DEMAND, BIG US CROPS & BRAZIL DROUGHT

Overview

Very disappointing action in grains today after yesterdays dead cat bounce. As all grains opened higher overnight only to give back all the gains and close lower.

Beans were -10 cents off their highs, corn -7, wheat -20.

Not a big news day today. The biggest piece of news is Brazil drought.

Bloomberg says that the Amazon drought is worse than it was in 2023.

Typically Brazil relies on hydro electricity. The water levels in the Amazon are so low that they are shifting to more gas due to the drought.

Low river levels could make shipments of grain smaller, and make it more challenging & expensive to ship grain.

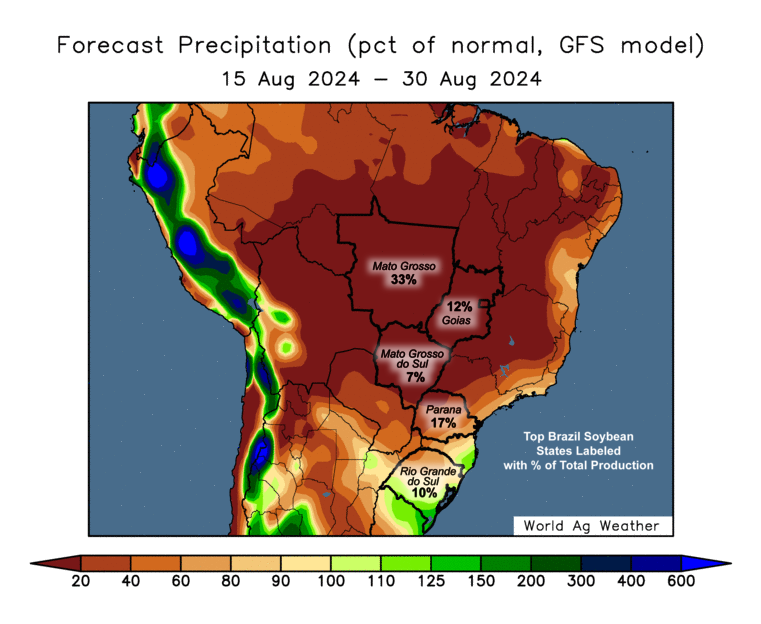

Next 15 Days Precip

Past 30 Days Precip

Is this a big deal?

It could be later down the road, but not today.

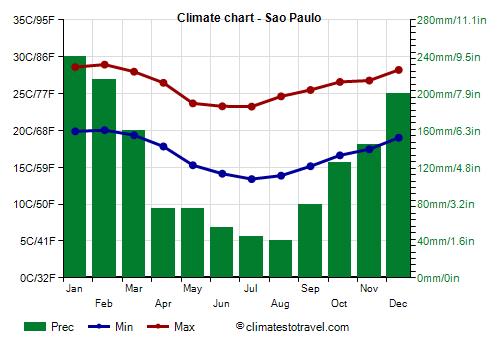

You have to keep in mind that Brazil is in dry season. Although it has been drier than usual, the rains usually don’t come until October to November.

Brazil Seasonal Rain

How could this wind up being a problem in the future?

Well of course if it stays dry and those rainy season rains don’t come, then we will be looking at a big problem for their crops. And we'd get a weather scare, somewhat similar to what we saw last year in November in the bean market.

This could also become a bigger issue if it gets so bad to the point where Brazil has such a hard time shipping grain, that it forces the world aka China to instead buy from the US. Which would increase our demand.

But so far, it is still far too early to tell if this will become a real issue or not. But certainly has the "potential" to be a friendly factor. All the talk is going to start shifting to Brazil weather in September as they start planting beans.

