NEXT WEEK WILL BE KEY

Overview

Solid price action from the grains to close out the week.

Wheat rallies, up +25 cents the past two sessions and despite us selling off hard to begin the week, Chicago ends the week down just -2 cents.

Beans close +15 cents off their lows to end the day slightly higher. Closing +12 cents higher on the week.

Corn higher today but remains in it's extremely tight range, as we traded in just a 10 cent range the entire week.

Often times when the market trades in a super tight range, it happens just before a break out to either direction. So perhaps the market is preparing for a big move.

Weekly Price Changes:

Something to keep in mind is that we essentially have one more full trading week left in the year because of the holidays. So expect some thin and volatile trade to close out the year with less traders.

The dollar reached 5 month lows with the Fed announcement yesterday. The dollar getting hammered is supportive of grains and helps out our exports.

China continues to buy soybeans. As we had yet another sale this morning. Marking 8 straight says of export sales, with 6 announcements this week alone. This week we had the best overnight sales for soybeans in over a month.

The market has been slightly disappointed that we didn’t get a continuation of wheat sales to China following the recent swarm of them.

Rumor is.. China might be on the hunt for a lot of US corn.

We had the NOPA crush report out today, it showed a record crush for the month. This was friendly for the bean market.

The biggest thing is of course going to be Brazil. So far, the reaction is mixed. It looks very hot and dry for the next week, but they continue to add rains into the forecast 6 to 10 days out.

