FUNDS CONTINUE TO COVER & RALLY GRAINS

Overview

Grains strong yet again, extending the rally to 3 days led by wheat futures as Chicago wheat is up +50 cents the past three days and KC wheat is up +45 cents.

This strength has carried corn higher, up +16 cents the past three days while beans are up +33 cents.

Wheat continues to lead the rally off the back of short covering due to war headlines and worries about this winter wheat crop that has lacked moisture.

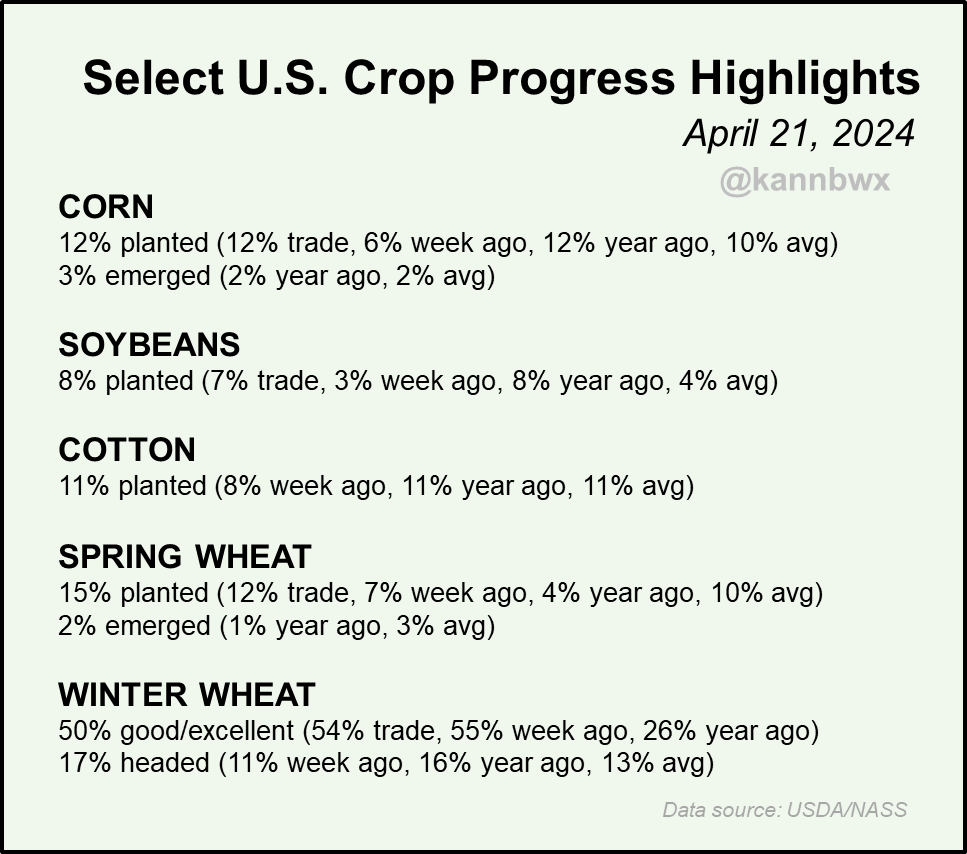

As yesterday winter wheat crop conditions surprised, coming in at 50% rated G/E. Down -5% from last week while the trade was expecting 54% G/E.