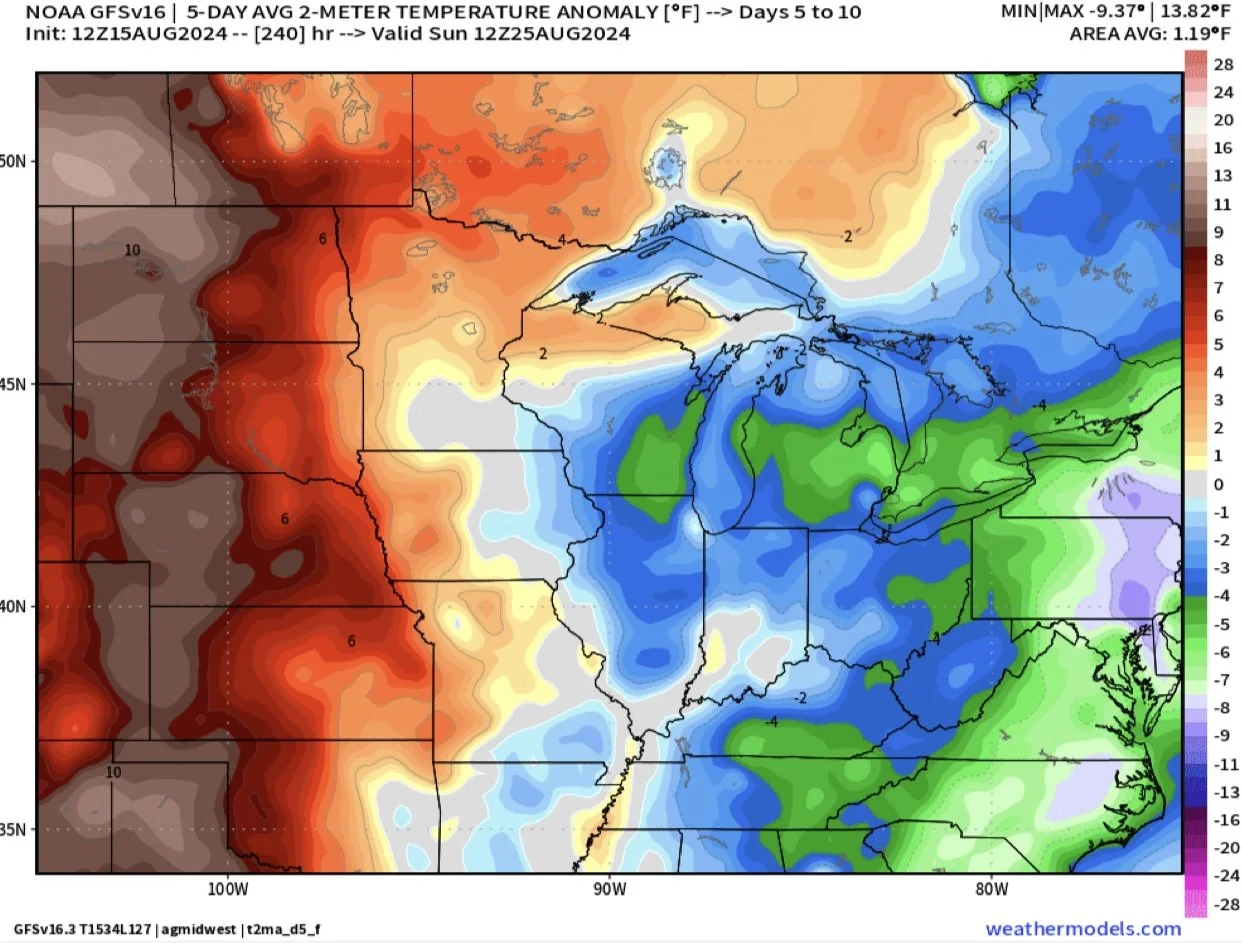

Weather in the US is non-threatening.

Here is the forecasts:

