USDA IN 2 DAYS

Overview

Blood bath as grains see heavy pressure for the first time in weeks as everyone is expecting Friday's USDA report to be a bearish one filled with huge stocks and high starting yields in the US.

Today we saw a lot of farmer selling, technical selling, and fund selling. As today there was just no reason to go straight higher especially with expectations of a bearish report. The big money are positioning themselves ahead of that report.

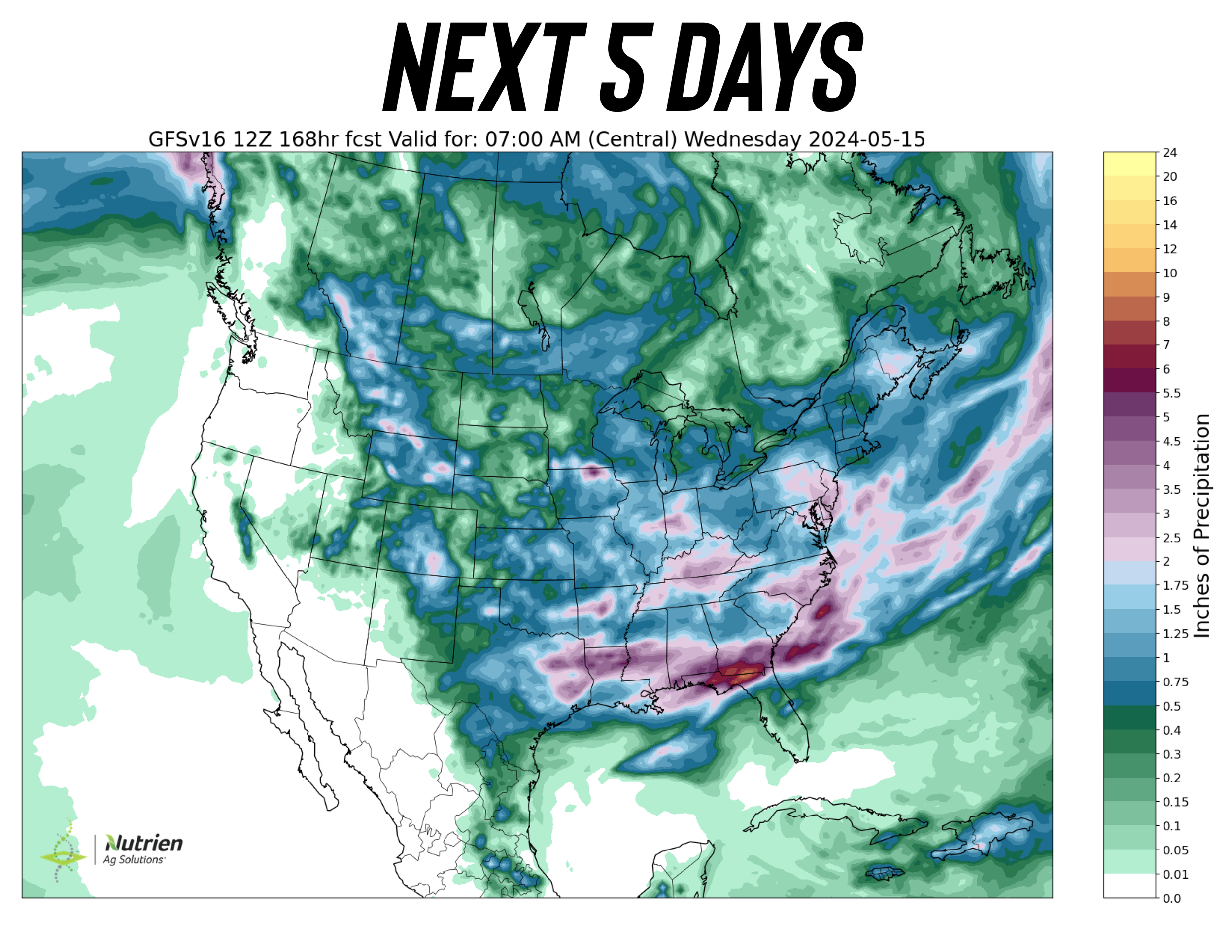

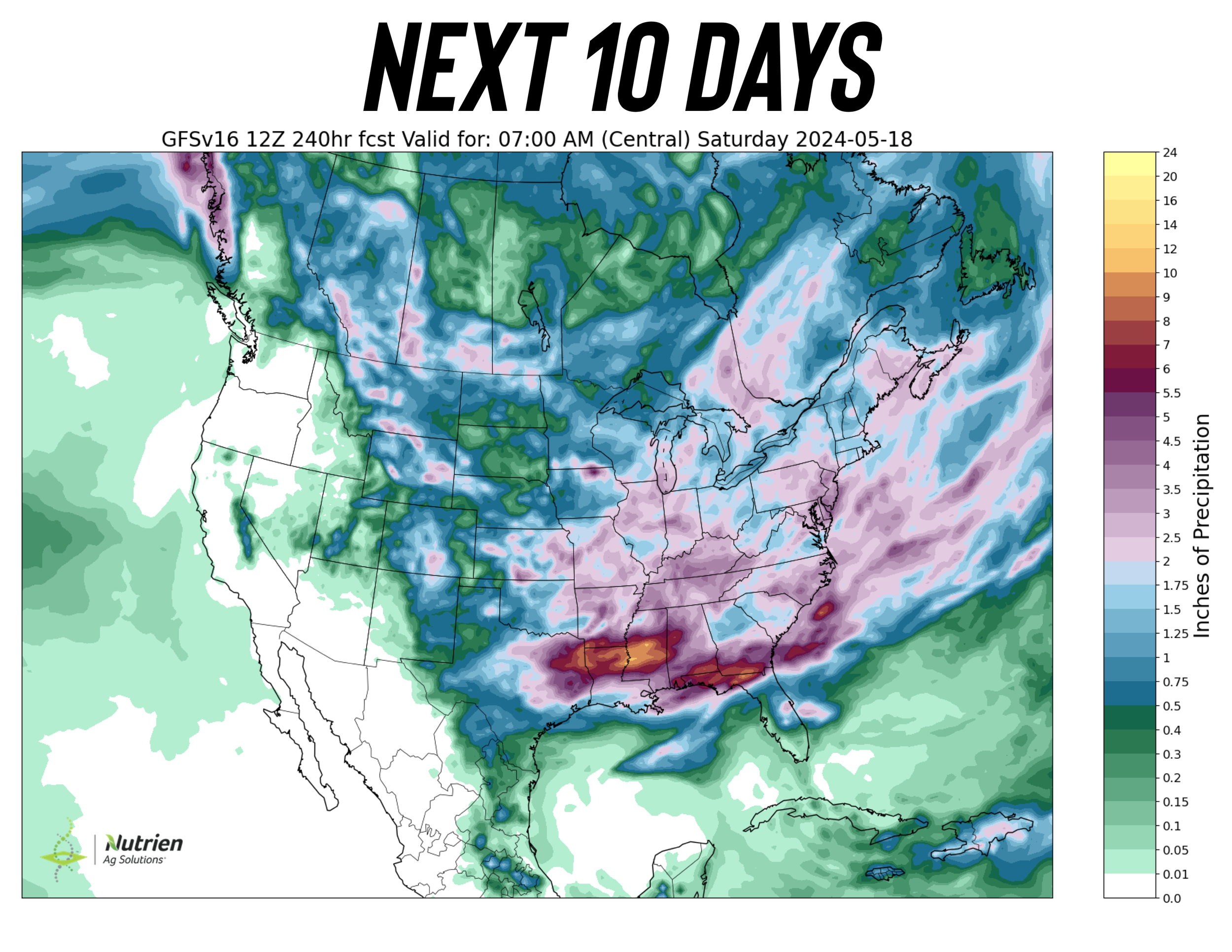

A better planting outlook window a week from now also added some pressure. As right now we are slightly behind, but we all know just how quickly we can catch back up if it dries out.

These next few weeks will be huge. If it dries out, the market could take it on the chin for a while. If the forecasts stay wet, then we could see more premium added.

