HAVE ENOUGH OF YOUR NEIGHBORS THROWN IN THE TOWEL SO WE CAN BOTTOM?

Overview

Grains trying to stay alive following the USDA outlook forum yesterday.

Soybeans see a nice bounce, wheat tested it's lows from November, and corn continues to trickle lower.

The outlook forum yesterday was bearish, as expected. But overall was not "more" bearish than expected. The world was expecting bearishness, so overall the report could’ve been a lot worse.

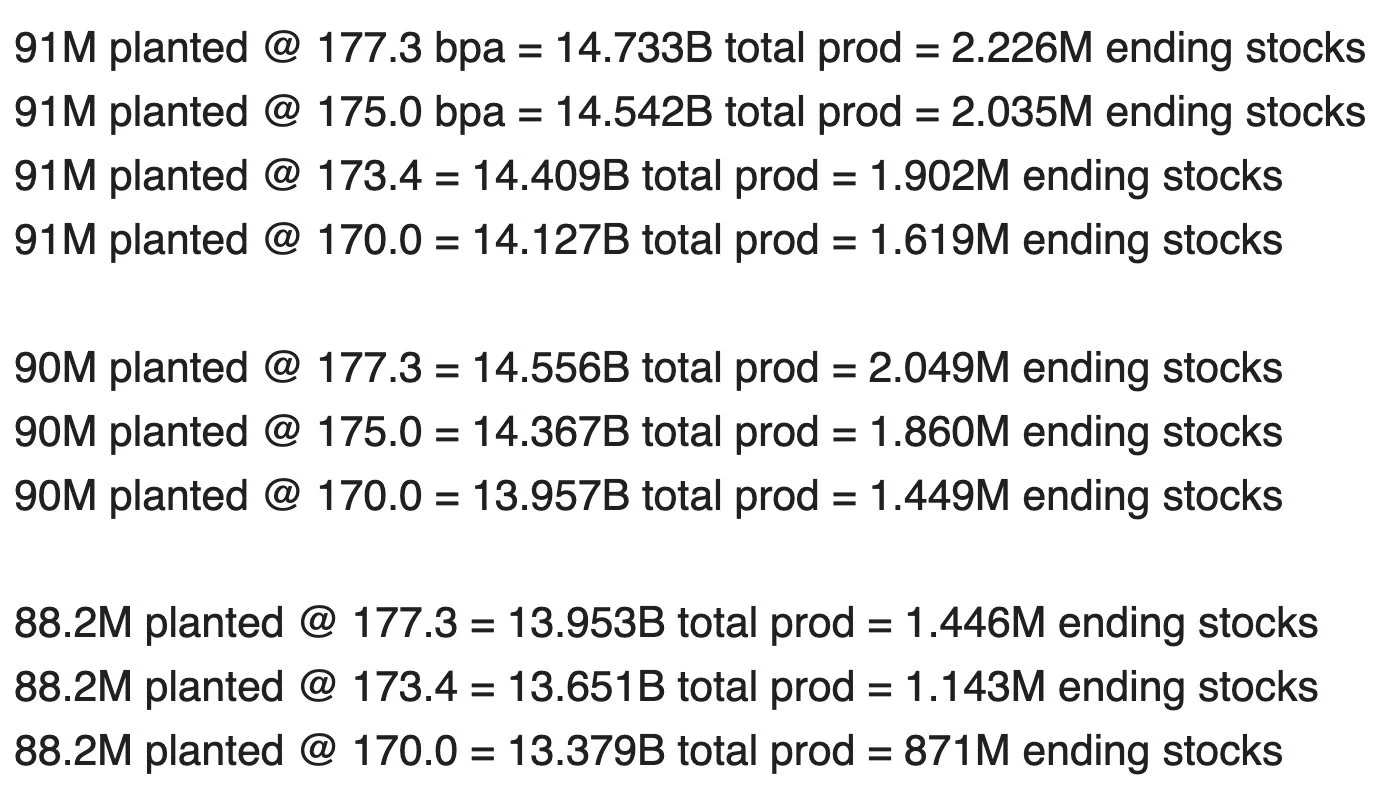

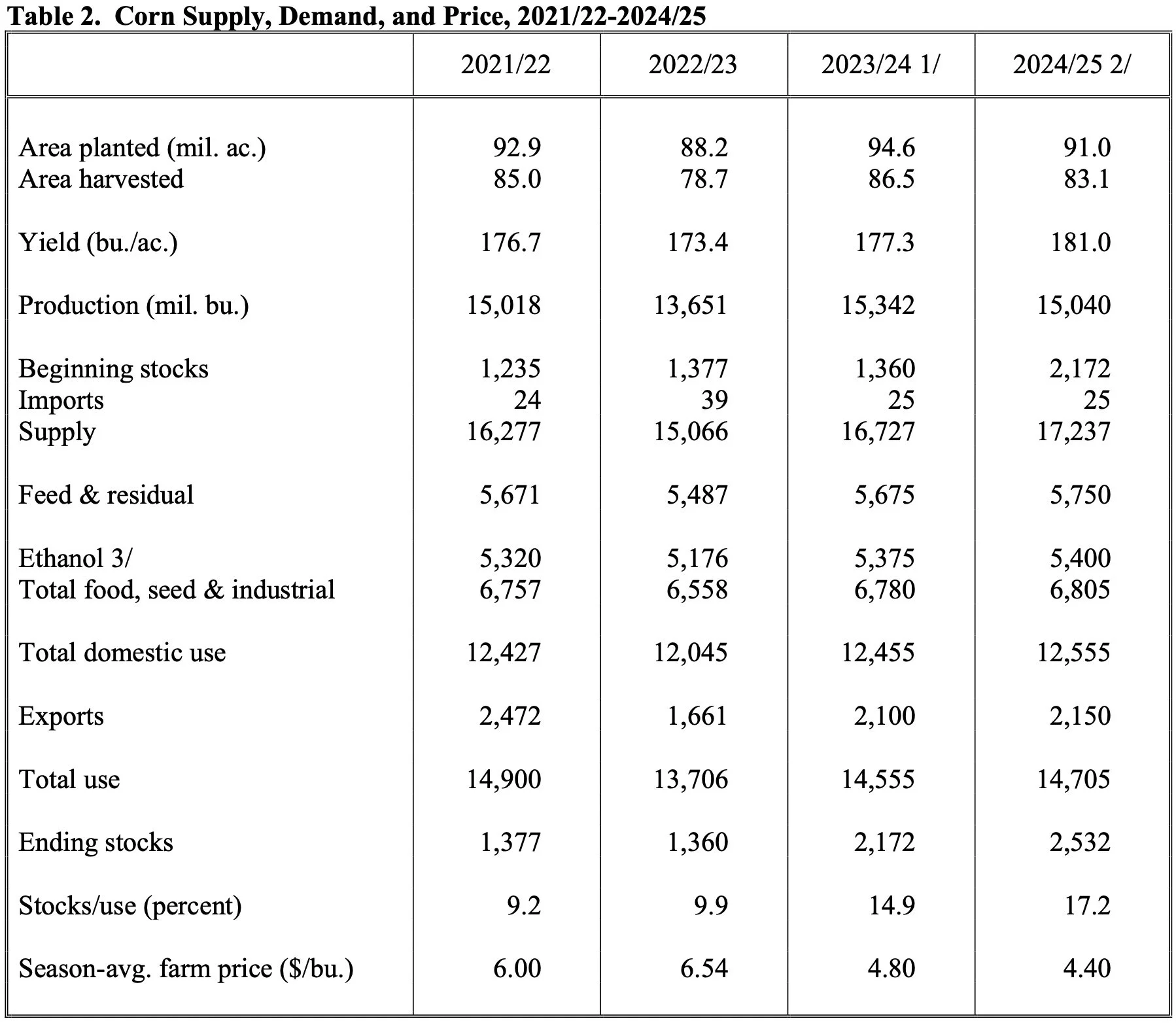

Here is a quick breakdown of the numbers.

The report wasn’t all that negative actually. These numbers are by no means bullish at all, but they could have been far worse.

They had corn carryout at 2.5 billion. Which yes is a large number, but there was a lot of talk about a +3 billion. Historically, the USDA has been too high on their ending stocks the last 5 of 7 years.

They are starting corn yield at 181, which is well above last year's all time record yield of 177.3.

That number is possible, but especially with prices at these levels I find it hard to fathom we will be remotely close to 181. Weather would have to be perfect for this to happen, but possible I guess.

In fact, the USDA is on average 6 bushels an acre too high on their February outlook over the last 5 years. Which if happened this year, would bring us to 175.

There is a lot of talk that the 91 million acres the USDA has will be too high because of the price of corn. The thought process is that there is no way producers will throwing extra expenses at this crop or be planting extra corn. But we all know reality is that Mother Nature will have a say on actual acres, as could other agronomic factors and price movements. The recent rally in cotton is not adding more acres to anything other then cotton.

Here are some great numbers Kevin VanTrump put together. He calculated our yield and acres planted to get our potential carryout numbers.

As you can see, the less acres we get planted can have a massive effect on where our carryout comes in at.

