RALLY TAKES A BREATHER

Overview

Grains all trade lower here as we take a breather from the rally. Chicago wheat took by far the biggest hit today, trading down 29 1/2 cents back below $7. Soybeans held up the best, losing just 3 cents and holding above that $14 level, as they bounced 16 cents off their early lows.

We have two main things going on in the market. Weather and war, as it has been for some time now.

Russia attacked Ukraine for the 4th straight day.

The weather is going to start to really heat up next week and be dry as well. With nearly every single key growing region getting hit by the brutal heat. Areas such as central Kansas are expected to see temps around 105 degrees. While the rest of the major states will be in the 90 to 100 range.

This type of weather is all coming at a very critical pollination period for corn, and beans are going to be setting pods soon.

We saw India ban rice exports. India is the worlds leading exporter of rice. Rice competes with wheat for world market share. So where will south east Asia get all of their protein? They might have to come for soy oil or wheat.

It looks like the market just wanted to take a breather following the big rally. There wasn’t any one key reason for the lower prices today. Mostly just profit taking.

If we don't see any type of agreement made surrounding the Black Sea deal come Monday, and the forecasts still look this hot and dry I expect us to trade higher.

Below is the 6 to 10 day outlook. They did throw in some better chances of rain. But still some scorching temps.

Today's Main Takeaways

Corn

Corn futures lose a dime today, resulting in the second straight day of losses following our +80 cent rally. Ending the day down a dime. Little bit of just a risk off day.

The December contract is now 30 cents off our highs and 55 cents off our lows from just a week ago. We ended 23 cents higher on this week's rally.

We saw some profit taking across all of the grains, as well as some optimism in a solution for the grain deal. I include a lot more info on the entire Black Sea situation in the wheat section.

Taking a look at next week, it is going to be very hot for basically all of the key growing regions. We are also entering a key pollination period for corn.

Before this heat and dryness being put into the forecasts, I don’t think anyone believed the current USDA yield. Now that we have these forecasts, it becomes even more clear. We will see another cut to yield. Just how big is the question.

The weather guys are saying that we have a high pressure ridge, which will keep the corn belt hot and dry at least the next 10 days. But it will then begin to cool down and we will get more rain somewhere around the first week of August.

The biggest thing going into next week will be the weather and war. How long does the heat stay around, and what happens in Russia & Ukraine.

Corn Dec-23

Soybeans

Beans end the day down just a few cents. We opened up 16 cents lower this morning and we climbed all the way back up and were trading higher at one point. So overall, not a terrible day for beans despite the small losses.

We all knows beans are made in August. It is still a tad early, but pretty soon we will be entering the prime stage for beans setting pods. The forecasts are still calling for very very hot temperatures nearly across the entire US the next 10 days.

If it stays that way until the first few weeks into August, I don’t see why we couldn’t see $15. But that doesn’t mean that for some of you, it might make sense to make a few sales here with prices still above $14 and nearly $3 off our lows. Depending on your situation, you have to ask yourself, would you be more mad if you sold and missed the extra dollar rally to $15 or if you didn’t sell and all of the sudden we lost this entire $3 rally and went back to $11 or $12. (Scroll for my recommendation).

