PREPARING FOR THE USDA REPORT

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

A rather quiet week for the grain markets as some of the volatility comes out of the markets. It appears that the weather card has been put on hold or maybe even done for corn and beans while it appears that wheat is attempting to put in a rounding bottom on the charts.

The weather card done doesn’t mean that we really know what damage was done or not done with the heat, nor is the weather card in SAM yet to get played. How important the weather card in South America will really be determined by what we find out once the combines in the US start to roll.

On Tuesday we will get a USDA update to bean and corn production while typically wheat production numbers won't get updated until the end of the month report with the small grain production and quarterly stocks. As for what the USDA will print it is hard to think that the USDA will print a super bullish number, as we really don’t know what damage was or wasn’t done to the yields on the latest heat that we had.

There is such a huge range of opinions on what our final corn/soybean yields will be. It is nearly crazy, but very few indicate that they believe there is a big risk of a number that the USDA will print something shocking. There are smart people that believe we will see some corn yields sub 170, with some even sub 165 or less. But I just don’t see the USDA having enough evidence to print those types of yields at least not yet, if they did the market would shoot straight up. Options are not pricing in a big move, so perhaps that is an opportunity as we do want to buy low and sell high.

So our recommendation is that if you believe longer term our corn and soybean crop will be something well below what the average estimate is for this coming report then make sure you have your hedge account open and buy those call options sooner than later. If you believe strongly that yields are not there, don't wait for the market to agree with you, buy those calls when they are cheap. Not after the USDA tells you that you are right. If you need help with a hedge account you can give me a call at (605) 295-3100.

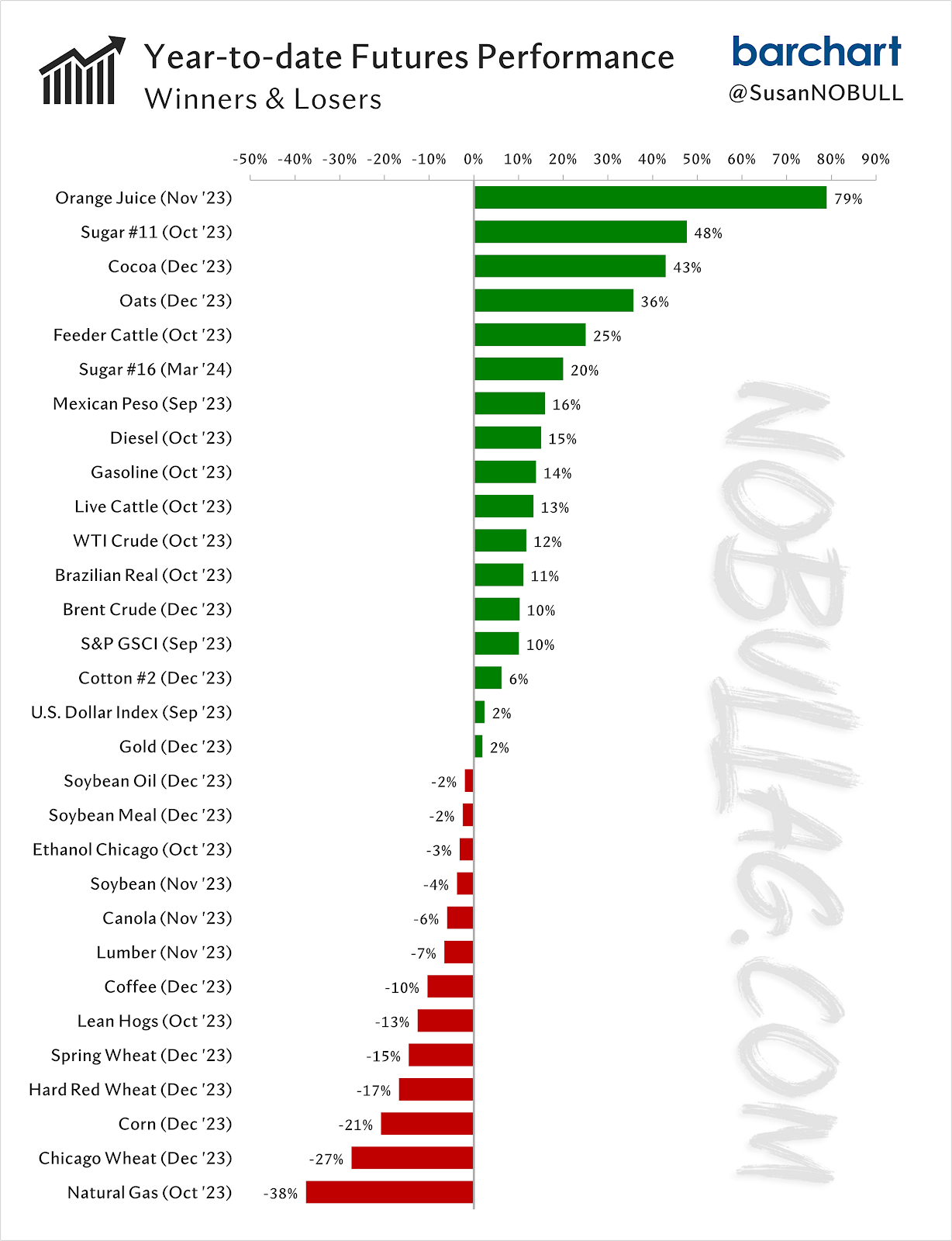

Below is a good graph to help keep things in perspective, it is just showing winners and losers year to date for various futures contracts. From Susan at NoBullAg.com

Our markets have always and will always be very volatile. I want to buy low and sell high. The headlines typically will make those in the green look to be attractive to the public, but soon after the public gets interested in a commodity it is all but over. The ones that have value are the ones in the red.