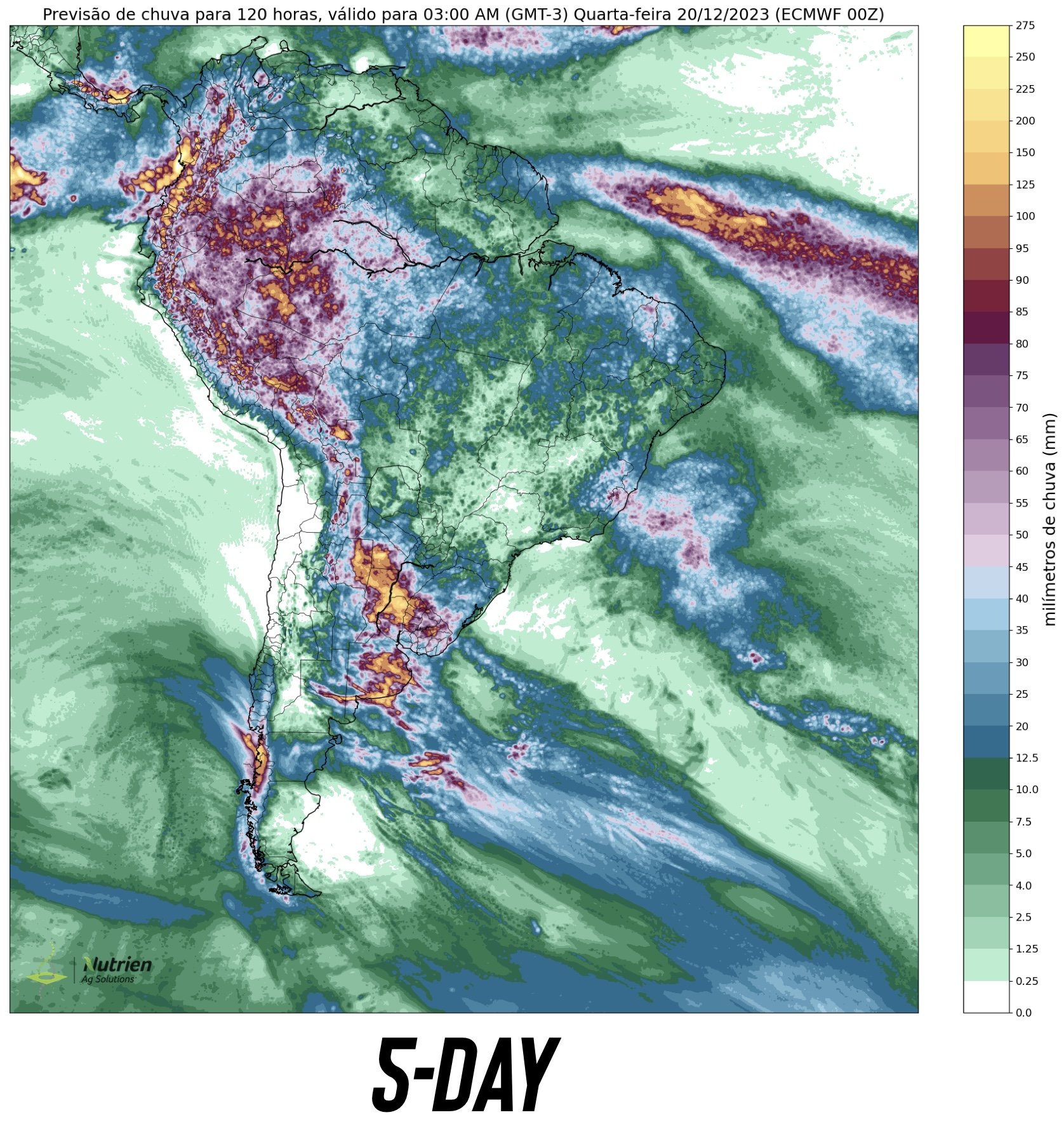

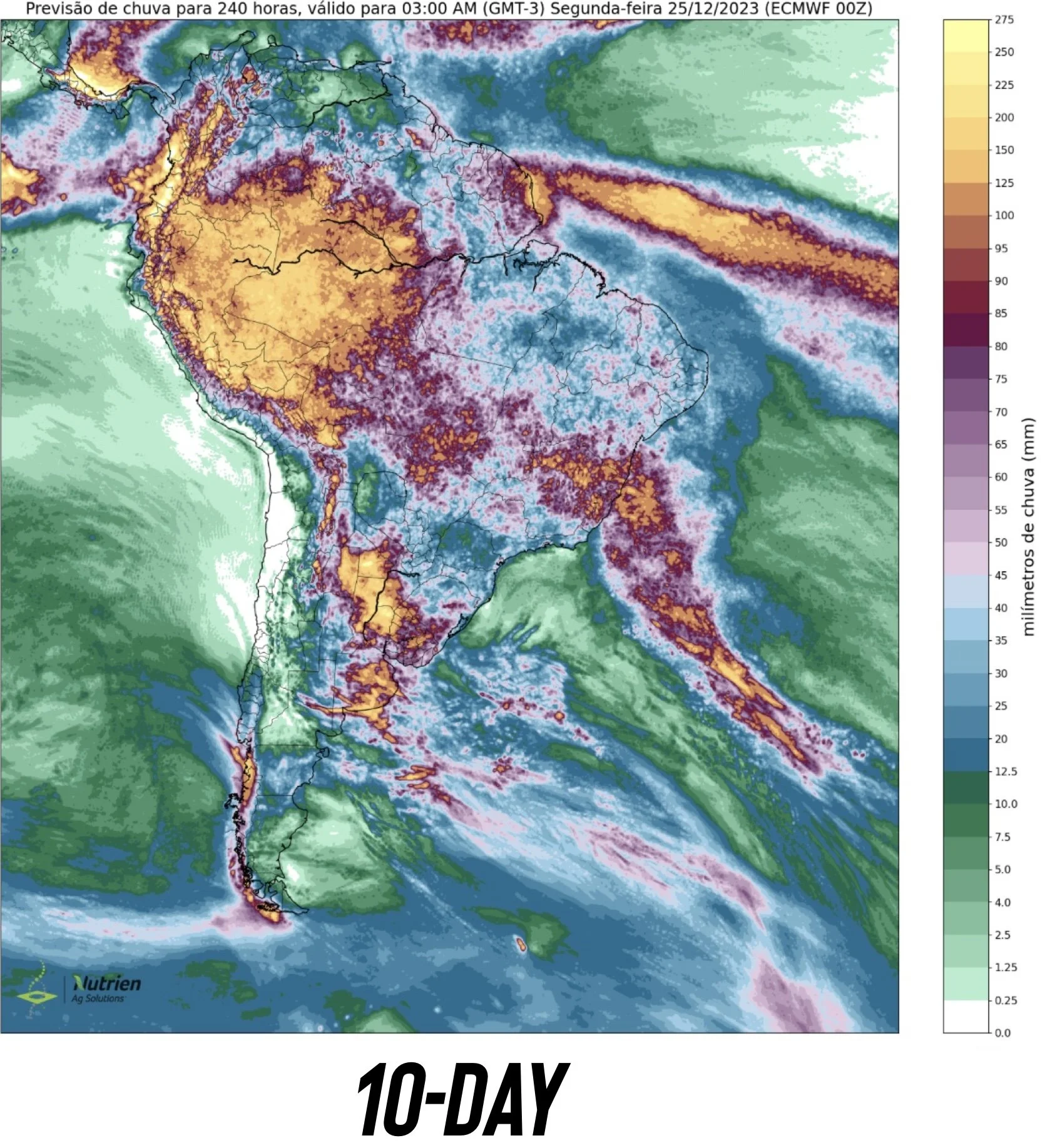

Here is the forecasts

However, this isn’t anything new. The forecasts have continued to add rains 6 to 10 days out time and time again, only for them to disappoint or disappear completely. Anything past 5 to 7 days out has been anything but reliable.

November in Brazil is like June in the US when it comes to importance for growing. Even though yes it's important, it is not the key time frame.

The absolute key period for growing in Brazil the middle of December into early January.

Which is right now. Next weeks rains will be extremely crucial for the future of their crops. If these upcoming rains miss, they will be in for a big problem. Not only do they need these rains to hit, they will need a continuation of rain and a full on trend change.

Brazil's fate could very well come down to these rains next week..

