USDA TOMORROW

Overview

Grains finally see some life led by wheat.

Looks like mostly a relief bounce and fund repositioning going into tomorrow’s USDA report.

CPI data came in at 3.0%, lower than the expected 3.1%. So this helped pressure the dollar and was a small friendly boost to the grains.

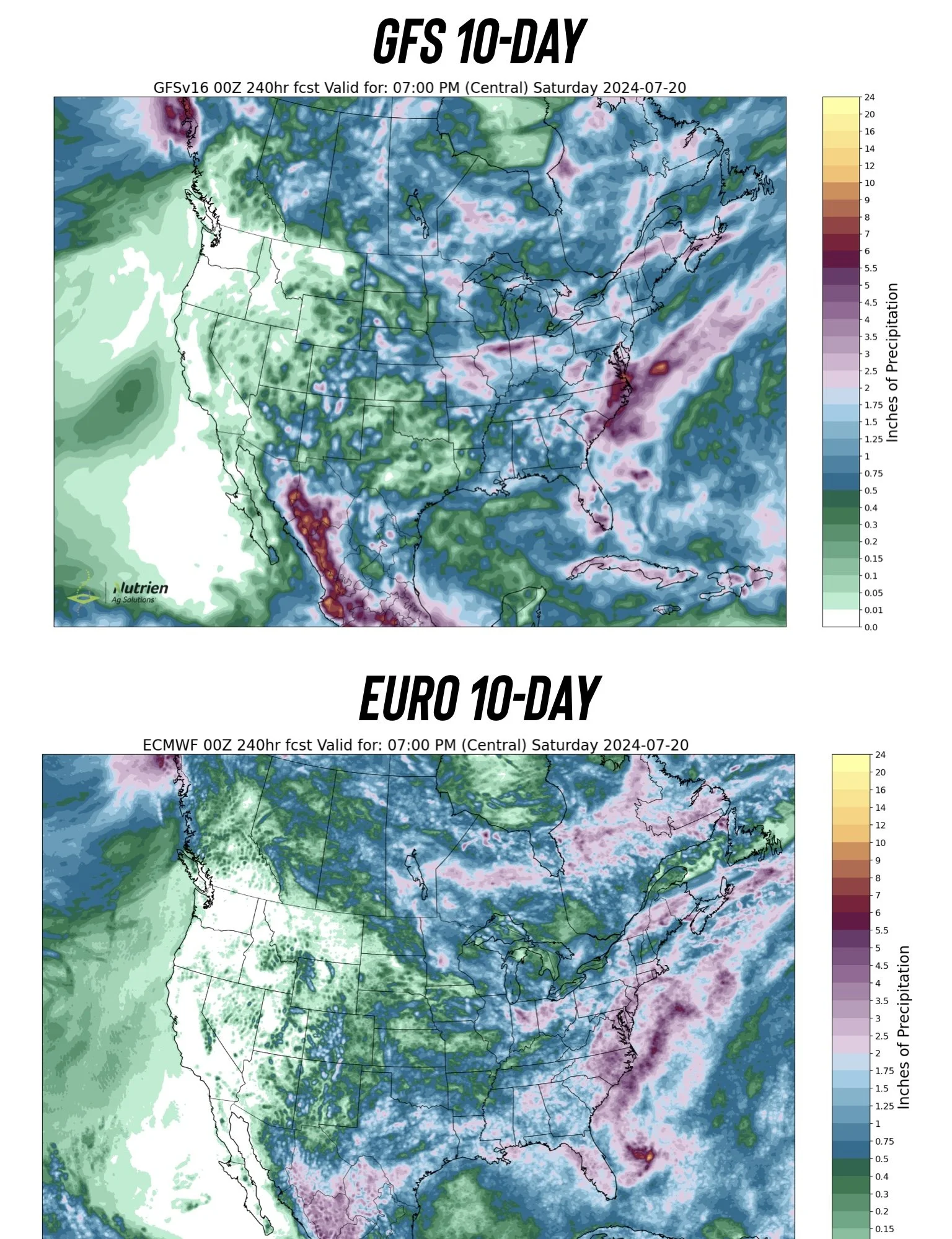

Currently the weather looks ideal for most of the corn belt, as it is expected to dry out the next 10 days following the timely rains that the hurricane brought to the eastern corn belt.

Kansas and Nebraska however are expected to be very hot and very dry with temps +100 and little rain.

