LA NINA, FUNDS, & USDA OUTLOOK FORUM

Overview

Grains mixed while soybeans gave back yesterdays gains ahead of Thursday and Friday’s USDA Outlook Forum.

Not a ton of fresh news for the markets to digest with both China and Brazil celebrating holidays. Soybeans were pressured from Argentina getting decent rains with little problems expected moving forward. The next big debate will soon be the US acerage.

We had the CPI (Consumer Price Index) data come in this morning. It came in higher than expected, signaling that the Feds might not cut rates until closer to summer now. This added a small amount of pressure to the grains and led to the dollar rallying to 4 month highs which doesn’t help the grains.

The biggest thing this week is the upcoming USDA Outlook Forum.

Most are expecting pretty bearish numbers because this report tends to be bearish.

The general talk is lower farm income. Which means bigger production numbers and larger stocks.

Analysts are expecting corn acres to come in a little smaller than last year, while expecting soybeans to come in a little higher. However, if you plug in the yield on corn to go along with demand, will very likely still be at a massive carryout.

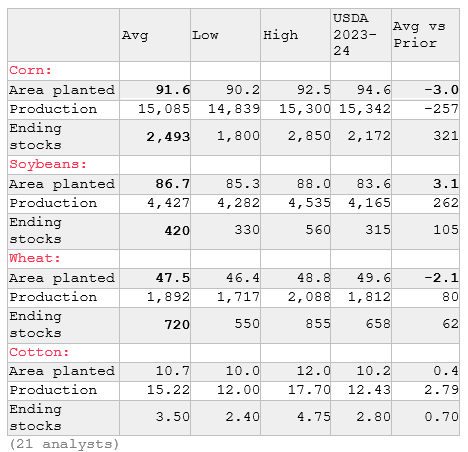

Here is a poll from 21 analysts at Bloomberg. These numbers are the analysts own numbers, not what they think the USDA will say.

If the USDA agrees with these analysts, they have soybean ending stocks up an aggressive +33% from last year.

They also see corn carryout to be a whopping 2.49 billion bushels.

If these numbers are even close, the US is going to need a lot more demand. Because overall, these numbers do not look good at all.

Dave Brock of Brock Report said:

"We did just our 24 balance sheets and are pretty close to these averages. Main takeaway was corn needs a miracle."

Mark Gold from Top Third said:

"I would expect lower wheat acres around the world to be a trend with the cheap wheat prices around the world. I would expect US acres to be down as well."

The funds still hold some of their shortest positions on record in both corn and beans.

They are short around -140k contracts of soybeans. The shortest ever only behind 2019's -169k contracts.

They are short around -300k contracts of corn. The shortest all time for this time of year, and very very close to approaching their shortest all time from 2019.

The funds have zero reason to cover before this report. If the markets take a hit from this upcoming report, most think we will see them at the very least look to cover a small amount of their shorts following this report simply because everyone was already expecting this report to be bearish and a lot of bearish factors are already priced in.

The funds are going to be key if we want any sort of rally.

From Arlan Suderman of StoneX:

"Big shorts already pushed this market hard. Farmer still has lots to sell on both sides of the equator. Won’t say it can’t go lower, but downside momentum is slowing."

