EARLY YIELD TALK, DROUGHT, BRAZIL, SEASONAL LOWS & MORE

MARKET UPDATE

Futures Close Friday

Overview

Grains finished last week mostly lower.

Corn ran into a little harvest pressure with rising talk about potential good early yields, posting two nasty red days in a row to end the week.

Meanwhile it looks like soybeans & wheat are trying to find some technical support.

Corn & wheat both broke their 3 week streak of green, but beans finished higher on the week for the 5th week in a row.

Weekly Price Change:

Corn: -11 1/2

Beans: +5 3/4

Wheat: -26 1/4

Friday was options expiration. On options expiration, the market tries to pin as many options as worthless as possible. Traders had A LOT of $4.00 corn puts, and $10 bean puts, those were what expired worthless.

What's driving the markets?

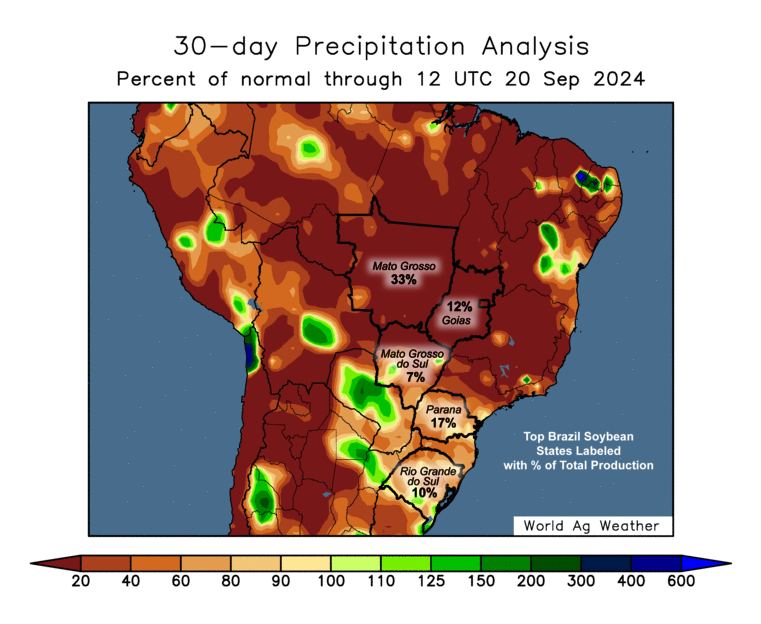

Another reason for the recent weakness is Brazil.