These recent rains were very timely for the crops. Potential for that typical weather scare rally is pretty much gone as we get into mid-July.

Yes, soybeans are made in August, but they typically do not react to weather in August like corn does in the summer months. The outlook for late July into early August also offers rain currently.

The market will start trading less and less weather from here on out unless something crazy happens.

Look at the received rain vs the areas that needed rain and you can see just how timely they were.

Rain Past 3 Days vs Drought Monitor

Rain Forecasts

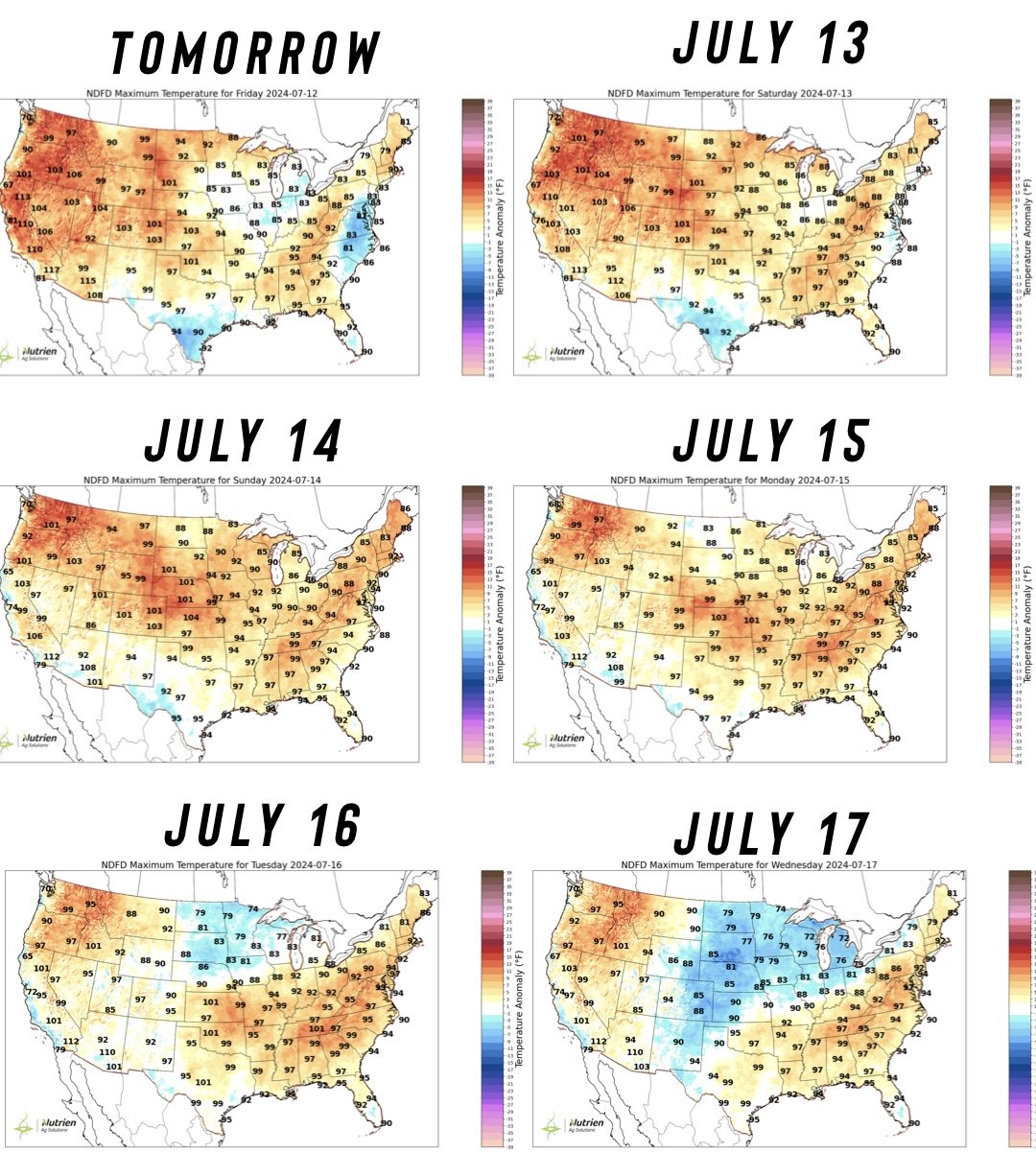

Temp Forecasts

Temps are supposed to heat up until Monday, especially in areas such as Nebraska and Kansas.