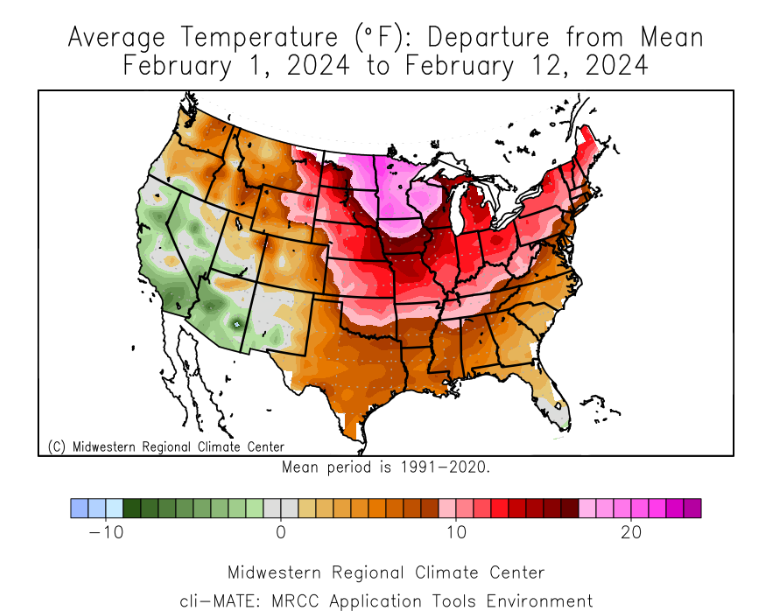

Next let's take a look at weather here in the US.

Many of primary growing areas are having their warmest February on record. With temperature anomalies around +20 degrees F in the upper midwest.

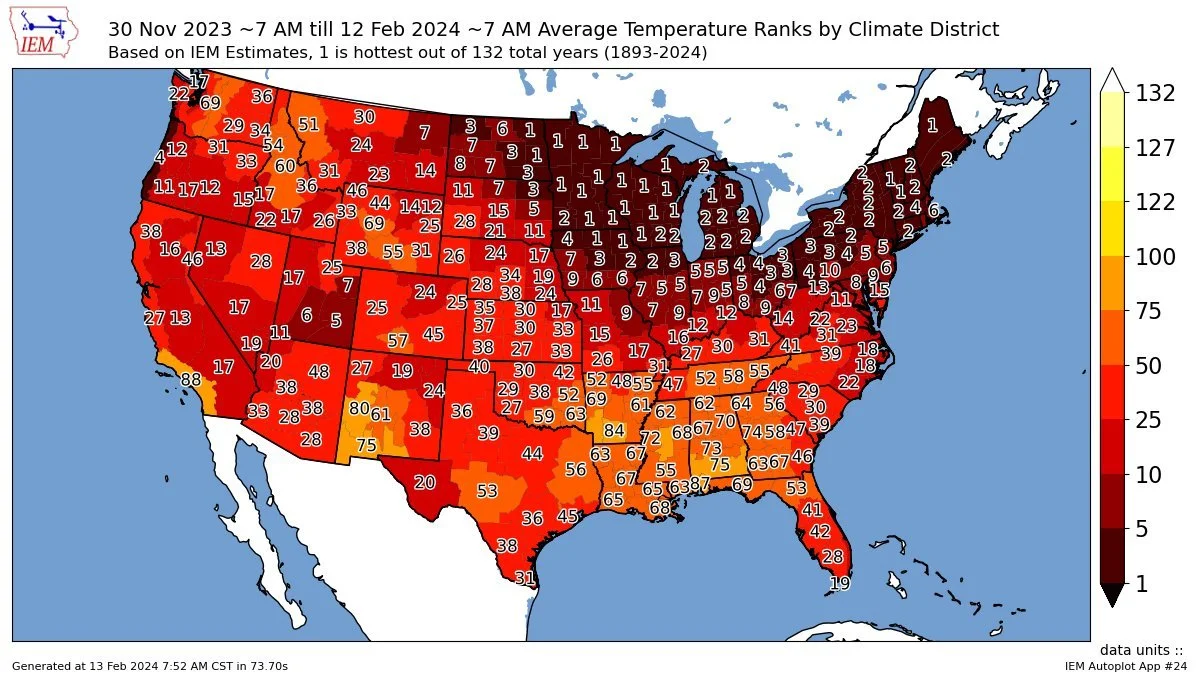

Now let's take a look at how temperatures since November until now shape up.

Again, a good portion are the warmest on record.