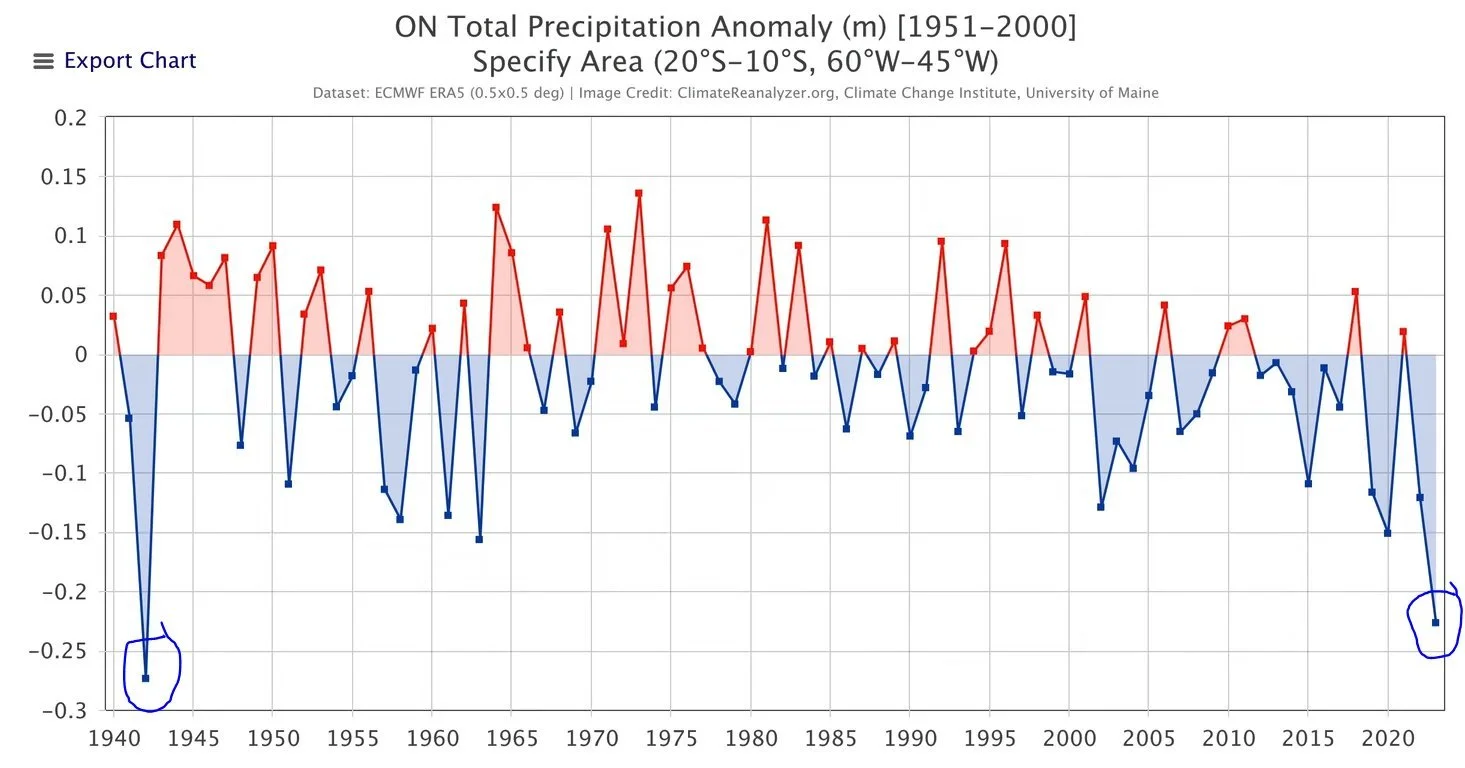

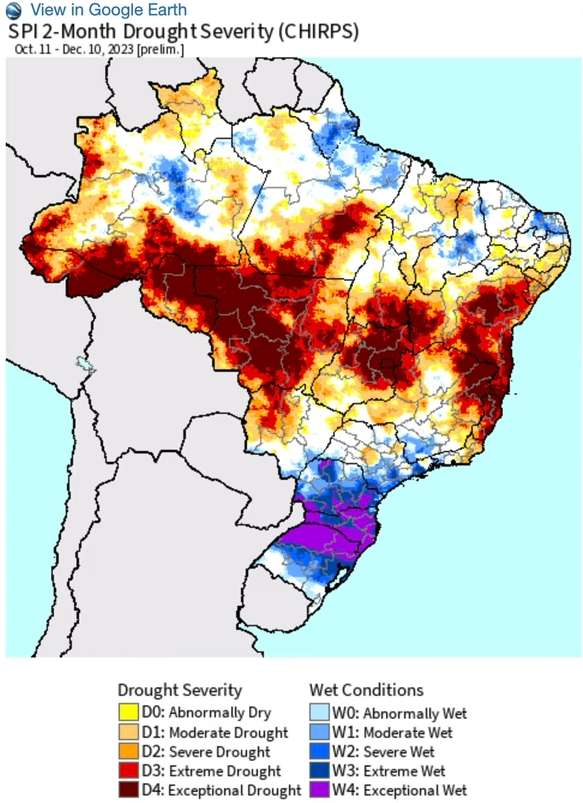

Why is next week so important? Just look at how historical their current drought is. Rain makes grain. No rain makes no grain. They absolutely need rain, soon.