What do I do with all of my grain if I don’t have enough room to hold it all? My first answer is build more bins or work to be more proactive for your situation in the future.

Before I give a better answer let’s look at the market structure for corn, beans, and the three wheats.

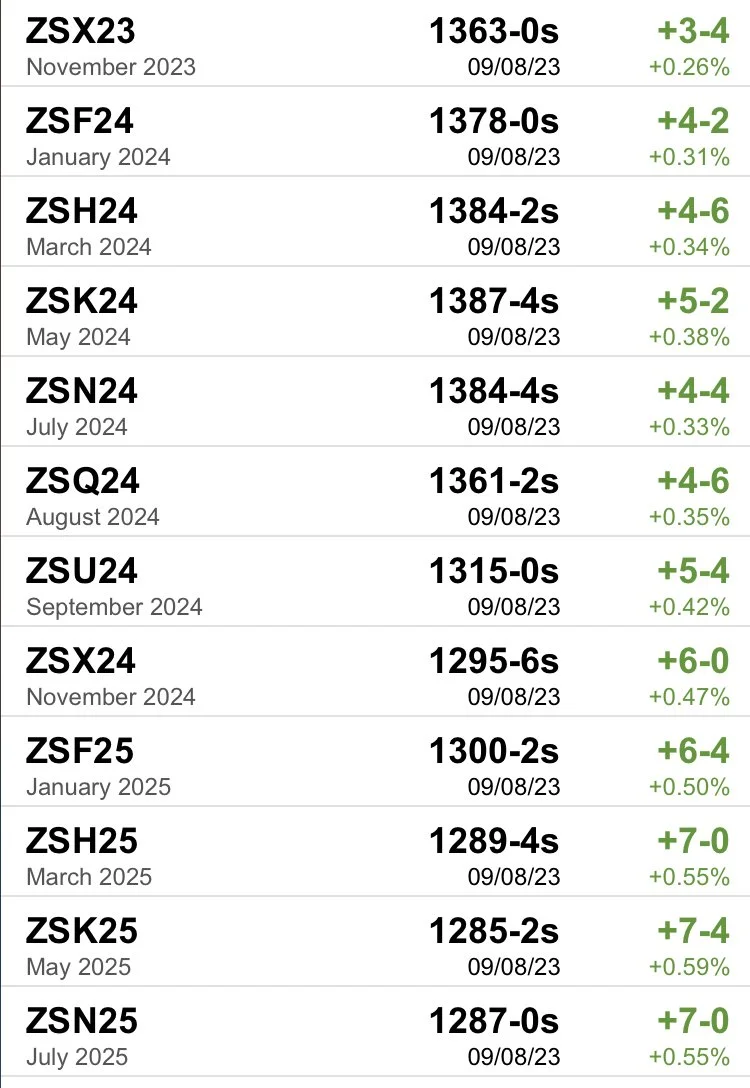

First is beans which has a decent carry but when comparing the base price of the product the carry is light versus corn as example.

Corn now has a carry from 2023 new crop to 2024 new crop.