Then come Wednesday they are suppose to cool down.

USDA Estimates & Preview

USDA tomorrow.

This will include the updated new crop balance sheets that include the data from the June acres report. So it will include the sharp increase in corn acres and slight cut to bean acres.

Yield is expected to be virtually unchanged. It is very unlikely that they make yield adjustments lower this early, especially given the good weather a large portion of the corn belt has seen.

They are looking for corn production to be higher than last month. This is because they are using the new planted acres that are higher.

Soybean production is expected to be a little lower due to the lower acres.

Old crop carryout is expected to see a slight increase because June stocks were higher than expected.

New crop carryout is also expected to be higher.

They will add bushels to corn production. However, they will probably offset this with something on the demand side of the balance sheet.

This is actually an instance where the USDA will do probably something that helps the balance sheet not look as bearish as it could.

World carryout is expected to see a slight increase in corn, with slight decreases to beans & wheat.

Wheat production is expected to see slight increases across the board.

The trade is expecting small cuts across the board for South America crops.

That includes the Brazil corn crop, however CONAB actually raised their Brazil corn number this morning. Keep in mind, the USDA's number is still far larger than CONAB though.

CONAB Today vs Last Month vs USDA Est. (MT)

Brazil Corn:

CONAB Today: 115.86 (+1.7)

CONAB Last Month 114.15

USDA Estimates: 121.3

Brazil Beans:

