USDA: NOT A BEARISH REPORT. DISAPPOINTING PRICE ACTION

AUDIO COMMENTARY

USDA breakdown

Zero changes on US balance sheets

Market disappointed didn’t see exports bumped

If you haven’t sold anything and still need to move something this could be a trigger

If you have to move something in 30-60 days

Who should make new crop sales?

Old crop led us lower like we’ve talked about

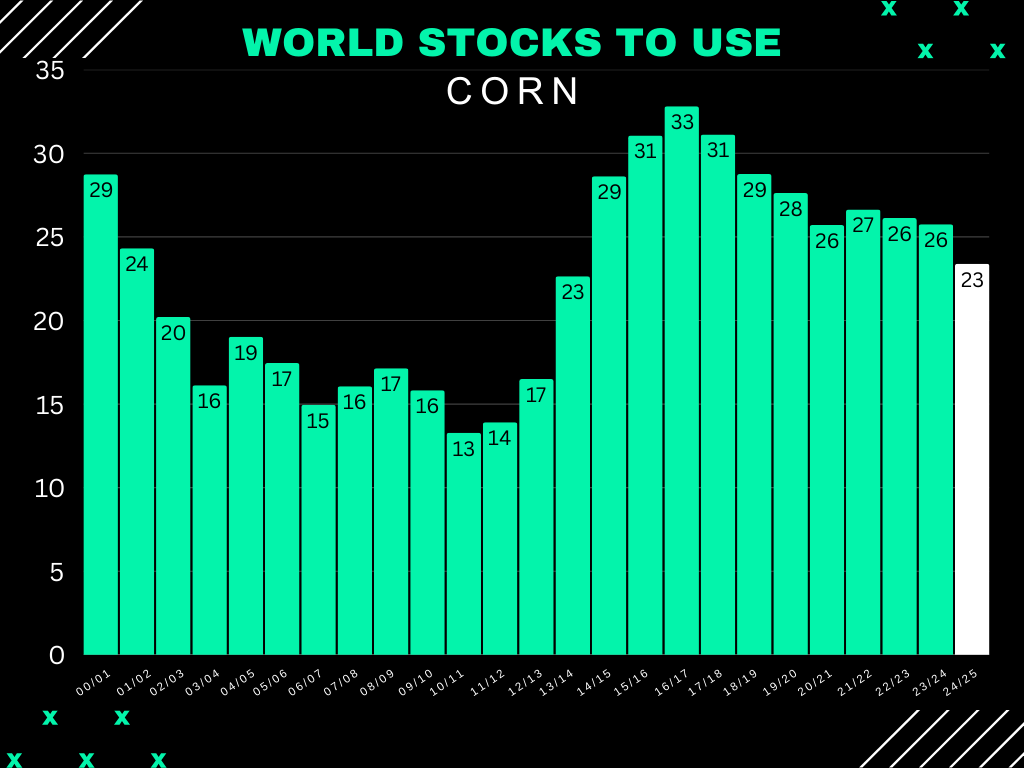

World situation for corn is very friendly

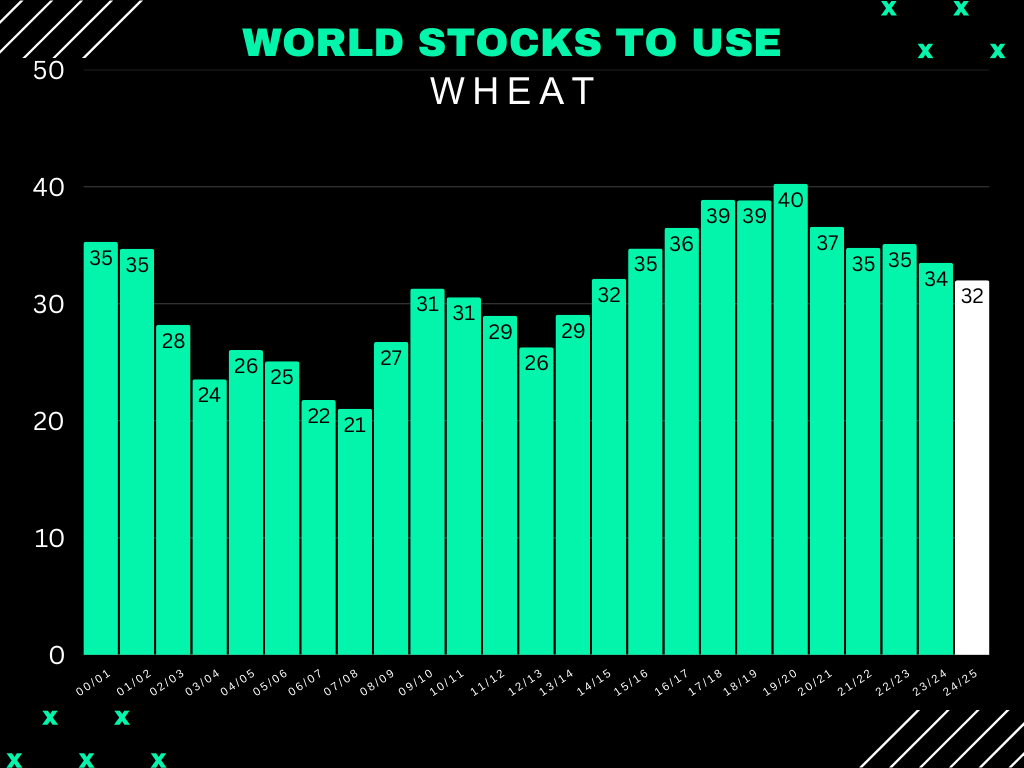

World situation for wheat is also very friendly

Why you protect what’s overvalued

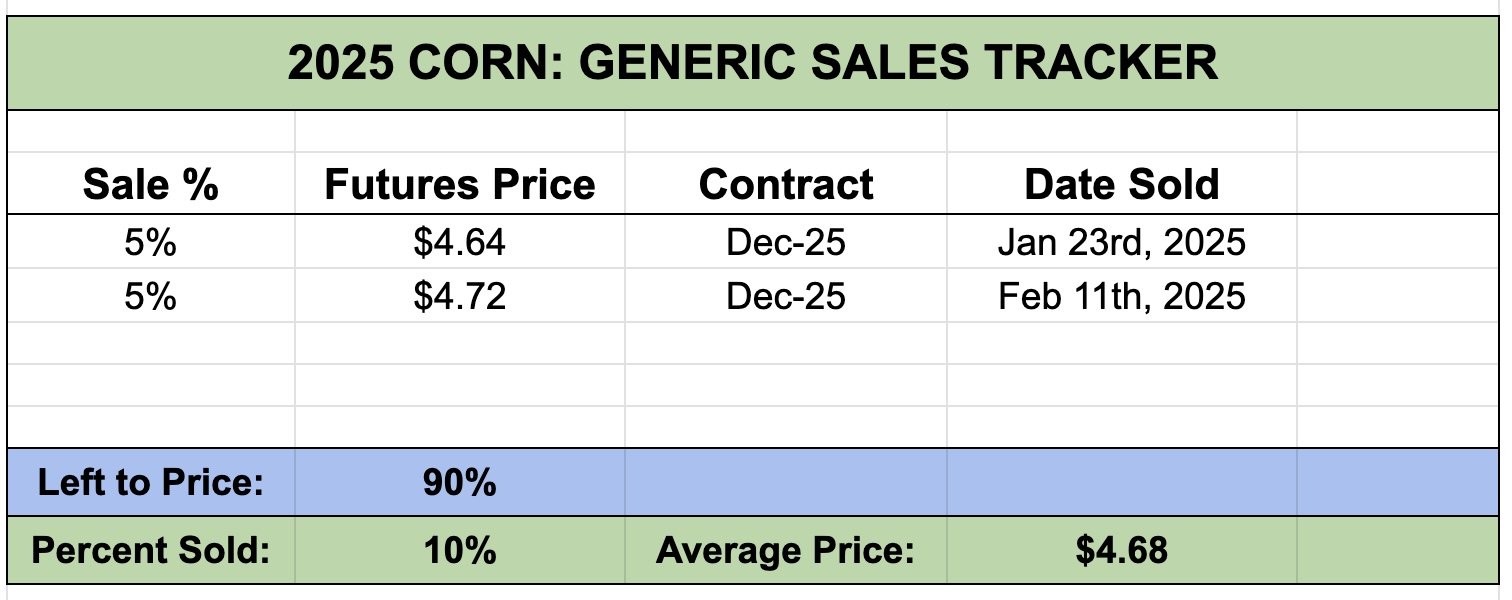