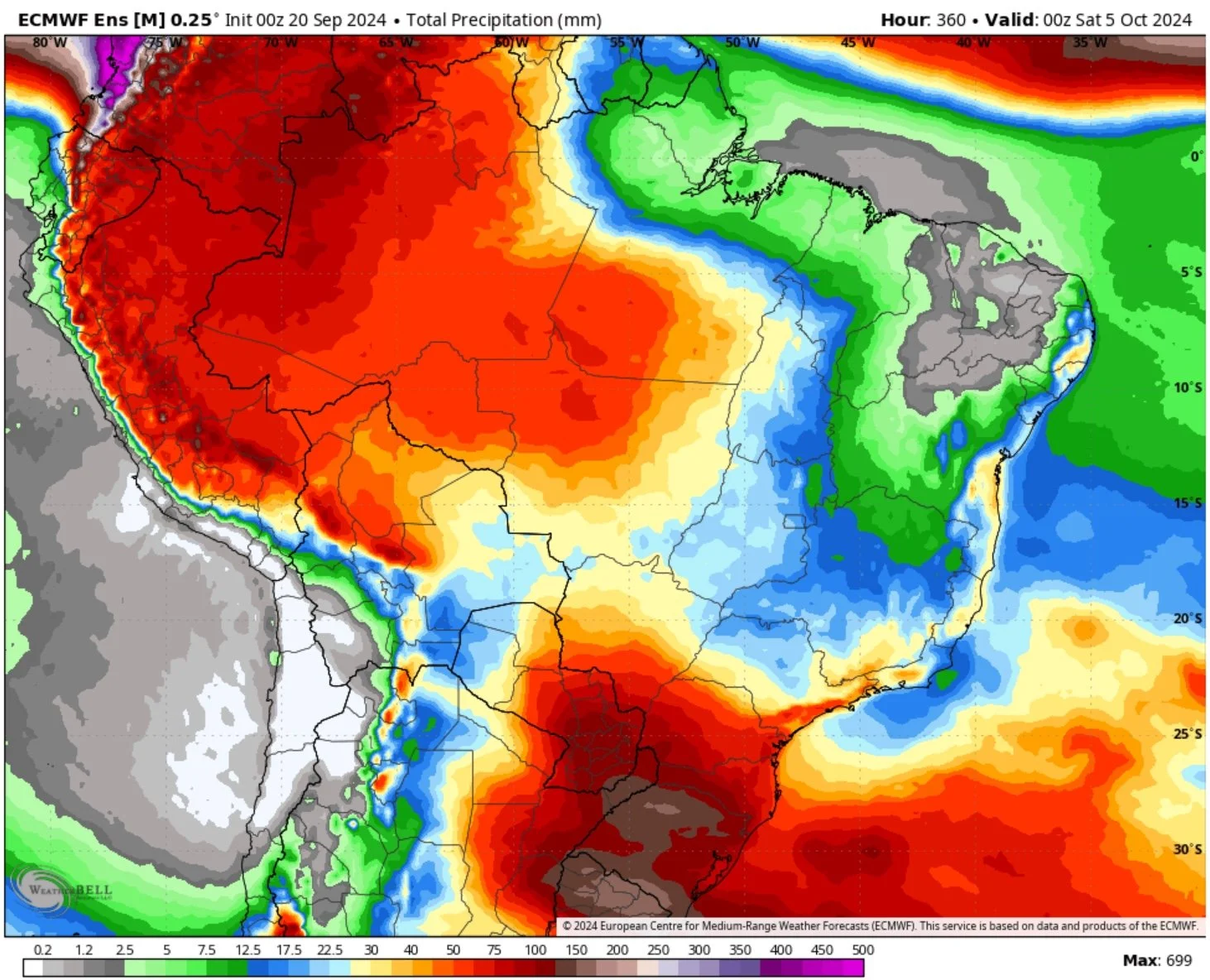

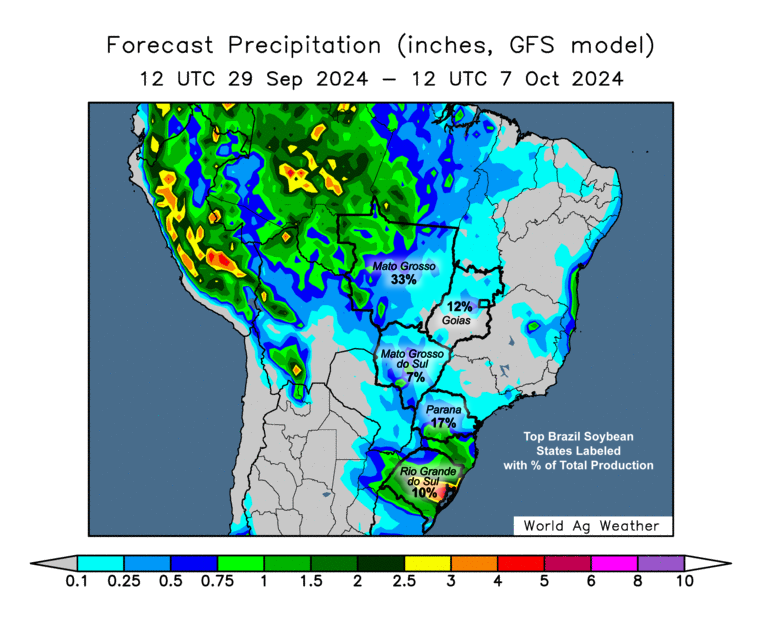

It looks like they are finally expected to get rain following their worst dry season of all time. As the driest areas of Brazil are suppose to get rain the first 2 weeks of October.

A little later than farmers there would have liked, but still in time if they fall.

Next 2 Weeks Rain

Next 2 Weeks Rain

Past 30 Days Rain

The dryness in Brazil wasn’t the number one reason for the recent rally, but it was certainly adding a little bit of weather premium especially in soybeans. The main reason for the recent rally was getting first notice day out of the way which meant less farmer selling to meet fund buying.

So if Brazil does get this rain, the bean market is going to have to remove some of the weather premium. Which means soybeans will likely see some pressure lower.

Yes. Brazil can still have a monster crop if they get rain, despite the record drought this dry season. In fact, the last 2 times Brazil was this dry this time of year they did wind up with trendline yields.