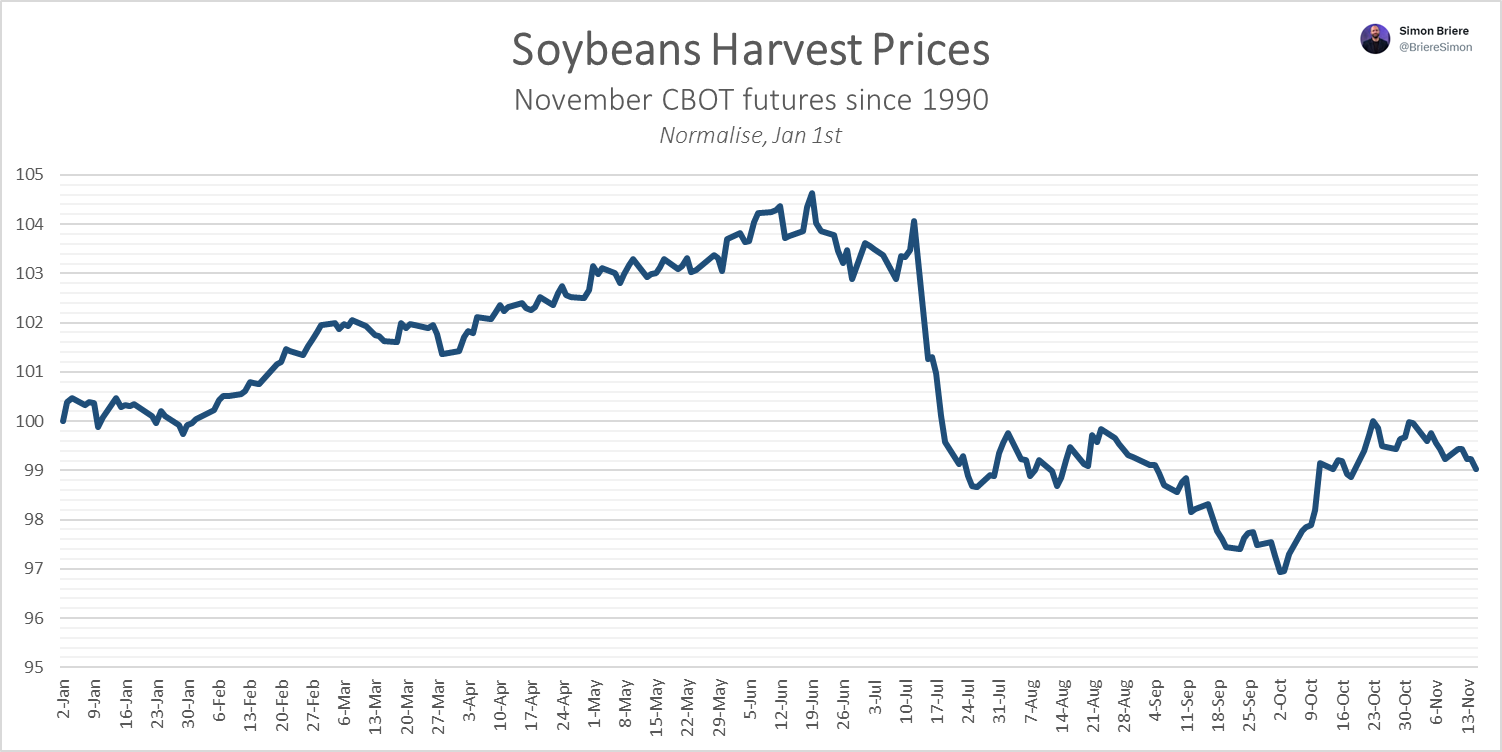

Just to put things into perspective, this is our seasonal trend since 1990. As you can see, we usually start going lower mid-July. However, this year has been anything but usual.

If you take a look at 2012 for example, there is actually some similarities. Has the drought and heat been nearly as bad? No. But that doesn’t mean we can't see a similar type of price action if the forecasts do stay this hot and dry. In 2012, we made our highs at the end of August and begin of September. (This chart is a few days old).

From what I can find, the forecasts start to shift a little cooler and wetter towards the middle of August. Will that be too late? It is tough to say. The bottom line is, I think we have a solid chance to trade $15 the first few weeks of August. But for some of you, it might make more sense to reward this rally and play it safe. For others, maybe it does make more sense to gamble and ride it out. Just be comfortable.

Taking a look at the charts, this time we actually created a bullish doji on the daily. Where we traded much lower, came back, and nearly closed green. Often times this is an indication of higher prices. But ultimately weather will be the factor at play. Bulls have still struggled to break out of that downward trend line we have talked about for weeks.

The worst case for near term downside would be our 200-day moving average, which sits all the way down at $13.33, that is if the funds decide to just take all of their profits following this near $3 rally. Do I think that will happen? No, especially with the hot and dry forecasts. But it's possible.

Recommendation

The past few days I said that this $14 area is a great place to take some risk off the table.

Overall, if I had to make a recommendation. I would say sell the remaining of your old crop beans or have your finger ready to pull the trigger.

Some other advisors may have you 40% or so sold on your new crop.

