TURNAROUND TUESDAY

Overview

Turn around Tuesday today as we got the exact opposite price action as yesterday. Yesterday beans rallied +30 cents while the wheat market sold off over -20 cents. Today beans were lower while wheat rallied. Corn has been following the wheat market, although the moves are far less drastic, trading in roughly a 5 cent range rather than a 20 cent range.

One thing to note on the last two days of action. Wheat took back nearly all of yesterdays losses, while soybeans only gave back roughly 1/3 of yesterdays rally.

Why the price action?

A simple explanation today is that the funds are simply reversing their positions from yesterday. They are trying to decide what to and if they want to cover shorts before the end of the year or not.

Yesterday the strength in beans was Brazil worries while the weakness in wheat was profit taking following the +80 cent rally the past week or so.

The main focus is still Brazil. So let's start there.

Overall, still hot and dry. They put some rains in the 10 day forecast which pressured us today, but nothing to really change the trend or pattern. Rains disappeared last weekend and the forecasts continue to turn hotter and drier.

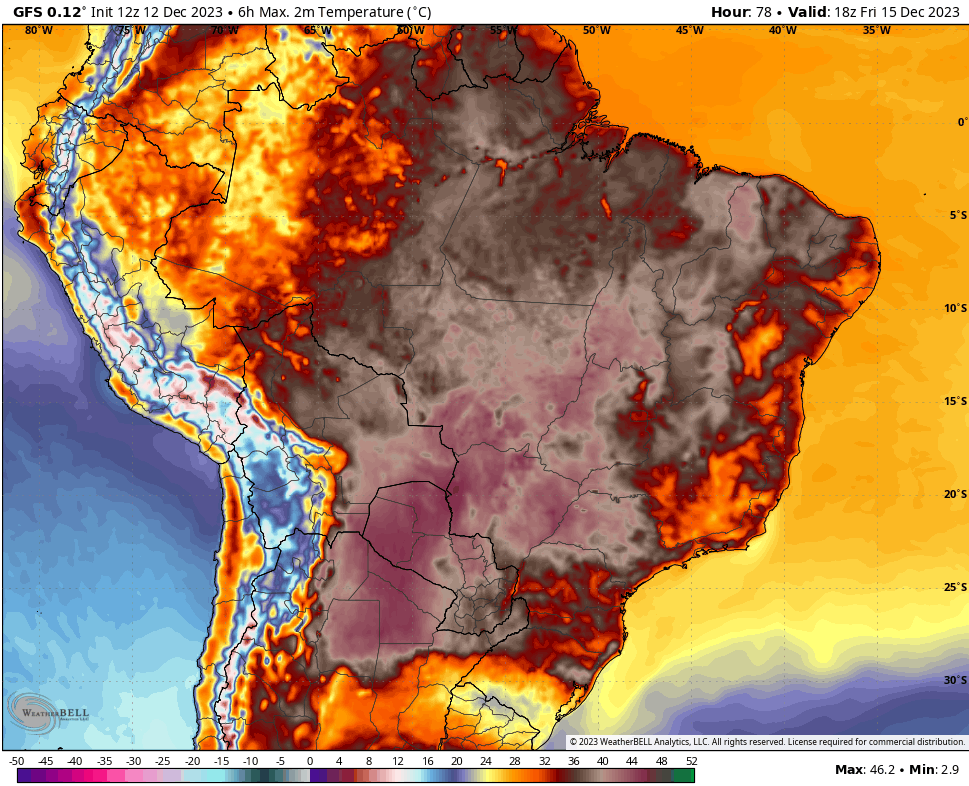

The GFS model continues to show heat with many areas showing 100+ degrees towards the end of this week.