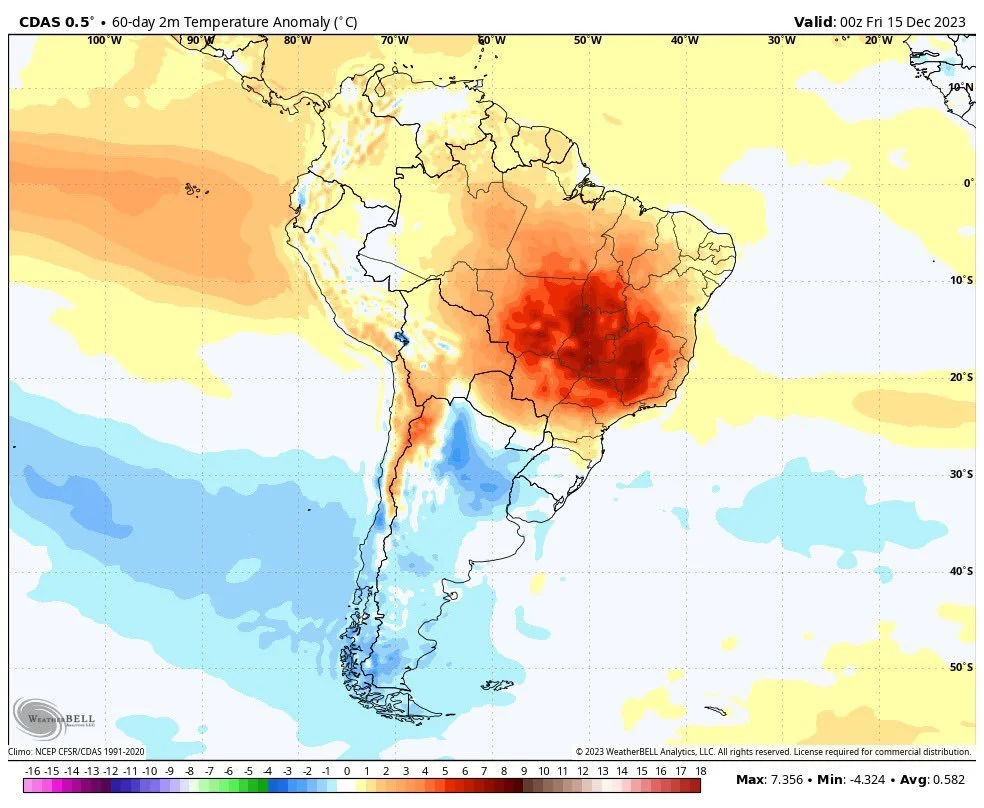

Here is the temperature anomaly the last 60 days. Temps have been very hot, 5 to 15 degrees above average the entire growing season so far.

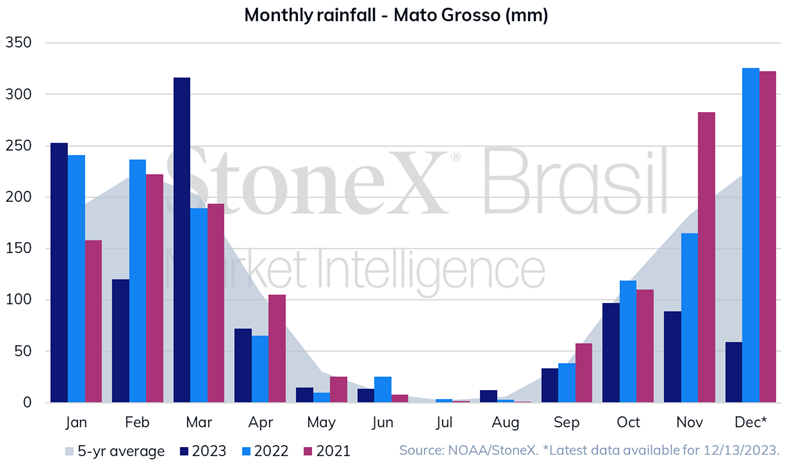

Now this next chart is an eye opener as to how drastic this lack of rain has been. Just look at December.

247 Ag said that December 15th, which is today. Was the absolute drop dead date to get soybeans in, followed by the safrinha crop.

This is why I believe the corn situation is being undervalued here and will come to light in January. Brazils beans will get planted, whether its late or not. A lot of their corn might not get planted at all. Later in today's update I will dive deeper into exactly how impactful this could be.

Reuters reported that soybean seeds in Brazil are getting hard to find due to all of the acres that have been replanted.. some even having to be replanted twice.

Those are the main things going on in the market, now let's dive into today’s update...

Pro Farmer:

"Brail farmers face desired soy seed shortage amid replanting needs.. In Mato Grosso, Brazil's top soybean producing state, Colp said around 15% of the soybean area needed to be replanted."

Jason Britt of Central State Commodities:

"On top of big export sales in soybeans, another 400k to unknown. China thinks we are idiots I am sure. Things on sale right now and we cheapen them up further.."

Kory Melby, Brazil Consultant:

"5 to 6 days of hell. Crop 2 weeks ahead of 2015 for this date. There is gonna be some surprises when combines really get into these earlier beans."

Kory Melby, Brazil Consultant:

"Rain coming, but I am not sure how many of these vulnerable beans can make it to next Tuesday."

Today's Main Takeaways

Corn

Corn continues to chop sideways. Trading in just a 10 cent range this week as mentioned.

When will the corn market start to take notice of the Brazil situation?

Right now, all of the talk is about the soybean crop. How they are being damaged and planted late. No one is talking about how 25% of the total corn is their first crop corn. If beans are suffering from the heat and lack of rain, corn is suffering even worse in their sandy soils.