Why does this matter? Well what if this same pattern occurs this summer?

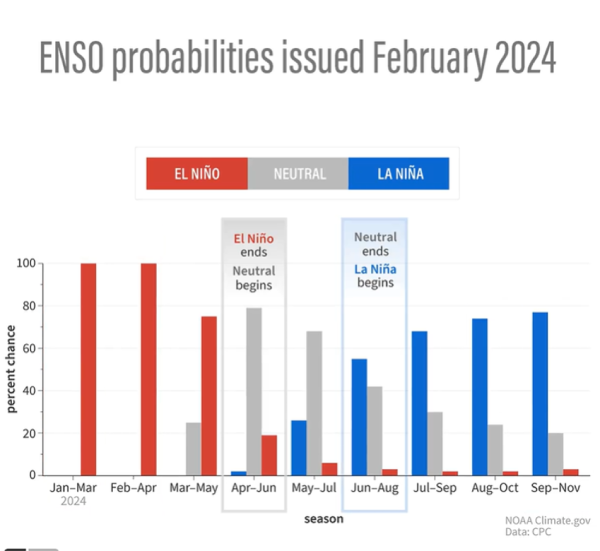

The official ENSO probabilities for La Nina are actually expecting La Nina to be in full effect come May and June. Which would bring hotter and drier weather if holds true. Still too early to make bold predictions, but could certainly be a big potential wild card looking long term.

From Farms.com Risk Management:

"Funds remain too short with La Nina (hot and dry weather pattern potentially returning as early as May of 2024. After 11 straight weeks of selling the commodities remain out of favor with big hedge funds and now almost as record short as they were in 2019."

"The fundamental impetus for a massive short covering rally could start from when we get a 'real' final read on South American soybean crop size and taken over by the North America 2024 growing season. (See chart below)"

Also from Farms.com Risk Management:

"The bullish key catalyst in a bear market is the potential for a massive short covering rally in the grain markets as the big hedge speculator funds are record short. The funds have overdone it to the downside.

But we need to give the funds a reason and our best guess is when the Brazilian soybean harvest is complete at the end of February, and we get closer to the 2024 growing season in North America is when we could finally see a recovery in grain prices."

"We never had a strong El Nino so a return of La Nina could happen sooner than expected but its still early and the funds are always late to the party just like the USDA and will not panic until they have to. Remember 2012 it was not until July 1 that the funds hit the panic button that took corn futures from $6.00 to $8.49 to an all time record high."

Now let's jump into the rest of today's update..

Today's Main Takeaways

Corn

Corn continues to struggle

Later this week we have the USDA Outlook Forum. It is expected that we will be seeing less corn acres and more bean acres. But the biggest thing bears are expecting is for them to reveal a massive carryout number in the realm of 2.5 to 3 billion. Which would be considered a pretty bearish number.

So expect this report to be bearish. We could certainly grind lower from here if it's negative. One thing the market does not have priced in is this report being not as bearish as expected. Meaning it will still probably be bearish from the outside looking in, but in reality it wasn’t quiet as negative as most thought it would be. Because right now everyone is expecting larger production and yields.

Most think we will see US planted new crop acres around 90 to 92 million vs 94.6 million last year.

If the USDA is going to use a 181 yield estimate, we would probably need to see acres come in lower than 91 million to get new crop production under 15 billion bushels vs last year's record 15.4 billion.

Then we have Brazil. Which is going to continue to be debated for weeks.

Many think the USDA is still far too high on their 124 estimate. The CONAB has 114. Dr. Cordonneir lowered his to 112 today.

From Kevin VanTrump:

"Bulls argue that the dramatically lower corn and soybean prices being paid to producers inside Brazil are not only limiting the number of acres being planted but also limiting the number of inputs being thrown at the crop. In other words, as producers in Brazil are being squeezed bu much lower cash prices, they are throwing a lot less money at the crop in the field. Hence, we could see a more sizable yield drag in some areas."