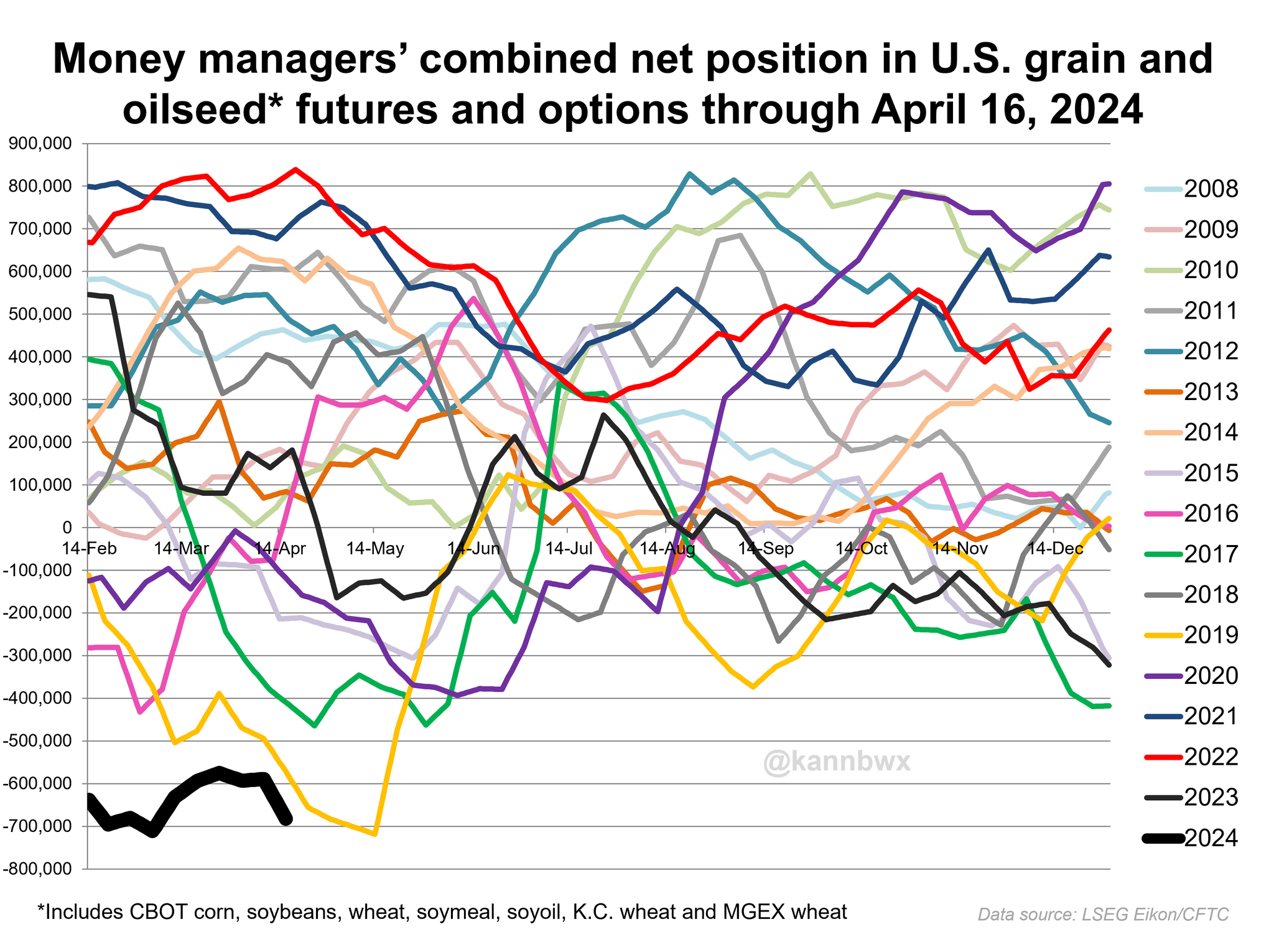

This has rallied the grains so much because the funds are scared. Which has led to a lot of short covering.

They were and are still holding massively short positions across the board.