The bean crops will be planted late, which will even further push back the planting of the second crop corn and lead to less acres. The corn that does get planted will be pushed back into a much less favorable growing time period because the dry season will have begun.

Wright on the Market said:

"I am surprised the market cannot see the obvious fact that Brazil will have at least a 20% and maybe a 50% reduction of corn production this year."

This could wind up being a massive deal later on. Yes, the US has this giant carryout. But who is the worlds leading exporter of corn? Brazil, not the US.

The weather in 5 months or so will play a bigger role, but it won’t matter if they are already starting off with 20% less planted acres.

Mato Grosso also extended the planting deadline for beans by 21 days. Why does this matter? Because the planting window for corn is now 21 days shorter. If you didn’t know, Mato Grosso is far and away the leading producer for both corn and beans.

When will the market take notice of this problem? I'd guess January, but it could wind up being February or even later.

Until the market comes to realize this, bulls will need a catalyst if we want to gain any upward momentum at all. One thing bulls are keeping their eyes on is Chinese demand, as there are plenty of sources that are saying China might be coming to buy a ton of corn very soon. Guess we will have to see.

Corn History Post WASDE

I shared this on social media yesterday, but I thought I would share it here as well. This is a chart from Naomi Blohm. She points out the fact that 16 years in a row, corn futures have rallied into January following the December USDA report.

Our average rally? +47 cents. Which would bring us to $5.32

However, this year isn't like every other year. We have to be aware of our 2 billion bushel carry out.

'How big were the rallies the last time we had a 2 billion carryout?

We had a +2 billion 3 other times. 2014, 2016, and 2017.

2014 was the most similar, with a slightly smaller carryout. That year we rallied +16 cents.

2016 we had a much larger carryout and rallied +20 cents. Same thing with 2017 and we rallied 15 cents.

Our average rally when we have a 2 billion carryout is +17 cents. If we take our $4.85 close after the USDA report, we get $5.02

Guess we will see how this year shakes out. We can expect higher prices, but our carryout certainly won’t help.

However, one thing I want to keep in mind is that carryout is just one way to look at supply and demand.

Another way that is just as important is stocks to usage. Meaning that a 2 billion carryout today is not the same as it was 10 years ago.

We also did not have the worst drought on record going on in Brazil those other years.

Bottom line, I expect higher prices. But, it will not be an easy rocket type of rally. At least not short term. I expect us to slowly grind higher from here until we get a Brazil of China wild card to spice things up.

Longer term, I believe Brazil and China will be both carry us higher and seasonals point higher.

We remain trapped under this brutal bear trendline. We have found resistance here 9 days in a row.

We have pretty much one more week left in the year. Can bulls break this? A breakthrough could potentially lead to more upside and short covering.

If you notice, we are nearing the end of this wedge. Often times an indicator of a breakout to either direction. Let's hope it's in the bulls favor.

Our downside risk is still our old lows of $4.70 which bulls have to hold, otherwise it would likely trigger more selling.

A break above $4.96 would likely bring even more technical buying.

We'd rather be making sales towards spring and summer. But if you have to make sales here because you don't have storage, need cash flow, etc. and you think local basis will improve, you can buy a put to establish a floor. We like the February $4.80's because they get you through the USDA report.

If you think basis will get worse, then you make a cash sale and you can buy futures or a call option or a basis contract with having an exit plan so you are not rolling it.

Corn March-23

Soybeans

Soybeans rally back over a dime after trading lower most of the day. So good price action.

The two biggest headlines are Brazil and Chinese demand.

We also had the NOPA crush out today that gave bulls optimism. The numbers eclipsed the predictions and it looks like we will have a record crush for the foreseeable future. Todays number was 5.5% bigger than last year. Demand doesn’t appear to be going away.

Bulls argue that the USDA is far too high on their Brazil estimates. Although it is still early to call this crop a disaster, I do believe they will need to lower their estimates. Even some of the usual bears on social media are saying the USDA has Brazil's crop at least 10 to 15 million metric tons too high.

