TRADE PREPARES FOR USDA REPORT

Overview

Grains mostly lower here today following some early strength where all the grains were trading higher. At one point soybeans were up 17 cents, closing up just 2 1/2 cents. The wheat market sees the most pressure, with Chicago down 21 cents followed by Minneapolis down 10 3/4 cents. Corn closes back below $5 after starting out the day a few cents higher, ultimately closing down 4 1/2 cents at $4.94 1/4.

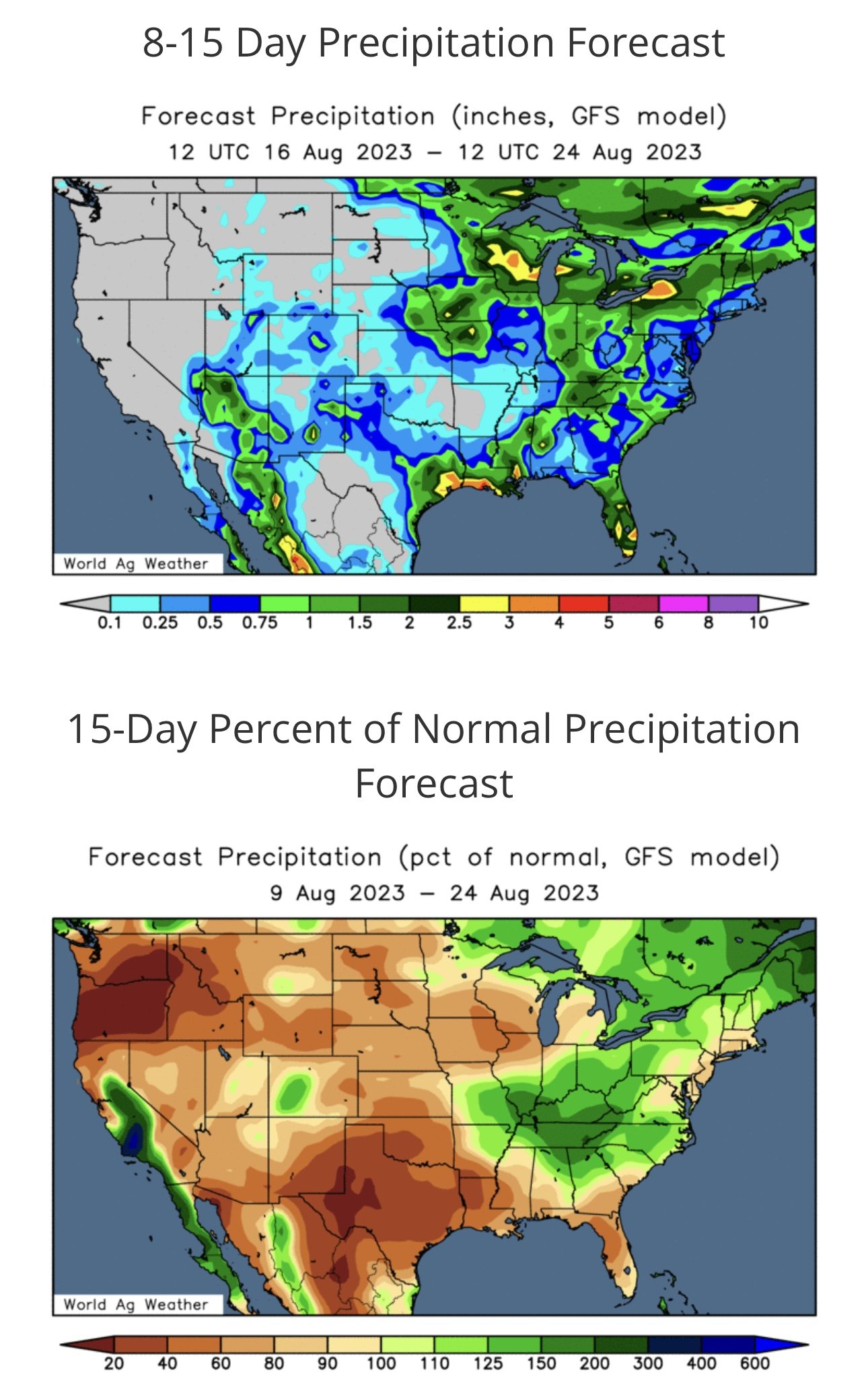

Soybeans opened up strong with more business to China, but ultimately came well off their highs as it is hard for beans to keep a rally with more rain and cooler temps on the radar. However, the forecasts have started adding more heat in both the 6 to 10 and 8 to 14 day maps.

