FIRST WEEK OF NEW YEAR FLOPS

Overview

An eventful week to start off the new year.

Soybeans continue their sharp downfall despite estimates from nearly everyone continuing to drop. As we break below our June $12.61 lows and hit fresh 7-month lows.

Corn makes yet another new low on today's action, taking out the previous two days of slight gains.

The wheat market continues higher following yesterday’s solid rally and reversal.

So why are soybeans falling off a cliff like this Brazil crop is made while everyone is lowering their estimates?

First of all, export sales were awful across the board. Beans saw a big reduction from unknown, which was likely China. This was not a good look, and to go along with that, there is still rain in the forecasts for Brazil to go along with the fact that yes they received some decent rains.

Let's take a look at some of the estimates we have now as we sit a week away from the January USDA report, and 5 days from the CONAB on Wednesday.

The USDA has their Brazil bean crop at 161. Now I’m sure this will drop, but by how much remains the question.

Today we saw Safras drop their bean number from 158.23 to 151.36. I found this one interesting because last year they were right on the money. They had their crop for Brazil at 157.8 and the final number came in at 158.

AgResource has the crop at 150.72

Pine is at 149.94

Dr. Cordonnier is at 151

Agricomp is at 149.53

Even StoneX Brazil is at 152.8

So why are soybeans down over $1.50 the past month and a half despite just having the worst 3-month drought period in history?

This crop has definitely gotten smaller since November, but the market just hasn’t seen that on paper.

Some think this crop can be somewhat "saved", others disagree. But it doesn’t matter what we all think. All that matters is what the market and big money think. Right now they think these upcoming rains are going to go a long ways.

At the end of the day, Brazil production will come down to how much of Mato Grosso's damage is beyond repair and what the funds want to do here ahead and following the report.