On the other hand, we just got reports today that sources like Ag Rural are raising their second crop corn production by +5 million metric tons to 91.2 million. Citing that farmers are planting an area larger than originally expected.

But nobody believes sources like this when they say the crop is small, so why would they believe them when they say the crop is bigger? Guess we will have to wait and see who is right.

I am still in the camp that Brazil's corn production could very well be a potential factor that gets the funds to cover their shorts.

Nobody knows exactly what that factor will be that makes them cover. It could be Brazil or Argentina, US planting concerns, business from China etc.

All we do know is that we have essentially never not had a weather scare or factor that pushes us higher.

How big of a rally we get when this catalyst happens remains to be seen. But we will be telling you when is a good spot to take risk off the table after we get that rally.

In the meantime, now is not the time to be making sales. Have unpriced bushels? Consider grabbing puts to lock in a floor. But at these levels I like courage calls to help me pull the trigger on sales rather than protecting multi year lows. If you do put in a floor, keep it very cheap. Give us a call if you want to talk or have questions about your operation (605)295-3100.

If we take a look at the chart, I have been saying for a few weeks that if $4.40 does not hold we will likely go test $4.20. Today we sit at $4.30. Do not be surprised to see us drop another -10 cents and go to the $4.20 range.

The funds are holding the shortest position ever for this time of year. They may not want to cover yet, but when we get that catalyst there is a lot of buying to be made. They are currently short nearly -300k contracts. Could they add 50k to 100k more? I mean it is possible, but I see that as a very unlikely scenario. It is very unusual for the funds to hold this short of position for much longer.

Corn March-23

Soybeans

Soybeans give back their gains from yesterday as they continue their sideways action.

Beans have been mostly pressured by favorable weather in Brazil while Argentina has been getting some decent rains following their drought spell.