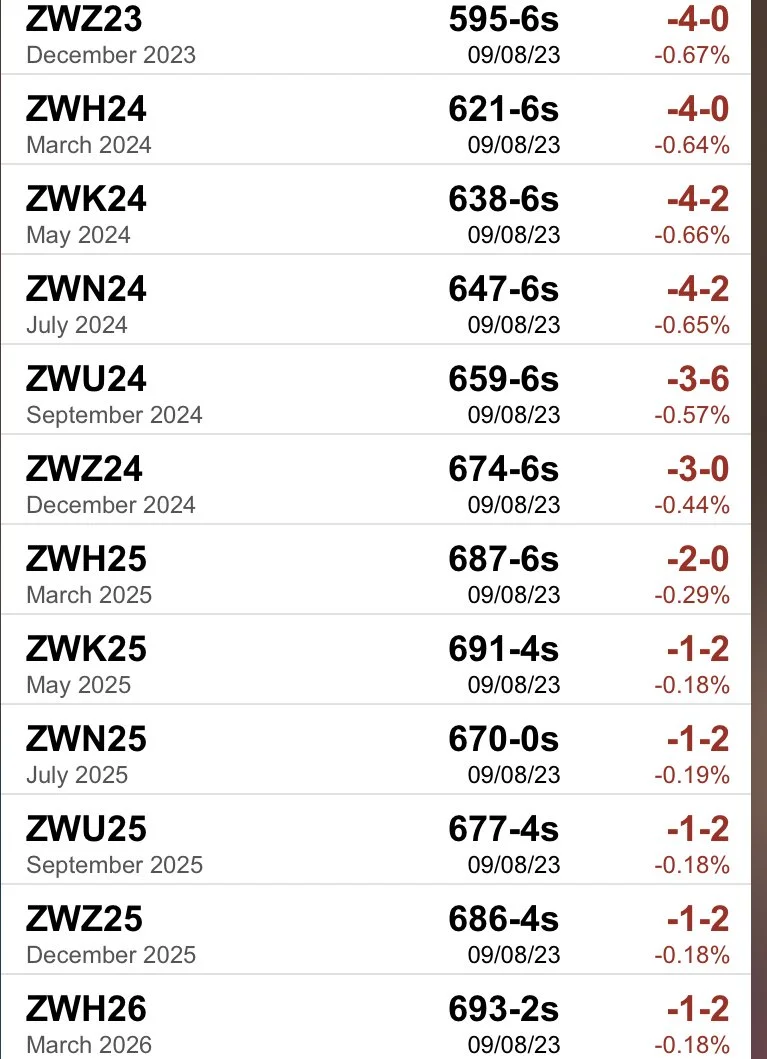

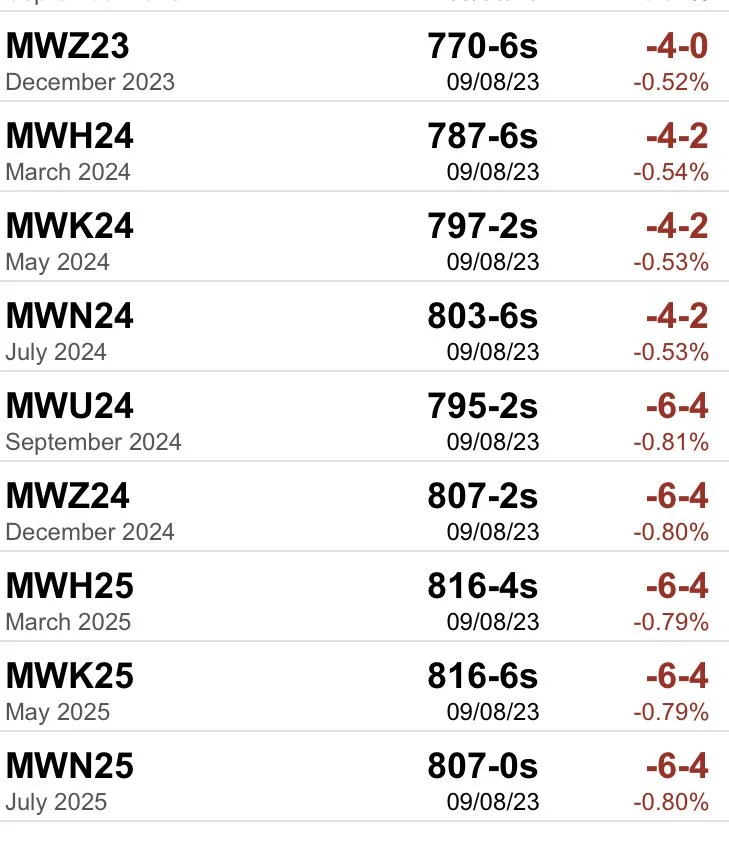

CBOT wheat carry is screaming sell the carry with nearly 80 cent premium from the Dec 23 to the Dec 24 contract.