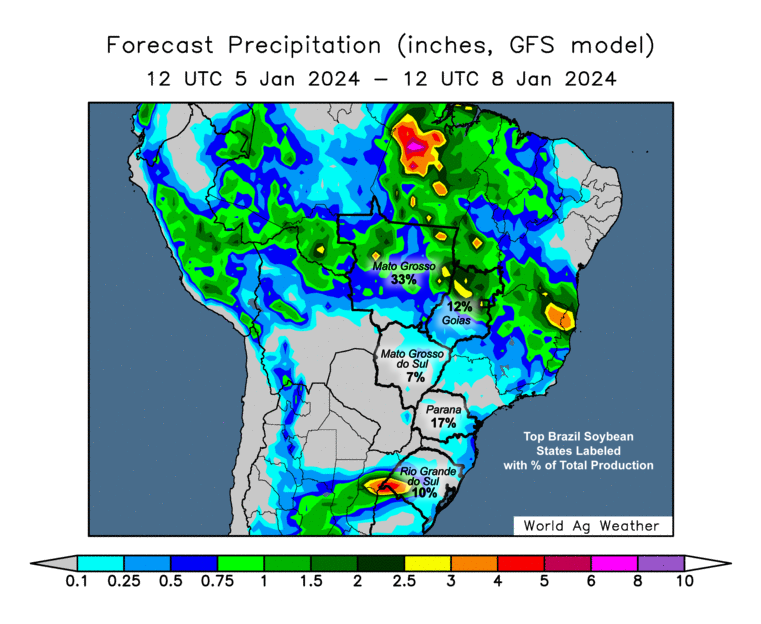

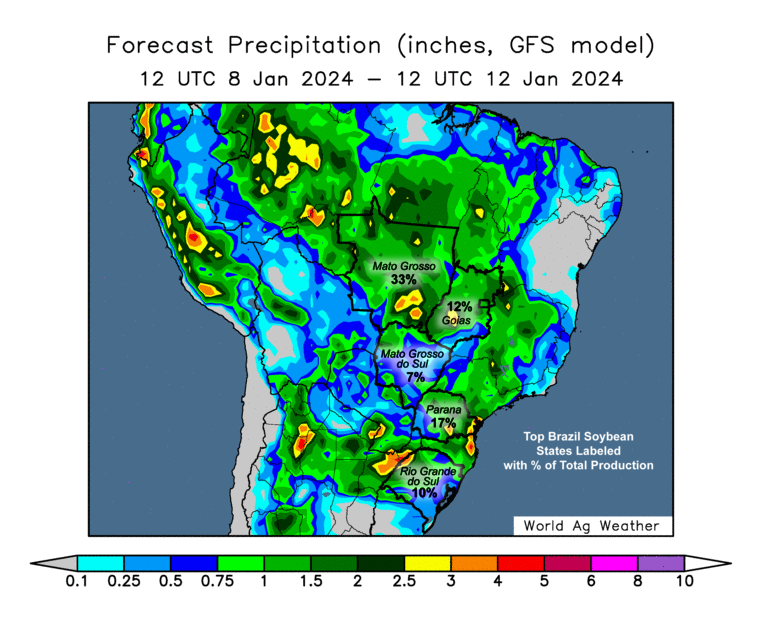

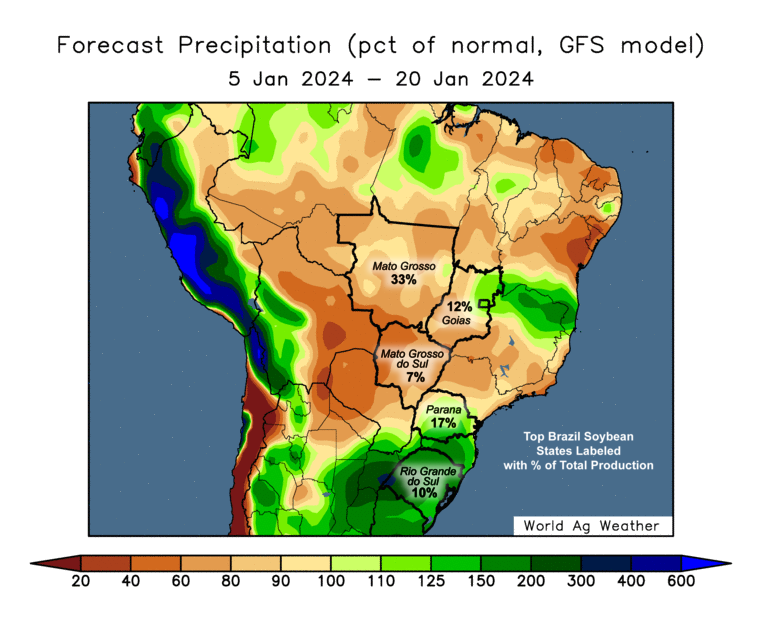

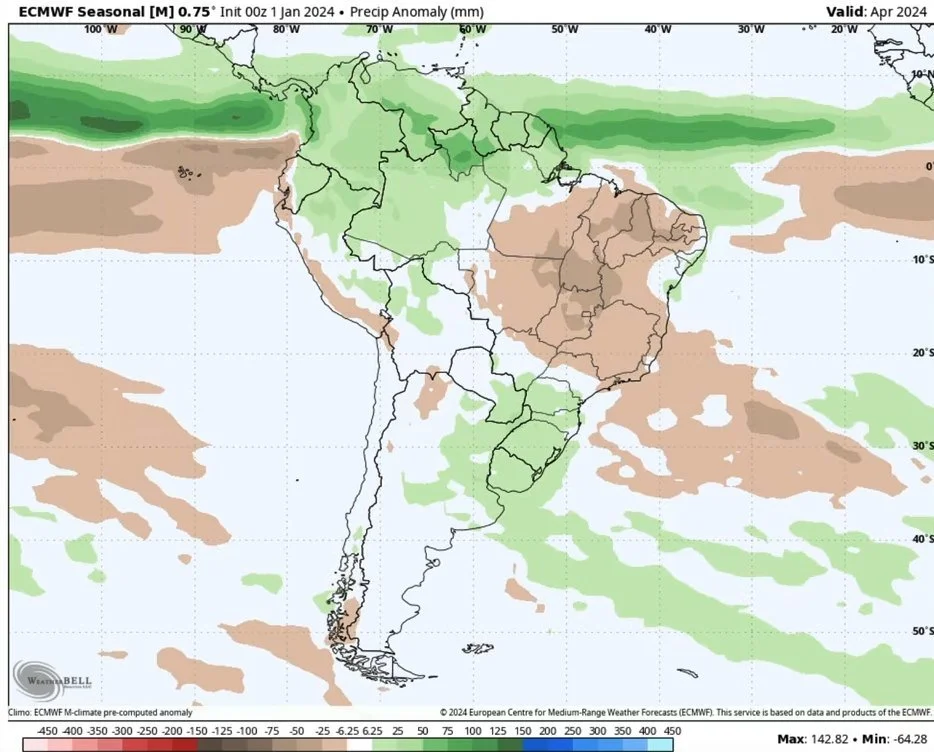

Here is the forecasts for Brazil:

1-3 Day Forecast

4-7 Day Forecast

15-Day % of Normal Forecast

7 Day Forecast Anomaly

January Forecast Anomaly

Yes the forecasts show rain for the next 10 days, then they are expected to back off and become hotter and drier once again.

Some are saying these upcoming rains could actually be "too much" and delay harvest and second crop corn plantings.

From BAM Weather:

"Now the million dollar questions in my opinion are: how long with this next dry and hot pattern linger before the next opportunity of rain?"

Friday's report is going to be a big one. Not only do we get their take on Brazil, but we also get final yields for US production and acreage as well as demand numbers.

Fund Rebalancing

Index fund rebalancing should be happening next week. Below is an estimate of what they should be doing. At least someone will be buying some grain.

Now let's dive into today's update..

Today's Main Takeaways

Corn

Corn finished the week lower due to the awful export data and a continuation of weakness from soybeans. As corn finished down 10 cents for the first week of the new year.

Corn has mainly been pressured by the funds here. They remain heavily short and they just don’t have a major reason to stop selling.

We have the Brazil situation, but this could take some time to come to realization.

It just doesn’t look like corn is going anywhere real fast and the path of least resistance is down until the funds find that reason to cover.

Altough I could certainly see lower prices and more pressure ahead looking short term, here are a few good arguments why longer term our world situation is not bearish from Wright on the Market.