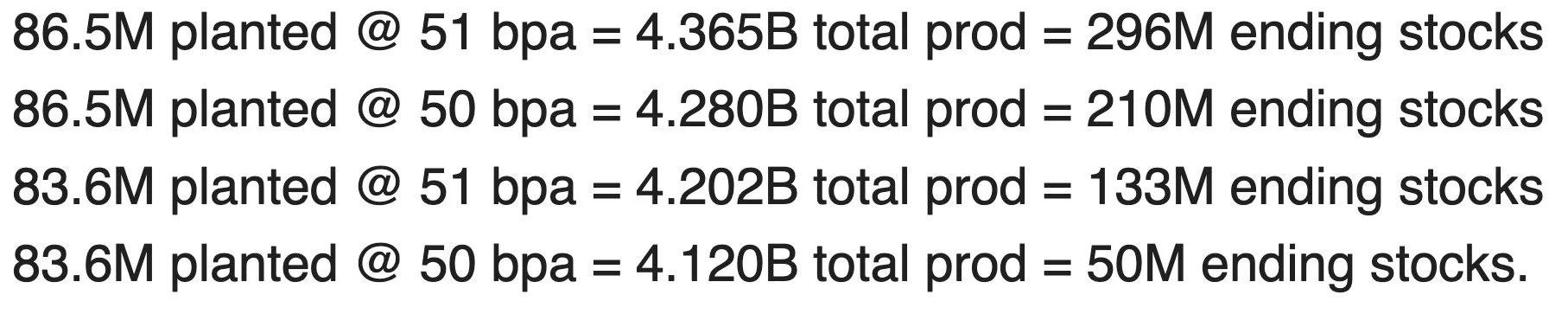

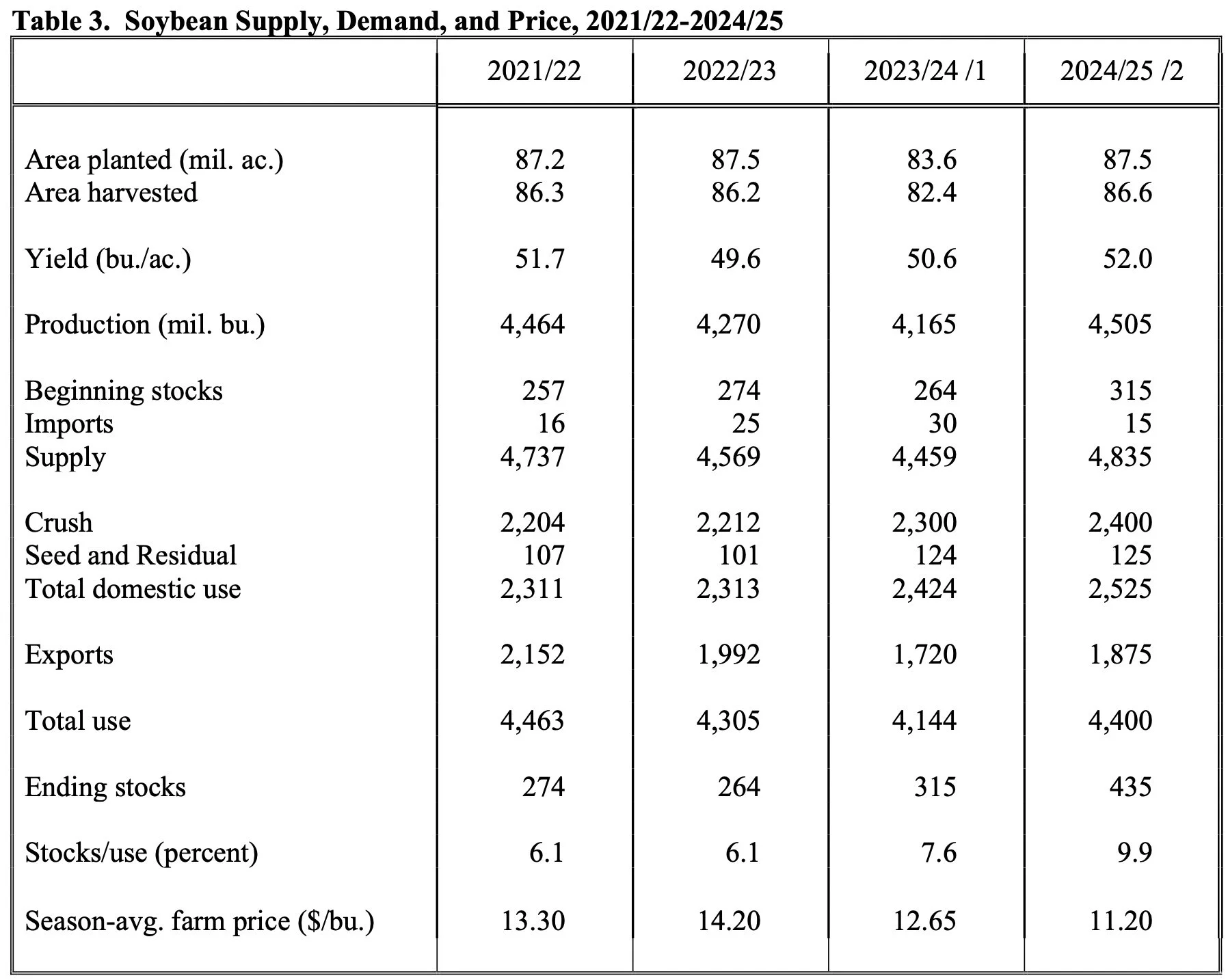

Soybean ending stocks were a lot bigger than last year. They came in at 435 vs last year's 315. The USDA has been too high on the carryout the past 12 of 16 years.

They are starting bean yield at 52. The USDA is actually surprisingly too low on the yield usually. They