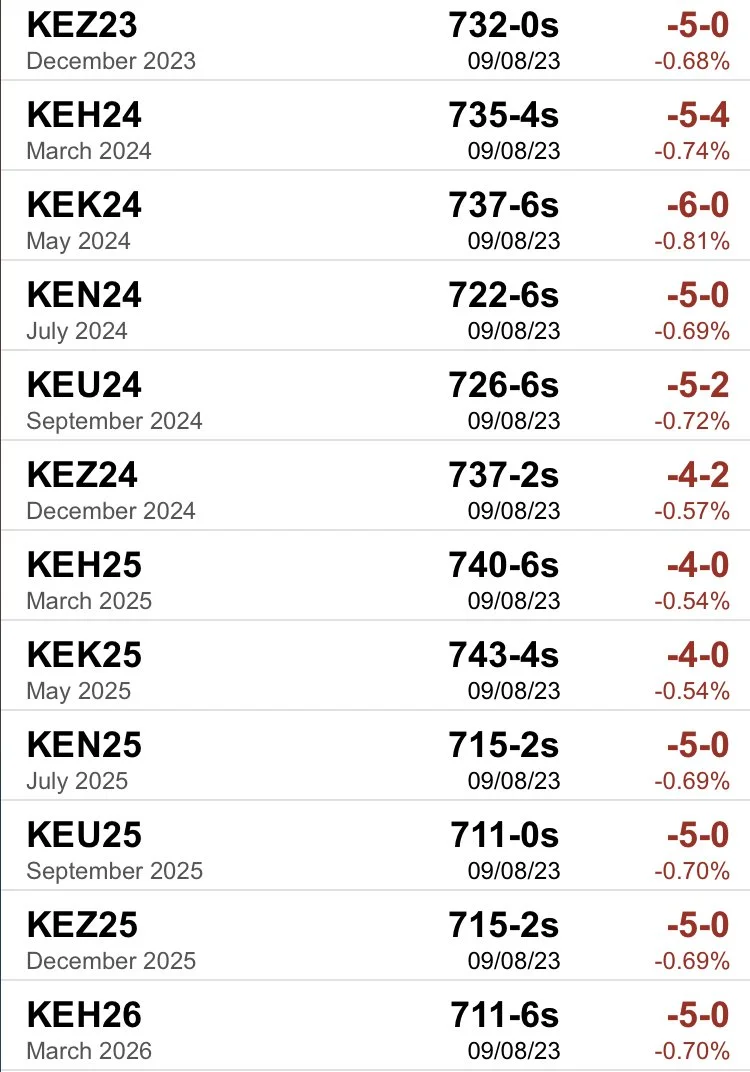

KC wheat shows a market despite the lack of nearby demand that is willing to pay more for 23 wheat then new crop 24 wheat.

While MPLS wheat has a nice carry as well out to next spring.

The carry in the markets typically indicate what the end users view as “true” supply and demand tightness.

So looking at the above you get left with this big mixed bag. Where the structures of the market are most bullish for soybeans, followed by KC wheat. But those same structures that are bullish in nature nearly force one to sell soybeans versus holding soybeans and selling corn or CBOT wheat.

Let’s take the example of a producer who has corn and soybeans. Let’s assume that he will end up holding whatever grain he doesn’t sell off the combine and he will employ his bins in about a year right before next years harvest. He doesn’t have room for both and is borrowing some money on his line of credit. The market is saying if he holds his beans he will take nearly 80 cents less. While if he holds his corn he will get nearly 25 cents more.

Plus the fact that he will get nearly 9 dollars a bushel more for his soybeans make it a no-brainer from a cash flow perspective to sell beans and store corn.

But fundamentally beans have so much more upside so why would one sell the soybeans? It is just how the market does its job in forcing farmers to supply product when they really don’t want to and maybe shouldn’t. It is also why many times it might make sense to the cash beans and re-own with call options.

Look at the wheat market in CBOT, are many or any of you selling the big carry? From who I have talked to it appears that very few put their operations in a situation where they can sell the big carry.

Hence why we see the pressure day after day on the charts, why we see basis weakness and why we have this huge carry. Because no one needs nor wants the wheat today. Cheap prices along with a wide carry will cure this, but when?

From others:

Here is from Wright on the Market. I agree with the thought that we could make our lows Tuesday or Wednesday if we haven’t already made them.

The following is a good write up from The Robinson Review:

Exhausted. Disappointed. And Angry. That sums up a lot of producers I speak to on a regular basis. That last blip up in June- where corn ran up $1.39- from $4.91 to $6.29- was a head-fake to bulls and producers.

Ditto the last bounce- from $4.81 to 5.72- 91 cent gift.July 13th to July 24th.

I was so concerned about that rally- I wrote an obnoxious letter entitled-- "Horse. Meet Water". Sent out July 20th. And for 5 days, those were the last days north of $5.50.

I had no idea that was going to be the case- or I would have sold the position limit- 1200 contracts- 6 million bushels. and have made a cool $4 million as of Friday's settlement.

But, I did know, after 33 years in these markets-- that it was a rally, worth rewarding.

Since we did not know if we could have gone back to $6.50 or $8.00? And anyone who sold there? I had or I gave the option-- or immediately re-owning

those sold bushels-- but after a 90-cent rally---- I wanted to make the sale..first,, and then hold back a max of 10 to 15 to stay long after the sale.

Those "conscience calls" eased the conscience of anyone who felt it was "too soon" to make any sale.

My job is to keep you in a position to make your best cash sales possible.

The hedges are there to keep you in position so you didn't feel the need to sell 4.90 corn on our first trip there in late May.

Those of you who had puts- or bought puts there instead of making a "cash sale in the ditch". You were rewarded with the chance-- to sell on that rally from $4.90 to $6.29.

What you did on that rally? That was your decision.

The same held true in mid-July when - after a dismal 4th of July weekend, we fell to $4.81.. Our puts kept you from selling into a $1.48 sell-off.

When we got the 90-cent rally to $5.70? Again- what you did with that rally? Was your decision.

Which brings us to today. We are in the ditch again price-wise.

We are in a wedge.

$4.74 holds the floor:

And only a push north of $5.00 can turn the trend and get us above that 3-month bear trendline.

We are being promised by perma bulls we'll get one more run "once the real yields are known". Or many are expecting a spike in prices-- just so "there are not any insurance payments"... I hear a lot of that...

And I hope they are right.

But--if we pull a 2013 and just grind lower all the way into Christmas?

Here's a spotlight on corn in 2013. Sep to Jan? Corn dropped a buck.

Can anyone promise me this won't happen again? Will those promising that we won't cut every farmer a check for a buck loss in revenue?

And basis? You bet the basis will go up if corn drops a buck. Commercials will have to throw a bone to producers to get them to part with corn.

But we hedge flat price. Best we can do.

This spotlight shows what happened in the spot month corn in 2013 between September, and January 2014

If the "perma bulls" on social media are wrong? Are they going to cut you a check for what you might lose in revenue if corn finishes the year sub $4.00?

I do not believe so.

So-- what is my advice? Keep a cheap put under your unsold bushels and hope we get one more rally to choose to do with what you will if we get it.