1-5 Day Temp

6-10 Day Temp

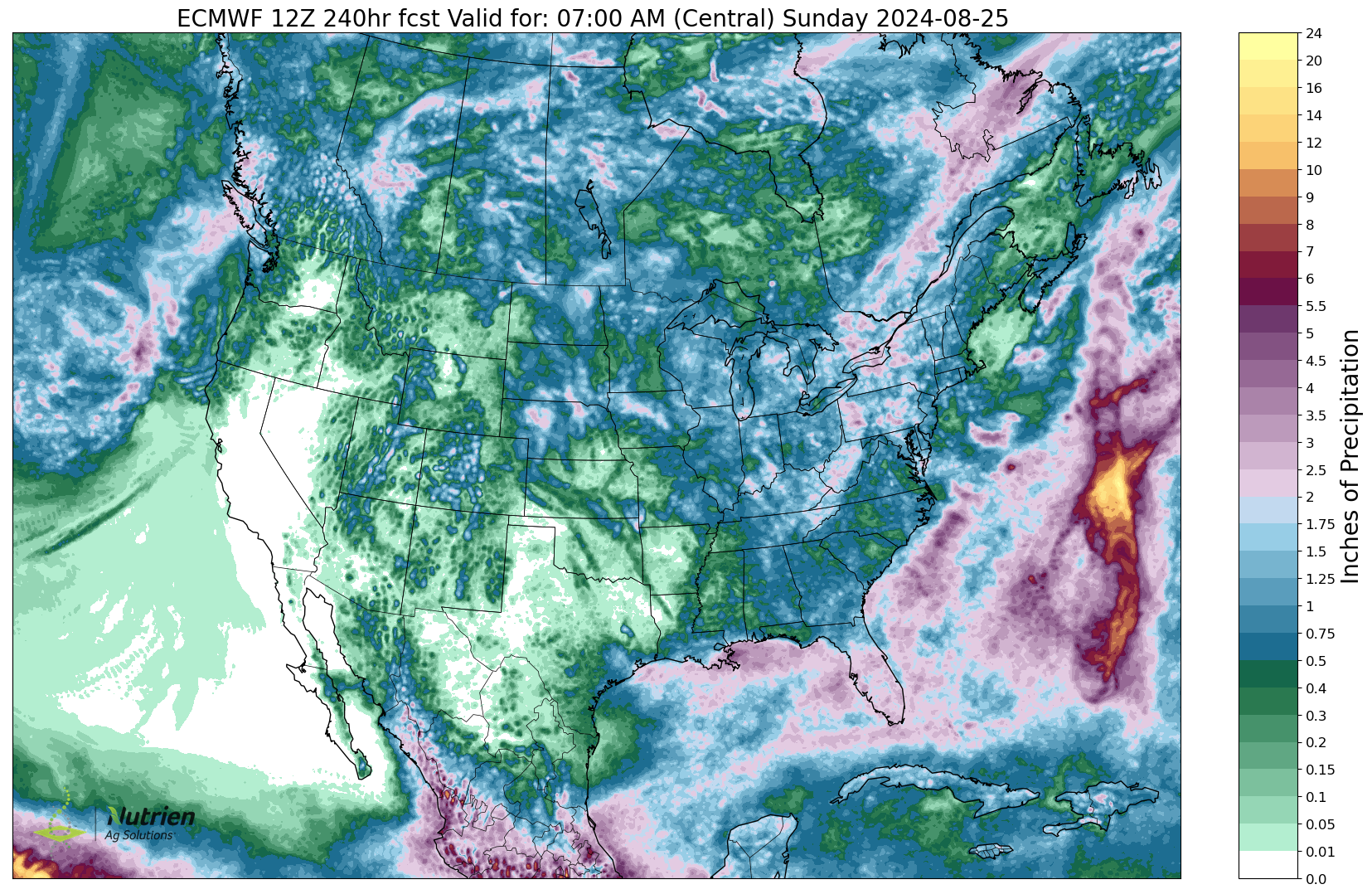

10 Day Precip: Euro Model

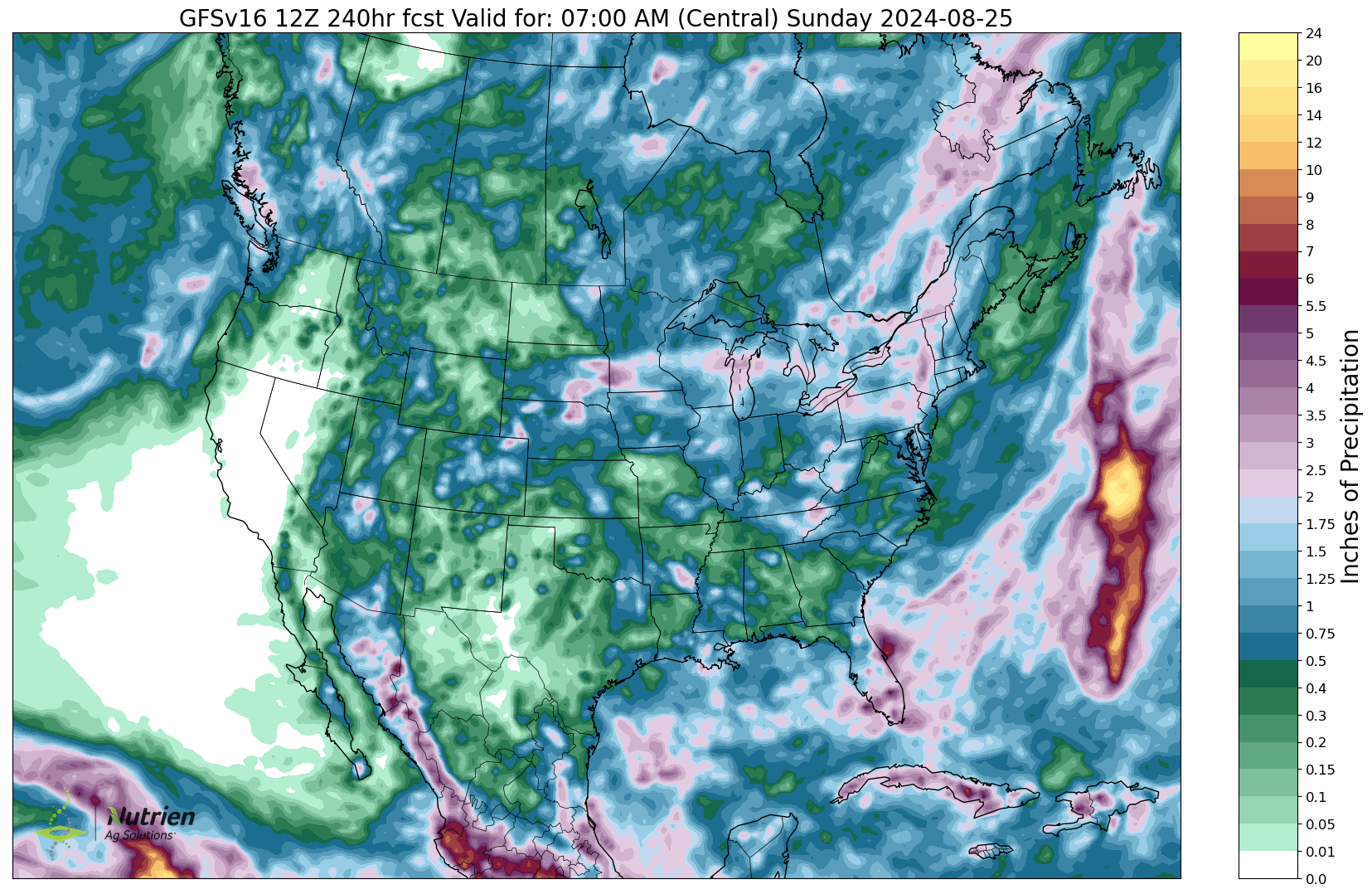

10 Day Precip: GFS Model

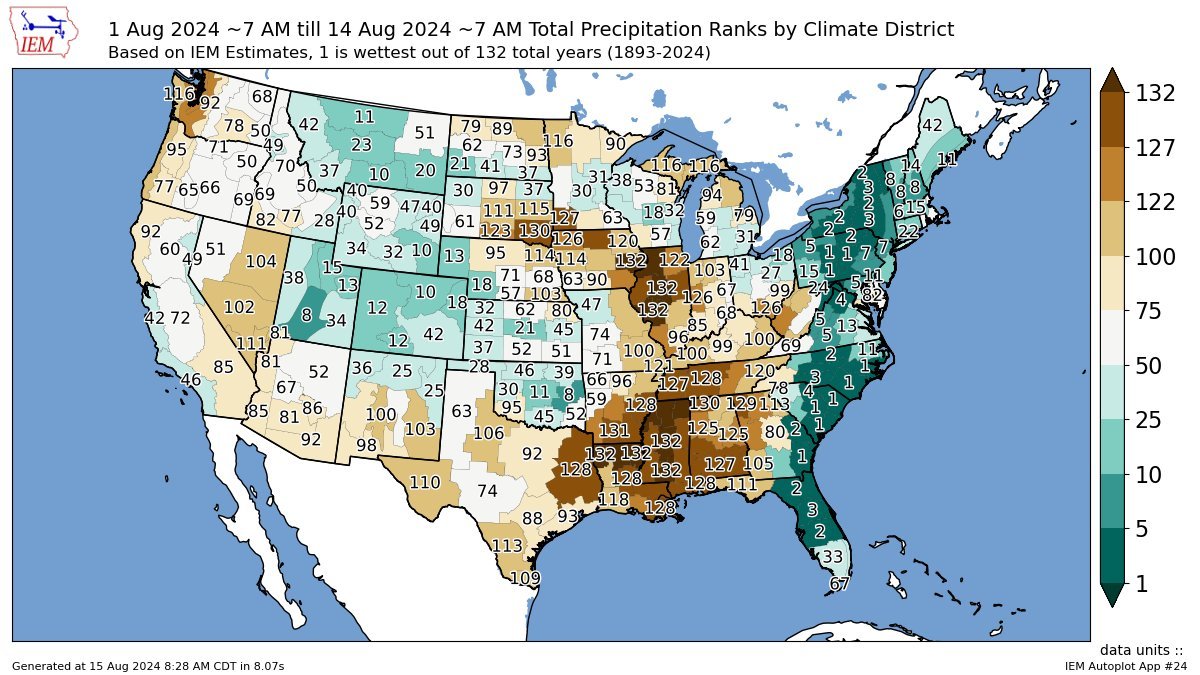

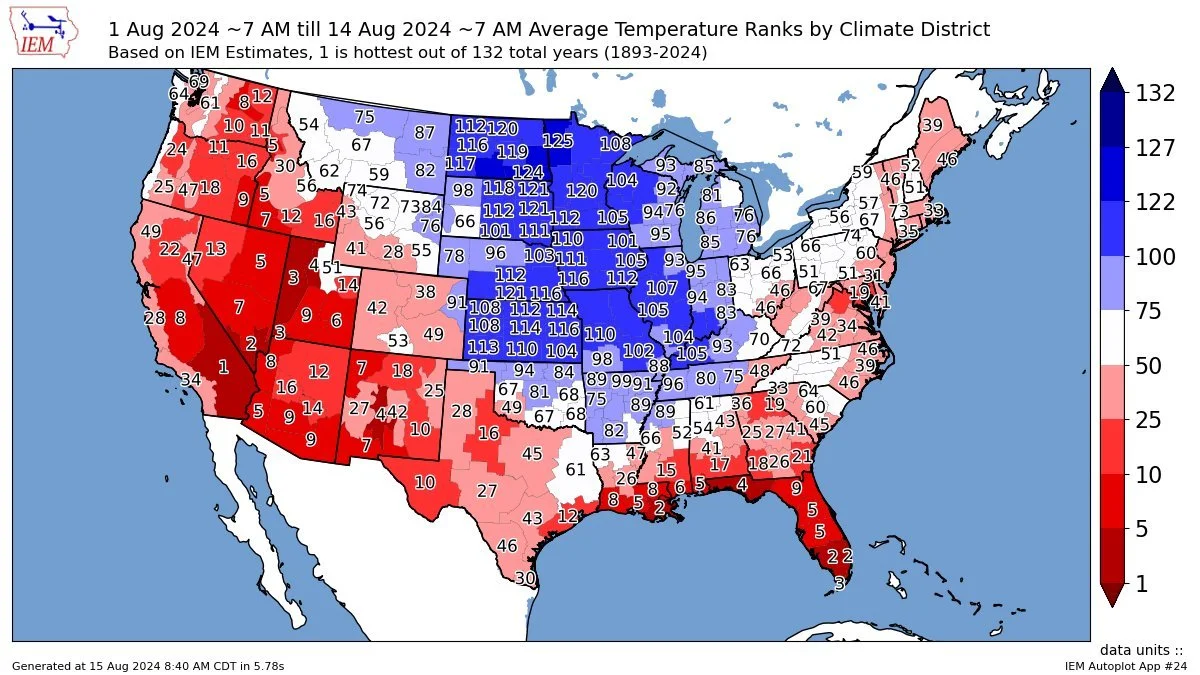

Here is how August shaped up so far. Although it has been very dry, it has also been extremely cool for the entire corn belt.

So essentially ideal thus far with no heat, following an abundance of rain this summer. Although, if the soybean crops don’t get some rain, we could see some slight issues. But likely nothing major.

August Precip Rankings (132 Years)

August Temp Rankings (132 Years)

Pro Farmer crop tours start next week.

The green areas are areas they will cover.

They will be covering areas that experienced all those flooding issues. So we should get a better idea of how much damage was or wasn’t done soon.

They will start in those areas, so the initial reports could report some issues, but should then report amazing crops as they work their way into Illinois etc.

Today's Main Takeaways

Corn

Not a great day for corn, as we closed well off the highs.

It wasn’t a good day technically on the charts, but no damage was done either. As we held the past 5 sessions lows and have essentially went sideways since the USDA report.

No real news today.

The USDA report showed that they to think these lower prices will create more demand. As they raised our export demand projections.

Although we have a 183 yield, carryout is getting smaller.

I think these low prices will ultimately create that much more demand, especially looking long term.

