GRAINS HIGHEST IN 4 MONTHS

Overview

New highs in the grains as the rally continues.

Corn and soybeans trade to their highest levels in 4 months, as beans rally +35 cents.

Wheat makes a new high for 2024, as it rallies +40 cents off todays lows.

So that means anyone who sold corn or beans since January, could have sold higher today than anytime in the past several months. The same goes for anyone who sold wheat this year.

And any of the funds who were selling short since, are now underwater.

While most were preaching for lower levels, we have been saying the opportunities were going to come in spring to early summer for months.

Soybeans are up +90 cents to start the month of May. Now over $1.00 of their April lows.

Corn is up +23 cents to start May, up +46 cents off the February lows.

Wheat is up +50 cents the past 3 days, nearly +$1.00 off their recent April lows.

All grains are now ABOVE the 100-day moving average.

Why are the grains rallying?

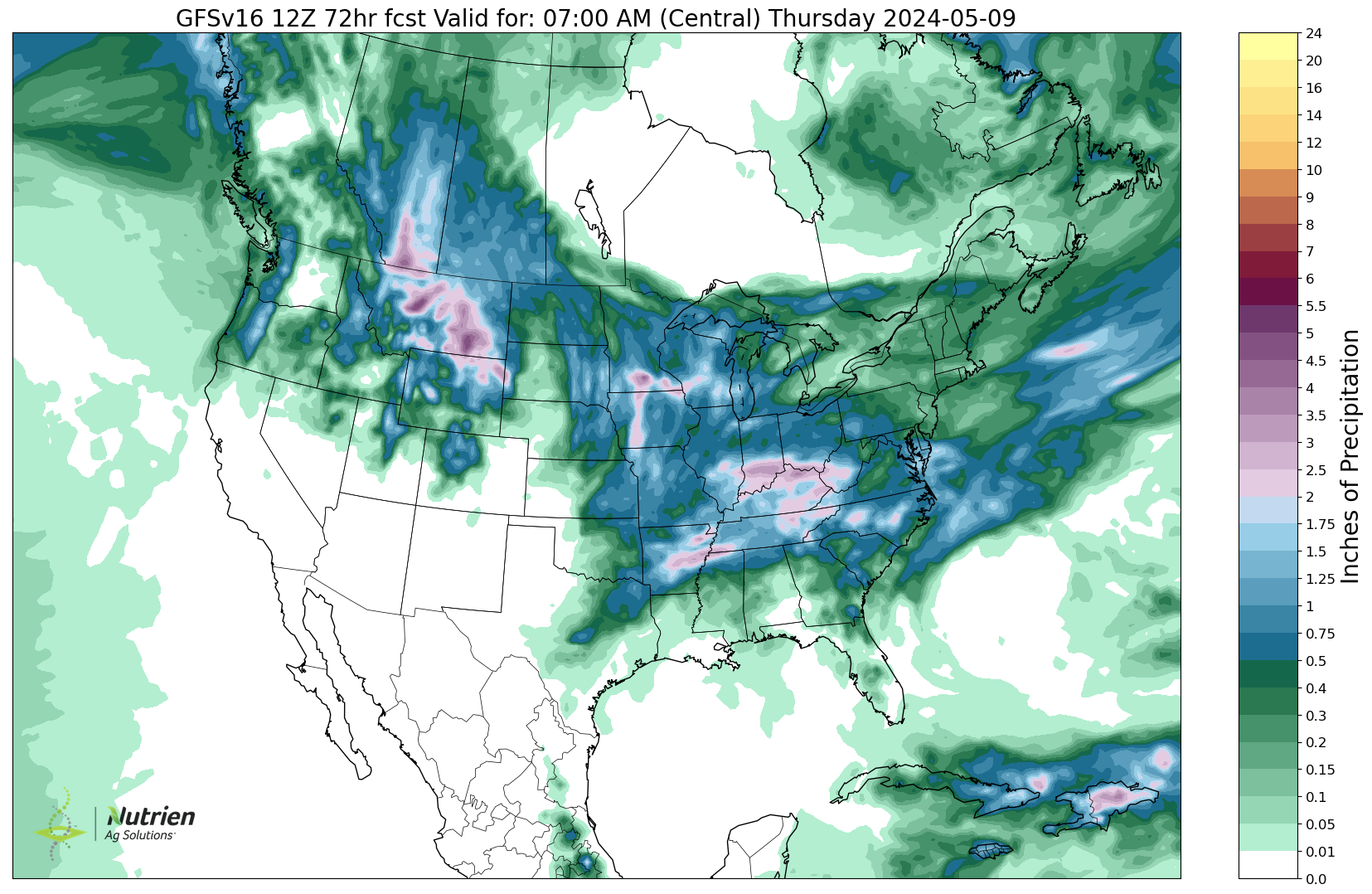

Corn

The majority of this corn rally has been short covering from the funds. We said this would happen, given that they have been holding a historically large short position for months, and that position hasn't been making money since February. They are still short over -200k contracts.

The funds are now nervous due to the thought of potentially late planting.

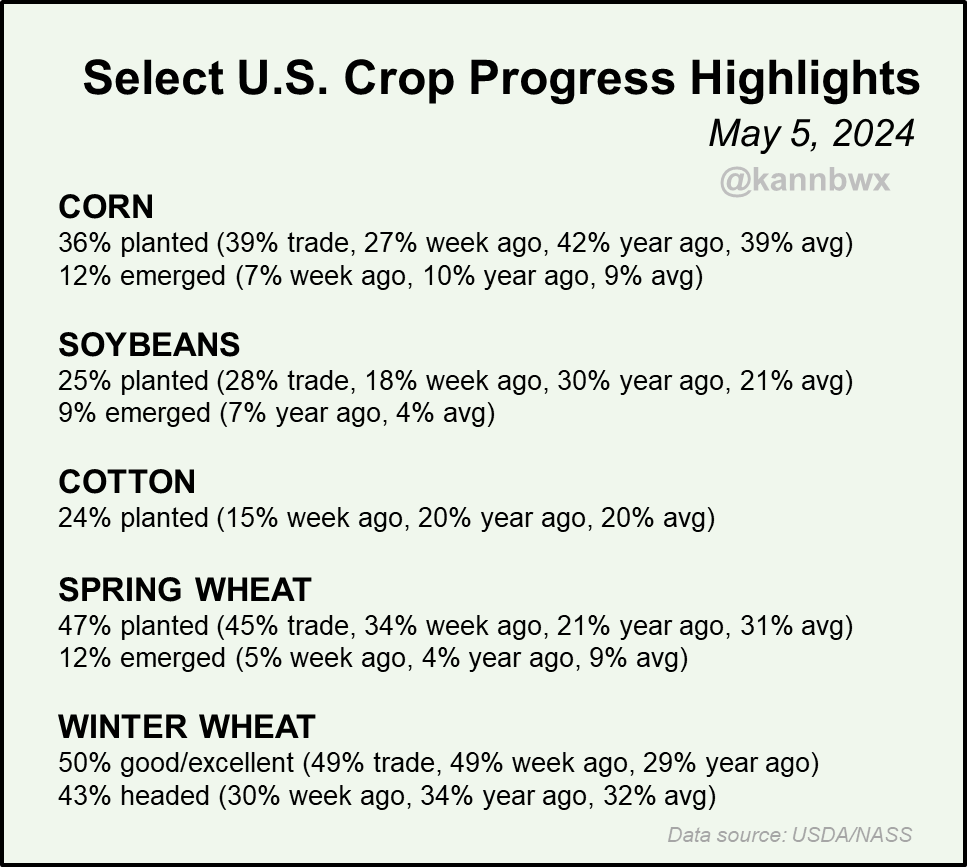

Planting progress today came in at 36%, which is now actually behind the average pace of 39% and slower than what the analysts were expecting.

I expect planting progress to come in even slower next week.

Chart Credit: Karen Braun

There is not a huge concern for delayed planting yet, as we are nothing close to 2019.

But the market is starting to take notice and price in the possibility.