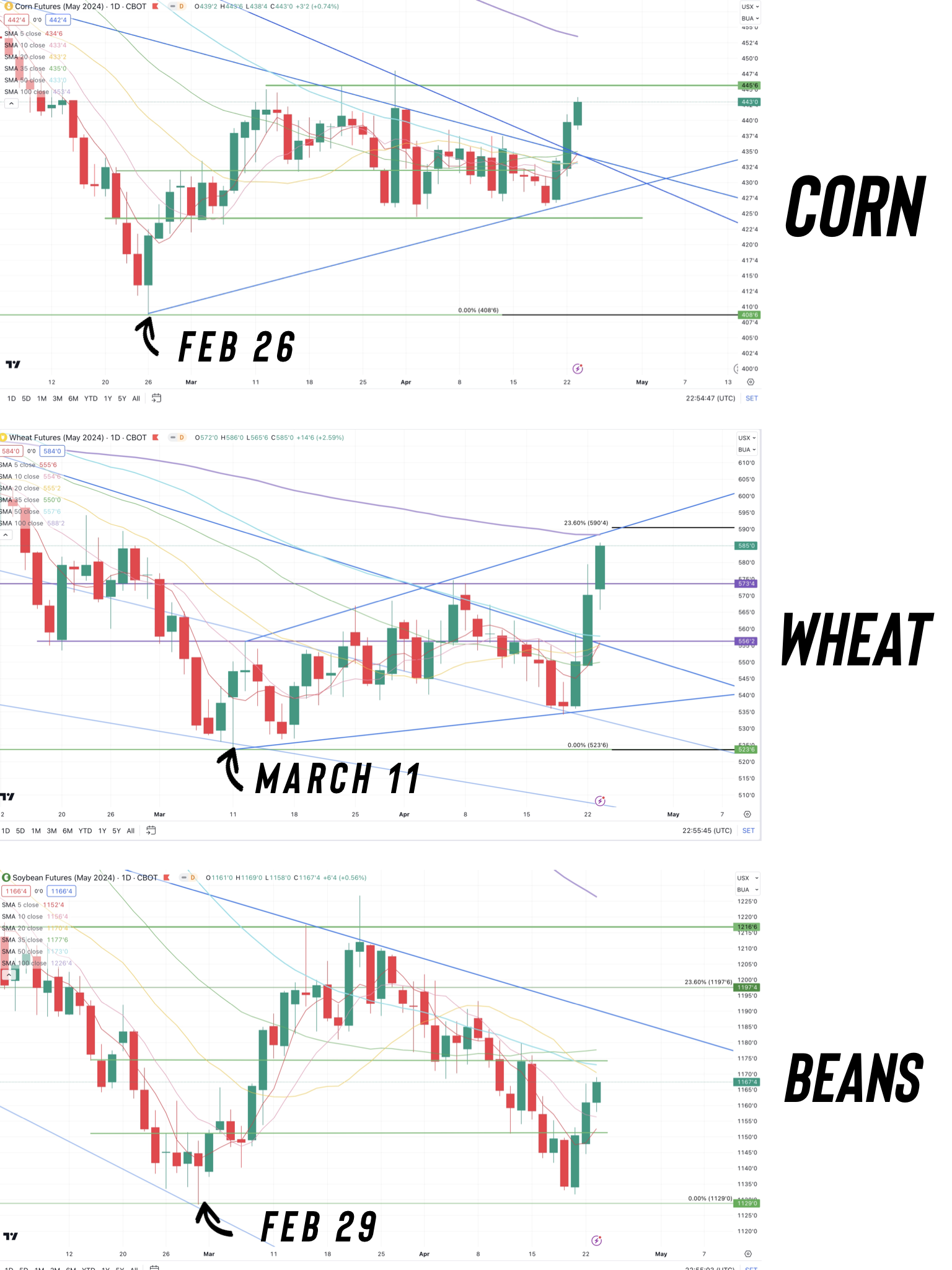

If you look at the corn and wheat charts, they have chopped sideways to higher since late February. So the funds were holding on to this massive short position that hadn’t been performing great like it did last year. The funds don’t like holding losing positions.

All of this uncertainty should give them all the more reason to cover and reduce their exposure.