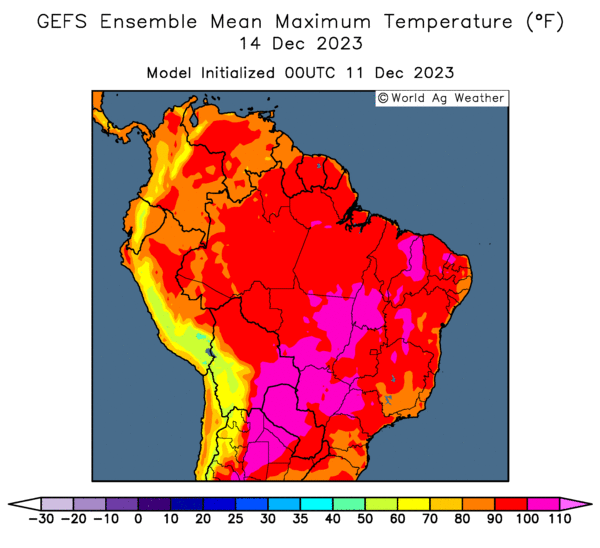

Now here is the current outlooks.

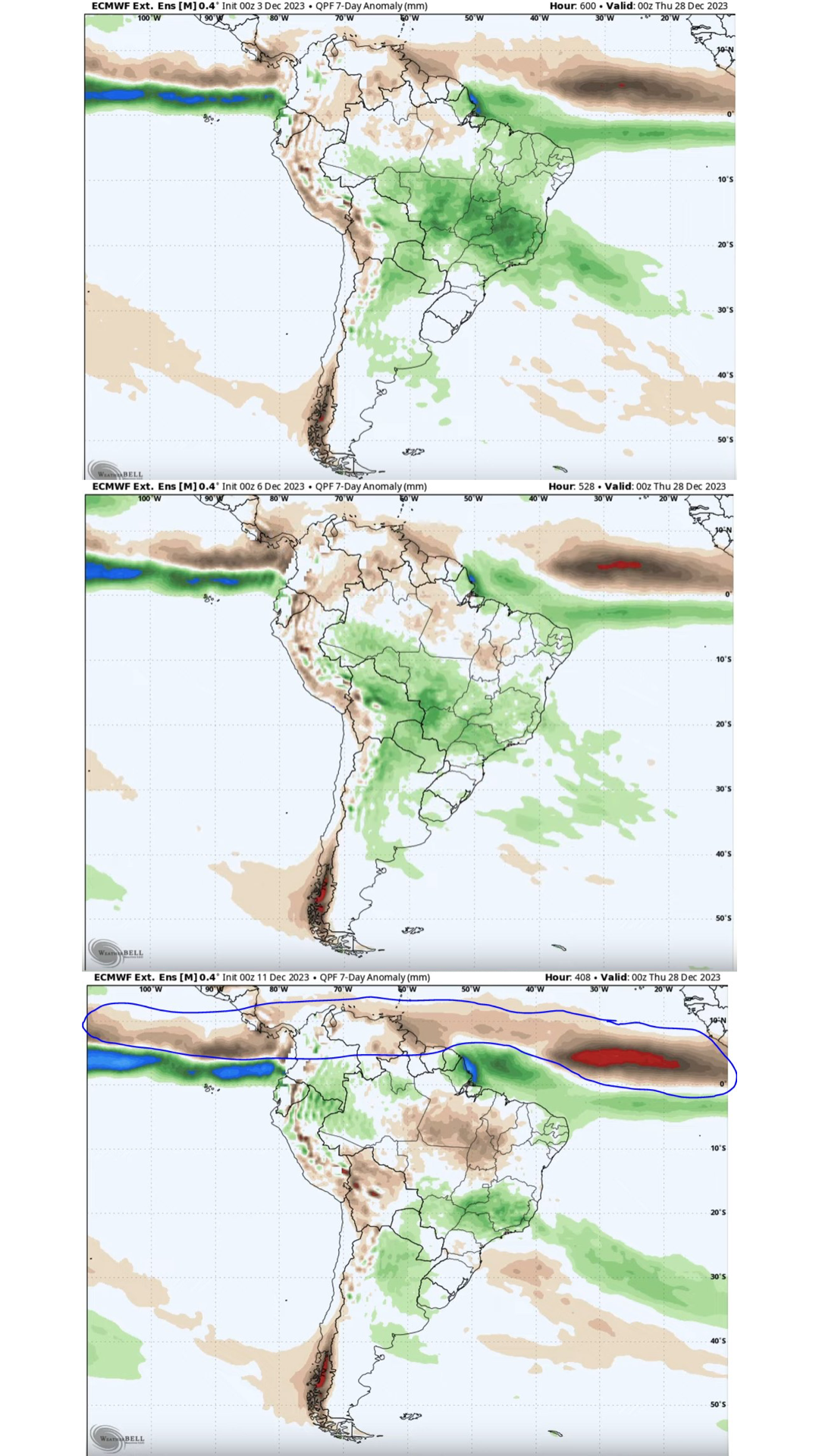

247 Ag pointed this next part out. The first map is one from a while ago. The second one from a week ago. Now this.

Just goes to show that these forecasts are constantly changing, and usually trending drier.