Chart Credit: Grain Stats

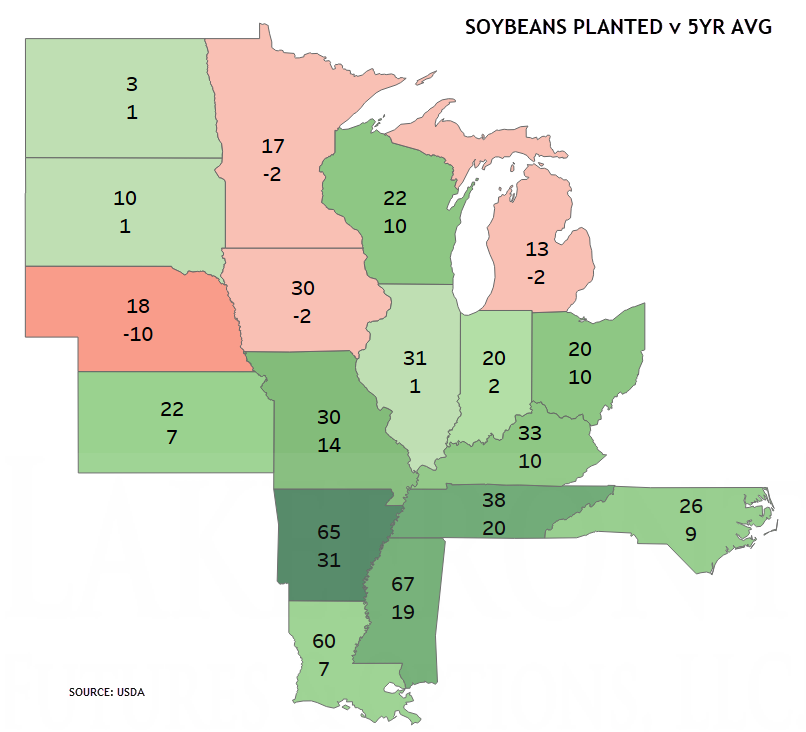

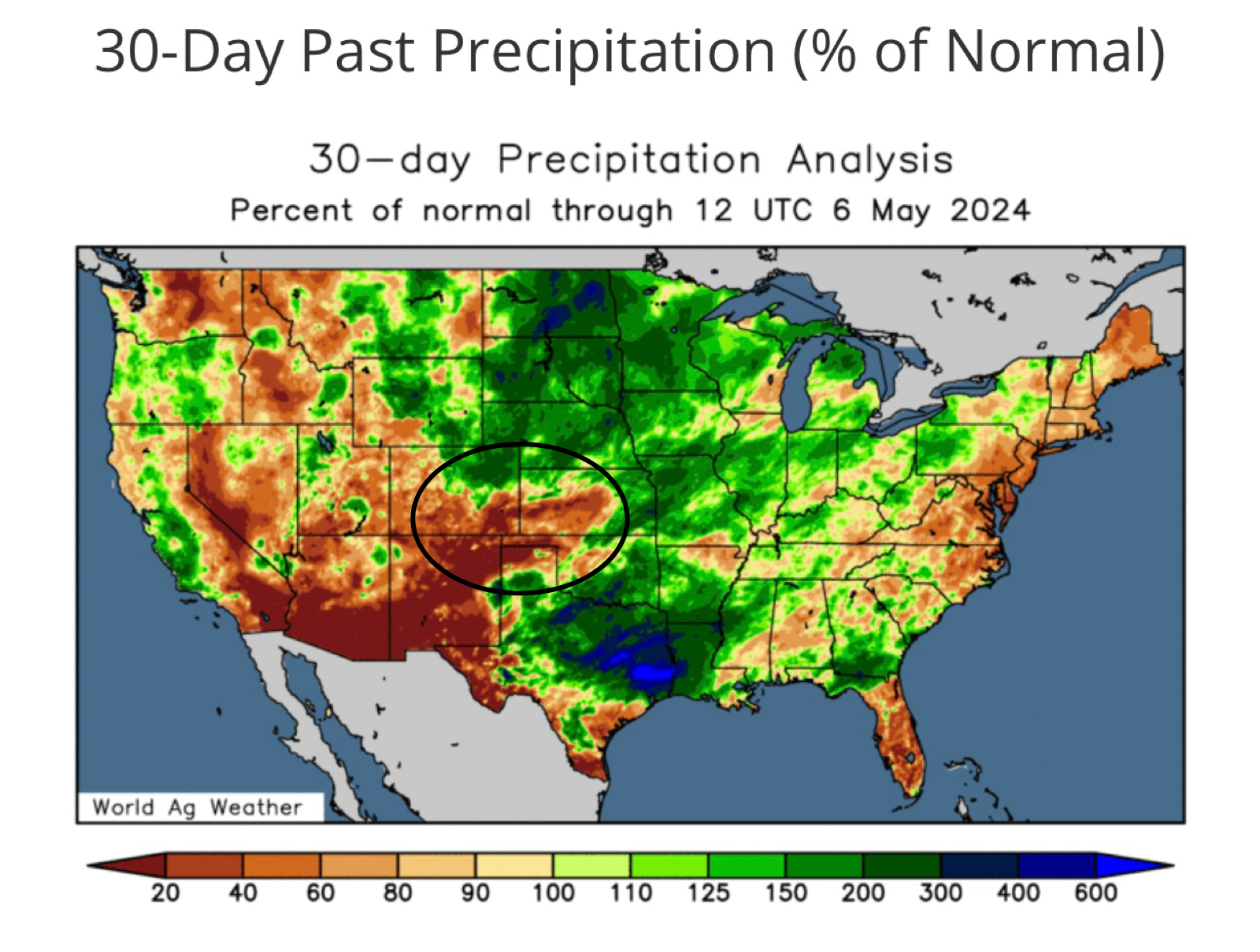

Planting is going to be slightly delayed and we are going to be getting rain in many areas the next 10 days. So field work will be slowed until around May 11th and the market is taking notice.

The funds are covering some of those shorts due to the "possibility" for this to continue. This is a "futures" market after all. It prices in what the future could look like.

