HOLIDAY TRADE, SEASONALS, TARGETS & DOWNSIDE RISKS

MARKET UDPATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Not a huge news day with the holiday on Thursday.

Grains were mixed as beans were the only one to close the day higher.

The dollar finally started to show some weakness, but that didn’t matter to the wheat market as it continues to fall apart.

Wheat seeing some pressure as global production forecasts rise with a bump to Australia's crop.

Beans of course still face the tailwinds from a bumper Brazil crop, concerns over Trumps support for bio fuels, and trade war fear.

But the good news is that beans have held that contract low of $9.74 thus far. Sitting roughly +12 cents above them.

Corn was lower but has held up decently well despite all of the basis contracts that will need to be priced or rolled by Wednesday.

Soybean Seasonal Hope

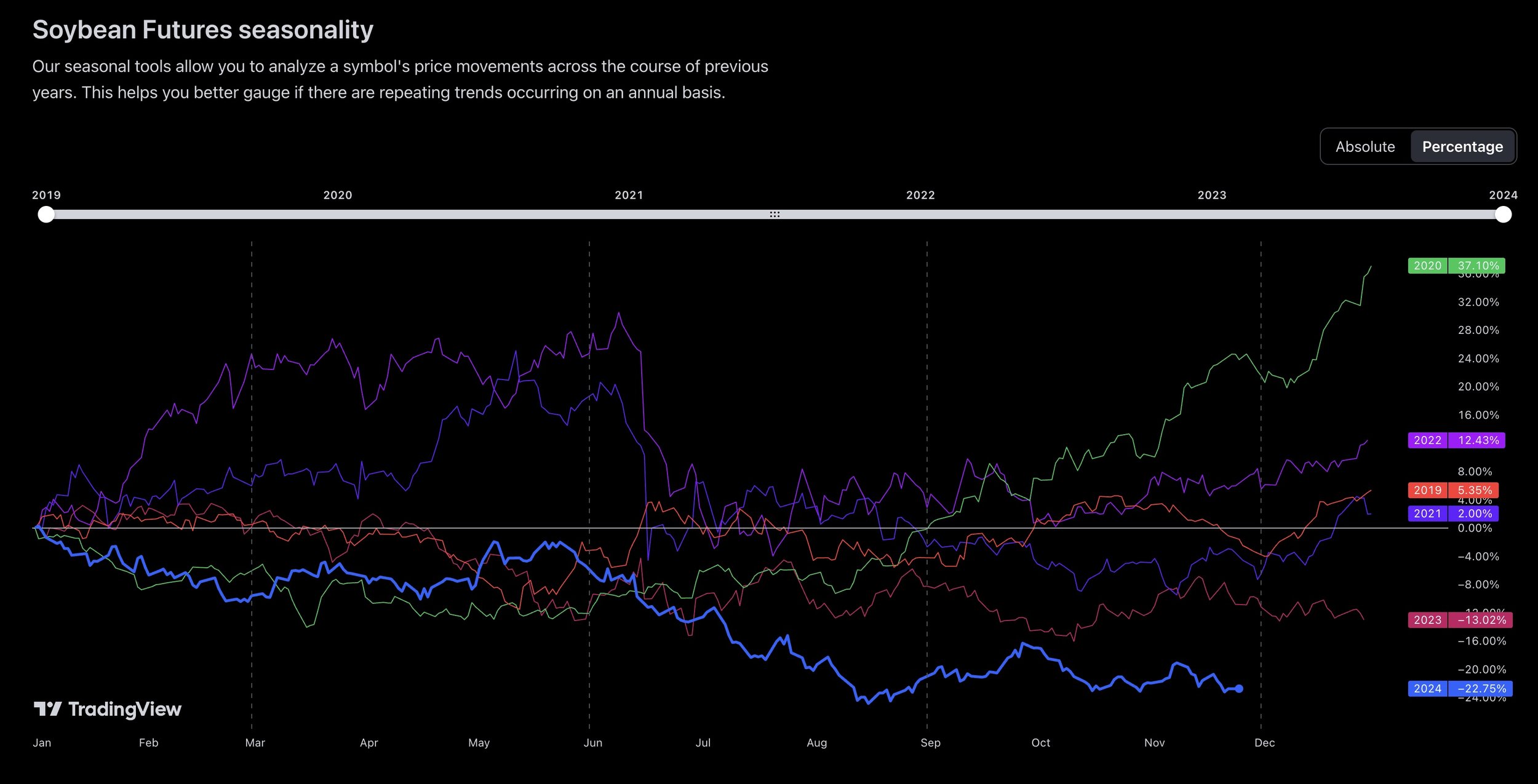

Seasonals are not perfect, but the bean seasonal gives bulls some hope.

Here is the past 5 years of soybean prices.

From Top to Bottom:

2020: Green

2022: Purple

2019: Red

2021: Violet

2023: Pink

2024: Blue

Every year except 2023, we bottomed around the first of December and rallied throughout the month of December and into January.