On yesterday’s lows we did bounce and hold right off of that 50% retracement at $12.83 and the 100-day moving average which bulls liked.

Corn and wheat have been pressured from slow demand and pre positioning for the USDA report on Friday. Another reason for the pressure in wheat was these rains, as we continue to get rains in parts that needed it. It might not have made a big difference for winter wheat but definitely helped out the soil moisture situation for the new crop.

Adding to the weakness in wheat, we saw Egypt purchase wheat from Russia. As the US remains uncompetitive in the world market. However, Egypt did pay a pretty penny so perhaps we will start to see a better balance in this wheat market.

Crude oil continues it's bull run, as it hit a new high for the year.

The USDA announced they may revise acres for oats, spring wheat, and winter wheat on the August report, with corn and beans on the September report.

Taking a look at the upcoming report Friday. Traders are expecting yield cuts to both corn and beans. Production is also expected to see a decrease from last month. (full estimates below).

Only 2 of the 20 analysts polled by Reuters voted for corn yield to come at or above last month's 177.5 bpa. While only 2 of those 20 saw bean yield staying at 52 bpa. However, no one predicted it coming in higher.

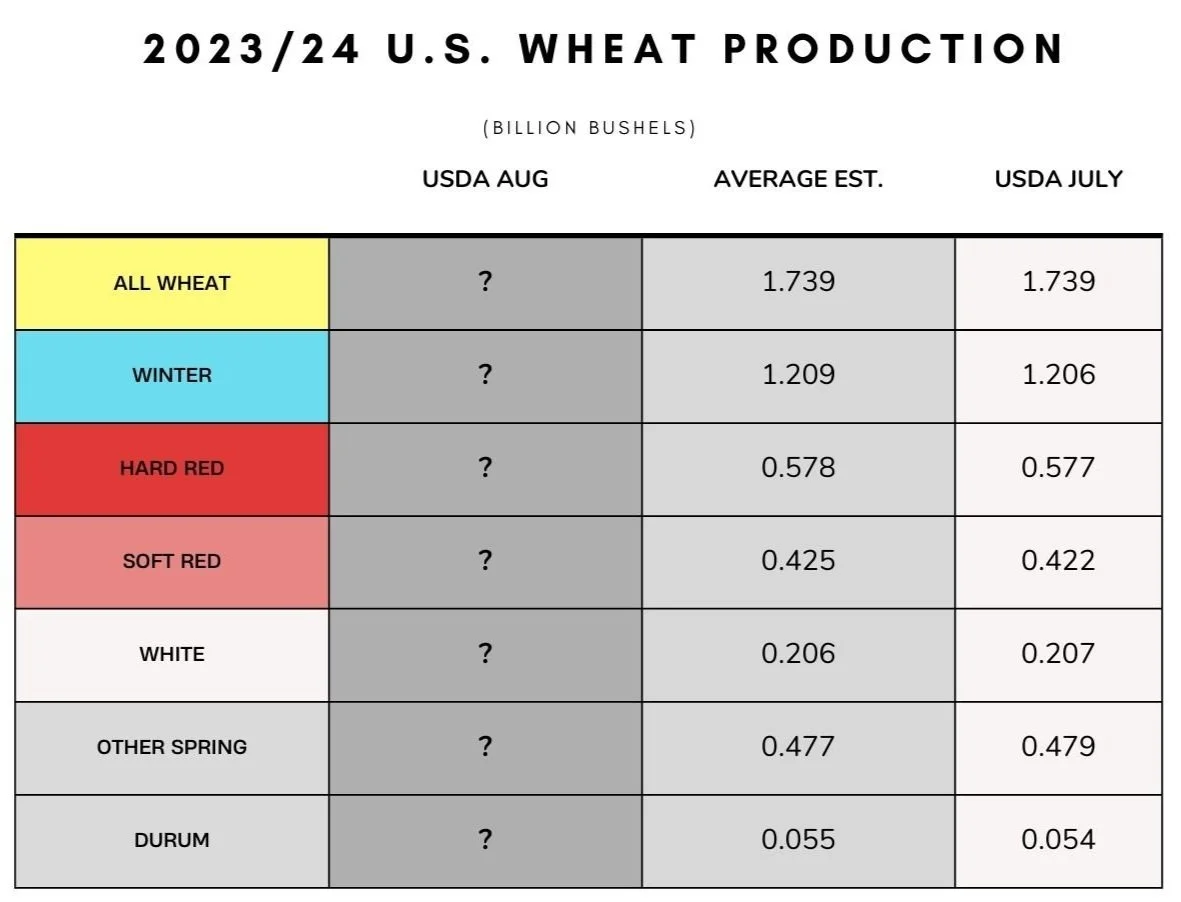

Wheat production is expected to come in nearly identical to that of last month's USDA estimates. With very little changes being made there.

Overall, the numbers look pretty friendly for corn and beans, especially on such a heavy break to the downside like this. We will have to see if we actually get them.

The funds are still heavily short wheat, while long beans, meal, and oil. We will probably see the funds defend their positions as we head into the report tomorrow.

Makre sure you read to the very end of today’s update where we include a great small write up from Wright on the Market where he goes over making money on the meal market as well as another write up from Scott Irwin where he goes over how the “Golden Number” is working out for the corn belt this year.

USDA Report Estimates

Today's Main Takeaways

Corn

Corn again gets caught in between the strength in beans and weakness in wheat. Corn traded a few cents higher, but ultimately closed down nearly a nickel.

Lack of demand has been the biggest thing bears continue to point at. As well as the big crop out of Brazil.

All eyes are on the USDA report Friday. The estimates have yield at 175.5 bpa which is a 2 bushel decrease from last month's report. The trade range is 172.4 to 178.