have been too low the past 7 of 10 years. Now this speaks volume for the demand we have in soybeans.

Again, here is some data Kevin VanTrump put together.

If we plant less than 87.5 million acres, things could get very tight very fast.

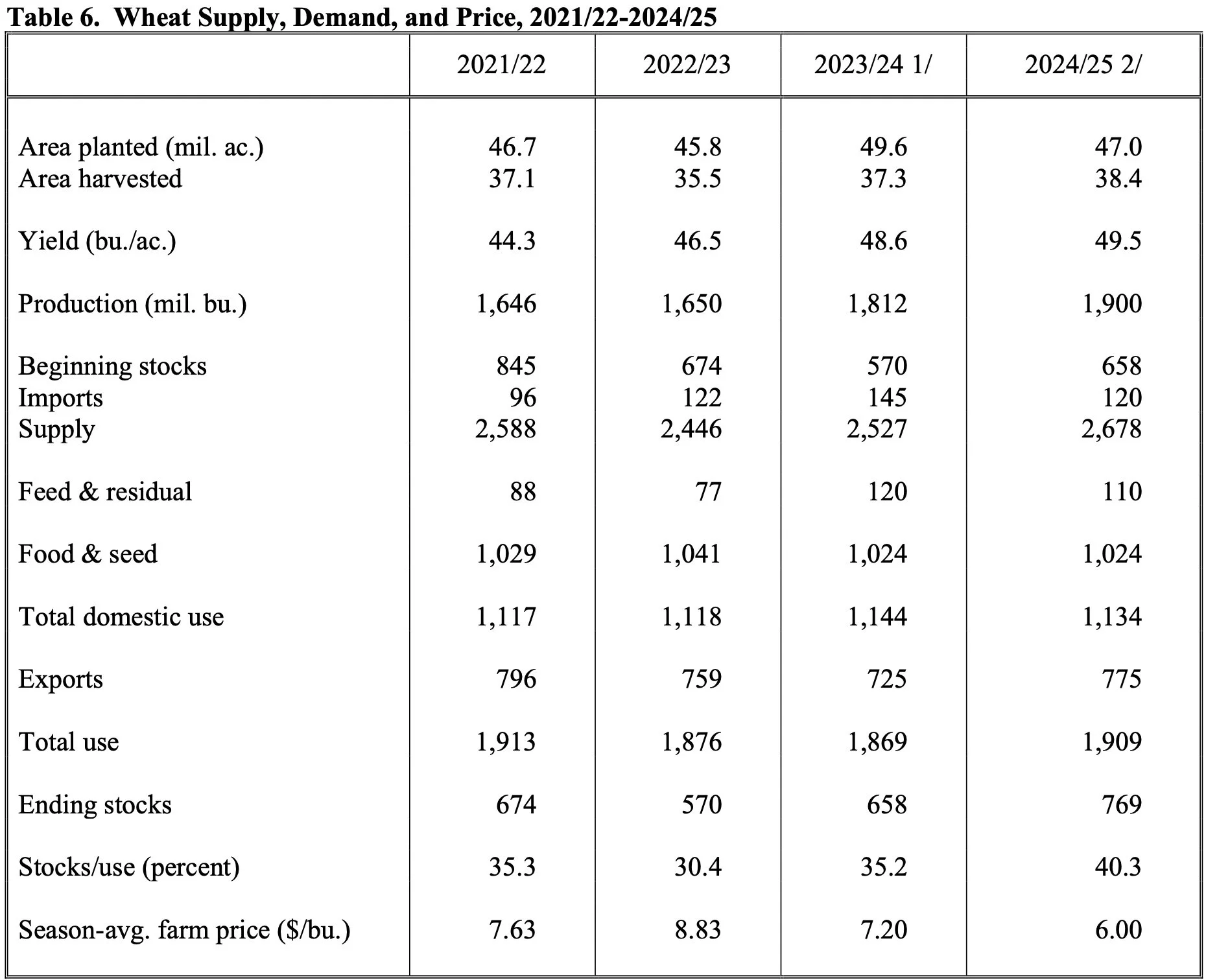

They had wheat carry out up as well, at 769 vs last year's 658.