CONAB Today: 147.38

CONAB Last Month: 147.35

USDA Estimates: 151.75

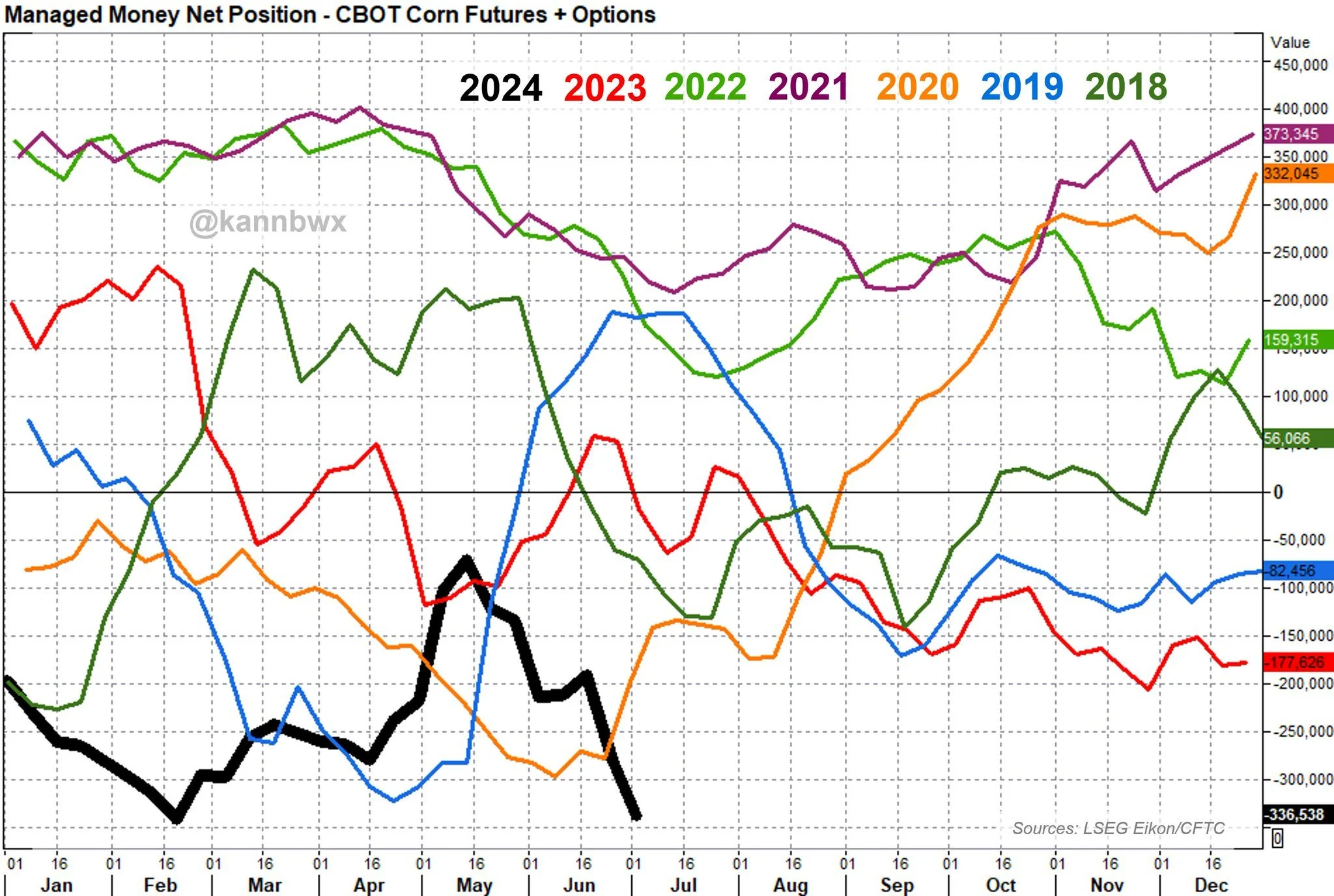

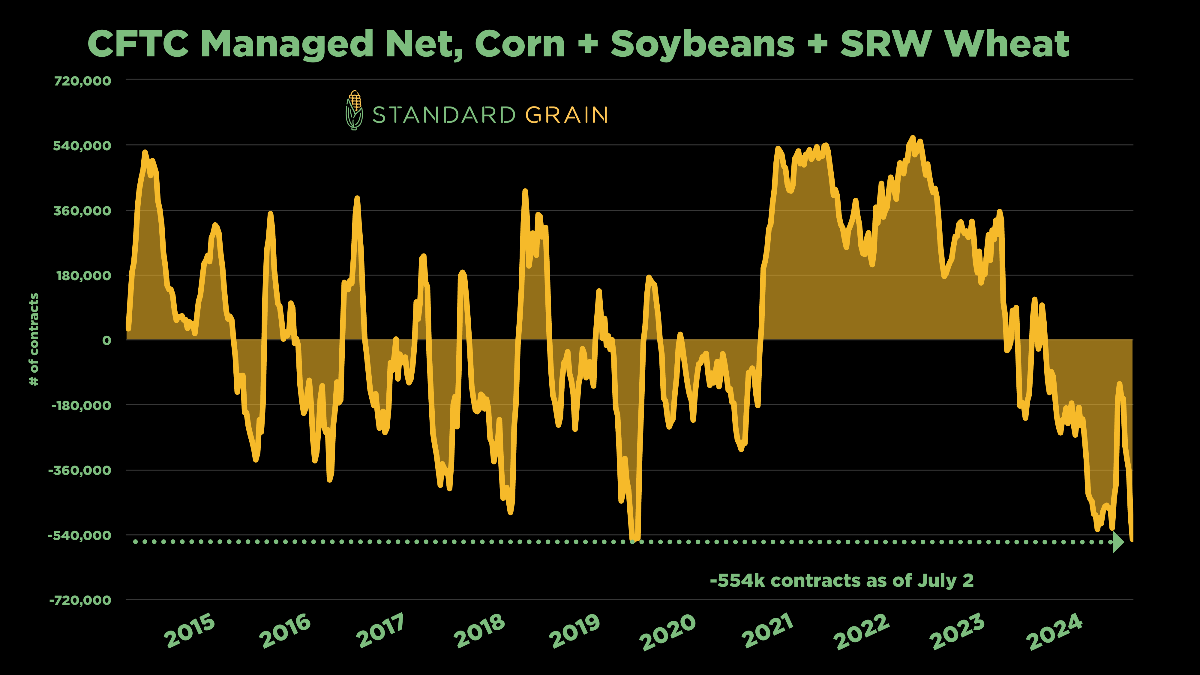

The Funds

We already know the funds are record short. Holding -350k contracts of corn.

This is the shortest they have gone into this report since 2020 for corn, shortest since 2018 for beans, shortest since 2016 for wheat.

The funds have been short 2 years in a row going into this report for corn. This is the first year since 2019 going into it short for soybeans. This is the 5th year in a row going into the report short for wheat.

Massive shorts.

So if there is a positive surprise, would lead to big buying. Not saying it will be a positive report, just pointing out that if it is, it could lead to even more upside.