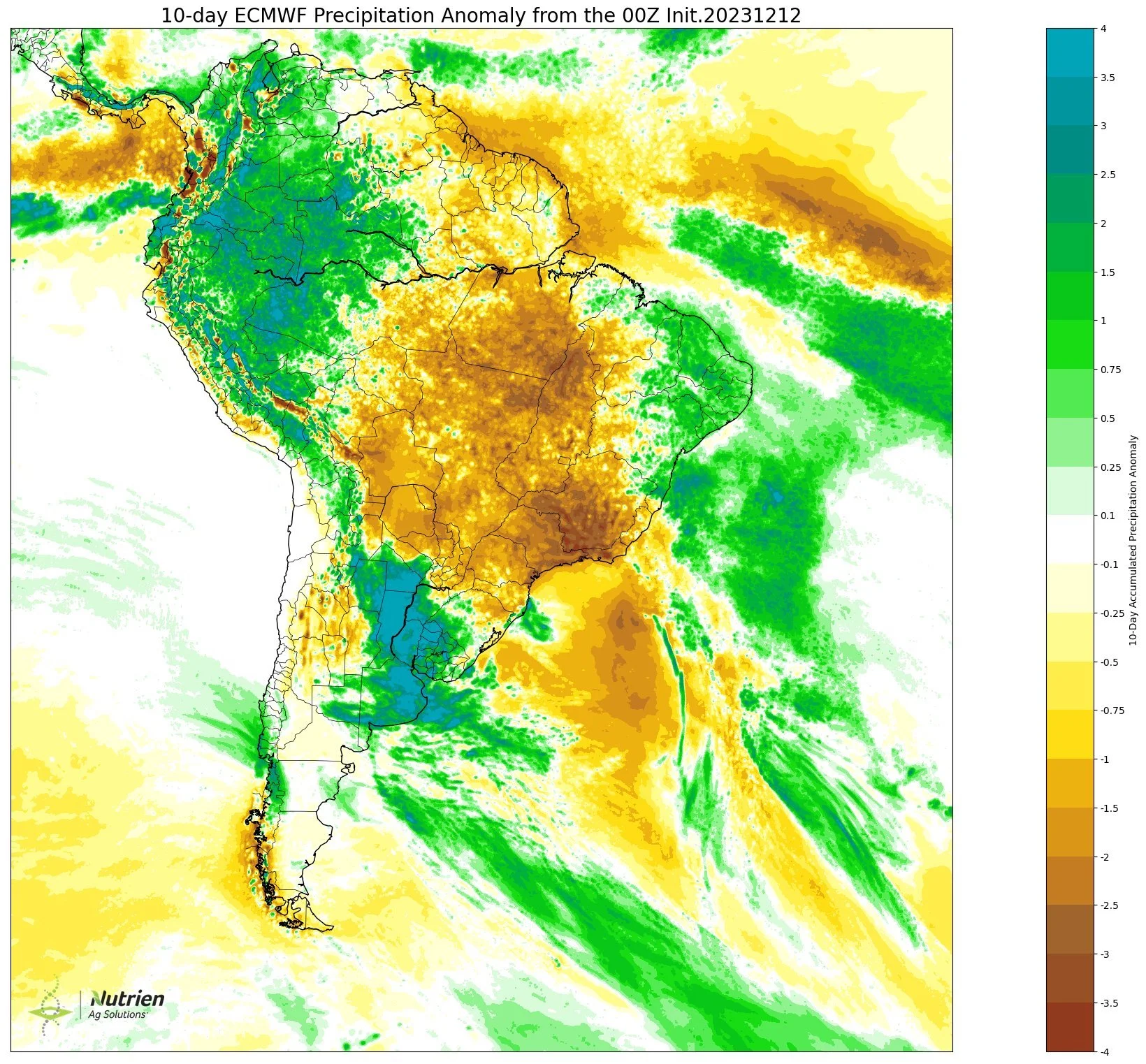

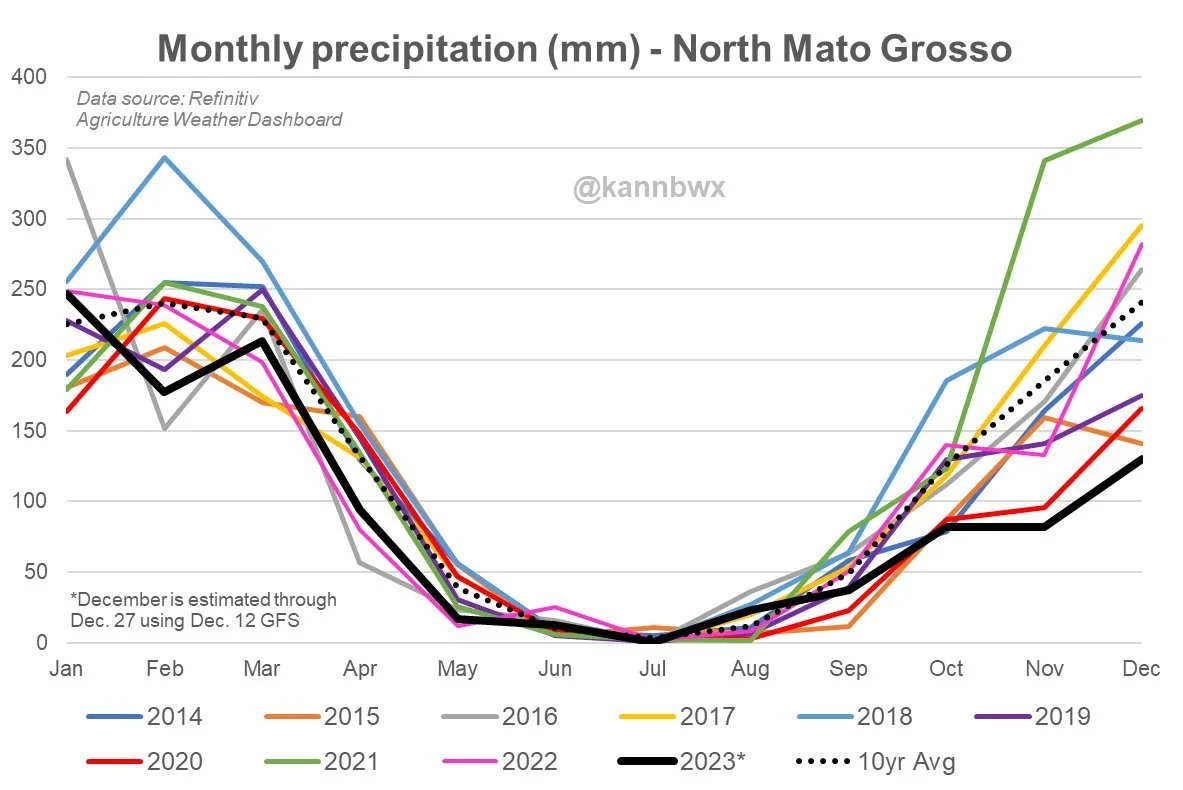

This next chart is from Karen Braun. It shows what the monthly precipitation would look like for Brazil using today's GFS rainfall forecast for December.