But that is still a risk. So if you are undersold, keep puts for protection or give us a call to come up with a 1 on 1 game plan. (605)295-3100.

Looking to next year, we have high fertilizer prices which could lead to less acres. Prices are at levels that are creating demand. Despite record yields this year, less acres & more demand could lead to a healthier balance sheet long term.

Short term, still plenty of risk. If you look at the monthly corn chart, $3.50 is certainly a possibility. I do not think we get that low, but it's a risk. We found support there several times in other bear market years.

If the bean market continues to fall apart, it could drag corn lower along with it. Even though the balance sheet for corn offers more optimism.

Monthly Front Month Corn

Taking a look at the daily chart, the selling has slowed down and we have started consolidating around this $4.00 area.

Upside scenario: If we take out $4.09, this chart opens up some upside. The next resistance would be $4.23. If we take out $4.23, then you could talk about the bottom being in.

Downside scenario: Until that $4.23 area is taken out, the risk and trend is still lower. If we take out the USDA report day lows of $3.90, then $3.80 is likely next.

Right now we are essentially range bound between $3.90 and $4.09, waiting for a breakout to decide which direction we are headed next.

Daily Dec Corn

Soybeans

Like the rest of the markets, not a good day on the charts. Closing well off our highs leaving a "reversal type" of doji candle which often times can indicate more downside.