Although I expect tight supplies and weather to push us higher, there are plenty of factors that could prove this wrong. Such as above normal rainfall in August. If we did get above rain, we probably wouldn’t see beans higher until later this year around October and November.

If prices go higher (as I think they could), you can buy puts and make money on the way down that you did not make on the way up.

This is why we very strongly encourage everyone to have a hedge account, because you then do not have to try to outguess and outperform the market.

If prices go up, they are the highest they have been all year long. So ultimately for a lot of you, it makes sense to eliminate the downside risk, and hope it goes higher so you can grab cheap puts and make money on both sides of the market.

Keep in mind, we were trading at $11.30 not too long ago.

If you want help with a hedge account, or just to simply talk about your operation and see what makes the most sense for you. Just shoot us a call or a text at (605)295-3100 and we would be happy to help.

Soybeans Nov-23

Wheat

Wheat futures take it on the chin here following the recent rally. As mentioned, Chicago led the downside while KC and Minneapolis lose around 15 cents. However they both managed to close well off their lows. As KC finished 18 cents off theirs, and Minneapolis nearly a dime off theirs.

There were a few reasons for the lower prices here today. First of all, we just saw some profit taking across all of the grains. Secondly we saw some strength in the dollar which didn’t help. But there is also some optimism that this whole Black Sea situation comes to an agreement. As Turkey's President came out and said he will do whatever it takes to ease the hardship of the grain deal being extended and will try to talk to Putin in attempt to get something figured out.

We also saw Ukraine announce yesterday that all ships traveling to Russia ports in the Black Sea will be considered transporting military weapons and be subject to missile strikes. No ships will be getting insurance either. If insurance companies don't cover the ships, the number one wheat exporter is out of business.

Below is a great summary of the what is going on in the Black Sea from Andrey Sizov.

He said:

So many wrong takes on the Black Sea Grain Deal. Here’s what you need to know if you trade wheat (and corn) as of today:

* Odesa shipments are over. The chance was high that the Kremlin would stop the grain deal and show everyone that they should stay away from Odesa. We gave a heads-up about such a scenario last week after the first light attack on Odesa and Putin’s angry interview (the market/media missed that – everyone was watching the NATO forum).

* Despite what the media/politicians are telling you, Odesa shipments are not a game-changer now. Ukraine can ship 40+ mmt of grain via other routes, and that more or less matches their 23/24 export potential.

* Other export routes are the Danube and via land to the EU. The almost-forgotten Danube has been expanding rapidly since the start of the war. In recent weeks for the first time, they loaded two handysize ships (17K)

* Is the Danube safe? We don’t know. Russia threatened all vessels in the Black Sea going to Ukrainian terminals, so that could potentially include ships going to the river. Some vessel owners are cautious and prefer not to send ships there currently, but overall the navigation is still active, and local traders are actively buying at CPT Reni/Izmail/Kilia.

* Potential attack on the Danube terminals could be a game-changer. Watch this carefully. Is it likely to happen? The chance is not negligible but low, the Kremlin clearly doesn’t want to mess with NATO, and Romania is very close. What is concerning is that Russian propagandists, who were happy about the Odesa attacks, are now starting to talk about the Danube…

* Potential escalation could come from the Ukrainian side. We do doubt that they would openly attack vessels going to Russian ports, but some attempts to disrupt the shipments are possible (ie more attacks on the Crimean bridge impacting Russian shipments from Azov…or Novorossiysk). If something big happens here, we could see a rally similar to Feb-Mar 2022….Russia has almost 50mmt+ of wheat to ship.

* A potential path to de-escalation? It also exists….we will be watching Erdogan. We do believe that Moscow and Ankara discussed the end of the grain deal some time ago – Ankara clearly wasn’t surprised. We also know that Erdogan still likes the deal and has a lot of leverage over Moscow.

The wheat market is all about weather and war, as usual. Personally I wouldn’t want to be short over the weekend solely due to the fact that we never know when we will get more war headlines.

I'd have to imagine that if we don’t get any sort of agreement by the start of the week, the wheat market would continue to be strong. To go along with if the forecasts stay as hot and dry as they are currently.

Let's take a look at the charts. Yesterday I pointed out that we had a bearish doji candle on the daily in Chicago wheat. Which means we typically see lower prices the day following, which we did. Bulls still struggle to break out from that year long downtrend and our 200-day moving average.