Late planting can push these crops into a less favorable growing window. Especially given the fact that we are expected to get a La Nina to drive very hot and very dry conditions in the US this summer.

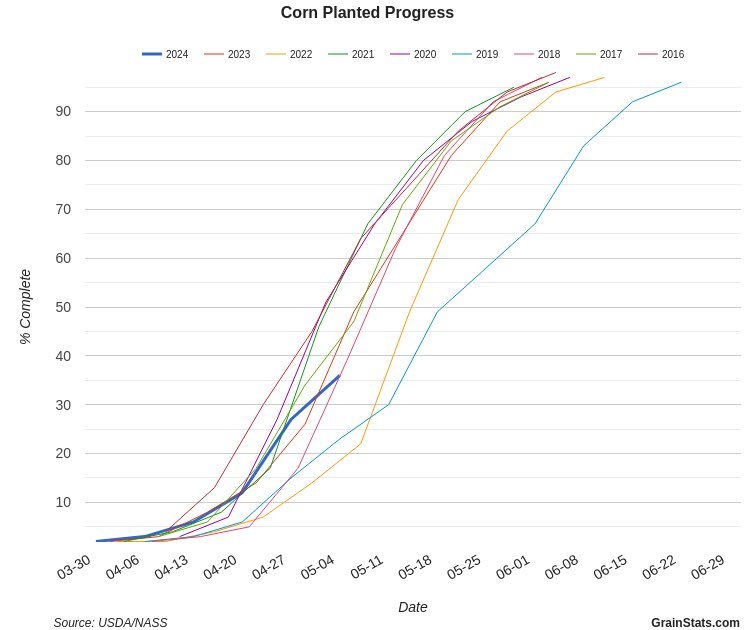

Overall, national planting isn’t that far behind. The concern is the eastern corn belt and the top producing states. The tops states of Iowa, Illinois, and Indiana are all seeing some struggle getting the crop in.

