THE RALLY CONTINUES

AUDIO & MARKET UPDATE

Crazy volatility continues

Weakness in dollar inclines money into the commodity casino

Putting your hedges in the right spot

Could wheat do what it did last year?

What to do if you are sold up or undersold

Would you be more upset with. Selling too early, or too late?

All of the factors going on in the markets

How high could grains go if China buying rumors come true

Different marketing strategies for each situation

Don’t follow the herd. What decision is best for you

Listen to today’s audio below

Overview

Grains rally across the board. What a wild two days it has been. Chicago at one point traded limit up across the board, ultimately falling just 3 cents short of doing so. Corn is up over 80 cents off it's lows from just last week. Beans finally close over $14 as they are now almost $1.80 off their lows.

The main factor today was the war, but that was closely followed by the hot and dry weather.

As for the war, we had another day of Russia bombing Ukraine grain ports, as they destroyed 60k metric tons of wheat in the process. Insurance companies are no longer issuing for anything shipping in the Black Sea.

The biggest thing now is, how will Ukraine retaliate against this? Keep in mind, Ukraine has a lot more weapons at hand than it did at the beginning of this thing over a year ago, with the NATO support.

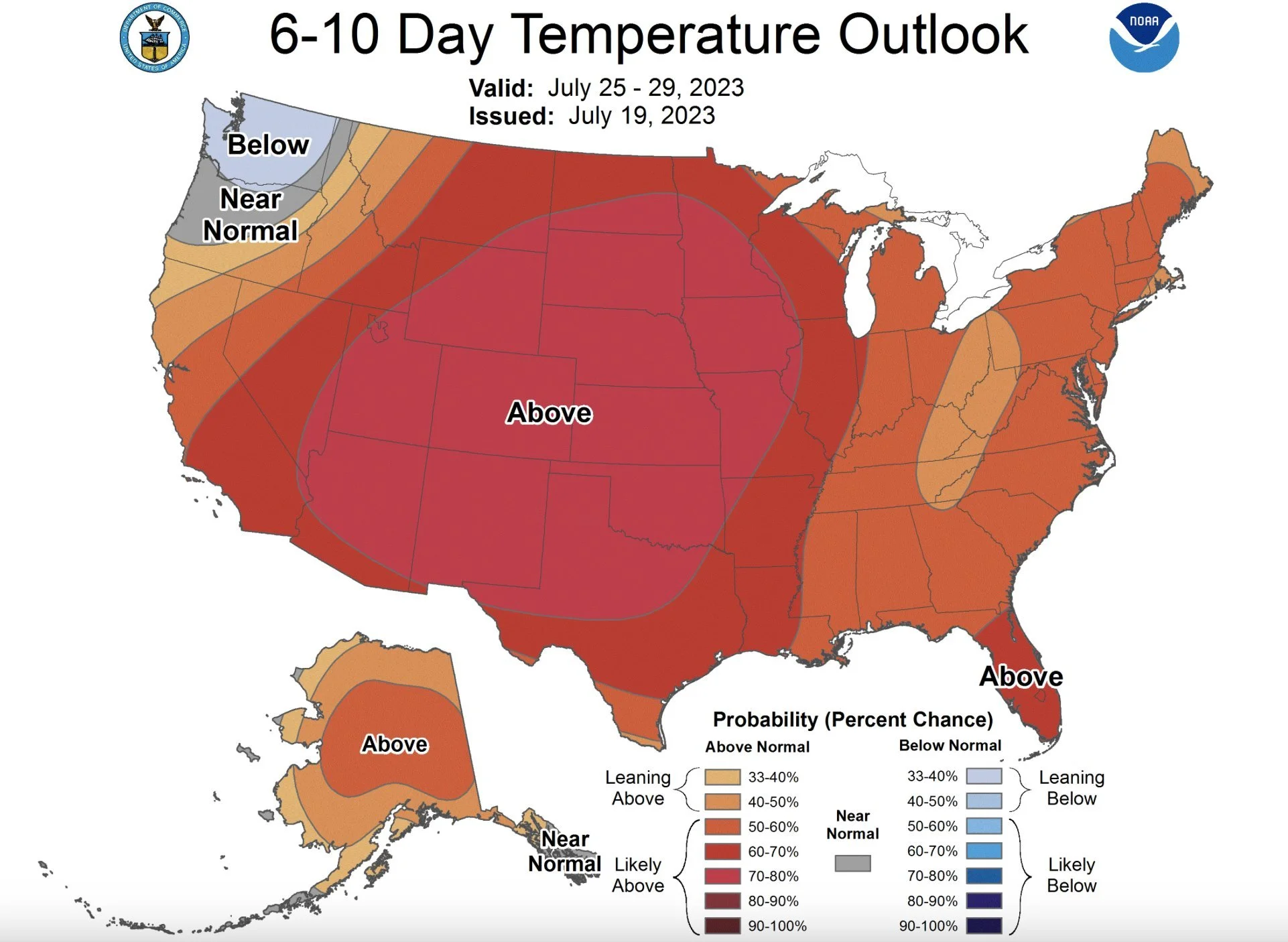

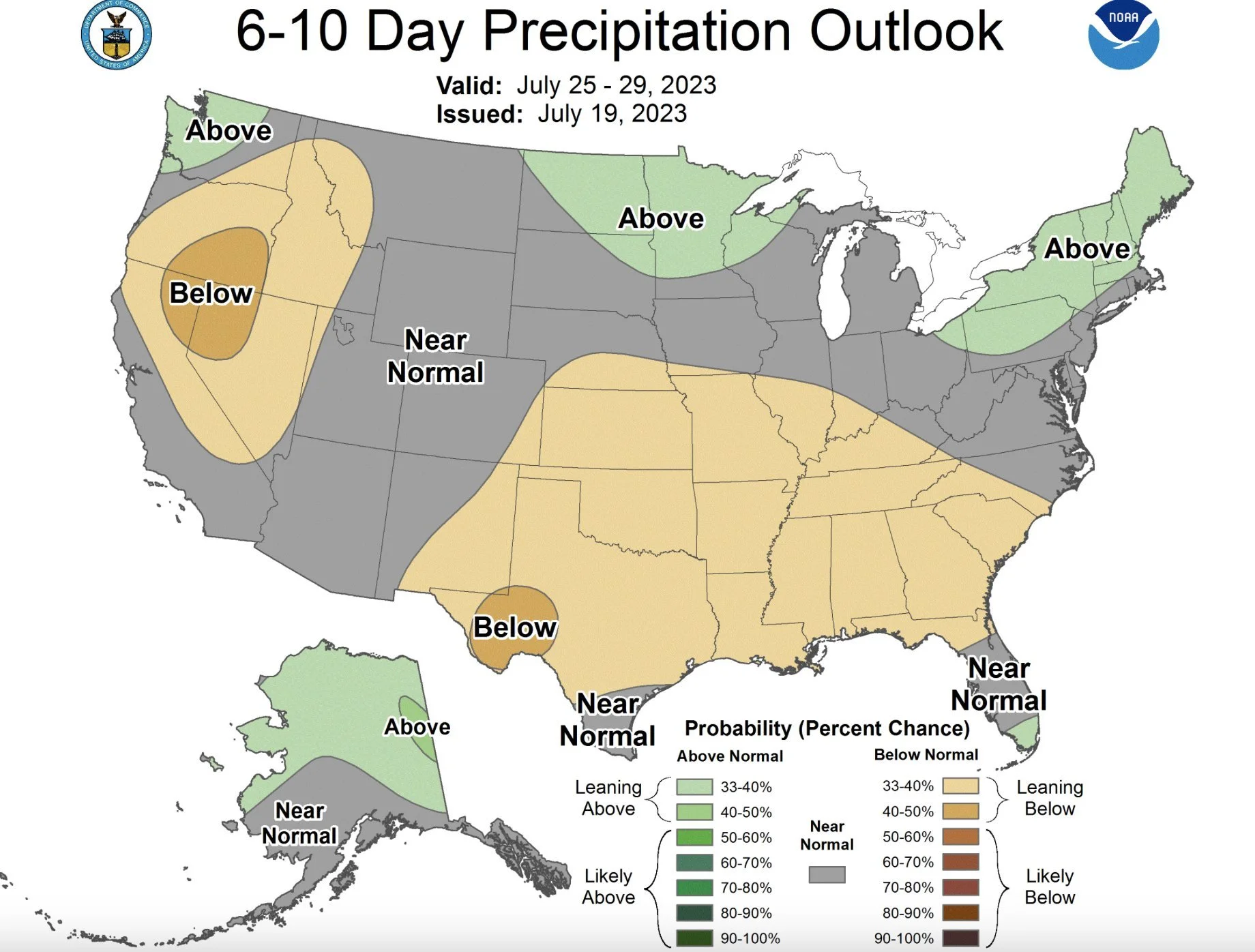

Taking a look at weather. There is still very little rain in the forecasts to go along with some pretty hot temps. The forecasts show a high pressure ridge moving into central US next week. This will keep out the rain and temps will be far above normal starting Sunday. This is projected to last throughout the end of the month, an keep rains out of the northern midwest, northern plains, and western Canada.

