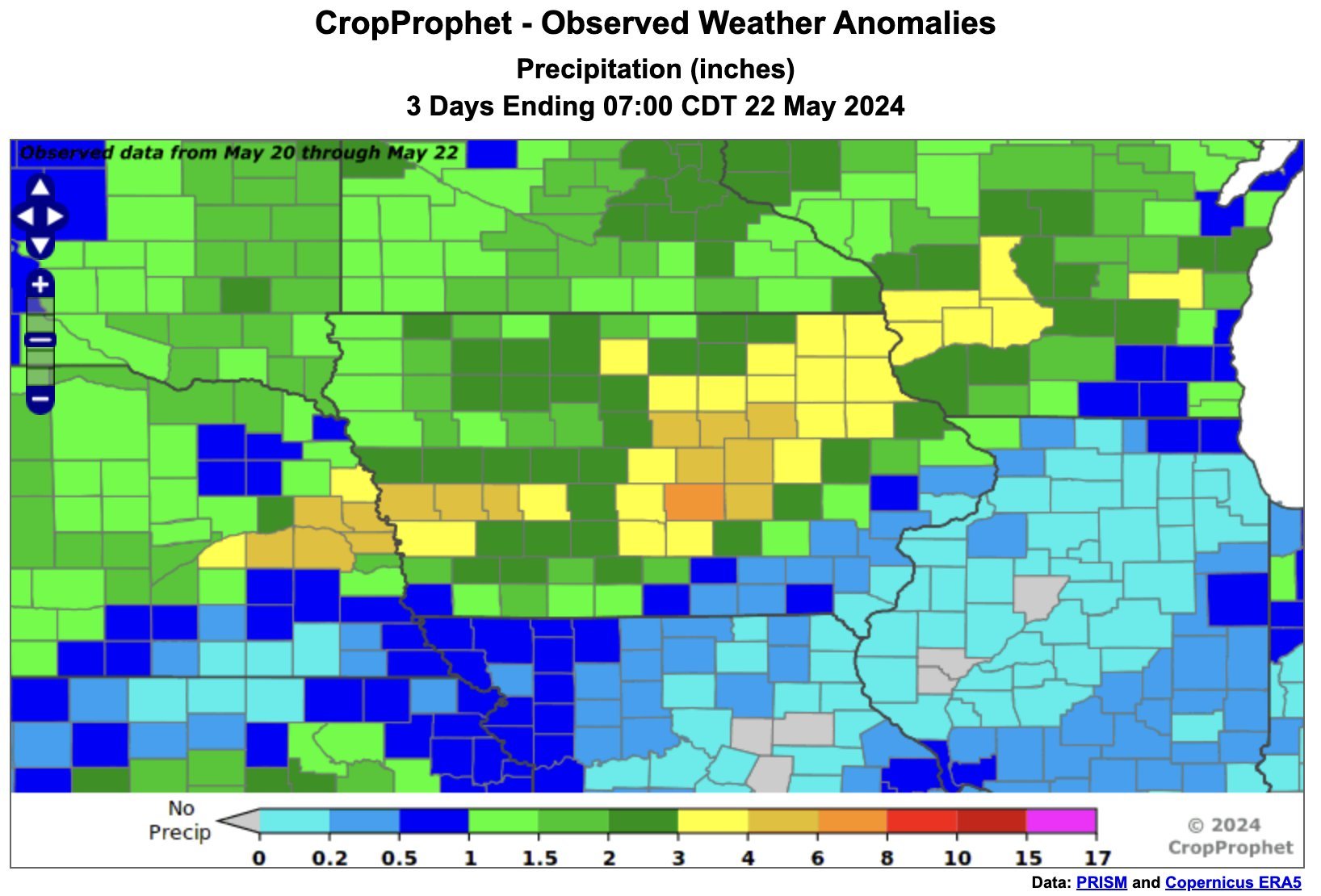

Future planting outlook is mixed. The eastern corn belt has been mainly dry the past few days, which should’ve offered a great window. The next few days should offer a window as well in the eastern belt.