Some tidbits from Wright on the Market:

Argentina is the world's number 3 exporter for corn. They have been importing corn from Brazil for months now and won’t have much if any of their own corn to sell until late spring or early summer.

Ukraine is the world's number 4 exporter of corn. They have half a crop of corn and a whirlpool of shipping problems.

"Brazil's second crop corn seed sales are down -22% to -26%, and with the late planted first crop soybeans, safrinha corn crop production will be 30% to 40% less than a year ago at the best."

So yes I do believe the corn situation in Brazil is flying way under the radar. When will the market care? Might not happen until late January or perhaps February. But to me it just doesn’t feel like the acres will be there will it's all said and done with the late planting etc.

We have mentioned this several times, but we do still need to be aware of the risks. Those are mostly correlated to US production. The risk is we raise a bumper crop on top of our already massive carryout we have.

Do I think this will happen? No, but it's a possibility we need to be aware of.

Historically corn rallies into spring and summer. But so far history hasn't been on our side.

Every year for the past 16 years in a row, corn futures had rallied after the December USDA report and into January. Yet, this year we did not and we broke that trend.

Bottom line, corn bulls need some help from the USDA Friday, the market to come to realization of the Brazil problems, or China to get hungry for US corn if we want to give these funds a reason to cover.

Risk Management:

If you are uncomfortable about the downside, options are cheap. So consider a put to place in a floor. However, we do like courage calls more than protecting multi-year lows.