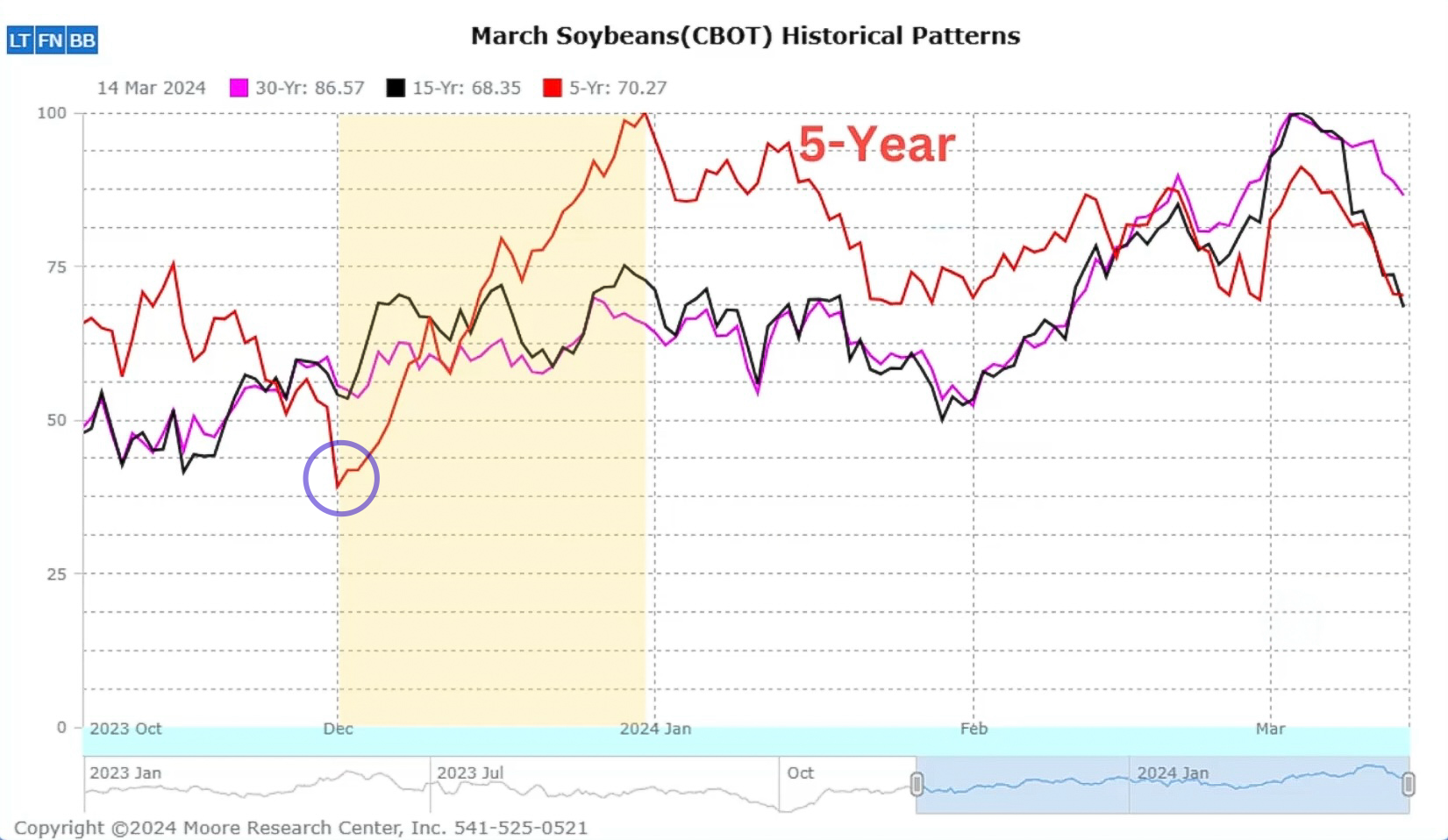

Now here is some data from Moore Research.

The red line is the past 5 years.

The black and pink line are the past 15 and 30 years.

Back a decade ago, Brazil wasn’t this huge player in the bean market. But now they are.

So we have essentially created a Brazil weather month for December, similar to the US and June.

Since Brazil has become a bigger player, the past 5 years we historically bottom on December 1st and rally into January.

In the 15 and 30 year seasonals, we do not see that rally. We went more sideways as Brazil wasn’t this major player.

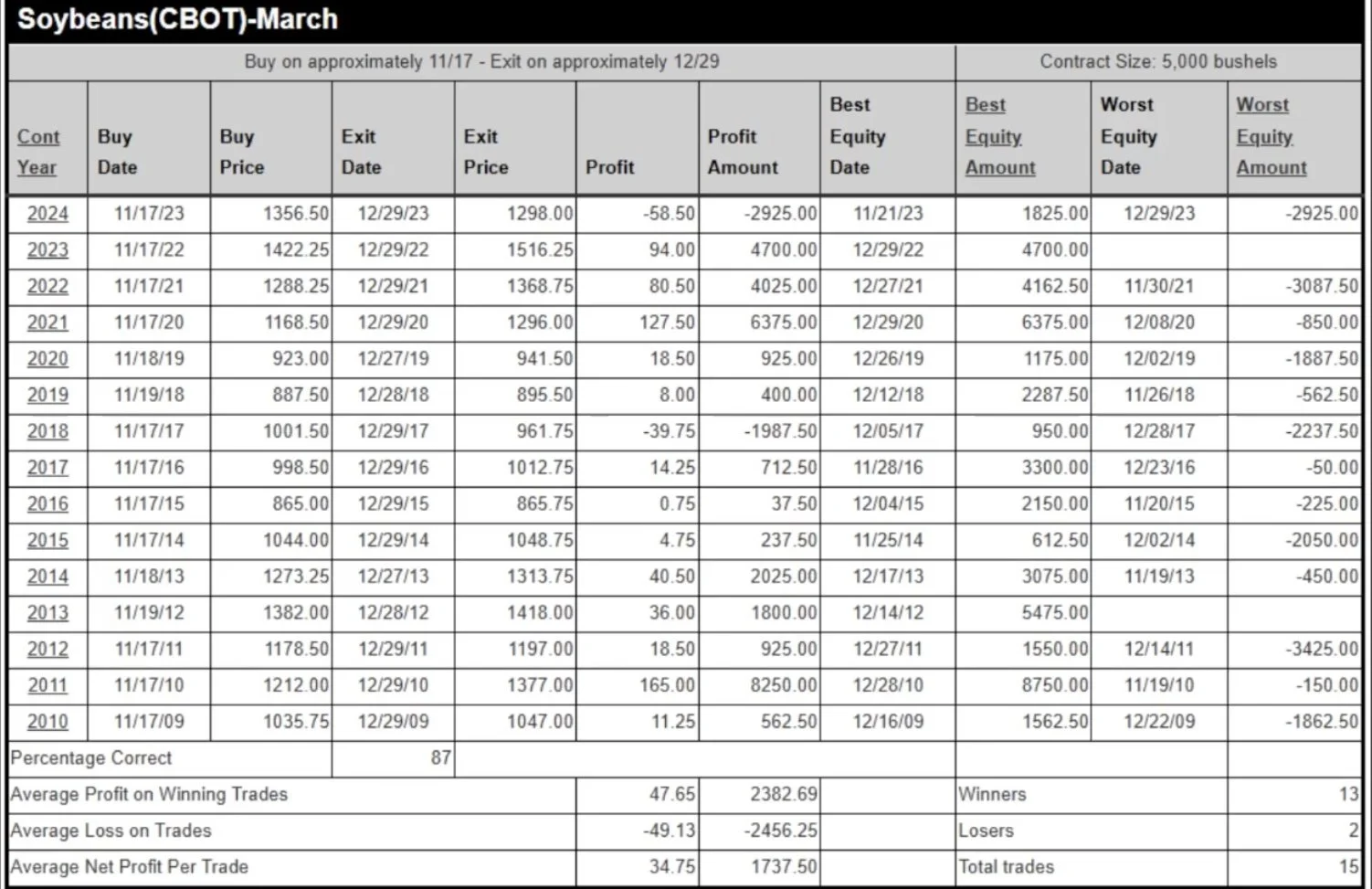

Here is another study done by Moore Research.

They go long soybeans on November 17th, and close the position on December 29th.

This trade has been a winning trade the past 13 of 15 years.

The only years it was a losing trade were 2023 and 2017.

Soybeans do not have to rally from here, but the data says history is on our side.

If this rally occurred, it would likely be spurred by some Brazil event or Chinese news. Usually it is caused by Brazil weather.

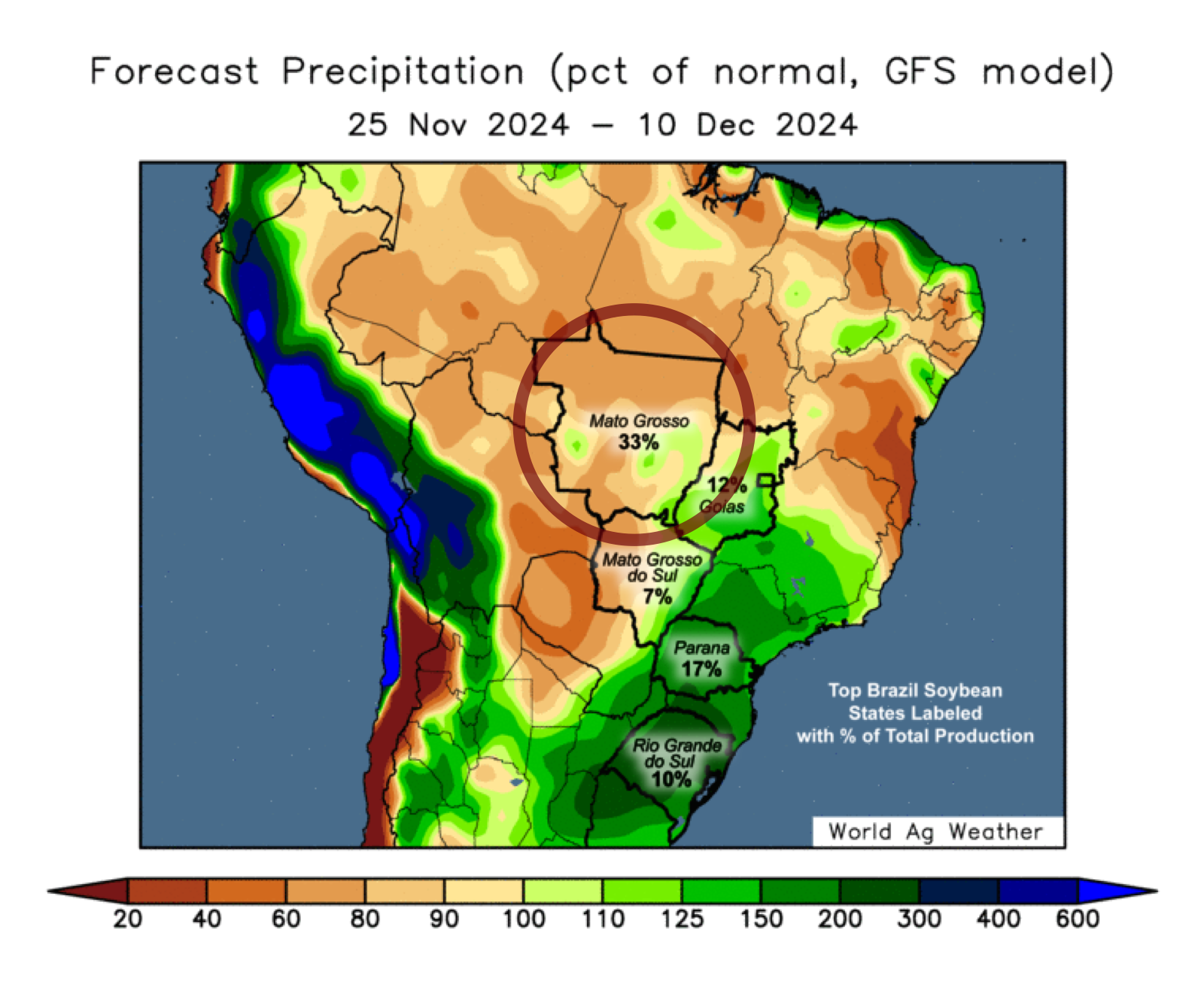

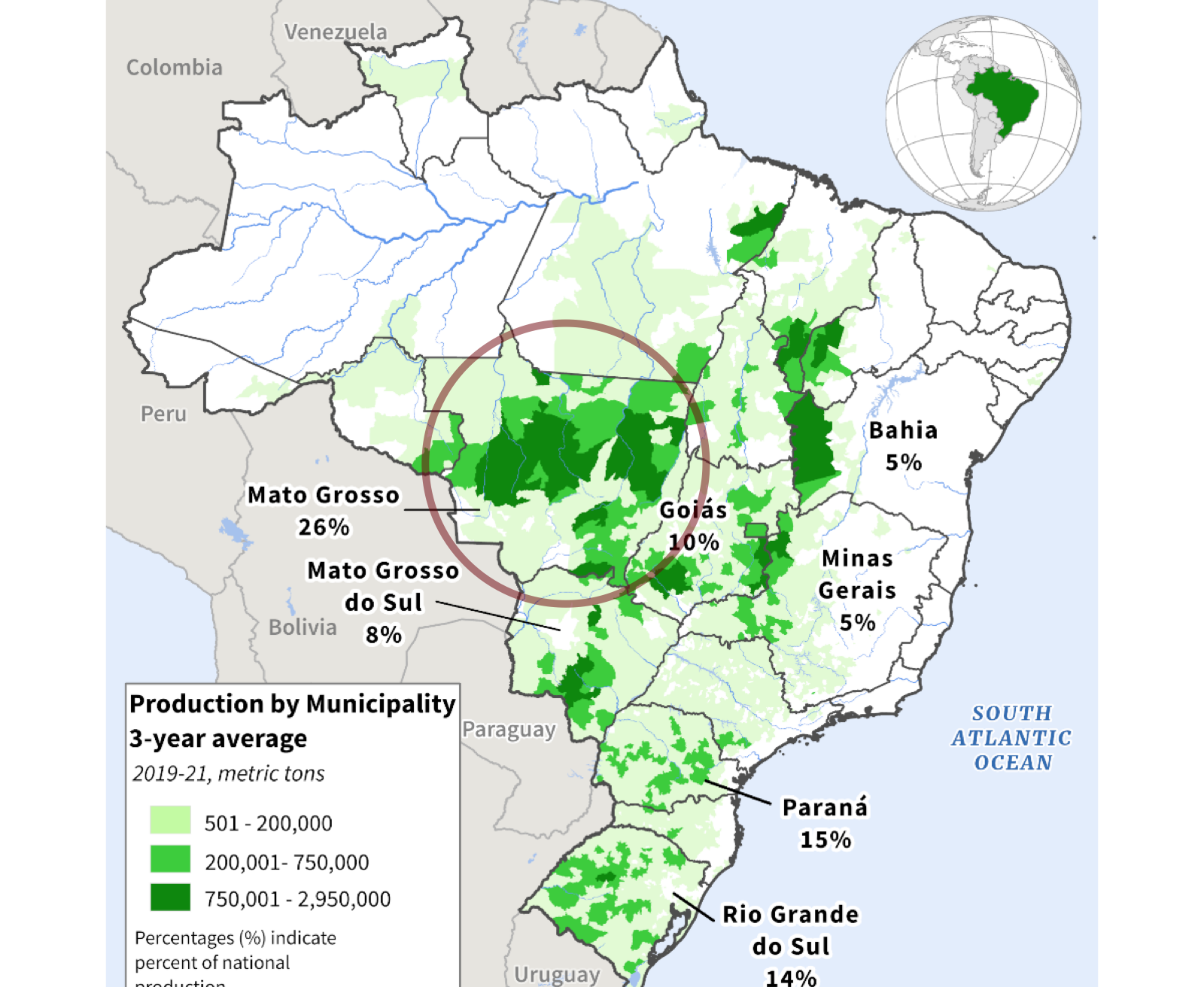

Brazil Rain?

Brazil has had great rain. So no real concerns.

But the next 2 weeks are looking on the dry side for Mato Grosso, so perhaps that could give soybeans a little boost.

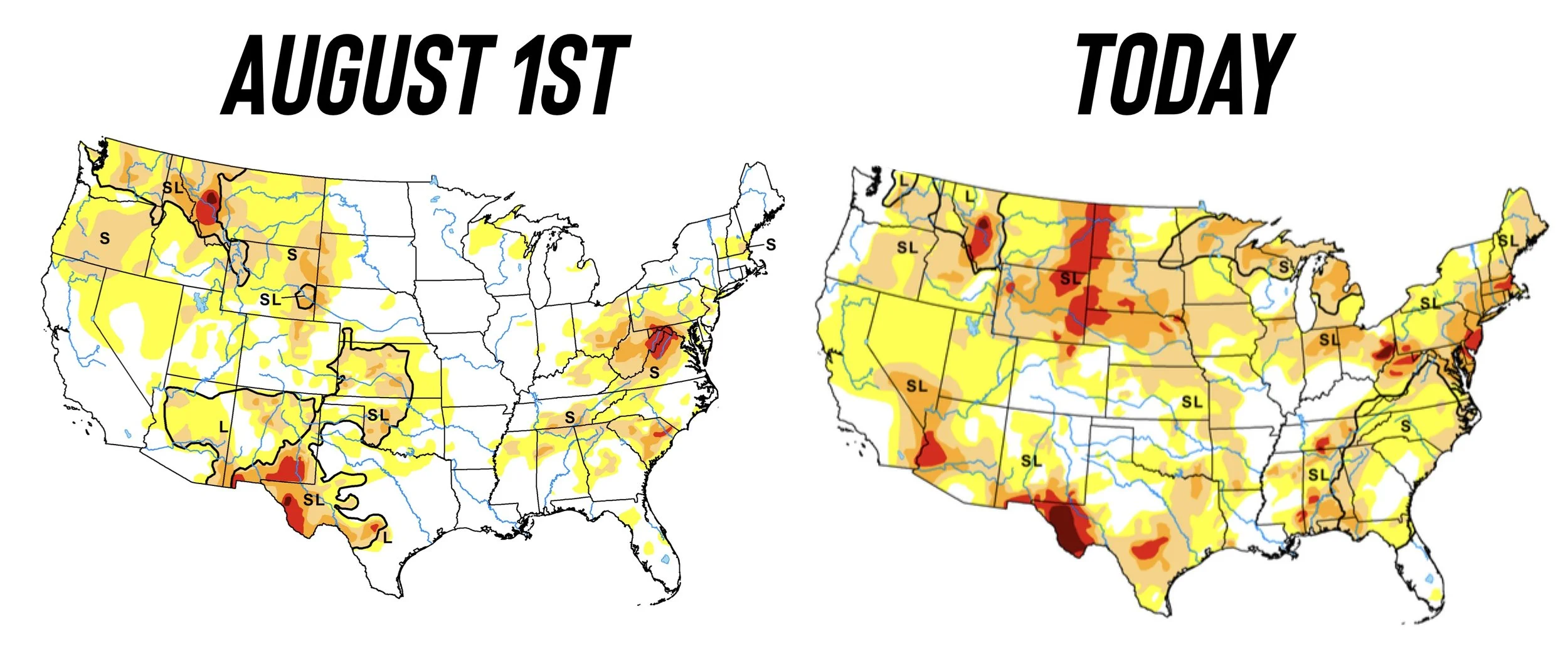

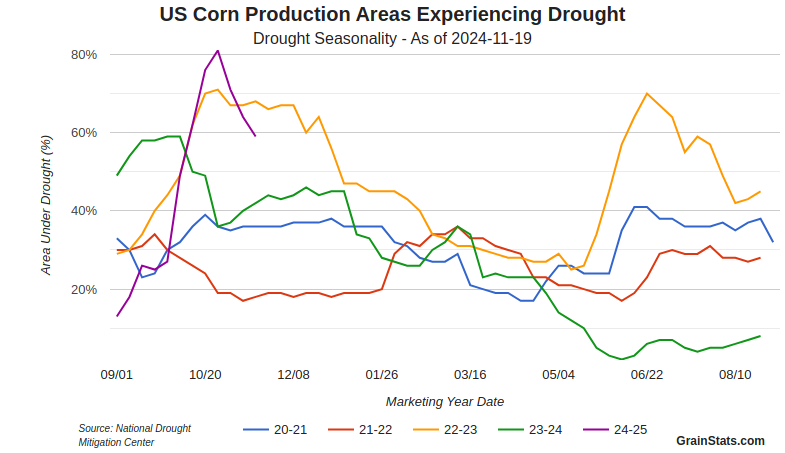

US Drought Update

Drought conditions have improved the past few weeks.

However, drought is still far above normal.

Still makes you wonder..

No there is zero correlation to drought now and the upcoming growing season. (Example: Last Year)

But Eric Snodgrass who is a widely respected weather analyst says this is the most concerned he's been at this point in the year going into the next growing season in over a decade.

Chart from GrainStats

Today's Main Takeaways

Corn

The spreads have been on fire for corn.

This implies that there is greater demand upfront.

It indicates that deliveries for first notice day shouldn’t be as heavy and means we don’t have much selling pressure.

This action in the spreads has some wondering if the US crop is a little smaller than the USDA currently says it is.

Spreads are doing the complete opposite as to what they did last year. Last year they fell apart and created a massive carry.

So this is a friendly sign.

Corn ethanol still remains at record levels.

Another positive.

The USDA is almost going to be forced to raise these numbers and add some demand to the balance sheet.

Chart from GrainStats

Exports still running ahead of pace.

Some still think this demand was front ran. Maybe it was.. maybe it wasn’t. Time will tell. Either way, they look great as of now.

A real argument to be made the USDA will have to bump export demand along with ethanol demand.

Chart from GrainStats

Short term, first notice day could add some pressure.