Most agree, this won’t be enough rain if true. That's IF the forecasts are accurate. Often times lately they have been over exaggerating rain.

Brazil Consultant, Kory Melby:

"Tough week ahead for MT. Rain comes December 21 or so, but the below normal November and December totals will catch up with this crop. Too hot for good bacteria and en the end hits the yield. Lots of empty pods in early soy."

Brazil Farmer, Romeu Gusatti Filho:

"The lack of rain and high temps is causing huge damage. This soybeans field received good volumes of rain until the beginning of December. In the reproductive period the need of water increases a a lot and the damage is irreversible."

Here are some estimates from a consultant in Brazil, Aluisio Pancracio.

These are very very bullish numbers if even close to true. Do I completely agree with them?

Not necessarily, but the people in Brazil have a better idea than anyone of what their crop looks like.

He said:

"Regarding the numbers, compared to the fantasy published by CONAB and the USDA, they can be considered extremely bullish.. but in relation to reality, I guarantee they are very realistic."

Do they know something the USDA isn’t telling us? Guess we will have to wait to find out. If these numbers are even remotely close, watch out.

For comparison, the USDA is at 129 for Brazil corn and 161 for Brazil beans. For Argentina the USDA has 55 for corn, and 48 for beans.

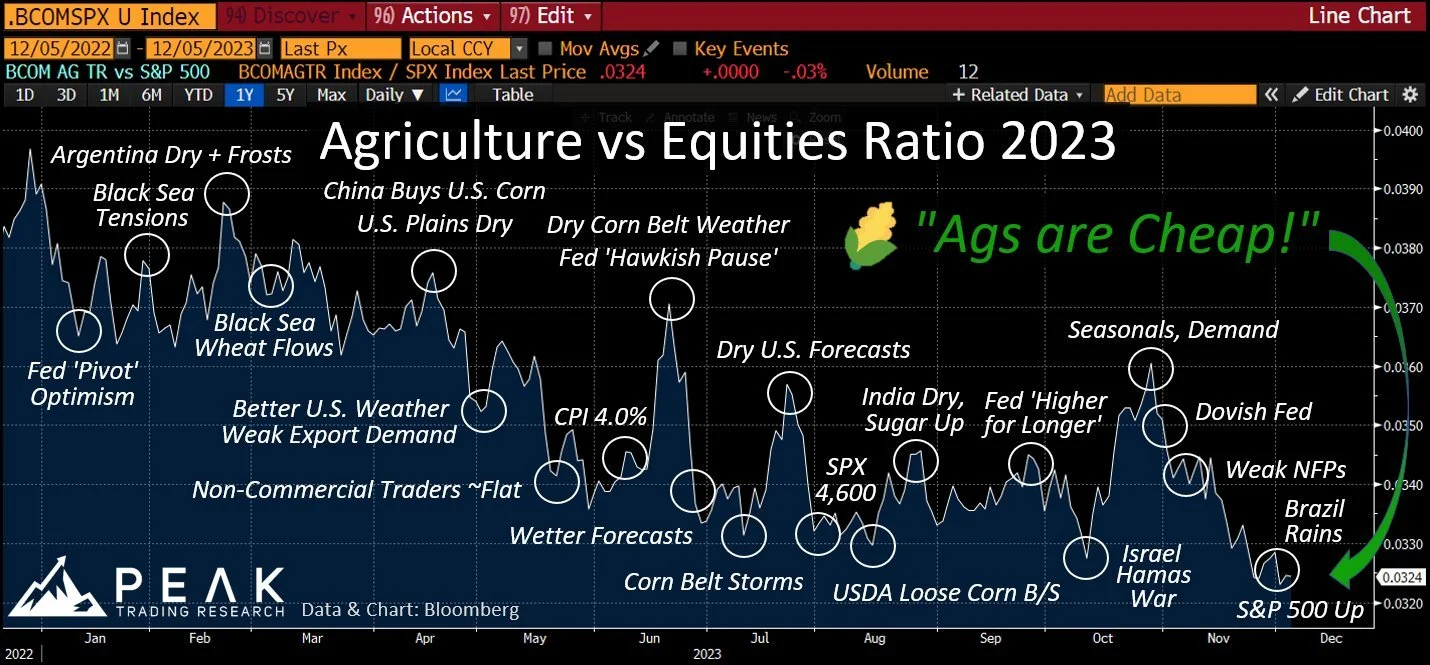

This chart is from Peak Trading Research. It shows the Bloomberg Ag Index vs the S&P 500 ratio. Today this made new lows.

What's this mean?

Ag futures are CHEAP compared to the US stocks. Perhaps another reason we may see big money want to take their gamble in the grain market casino. If interest rates go down this could be story.

Now let's dive into today's update...

Today's Main Takeaways

Corn

Corn continues to chop around in it's recent small range, having the most boring trade of the three grains.