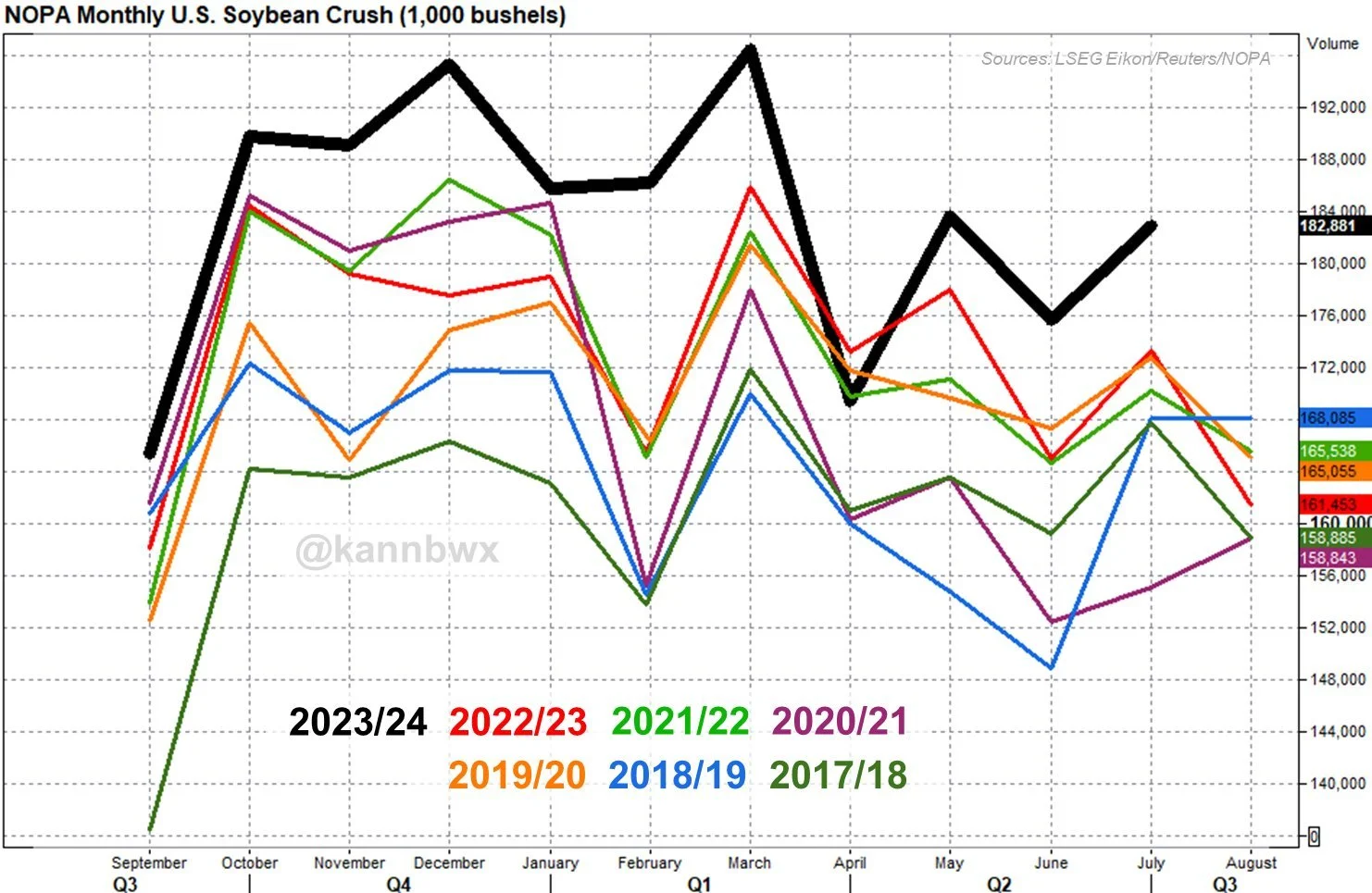

Outside of the Brazil news, the only other news today was NOPA crush.

NOPA crush came in above the trade estimates at 182.88 vs 182.37 million bushel est.

This was above last year's July record by +5.5%.

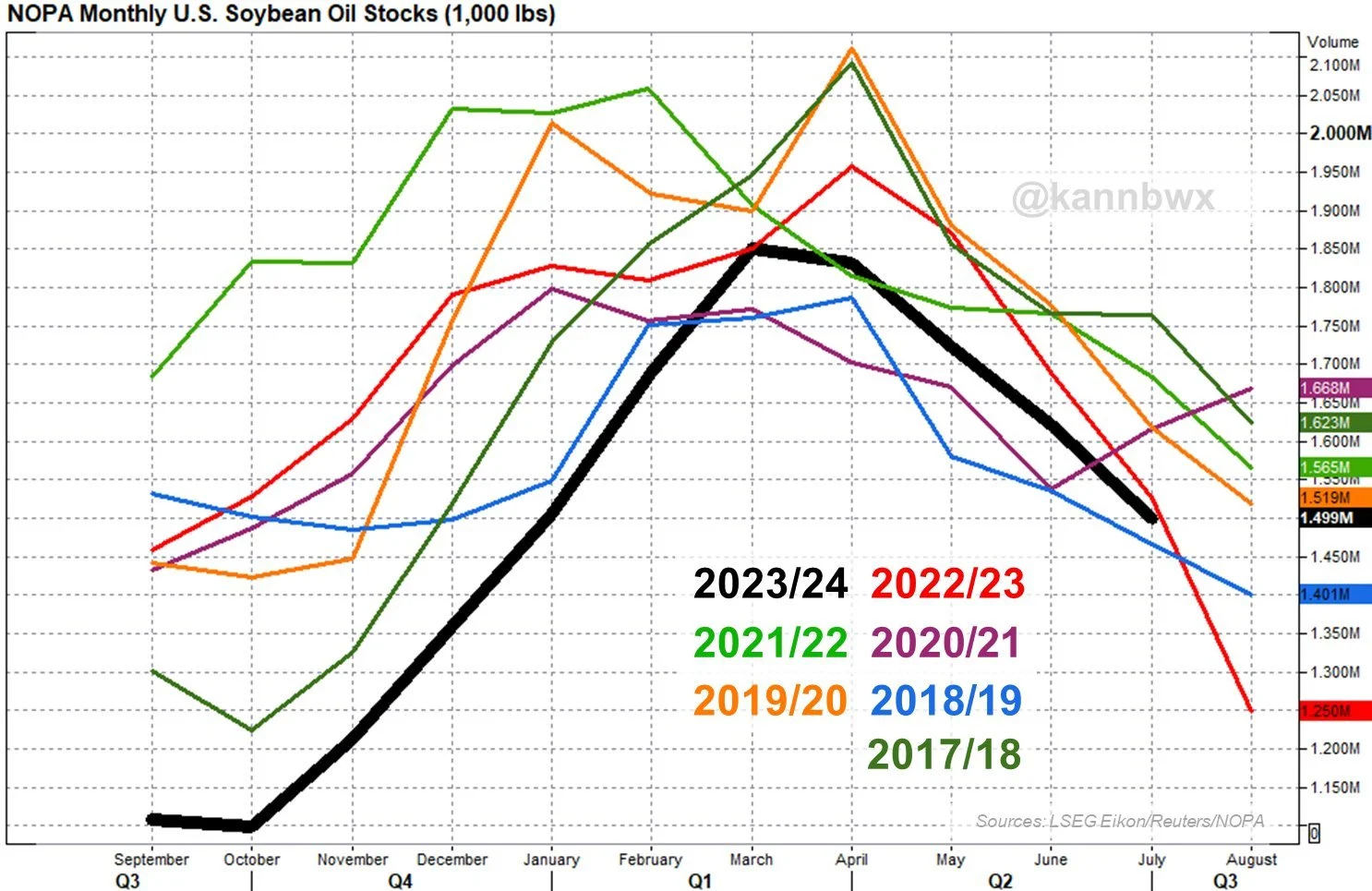

Soyoil stocks were 1.5 vs trade est of 1.6 billion bushels. A 7 month low & -2% YOY.