Hit $4.72 target Dec-25 corn (chart below)*

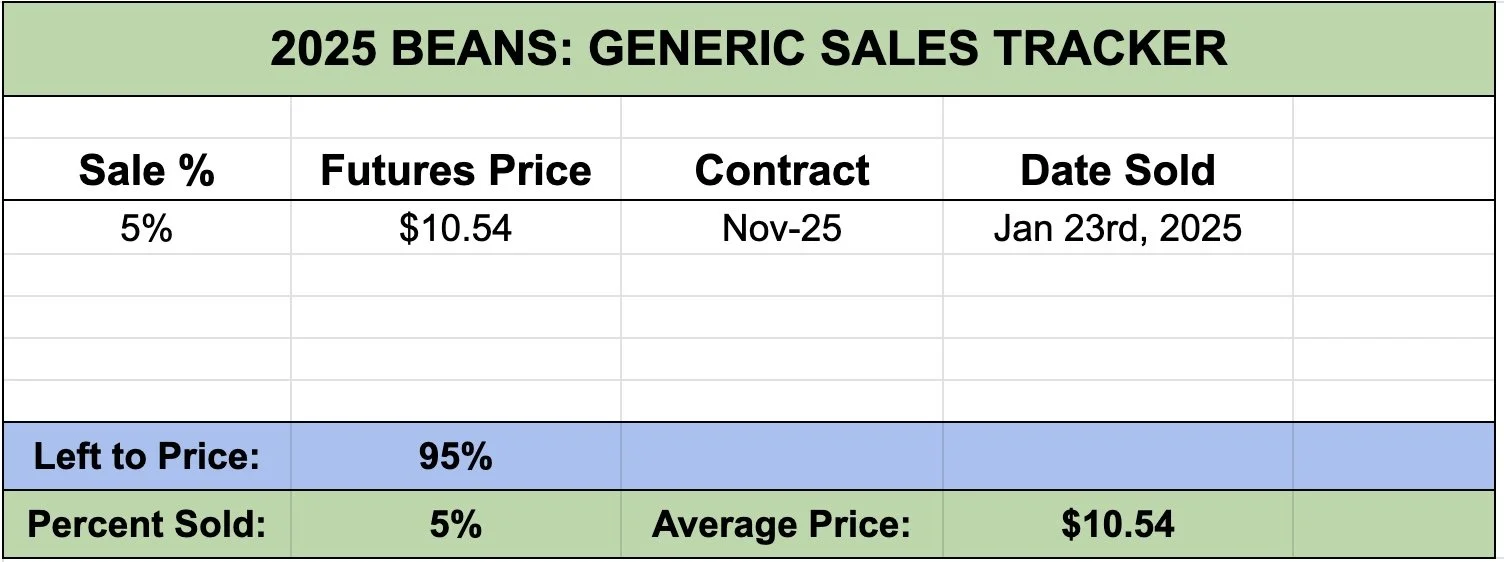

Made a 5% sale on generic sale tracker for new crop corn (tracker below)*

Listen to todays audio below

Want to talk or put together a market plan? Call or text us anytime:

CHARTS

March Corn 🌽

If we get a correction, looking for a bounce in the green box.