Soybeans are a slightly different story, as we traded lower for an entire month and nearly made new lows last week before bouncing.

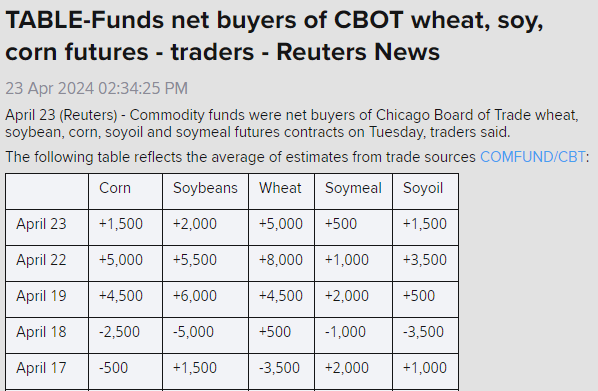

Take a look at how much the funds have covered the past 3 days.

Still plenty of room to cover across the entire grain complex.

Chart Credit: Karen Braun

Planting is going well so far. Nothing too crazy, as planting is slightly ahead of the average pace across the board.

Chart Credit: Karen Braun

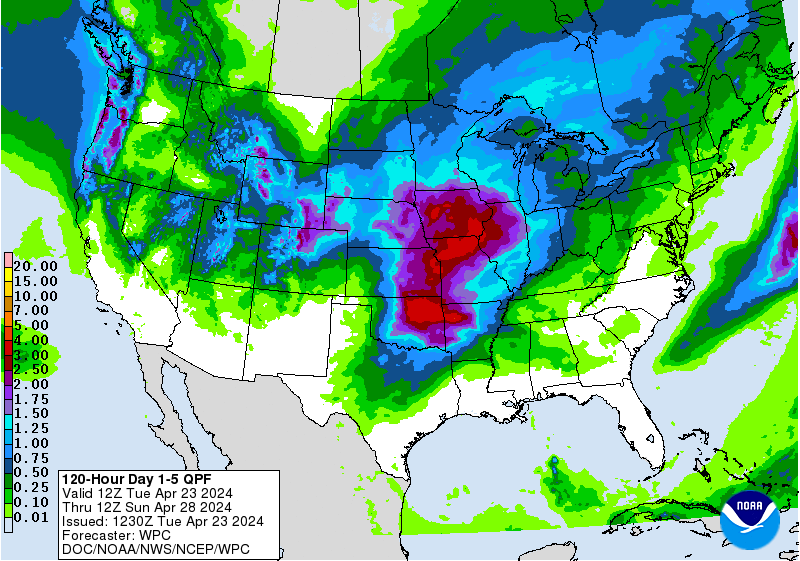

As for the future outlook of planting, it looks like we should get a good chunk done early this week in most areas but we have rains moving in later this week and into next which could slightly delay things.

No I do not think this will cause a major delay. Most of this rain is coming to areas that really needed it, like Iowa. Long term this rain will be viewed as beneficial unless it just randomly continues to rain and floods everyone out like 2019. But I don’t see this happening.

Most are expecting planting progress to come in pretty good on Monday again.

2-3 weeks from now, this rain will help the subsoil moisture look a lot better than it did in those areas that were super dry.

It also looks to get very warm, which should help guys get in the fields once this rain is over.