It’s not just the US however. We are seeing extreme cases of heat across the globe. Tokyo just had it's hottest temp in over 150 years. Rome just recorded it's hottest temperature ever. Phoenix broke the record for most consecutive days of over 110 degrees. Australia and China are also facing some issues.

Today might have been an amazing opportunity to take some risk off the table for some of you guys. I have heard of other advisors locking some new crop corn and beans in, as well as being fairly aggressive with 23 wheat.

We will get into our personal recommendations later, even though we still see a lot of upside in all of our markets, we should always find a way to reward a rally of this magnitude. Whether that is with a few cash sales, or by utilizing puts. With corn on an 80 cent rally, beans $1.80 off their lows, and the war giving us a limit up day in wheat has Chicago now up $1.00 in not even a week.

Although I think prices will continue to be strong with the forecasts, expect some extreme volatility. Don’t be surprised if this rally decides to take a breather soon, especially as the trade has already started to price in some war and weather headlines.

Today's Main Takeaways

Corn

Corn continues it's recent rally, up 50 cents in the past two trading days. Exactly reaching our $5.50 target we mentioned a week ago when we were at our lows of $4.80. As corn has now reclaimed essentially half of it's sell off.

Again, it's all weather and war. As we mentioned yesterday, the markets are called futures markets because it's not what has happened. It is what does the market expect to happen. Right now the market is expecting war escalations and some very bullish weather to close out the week.

We touched on the war earlier. But why is this such a huge deal for corn? I brought up this chart a few days ago from Standard Grain. It shows the world's leading exporters for corn. Ukraine is still the 4th largest. What would happen if Ukraine happened to lose half of it's exports? That is a huge deal.

Here is another chart, showing that Ukraine accounts for roughly 1/6 of the world's global corn trade in 2022/23 despite the war.

I don’t think anyone knows where this war is going or what is next. Headlines I've been reading say "Putin says if all conditions are met, we will immediately return to the grain deal." So from what I can see, they are willing to make the deal work but only if their conditions are met. As mentioned, I think the biggest thing from here as to how this thing escalates is what does Ukraine do? Do they retaliate or give in.

The recent shift in forecasts has the trade agreeing that yields are still probably too high. The USDA still somehow thinks we are better than last year by 4 bpa. Which we said weeks ago wasn’t possible without near perfect weather. It looks like we won’t be getting that perfect weather. I fully expect more cuts to yield down the line. The bigger question is what does the trade have already priced in.

Here are the forecasts.