Thats the level bulls need to hold to keep an upward bias.

Continuous Corn 🌽

See how major of a spot this $4.97 level is?

It was major support several times, it is now resistance.

Like I mentioned a week or so ago, if we are going to struggle it would make sense to do so here.

If we bust above this level, it opens the door wide open to higher prices.

Big picture target is still $5.37

Dec-25 Corn 🌽

We hit my 2nd target at $4.72

So on my generic sales tracker I did price another 5% at $4.72. Bringing my total to 10% sold.

March Beans 🌱

Bulls would like to bounce right about now, otherwise it could trigger another leg lower.

We could technically drop all the way down to $10.13 to $10 and be fine from a technical standpoint as that would be the 50-61.8% retracement from this rally off the contract lows.

Bulls need to hold that green box however.

Looking to the upside, first upside objective is still another test of that black downward trendline. IF we bust that, then next target is $11.35

Nov-25 Beans 🌱

Next target I am looking to de-risk at is still $10.82

Then the bigger picture “possible” target several months from now is still the $11.50 area.

As it is the implied move from the inverse head & shoulders pattern as well as 78.6% of the May highs.

March Wheat 🌾

If we correct I am looking for a bounce in the green box (50-61.7% retracement of the recent rally). Bulls need to hold that.

Looking to the upside, $6.20 is still my target I am looking at to take risk off the table.

March KC Wheat 🌾

Would like to see us hold that green line at $5.89, but it is not the end of the world if we don’t.

Either way, next target to take risk off is still $6.30

USDA NUMBERS

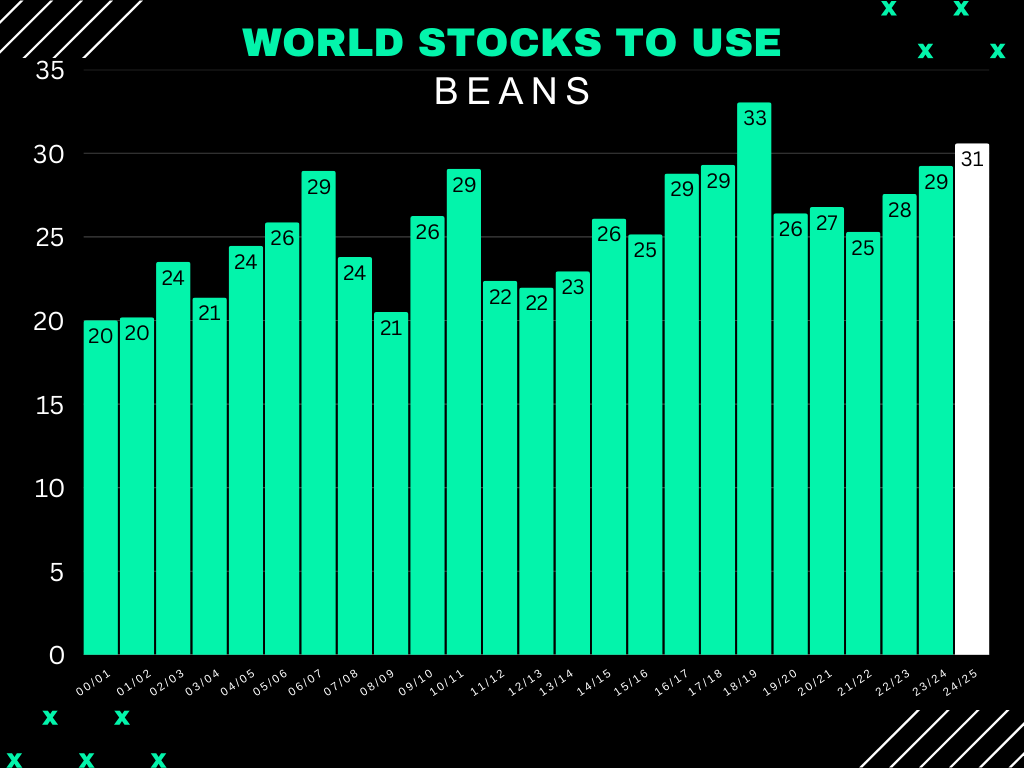

UPDATED WORLD STOCKS TO USE

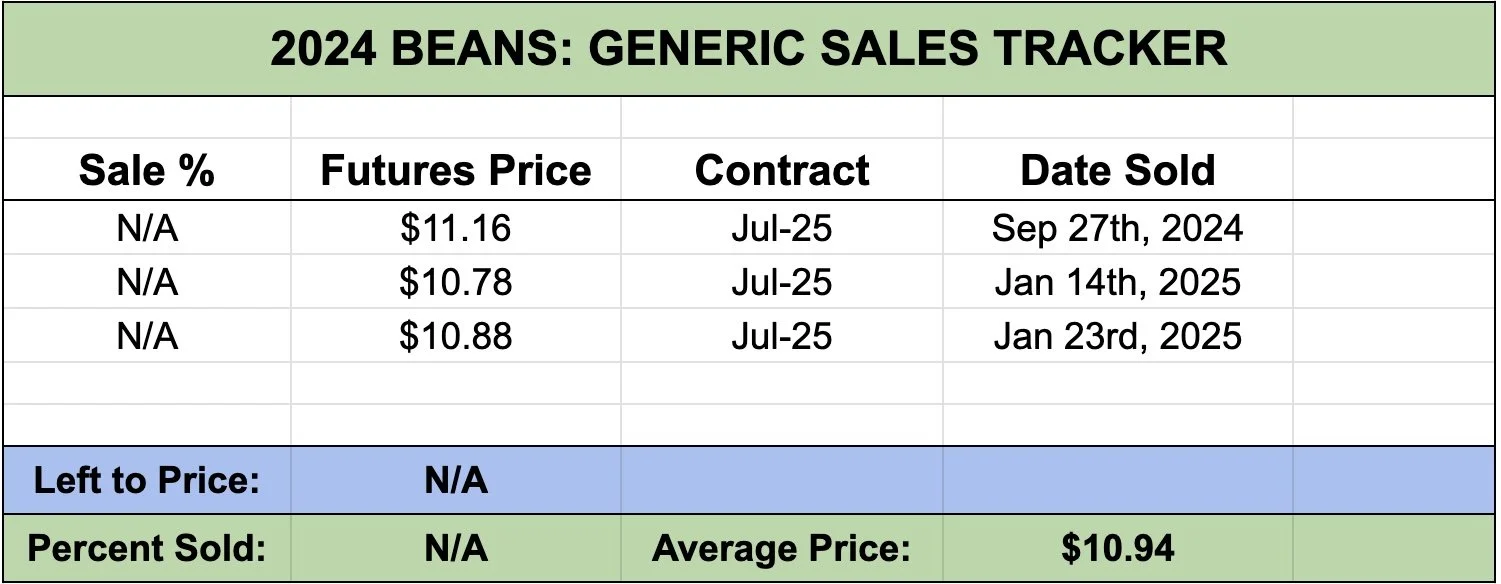

Generic Cash Sales Tracker

Due to requests here is our generic cash sales trackers.

This does not include any hedge recommendations etc. Simply cash.

This is futures prices.

For old crop there is no percentages as we only recently started tracking our generic sell signals. Future new crop sales will have percentages as we continue to make sales.

This will be included at the bottom of every update.

*NEW SALE: 5% NEW CROP CORN AT $4.72

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

2/10/25

USDA TOMORROW. LONG TERM PATH FOR SUB 10% CORN STOCKS TO USE?