Give us a call if you have questions or want specific advise on your situation. 605-295-3100

Link to Open Hedge Account

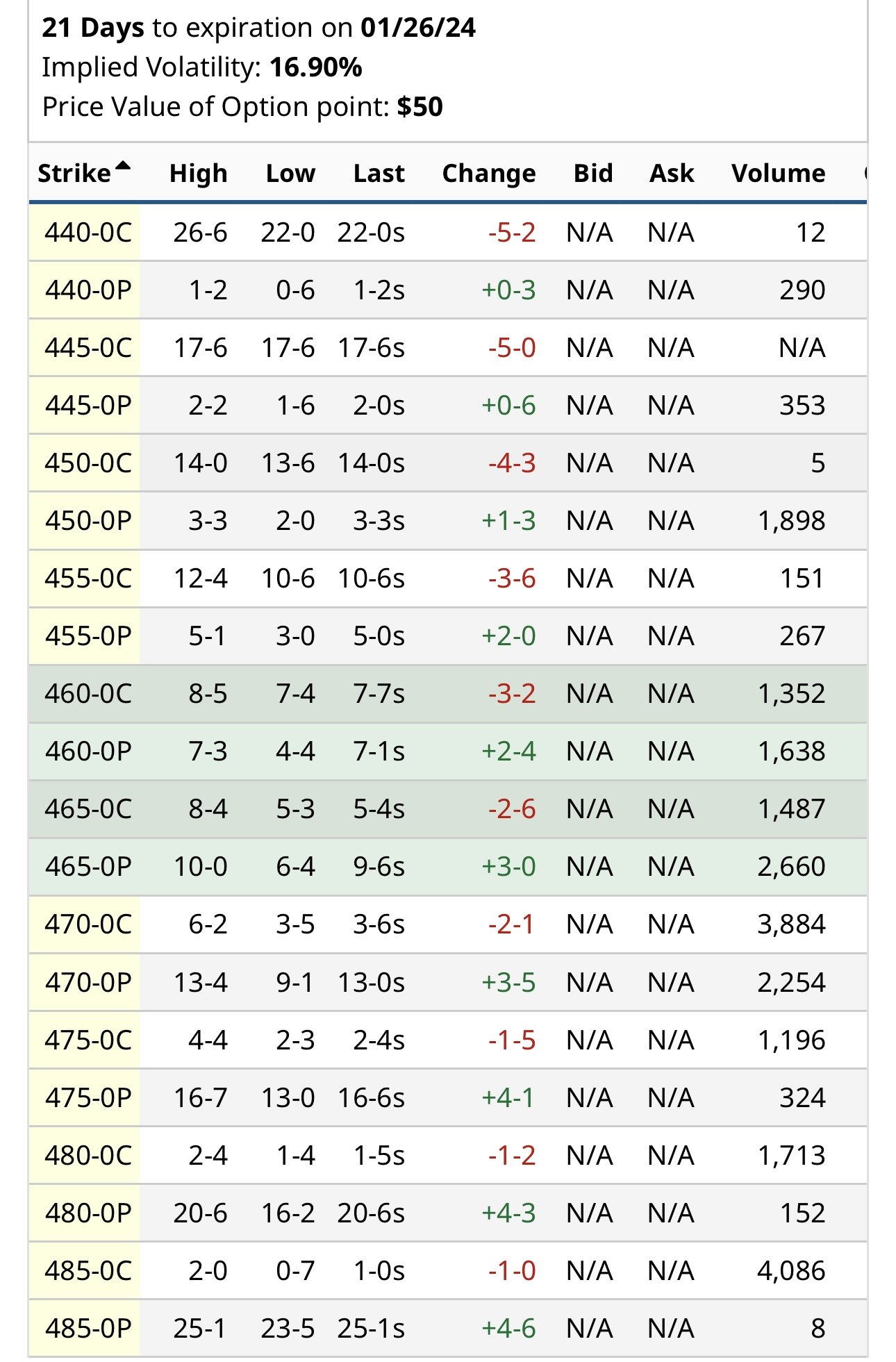

Feb Options

March Options

Taking a look at the chart, we made new lows and broke support. Which does open the door to $4.50 as our next major support level.

Upside targets? The first target bulls need to break is $4.69 if we want to break out of this slump. Then our 20-day moving average around $4.75.

Corn March-23

Soybeans

Soybeans are by far hit the hardest to start the new. Ending down -40 cents on the week.

As mentioned, we are lower because of the Brazil forecasts showing rain.