It is highly doubtful we see yield left unchanged or higher with the dryness and heat we saw in July which we all know is where the corn crop is made. But who knows, perhaps we do see them once again decide to "kick the can down the road" and make very little change. Does anyone still think we are far better than year like the USDA does?

However, an argument I am seeing heading into the report is that even if bulls get their wish and yield drops to say the 172 range. The USDA might just offset that on the demand side. So there is talk that the bears are going to win no matter what yield they print come Friday. Guess we will have to see what kind of changes are made.

If we take a look, anything above a yield of 173.8 still gives us a +15 billion in new crop production. The record is 15.14 billion in 2016. The current estimate is at a record 15.32 billion with the 177.5 yield. So this is the thing bears are watching. They are also making the argument that we will ultimately need to see the USDA trim its corn used for export and ethanol.

Overall, demand is the number one thing holding corn back. Going into the report I expect a cut to yield, just how big of one is the question. With us heavily oversold here, I think we might get a nice bullish surprise from the report, leading to a nice bounce. That's just my thoughts. The bigger question there however is can we hold the bounce or will the rally be sold like it has been? I don’t think a bounce into the $5.38 range would be all that unreasonable.

Upside targets are still $5.16, a gap fill to $5.30, then $5.38. While the downside support bulls need to hold is $4.81. If we were to break that support we could be in for another leg lower into perhaps the $4.50 range which I don’t want to see happen, but could.

We still like the idea of reowning with cheap calls here depending on your situation. If you made sales north of $6 and north of $5.55 to $5.72 on the recent rally, perhaps take a look at cheap calls.

If the USDA does give us a bullish surprise, we want to catch the move before it happens. We want to be hedging, not chasing a move after it's made.

This idea isn’t necessarily for everyone. If you want specific advise or help with your operation shoot us a call free of charge and we will gladly help you with anything you need. (605)295-3100

Corn Dec-23

Soybeans

Beans continue to find a little bit of support as traders prepare for the USDA report. The funds are still long beans, so we will see if they want to defend their position tomorrow.

Beans were initially seeing a nice little rally off the back of yet another sale to China, but just can’t hold on to the gains when the forecasts are as favorable and bearish as they are.