And hope that the perma bulls are right and we see $5.50 one more time.

If we rally to $5.50 and then you still sell nothing? Once again-- that will be your choice.

End of rant.

Ok,

Money Flow?

Funds still long everything in the commodity space- except corn and wheat.

This week, as of Tuesday:

Corn: Short 94K- Added 7K new shorts. Now short 470 million bushels. Tell that to your spouse if they say you are "over-trading" :)

Soybeans: Long 82K- Lightened the load by 8K: Long 410 million bushels.

Wheat:

Chicago: Short 79K-- lightened the load by 1K contracts

KC: Short 10K -- Added 4K new shorts

MN: Short 11K- added 3K new shorts

Soymeal: Long 65K- sold 9K

Bean Oil: Long 55K- sold 3K

Cotton: Long 52K-- added 14K new longs

Protein Complex: Long/ Long/ Long

Live Cattle: Long 94K Unchanged

Feeder Cattle: Long 13.5K-- sold 1300

Lean Hogs- Long 32K- Added 5K new longs

The quickest way to get corn to $5.50? Have the funds be forced to cover 400 million bushels. So the USDA data has importance on Tuesday.

Corn:

For the week, CZ had just an 11.75 cent range for the week. Light volume. Light interest.

Net price change on the week- Up 2.25 cents

The wedge- holds the key.

A settlement below- $4.73-- and the funds will drop more bombs and cannonball their short position.

A settlement above $5.00 has to happen to turn the tide and get the funds to think about covering shorts.

Soybeans:

1) Friday's letter about the trendline-- ? It held on the daily charts.

Is that a solid line of support now? It passed a quiz. The big exam=- comes Tuesday.

Certainly, beans are the only one of the row crops with even the hint of a "bullish" fundamental story.

Funds are bet long.

Friday's settlement was just 72 cents "under" our contract high at #14.35 we hit back in late July.

Better yet, for anyone who had done "nothing" to protect or reward 2013 prices? We are $2.33 above the contract low we hit May 31st.

Any sale north of $13.33 is in the "top 1/3 of available prices" So this is one contract where refusing to sell or hedge anything has not decimated your bottom line- in fact- you are in pretty darn good shape.

If only the same strategy had worked this year for corn and wheat....

SX23

Weekly Range- 32.25

Net Weekly price change? Down 6.25 cents.

Key support- $13.55- this 4-month bull trend line.

Chicago Wheat:

$Sub 6.00

A fresh contract low-- but-- a slightly higher settlement on the week

5.95 3/4 vs. last week's 5.95 1/2. Grasping for straws here? Feels like it.

Can world events or a rally in corn pull the bulls from the fire next week?

Dec could rally a $1.50 and still be in a downtrend

Producers- if you are storing-- keep a floor. Look at that 2013 chart for corn.

Here's the 2013 chart for wheat in the same time frame.

Just as corn dropped a buck from Oct to Jan-- so did wheat.

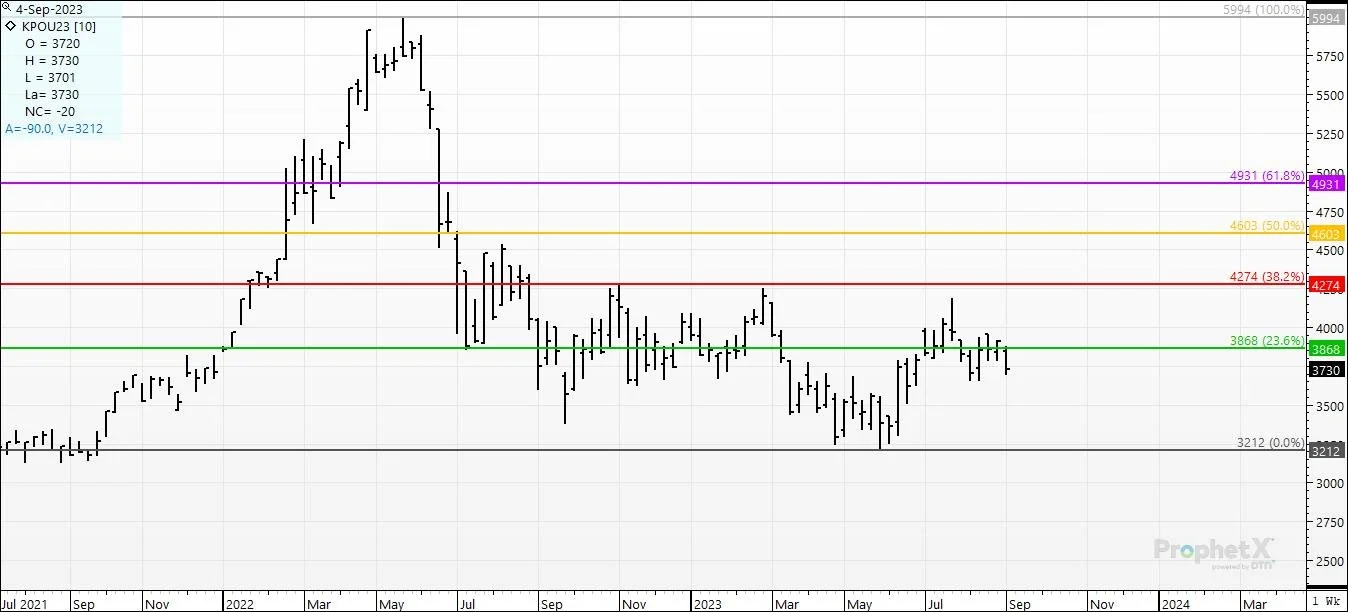

KC Hard Red Winter:

A fresh 2 year low- $7.13 3/4.