We have sold off since mid-November even though December is a key growing month and was the driest on record, the market just hasn’t seemed to care. For the market to care, I guess they will need to see some numbers on paper.

Next week is going to be about a few things.

First off, how much rain falls in Brazil. Is it enough to save some of the crops?

Then it is going to be the forecasts. Do the forecasts look hot an drier again after this week of rain?

Then we the anticipation and how the funds decide to position themselves ahead of the report. Do they continue to sell with with the wet forecasts, as they are now net short beans. Or do they stop the selling here to ease some of their risk in case the USDA comes in on the bullish side?

If more rains fall, that is mostly priced in but we could still see additional pressure.

If rains come up short, we probably go higher. But more than anything, this market has seemed to trade the forecasts. If the forecasts can shift drier and hotter that would be beneficial for futures. If they stay wet, then we likely continue to fall at least short term.

If they do continue to fall, then we could start looking at the effects of how this would delay harvest. But we aren’t quiet to that point yet.

Brazil had it's worst planting season weather since they started planting beans over 60 years ago.

Outside of the Brazil situation, longer term, we still believe the sustainable aviation fuel situation could go a long ways in pushing prices higher. Key word "long term". This could months or even a year or longer. But it should create far more demand for soybeans.

From Brazil Consultant Kory Melby:

"There is farmer chatter even below 130. Traders tell me not above 155. Not sure the pivot point to get bears to cover, but it will likely be tense ahead of the report. In my opinion, anything below 155 will raise eyebrows and anything below 150 will make bears sit up straight in their chairs."

Will the USDA come in at 150? I'd love that, but I’d say no chance. We all know how they operate. Nice and slow while kicking the can down the road. A realistic number we see next week? Probably low 150's to 155. A cut below 155 would perhaps be enough to stop the heavy bleeding. But we'd need a number closer to 150 or lower to really get things moving in the favor of the bulls.

Bottom line, expect some volatility ahead of the report. It is going to come down to weather and money flow.

These forecasts are mostly priced in. Until we see some damage and numbers from harvest, bulls will need to start seeing some demand. As we just haven't had much. If China was worried about the Brazil crop, it'd make sense for them to come in and start buying, but they just haven’t. So we need China to start buying until we get actual facts from the fields.

Longer term I still think we have a solid chance to see prices much higher. But although you should also realize the possibility of higher prices, you need to be aware of the risks in this market. Because there is definitely some risk here.

Look at the chart below. From a technical standpoint I see a big risk. We broke our June lows. If we don’t find support soon, the funds could look to push us even farther down with that big pocket of air to the downside.

I am hoping we can bounce out of here, but that doesn’t mean it's going to happen.

Risk Management:

If you are worried about the downside, consider protecting the downside. However, we would still rather be re owning previously made sales or courage calls.

If you are unsure of what to do or want specifically tailored recommendations, please give us a call or text at 605-295-3100 and we'd be more than happy to help you free of charge.