However Iowa has had 3-8 inches of rain, with more on the way. This could be a drought buster for Iowa.

We have bred genetics that are able to handle a drought fairly well. Take last year for example. However, we can’t teach the crops to swim. Most would agree that a wet spring like this is far worse than a drought.

It's not so much the fact that we aren’t going to get the crops in. That isn’t really the concern. There is some concern about pushing the crop into a less favorable window, but we all know how quickly we can get things in the ground.

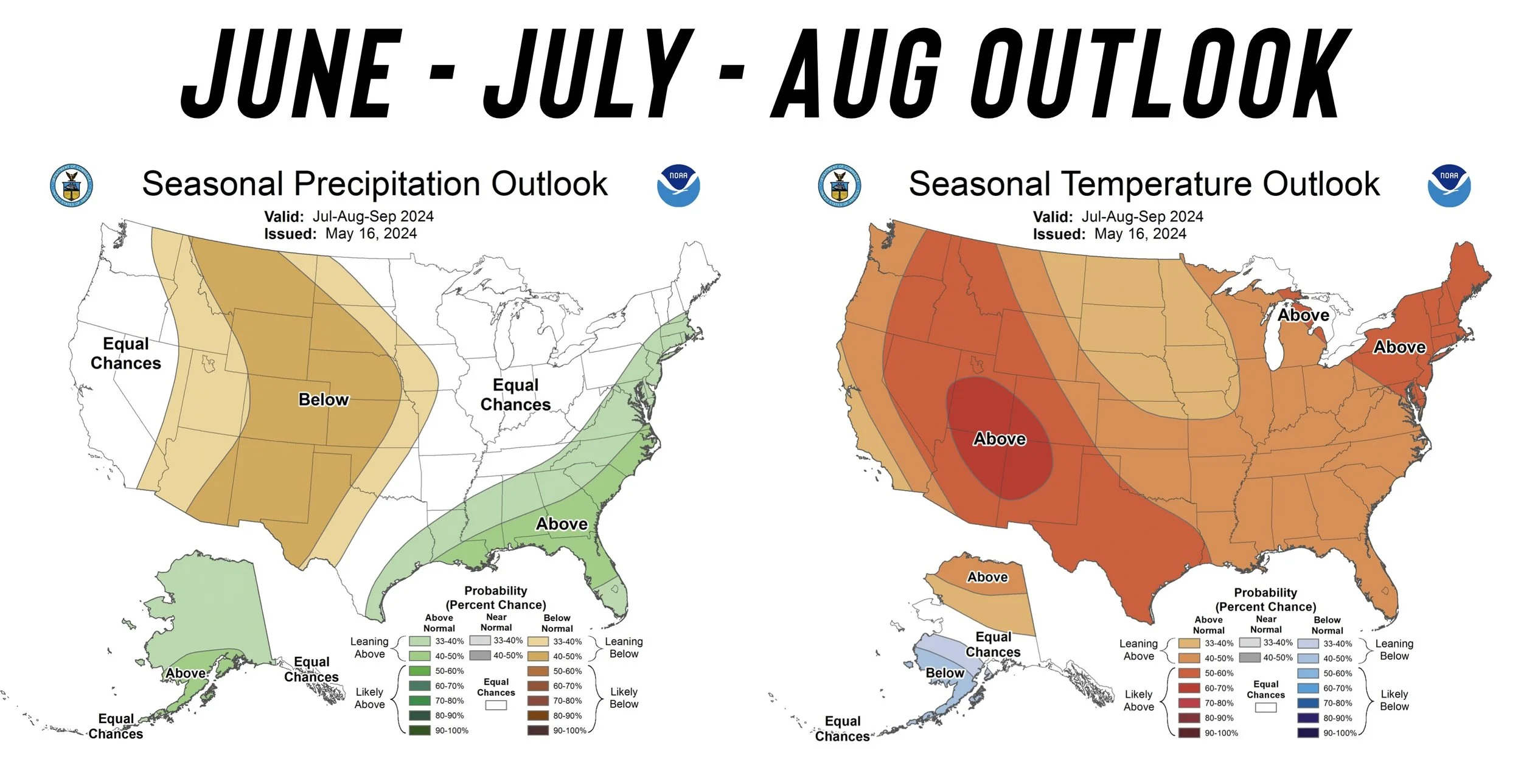

The biggest issue I see with this wet of a spring is mudding the crop in the ground. The compaction issues that come with that. Heavy rain springs require timely rain through out summer as well. Right now the summer outlook still points hot & dry with the La Nina.