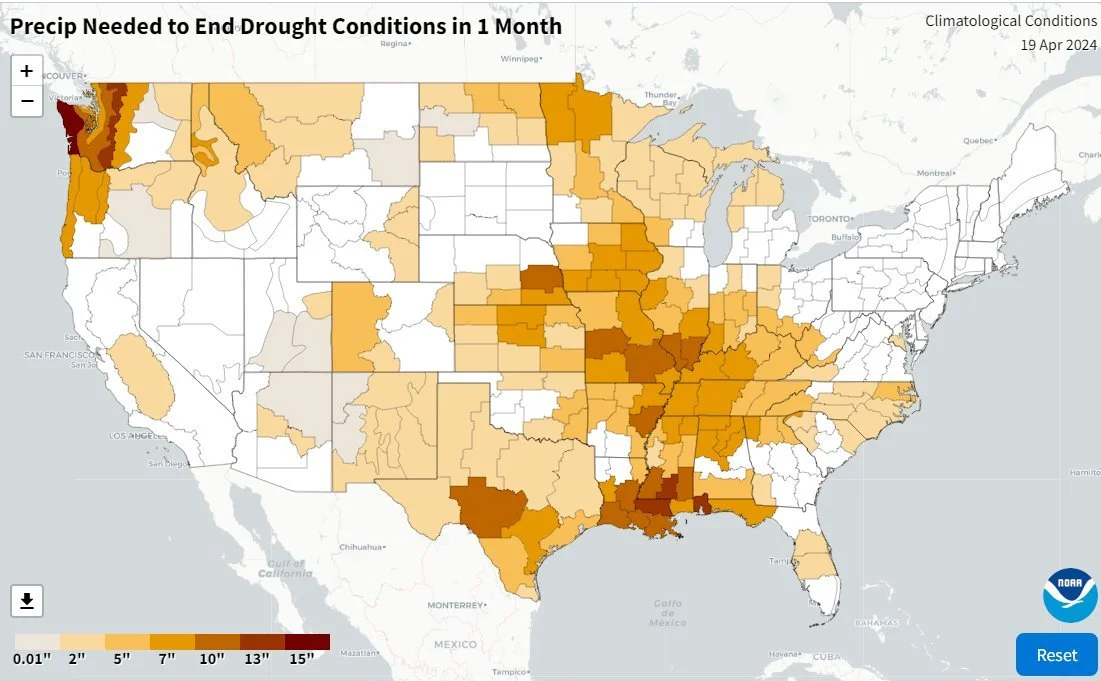

A lot of the areas that were in drought should be getting some good relief.

Next 5 Days Forecast

Precip Needed to End Drought

The two biggest things aside from weather that you need to be aware of is:

First notice day and basis contracts needing to be priced or rolled

Options expiration

May options expiration is this Friday.

First notice day is April 29th.

These both often can lead to farmer selling, and typically we do see futures take a slight decline heading into these events.

If you have basis contracts and are not sure what you should be doing, please listen to yesterdays audio where we go over this. LISTEN HERE

Let's dive into the rest of today's update....

Today's Main Takeaways

Corn

Corn continues it's mini rally, now +16 cents off the recent lows.

Today we actually posted our highest close since February 8th.

There is nothing fundamentally driving corn higher right this second. Corn has been following wheat higher and the funds have started reducing some of their risk across all of the grains.

As I have mentioned before, the funds have never not got long during a year. I do not know if this year will break that trend, but right now they are short around -250k contracts or more. With plenty of room to cover if things get uncertain. Such as US weather this summer.

For the rest of the week, I would not be surprised to see us struggle a little bit.

Why?

Because of options expiration and all of the May basis contracts that are going to have to be priced.

If you remember, the pricing of the March basis contracts is what drove us to new lows. That was the day we marked our lows before moving higher.

So once this is out of the way, I think we finally start to break out this brutal chop.

Fast planting is still a possibility. So there is still a chance that this mutes a major rally looking short term the next month.

But we all know summer and the actual growing season is where everything matters.