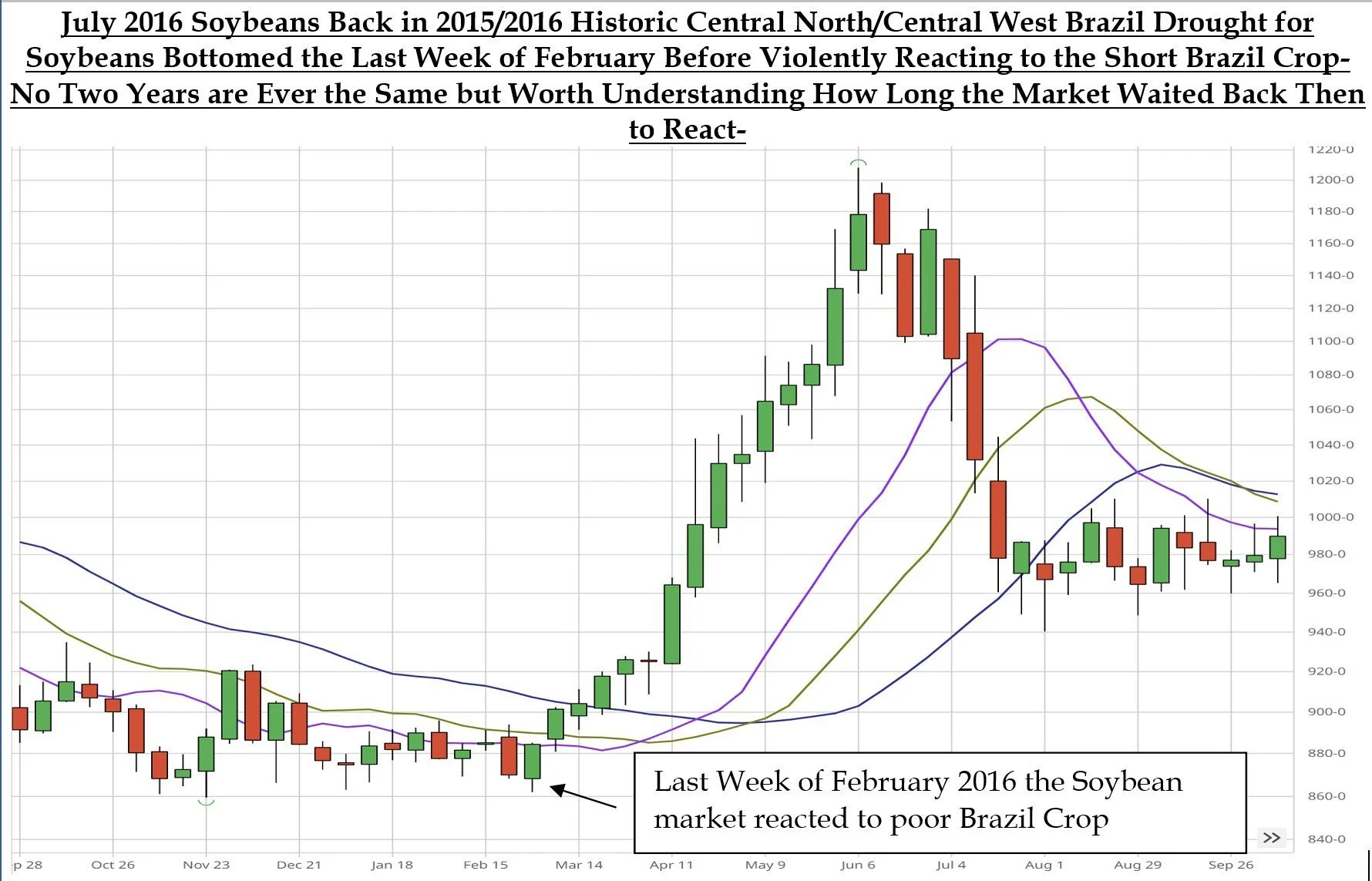

What happened the last time Brazil had a drought?

The 2015 to 2016 growing season they had a historical drought. Soybeans continued lower despite the concerns but eventually found a bottom the last week of February before the market finally started very aggressively to the upside once they realized the short Brazil crop.

No two years are the same, but it is definitely worth noting at just how long the markets waited to react.. A very similar situation could unfold this year if the Brazil crop winds up being as small as some of the bulls indicate is it.

This chart is from Shawn Hackett.

Currently the USDA has Brazil's bean crop at 156.

Far higher than virtually every other estimate out there. The CONAB has 149.

Dr. Cordonnier just lowered his to 147.

As for the USDA Outlook Forum. EVERYONE is expecting this report to be very negative soybeans more so than for corn.

Most are thinking we see acres come in around 87 million. Last year we planted 83.6 million and in 2022 we planted 87.5 million.

If the USDA starts with a 52 bushel yield, then new crop production on paper could jump +300 or so which would be a negative.

If we take a look at what the anaylts are thinking, they see ending stocks up +33% from last year

Here are the possible factors that could help to see higher soybean prices:

US producers plant less than 86 million acres

A scare from Brazil or Argentina, or for their crops to be worse than expected as we start to see results from the fields

A big jump in Chinese demand

Bottom line, this report will probably be bearish. It is tough to know exactly what type of bearish numbers are priced in.

If we get a bearish report and struggle to find a reason to go higher, we could very well continue lower throughout the rest of the month.

This is still not the time to be making sales. If you have unpriced bushels I like protecting the downside on soybeans because there is still some downside risk. Give us a call if you have questions. (605)295-3100.

I still see higher prices, but that doesn’t mean we can’t go lower first. If $11.75 fails to hold. We still have a wide gap to our summer lows of $11.45 last year.

Soybeans March-23

Wheat

Wheat continues to trade completely sideways stuck in this recent range.

One thing bulls got today was that France wheat acres are estimated to be nearly -8% lower than last year after the heavy rain disrupted planting and led to the slowest planting in 30 years.