Crush Chart from Karen Braun

Soyoil Chart from Karen Braun

Now record crush is friendly. However, it is not quiet enough to negate the weak export demand & record crops in the US.

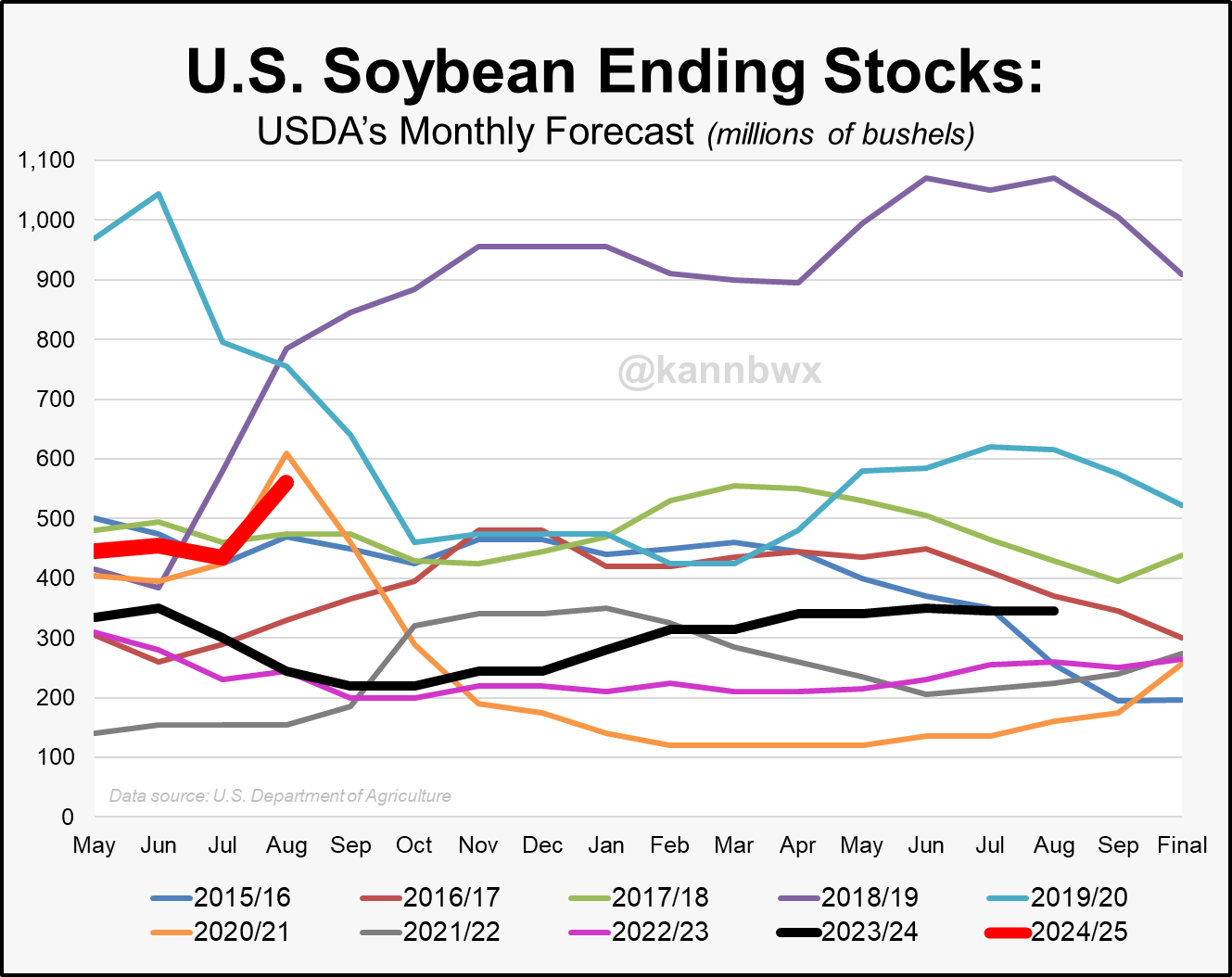

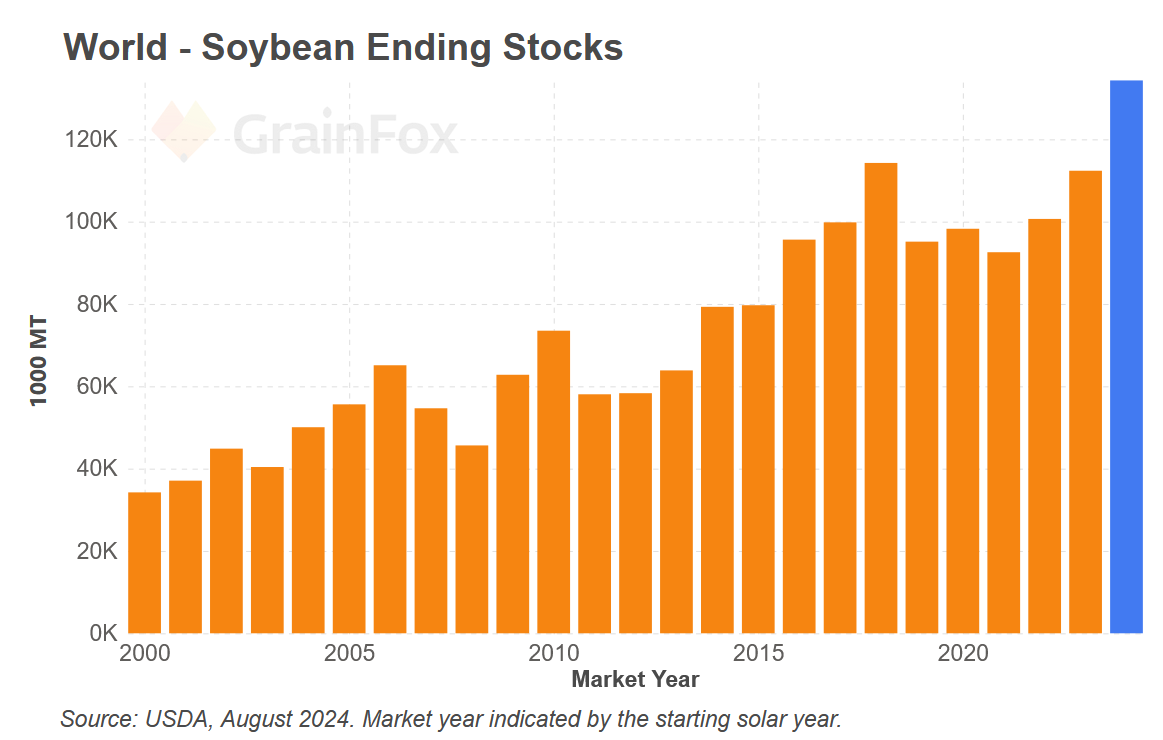

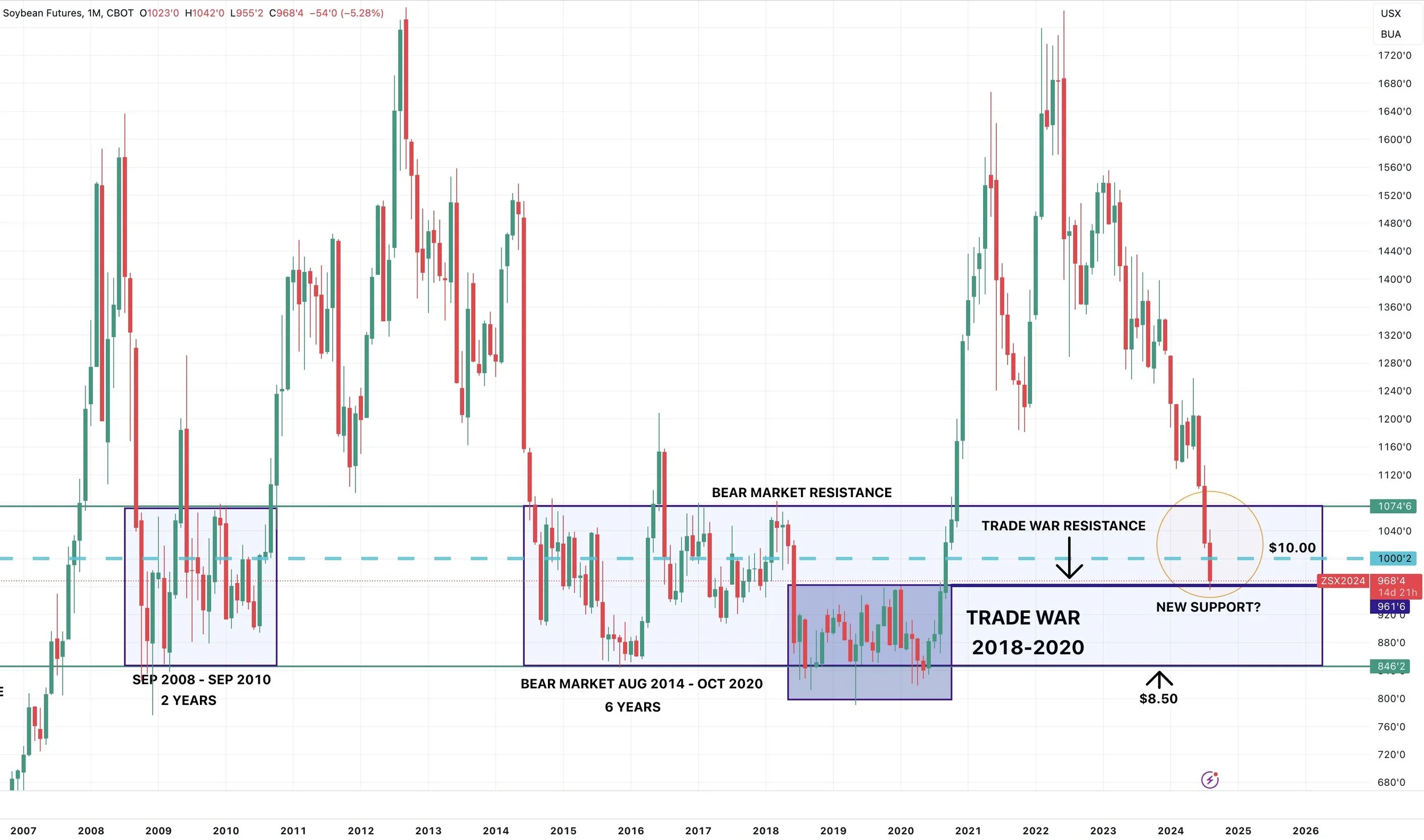