There just simply isn’t anything new for bulls nor bears to get excited about here in the corn market.

One thing bulls are talking about is the possibility that we see new crop acres in 2024 come down and perhaps tighten the balance sheet.

However, from now until then the main focus is of course going to be South America.

The USDA currently has total South America production around 191 million metric tons vs last years 177 million.

But there is a lot of private sources calling for much lower numbers than the USDA. The biggest wild card is going to be Brazil.

Even sources such as CONAB have their Brazil crop much lower than the USDA's. With their number at 119 million vs the USDA's 129.

There is a chance that Brazil is still able to produce a "decent" soybean crop. I mean look at how the US crops turned out. However, if the problem continues throughout this month it won’t be good. Remember, the US received rains in key growing months. The key growing month for Brazil? December and into January.

Altough there is a chance for the bean crop, the one thing there is not a very good chance of is the Brazil second corn crop.

80-90% of second crop corn production is grown in those areas suffering from brutal heat and sub par rain. Unlike soybeans where the growing areas are more even. The first crop in the ground will always be soybeans, not corn.

Keep in mind, the global leading exporter for corn is the same as beans. Brazil.

There is a very solid chance that we will be looking at far less acres of corn in the coming months.

If I had to guess when the market will come to this realization, I would say January, but it could very well end up being February.

Until the market comes to the realization that Brazil will not be having a good corn crop, we will probably struggle. Remember, the situation here in the US isn’t the most bullish story with our massive carry out. But Brazil can and will shake things up.

Bottom line, corn can struggle short term. Long term I am remaining patient knowing prices should be higher going into spring and summer.