Chicago Sep-23

Here is Minneapolis. For the past few days I have kept pointing at that $9 resistance which we again failed to break. Additionally, the past few days I mentioned that for some of you that $9 range isn’t a bad spot to take off risk if you were afraid of the downside. I still think that for some of you, this is still a great spot to feather in some sales. Prices are still over $1 off our lows from earlier in the year. Could we see more upside? Of course. But that $9 level has been a tough level to crack.

MPLS Sep-23

As for KC, we again failed to break out of that $8.87 which we have tested on every rally. Bulls would like a break above $9 in hopes of seeing higher prices. For some of you, not all, this area still isn’t a bad place to take risk off the table especially when we crawl into the upper end of that range.

KC Sep-23

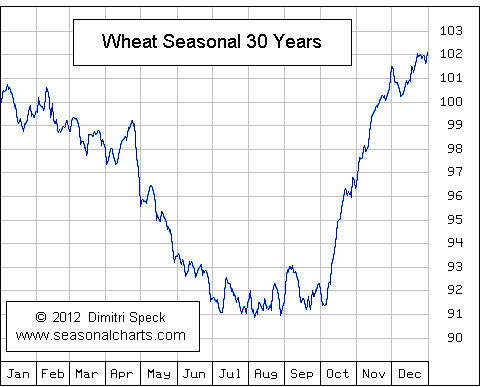

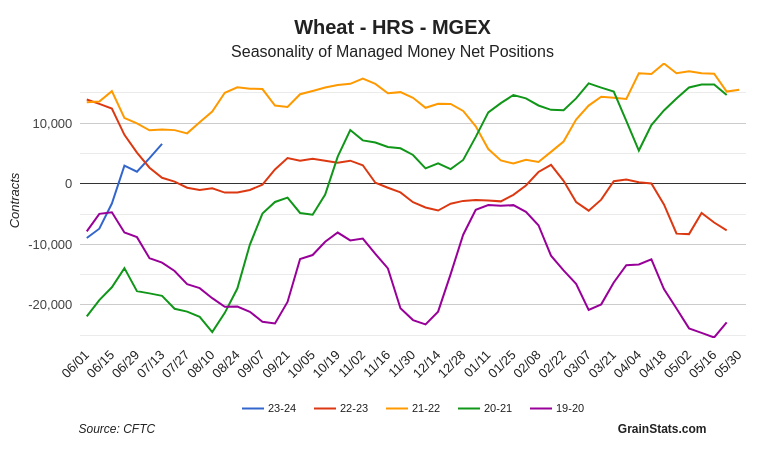