However, demand has been pretty solid so that is a bright spot for beans. Despite the recent uptick in demand and sales, bears still make the argument that yes we are still behind the 5 year average pace by quiet a ways still for export demand. So all in all, there is a little bit of something for both bulls and bears to chew on there.

We will have to see if we will continue to see Chinese demand, or if these recent purchases are just a simple insurance bet in case South America sees any hiccups down the road.

The next two days are all going to be about the report. We of course have the weather, which doesn’t look beneficial at all as of currently, but this great weather is starting to become more and more priced in. Tomorrow will be all about how the funds want to position themselves ahead of the report. Do they even out their position a bit or do they defend their longs? Considering how oversold we are, and the fact that we got a very nice 30 cent bounce from yesterday's bounce, I have a little bit of a bullish tilt heading into tomorrow.

However Friday, there is a lot of things up in the air. The trade estimates have bean yield at 52.3 bpa. a 0.7 decrease from last month. With a range of 50.5 to 52. One thing to point out is that not a single analyst saw bean yield coming in above 52.

There is an argument bears are making going into this thing. The argument is that the USDA may actually opt to completely leave soybean yield unchanged at 52 bpa. Why would they do this? The reason that this is a possibility is because if they choose to lower it now, there is a chance they have to go back and raise it in the future given how near of perfect weather we have seen thus far into August due to the rains, cool temps, and favorable forecasts. Just a possibility we need to be aware of.

If we take a look the balance sheet side of things, I'd have to imagine that we continue to see the balance sheet get tighter

Taking a look past the report, weather isn’t in the bulls favor. Unless we might struggle to hold on to a rally. But bulls are hoping that perhaps demand can do the heavy lifting and combat any bearish production headlines we see.

Ultimately I do think we are in for a nice bounce going into and perhaps following the report.

Yesterday we bounced exactly at that 50% retractement of $12.83 we talked about on Monday. On today's move to the upside we tested that 38% retracement of $13.18. We saw a wide 40 cent range from yesterday's lows to today's highs.

Bulls next targets are $13.18, $13.37, then $13.63. Support is still that 50% retracement of $12.83 which bulls would love to hold, otherwise a break below could lead to the $12.60 or so range which is where we found support at the end of June before our July rally.

Similar to corn. If we happen to get a bullish surprise from the report. We want to be making plays before the move is made. If you need help or want advise on your specific operation don't hesitate to shoot us a text or call at (605)295-3100.

Soybeans Nov-23

Wheat

Wheat futures lower here today, with Chicago and Minneapolis both down double digits.

As mentioned we saw Egypt buy from Russia which was part of the reason for the lower prices.

The good rains have also added some pressure. The rains might not have done a whole lot to help the winter winter wheat crop, but the story there is that these might have improved the soil moisture situation.

War headlines have been pretty nonexistent to the trade the past few days. No real major changes or updates. As we have mentioned in the past, the biggest thing to watch for with all of this is whether we see a situation to where Russia's exports get disrupted. This would still be a huge deal. If it happened we could be looking at a $1 or perhaps even $2 rally. But as always this is still just a big "what if" scenario that is impossible to predict.

As for the USDA report Friday. Wheat production estimates are expected to see pretty much zero changes across the board.

Bulls are hoping we can see a reduction to spring wheat yield, while bears are thinking that maybe we see higher winter wheat production.

On the demand side of things, there is an argument from bears that the export estimates are too high. However, there is still a ton of time left in the new crop marketing year. So we will likely see the USDA slow play things there.

Overall, we have the USDA report, war headlines, drought in Canada, weather across the globe such as Australia and Argentina, Chinese and US demand, all of which will continue to play important factors moving forward. I still think there are more possible bullish wild cards than that of bearish ones moving forward.

Taking a look at the charts, Chicago wheat still holds its uptrend, bulls would like to continue to do so. The important support level is around $6.25. If we get a break below it could spark the funds to push us even lower. Taking at KC, we broke plenty of support levels. Bulls want to find support here otherwise we might look to test our April lows which are another 25 cents lower.

Tomorrow ahead of the report, the path of least resistance might be to the downside as the funds still hold heavy shorts going into the report. We will have to see if the report provides any surprises that can liquidate some of those.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

Meal Puts?

From Wright on the Market,

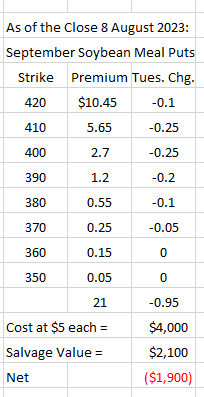

September options expire August 25th. September soybean meal futures price was down 90¢ yesterday to settle at $418.30. However, the puts lost value yesterday because they expire in 13 business days. The lost time value was more than the increased intrinsic value of the futures price being down 90¢.

What should you do? Roger suggests you stick with the plan. If September meal declines about $5 this week, you would be able to do better than breakeven. However, if these puts were for corn, or beans or wheat, we would strongly recommend you hang on to them through the S&D on Friday.

The plan was and is this: if the Soybean meal is high enough when these September options expire that the price highly likely to decline in the coming months, salvage what you can on the September puts in the last week or so of trading and buy one or two January or March puts at whatever strike price you can buy for $5 a ton, same as paid for the September puts.

In the meantime, the seasonal trend is down for meal and beans, weather is good for bean production here in the US, China’s economy is not doing so good, and the soybean crush margin is very profitable at $5.44 per bushels, meaning there is a lot of bean meal being produced. You can use these meal puts as price protection for your new crop soybeans. A month ago, September meal was $24 lower than it is now.

How Is "Golden Number" for US Corn Belt Working Out This Year?

From Scotthirwin.com,

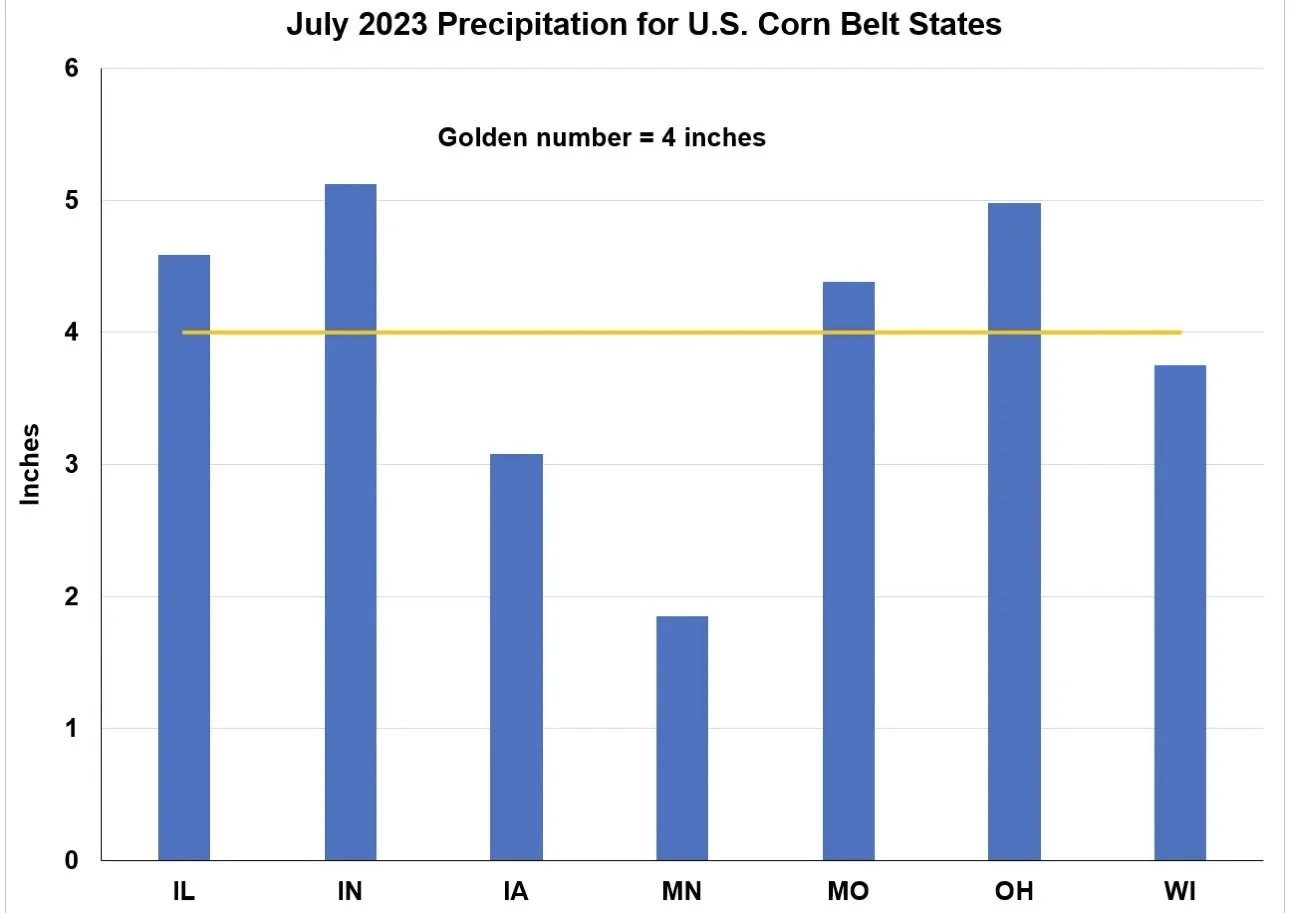

In a previous post, I talked before about the “golden number” for crop production in the U.S. Corn Belt. While it is certainly not the only important yield factor, July precipitation is clearly at the top of the list. Historically, average July precipitation in Corn Belt states is very close to 4 inches. When July precipitation is near or above this average, then corn and soybean yields are usually pretty good. Below this average, then yields tend to disappoint. This is why I call 4 inches of precipitation in July the golden number for yields in the Corn Belt.

So, what happened in July 2023? The chart below shows a mix of outcomes. Illinois (IL), Indiana (IN), Missouri (MO), and Ohio (OH) were clearly above the golden line, while Iowa (IA), Minnesota (MN), and Wisconsin (WI) were below. Iowa and Minnesota were well below 4 inches, with Minnesota more than 2 inches below the average. It will be interesting to see if Iowa and Minnesota corn and soybean yields are as negatively impacted as this simple analysis suggests. The USDA August crop report will be released this Friday, and it will give us our first “official” yield estimates. I will be watching closely whether the state yield estimates in the USDA report line up with this simple but important indicator.

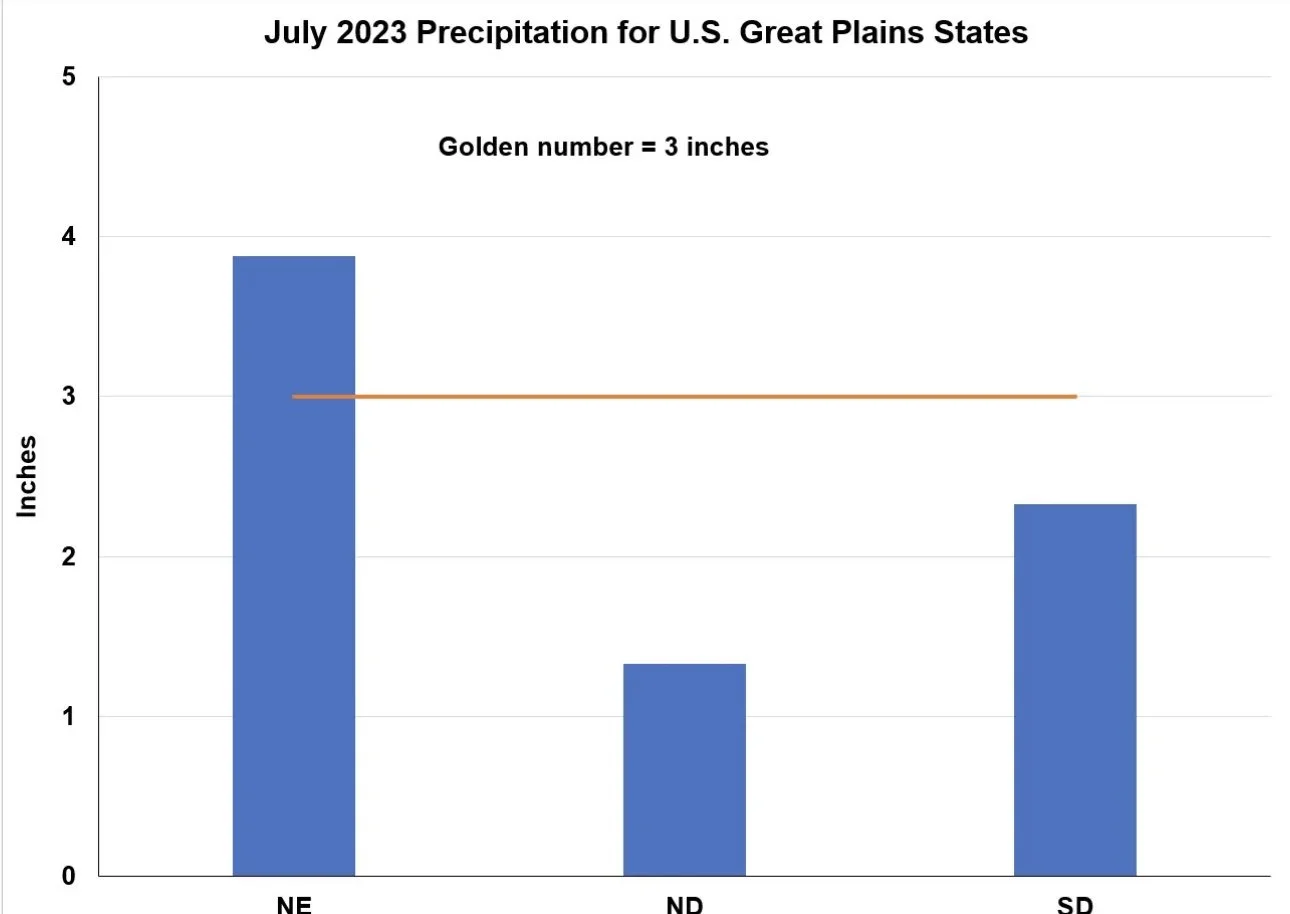

What about July precipitation in Great Plains states, where there is now a bunch of corn and soybean acres? The golden number is lower out west due to a drier climate, with the average being roughly 3 inches for July precipitation. Using this standard, the following charts shows that Nebraska (NE) is looking good, with South Dakota (SD) hurting a bit and North Dakota (ND) hurting a lot. July precipitation for North Dakota was only 1.33 inches, less than half of the golden number for that part of the world. Again, it will be interesting to see whether the state yield estimates for the Great Plains in the August USDA crop report line up with this data.

While July precipitation is certainly important in determining Corn Belt and Great Plains corn and soybean yields, we know that other factors are also important, like June precipitation and July temperature. As a specific example, we know that Missouri was very dry in June of this year, but the state received good rains in July. The precipitation in July also may not have hit the heavy corn and soybean production areas within Missouri. So, like your grandmother always said, take this analysis with a grain of salt.

Finally, if you are interested in a thorough and in-depth historical analysis of the relationship between growing season weather variables and corn and soybean yields, I recommend taking a look at a research report I co-authored with Mike Tannura (a graduate student at the time) and Darrel Good entitled, “Weather, Technology, and Corn and Soybean Yields in the U.S. Corn Belt.” It is definitely one of my favorites.

Weather

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

8/8/23 - Audio

MARKETS PUT BANDAID ON THE BLEEDING

8/7/23 - Market Update

BEANS SELL OFF WHILE WHEAT RALLIES

8/7/23 - Audio

NAVIGATING WEATHER & WAR YOYO

8/6/23 - Weekly Grain Newsletter

ARE YOU READY FOR THE NEXT BIG MOVE?

8/4/23 - Audio

CAN OUR MARKETS BOUNCE ONE MORE TIME?

8/3/23 - Market Update

YIELD, DROUGHT UPDATE, TIME FOR CALLS?

8/3/23 - Audio

BUYING RECOMMENDATIONS

8/2/23 - Audio

WEATHER & WAR VOLATILITY CONTINUES

8/1/23 - Weekly Grain Newsletter