Chart Credit: Darin Fessler

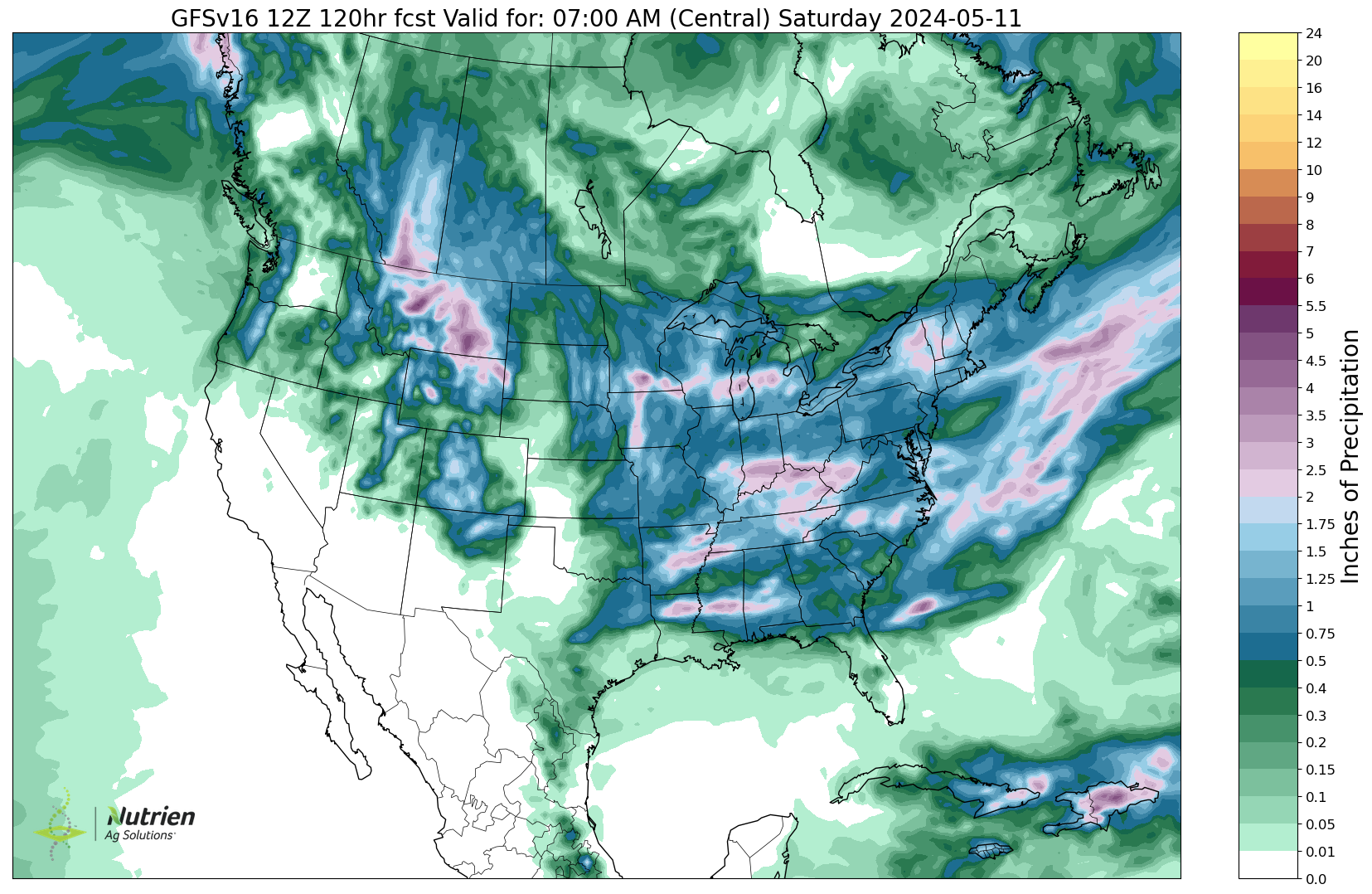

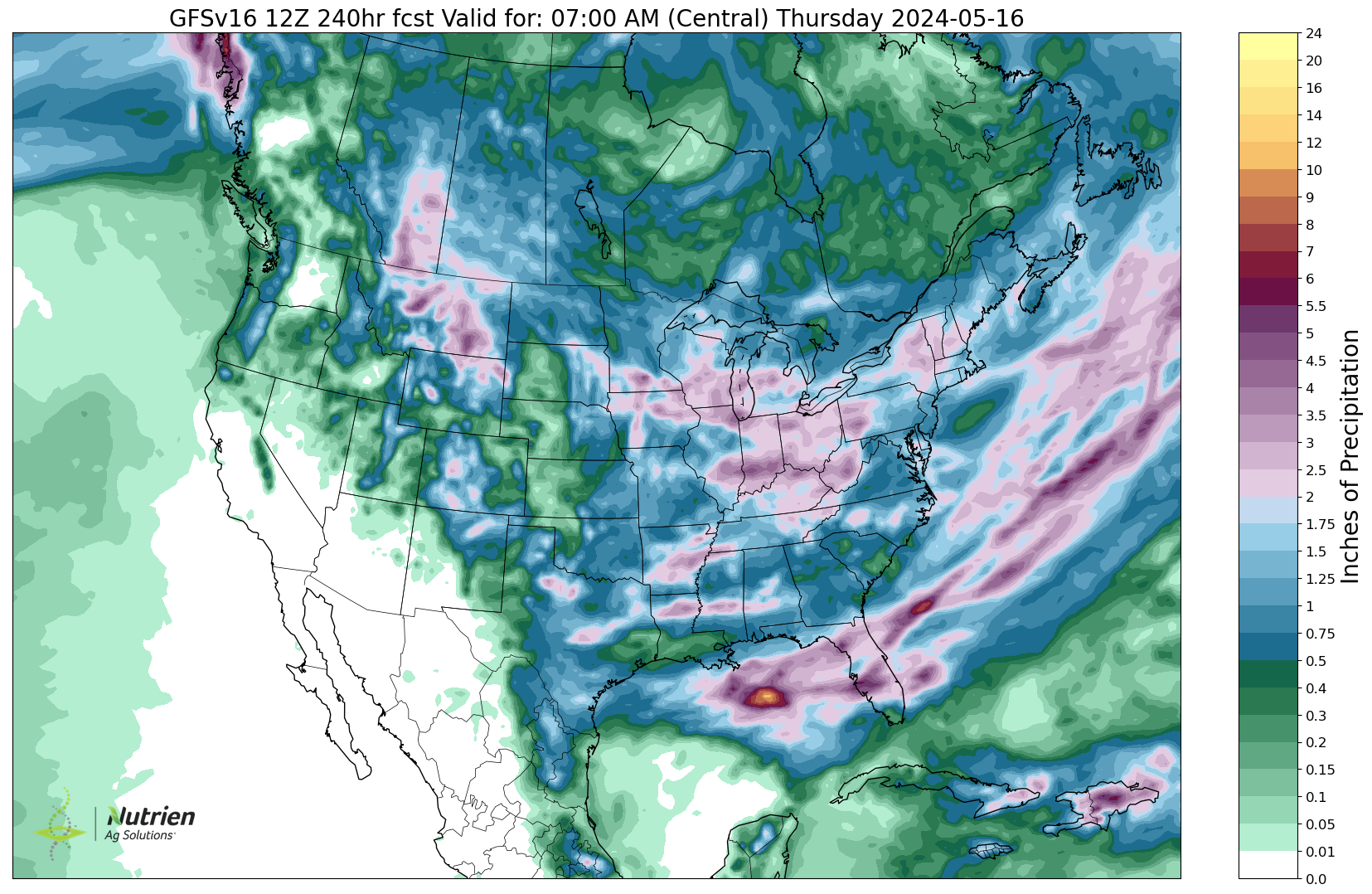

Here is the forecasts. Still pretty wet for the next week or two especially in those top growing state areas.

Next 3 Days

Next 5 Days

Next 10 Days

Last year we got spoiled with an ideal spring. When we go from that to this, it can cause issues. If this crop is still seeing delays 2-weeks from now, then we could continue to rally. If we find great planting window, then this market could pull back short term.

Not only does this push the crop to a less favorable window, but the bigger concern might be the compaction issues a wet spring brings.

Those issues don't go away, the only way to have an outstanding yield after this is if it rains all year long. If we go through a dry spell, there won’t be root structure and it's not going to yield as well.

Did I mention summer is supposed to bring potential record heat and dryness?