Took out last week's low by a penny on Tuesday, then managed a 40-cent rally-- just enough for another "false flag" rally.

Weekly trading range:40.5 cents

Weekly Price Change: UP 9.25 cents

For 7 weeks, we've made new lows. For 7 weeks, every attempt to buy or get long has been a failure.

Keep your puts on the books until you sell your wheat.

The July 2021 contract low? $6.31 1/2 . The machines have that on their shopping list if they can keep pushing prices lower.

6 weeks ago- we traded 9.36. A $2.22 dump from that gift of a rally.

Is there a force in the universe that could get us to rally back to that 1 year bear trendline? If so? It comes into play at $9.17.

If you are going to dream-- dream big!

What do oats know?

A $2.21 rally- looks like the mirror of wheat and corn-

Any day now, corn and wheat can be free to "chase the oats".

Soymeal:

The last June rally-- the 70-point rally from 362 to 472-- remains our "trading range" as we wait for a new break out.

Once again- we finished the week "in the middle of that 70-point range.

Above 397.

That is the pivot for bulls and bears next week.

Bean Oil:

December:

A falter in bean oil-- from that big resistance at 64.

I cautioned bulls about getting over-aggressive at the top of a rally.

This is what I was afraid of.

A pullback as longs took profits in a thin contract.

The rally from May's 2-year low-- sub 45 trade- up to the 11-month high at 65.40 ? did a lot of damage to anyone short.

We pulled back this week to the 25% retracement of that big move.

This felt like pre-report positioning and profit-taking.

On the world stage? Palm oil:

This contract has been whipsawing in a 1000 pt range for about a year now.

It's failed time and time again at 42.75

Level to watch as if we ever take it out-- it will bring spec buyers into bean oil.

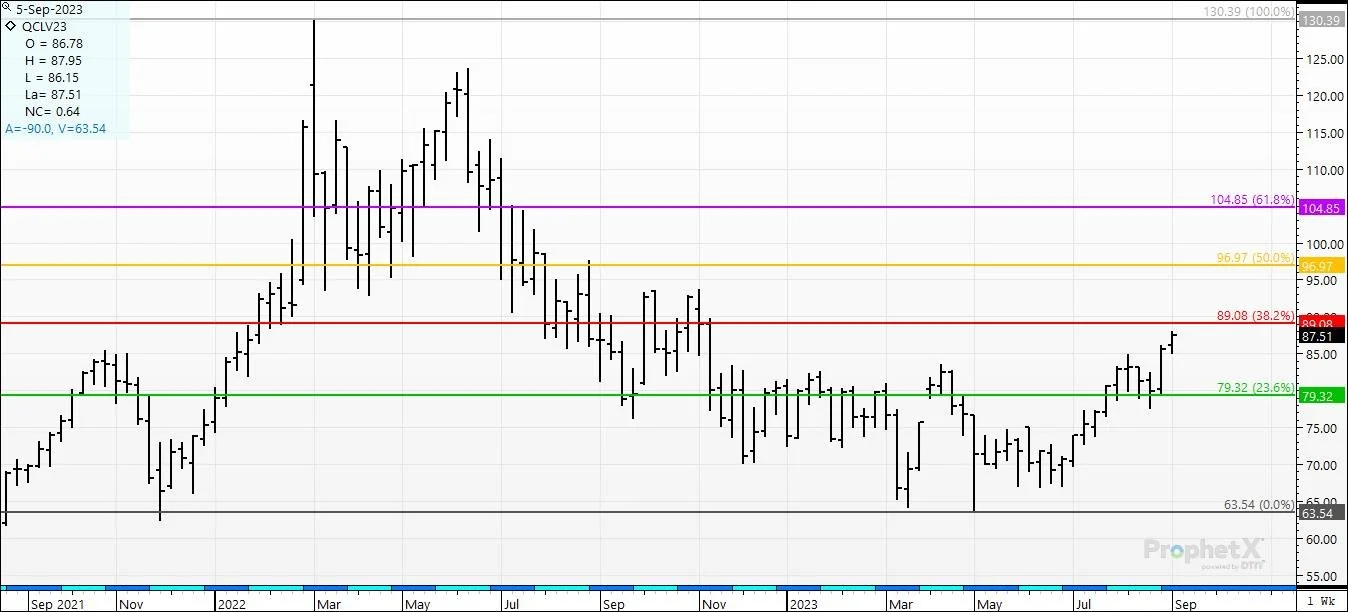

Crude Oil:

We never refilled the SPR after selling 180M barrels right before the election -- at an average price of $95.

Back in March, the Saudis did a cut, and we spiked to 82, but then-- in a gift of gifts--- the market fell back to that 65 level.