Chart Credit: Karen Braun & Standard Grain

Past Report Performance

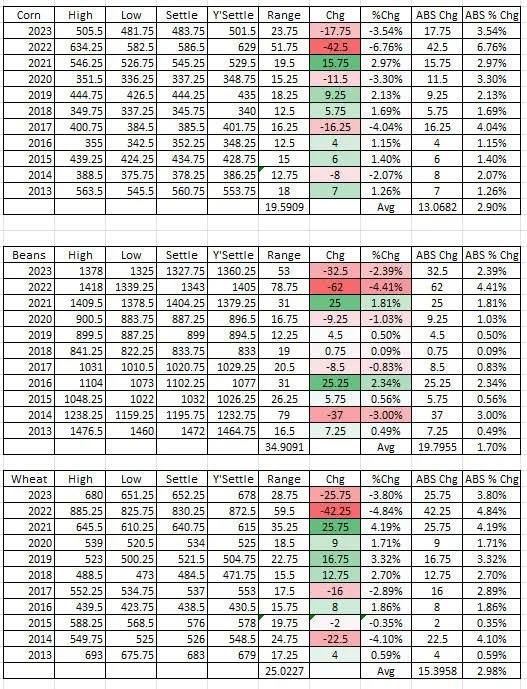

Here is the price changes from this report the past 11 years.

The last 2 years have been a blood bath for all of the grains.

For corn it has been friendly 6 times, negative 5. However, the negative reports were very ugly. The friendly reports were "meh".

For beans it has been friendly 6 times, negative 5. There were only two reports that resulted in a decent rally. (2016 & 2021)

For wheat it has been friendly 6 times, negative 5. Friendly the past 4 of 6 years. This report has actually been a consistent decent market mover for wheat.

Chart Credit: Jake @WalkSquawk on X

Overall some years it is a big market mover. Some years it is not.

Since everyone is comparing this year to 2014, in 2014 it was a very negative report. So if this report isn’t extremely ugly, maybe we break away from that comparison.

I don’t personally see this report being a major market mover. Everyone is bearish going into this report, and the trade is already aware of this.

Unless we get a major surprise like we did with the high acres in the last report, I don’t think it will offer much.

Do not expect them to lower yield. Some are actually talking about the possibility for them to raise yield to as high as 183 due to all the rain. I don’t think that happens, but it is possible. Of course would be very very bearish if so.

Bottom line, I am not expecting much from this report. Most will be stuff everyone already knows.

Let's jump into the rest of today's update....