They have budgeted in some big yields and production. What they haven’t budgeted in is the wheat acres continue to move lower across the world.

We still have several months to get the wheat crop in the bin and the market is acting like the wheat crop is in the bin, but it's not.

So the market had a negative reaction to the report, but the fact that most of the markets were actually higher today was HOPEFULLY a sign that perhaps a lot of this bearishness is already priced in.

Like we said earlier this week, this report and these numbers "should" send us straight down, but a lot of it is already priced in.

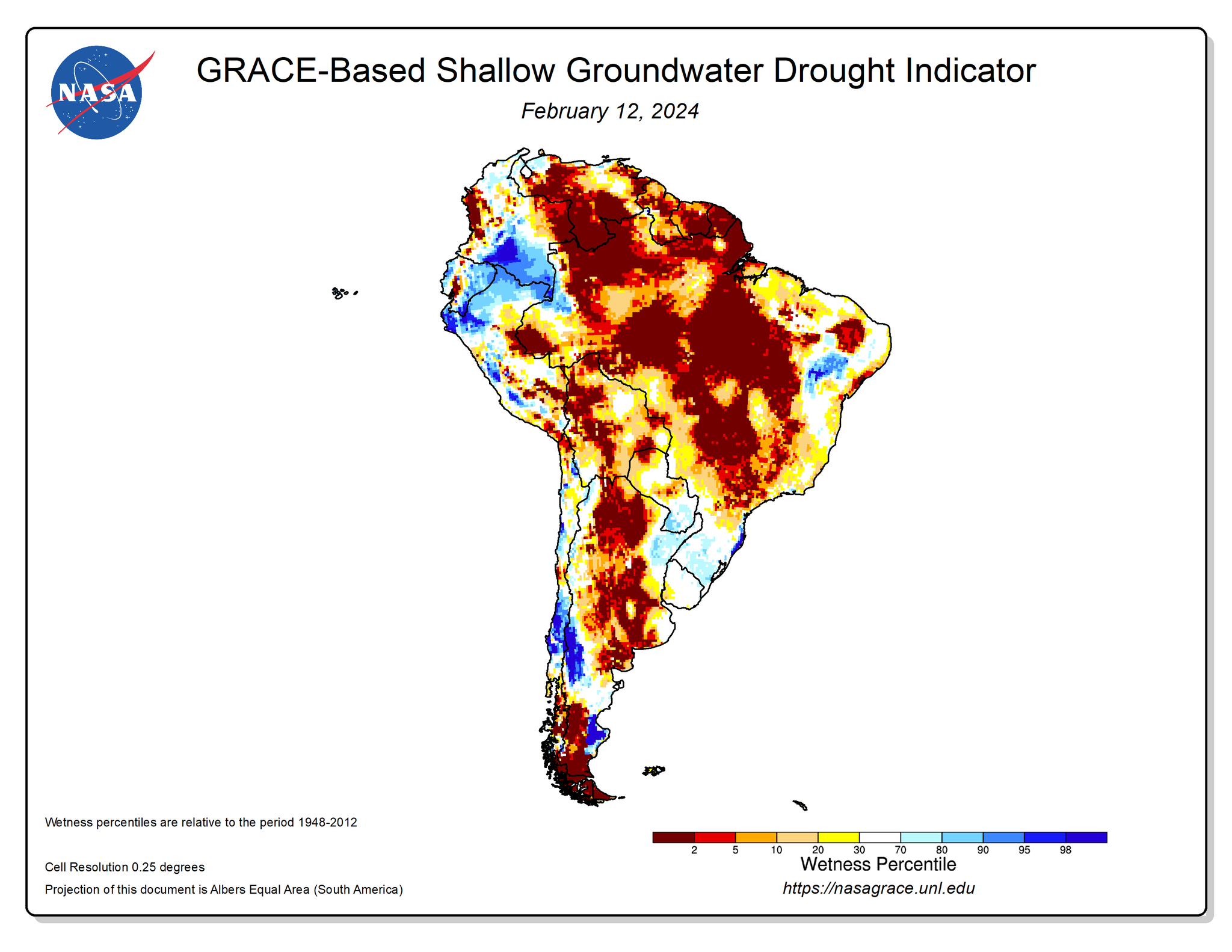

What happened the last time Brazil had a drought?

I pointed this out the other day in a soybean chart.

It took them until the last week of February to realize the damage.

Not saying the exact same thing will happen this year, as there are several different factors at play. For example, our +2.5 billion carryout in corn and Argentina expecting to have nearly double the soybean crop they had last year.

But it is interesting to note at just how long it took them to realize it last time. So who is to say something similar can’t happen this year?

Just something to watch.

Here both the corn and soybean continuous charts from 2016.

Soybeans found solid footing at the end of February. Corn chopped sideways until finding a bottom in late March.

Both rallied substantially before making their highs in June. Corn rallied +92 cents. Soybeans rallied $3.50.

Now let's jump into the rest of today's update..

Today's Main Takeaways

Corn

Corn continues to trickle lower.

We talked a lot about elevators forcing producers to exit their basis contracts yesterday. You can listen to that audio HERE.

Make sure you do your due diligence and understand exactly what your contract says as to what happens when you take an advance. Also keep in mind that one of the devils greatest tricks was convincing the world he didn’t exist. Don’t put it beneath a grain buyer to try to scare producers to sell "before it goes lower".

Here is a good Twitter thread I saw between respected people in the industry that mentioned corn and soybean prices will rally in order to buy acres to encourage planting, and price in weather premium as it's early to be trading trend line yields.

This is similar to what I said about not putting it beneath a buyer to sell you fear. Who is the biggest buyer in the world? China.

From Brian Wilson, Options Trader:

When discussing the markets, "They play us like a fiddle everytime and the current fear of lower prices us ripe to hand everything over to them at the prices they decide."

Corn is trading at $4.16. When adjusted to inflation, this is roughly equivalent to $3.01 corn before COVID.

The last bearish cycle, corn bottomed at $3.01. Which means corn is currently sitting at an all time low when adjusted to inflation.

But looking forward, this is a good thing for the prices. Right now it feels like all hope is lost for the market. Right when everyone thinks it's game over is typically right around the time we start to turn around.