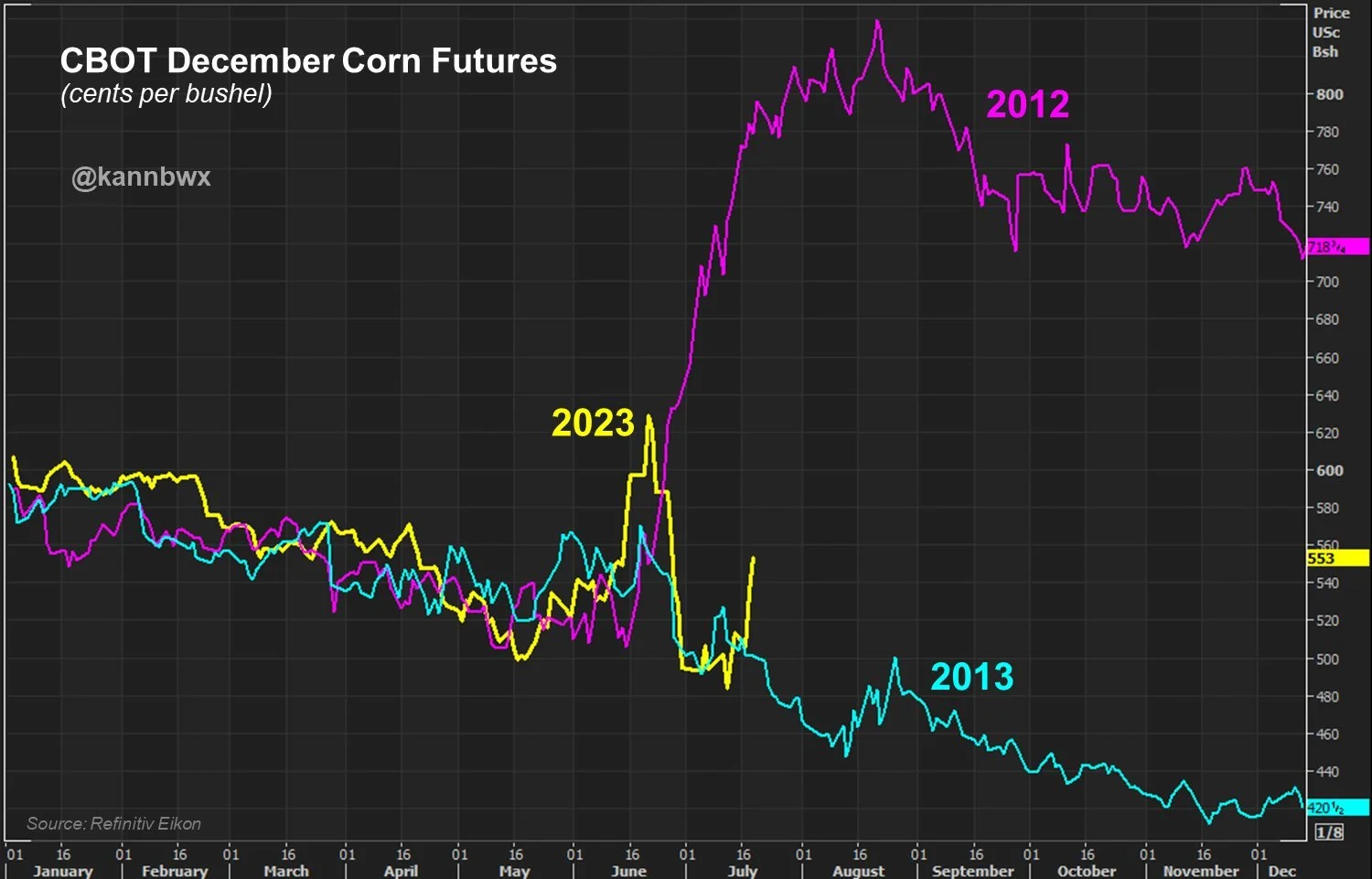

Below is a chart comparing this year to 2012 and 2013. As you can see this year is a year of it's own. When the drought had us trading over $6, yes we thought there was a chance we saw a similar situation to 2012. But that just wasn’t the case anymore once we got rain. After the sell off, everyone was saying this was a 2013 repeat. We said that wasn't the case either, because 2013 didn't have any drought in the Midwest.

Here is the price chart from Karen Braun. Corn just set a 2-day record for the December 23 chart, gaining 9.3% the past 2 days.

We reached that $5.50 target we put out last week very fast. Faster than I thought we would. With us reaching that target, some of you may want to partially reward the rally. If you can’t or don’t want to sell yet, maybe consider looking at some puts to lock in some of this rally. What you decide to do comes down to your situation. Keep in mind, we just rallied 80 cents in 3 days, and last week we made a 21 month low.

Do I think we can still go higher? Yes. If forecasts remain this hot and dry, it could cause quiet a few problems. Our next upside target is the $5.74 range, which I wasn’t totally optimistic about a few days ago, but the recent uptick in war escalation changes a lot and nobody knows how the global issues or the US weather will shake out.

I include a short write up from our friend and highly respected advisor Wright on the Markets later in today’s update. He goes over the potential damage the smoke from the wildfires could have on yields. He also advises to not sell any 2023 corn until we see how this short corn pollinates, how much damage the smoke does to yield, and how long the weather stays hot and dry.

If you have questions or want specific advise on your operation, shoot us a call at 605-295-3100 completely free of charge.

Corn Dec-23

Soybeans

Beans continue their bull run and finally break that $14 level we had been talking about for weeks. At one point today, we traded as high as $14.29 which is the highest we have traded since December 30th of last year. We also had our highest close of the year.

The markets continue to point at the forecasts turning awfully hot and dry towards the end of the month as we head into August. As nearly all of the United States is going to be suffering from temps far above normal. This is couple with below chances of rain for a majority of the key growing regions.

We all know that August is the most crucial time for beans.

Should you be locking in some sales? We all have different risk to reward profiles. But I think this is an amazing spot to at the very least reduce your risk. We were trading at $11.30 a month and a half ago. We are now trading at our highest levels all year long.