Today's Main Takeaways

Corn

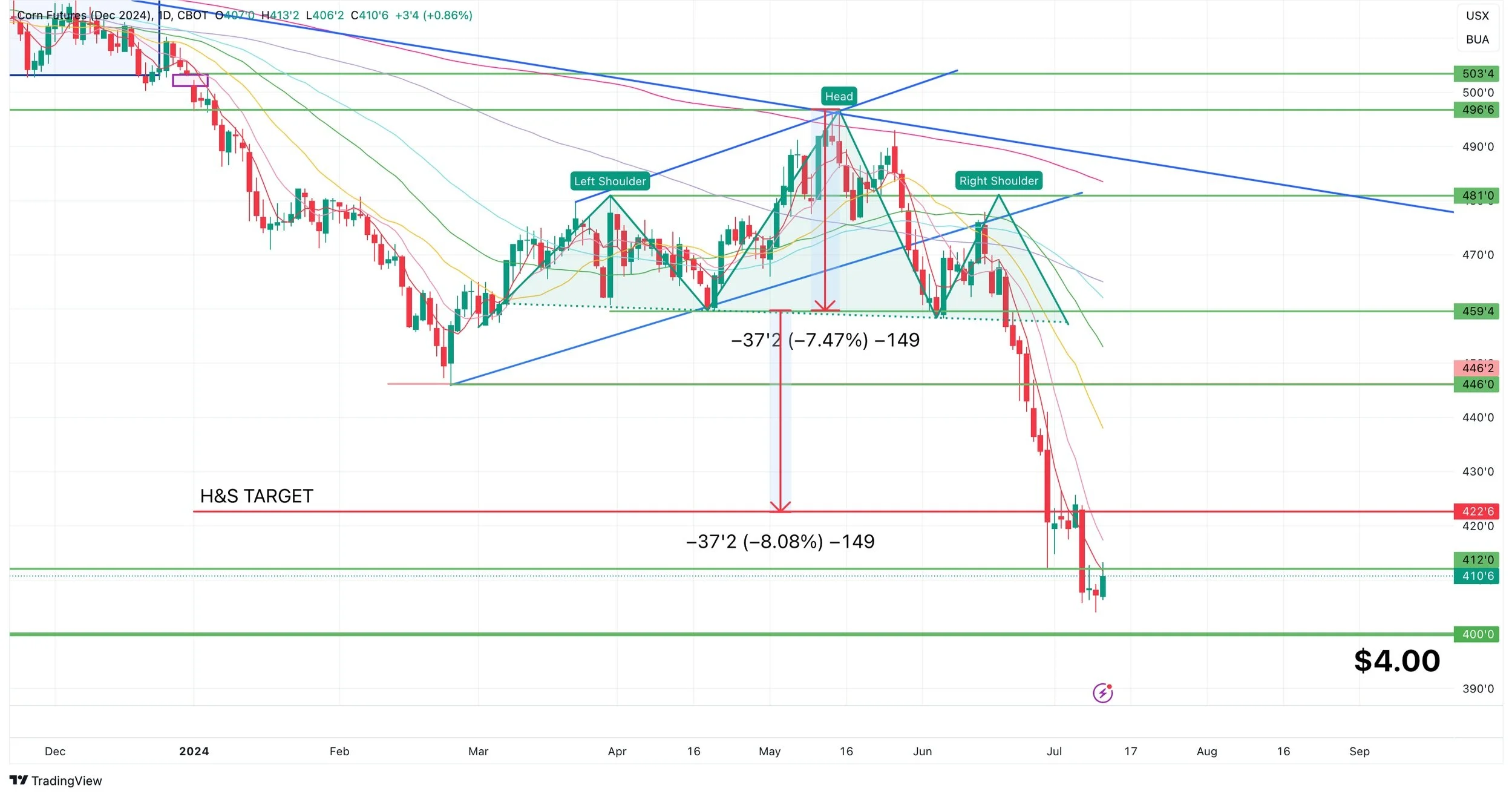

Corn puts together a decent bounce.

This morning CONAB raised their Brazil number, yet corn traded hiigher. Which was a positive sign.

The most interesting thing about corn is the Sep/Dec spread firming significantly the past few days.

Nearby spreads are a good indicator at how the actual grain pipeline supplies are vs demand.

When spreads firm or we see carry in a market being removed, it is usually a bullish sign. As it means there is less supply on hand than needed. So when supply isn’t moving as well as the pipeline wants we see spreads firm to encourage less holding of grain.

Overall, tomorrow's report is unknown. The numbers are probably going to be bearish because it will include the new higher acres and likely trendline yield. However, everyone already knows this.

Either way, if you are undersold I HIGHLY suggest keeping puts ahead of the report. Your risk is to the downside. I would be lying if I said we couldn’t see another possible 50 cents of downside. Keep a floor until you sell. Especially if you don’t have storage going into harvest.

Nobody likes making sales here at multi year lows and levels that are not profitable. For those that are going to be forced to sell down here due to your banker or for whatever reason, you could look at cheap calls. We could go to $3.50 corn or rally at anytime. Nothing would be more demoralizing than selling at 3 years only to see us higher a few months from now.

For those with plenty of storage, I like being patient.

Short term, I still think we could struggle. Of course I hope we go higher, but I am not so sure that corn didn’t come at all the way down here to at least see a $3.99. I think there is a chance we could test $4.00 before higher, but hope I'm wrong.

A summer weather scare is probably out of the cards. Which means a sustained rally will have to come from demand and or short covering. But right now the funds don’t have a reason to cover.

Long term I see higher prices. These lower prices will help create demand. Demand is something we desperately need. There are two sides to a balance sheet. Supply & demand. Right now it looks like supply will be there. However could easily see a scenario where these low prices are enough for China to step in and start buying, then all of the sudden if this US crop isn’t as big as advertised and if the effects from wet planting, floods, hail etc start popping up. That would be a reason for the funds to cover and for us to see higher prices.

With the funds as short as they are, once they find a reason to cover it gives us the ability to see a pretty big short covering rally. Eventually, it will happen. It's a question of how low can we go before that happens and how long can they stay this short.

Bottom line, if your risk is to the downside. Protect it.

Give us a call if you want to walk through your operation ahead of the report and come up with a game plan. (605)295-3100.