With corn sitting at these levels, and the funds holding a record short position is actually friendly looking long term. Now no we probably won’t see $6 corn this year. But these funds will have to cover eventually.

The silver lining is that HOPEFULLY it "can’t get much worse", I hope. Most including us thought this a while ago as well. But I am confident we will be trading higher at some point this year.

Can we go lower? Yes it is possible. But I would not want to be short here.

Looking towards later this year is sub $4 corn a real possibility? Yes it is. But there are many factors that can and should lead to a rally before hand. There is a chance we rally back to $5 this spring and summer, but then go down to $3.80 this fall. There are several factors at play that will determine how low we go after we get the usual weather scare rally in spring or summer.

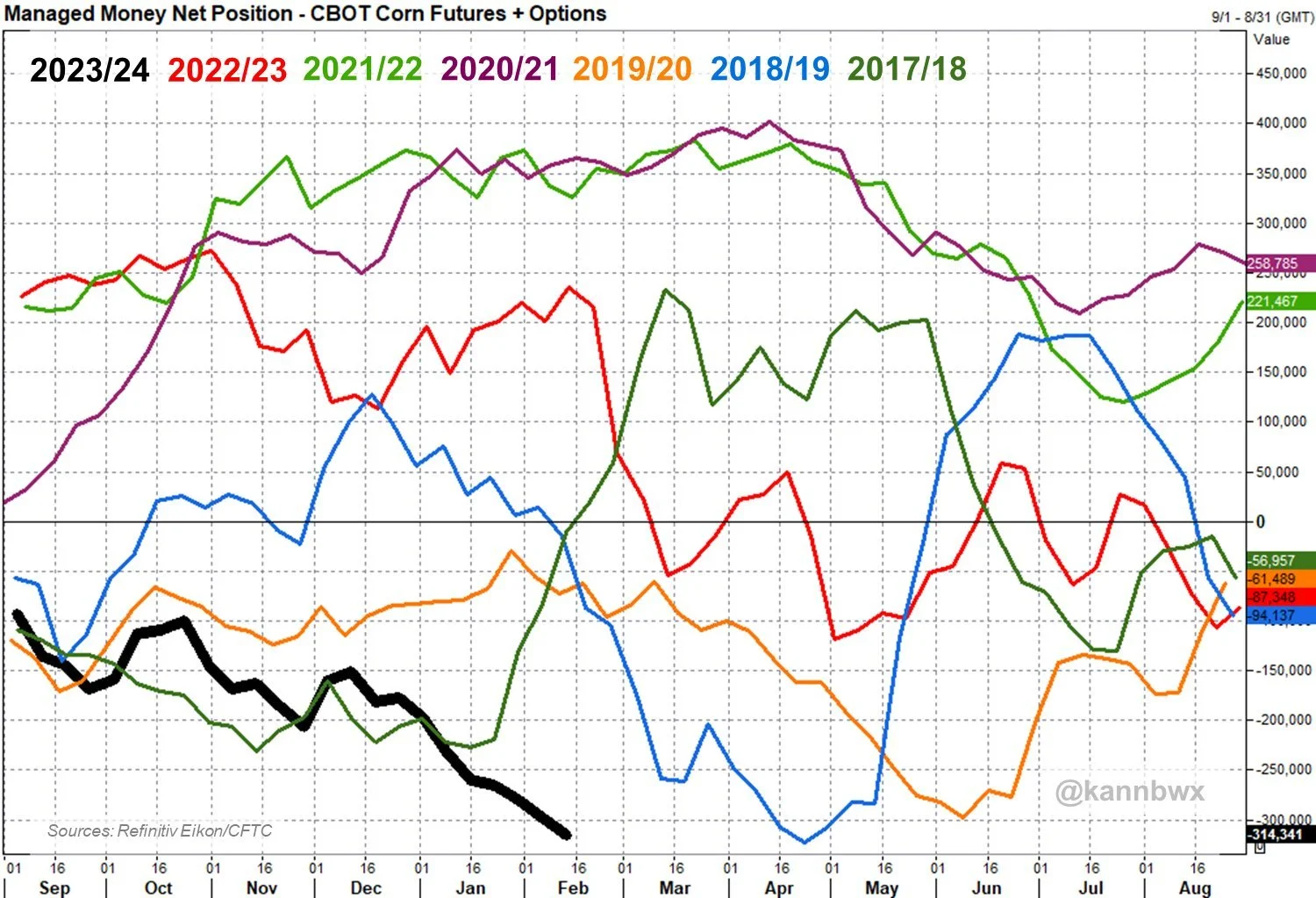

The funds now hold a record amount of shorts. When they have to cover, they will have to buy a massive amount.

From Brian Wilson, well respected options trader:

"How will the h/k corn spread act when the funds roll 300,00+ shorts?"

"There aren’t enough market makers to make this exit seamless"

Take a look at the fund positions for corn. When they reach levels this short and are forced to start buying back. Often times the buying comes quick. Just like Brian said, their position is so massive that exiting it will not be this seamless task.

The reason for them to cover could be a multitude of things. But the three main ones I could see happening are:

1) A weather scare here in the US. Could be during planting or growing season. Last year, despite us having a good crop, we did get that scare in June that pushed us $1 higher in just a month. We almost always get one, but yes the size of the rally will be heavily dependent on how big of scare.

2) Brazil or Argentina. Nobody knows exactly how good or bad of a crop they have or will have. But as mentioned, last time Brazil had a drought it took them until February and March to realize it. Last year during the Argentina drought, it also took them a while. We will have to see if this drought had a bigger effect than realized or not.

3) China. We absolutely need China to start coming in here to buy. This is one of the biggest things our market is lacking. Demand. We had all this chatter about China looking for corn, but nothing has came of it yet.