Any acres planted after the 15th of May are at a greater risk to yield loss. Some historical data says that every week we are behind on planting equates to roughly a 4 bpa loss on corn. Which would already give us a 177 yield vs the USDA's 181.

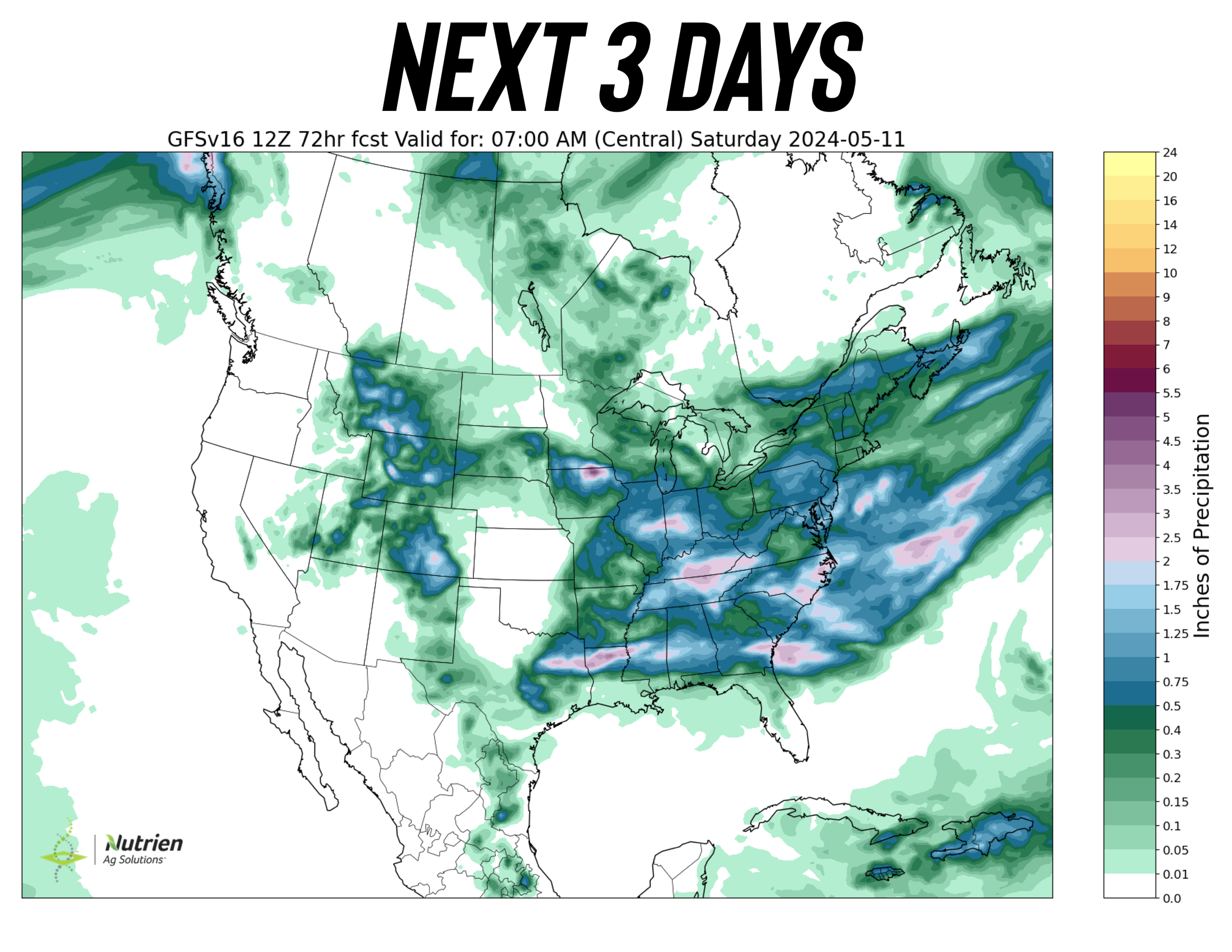

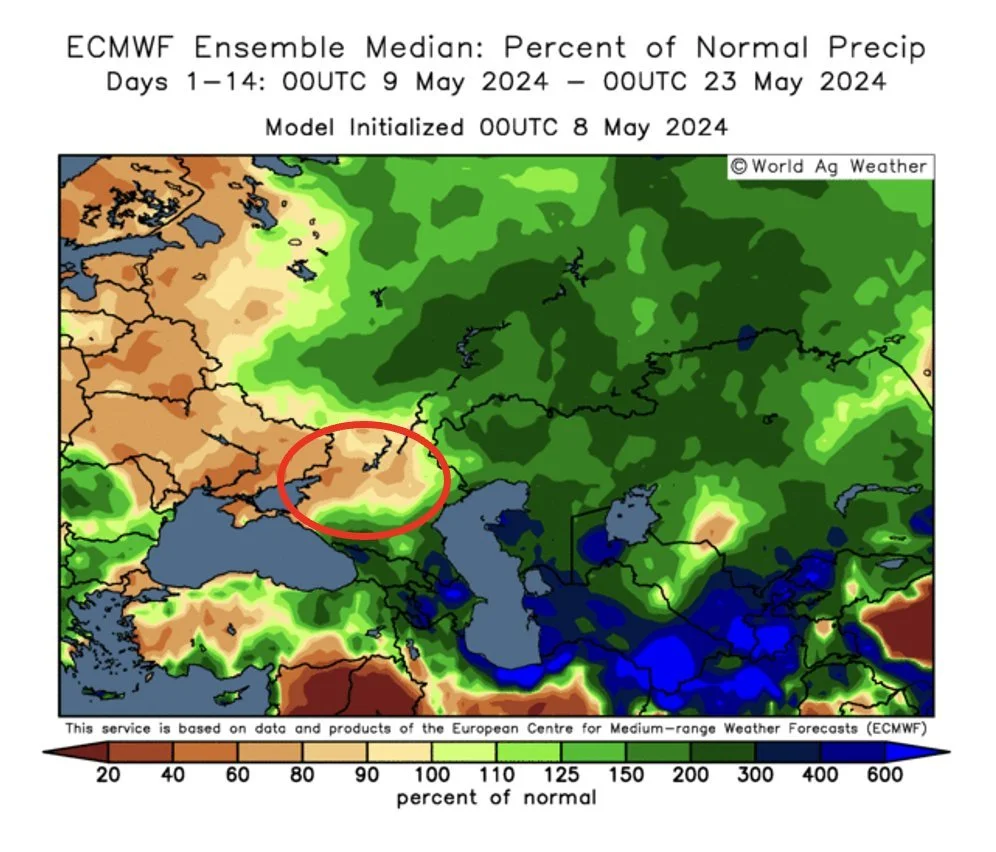

Here is the current forecasts. Still pretty wet over those leading I-states that are seeing some issues right now.

USDA Preview

This report will very likely not be bullish on the US side of things.

We will probably see a 181 yield.

Why?

There have only been 2 times the past decade where May yield came in lower than the February yield.

Those two years were 2013 and 2022.

May 1st Planting Progress:

2013: 8% (Yield Down in May)

2019: 18% (Worst Delayed Planting)

2022: 14% (Yield Down in May)

2024: 27% (This Year)

As you can see, planting progress is far ahead of those years. Altough we are seeing slight delays, there is still not a major concern. And we all know the USDA does not jump the gun.

Soybeans will likely come in at 52 as well.

However, I do not think the market is going to care about these yield numbers. These are already baked in from the February Outlook.

Looking at ending stocks, 2024/25 stocks are expected to be up a lot higher than last year. But down from the February USDA Outlook.

The estimate range however is massive for ending stocks. On corn the estimates range from 2.5 to 2 billion. A 500 million gap. On soybeans its a 240 million gap between 550 million to 310 million. Wheat has a near 200 million one as well between 880 million and 700 million.

Extreme wide ranges. So these numbers could come in anywhere.

Lastly South America numbers. These continue to shrink.

They are expecting sizeable cuts to both Brazil corn and soybeans. While Argentina corn is expected to take over a -5% trim due to disease.

CONAB is out next Tuesday, their estimates are far smaller. With Brazil beans at 146.5 and corn at 111. A massive difference, will be interesting to see if the market respects their numbers.

What should you expect from this report?

Overall, I do not see yield being much of a factor at all. The market is already anticipating big yields and yield in early May doesn't matter at all.

The market is going to take yield with a grain of salt here. We will continue to trade weather. If we raise a good crop, we will go a lot lower. If we raise a poor crop we will go higher.

If we are going to see something negative, it could come from a larger carryout. But then again, the estimates are lower than where they were in February and April. Which means even if we come in at the estimates, those numbers are lower than what we have been trading since February. We could see 2024/25 corn stocks come in at 2 billion or 2.5 billion.

The South America numbers will probably be on the friendly side, they could leave the crop unchanged once again. But the trend is smaller and they aren't going to increase the crops.

Overall the US supply and demand numbers probably won’t be bullish. But the market will quickly move on if they are bearish. We have already traded these bearish numbers with the Outlook Forum etc. So if it's negative, it will just be a one day knee jerk reaction then go right back to trading weather and the funds.

One last thing to note. Everyone is very bearish heading into this report. A lot of times the market will do exactly the opposite of what everyone is expecting, because the market is already anticipating bearish numbers. Which means even if we get negative numbers, we might not sell off like everyone expects.

It is never a bad idea to add some downside protection before a report especially if you are undersold and your risk is to the downside. Give us a call if you want to discuss the best ways to manage your risk before the report. (605)295-3100.

Today's Main Takeaways

Corn

Corn posts it's first red for the month of May.

Mainly fund selling and pre-report positioning.

We know the US numbers will likely be considered bearish. But I expect the market to shake it off a day or two later even if so. Weather will dictate this market.

We also have a Brazil 2nd crop that is suffering. As their entire growing season is two weeks behind. Which puts this crop in an even worse position as their wet season ends. Then we have the reports that Argys corn crop is -15% smaller due to disease.

The South America numbers could be the surprise in the report.

Where could corn make it’s highs?

If you take a look at 2011 to 2014 it looks awfully similar to that of 2021 to 2024.

The only difference between 2014 and 2024 so far is that in 2014 we bottomed a month earlier, in January instead of February.

In 2014 we topped out on May 9th. So if 2014 and 2024 price action follows the trend of prior decades following each other, this suggests corn will top out in early to mid June around that $5.19 area.

No two years are the same, but just an interesting observation.

(Note: This chart is the front contract)

I think Monday we will see crop progress slow once again, but after that it will all be dependent on Mother Nature.

Bottom line, we are having the 3rd slowest planting in 10 years. So planting is behind. If we continue to fall behind, the market will get excited and push higher.

If we dry out and catch up fast, the market will go lower.

However, when you get late planting due to an overly wet spring, you NEED rain during the summer. Timely rain.

Not only does this push the crop to a less favorable window, but it brings compaction issues.

The only way to have an outstanding yield after this is if it rains all year long. If we go through a dry spell, there won’t be root structure and it's not going to yield as well.

Summer is projected to be very hot and dry due to El Nino.

There is a chance that this late planting already knocked off a few bpa of yield.

Nonetheless, I still think we will have a better pricing opportunity come June. We get some sort of weather scare-driven rally every year. Typically by the 4th of July we want to have a good chunk of sales made.

The funds are still heavily short.

Taking a look at the charts.

July corn has traded in a sideways 25 cent range for 2 months.

We finally saw a break out of that range. Based on the measured move, since we were in a 25 cent range ($4.35 to $4.60), the implied upside move would be another 25 cents which would bring us to $4.85. That is also where our 200-day MA sits. That $4.85 to $4.90 area is a big area and a decent spot to take some risk off the table. Although I do think we could a lot higher. That is a target.

If we can hold the 10-day MA or bounce off of it at $4.56 that would suggest the funds continue to cover. We are sitting on some good support here.

July Corn

On Dec corn, we have found resistance at that 38% retracement from our June highs. The next target is that $5.03 gap and the 50% retracement. That would be a decent spot to consider taking some risk off the table.

The next target on Dec corn would be around $5.19. Because from our lows to our March highs was a 35 cent rally. The measured move to the upside past those March highs would be another 35 cents. Which would be another good spot to consider taking some risk off.

Dec Corn

Soybeans

Soybeans get hit hard, but are still up +13 cents on the week.

There just wasn’t a reason for us to go higher, and we just rallied $1.00 so a pullback was expected. It is not healthy for markets to go straight up.

Southern Brazil is still flooding, which is friendly for bean prices but a good chunk of that crop is already harvested. Even if they completely lost the rest of that crop in Rio Grande South America as a whole would still be sitting on a decent crop.

Just like corn, even if we get bearish numbers on Friday, the market may take it on the chin Friday but will quickly go back to trading the basics.

US growing season is still going to be the ultimate factor. We have a far tighter situation in beans than corn, so even if we lose a small amount of yield and come in at 48 for example instead of 52 our entire carryout could disappear.

I think beans have more upside. Nobody knows how the actual crop will turn out here in the US. If we somehow get this bumper crop along with the competition from South America, beans could be a lot lower come harvest. At the same time, if we have a poor crop we could be $1.00 higher.

It's all about managing risk.

I think this is a good spot to put in a floor for beans.

If making sales makes sense for your operation then by all means take some risk off the table. We are still nearly an entire $1.00 off our February lows.

Looking at the chart, we are sitting right above some good support with that old trendline and the 100-day moving average.

My upside target is that gap above $13.00 and our 62% retracement from our November highs. That would be a good spot to take a lot of risk off the table. The funds are still very short.

Like I said, although I see higher prices I still like adding a floor to soybeans for some of you because if planting does catch up extremely fast and we raise a decent crop, the market could suffer. Please give us a call if you have questions. (605)295-3100.

July Beans

Wheat

Back to back red days for wheat, still up double digits on the week.

Russia news is adding support. We have the dryness which is a concern still.

From Andrey Sizov Wheat & Black Sea Guru:

"The Russian South forecast is still drier than needed. This is a point of no return. #1 country's wheat growing region will likely get below average yields this year. And 2-3 months ago it looked like a bumper crop."

Then we also are seeing headlines about frost damage in Russia.

As 3 regions in Russia that make up 10% of all their winter wheat production declared for a state of emergency due to frost damage to their crops. Yet the market didn’t seem to concerned.

We are getting rains in US winter wheat country which is helping stabilize the losses in those crops.

As we have said the past week:

If you do not have storage, will have to make sales soon, or sell wheat off the combine then make sales and or put in a floor here.

If you can hold wheat for a year or longer, then wait. Because long term this market could be a lot higher.

There is a chance the highs for the year are in. Myself and nobody else is smart enough to know for sure.

The wheat market is a headline driven one. Without one, there might not be a major reason for wheat to continue to scream higher.

We just don’t have anything today that says "we are 100% going higher". Unless Russia's crop continues to suffer, then we will.

Seasonally, May is one of the best months to sell wheat. (However seasonals don't work as well on wheat or beans like they do corn because there are countries like Russia who play a larger role than the US for wheat. The same concept goes for Brazil and beans).

Despite the concerns with the Russian crop, news came out today that Russia wheat stocks are near record highs which was another reason for the pressure today.

Could there be some unknown event that causes wheat to go $1.00 higher? Absolutely, but nobody knows. Wheat is the most unpredictable market.

So if you know you are going to have to be making sales relatively soon, then make some sales and or put in a floor with puts.

If we go higher, you lose the value of your put but will get a better opportunity at making sales. If we go down, you make money on your put to make up for the loss of the missed cash sale.

You can’t outguess the market, just manage your risk as best as possible.

If you have questions on your specific situation or want to know if you are someone who should be making sales or utilizing puts, give us a call (605)295-3100.

July Chicago

July KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24

WILL FUNDS BE FORCED TO COVER?

4/24/24

WHEAT CONTINUES BULL RUN & CORN FAILS BREAK OUT

4/23/24

FUNDS CONTINUE TO COVER & RALLY GRAINS

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24