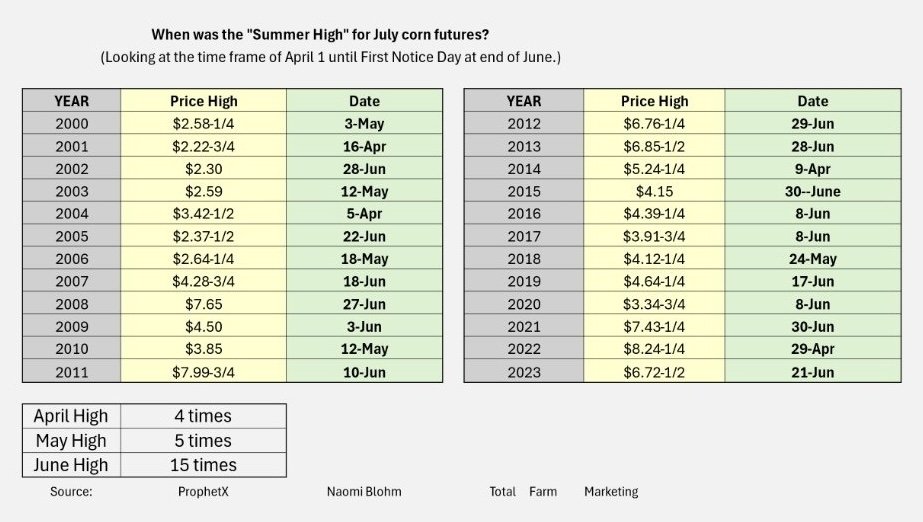

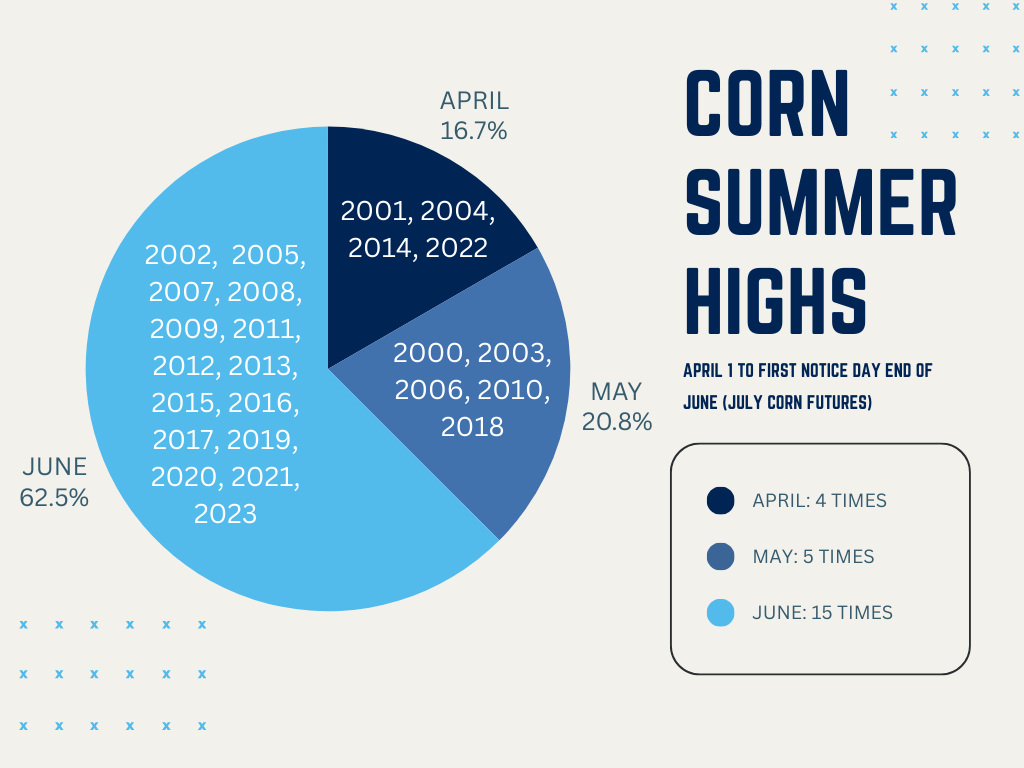

Take a look at this chart, when do we typically make our summer highs?

We have made them in June the past 15 of 24 years (63%)

Chart Credit: Naomi Blohm

This summer should provide opportunities.

The US growing season is extremely important.

If you were to take the current projected 181 yield with the current 90 million acres, we would get a carryout around 2.3 billion bushels. Not a bullish number.

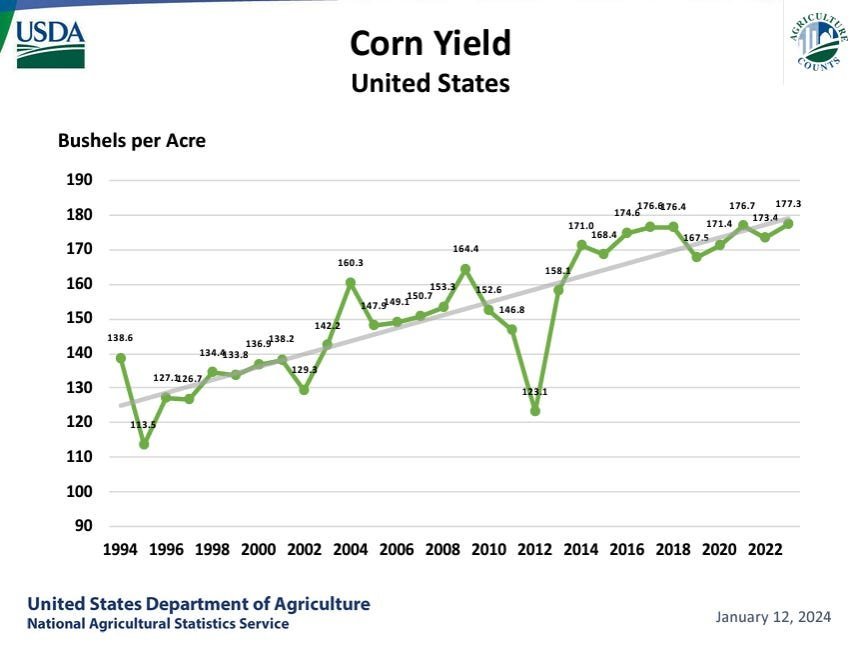

But 181 is an extremely optimistic number. We have struggled to get 176. So why would we get 181 this year?

The "trend line" yield has stalled out the past decade.

I think a more realistic number would be 173 to 176.

Let's say yield ends up at 176, which would be a near record yield, we would still see a carryout below 2 billion.

Now say yield drops to even just 173 which is possible, carryout would drop to around 1.6 billion bushels.

If yield drops, the market will have to move higher to ration demand.

We don’t even have to have an actual drought or have a yield of 173. All we need is for the trade to think we will see a yield like that or lower for even a week to create an opportunity and rally this market. It happens nearly every year.

Even last year it happened, although we did struggle and continue lower until June, we rallied $1 in just a few weeks.

If you take a few bushels off the yield, it changes the entire landscape for the corn market.

We do NOT use targets when pricing grain. We wait for triggers to tell us we are nearing the highs. Right now, I just don’t see any reason to believe we won’t get a pricing opportunity this summer.

We are finally higher than where we closed at the day of that March 28th USDA report but have still yet to take out the highs.

If we take out $4.46 on the May and or $4.54 on July, which we are very close to. I think it leads to more short covering.

If you take a look at the wheat chart later, I do believe wheat has room to run and could pull corn higher along with it as well.

Corn May-24 & July-24

Soybeans

Soybeans sit +33 cents off the recent lows.

Funds continue to cover their shorts. But as I mentioned earlier, the funds position since February hasn’t been as poor in soybeans as it has in corn and wheat. So perhaps there is not as much incentive to cover beans as their is corn and wheat, because their bean position has still performed pretty given the fact that beans nearly posted new lows last week.

However, the funds are holding near record shorts in soybeans. The harder you pull a rubber band, the harder it snaps back.

There is not a ton of fresh news in the soybean market, planting is still going at a slightly faster pace than usually but with the upcoming rains we could see small delays. But will probably still be right around average.

One thing that isn’t the most friendly for soybeans is demand, as the South America crops are decent and there is some slight risks that we could pick up a few more acres here in the US. So bulls really would like to see some demand.

Like I mentioned in corn, the growing season is what really matters.

Unlike corn, soybeans already have a pretty tight situation.

Meaning that if we lose yield on soybeans, this carryout could get extremely tight very fast.

Right now we are looking at a 400 million bushel carryout with a 52 yield with the current acres.

What happens if yield were to drop to 48? Our carryout nearly disappears.

Bottom line, there are plenty of reasons we could go higher from here. Still remaining patient. Given how the growing seasons are for corn and beans, we will typically be making bean sales a tad later than corn sales.

Beans are made in August. The outlook for June, July, August, and September is very hot and very dry.

The soybean chart does not look as good as the corn and wheat chart as we have not taken out any real resistance. However we did put in a key reversal on Friday.

Soybeans May-24 & July-24

Wheat

The wheat market continues it's impressive rally.

The past 3 days the wheat market is up nearly +50 cents in both Chicago and KC.

Why?

First we have two wars going on. First we have the middle east war, which no does not directly affect the grains. But headlines of nuclear war is enough to make the funds reconsider some of their shorts.

Then we also have the Russia and Ukraine war which is still a factor. However, as we all know, war headline rallies have not typically held.

But war is not the only reason for the rally.

One of the other bigger reasons is worries about this winter wheat crop.

Kansas produces 25% of the entire US winter wheat crop. Drought currently effects 65% of Kansas.

Winter wheat crop ratings plunged -5% Monday to 50% rated G/E, -4% more than was expected. Now this is a bullish surprise, but this current crop is still the best since 2021. As the 10 year average is 44% G/E.

Most are expecting to see this moved slightly lower next week as well due to the potential freeze scare in the northern plains.

Then we also have dryness in Russia which is becoming a concern. As the southern region where 1/3 of their wheat is grown is struggling with dryness.

Bottom line, I have been saying all wheat needed was a catalyst and it had a lot of upside potential.

This catalysts are starting to unfold. Now there is nothing wrong with rewarding a +50 cent bounce especially if you are undersold. But personally I think this market has more room to run.

Many advisors I follow suggested selling 10% of your July KC winter wheat today. Again, there is nothing wrong with that, but I think we have more upside.

Give us a call if you want specific advice and to know if making sales here makes the most sense for your operation or not. (605)295-3100.

Because there is a lot of advisors are making generic recommendations but grain marketing is not one size fits all. So if you want to know if you should or shouldn’t be selling, please give us a call or text.

Looking at the charts, we had a very very strong close.

We finally took out that key resistance in both Chicago and KC I had been mentioning. We also closed above the 100-day moving average for the first time this year in July Chicago and the first time in KC since August.

These charts look very friendly and the techicals point to more short covering from the funds.

We are a little overbought, so don’t be surprised to see a slight pullback short term.

Like I said in corn, we will wait for triggers to make sales. Not targets.

SOMETHING TO KEEP IN MIND:

Often times we will see wheat have these crazy rallies that last for a few days or even a few weeks, only to give it all back. This could happen again, although we think this rally is a little bit different.

May-24 & July-24 Chicago

May-24 & July-24 KC

Cattle

Cattle market continues to show some strength following the recent sell off.

It still looks like we are carving out a bottom and could go back and test those recent highs.

I was skeptical that the bottom was in as I didn't want to catch a falling knife, but this chart is starting to show signs of renewed strength.

Give us a call if you want to go through any strategies. (605)295-3100.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24

HOW BIG OR SMALL COULD CORN CARRYOUT GET?

3/28/24

WHAT THIS USDA REPORT MEANS MOVING FORWARD

3/27/24