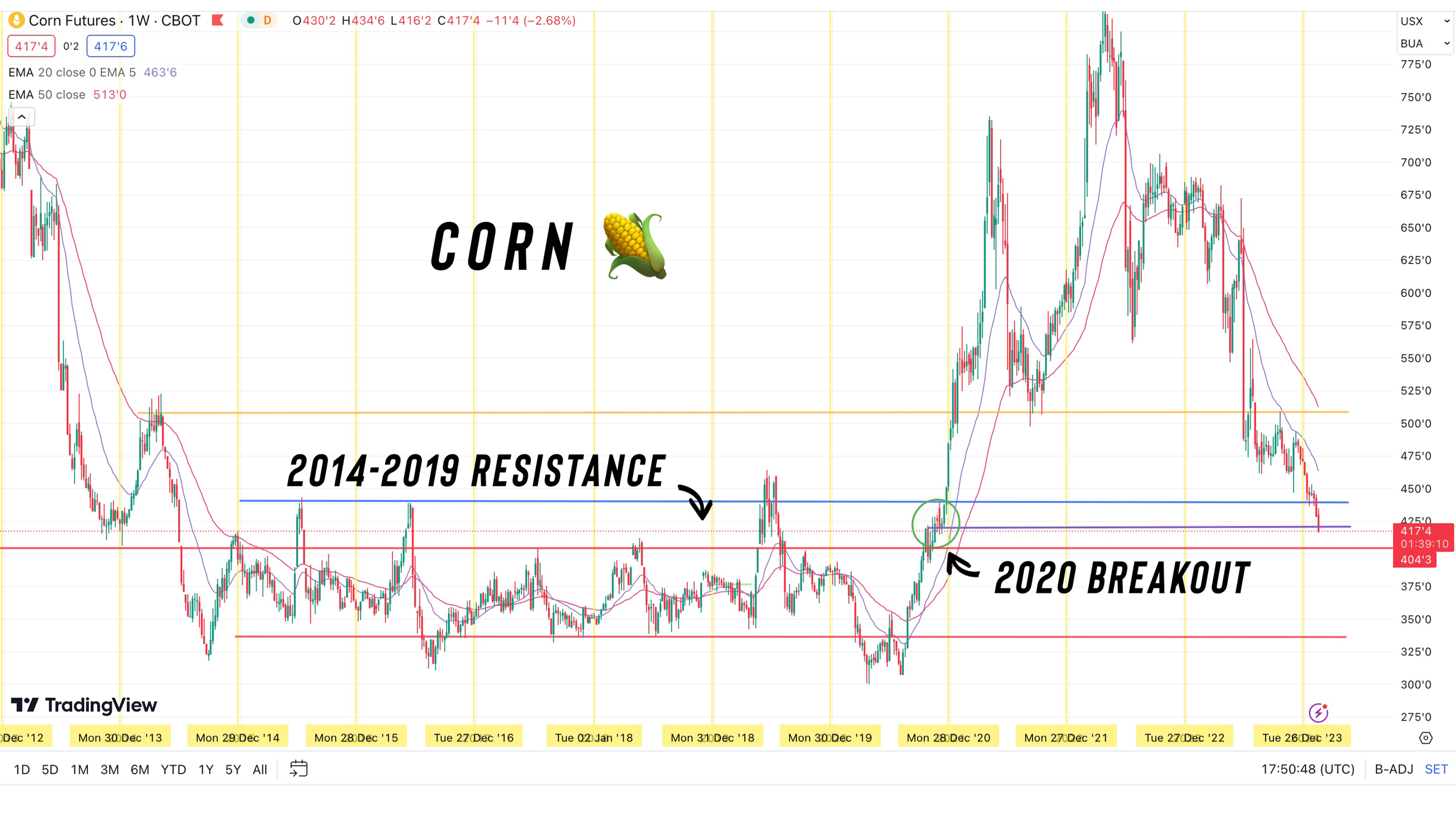

I have talking about the $4.20 level as a possible bearish target for weeks now. Well we are here. This is the exact area in which we broke out of that range we traded in from 2014 to 2019.

I am still confident we will hold around this area and turn that old resistance into new support. The $4 level is extremely important. If we break below that, there is a chance we go back to those pre-COVID levels. But I like our chances of staying in this new $4 to $6 range looking forward.

The risk we see corn start with $3? If we raise a bumper crop here in the US and somehow wind up with a +3 billion bushel carryout and trend line yields. But the odds of that happening are not very high.

Take a look at this chart. The USDA's "trendline" has continued to increase. But actual yields have plateaued the the past decade.

Bottom line, still don’t want to be making sales here at these levels. I think we are close to bottom. But of course who knows where the actual bottom will be or how much lower we have to go before the funds cover.

Im still a firm believer we will get that usually spring or summer rally. In the meantime, if you have unpriced bushels, maybe look at puts to add protection if you are someone who thinks corn will go sub $4. But instead of protecting multi year lows I still like courage calls more on corn.

For courage calls you can either use them to give you the courage to make a sale after we get a rally, or you can make a sale and use a courage call to participate in the upside. Give us call if you have questions or want 1 on 1 help. That's what we are here for (605)295-3100.

If you have to move something in the next month or so, you should have been proactive the past few months. Keep in mind, that in bear markets you need to sell ahead of time and wait for basis typically and try to roll and pick up the carry.

Overall, we want to wait until April, May, June, July to make our sales because that is seasonally when we make our highs and we will HOPEFULLY get that opportunity this year as well. But you will want to be set up to start making your sales or putting protection in place when you start to get uncomfortable as to what you and the US will raise.

*HOPEFULLY is in all caps because hope is not a true risk management strategy. But history does tend to repeat itself.

Corn March-23

Soybeans

Soybeans get a nice bounce despite the bearish report yesterday.