Our stocks to use ratio is 12.8%. The highest since the trade war. We have the 3rd biggest carry out on record for beans.

Both of these would indicate that sub $9.00 beans is a very real possibility, unless demand eats into that carryout.

An individual on Twitter:

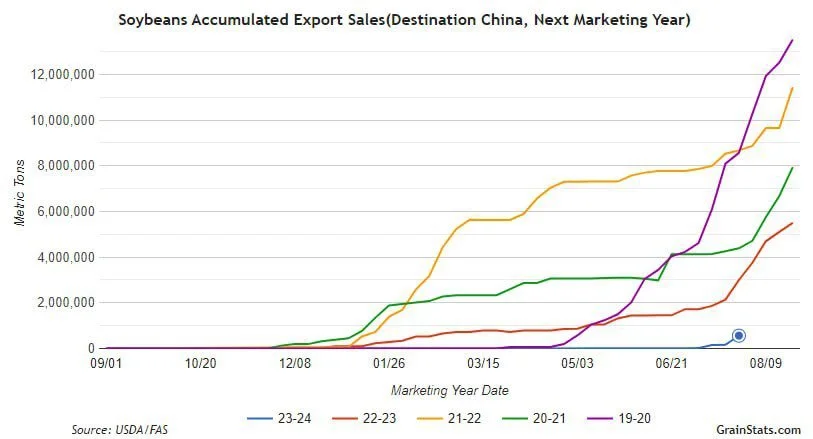

"A wise man told me many years ago that beans don’t trade this nonsense. Beans trade China order flow."