Once crop conditions come out, Iowa is going to be looking at likely a sub 50% G/E for corn. When we get these conditions and they start coming in lower than last year, the market could get excited.

To go along with this, there is talk about potential prevent plant acres on corn.

Only part of this rally has been a "delayed planting rally". We have drought in central Brazil, flooding in the south. Cuts to Argy crop. The Russian wheat situation. And more than anything, this rally has been driven by the funds and technicals...

Let's jump into the rest of today's update...

Today's Main Takeaways

Corn

Good action in corn the past few days. Fast planting, yet we held in there.

As mentioned, delayed planting isn't the only factor I see driving this market.

You can’t mud a crop in then have a dry and hot summer.

Brazil is starting to harvest that second corn crop. Take a look at how dry the key growing region has been.

I posted this a few weeks ago, but the similarities between 2014 and 2024 are still there.

2011 was like 2021, 2012 like 2022, 2013 like 2023.

So far 2014 is stacking up just like 2024, only 2024 is a month behind.

This would suggest we have another month of two of gains. In 2014 we topped out around $5.20

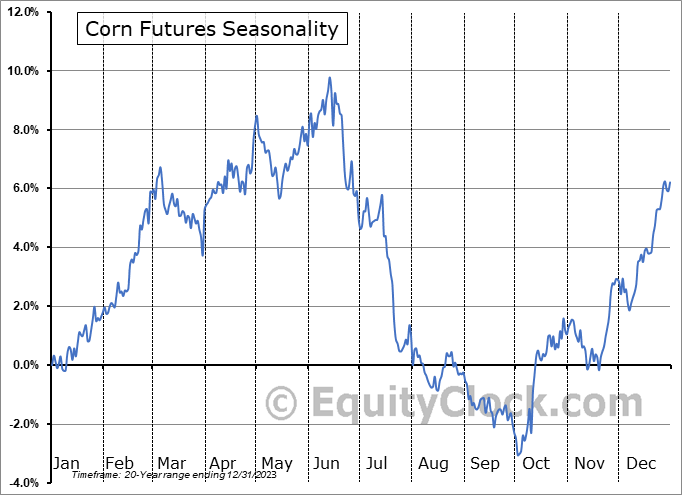

The seasonals also suggest 3-4 weeks of higher prices. No seasonals do not always work, but typically by mid-June we want to be done with old crop corn. And have anything that you can’t store for new crop corn priced as well. Typically we want to have this done by July 4th most years.

June 28th will be another big date to watch. As that is the quarterly acre report. Which could very well be negative, but time will tell.

Bottom line, I do think corn will make new highs within the next month. The funds are still short -70k contracts with room to buy. They are already long wheat and nearly long beans.

On the charts, we need above $4.75 on July corn. That would bring more buying. $4.85 is still my first target to take some risk off for July corn. Why $4.85? We chopped in a 25 cent range for two months ($4.35-$4.60) so the next implied move would be another +25 cents over $4.60.

Looking at Dec corn, that $5.03 gap is going to be a point of interest to look at taking risk off the table. Before gapping lower, we chopped in that area for months. Last week I suggested some take risk off the table when we traded $4.93.

Overall we will be waiting for a trigger to make sales in corn. Give us a call if you have questions about puts or sales or anything. (605)295-3100.

July Corn

Dec Corn

Soybeans

Soybeans lead the pack today. Nearly posting new highs.

One big headline today was that soybeans in China hit their highest prices of the year today. Equivalent to $15.27 a bushel.

We had a bearish USDA report not too long ago, and prices are right back near the highs.

Like we said after the USDA report. When we get bearish news but go higher, it is typically a buy signal. Vice versa when we get bullish news and trade lower.