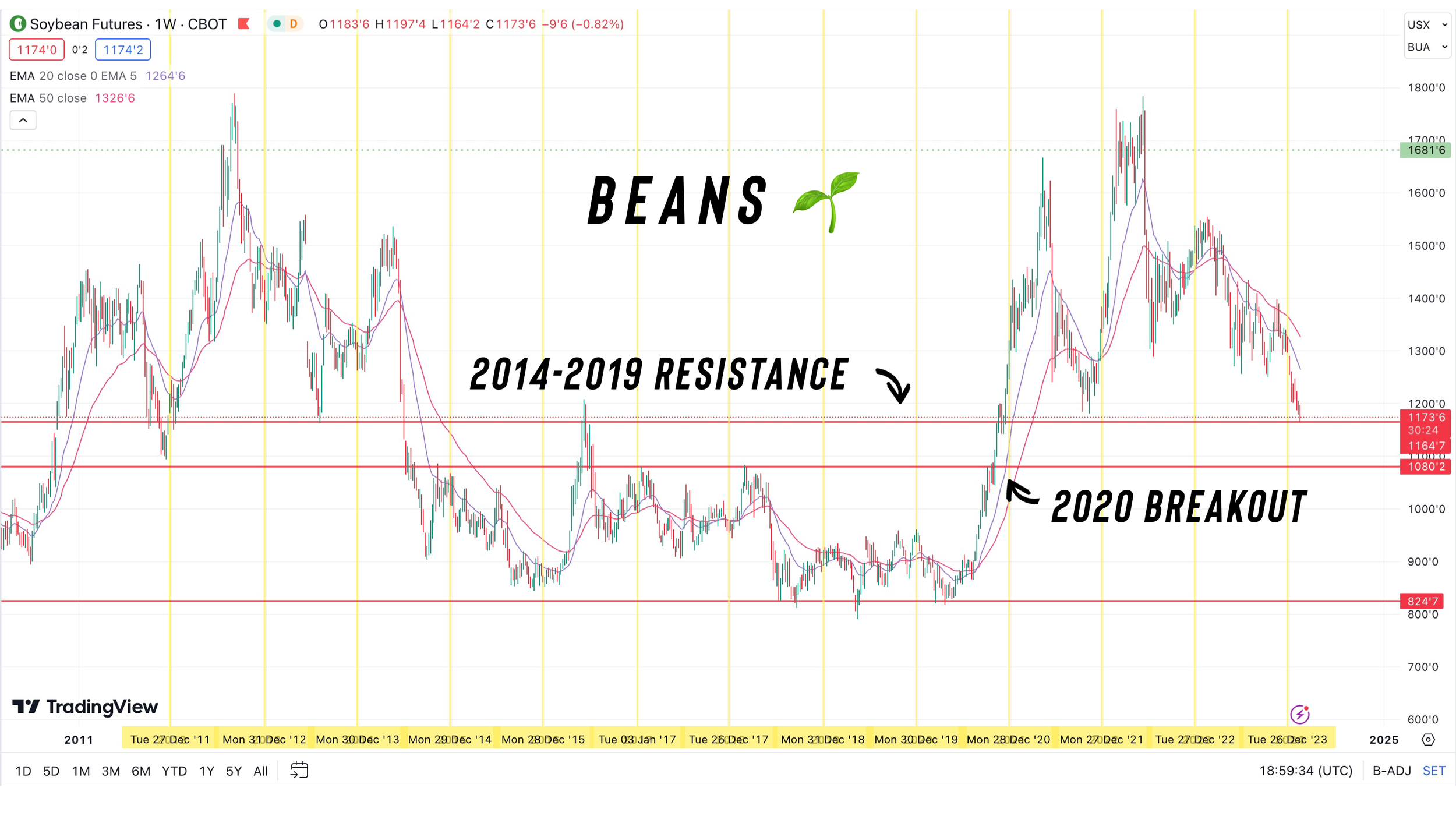

Just like in corn, soybeans are nearing a critical support level. Where we are seeing our old resistance look to be new support from our 2014 to 2019 range.

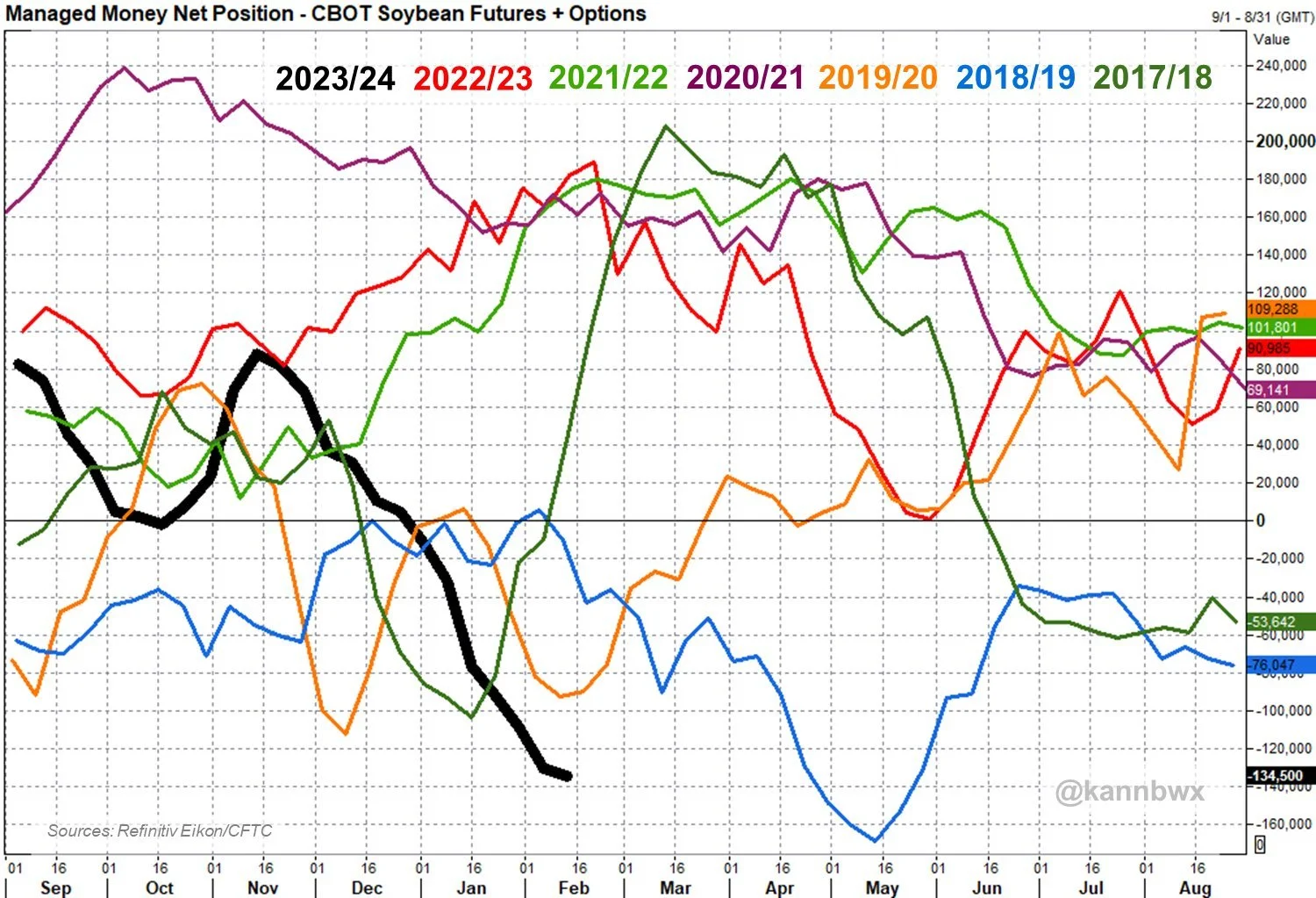

Here is the fund position for soybeans. The shortest only behind April and May of 2019.