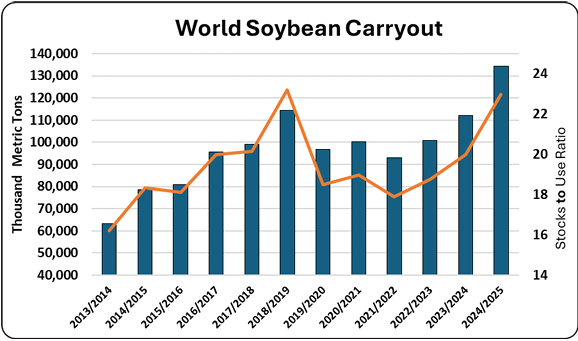

IF Brazil does produce what the USDA expects, it would push global bean stocks to the highest on record.

Consequently, if Brazil underproduces it will lead to that much more demand for the US and less supplies globally. Thus pushing our prices higher.

Through the first 8 months of the year, China imports from Brazil are up +217% from last year and imports from the US are down -73% from last year.

China will need beans. They always do. But we need some of that business.

This Brazil drought could lead to a lot higher priced beans, or a lot lower. The US is no longer the king of soybeans like years ago, Brazil far out-produces us now meaning their crop has a major impact.

Intersting side note:

CONAB expects Brazil exports to drop -6%, yet they expect production to be up +12% vs last year.. So essentially their local demand is offsetting exports. So perhaps they might not have all of these beans for China to buy.. because they are going to use them themselves.

Bottom line. The drought card is still too early. One monsoon rain can fix it all. BUT if it stays dry for a few more weeks the market will pay attention.

Harvest & Early Yields

So far the early fields are showing good results for corn. Not everyone has perfect corn, but a lot of the time the early fields can be some of the best ones. So it adds pressure short term.

It seems like most think the bean crop isn’t "bad" but it isn’t quiet as good as most were originally expected due to how poorly we finished the crop the last month or so since July. I'm sure the poor finish also took a little off the top of the corn crop, but most think that crop likely had enough early on to get the job done.

Early yields usually show good crops, so there might be some bigger concerns the further we get into harvest especially for the bean crop. So consensus right now is that the early stuff is at or above expectations, but the later stuff probably won’t look as good. Short term, this could add pressure.

Arlan Suderman of StoneX:

"Early harvest results are always mixed. Hearing more big impressive corn yields to offset problem areas. Probably more disappointing bean yields at this point due to the dry finish. Still large supplies but maybe not as large as feared."

Are the lows in?

Historically, October 1st is the "magic date" where seasonally we go higher.

But the past few years that hasn’t been the case.

From Pro Farmer:

"September is historically one of the most bearish months out of the year for corn as harvest ramps up, but in recent years, prices have faced less selling pressure than historically normal. If prices do continue lower next week, we expect a bottom at the end of the month before prices move higher through harvest."