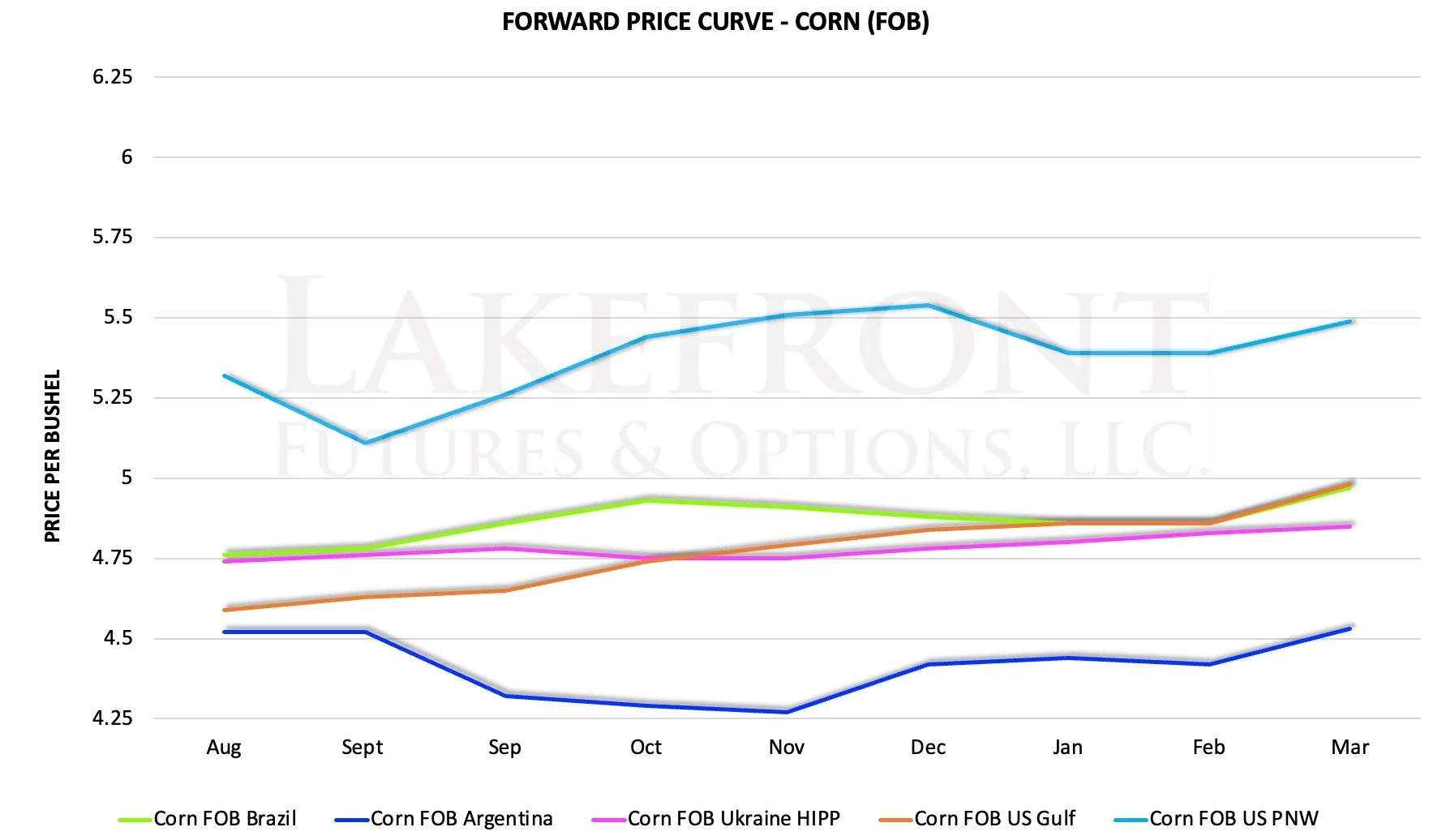

Here is a forward price curve chart comparing US FOB corn prices to other countries. The US is actually very competitive and cheaper than Brazil until December and cheaper than Ukraine until October. Argentina is the cheapest in the world however. Overall, US corn is cheap for August and September and we need demand.

Chart Credit: Lake Front Futures

We just barely failed to close above the $4.12 USDA acre report day lows. Which is disappointing. If we can close above, it would be a good sign.

Dec Corn

Soybeans

Soybeans were up double digits early, but ultimately gave it all back.