And he would be somewhat right. For the bean market to go reasonably higher, and to prevent sub $9.00 beans, China HAS to step in here.

We already know we have a huge crop in the US. The only thing that could eat into that massive carryout is demand.

So the ball is really in China's court here.

Do they wait to start buying because they think they will be able to buy lower? Or do they take the discount since they are severely underbought?

Sales to China from GrainStats

IF China does NOT start buying, sub $9 beans is the risk. In other bear market years we often found support between $8.50 to $9.00.

One would think they do being so underbought and the US Gulf having the cheapest beans in the world. But the risk is lower until they do. When they buy heavy, you'll know the bottom is in. All of these recent small purchases do not move the needle.

Until China starts buying heavy, there is no easy way to tell just how low we will have to go to create enough demand to justify higher prices.

Basically beans either need China to come in heavy or to see some big problems out of South America. Otherwise there is still a ton of downside risk in this bean market.

$15 beans cured $15 beans. The same will happen with $8 or $9 beans. But that doesn’t mean it has to happen on your time table.

If you are undersold, keep some downside protection with puts or give us a call and come up with a plan. (605)295-3100.

Monthly Beans

Daily Nov Beans

Wheat

Not great action in wheat, as we closed -20 cents off the highs. On the bright side, the chart is not broken and we held the past few days lows.

Some of the recent weakness came from that massive 3 million wheat tender from Egypt to Russia being changed. As they cancelled it and now Egypt is negotiating privately to supply half that amount. So in attempt to secure huge wheat supplies at a discount, it resulted in a much smaller purchase and wound up being costly.

We saw a bunch of news about a missile hitting a grain facility in Odesa. The market cared for a little hence why we saw an early rally, but war news is mostly old news. And every war rally is sold.

Some say the missle didn’t cause any damage to any stored grain, some say it did. Either way the market didn’t care.

We do however have France projected to see one of their worst wheat crops on record which is supportive.

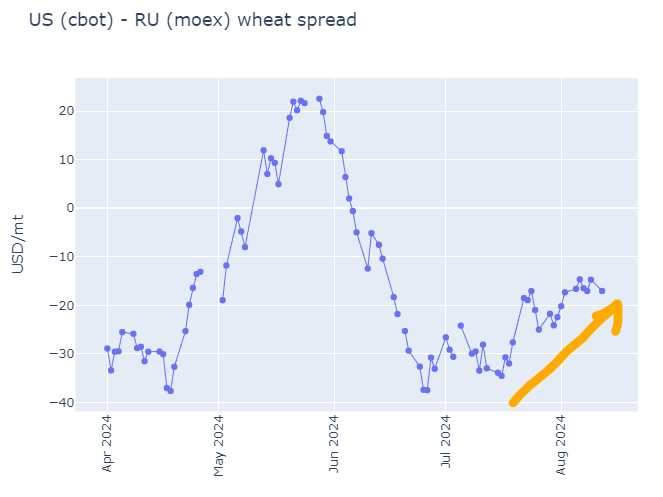

From an individual on Twitter:

"When SRW wheat is cheaper than Russian, there is no good reason for the market to keep going down.."

Here is SRW wheat vs Russian wheat spread:

Overall not much else for wheat.

We remain stuck in that 30 cent range (green box).

A break above $5.67 would look good. My upside targets for those that are behind on sales are $6.00 and $6.25 (our 50% retracement from the May highs).

If you are undersold, you might want to keep puts on until you make a sale. I do think you will get a pricing opportunity of at least $6.00 or higher in the coming months with all of the global issues and the fact that we will likely be looking at less wheat acres.

Daily Sep Chicago

Daily Sep KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

8/14/24

DEAD CAT BOUNCE

8/13/24

POST USDA SELL OFF

8/12/24

USDA REPORT: BEARISH BEANS. SMALLER CORN CARRYOUT & RECORD YIELDS

8/9/24

USDA REPORT MONDAY

8/7/24

HUGE USDA REPORT MONDAY

8/6/24

WHEAT UNDERVALUED? CORN YIELD? WHAT TO DO WITH GRAIN OFF COMBINE

8/5/24

GRAINS STRONG WHILE WORLD PANICS

8/2/24

GRAINS RALLY, YIELD ESTIMATES, CHINA STARTS TO BUY

8/1/24

MARKET EXPECTS A PERFECT CROP?

7/31/24

CORN BREAKS $4.00, FAVORABLE WEATHER & CHARTS

7/30/24

GRAINS FAIL REVERSAL BACK NEAR LOWS

7/29/24

GRAINS SHOW SIGNS OF REVERSALS

7/26/24

BLOOD BATH IN GRAINS: EPA REVERSAL & WEATHER

7/25/24

CHINA, DROUGHT, FUNDS & RISK

7/24/24

BEANS LOWER DESPITE DROUGHT TALK

7/23/24

BACK TO BACK GREEN DAYS FOR CORN & BEANS: MARKETING DECISIONS

7/22/24

BEST DAY FOR GRAINS IN A LONG TIME

7/19/24

DULL MARKETS: STRATEGIES TO USE IN GRAIN MARKETING

7/18/24

DEMAND, CHINA, POLITICAL PRESSURE, & TECHNICALS

7/17/24

DIFFERENT GRAIN MARKETING SCENARIOS YOU MIGHT BE IN

7/16/24

RELIEF BOUNCE FOR GRAINS

7/15/24

GRAINS HAMMERED. TRADE WAR FEAR

7/12/24

USDA REPORT: LOW PRICES CREATING DEMAND

7/11/24

USDA TOMORROW

7/10/24

GRAINS CONTINUE TO GET HAMMERED

7/9/24

RAINS, RECORD FUND SELLING & 2014 COMPS

7/8/24

PUKE SELLING, RAIN MAKES GRAIN & FUNDS RECORD SHORT

7/3/24

THIN HOLIDAY TRADE FOR GRAINS

7/2/24

BEARISH WEATHER, RECORD SHORTS, & CHINA

7/1/24

SUPPLY WILL BE THERE, BUT CAN DEMAND LEAD US HIGHER?

6/28/24

GARBAGE USDA REPORT

6/27/24

BIGGEST USDA REPORT OF YEAR TOMORROW

6/26/24

USDA PREVIEW & COUNTER SEASONAL RALLIES?

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL-OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24