That was the time when the SPR could have been refilled- with plenty of $$$ left over.

Now-- every day we inch towards, 95/bbl, the "profit" that was once $30/bbl? dwindles.

Seems like someone's ego got the better of them, in my opinion.

Maybe they should have bought some calls as a hedge:)

$89 is the next resistance- its the 38% retracement of the entire move-- from 130.50 in March of 2022-- The Putin Top----

Down to May's 18-month low at 63.64

Look at the "halfway-back" level-- 97.00 If we get there--- the $30/winner they had on 180M barrels-- becomes a loser.

On to the protein complex:

Cattle- Just keeps on grinding higher.

Continuation charts to look at.

Live Cattle:

spot traded on the board- 184.52. Get your 200 calls on the books?

Puts are your best friend if you are long cattle- trying to stay long, but with a protective floor.

Throw in the fact that corn and wheat- are at 2 yr lows- and anyone feeding cattle- has a pretty good math problem on their hands right now.

If you feed cattle? 5.10 calls for 76 days are a dime right now. Cheap protection against a spike in corn.

Here is April 2024 cattle: Closing in on a 200 print.

Looking for downside support? Take your pick on these two long-term trend lines-

There is at least 10 bucks of risk out there right now if the stock market ever did a "dipsy-do" into October....

Feeder Cattle - Continuation

Weekly Nearest:

244- the 2014 high- is now the new "floor" as we keep tracking up Mt Everest. Just remember, there are a bunch of dead bodies up on Everest.

Keep a put, and keep on rolling.

Feeders:

264 April Feeders?

Up 36 bucks in 5 months, Is this sustainable?

Buy a put. Keep your upside open.

When the Grim Reaper comes- that put will prevent him from cutting you too deep.

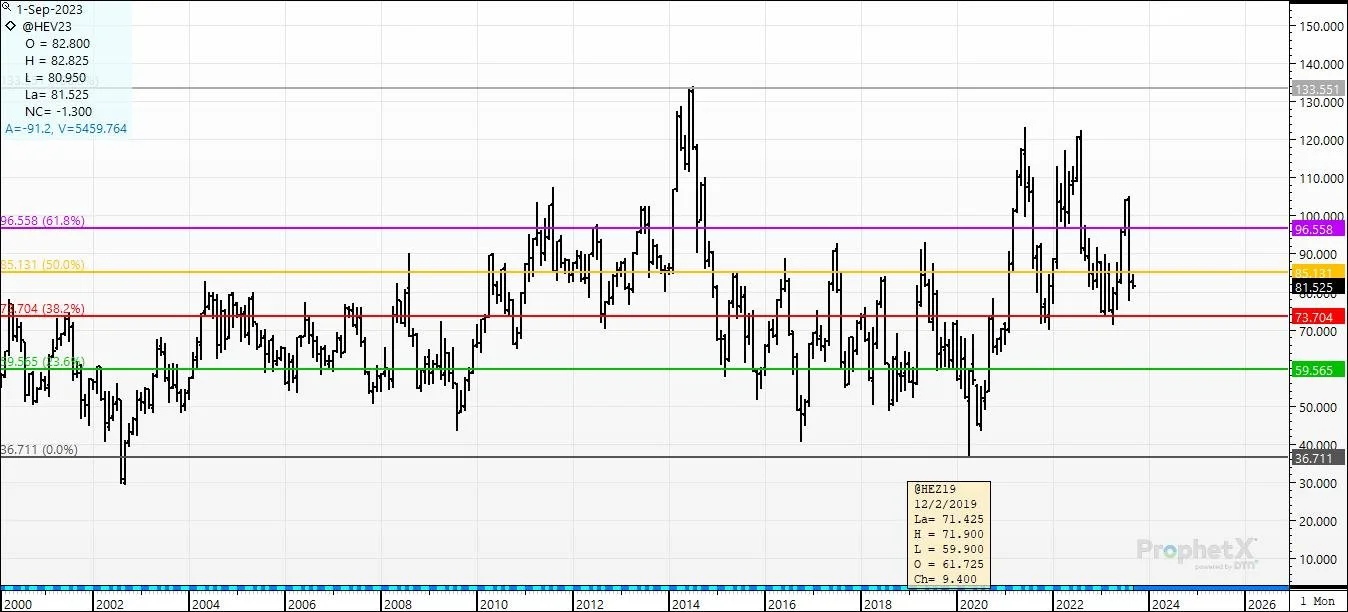

Lean Hogs:

The Trend for 2023- has been down and to the right--- bearish.

This last bump-up was a gift to producers.

Look at 20-plus years of prices--- the 30K foot view--

85 cent hogs is right in the middle of all the available prices over that big long time frame.

Let's not be looking at 75 or 60 down the road, without a put.

April 2024 hogs:

85 is in the "middle" of available prices in 2023.

Let's not re-visit 77 cent hogs without a floor.