Some think the weakness the past few days was the EPA statement made on Monday that said the 2026 RFA mandate ruling would be delayed from October to March.

The biggest news recently is China. Even they couldn’t resist buying some soybeans here.

No this was not a big amount. They only bought 132k MT of new crop beans. Not nearly enough to make a difference. But this was the first new crop sale of the year and a good step in the right direction. We have the worst new crop book of bean sales in 20 years. In most years they would’ve already started buying weeks ago.

Export sales to all destinations this year are actually worse than they were in 2019 with the trade war.

The USDA says that over 40% of all soybean demand will come from exports. China makes up for 50% of all US exports.

So you can see why the trade is concerned that we haven't been selling any soybeans to China.

Is this a big deal? Kind of, but China will eventually come in and buy our beans. China buys a ton of beans.

Just like corn, these lower prices will help create more demand. Which is what this market really needs if we want to see higher prices.

Like I mentioned earlier, soybeans are made in August. So there is still a chance for some type of weather supply driven rally. But if it happens it wouldn’t be as dramatic as the one we usually see in corn in June & July.

Short term, I'm not trying to catch a falling knife and pick a bottom.

If your risk is to the DOWNSIDE. PROTECT IT. That means if you are undersold, grab puts for protection. Nobody knows if this market will bounce tomorrow or lose another $1.00.

Long term I still think these lower price levels will help create more demand. Demand is the #1 thing we need.

I hope it doesn’t take us another 50 cents or $1.00 of downside to find a level that create more demand. But as a producer, that is your risk. So find a way to get comfortable knowing it is possible.

Give us a call if you have questions or want to talk through things. (605)295-3100.

Nov Beans

Wheat

Wheat was the star of the grains today. Up +10 in Chicago and nearly +20 in KC. However it was disappointing to see Chicago close -10 cents off of it's highs.

From a technical standpoint, Chicago bounced exactly where it needed to. Right off those June 26th lows.

The sell off in the dollar due to the CPI data helped wheat. Weakness in the dollar benefits wheat more than it does corn & beans typically.

There was news that Ukraine is trying to reach a peace deal with Russia before the election due to the chance of Trump being elected.

They want to come to an agreement before because Trump said that he is going to cut off military support to Ukraine.

If they come to an agreement and the war officially ends, it would actually probably be somewhat friendly for wheat.

Anytime we get a war driven headline it is either short lived, or the market doesn’t care because it is old news. Since the actual inception of the war, wheat has pretty much just continued lower since that initial major rally.

Standard Grain pointed out some good points as to why the war ending might be friendly.

If the war ended, we the US would stop funding Ukraine. Which means we would no longer fund their agriculture. Which means that Ukraine might not be able to continue to supply wheat and corn cheaper than the US anymore.

Another reason it could be friendly is because some think Russia is only selling their wheat so cheap to fund the war. No war means no reason to sell wheat cheap to fund the war. Russia's cheap supply entering the global exports is what has kept a lid on our wheat prices for the most part. It is hard to justify our wheat being expensive if Russia's is cheap.

Outside of that, weather is a slight positive right now. As wheat areas such as Kansas and Nebraska are going to be dealing with major heat the next week.

Winter wheat harvest is over halfway over which means less harvest pressure.

Canadian wheat areas are expected to see above normal temps with below average rain the next few weeks.

Overall, I think wheat is close to a bottom if we haven’t found it yet.

I am not saying we are going to scream +50 cents higher by next week, but I think there is a good chance we are done free falling.

However, if you are someone who did not make sales near the highs or is still undersold please keep some puts for protection under your unpriced grain.

For those that made sales on our signal near the highs, this is a good spot to look to re-own if you want.

Sep Chicago

Sep KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

7/10/24

GRAINS CONTINUE TO GET HAMMERED

7/9/24

RAINS, RECORD FUND SELLING & 2014 COMPS

7/8/24

PUKE SELLING, RAIN MAKES GRAIN & FUNDS RECORD SHORT

7/3/24

THIN HOLIDAY TRADE FOR GRAINS

7/2/24

BEARISH WEATHER, RECORD SHORTS, & CHINA

7/1/24

SUPPLY WILL BE THERE, BUT CAN DEMAND LEAD US HIGHER?

6/28/24

GARBAGE USDA REPORT

6/27/24

BIGGEST USDA REPORT OF YEAR TOMORROW

6/26/24

USDA PREVIEW & COUNTER SEASONAL RALLIES?

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24