Link to Open Hedge Account

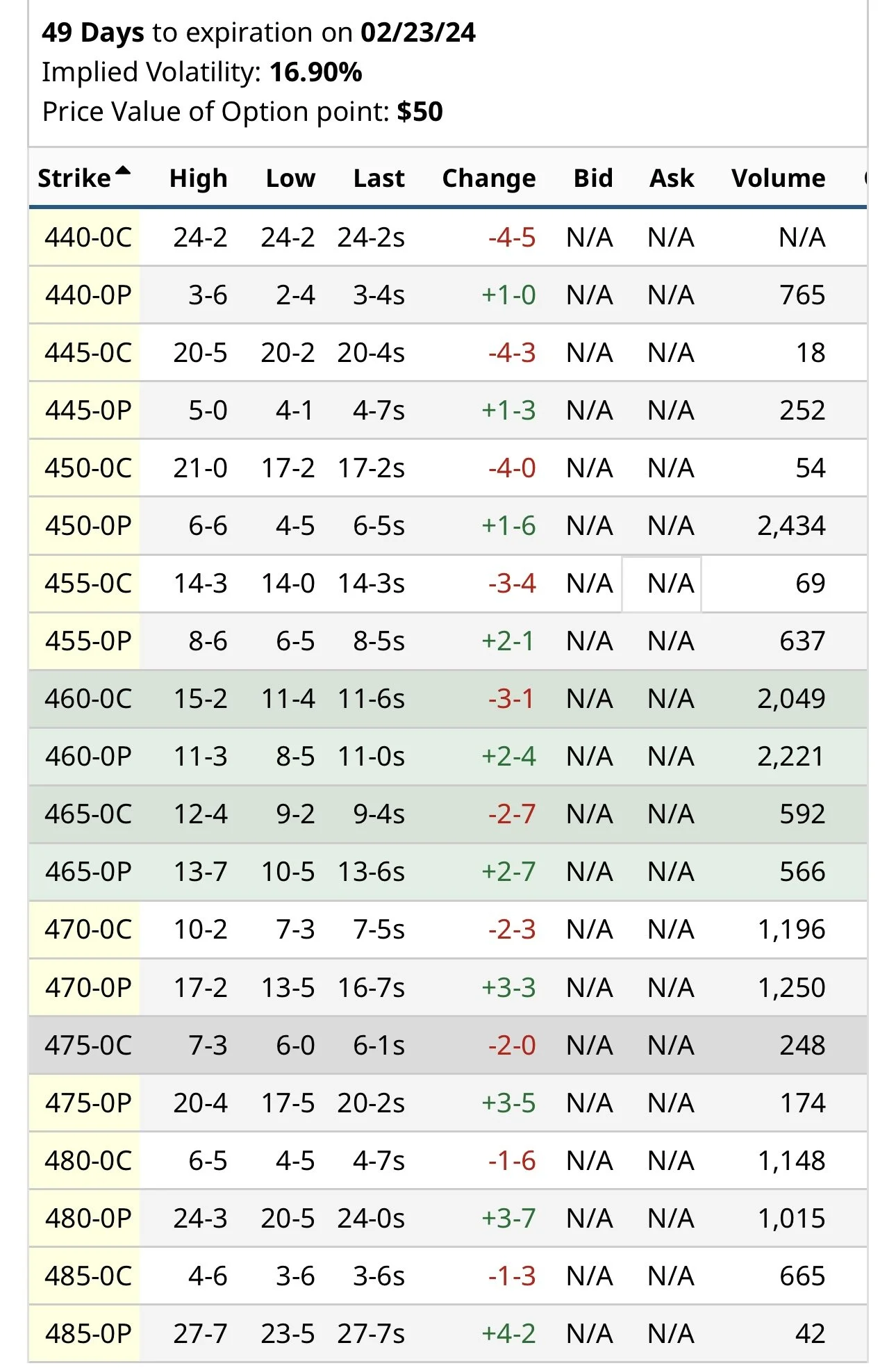

Feb Options

March Options

Taking a look at the chart, we took out our June lows. The next big level to watch sits just 3 cents away. The $12.53 which is our 62% retracment to the downside from the entire $11.45 to $14.28 move. From a pure technical standpoint, a break below could certainly open the doors to perhaps another 50 cents of downside. Hoping that's not the case, but it's possible. Let's hope it's a bear trap as it doesn’t look very promising.

Soybeans March-23

Wheat

The wheat market puts together 2 solid days to close out the week, but just like corn and beans finished down for the week. Closing down a dime on the first week of the year.

Corn and beans have been pressured by Brazil rains and fund selling.

Brazil isn’t a wheat grower. So why is wheat getting pressured?

Comparatively, wheat held up far better than beans this week. But the main pressure has been the fact that our winter wheat crop here in the US is looking quiet a lot better than it was last year.

Aside from that, we are still in a time period where there just simply isn’t a ton going on in the wheat market.

Wheats movement is going to be heavily influenced by the funds, and I do believe short covering could continue to support the wheat market here.

Long term, we still view wheat as a major sleeper. But that doesn’t mean the big move to the upside is going to happen relatively soon.

We still have tons of problems globally and have a world that is consuming more wheat than it is producing for the 5th year in a row.