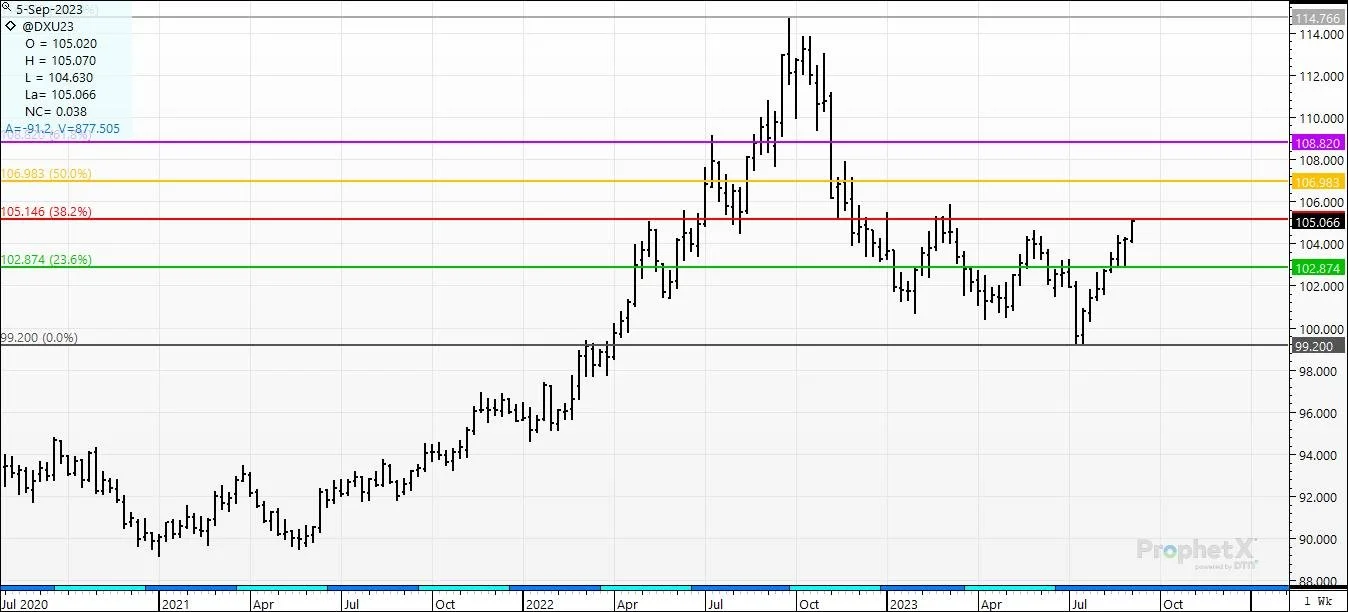

Lastly, The Dollar & Stock market:

First the dollar. At a 6-month high this week.

May gave us an 18-month low- marked a 13.5% drop from the 2022=--- 22-year high in the Dollar.

Yes, we've rallied, but the big picture? We are still not even "halfway back" of that break.

In fact- we hit the 38%-- surprise surprise-- on this bounce to the 6-month high.

A higher dollar doesn't help our exports.

But don't tell that to cattle.Or soybeans. Beans are higher because of supply issues. And a higher dollar? Isn't going to stop people from eating.

If there isn't enough supply, people have continued to pay up. So that--- "higher dollar- bad for exports" mantra works, but not all of the time...

Supply wins all price currency arguments-- generally.

The S&P 500:

347 points from the ATH at 4808 Just 7% away from that old all-time high.

The trend since the covid slam? Higher. Despite all the negativity out there, this stock market has killed more bears than Davey Crockett. And it just keeps on keeping on.

This long-term chart suggests that we could drop to 4000 and still- be in an uptrend. Food for thought.

No guarantees.

a 6-month US tbill gives a riskless 5.5% .

The 2-year note? yielding 4.98% as of Friday's close.

Again-food for thought- I am NOT a certified financial planner. CFP. But these are where rates are today.

That's a wrap for this week.

Tuesday represents risk and reward.

Buying a put isn't "betting on a sell-off"- it's protecting a worse case and staying positioned to make a better cash sale.

End-users and speculators Corn and wheat are at 2-year lows. Calls are on sale. Funds are bet short both corn and wheat- The contrarian play is to get long and try for a "pick six".

Cheap protection for end-users who need to defend against what every farmer is praying for. $5.75 corn and $9.00 wheat.

Check Out Past Updates

9/8/23 - Audio Commentary

WILL USDA REPORT BOOM OR BUST?

Read More

9/7/23 - Market Update

BEANS GIVE BACK GAINS, TRADE PREPARES FOR USDA

9/6/23 - Audio Commentary

BE PATIENT MAKING SALES AT HARVEST TIME

9/5/23 - Market Update

WEATHER IMPROVING, BUT DAMAGE WAS DONE

9/1/23 - Audio Commentary

HOW MUCH DAMAGE WAS DONE & WHAT IS MARKET EXPECTING

Read More

8/31/23 - Audio Commentary

THIS CROP HAS MORE DAMAGE THAN MOST REALIZE. DON’T PANIC SELL

8/30/23 - Audio Commentary

THIS VOLATILITY ISN’T GOING ANYWHERE

8/28/23 - Market Update

WEATHER REMAINS BULLISH BUT CROP CONDITIONS DISAPPOINT

Read More

8/27/23 - Weekly Grain Newsletter

ECON 101 APPLIED TO GRAIN SALES

Read More

8/25/23 - Market Update

BEANS CONTINUE BULL RUN

Read More

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio