USDA PREVIEW & COUNTER SEASONAL RALLIES?

Overview

This is our only write up this week. So today's update is longer as we go over a lot of stuff with the upcoming report.*

Fresh lows in the grains after opening the day higher across the board.

July corn closed -11 cents off it's highs, July beans -17 off their highs, and July wheat -15 off their highs.

Overall awful performance, closing well off the highs which leads to the charts looking even more vulnerable to further downside from a technical standpoint.

We have a few main reasons for the lower prices.

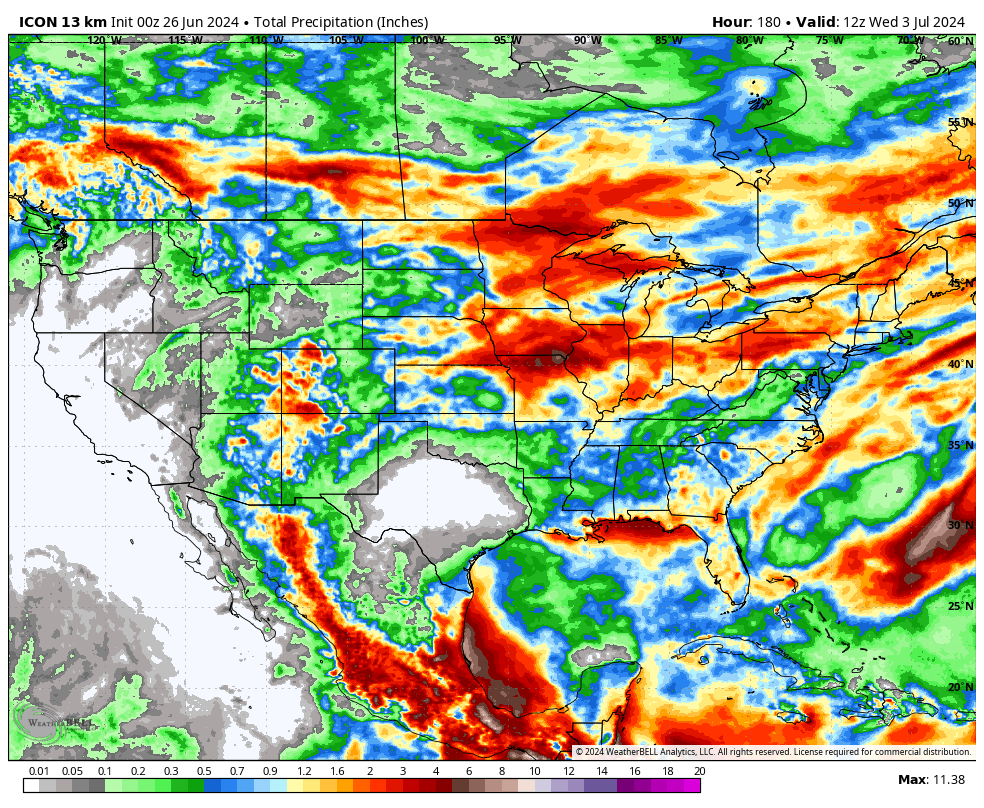

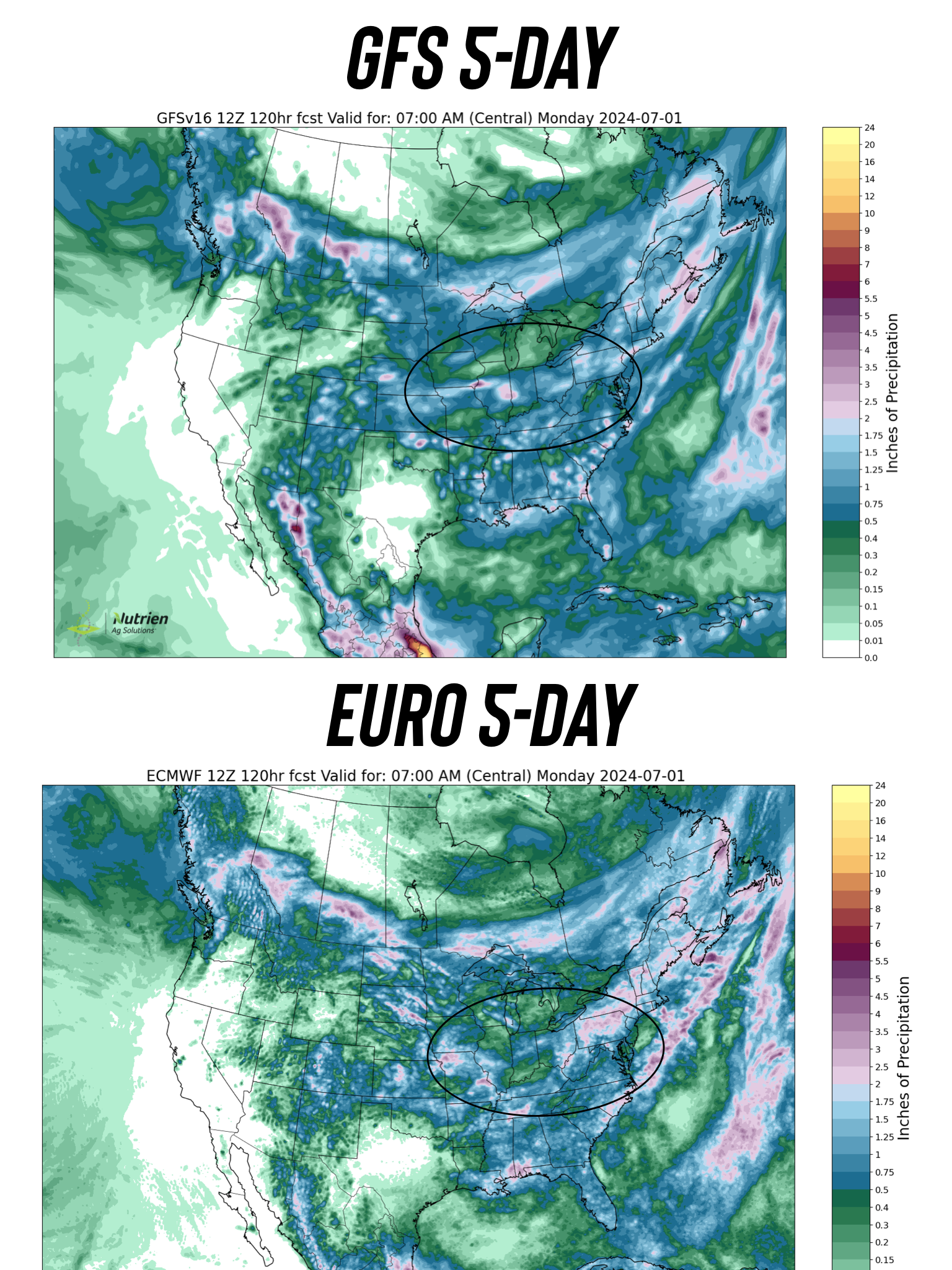

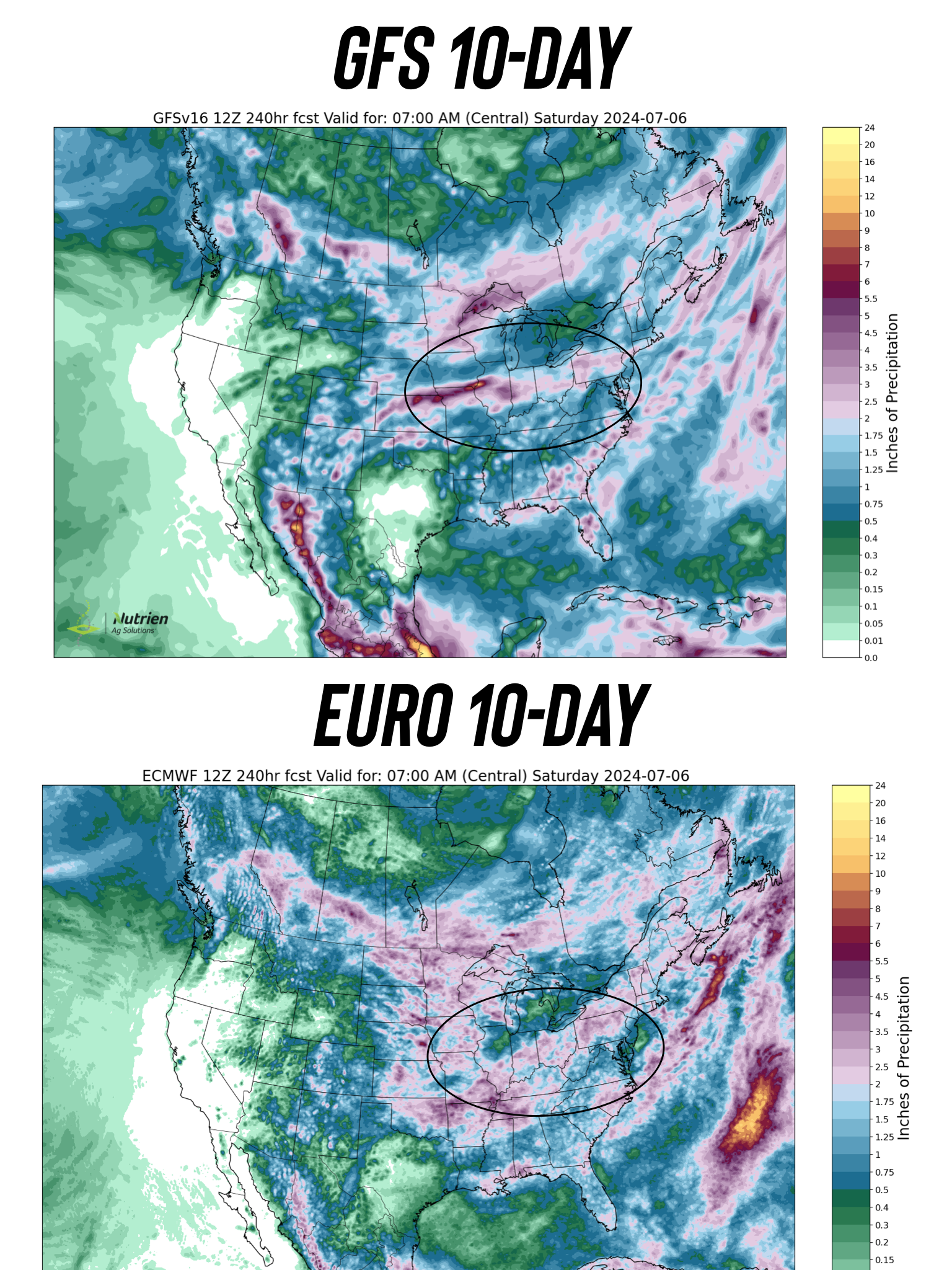

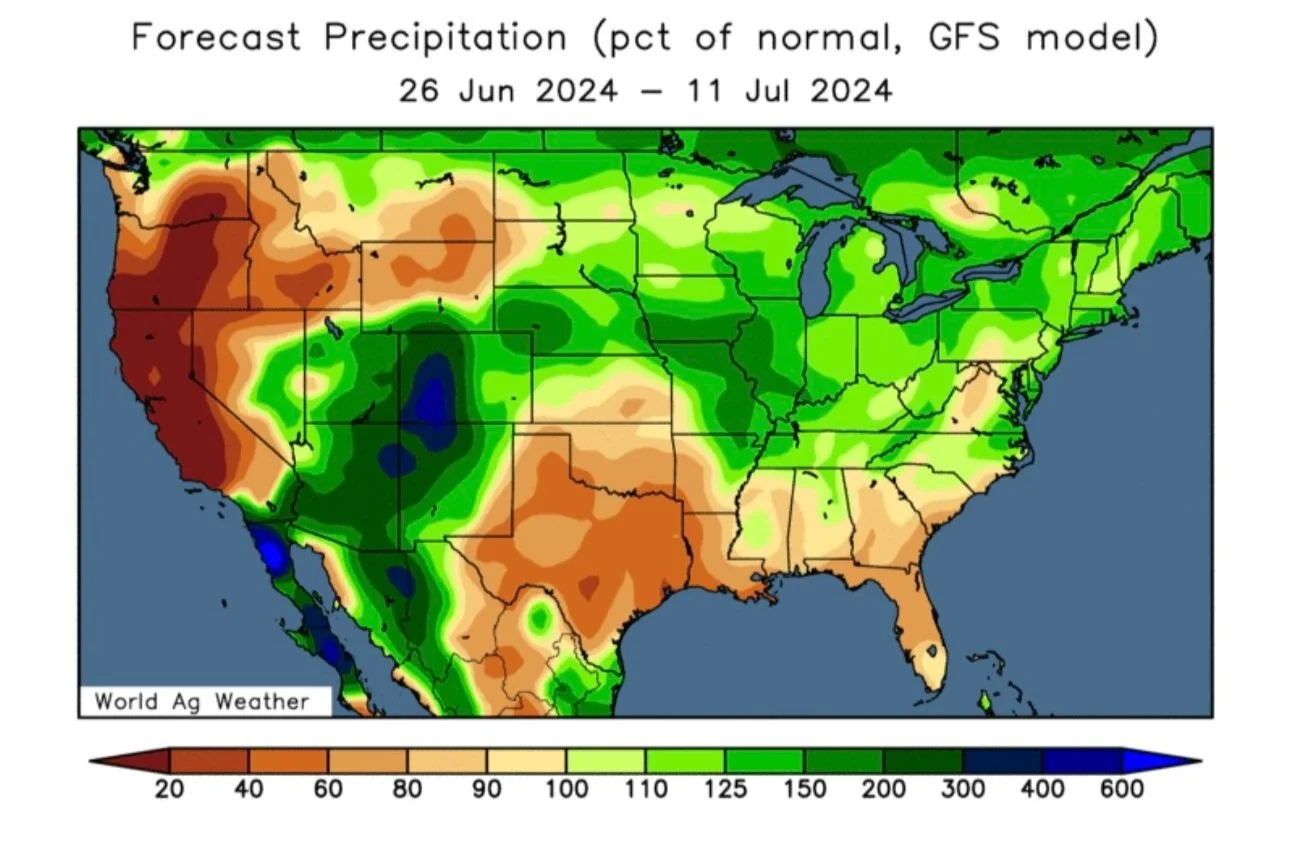

1.) There is rain in the forecasts for areas that have missed it. Some of those rains from Minnesota and South Dakota area are flowing into the eastern corn belt.

Rain in late June will always be viewed as bearish. No matter how many areas are suffering from flooding. The trade views this as rain makes grain. Above average crop conditions to go along with a wet forecast is negative.

2.) We have basis contracts that need to be rolled or priced along with first notice day. This almost always brings some bearishness especially if the US farmer is holding a larger amount.

3.) The USDA report Friday. It has the potential to be the biggest of the year. Everyone and the trade has started penciling in and preparing for bearish numbers.

The forecasts won’t be what matters Friday. This report has the potential to set the stages for higher or lower prices for the next few months.

USDA Preview

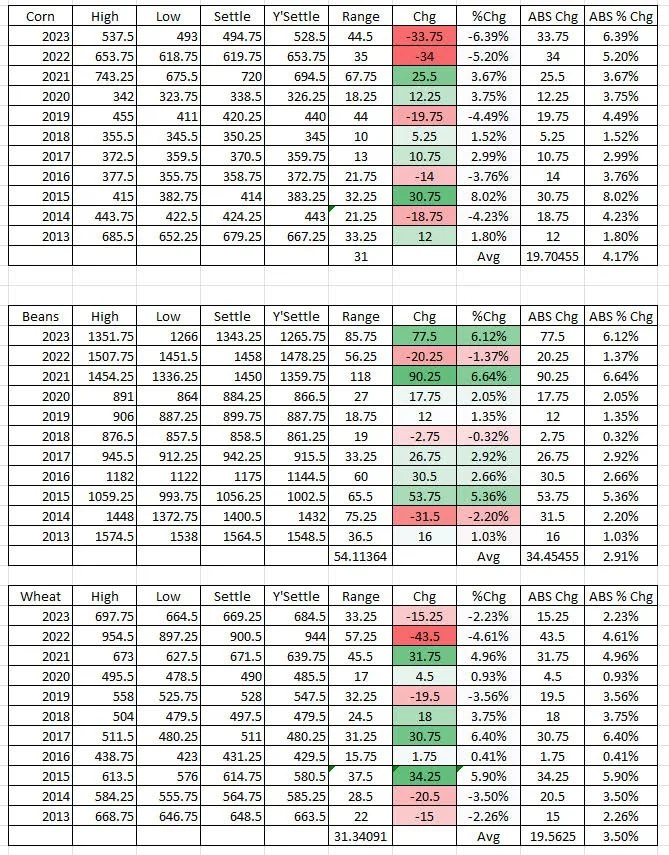

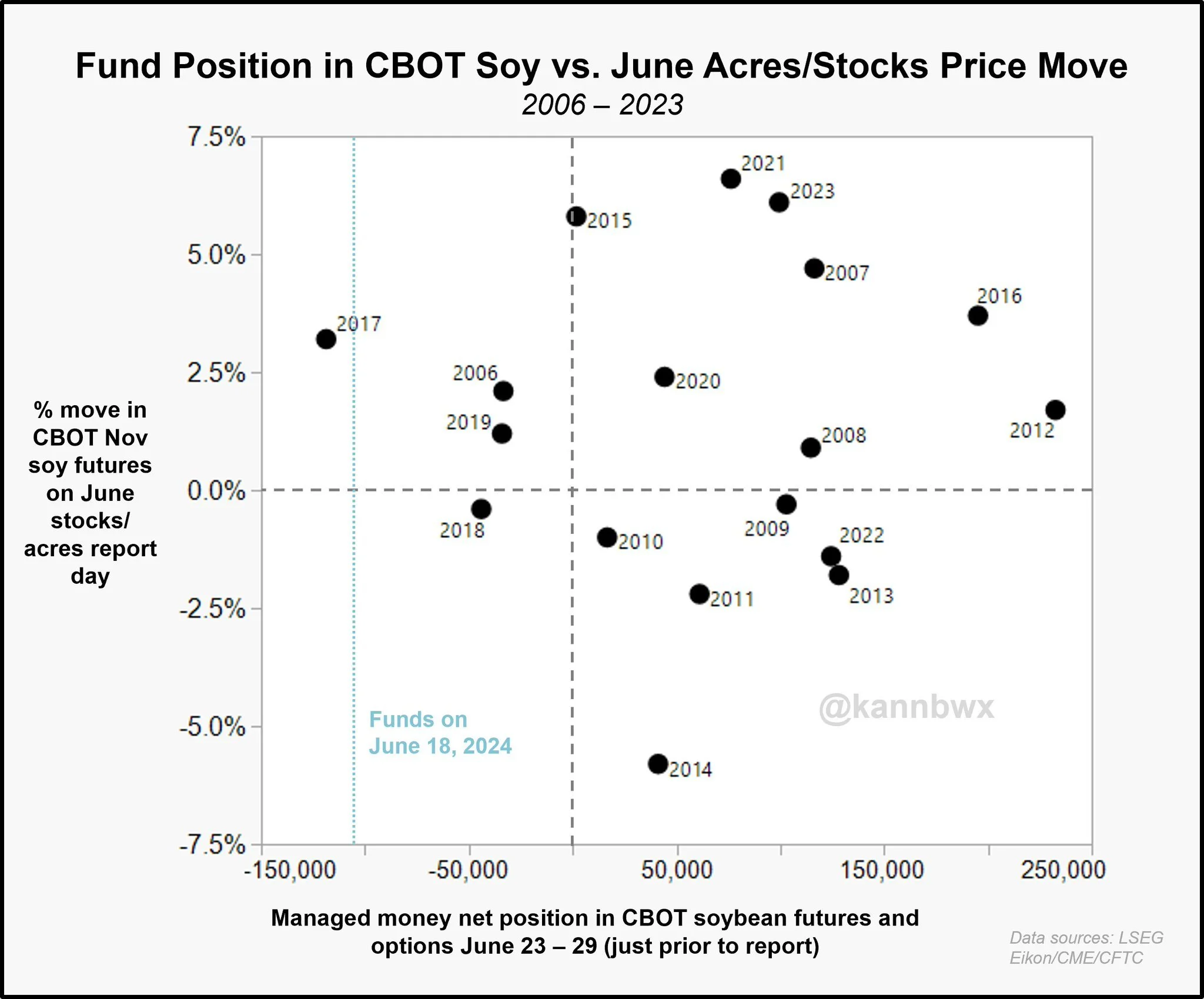

Here is the past 10 years of price changes the day of the report from @WalkSquak on Twitter.

As you can see this is a MAJOR market mover.

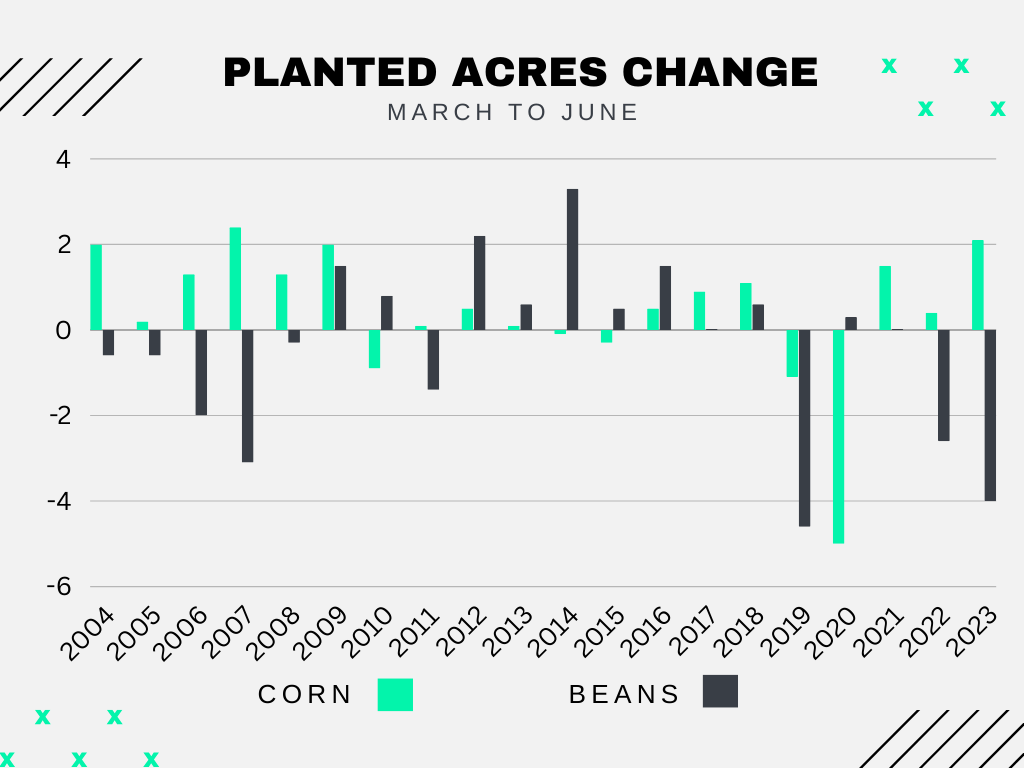

They see acres up slightly from March for both corn & beans.

The ranges:

Corn: 89 to 91.3

Beans: 85.5 to 87.5

We typically do not see acres come in lower from March to June for corn.

We have only seen them lower essentially 3 times.

Beans on the other hand have been a mixed bag.

We have only seen both fall one time. While we have seen both raised 4 times.

Usually we see one higher and one lower, or pretty much unchanged.

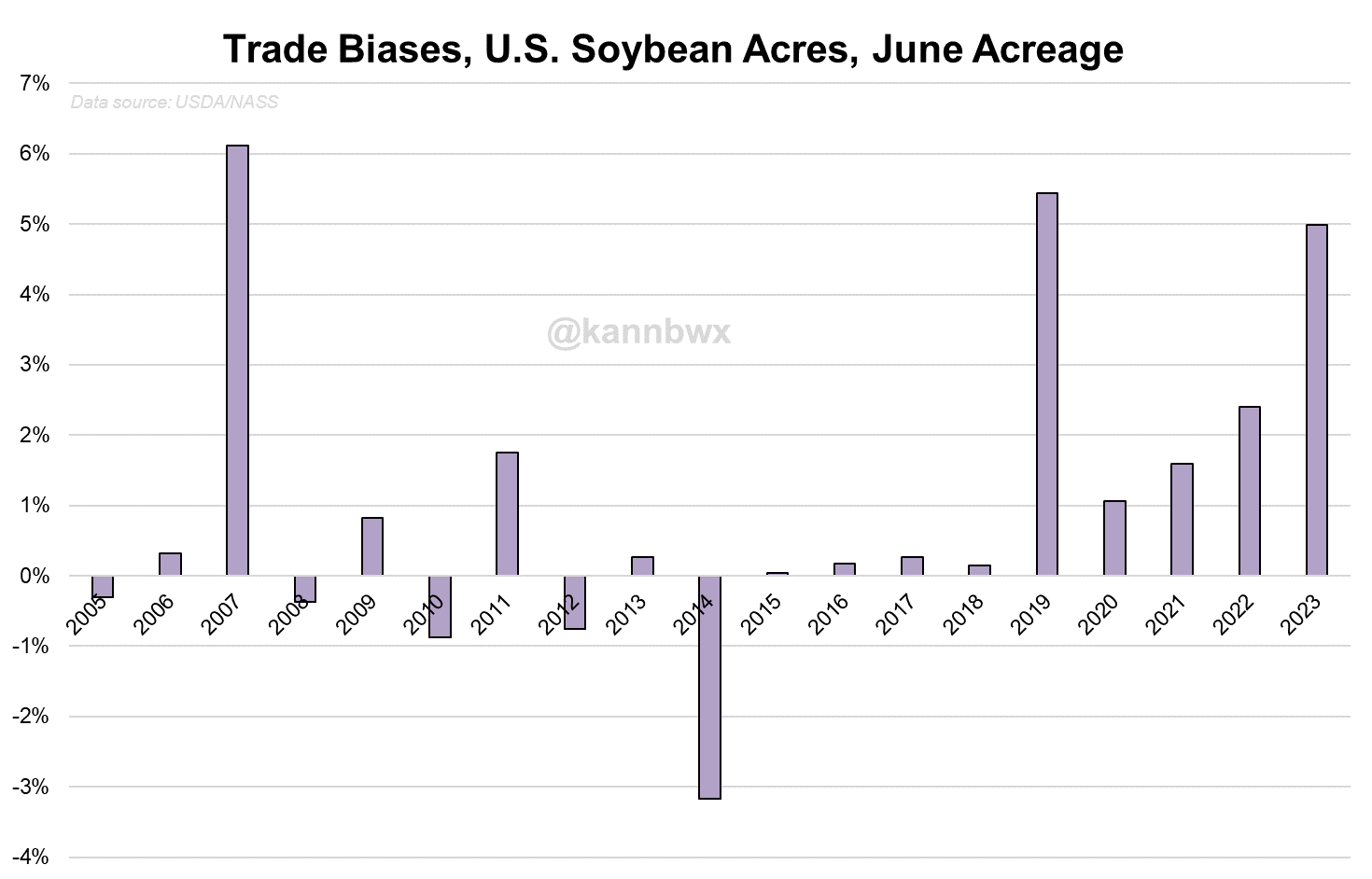

June acres tend to surprise.

We have landed outside of the trade range 4 of past 5 years in beans. 3 of the past 5 years in corn.

The estimates for soybeans have been way too high the past 5 years in a row.

There have only been 3 times where the trade guess was too low for bean acres.

Chart Credit: Karen Braun

Then the stocks.

This will be a good indication of how much the US farmer is holding. The less the farmer is holding, the easier it will be for prices to rally. The more they hold, the harder a rally will be.

Some of you that remember the 2009 light test weight crop, will also remember the USDA June 2010 report that lead to a multiple year bull run for the grain markets. As all of the sudden we lost the stocks, which actually where never there. So this report has a history of being when the USDA has had to come clean about previous years crops.

Will this happen on Friday? Basis indicates it is possible.

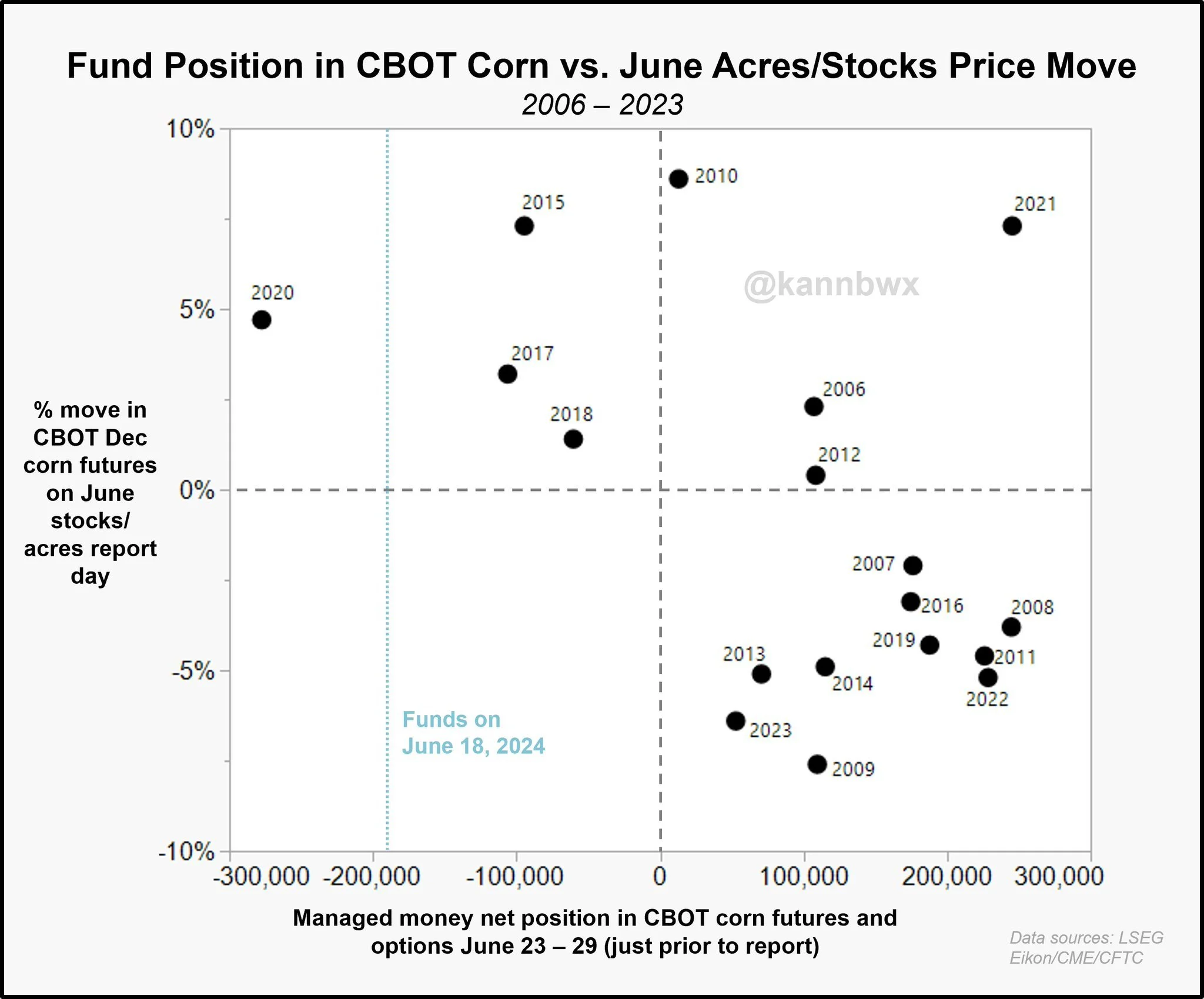

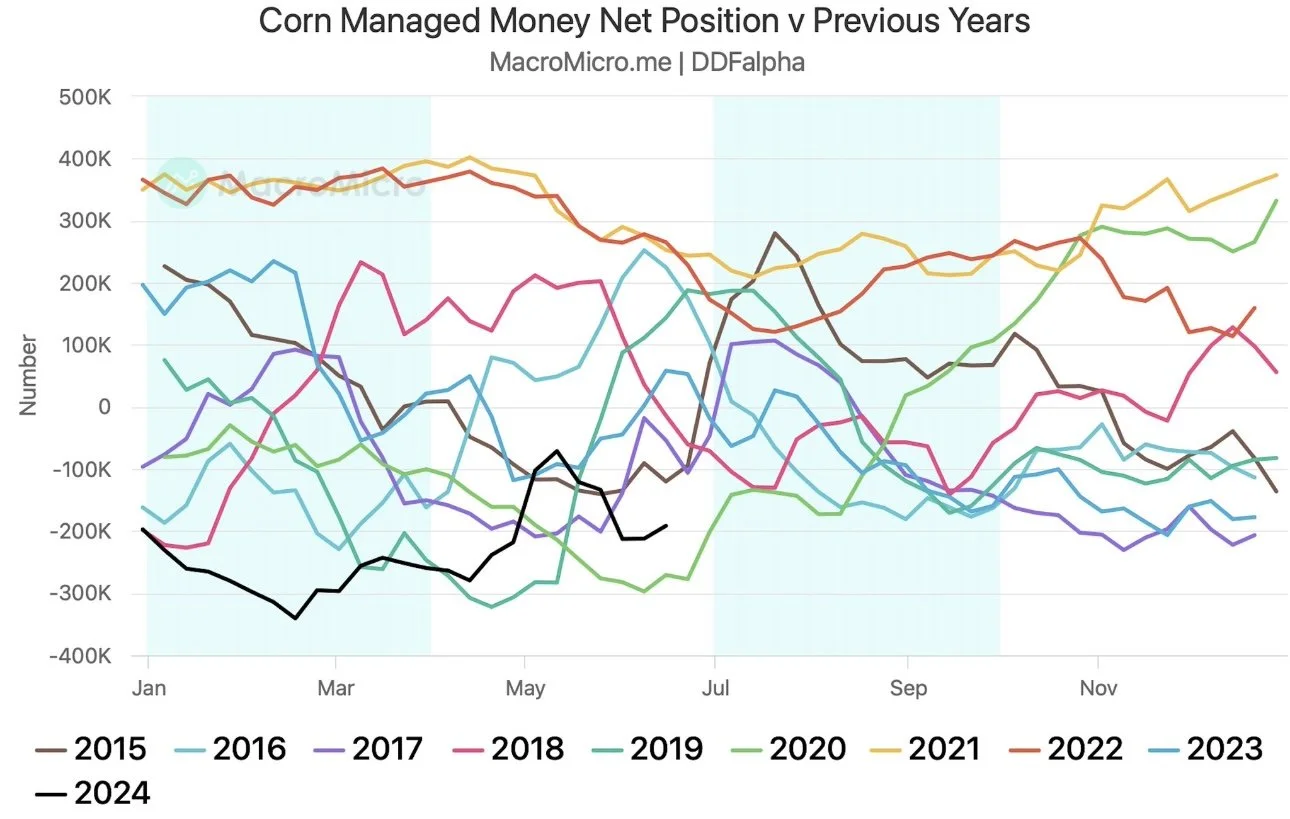

Here are two more interesting charts from Karen Braun.

We know the funds are heavily short. Some of the shortest all time for this time frame of the year.

The funds are usually long this time of year.

She pointed out that Dec corn has not fallen on report days when the funds were short. (Top left dots).

Just like corn, the funds are not usually short beans this time of year.

There isn’t many examples, but when they have been short the only year we got a bearish report was 2018.

Today's Main Takeaways

Corn

Corn posts new lows, as July corn finally broke below those Feb lows of $4.22 and Dec corn trades to it's lowest levels since 2021.

2014 or Counter Seasonal Rally?

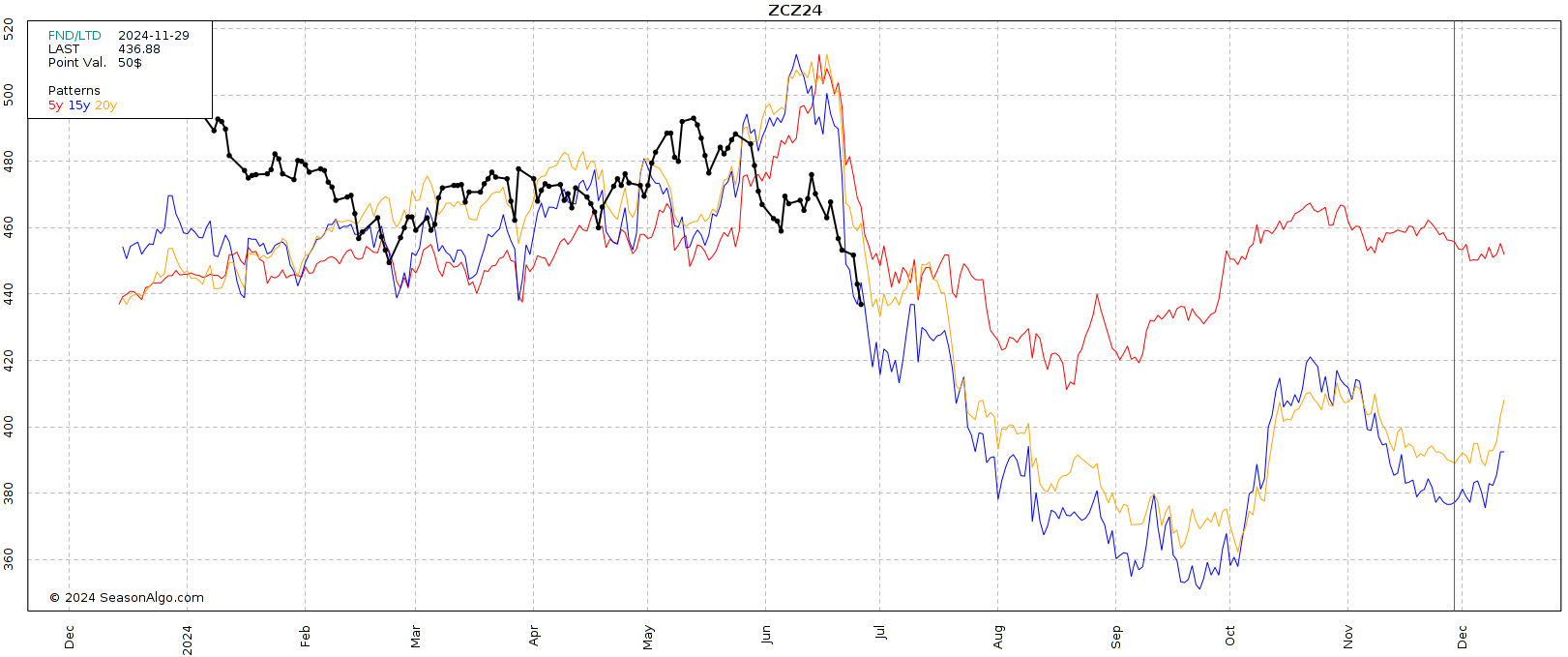

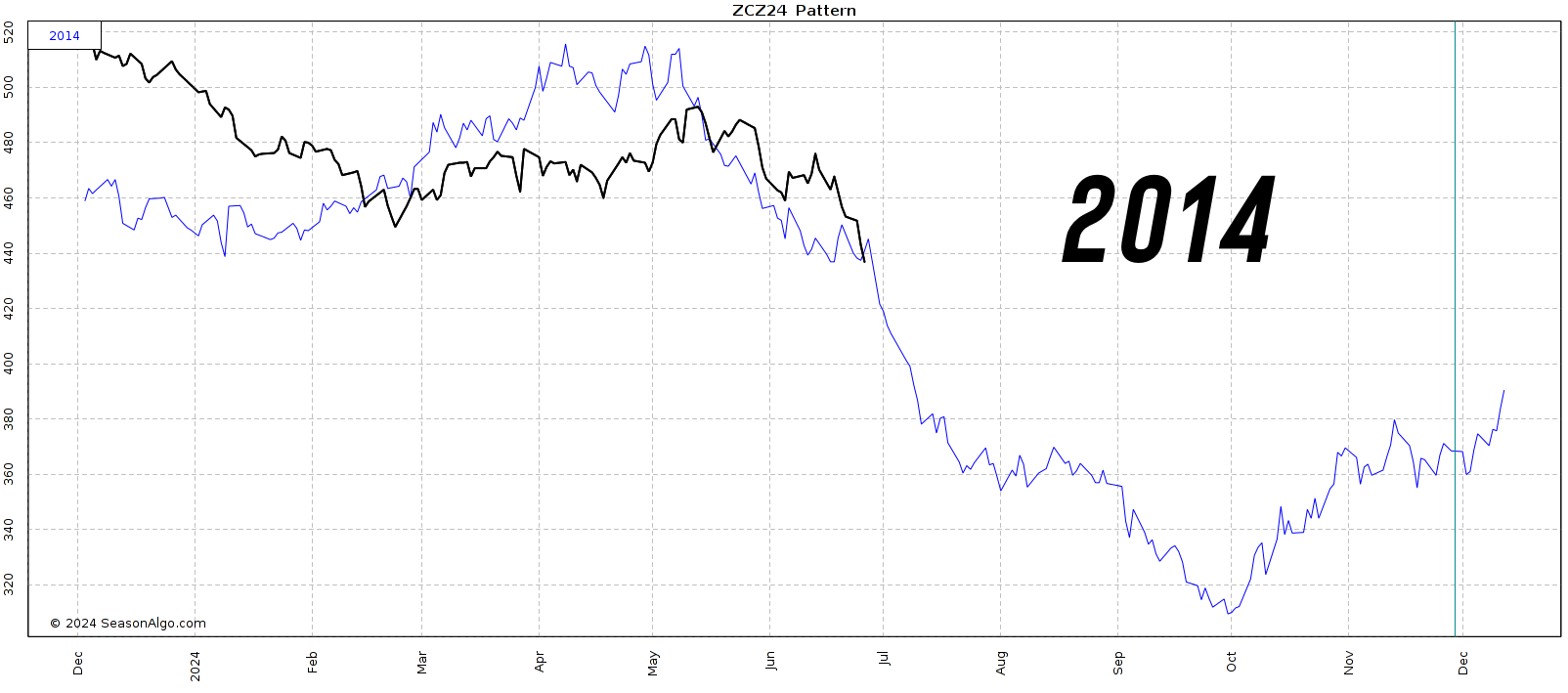

Here is Dec 2024 corn (black line) compared to the 5, 15, & 20 year patterns.

Seasonally, yes the majority of the time we do lower from here.

Many people are quick to point out the fact that this year is very similar to 2014 in terms of price pattern thus far.

The argument is that so far 2010 was like 2020, 2011 was like 2021, 2012 like 2022, and 2013 like 2023. So 2014 should be like 2024.

Here is an example of 2013 & 2023.

For 2014 & 2024, yes they are somewhat similar.

In 2014, we didn’t get that major summer weather rally scare either. Instead we got about $1.00 rally in March & April and it was about this time where we started falling much lower.

Exactly 10 years ago, June 26th 2014 we were trading at $4.43. This morning in 2024 we also opened at $4.43.

In 2014 on the June stocks report we dropped over -20 cents. We continued lower and by mid-July we were at $3.80 and our harvest low that year was $3.18.

I am not saying 2014 is impossible. However, one could argue the more likely scenario is 2010 or 2020.

In 2014 we didn’t have the wet spring issues, the floods to the west and dryness to the east. No year is like the other, but 2010 was one of those years where the wet implications did not show up until later in the year.

More importantly in 2010 the sky was falling we had made new lows the day of the USDA report, then all of the sudden the USDA dropped the stocks by 300 million bushels. Limit up here we came and we didn't look back for several years.

Then we have 2020, which was more of a demand driven rally that kept prices elevated a few years.

This is something we talked about yesterday. A counter seasonal rally.

This year has been unlike any other. Remember back in December, everyone talked about how corn had rallied after the Dec USDA report into January every single year for 16 years in a row? That didn’t happen this year.

We also did not get that typical scare that leads to a short lived rally like we do normally every other year.

The funds are near record short for this time of year. They still have not gotten long despite having gotten long in every single year thus far at some point.

Like we said yesterday, we see this rally being a demand driven one. Overall demand for corn has gotten better year over year. Corn demand is the largest is has been in 4 years.

We have the chance to see a 181 yield yet our carryout could shrink year over year. Now that isn’t bearish. A 181 yield is also off the table at this point.

Don’t forget the issues this wet spring brought. Root structure issues. Nitrogen loss. Those are all problems you cannot see from the road (aka crop conditions, a pure eye test). These problems pop up later in the year.

Now could we see another -30 cents or more downside or sub $4 corn if acres come in high? Absolutely it is possible. You can’t rule it out. If acres come in at 92 million that is a real risk.

Right now the market is likely pricing in something around 91 million. So even if we come in at the 90.3 estimates, it would be looked at as supportive. If we fall below 90 million, I don’t even have to tell you how bullish that'd be. Then if stocks surprise, things could get interesting real fast.

Here are the 3 main reasons we are going lower. I mentioned these earlier, but added some more context:

1.) The rain in the forecasts. Rain in late June is always going to be bearish, no matter how many suffered from the recent flood. The market sees it as rain makes grain.

(Something to keep in mind with these floods: It might be a bigger problem than the market thinks today. The problem is a lot of these acres will be completely wiped out, not just a crop that yields poorly).

2.) Then we have all of these basis contracts & first notice day. This almost always adds some pressure to the markets, especially if farmer ownership is larger.

(Remember back in February? It was basis contracts and first notice day that pushed us to new lows. Once we got that out of the way, the market found a reason to go higher.)

3.) Lastly, the USDA report. Nearly everyone is getting ready and preparing for a bearish USDA report.

Once we get past Friday, as long as this report is not super bearish. I think we will find reasons to bottom. We will get 2 of these 3 bearish headlines out of the way. Throw a dry forecast in there and things get more interesting.

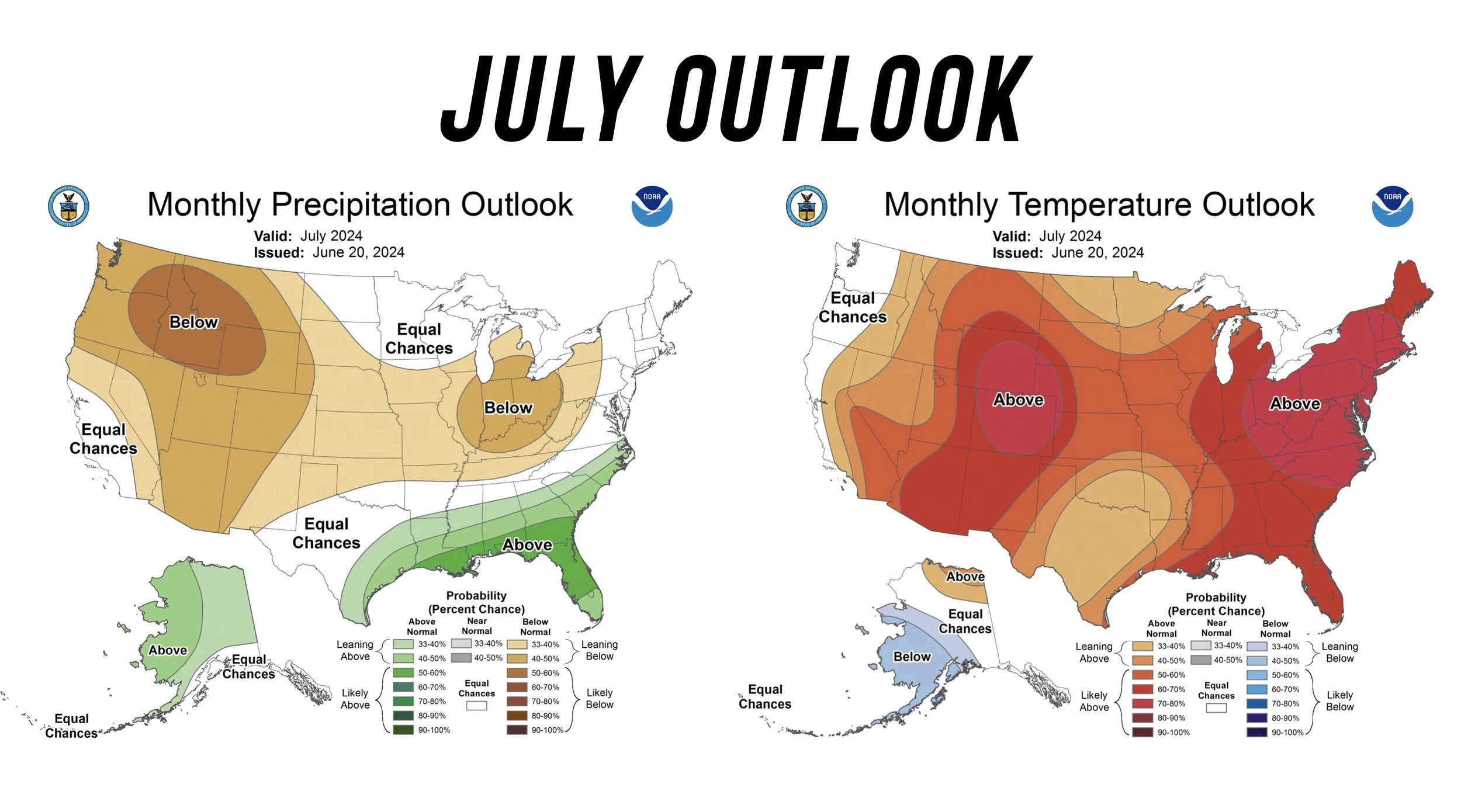

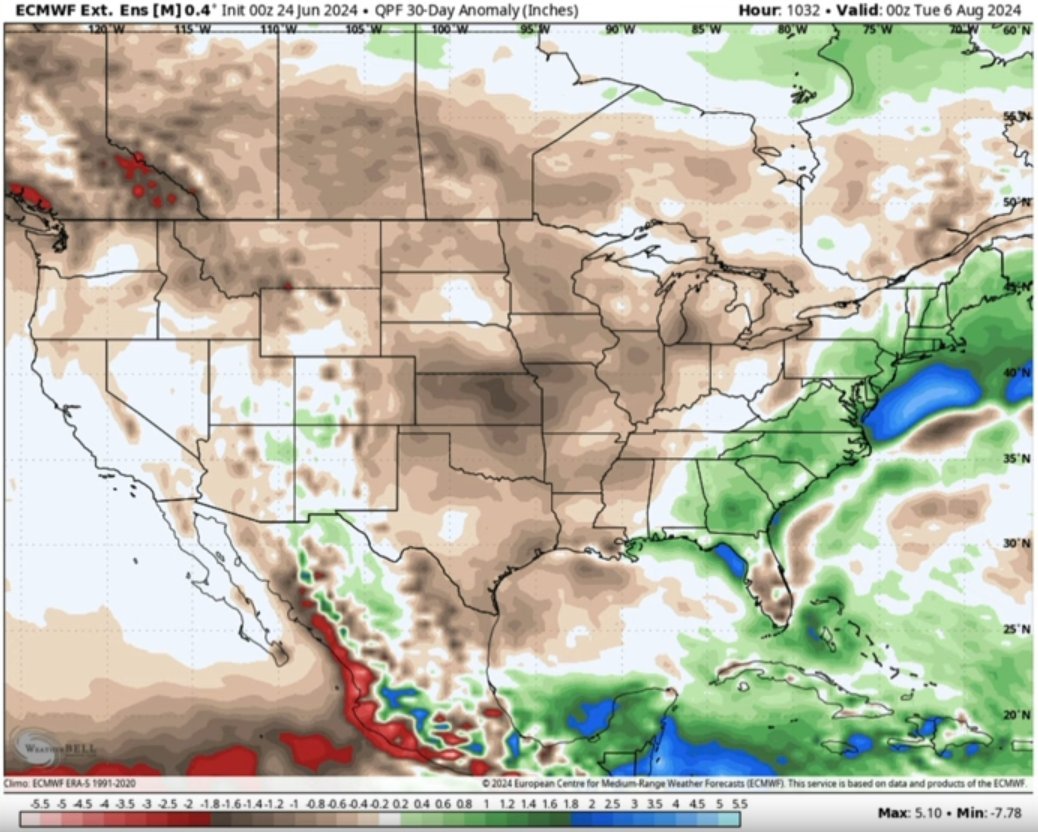

Despite the upcoming rains, the outlook for most of July is pretty dry and hot.

I am not saying we see a major rally next week, but later this year I do think we will find demand, less yield, all of which will create some better pricing opportunities.

IF YOU ARE NEVOUS OR UNDERSOLD:

Two choices.

Simply grab puts for protection. I do not love spending a ton of money here at these price levels, but if you have crop insurance and are undersold it makes sense to protect your bottom line for worst case scenario. You give up some potential upside to protect from downside.

Or ride out the storm.

***

From Wright on the Market:

"July basis contracts must be rolled or priced by the close of business tomorrow. We highly recommend you do what you must do to meet cash flow needs and stay long corn and beans.

The market is trading rain makes grain. True, but the market is miss-judging the big weather picture, nitrogen loss, compaction of the muddies in crops, and, as always, the market has overreacted because the anticipation of an event will move the market more than confirmation of an event. The corn crop will not yield 181 bushels per acre, which is what USDA expects."

July Corn

Dec Corn

Soybeans

Nov beans make new lows, falling to lowest levels since 2021. While July beans fail to break above the $11.76 resistance for the 5th time in 6 days.

One of the biggest things I am still looking at is the July-Nov spread.

This spread reached a +60 cent inverse today. That is massive. This is also viewed as a bullish thing.

It indicates that we have more demand up front, and that perhaps we don’t have all of these soybeans sitting around like the USDA and trade seems to think.

With this massive spread, brings opportunities.

That opportunity is basis contracts.

In the past we have said to not use basis contracts in a CARRY MARKET. Because it makes zero sense to do so. Doing a basis contract in a carry market could bite you.

You do basis contracts in an inverted market. Which is what we have here. So look at your basis bids in your area. If they have a big inverse that needs to be on your radar.

The majority of you should be locking in old crop bean basis in the next 2-4 weeks.

Give us a call if you have questions. (605)295-3100.

July Beans

Nov Beans

Wheat

Wheat has now given back 100% of that Russia rally, barely holding those March lows of $5.37. Now over $1.60 off our highest close.

It's more of the same story for wheat.

The market isn’t concerned about the Russia crop anymore. There is rumors that perhaps the situation was actually overstated by the analysts over there as well.

We have wheat harvest in full swing here in the US which is adding harvest pressure and will continue to do so until we get through a good chunk of it. Typically you start seeing less harvest pressure when harvest reaches 50% complete. Last week we came in at 40%.

There simply isn’t a whole lot to say today about the wheat market. We struggle to find a reason to go higher. Which is reasonable. The situation here in the US isn’t bullish, Russia headlines are in the rearview mirror for now. I have been saying for weeks we would need another Russia driven headline if we want to go higher, and we haven’t got one.

With us sitting near the lows, I do think we start to find a bottom within the next week or so. I think a majority of the heavy bleeding is out of the way.

Yes, we could still go lower, as we don’t have a real reason to go higher here today. But I think we at least see this market stabilize shortly. We are heavily oversold here as well.

If you did not makes sales on our sell signal when wheat was over $7, your only real option aside from puking out is to either remain patient or to grab some puts for further downside protection, although I don’t love the idea of spending any money on puts at this time.

For those that did make sales near the top, this is a great spot if you want to look to re-own. But there is absolutely nothing wrong with walking away from a sale you are happy with.

Long term (+6 months) I could see us a lot higher. Short term, I am not trying to catch a falling knife realizing we don’t have a huge reason to go higher without some unforeseen headline.

July Chicago

July KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24