THE SOYBEAN PROBLEM. NEW WHEAT LOWS. CORN UPTREND

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Soybeans see a relief bounce, leading the way higher while corn followed. Wheat on the other hand continues to fall apart as it posted another round of new lows today.

Why did soybeans bounce today?

On the charts we were oversold. The stochastic as I mentioned yesterday suggested at the very least a bounce was coming as they bottomed out.

But probably the biggest reason was the US Dollar vs Brazilian Real.

It was down -3% at one point today after reaching it's highest levels all-time yesterday.

What happened yesterday?

That level we broke yesterday was a massive support for 4 months.

When traders look at a chart, they always buy at support. So there was a bunch of traders long at that $9.75 support level with stop losses right under that support.

When that support gave out, it created this cascading event. As it caused all of those long traders stop losses to be triggered, causing their long position to liquidate.

This creates even more sell pressure and pushes the prices even lower.

That is why we took out that support so violently rather than just barely breaking it by a few pennies.

Kind of think of it like a dam that is about to break. It builds up all of this pressure, when it breaks the water comes flooding out.

The Brazil Problem

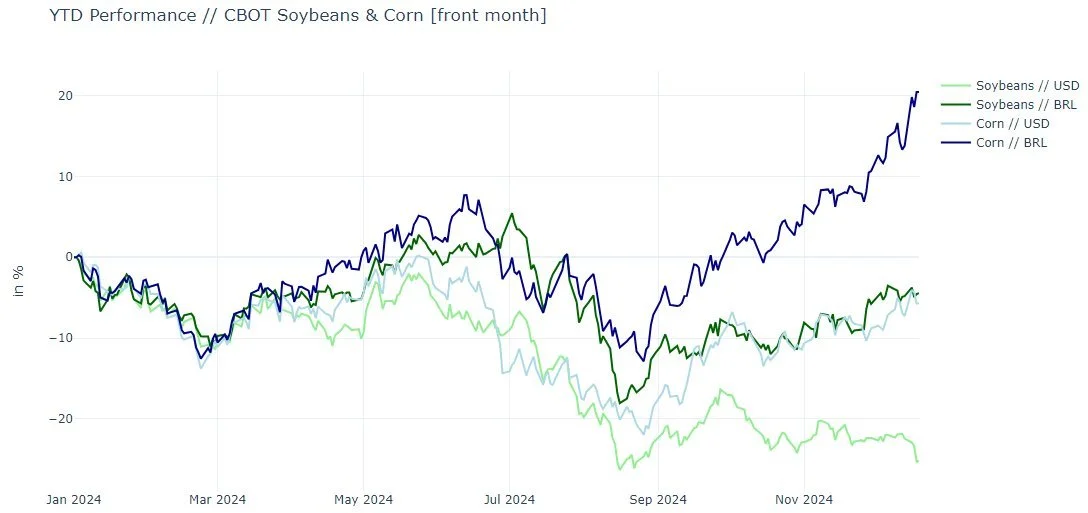

Below is a chart that shows corn & soybeans YTD performances in US Dollars vs corn & soybeans YTD performances in Brazilian Reals.

YTD soybeans are down -$3.50 (-27%) in US Dollars.

Meanwhile, that is equivalent to soybeans only being down -$0.50 cents (-5%) in Brazil.

This is due to the Brazilian Real hitting it's lowest value all-time compared to the US Dollar.

Why is this a big problem?

Our biggest competitor on the global bean market's currency continues to get cheaper and cheaper, while our currency continues to get more expensive.

Which also means their soybeans are cheaper on the world market. Making it that much harder for the US to compete for business.

We add on their monster crop and it makes things really difficult moving forward.

As for corn, relative to the US Dollar corn is down around -5% YTD. That is equivalent to corn being up +20% in Brazil.

This isn’t as big of a problem for corn as it is soybeans.

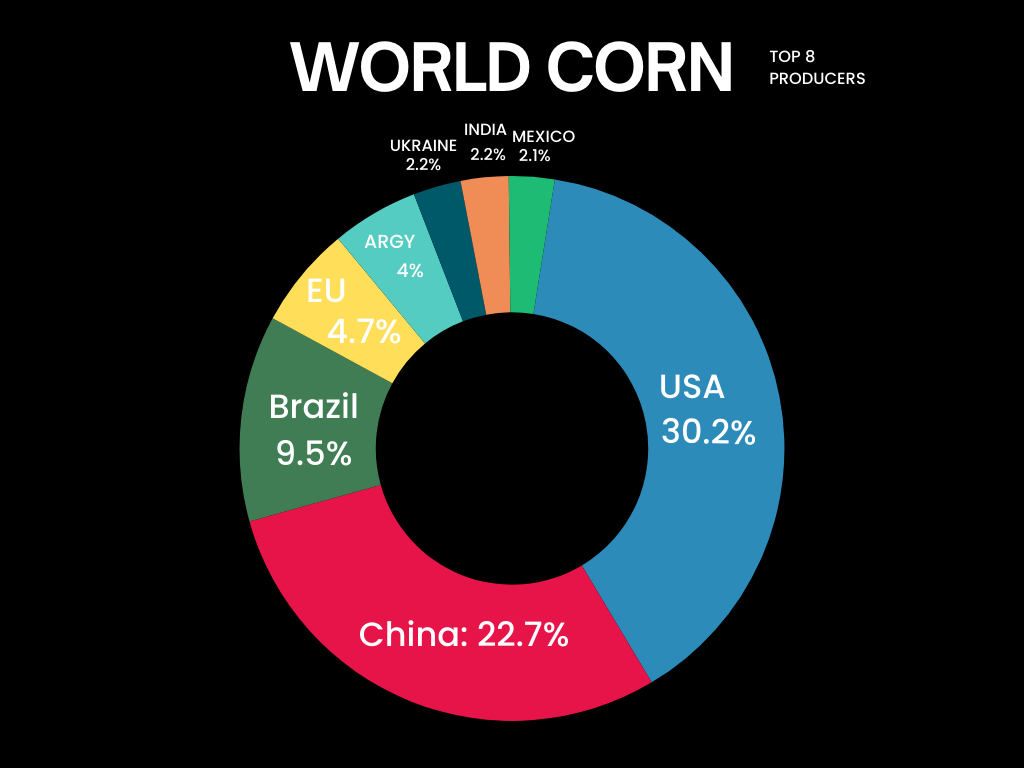

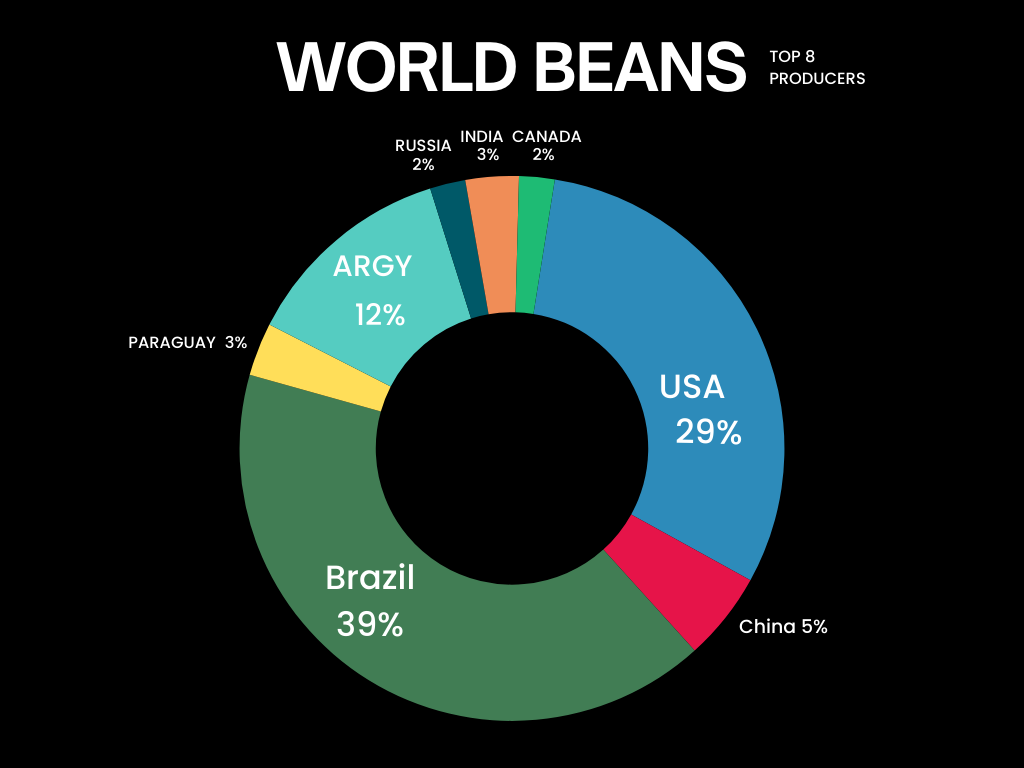

The US dominates the corn market with 30% of global share. Brazil only has 9.5%.

Soybeans on the other hand are dominated by Brazil at 40%. The US only has 29%.

What's wrong with soybeans?

Our biggest competition not only has a monster crop with zero weather scares in sight.

But their currency is getting cheaper and cheaper vs the US dollar.

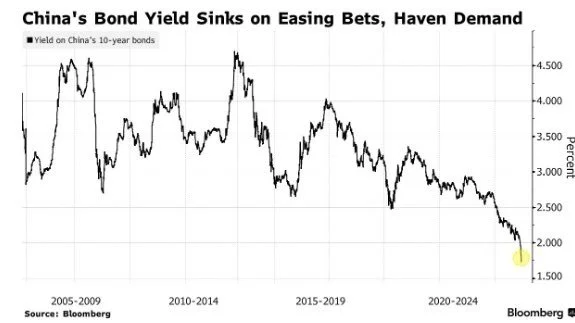

Then we also have the worlds #1 soybean buyers economy on the brink of collapsing. (China)

Below is China's 10 year government bonds. They yield only 1.75% (USA's yield 4.57% for comparison)

However, one good argument to be made surrounding China's economy I saw was this:

From Cordon Sroka:

"I'm not an expert, but if I ran China and my economy was junk I'd consider paying a premium for US ag products to keep Trump happy vs risking economic collapse with more tariffs. Just a thought."

Corn Acre Problem

This is one of the biggest risks corn faces next year.. more acres.

With soybean prices falling apart and corn being relatively strong, it increases the odds of us seeing more corn acres & less bean acres next year.

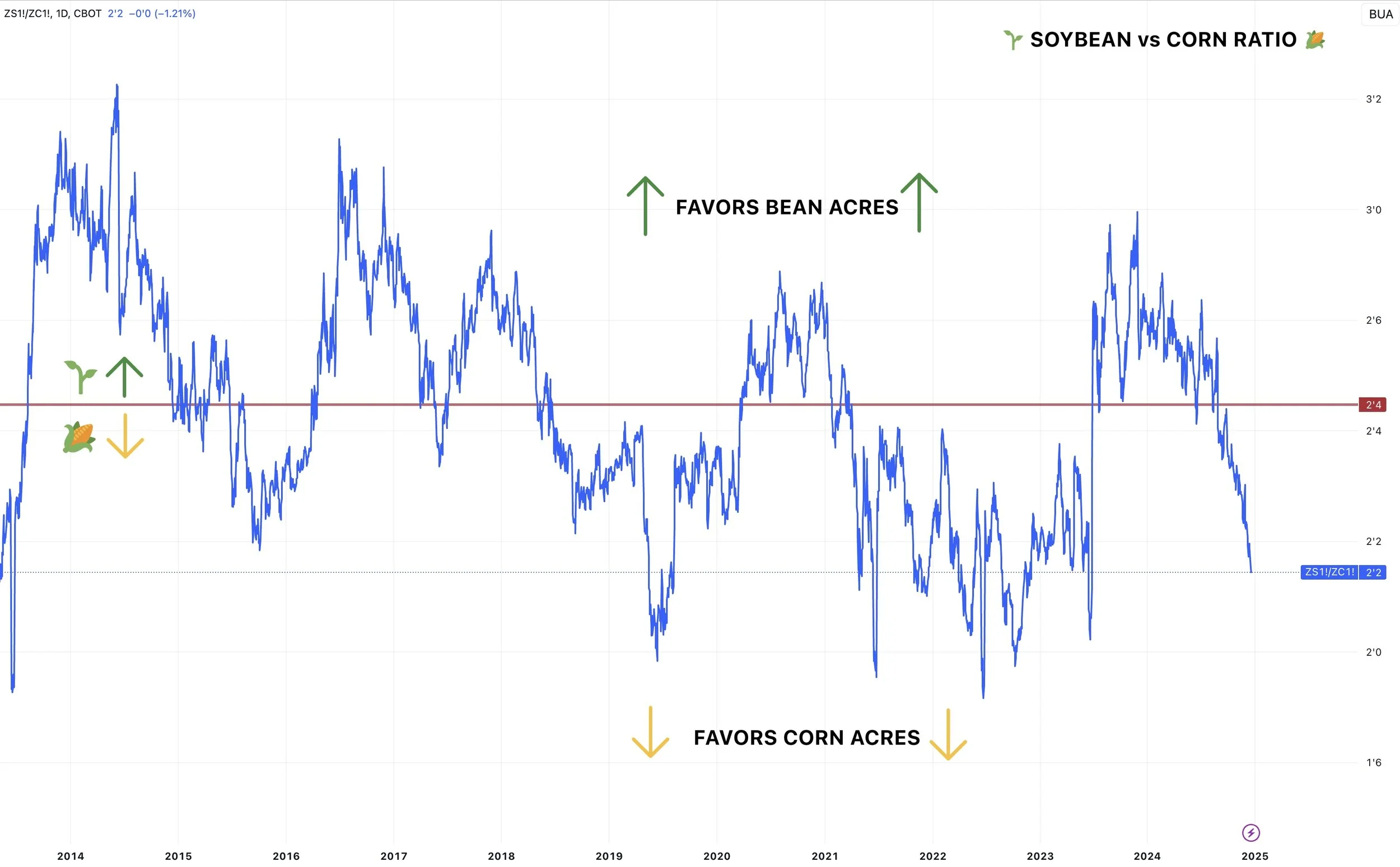

Below is a chart that shows the bean to corn ratio (Soybean price divided by corn price).

Above the line favors more bean acres 🌱

Below the line favors more corn acres 🌽

We have fallen well below that line the past 3 months.

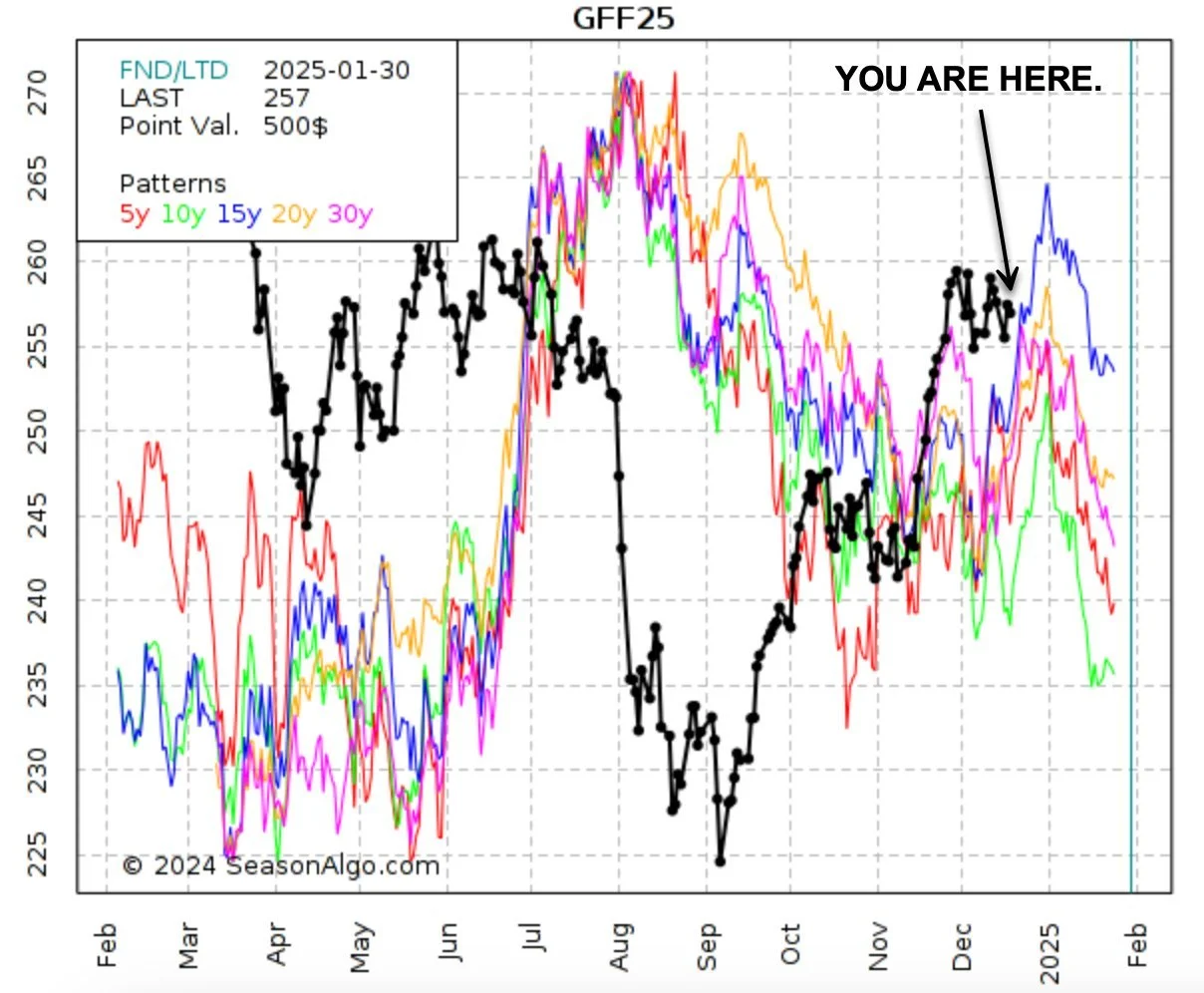

Feeder Cattle Seasonal

We do not cover cattle a whole lot, however I just wanted to show you the seasonals here for you cattle guys.

Nearly every seasonal pattern peaks by the end of the year.

Have a Marketing Plan

With harvest over, this is the time where you need to be proactive and have a marketing plan.

So if you'd like to talk through your operation, please feel free to reach out to us. It doesn’t cost you anything. We'd be happy to help.

(605)295-3100

Today's Main Takeaways

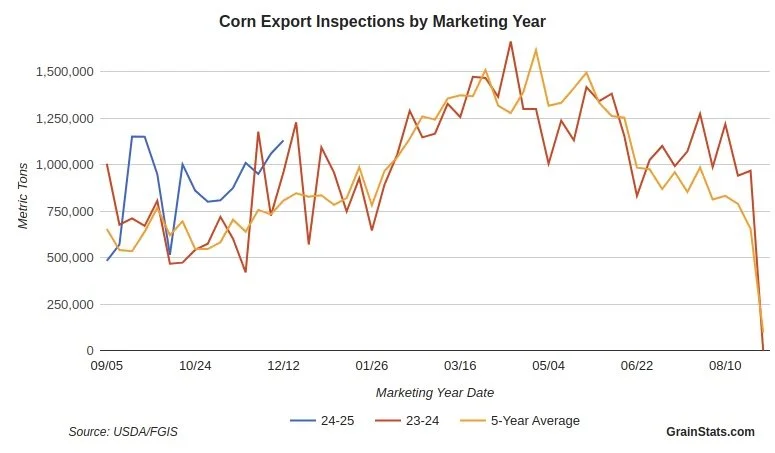

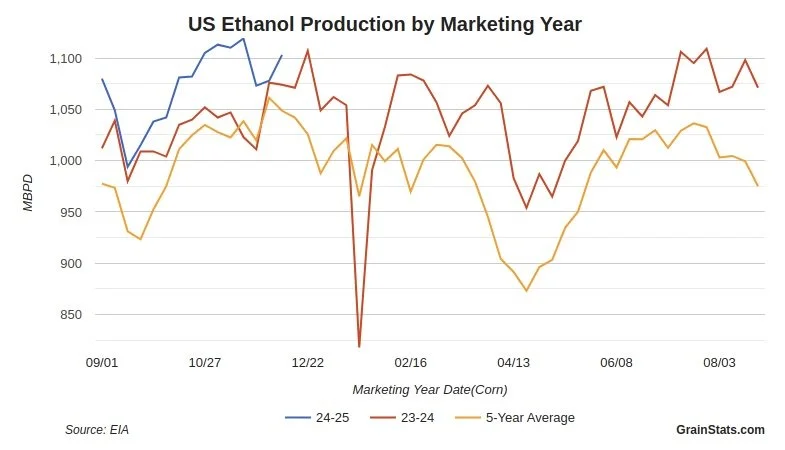

Corn

Corn demand stil remains solid.

Here is the current exports & ethanol numbers from GrainStats.

Both still well ahead of the 5-year average.

Our carryout is 1.74 vs 1.8 billion bushels last year. Yet exactly a year ago today, corn was $4.80 vs $4.40 today. To me this means we might still be undervalued here for now.

As for price action, we are still trying to find support from the recent correction.

We are bouncing right in this golden zone and almost perfectly bounced off the 61.8% retracement and this symmetrical triangle.

Personally I think we continue to consolidate around this area perhaps a little lower.

Ideally, we hold that blue uptrend.

My bias still leans higher unless we break below the black channel support (black line). If we break that my bias will likely switch lower.

(If you missed last week's sell signal: Click Here)

The stochastics still have room to cool off more, signalling that the correction might not be over yet.

One positive sign is that the 100-day MA (purple line) is curling up.

This is only the 2nd time and the longest it has ever done so in the lifetime of the March contract.

When the 100-day MA starts turning up, it signals that longer term price trend is turning more bullish and signalling an uptrend.

Soybeans

There is still very little reason to be bullish on soybeans.

The risk and path of least resistance remains lower until proven otherwise.

We went over pretty much everything going on in the bean market, so let's just look at the charts.

We took out that massive support level of $9.75, so instead of that being support it now resistance.

Looking to the downside, you still have to be very aware of the possible risk.

I have been stating for months that if we broke this support, it would create massive sell pressure and that the implied move of this pattern was +$1.00 lower.

We could bounce anywhere, but $8.63 is still the implied move. So that is your risk.

We cannot control the markets, but we can control our risk. So if you have something to move in the next few months you might want to consider grabbing some downside protection.

Because the worst possible outcome for someone that doesn’t have protection that has to move something in the next several months is that beans fall another $1.00 and you are stuck selling at bear market lows with zero profit from a hedge.

If we go higher from here? Great. Your put expires worthless, but at least you have peace of mind knowing you are okay if we do go lower.

Looking at monthly beans, that implied move of $8.63 also coincides with our lows in other bear market years.

In the trade war we were especially range bound between $9.60 being our lid and $8.50 being our floor.

Or perhaps that old $9.60 ceiling turns into new support (a case of old resistance turned new support).

Either way, you have to realize $8.50 is a possibility.

Here is a closer up look at the weekly chart to better show you that this $9.60 level is "potential" support.

Wheat

Yet another round of lows for wheat.

Now what?

Let's take a look at the charts to see where our next stop might be.

For this we have to look at the continuous wheat chart (shows front month wheat).

Our next big support might come around $5.23 (blue line) (We are at $5.33 today).

If that support fails, the next stop might be that longer term support line (black line). Which happens to be in the realm of $5.00

To consider the fact we are done going down, we first need to break this bigger picture downward trend we have been trapped in since May. (green line)

Overall, I still think wheat has plenty of potential looking to next year.

We have the Russian winter wheat crop story.

A bullish global balance sheet.

A stocks to use ratio for major global exporters that is the lowest since 2008.

But these factors don’t have to come into play anytime soon.

Wheat's time to shine will come again some day. Until then I'm remaining patient waiting for opportunities.

Looking at KC, on the bright side we have not taken out those lows like we did in March Chicago.

If this level here fails we could be looking at another leg lower. Potentially as low as $5.00.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

12/18/24

BEANS BREAK SUPPORT & OPEN FLOOD GATES

12/17/24

SINK OR SWIM TIME FOR SOYBEANS

12/16/24

SOYBEANS & WHEAT FIGHTING LOWS. WILL CORN DEMAND CONTINUE

12/13/24

POST USDA COOL OFF

12/12/24

CORN CORRECTION. WHY WE ALERTED SELL SIGNAL YESTERDAY

12/11/24

USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

12/11/24

CORN SELL SIGNAL

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24

TARIFF TALK PRESSURE

11/25/24

HOLIDAY TRADE, SEASONALS, TARGETS & DOWNSIDE RISKS

11/22/24

CORN TARGETS & CHINA CONCERNS

11/21/24

BEANS NEAR LOWS. CORN NEAR HIGHS. 2025 SALE THOUGHTS

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24