2/7/25

WHY WOULD THE FUNDS EXIT THEIR LONGS?

2/6/25

WHEAT FINALLY CATCHING A BID

2/5/25

COMPLETE THOUGHTS ON MARKETS: BACK & FORTH DISCUSSION

2/4/25

STRONG JANUARY LEAD TO STRONG YEAR? TARIFFS, CHARTS & MORE

2/3/25

TARIFFS PUSHED BACK

1/31/25

TARIFF NEWS ALL OVER THE PLACE. ARE YOU PREPARED FOR POSSIBILITIES?

1/30/25

WHEAT BULL ARGUMENT. TRUMP ADDS TARIFFS

1/29/25

CORN APPROACHES $5.00

1/28/25

TARIFFS, CORN FUNDS, SOUTH AMERICA & MORE

1/27/25

HEALTHY CORRECTION WE TALKED ABOUT & TARIFF NEWS

1/24/25

GRAINS DUE FOR SHORT TERM CORRECTION?

1/23/25

OUR ENTIRE NEW CROP SALES THOUGHTS & OLD CROP SELL SIGNAL

1/22/25

GRAINS TAKE A BREATHER. IS CORN IN A BULL OR BEAR MARKET?

1/21/25

HUGE DAY IN GRAINS. WHAT TO DO WITH OLD CROP VS NEW CROP

Read More

1/20/25

VIDEO CHART UPDATE

1/17/25

TRUMP, CHINA, ARGY & USING THE SPREADS INVERSE

1/16/25

OLD CROP LEADS US LOWER. MARKETING THOUGHTS

1/15/25

SIGNAL & HEDGE ALERT QUESTIONS EXPLAINED. IS $6 CORN EVEN POSSIBLE?

1/14/25

MORE DETAILS ON TODAYS HEDGE ALERT & SELL SIGNAL

1/14/25

CORN & SOYBEANS HEDGE ALERT/SELL SIGNAL

1/13/25

USDA GAME CHANGER OR NOT?

1/10/25

BULLISH USDA FOR CORN & BEANS

1/9/25

USDA OUT TOMORROW

1/8/25

2 DAYS UNTIL USDA. BE PREPARED

1/7/25

THE HISTORY OF THE JAN USDA & MORE

1/6/25

MAJOR USDA REPORT FRIDAY

1/3/25

UGLY DAY ACROSS THE GRAINS

1/2/25

LONG TERM CORN UPTREND? JANUARY DROP OFF IN BEANS? LONG TERM WHEAT FACTORS

1/2/25

CATTLE HEDGE ALERT

12/31/24

MASSIVE DAY FOR GRAINS. FLOORS? 2025 SALES? GAME PLAN? CHART BREAKDOWNS

12/30/24

GRAINS FADE EARLY HIGHS

12/27/24

STILL LONG TERM UPSIDE POTENTIAL, BUT TAKE ADVANTAGE OF 6 MONTH CORN HIGH

12/26/24

CORN ABOVE 200-DAY MA. ARGY DRY. BEANS +44 CENTS OFF LOWS

12/23/24

CORN & BEANS TALE OF 2 STORIES. BEANS REJECT OLD SUPPORT

12/20/24

PERFECT BOUNCE IN CORN. SIMPLE BEAN BACKTEST BEFORE LOWER?

12/19/24

THE SOYBEAN PROBLEM. NEW WHEAT LOWS. CORN UPTREND

12/18/24

BEANS BREAK SUPPORT & OPEN FLOOD GATES

12/17/24

SINK OR SWIM TIME FOR SOYBEANS

12/16/24

SOYBEANS & WHEAT FIGHTING LOWS. WILL CORN DEMAND CONTINUE

12/13/24

POST USDA COOL OFF

12/12/24

CORN CORRECTION. WHY WE ALERTED SELL SIGNAL YESTERDAY

12/11/24

USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

12/11/24

CORN SELL SIGNAL

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24