I quoted Brian Wilson a lot today. But he's extremely knowledgeable. This is another thing he said:

"Way overdue. Funds will try to force the market into uncomfortable. When they are uncomfortable is when the market starts in my opinion."

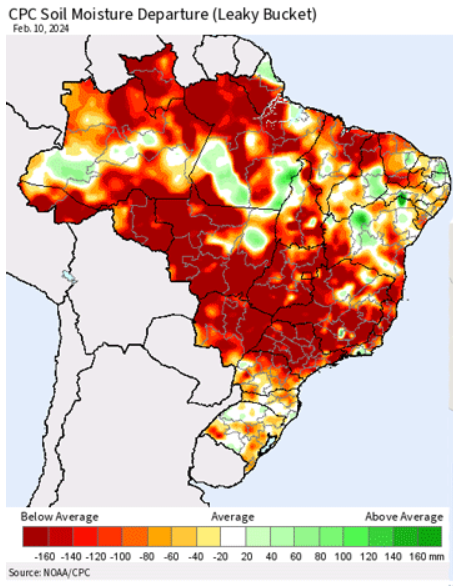

For soybeans, the biggest factor near term is going to be Brazil.

There is a lot of chatter about the USDA lowering their number sharply next month.

There was an estimate out today that had 136 for the Brazil bean crop. That is a whopping 20 million less than what the USDA has today.

Here is the soil moisture situation. USDA says everything is fine.

The funds are short a record amount. What happens if the crop turns out smaller than expected like it did in 2016? Guess we will find out over the next month or so.

Then we have the situation here in the US. If we see any problems here with our crop, whether it's lower yield or less acres planted. Things could very well get tight in a hurry.

For soybeans when it comes to managing risk, there is more risk here than there is in the corn market. So if you have unpriced bushels, consider puts but make them as cheap as possible. If we bounce, you don’t want expensive puts to go worthless. For some of you, courage calls might make more sense. Give us a call if you want to talk about any of this or have any questions on any of your marketing (605)295-3100.

If we take a look at the chart, I am hoping this is going to be deja vue.

If you look at yesterday’s close, and where we closed the day we put in the $11.45 lows last summer. Nearly identical. Then today we followed it up with a great move higher.

I am not saying this is the bottom. Because could definitely see another -30 cents or more downside if we can’t manage to put some good days together.

Overall, I see higher prices especially long term. I'd like to think we see the funds start to cover towards the end of the month. But nobody knows how low we will have to go before the funds want to cover. What we do know is that just like corn, we want to be making sales in the spring and summer time.

How many people thought we would see $14 beans last year when beans were trading at $11.30 in June? Not many, but we talked about the possibilities for it to happen.

Soybeans March-23

Wheat

Chicago wheat bounced right off those November lows. Putting in a potential double bottom. Overall, disappointing action in wheat. But we managed to hold the lows and bounce a nickle off that old support.

KC and Minneapolis on the other hand continue to put in new lows.

The biggest news in the wheat market today was that Egypt bought Ukraine and Romania wheat. But there is talk that the problems in the middle east could move some of the business to Canada and the US.

Bears continue to look at cheap wheat globally in Russia and the EU. These are the leading exporting countries, so it's not hard to realize why this is negative. Cheap competition doesn’t help our exports.

As I mentioned, the outlook report was negative. But the market has not priced in the lower wheat acres across the lower. France's acres for example are expected to be down -8% this year. That's a big deal

Pro Farmer advised this today:

"We advise wheat hedgers and cash-only marketers to sell another 10% of 2023-crop to get to 70% priced in the cash market. We also advise selling another 10% of expected 2024-crop production to get to 20% forward priced for harvest delivery."

That may make sense for some of you. However we disagree with this recommendation. Wheat fundamentals seem to point to higher to prices.

Going to sound like a broken record, but wheat is still a sleeper.

Mar-24 Chicago

Mar-24 KC

Cattle

Bullish weekly high closes in the cattle.

Our recommendation is the same as it has been for a week. I still think it would be wise to be taking advantage of this rally. Take advantage on paper with a hedge.

Yes prices could absolutely go higher. I would not be surprised to see us test those highs. In fact I think we will.

Adding a hedge does not mean you think the highs are in. It is simply good risk management.

A long put is one option you may want to consider. This would give you a floor but keeps the upside completely open in case prices do higher. The only downside to this method is that you have to pay the put upfront.

Give us a call if you have questions. (605)295-3100.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

2/15/24

BASIS CONTRACTS & USDA OUTLOOK

Read More

2/14/24

SELL OFF AHEAD OF USDA OUTLOOK: STRATEGIES TO CONSIDER

2/13/24

LA NINA, FUNDS, & USDA OUTLOOK FORUM

2/12/24

WHAT TYPE OF GARBAGE USDA OUTLOOK REPORT IS ALREADY PRICED IN?

2/9/24

RECORD SHORT FUNDS, SOUTH AMERICA, & MANAGING RISK

2/8/24

CONAB VERY FRIENDLY. USDA NOT. FULL BREAKDOWN

2/7/24

NEW LOWS IN CORN & USDA PREVIEW

2/6/24

WHAT IS EXPECTED FROM USDA & WAYS TO GET COMFORTABLE

2/5/24

STILL NO CLEAR DIRECTIONS IN THE MARKETS

2/2/24

NEW BEAN LOWS.. HOW LOW CAN CORN GO?

2/1/24

NO CONFIRMATION OF HIGHER OR LOWER PRICES IN GRAINS

1/31/24

HOW SHOULD YOU BE SETTING YOUR TARGETS?

1/30/24

OUTSIDE UP DAY IN ALL THE GRAINS

1/29/24

GEO POLITICS, CHINESE, BRAZIL, ALGOS, & BIG MONEY

1/26/24