The funds are now barely short soybeans, as it looks like they want to be long now. After going from record shorts. This alone is a sign. Big money is not longer betting we go lower here.

The funds are one of the biggest things driving this market.

One of the stronger tendencies in soybeans is the final stocks vs the USDA May estimates. They fall nearly every year. Something to take note of.

Not a ton of fresh news.

I think soybeans have upside, but for some of you it makes sense to lock in a worst case scenario using puts here on any unsold bushels. Give us a call if you have questions. (605)295-3100.

Beans have had higher lows for 6 days in a row now. They look extremely strong.

Take a look at the chart.

A break above $12.50 would look amazing and give us a lot of room to run.

We have not closed above there since mid-January. Once we take that out, it could be rally time.

That gap over $13.00 is going to be a point of interest to start scaling heavier into taking risk off. Like corn, will be waiting more for a trigger. But that's the target for now.

This bull flag breakout also has an implied move to $12.99

July Beans

Wheat

Wheat remains the biggest headliner in grains.

From Shawn Hackett:

"We just had the coldest temps on record in core Russian winter wheat areas followed by the warmest April/May on record. This combo has led to the worst frost damage seen in modern times. Now we have to deal with hot and dry conditions. The perfect bullish storm"

Take a look at this. These are IKAR's Russian crop estiamtes.

Feb/March: 93 MMT

May 3rd: 91 MMT

May 10th: 88 MMT

May 13th: 86 MMT

May 21st: 83.5 MMT

These estimates are dropping fast.