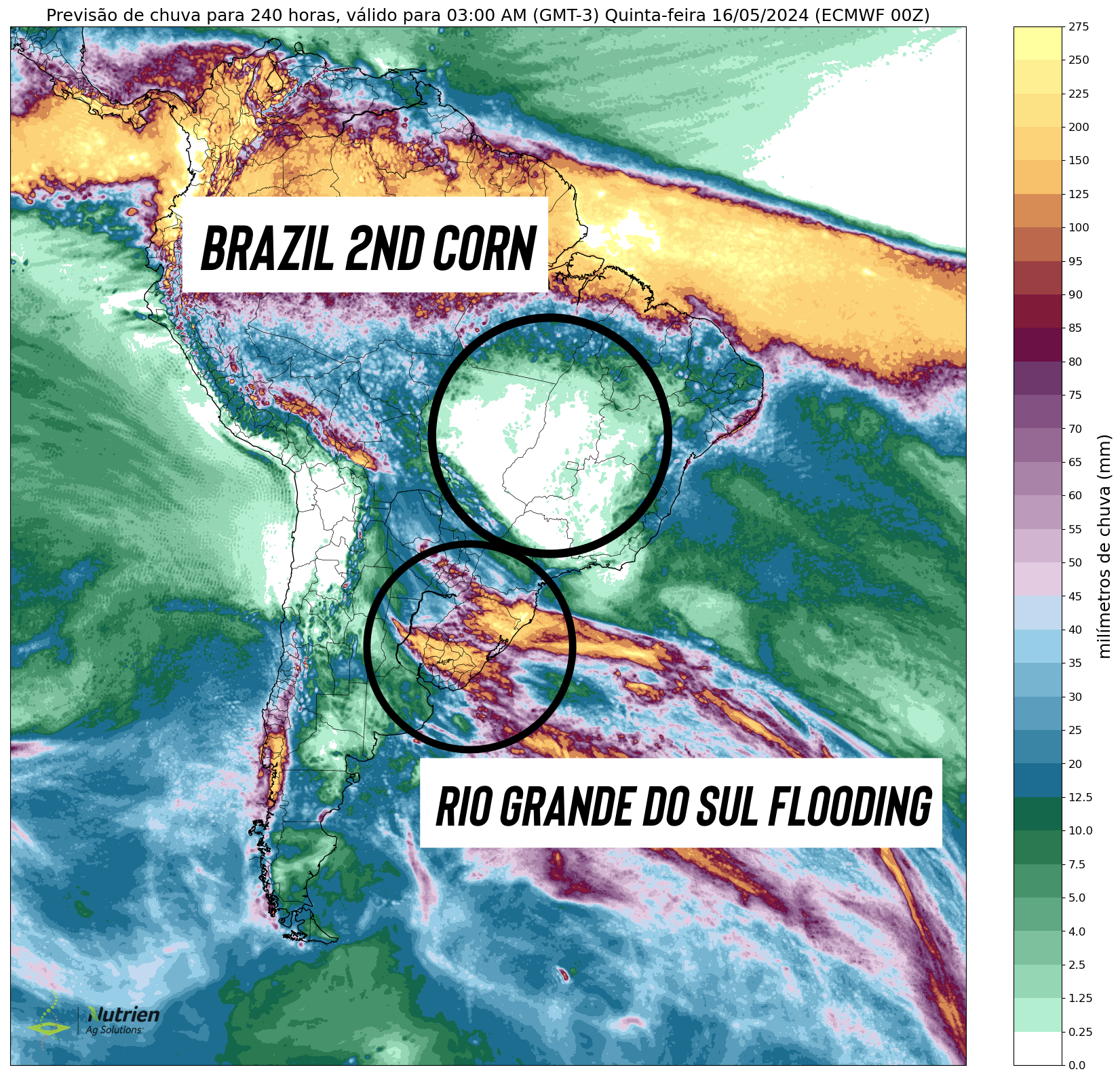

To go along with this potential delayed planting, something that we have been mentioning for months is the 2nd corn crop in Brazil.

The wet season for this crop is on the way out. In a normal year that would fine. As April is typically the prime growing season and May is where the crop matures and early harvest starts.

However, that isn't the case this year. I have been saying since last year that this entire crop is behind. The soybean planting was behind which pushed this crop behind. So the dry forecasts could be a real problem as the 2nd corn crop makes up 75% of total corn production.

Take a look at this map. Virtually no rain in the corn growing area. However, it is severely wet to the south, which brings us to soybeans..

Soybeans

Fund short covering is leading the way as now we have some problems in Brazil that are making the funds rethink their historical large short position. They are still short over -110k contracts.

The 2nd largest soybean producing state in Brazil is having it's worst flooding in over +80 years. About half of their soybeans are still in the fields as they try to finish up harvest.

These floods are serious. More than 100 people are missing, and 40 have lost their lives. Thousands are left without power. This is also the 4th flood this year.

Reuters expects losses of 2-5 million metric tons, with some saying it could be as much as 7-8 million.

Wheat

The main story is still dryness in Southern Russia. This is leading to Russia wheat export prices to rise. The biggest thing keeping wheat back all these months has been cheap supply from Russia.

Then we have France, who's crop is rated just 63% G/E. This is down from 93% last year.

We also still have concerns with the crop here in the US.

While most of the corn belt is experiencing a downpour, winter wheat continues continues to miss rain.

So who should and should not be rewarding this rally and how high can these markets go?