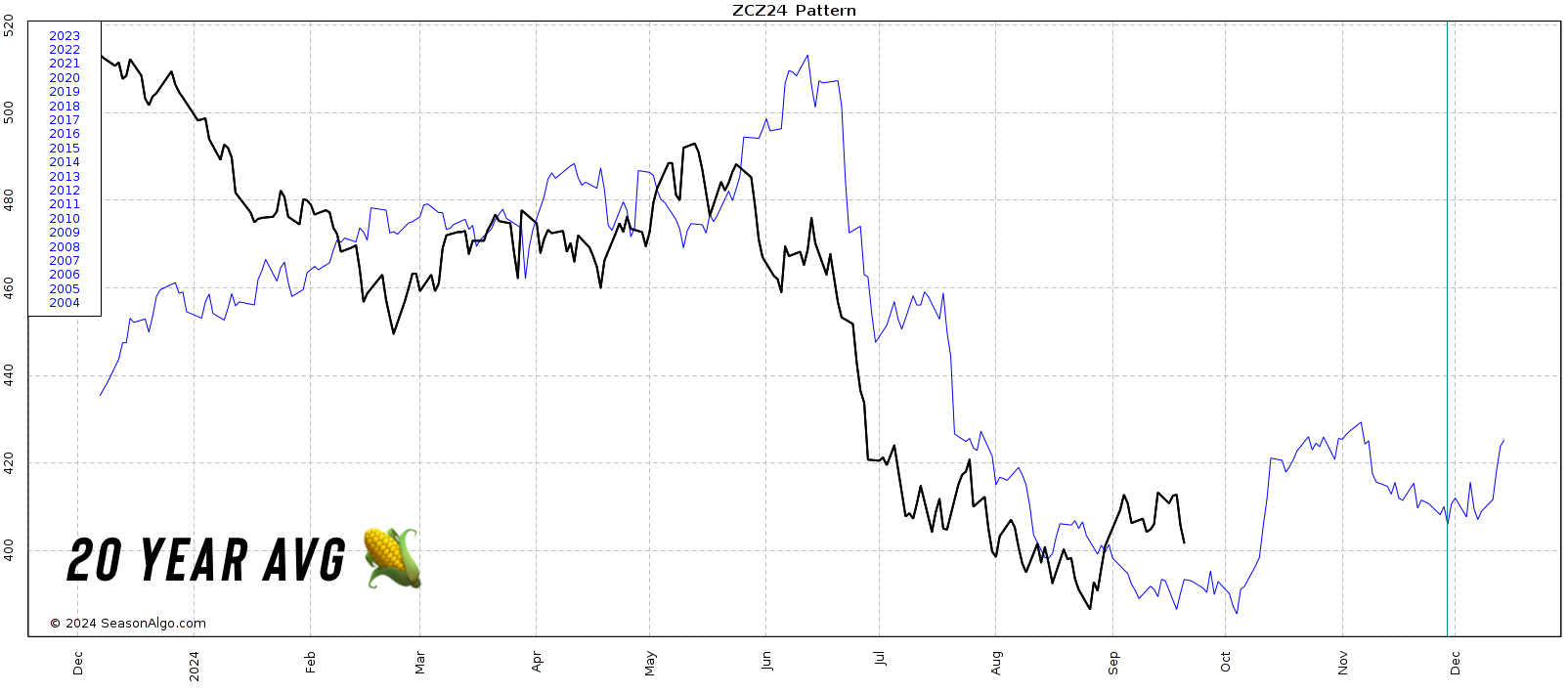

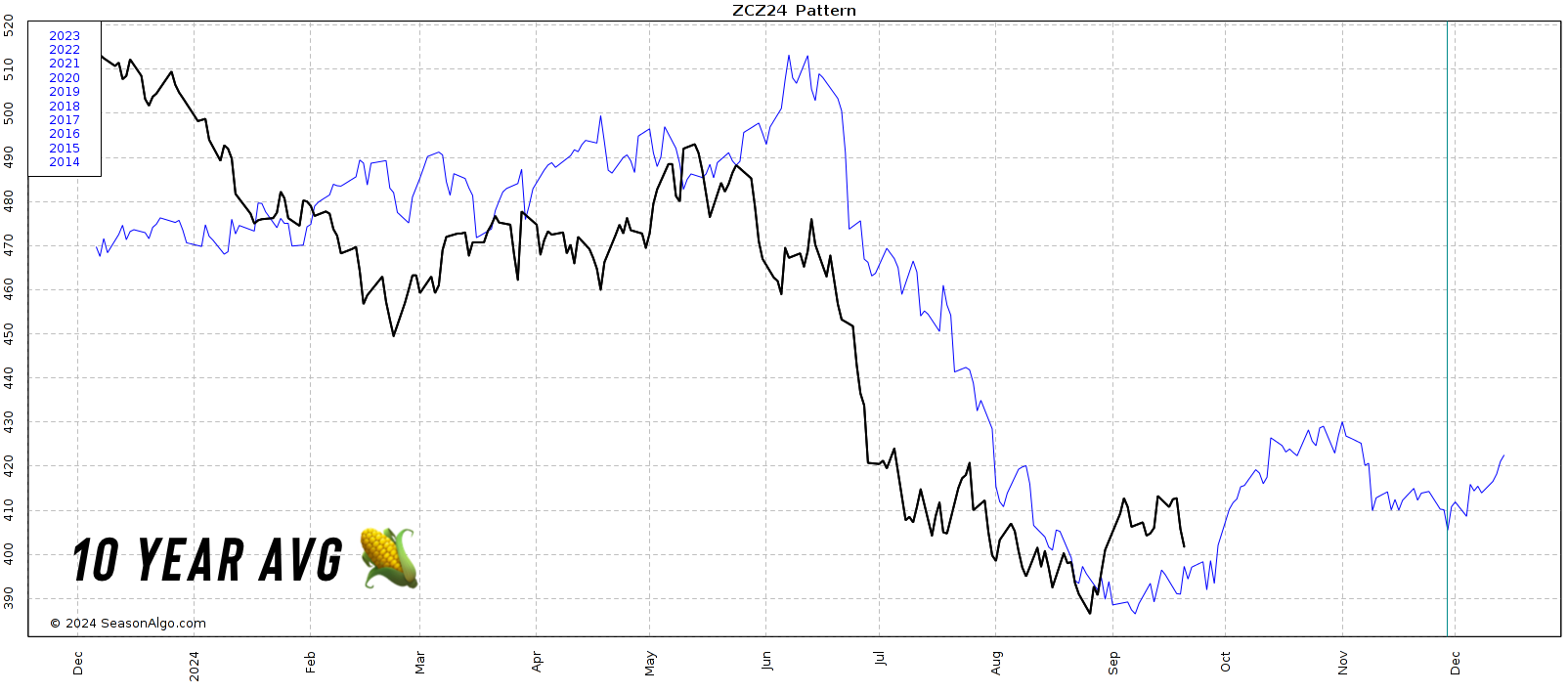