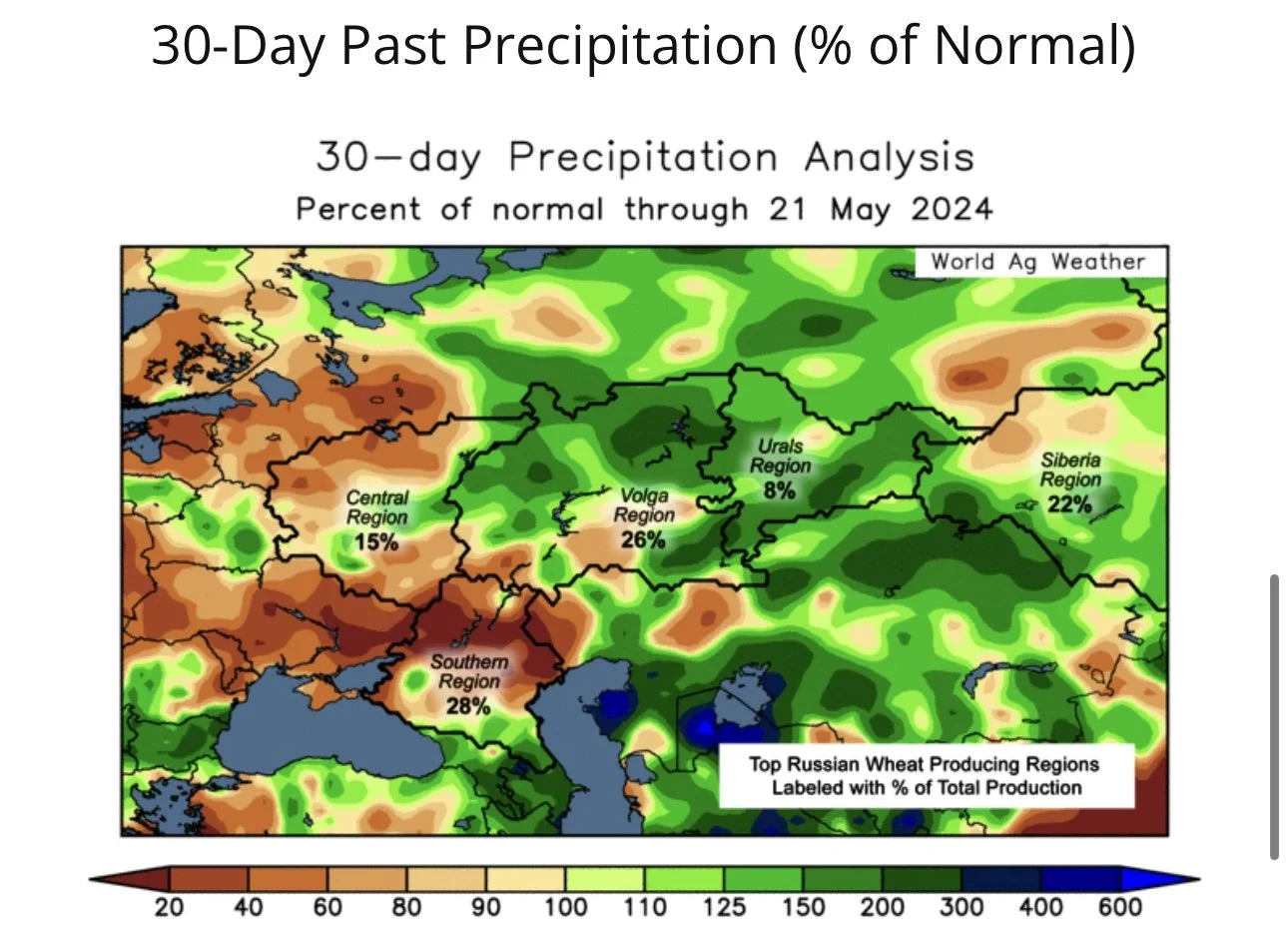

We continue to see cuts to the Russian crop due to the frost damage and dryness.

Remember what has held wheat back the past year or so? A cheap massive supply from Russia. This could potentially be a game changer.

Those areas that is experiencing dryness accounts for a massive amount of their production.

One may argue: "Oh but the winter wheat crops in the US are so good this year".

Which is true. They are great in comparison to last year. But this could be friendly for wheat. The last few years we haven’t had any wheat to export. If we actually have some to export, it could help our demand.

Grain Sale Alert: Wheat

You should have already received this alert. But today we made our first wheat sale of the year.

For those that have to move wheat soon or off the combine, or need cash.

We recommend scaling into protection or sales at the highest levels we have seen since July of 2023.

Grain marketing isn't one size fits all. Give us a call to go through specifics. (605)295-3100.

Everyone else told you to panic sell at the bottom a month ago. Not many people believed a $1.80 rally ($5.34 to $7.17) was possible. But we did.

Yes I still believe wheat has a lot of room to run. Especially looking long term. However, the price action today was not great.

If you look at the chart, we exactly touched that bull flag breakout implied upside move we had been talking about ($7.16). Never a bad idea to take risk off the table on 10 month highs.

If we can close above $7.00, (right at the 62% golden retracement from last years highs) the funds will likely want to continue to buy. It just feels like big money wants to send this thing higher. I could see this market going higher than anyone thinks, but manage your risk on a near $2.00 rally.

If you don’t want to make a sale, puts here might make sense for a lot of you. Create a worst case scenario.

For others that think this market is going higher and want to stay in the game, making a sale and using calls to re-own might be another option.

The market is currently $1.55 off the lows. An example would be to spend 15 to 20 cents or so on calls. Which would lock you in a guaranteed $1.40 or so of this rally. With the worst case being you lose the 15-20 cent value of your puts.

If you choose to do nothing and this market gives back half the gains, well you'd lose out on 80 cents instead.

Keep in mind this with this recommendation, if you are in a situation where you are selling because it is profitable or to take risk off it might make more sense to sell the carry in the deferred contracts rather than the nearby. Because there is a 50 to 60 cent carry in this market.

This is also one negative the wheat market has. This huge carry. This market is fund driven. Not commercial driven. If it was commercial driven there wouldn't be a carry and elevators wouldn’t pay you to store it for later. So to capture that carry you could sell the March 25 futures and wait for basis to improve, the market to remove the carry, or that time period to ship.

July Chicago

July KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24

WILL FUNDS BE FORCED TO COVER?

4/24/24

WHEAT CONTINUES BULL RUN & CORN FAILS BREAK OUT

4/23/24

FUNDS CONTINUE TO COVER & RALLY GRAINS

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24