Let's dive into the rest of today's update and find out....

Today's Main Takeaways

Corn

The funds are finally starting to cover. We have all of these uncertainties.

We haven’t even actually seen that much short covering, and prices has had a decent rally. As the funds are still short -200k contracts. So there is still room to cover more.

We have planting concerns, Argentina crops getting hit with disease, dryness in Brazil, and the funds still heavily short.

The next 45 to 60 days are going to be when we likely make the highs in these markets.

If you take a look at the chart, we closed above the 100-day moving average for the first time since last July. With our highest close since January. This should force the funds to continue to cover more of those shorts.

If things dry out, this market could take it on the chin short term. If the delays continue, then we likely continue higher.

Longer term towards June, I still believe we are going to see a weather or drought driven story that will provide opportunities.

The market just has to believe that a 172 or so yield is possible for just a few weeks. It does not have to actually happen. The USDA giving us a starting point of 181 gives us all the more power to see yield come up short.

If we do raise a great crop, there is the risk we go a lot lower come fall.

Nonetheless, we want to be making sales when the market is unsure what we are going to raise. When everyone is screaming for $6 or $7 corn and it feels like we won’t go down. We are not there yet.

If you are someone who does NOT have storage, there is nothing wrong with adding protection and being more aggressive than those who have time. Those who have time, we want to be patient and have our finger on the trigger.

That is why we had those courage calls bought the past few months, to give us the courage and better ability to make sales without having to time the top perfectly.

As I mentioned, this delayed planting could make a potential drought even worse. One month of constant rain isn't going to last all summer, and the outlook is still very hot and dry.

I do believe there is more upside. I will let you know when we get that trigger to make sales.

The charts look like an upside break out. Our next resistance is around the $4.90 area on July corn.

July Corn

Dec Corn

Soybeans

Soybeans went from near 2024 lows, to the highest levels since January in less than a week.

The funds still hold a historically large short especially for this time of year. They are realizing that was the wrong choice.

We have the problems in Brazil. We have an entire growing season here in the US, with a carryout situation tight enough to where we can’t afford to lose any yield or things will get tight extremely fast.

For Fridays USDA report, it might be time for the USDA to start cutting the soybean carryout by increasing the crush. Crush has been incredibly strong and I don’t see why they won’t add more on the crush side.

Soybeans closed above the 100-day moving average along with corn, which should spark more fund buying.

Our next major resistance might be the $12.90 area which is the 200-day moving average and then that gap over $13.

Chart looks very strong.

There is nothing wrong with rewarding a $1.00 rally, but I am being patient waiting for a trigger. Seasonally, soybeans trend higher until June and sometimes July. However seasonals aren’t as accurate in beans as they are corn due to Brazil being such a big player in beans.

For those that do NOT have storage, you should be ready to pull the trigger. It might even make sense to perhaps buy some puts and give yourself a worse case scenario. Give us a call if you want to discuss your situation and want specific recommendations. (605)295-3100.

July Beans

Wheat

Wheat rally continues, now $1.00 off the lows.

Should you be rewarding this rally?

If you do NOT have storage or know you will have to be moving something soon or will be forced to sell wheat off the combine, you should reward this rally or add protection with puts to give you a worst case scenario.

For those that can sit on wheat forever or a year or two at a time, there is nothing wrong with taking advantage of this rally. However, I still am waiting for a trigger to say the top is in, as I think we have more room to run.

However, I do like grabbing puts and putting in a floor $1.00 higher than where we were just two weeks ago. For a lot of you.

Something to keep in mind is that historically May is one of the best times to sell wheat.

So please give us a call if you have questions regarding your situation and want to go over things (605)295-3100.

With crop progress showing winter wheat improving slightly, I wouldn’t be surprised to see us take a breather here.

The charts look very strong, we closed above the 200-day moving average in both Chicago and KC, which should spark some more fund and technical buying.

If you want a long-term target, $6.99 on July Chicago wheat is the 61.8% retracement level from our highs last summer. Often times this retracement level is referred to as the "golden retracement".

July Chicago

July KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24

WILL FUNDS BE FORCED TO COVER?

4/24/24

WHEAT CONTINUES BULL RUN & CORN FAILS BREAK OUT

4/23/24

FUNDS CONTINUE TO COVER & RALLY GRAINS

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24