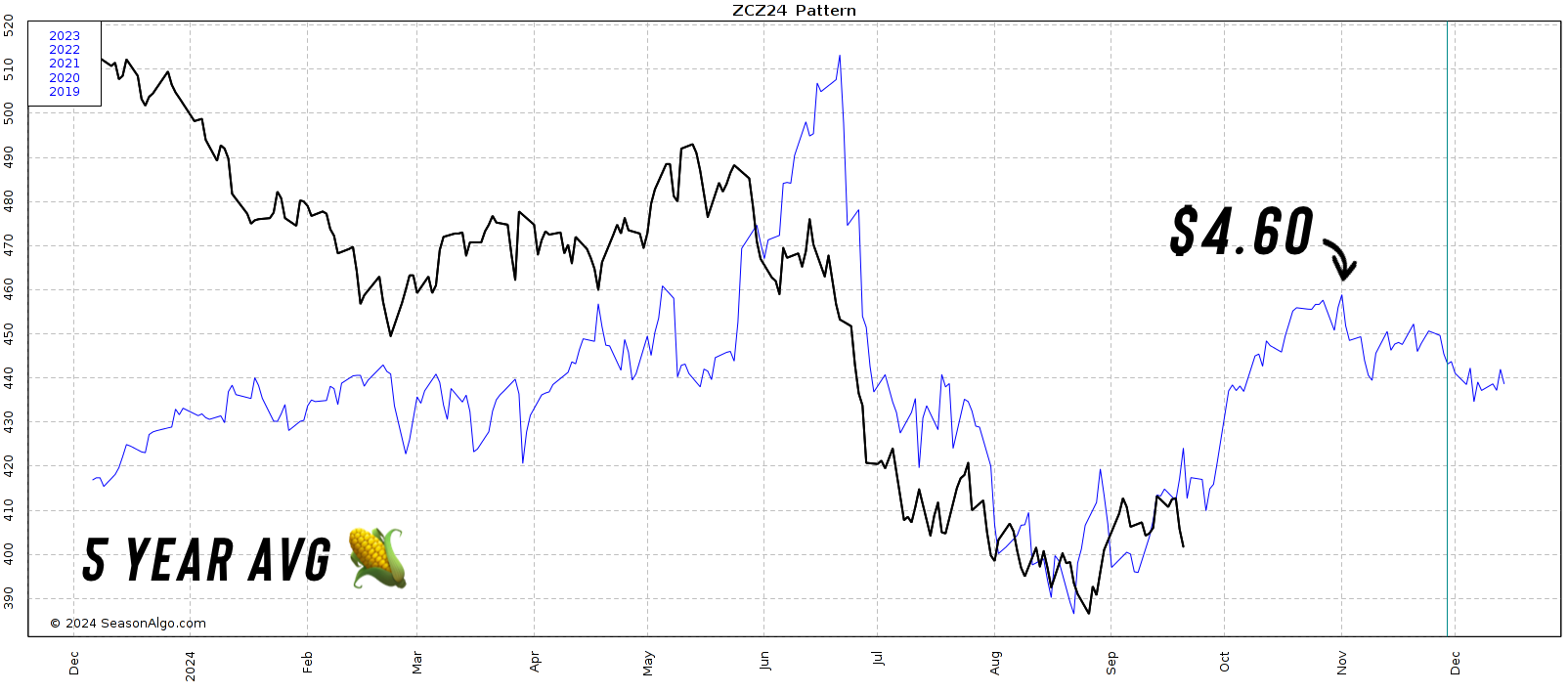

Let's look at corn seasonals.