Even though the war headlines are pretty much a non factor, it's still a potential wild card (not holding my breathe on a war headline though).

The biggest things holding back wheat continue to be a large cheap crop out of Russia and now we are looking at an improved crop here at home.

There are plenty of factors that could push higher in the future. Until then I’m remaining patient. Seasonally we do go higher from here as well.

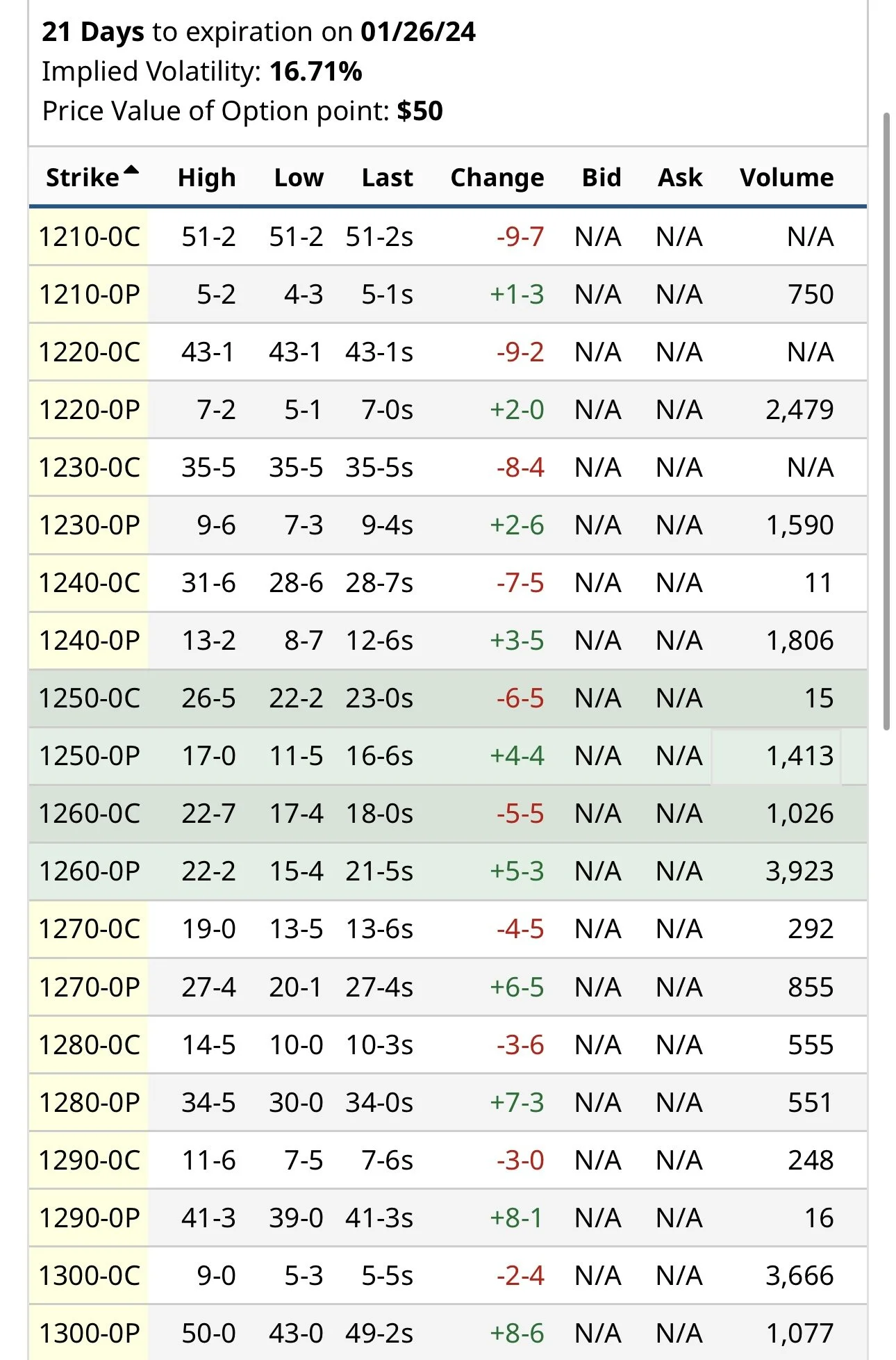

Taking a look at the chart, if we could take out last week's highs it could go a long way in inciting the funds to want to cover more.