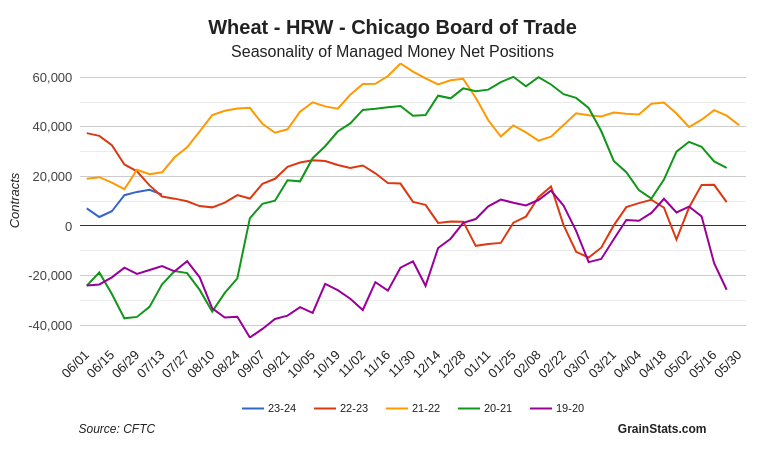

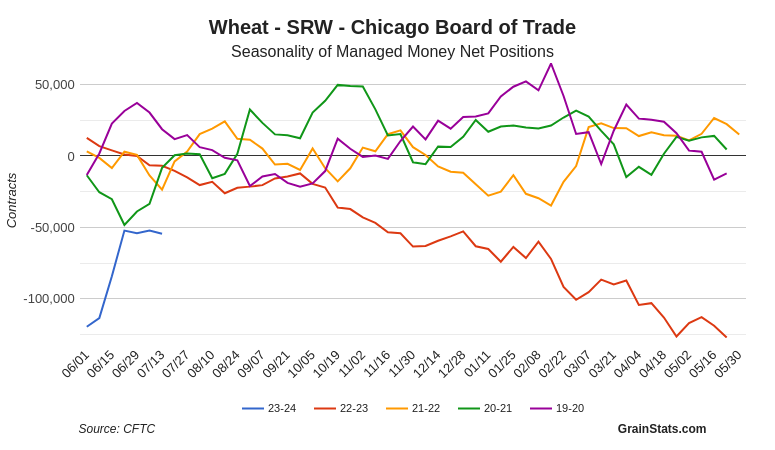

If we take a look at the seasonal chart, the seasonal trend is down until September.

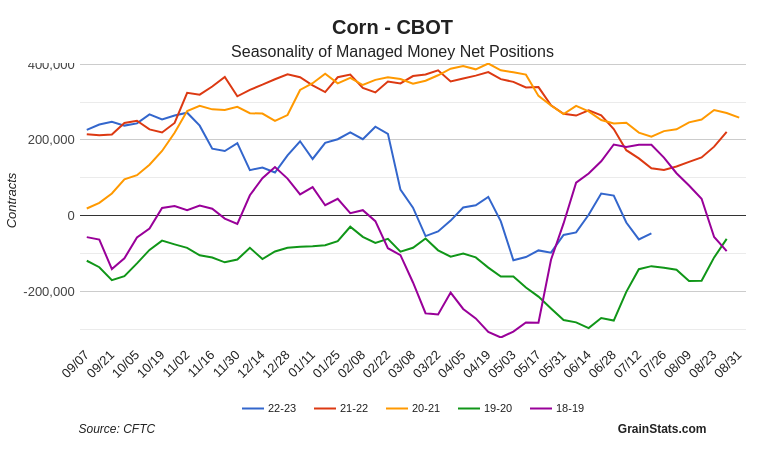

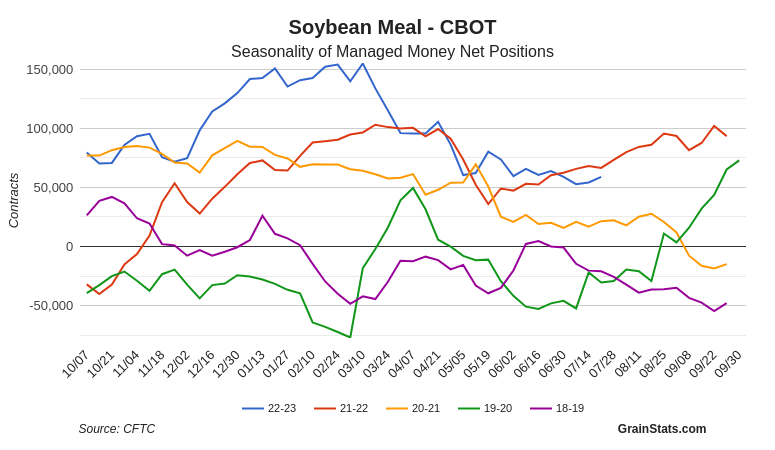

Commitment of Traders

Shout out to GrainStats for the charts.

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

7/20/23 - Audio

BEING COMFORTABLE NO MATTER HOW THIS SHAKES OUT

7/19/23 - Market Update & Audio

THE RALLY CONTINUES

7/18/23 - Audio

WEATHER & WAR

7/17/23 - Market Update

RUSSIA EXITS GRAIN DEAL. BUY THE RUMOR SELL THE FACT

7/16/23 - Weekly Grain Newsletter

MANAGING THESE VOLATILE MARKETS

7/14/23 - Market Update

WHEAT RALLIES & CORN MAKES KEY REVERSAL

7/13/23 - Market Update

GRAINS BOUNCE BACK AFTER BEARISH REPORT

Read More

7/13/23 - Audio

DROUGHT & DOLLAR ERASE YESTERDAY’S LOSSES

Read More

7/12/23 - Audio & Report Recap