The past 20 years on average, we bottom early October.

The past 10 years, we have started to rally by early October and typically bottomed in September.

The past 5 years on average we bottomed exactly where we might have this year. In August.

So far we are still closely on track to this 5 year seasonal.

Even if we run into harvest pressure, it does not mean we couldn’t have very well found a bottom.

Moore Research provided a seasonal trade they have tracked for 15 years.

Long corn from Sep 30th to Oct 23rd. It has worked out 13/15 years.

Long beans from Oct 3rd to Oct 27th. It has worked out 14/15 years.

What others are saying

Jody Lawrence:

"The funds have cut their net short position in half & index funds are entering the market on the long side as US harvest expands & another SA growing season begins. IF yields can start to move toward 181 and 52, a bullish trend could emerge."

Matthew Bennet of AgMarket.Net:

"The bean market has plenty of reasons to move lower yet, but it sure is hanging in there. Im hesitance to think w big rally might unfold, even though it appears the low very well could be in."

Jim McCormick of AgMarket.Net:

"A lot of people thought the funds were getting out due to what they were hearing yield wise. I believe it had more to do with the FEDs. They pushed this down hard, then they lightened up going into the FED numbers. They got the FED cut. Now I think they wait and see where the yields go. If the yields are good, and if rain comes in Brazil I think we get one shot lower into the fall. We get that fall low in, then that will attract those funds to come in."

Jason Britt, President of Central States Commodities:

"Hearing more soybean yields that are disappointing. In no way a disaster, but the poor finish to this crop is showing up for sure."

Scott Irwin, Economist at U of Illinois:

"1/3 of bean production now formally in drought. Hard to not see how this has not trimmed the US soybean yield a bit. My view is the late season nature of the drought will have minimal impact on US corn average corn yield. Just a little too late I think."

US Drought Update

Areas Experiencing Drought (Weekly Change)

Corn: 26% (+8%)

Beans: 33% (+7%)

Spring Wheat: 19% (-3%)

Winter Wheat: 58% (+1%)

Today's Main Takeaways

Corn

The funds could likely be playing the waiting game here and seeing where yields start to come in at.

We are sitting at some important support, just over $4.00. A break below could bring additional downside.

Long term I expect us to move higher, but short term more downside wouldn’t surprise me. Perhaps another few weeks of choppy to even lower action, before moving higher into October and crop insurance pricing.

Maybe it's just a conspiracy, but I don’t think the government wants to fork up a bunch of extra checks.

If you have to move something off the combine, I like the idea of keeping a floor under just in case we do decide to make another leg lower.

I especially think we see more upside looking towards next year.

High fertilizer prices, high costs, less acres etc. We could very well see a lot less acres next year. I think the only way we don’t get higher prices long term is if we somehow get a monster crop closer to 185. If that's the case, there is still plenty of downside. But I am not in the 185 camp. Our carryout likely falls below 2 billion if yield shrinks from here.

Looking at the chart, for now this is pretty much the biggest thing I am still watching.

I cannot confirm more upside until we break above this pink line.

Daily Dec Corn

We did break our short term uptrend, so this could lead to a little more short term pressure. Or it could "potentially" be a bear trap. If we do not bounce tomorrow, it could lead to another leg lower.

Looking at the weekly chart, we still have a giant volume gap up to $4.60. So I am looking at that as a "potential" LONG term target. But we will definitely be signaling to take risk off far before, as that is a big move away still.

Weekly Dec Corn

Looking at the RSI (determines how overbought or undersold we are) we do have some more room lower, another reason why some short term pressure would not surprise me. Last Friday I said the RSI was looking toppy.

Soybeans

So far the bean market is holding in there while corn has seen pressure.

Majority think we start to see more disappointing yields the further we get into harvest. This certainly wasn’t the most ideal finish.

I feel pretty confident that we printed our highest yield we will see this year.

The two biggest things to be watching are Chinese demand & Brazil weather.

If we see more big daily announcements that China is buying, that is a good sign.