Can we go higher? Yes. We absolutely can. Personally, as I have stated for a while now, we could very easily trade $15 by August. While I do think this will happen, there is nothing wrong with feathering in a few more sales on this near $3 rally. In Monday's update I wrote that some would have you sold at 40% to 50% of expected production for new crop. But we like you focusing on your individual comfort level.

Taking a look at the charts. If we take a step back, this is essentially the 3rd time we have traded at these high of levels. The only other times being all last year in spring, June, and December. Our high today was $14.29. The contract high is $14.48 from last April. We tried to break out from that downward trendline, but ultimately failed to do so. If we can get that break and close above yesterday's highs, the next stop could be $14.48.

Soybeans Nov-23

Wheat

Wheat futures soar on more war headlines, as at one point Chicago was trading limit up and was up 9% on the day.

I already mentioned pretty much what was going on earlier in today’s write up. Russia bombed Ukraine. How far this continues to escalate is anyone’s guess. Putin did make comments saying that he wanted to work things out, but only if all of his conditions are met. It will be interesting to see not only what he does, but if Ukraine retaliates at all following the attacks.

In the US, the trade is looking at the winter wheat harvest and storms that could potentially be damaging the crops that are still in the field.

On the other hand, spring wheat conditions remain dry, although we did see a big improvement in Monday's crop conditions update.

Taking a look globally, we still have plenty of world weather issues as I touched on in the corn section. We have concerns over dryness in Australia and the EU. Canada remains in a very brutal drought.

Some would say today's crazy rally was this amazing selling opportunity in wheat. Which it may be. Prices are well off their lows. But nobody knows how this will all shake out. What if the war escalations continue? What if wheat does what it did last year? I'm not saying that will happen, but we have to imagine the possibilities. Depending on your situation, there are plenty of you that should look to reward this rally. While some of you in different situations, that might not be the best thing for you. We talk more about this in today’s audio if you missed it.

I wanted to look at the charts here. The first one we have is Chicago. We have rallied $1 the past week. We didn’t make any new highs or anything. We actually didn’t even break our levels from our late June rally. No clear technicals. We did however break that over year long downtrend. Could we see another 40 to 50 cents? It’s possible. Will heavily rely on the war and weather. The Minneapolis chart is more interesting.

Chicago Sep-23

Here is Minneapolis. As you see, we again found resistance at that $9 level. Which has kept a lid on prices for over a year now. If you are worried about the downside, not a bad place to reward the rally. If we break that $9? Who knows how high it could go.

MPLS Sep-23

Here is KC. We remain stuck in this recent up and down range inside this wedge. Bulls want to see a break over that $8.87

KC Sep-23

How Does Smoke Effect Yields?

From Wright on the Market,

Pioneer agronomist, Ben Jacob said: "Based on what is known about the effects of reduced solar radiation, it seems very plausible that wildfire smoke could cause reductions in crop yields."

That is such a tactful statement. Let’s restate it: Smoke will reduce yields by:

• Reduced Sunlight Intensity: Smoke provides shade.

• Increased Sunlight Diffusion: Smoke reduces photosynthetic radiation.

• Increased O3 Levels: Ground-level ozone has the potential to significantly reduce crop yields, soybeans more than corn.

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

7/18/23 - Audio

WEATHER & WAR

7/17/23 - Market Update

RUSSIA EXITS GRAIN DEAL. BUY THE RUMOR SELL THE FACT

7/16/23 - Weekly Grain Newsletter

MANAGING THESE VOLATILE MARKETS

7/14/23 - Market Update

WHEAT RALLIES & CORN MAKES KEY REVERSAL

7/13/23 - Market Update

GRAINS BOUNCE BACK AFTER BEARISH REPORT

Read More

7/13/23 - Audio

DROUGHT & DOLLAR ERASE YESTERDAY’S LOSSES

Read More

7/12/23 - Audio & Report Recap

FULL USDA REPORT BREAKDOWN

7/11/23 - Audio

WHAT TO EXPECT IN TOMORROW’S REPORT

7/10/23 - Market Update

CORN & BEANS STRONG AHEAD OF REPORT

7/9/23 - Weekly Grain Newsletter

ARE YOU COMFORTABLE WITH WHAT’S ABOUT TO HAPPEN?

7/7/23 - Market Update

GRAINS SLIDE WITH FAVORABLE FORECASTS

7/6/23 - Audio