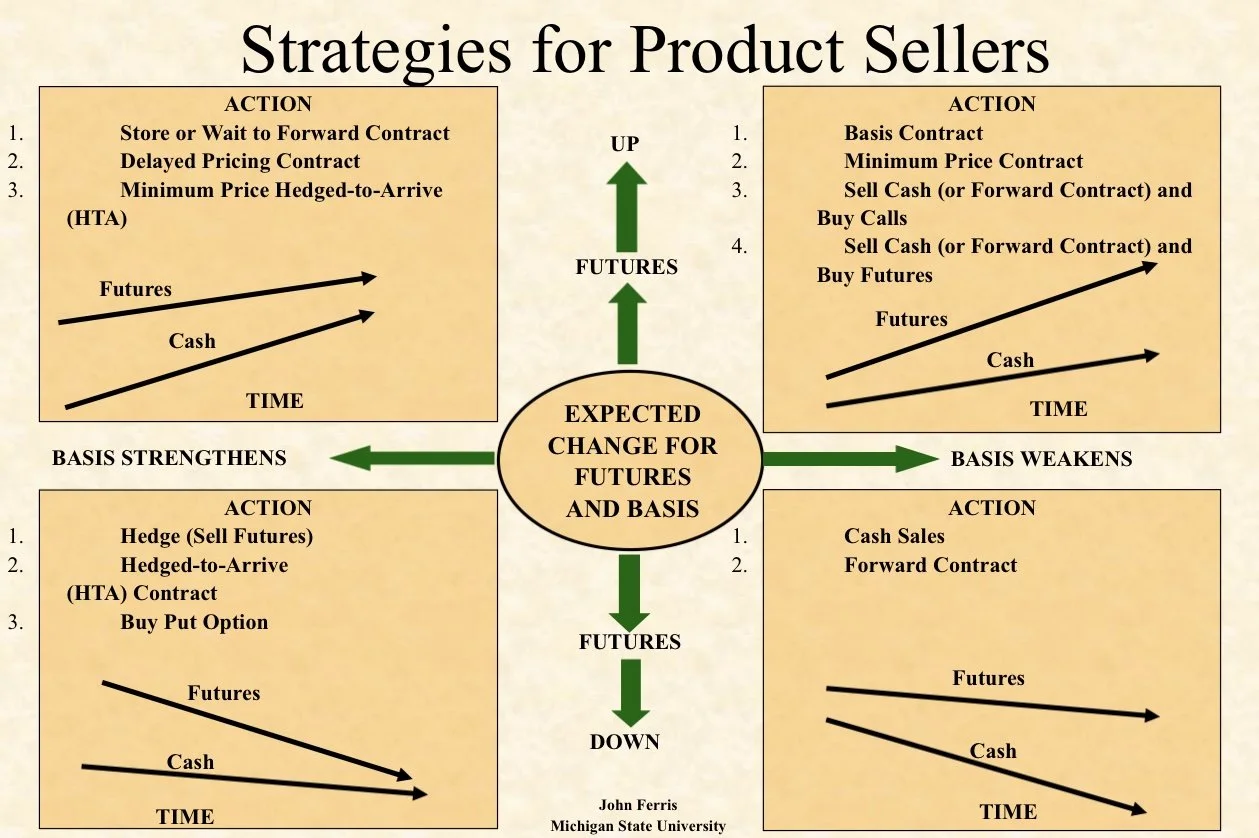

If you have to make sales here because you don't have storage, need cash flow, etc. and you think local basis will improve, you can buy a put to establish a floor. We like the February $4.80's because they get you through the USDA report.

If you think basis will get worse, then you make a cash sale and you can buy futures or a call option or a basis contract with having an exit plan so you are not rolling it.

Here is a good chart that explains strategies for different situations from Frayne Olson.

Is China Lying?

China announced that this was their best corn crop they have ever grown. Wright on the Market had an interesting tidbit about this. He went on to say that China never tells the truth when it comes to the markets.

He said that if they had all of this corn to export, China would be telling the world that their corn crop was the worst crop ever and exports will be restricted (to push prices higher to sell). The fact that China reported the best corn crop ever means that they are about to buy a lot of corn. (trying to keep prices low by saying they have a massive crop).

I just found this interesting. Guess we will see if China starts to come to the game.

On the chart, we are nearing the very end of this wedge from the July downtrend. Often times this is an indication of a breakout to either direction. Guess we will see if we get one or continue to chop around this recent range for now.

We have support at the $4.77 level with additional support at our old lows of $4.70 which bulls need to hold if we don't want to see more downside. We need a break above $4.96 to bring more technical buying.

Corn March-23

Soybeans

Soybeans continue to be pushed back and forth by Brazil headlines and the funds as they try to depict how these forecasts will actually play out.

We saw another sale of beans this morning, with 198k metric tons to unknown to add on to yesterdays purchase.

Brazil is by far the most important factor, but unlike corn, we have a tight balance sheet here in the US as well.

Right now most forecasts are calling for brutal heat with little rain nearby, followed by some somewhat more cooperative weather later on in the year.

Some parts of Brazil are still trying to plant beans, while others are starting early harvest, so there is going to be a wide variety of conditions.

We are seeing a ton of private estimates work their lower for the Brazil crop. Kind of funny how the private ones are always so much lower than the government run ones..