Longer term going into next year, I still think we have a demand story that can lead us higher.

First target to re-hedge or make some sales is still $4.39 to $4.46

That green box and the 200-day MA.

*Note: Todays update shows Dec contracts for corn & wheat. We will switch to March next update

Soybeans

I am still more concered about Brazil's monster crop than I am a trade war.

Even without a trade war, if Brazil has this huge crop, that alone could send prices much lower.

Trade war or not, unless something changes we still have the 2nd largest global stocks to use ratio of all time.

Last trade war, there is argument to be made that it wasn't the actual trade war that sent prices into the dumpster. We have to remember that China had major issues with African Swine Fever that killed demand.

Short term over the next month, we do seasonally go higher. So that offers some hope.

Brazil is looking drier than normal for the next 2 weeks, so perhaps that will spark a little life into the market.

If we want a real pricing opportunity, we will need a Brazil scare. (Unless we get unforeseen news out of China. Such as more stimmy money)

Simply so many unknowns in beans.

If Brazil gets a monster crop, we go lower.

Then if we get a trade war on top of that, it adds even more risk to the downside.

I REALLY want to see us hold those contract lows.

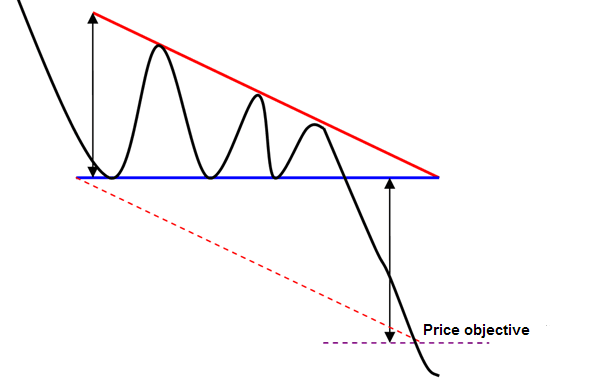

PURELY based on technical patterns, we are sitting in a descending triangle. The implied move if we were to bust below this support is well below $9. Something to be aware of. (Desending triangle pattern below).

To negate this pattern, we need to bust that downward trendline.

My next spot I am looking to re-hedge or make a few sales will be if we can crawl up and test that downward black trendline.

Here is an illustration to show you the potential implied move for beans.

The patterns says the move to the upside usually sees an equal move to the downside.

From the lows of $9.74 to the highs of $10.87 was a $1.12 upside move.

So the downside target would be $9.76 minus $1.12 = $8.64

I really hope this does not happen, but you have to be aware of all possibilities and what the charts say.

If this move did happen, it would take us back to those trade war levels where $8.50 was essentially our floor.

Wheat

Wheat hammered today, as we have given back that entire mini rally.

Really nothing new on wheat. Looks like we might’ve had a little war premium built in, but that is completely gone now.

Seasonally, we are at the time of year where wheat doesn’t have a real reason to rally.

We also saw headlines that Australia's crop is seen as getting bigger, not smaller. So that added some pressure.

The US dollar did take a good hit today. If continues to break down, it would be friendly for wheat. As this was one of the main drivers of this sell off since the election.

Wheat still has plenty of potential going into next year. But doesn’t mean we still can’t go lower from here. Because we can.

Our last 3 sell signals for wheat were:

Oct 2nd: $6.12

Sep 13th: $5.98

May 22nd: +$7.00

So for now I am remaining patient for another opportunity.

To say the bleeding is done, we still need to close above $5.70

Until we do so, you'd just be trying to catch a falling knife and we could easily go test that longer term support (black line).

Here is a weekly chart to give you a better view on that potential support if we do not hold this level.

Same concept applies for KC. Ideally want to see us take out $5.80 or so to say the bleeding is over.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

11/22/24

CORN TARGETS & CHINA CONCERNS

11/21/24

BEANS NEAR LOWS. CORN NEAR HIGHS. 2025 SALE THOUGHTS

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24