Chicago March-23

KC March-23

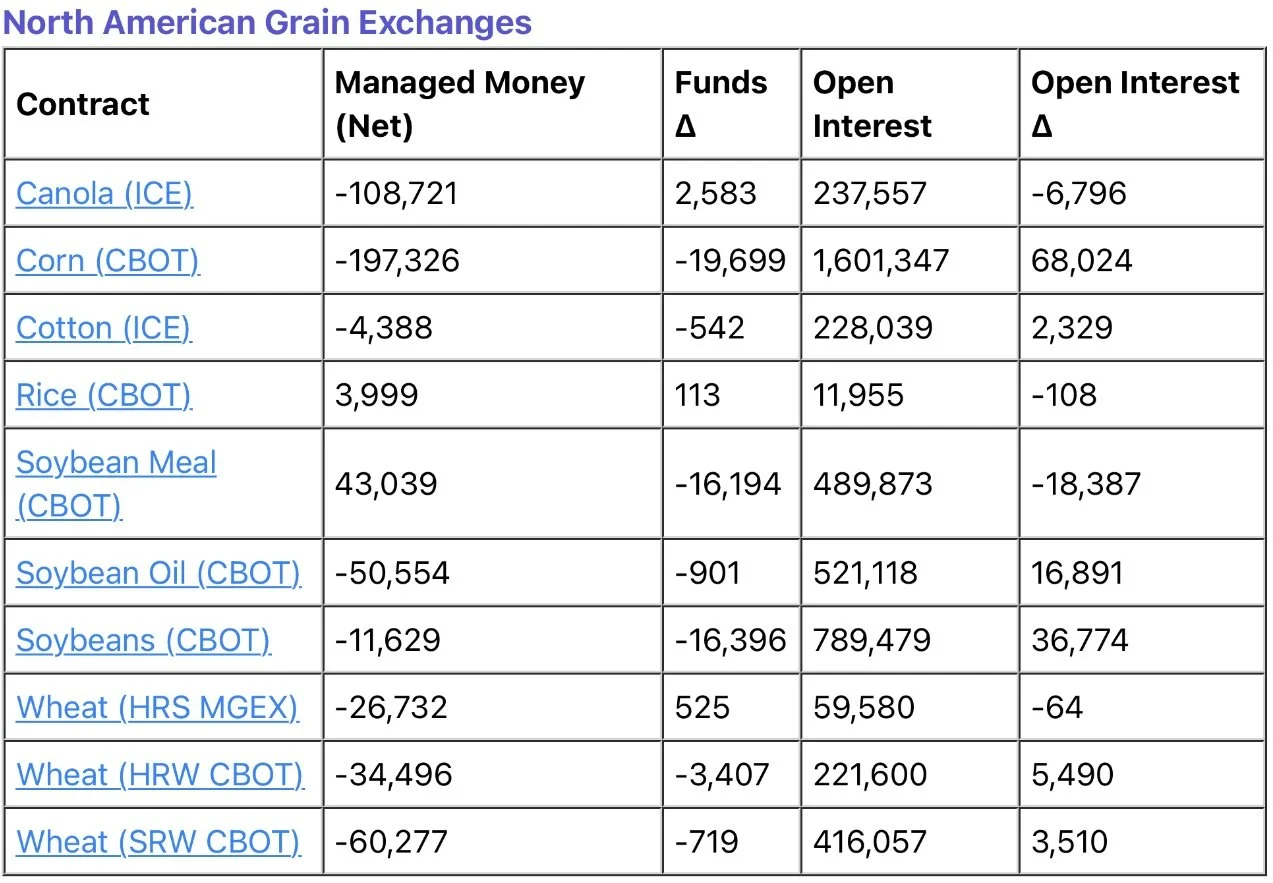

Commitment of Traders

Chart from GrainStats

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23