If Brazil gets rain, we probably see some pressure. If it stays dry, we will go higher.

I don’t love making sales here, but for some of you, rewarding this 75 cent rally might make sense. For others it might not. Some can make cash sales, while others that intend to store their beans can consider adding a floor with puts. Give us a call if you want to talk 1 on 1. (605)295-3100.

Looking at the chart, we are really just range bound here for now. (Between the black lines). A break above would look friendly.

$10.00 remains the key support.

$10.42 still remains the level I want to take out to confirm a bottom, as that would mark our first higher high.

Daily Nov Beans

Wheat

Awful week for wheat, but it looks like we might be trying to find support here.

Wheat tried to break out on war news, but like I said last Friday.. a lot of times the war headlines are sold very fast and do not last. Hence why we alerted a sell signal on Friday. As I was skeptical it would last.

Right now, there is plenty of wheat in the US so that is keeping prices somewhat in check.

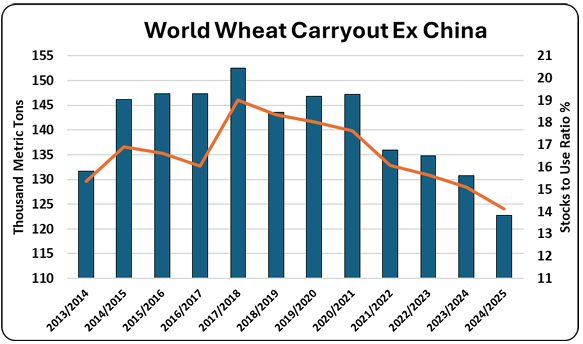

BUT the global wheat situation in my opinion is a friendly one.

Global stocks continue to go down. The world continues to consume more than it produces. We have dryness issues across the globe. We won’t be looking at extra wheat acres here in the US with the low prices.

Just look att his global wheat carryout that excludes China. Continues to get smaller and smaller.

Bottom line, I do think we will get a chance to price wheat over $6.00 at some point. I could see us finding support here. We bounced right where we needed to Friday. If we fail here, my next big support is all the way down at $5.45. If we can break this green box for longer than a day, the chart opens up. I still have targets of $6.12 then $6.40 potentially.

Jason Gehler of Hedge Plus:

"Dec Chicago should be well supported within $5.50 to $5.60 zone while dryness concerns are in effect for US plains, the EU, Black Sea region, Australia, & Argentina. Tighter world supplies should lead to higher prices down the road."

Daily Dec Chicago

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

9/19/24

GRAINS SEE TECHNICAL SELLING

9/18/24

FED DROPS RATES, BRAZIL STORY, 2025 SALES?

9/17/24

TARGETS & WHAT TO DO IF YOU BOUGHT PROTECTION

9/16/24

WAS TODAY HEALTHY CORRECTION BEFORE GRAIN RALLY RESUMES?

9/13/24

CORN & WHEAT BREAK OUT: EVERYTHING YOU NEED TO KNOW

9/12/24

USDA RAISES YIELD BUT REPORT WASN’T ALL THAT BEARISH

9/11/24

USDA TOMORROW. MAKE OR BREAK SPOT ON CHARTS

9/10/24

USDA THURSDAY

9/9/24

LOWS ARE IN UNLESS SOMETHING FUNDAMENTALLY CHANGES?

9/6/24

GRAINS WEAK. OUTSIDE DOWN DAY ON CHARTS

9/5/24

GRAINS GET HEALTHY CORRECTION. GETTING READY TO PROTECT DOWNSIDE

9/4/24

GRAINS CONTINUE RUN. WAYS TO PLAY THE MARKET. WHAT’S YOUR SITUATION?

9/3/24

GRAINS CONTINUE BREAK OUT FROM LOWS

8/30/24

ANOTHER STRONG DAY. GETTING MORE CONFIDENT BUT NO CONFIRMATION

8/29/24

CHANCE FOR A BOTTOM, BUT STILL CAUTIOUS. DIFFERENT MARKETING APPROACHES

8/28/24

WHEAT FOLLOW THROUGH WHILE CORN & BEANS GIVE BACK

8/27/24

DECENT PRICE ACTION. BASIS CONTRACTS. ROLLING VS FUTURES. NOT FALLING FOR BIG AG TRAP

8/26/24

FIRST NOTICE DAY PRESSURE & CROP TOUR RECAP

8/23/24