Safras & Mercado revised their bean crop to 158.2 million metric tons due to the dryness. The USDA is at 161.

There is a saying that rain makes grain, but no rain makes no grain.

If this Brazil crop burns up the way some say it could, the upside in the bean market is truly unbelievable. I’m talking $15, $16, or potentially higher. I am not saying that will happen, I am saying there is a clear path way that could result in these prices. For example, there is not a clear path to see $7 corn, but there is one for $15 to $16 beans.

Now yes, it is still possible for Brazil to produce a decent a crop. On top of this, Argentina is going to have a far better crop than last year. So there is definitely some risk we need to be aware of.

But remember last year how they kept kicking the can down the road on the Argentina crop? Eventually they realized the problems and the crop wound of being one of the worst ever. Could we be looking at a similar situation this year in Brazil? Time will tell.

Most of what I'm seeing from Brazilian producers say that this drought is destorying crops and being severely underestimated by the USDA. But we do have to ask the question if they over state the damage similarly to what we saw this summer from some US producers. Nonetheless, I trust the producers who are actually going through this and experiencing it first hand rather than a government agency.

As long as Brazil doesn’t see a ton of relief in these forecasts, I think the forecasts alone could be enough to push us up towards that $14. If the crop doesn’t pan out, we have a ton of upside.

I believe we will see higher prices long term, but there are plenty of unknowns. If you are worried about the downside, are undersold, or needing to make sales in the next 60 days, be proactive such as buying puts to establish a floor or minimum price level. Or refer back up to the chart in the corn section to make a decision based on your outlook for basis and futures.

If you need help doing so, have questions, or want tailored advice shoot us a call free of charge (605)295-3100.

Lastly, another thing to note is that we have the NOPA report on Friday. Which should show another record December crush. As we continue to bring on more crushing capacity, that number should continue to strengthen.

Soybeans Jan-23

Wheat

Wheat market bounces and takes back nearly all of yesterday's losses. Keeping some of the bulls upside momentum in their favor.

The strength today was mostly short covering from the funds.

Wheat was pressured yesterday because we didn’t see a continuation of purchases from China. There was also talk about China shifting their focus to France and Australia as the rumor is that they both offered cheaper wheat.

Bulls are hoping we can see more interest from China, remember China doesn’t buy our grain very often. So that recent buying was perhaps an indication that they see these price levels as a bargain.

If we do not get any more Chinese headlines, we could struggle to find momentum to the upside here short term unless the funds decide they want to keep covering their shorts before the end of the year.

Nonetheless, I believe the wheat market still has so much upside especially looking long term. As we have mentioned for a while now, wheat remains a sleeper.

Similar to soybeans, if you are uncomfortable with the downside, don’t have storage, or will need to be making sales soon, consider buying puts to establish a floor and minimum price level. There is nothing wrong with rewarding an +80 cent rally. But for those of you that have until spring or summer and can sit on your hands for now, I believe we will have better pricing opportunities ahead. Remember to at the very least keep a hedge account open to be prepared when we get an opportunity to price or protect prices at a good profitable level.

Taking a look at the KC wheat chart, we are finally nearing a breakout from this brutal range we have been stuck in for nearly 2 months. Bulls need that break above $6.72

Chicago March-23

KC March-23

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Our Price Maker Program

Become a price maker and take your marketing to the next level.

Check Out Past Updates

12/11/23

IS THE WHEAT PARTY OVER & BEANS JUST STARTING?

Read More

12/8/23

GARBAGE REPORT AS EXPECTED & CHINA STOCK PILES GRAIN

12/7/23

RALLY AHEAD OF USDA REPORT

12/6/23

RISKS, FACTORS, & WHAT TO WATCH

12/5/23

WHEAT CONTINUES RALLY & BEANS BOUNCE BACK

12/4/23

IF CHINA IS BUYING, I’M NOT SELLING

12/1/23

BRAZIL, CHINA, FUNDS & SEASONALS

11/30/23