Bears continue to look at the cheap crop out of Russia.

We have also seen some better weather here in the US due to this being one of the warmest past 30 days in history for this time period.

However, bulls argue that along with this, we will lack snow cover. Which opens up the door to potential winter kill if temps get real cold again. But the forecasts look pretty warm so I don’t see this as a huge threat but it's a possibility.

As for the outlook forum this week, they are looking for less planted acres but are expecting ending stocks to be quiet a bit higher than last year.

The biggest thing that has been happening in the wheat market is the Chicago spreads.

We had a huge carry not too long ago, now we have a small inverse.

Take a look at this spread chart. On January 16th we were at a -14 carry now we are at a slight inverse.

From a commercial standpoint, one of the first things you are taught to get grains to move is to A) improve basis or B) take out the carry in the market or invert the market C) when that doesn't happen, the last thing to get the grain to move is the futures will rally.

If you look at it from a fundamental standpoint now vs a month ago, the outlook is a lot more bullish.

When the market is at a carry, they are paying you to store your grain, that is bearish because it means they are paying you more for later. Meaning they don't have enough demand upfront and there is more supply than demand. That is bearish.

When the market is at an inverse, the crop is worth more upfront. Meaning there is more demand than there is supply. That is bullish.

So overall, these spreads are a friendly sign. I know I'm beating a dead bush when I say wheat is a sleeper. But it is. Still remaining patient.

As I've pointed our numerous times the past few weeks, we are still stuck in this wedge. We have bounced right off that support line multiple times and found resistance there as well.

Look for a breakout to either way for an indication of higher or lower prices. These lines seem silly, but big money watches these. A break could accelerate some movement and break us out of this brutal sideways action.

Mar-24 Chicago

Mar-24 KC

Cattle

Cattle giving back a little of their recent bull run today. Our recommendation remains the same as it was Friday.

Recommendation

You should be taking advantage of this recovery rally. Take advantage on paper with a hedge.

Yes prices could absolutely go higher.

Adding a hedge does not mean you think the highs are in. It is simply good risk management.

What are your options?

A long put is one option. This would give you a floor but keeps the upside completely open in case prices do higher. The only downside to this method is that you have to pay the put upfront.

Give us a call if you have questions. (605)295-3100.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

2/12/24

WHAT TYPE OF GARBAGE USDA OUTLOOK REPORT IS ALREADY PRICED IN?

2/9/24

RECORD SHORT FUNDS, SOUTH AMERICA, & MANAGING RISK

2/8/24

CONAB VERY FRIENDLY. USDA NOT. FULL BREAKDOWN

2/7/24

NEW LOWS IN CORN & USDA PREVIEW

2/6/24

WHAT IS EXPECTED FROM USDA & WAYS TO GET COMFORTABLE

2/5/24

STILL NO CLEAR DIRECTIONS IN THE MARKETS

2/2/24

NEW BEAN LOWS.. HOW LOW CAN CORN GO?

2/1/24

NO CONFIRMATION OF HIGHER OR LOWER PRICES IN GRAINS

1/31/24

HOW SHOULD YOU BE SETTING YOUR TARGETS?

1/30/24

OUTSIDE UP DAY IN ALL THE GRAINS

1/29/24

GEO POLITICS, CHINESE, BRAZIL, ALGOS, & BIG MONEY

1/26/24

SOLD RALLIES & HISTORICAL HIGHS

1/25/24

DEVELOPING A GRAIN MARKETING PLAN WITH TECHNICALS

1/24/24

5TH GREEN DAY IN A ROW: WAYS TO OUTPERFORM THE MARKET

1/23/24

GRAINS CONTINUE TO BOUNCE

1/22/24

HAVE MARKETS FOUND A BOTTOM?

1/19/24

FAILED REVERSALS & ELECTION YEAR RALLIES?

1/18/24