But this has the "potential" to send beans much much higher. As I mentioned, next week's rains will be major. If they too disappoint or miss entirely, I don’t see how we don’t go higher. If the rains do fall, we will see some pressure, but overall one rain isn’t going to save the crop. We need to keep in mind, their soil situation is not the same as ours. They have sandy soil.

Just take a look at their soil moisture. It will take some consistent rain to fix this problem. Again, it's still early to call their a total flop, but we are nearing the most absolute critical time period.

Then we have the sustainable aviation fuel situation which isn’t being talked about much. Biden is expected to make a decision this weekend, but this could be very bullish looking term for the bean complex.

When you add all of these factors together, SAF, China buying, Brazil worries, we just get what looks like the perfect recipe for a "potential" major rally.

Nothing is set in stone, but the potential is there for $14, $15, or even $16 beans. I'm not saying it "will" happen, I am saying it is possible given the factors at play.

With 8 straight days of purchases from China, do they know something we don’t seem to realize? Perhaps they think the Brazil crop won’t be there.

Next weeks rain or no rain will be key...

Here is a chart from Darren Frye with his predictions labeled.

He said he believes we are early in wave 3, but need a close above $13.75 to turn the charts up.

He also said his prediction for the Brazil crop is sub 150 (USDA currently 161).

Some pretty bullish targets on this chart. He has a rally from here up to $15.10, followed by a pullback to $14.48, and then lastly a high of $15.65.

Just found this interesting.

Taking a look at our chart, we continue to tread water and bounce off of that lower trendline. 7 of the past 9 sessions we have bounced right off of this line.

I still believe we could be looking at a quick run and retest of $14 if next week's rains in Brazil fail. But if not, are you comfortable with the risks and where you are at in your marketing?

Would you be more mad if you sold and we rallied, or if you didn’t sell and we sold off?

If you are worried about the downside, are undersold, or needing to make sales in the next 60 days, be proactive. One way would be buying puts to establish a floor or minimum price level.

If you need help doing so, have questions, or want tailored advice shoot us a call free of charge (605)295-3100.

Soybeans Jan-23

Wheat

The wheat market has put together a solid two day rally following our recent correction.

Bulls were happy as we got a marketing year high in the weekly export sales.

Bears were disappointed we didn’t get any more purchases from China. Bears are also pointing at the cheap wheat in Russia as well as some potentially higher production estimates being thrown out there. We also are seeing the winter wheat drought situation improve, as yesterday we saw the drought stricken areas reduced by -5%.

We had the dollar get crushed recently, which is very supportive of the wheat market typically.

Bulls need another factor to create more short covering. Whether that be demand driven or weather driven.

Keep in mind we still have global weather issues with India potentially shifting to an importer rather than leading exporter. Australia still has their issues. And we still have a war.

Other than that, there isn’t a ton of fresh news. The action is going to be led by the funds. Do they want to continue to cover their shorts?

Long term, I still see plenty of upside, but short term I wouldn’t be totally surprised to see this rally stall out unless we do get that bullish catalyst or if the funds decide they want to continue to cover.

If you are uncomfortable with the downside, don’t have storage, or will need to be making sales soon, consider buying puts to establish a floor and minimum price level. There is nothing wrong with rewarding a rally. But for those of you that have until spring or summer and can sit on your hands for now, I believe we will have better pricing opportunities ahead. Just be prepared when we get an opportunity to price or protect prices at a good profitable level.

If we can take out last week's highs, it would really open up these charts to the upside and could very well lead to additional short covering.

Chicago March-23

KC March-23

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Price Maker Program

One of a lind programed designed to take your marketing to the next level.

Check Out Past Updates

12/14/23

WHY WE DON’T SELL FEAR

Read More

12/13/23

ARGENTINA, SAF, RISKS, & WILD CARDS

12/12/23

TURNAROUND TUESDAY

12/11/23

IS THE WHEAT PARTY OVER & BEANS JUST STARTING?

12/8/23

GARBAGE REPORT AS EXPECTED & CHINA STOCK PILES GRAIN

12/7/23

RALLY AHEAD OF USDA REPORT

12/6/23

RISKS, FACTORS, & WHAT TO WATCH

12/5/23

WHEAT CONTINUES RALLY & BEANS BOUNCE BACK

12/4/23