ARE GRAIN SPREADS TELLING US SOMETHING?

Apologies for getting this out late as we are traveling*

Overview

After 7 brutal days corn and beans finally rally. Both posting one of their best days all year year long.

Corn had a phenomenal close at the highs. Engulfing the past 4 closes.

On the other hand, despite continued worries about the Russian wheat crop, harvest pressure led to lower wheat today. Harvest is going well and so far the crops are looking good. However, these crops looking good was expected. We have better ratings than the last two years and the crop tours already confirmed this a while back.

Today's rally in corn and beans was a lot of technical and fund buying. This sell off was overdone and the funds realize that. Like I mentioned earlier this week, there wasn’t a major reason for prices to continue to fall out of bed.

Not only did we have technical and fund buying, there is rumors that China is looking to buy. As we made sales to Spain and unknown (likely China).

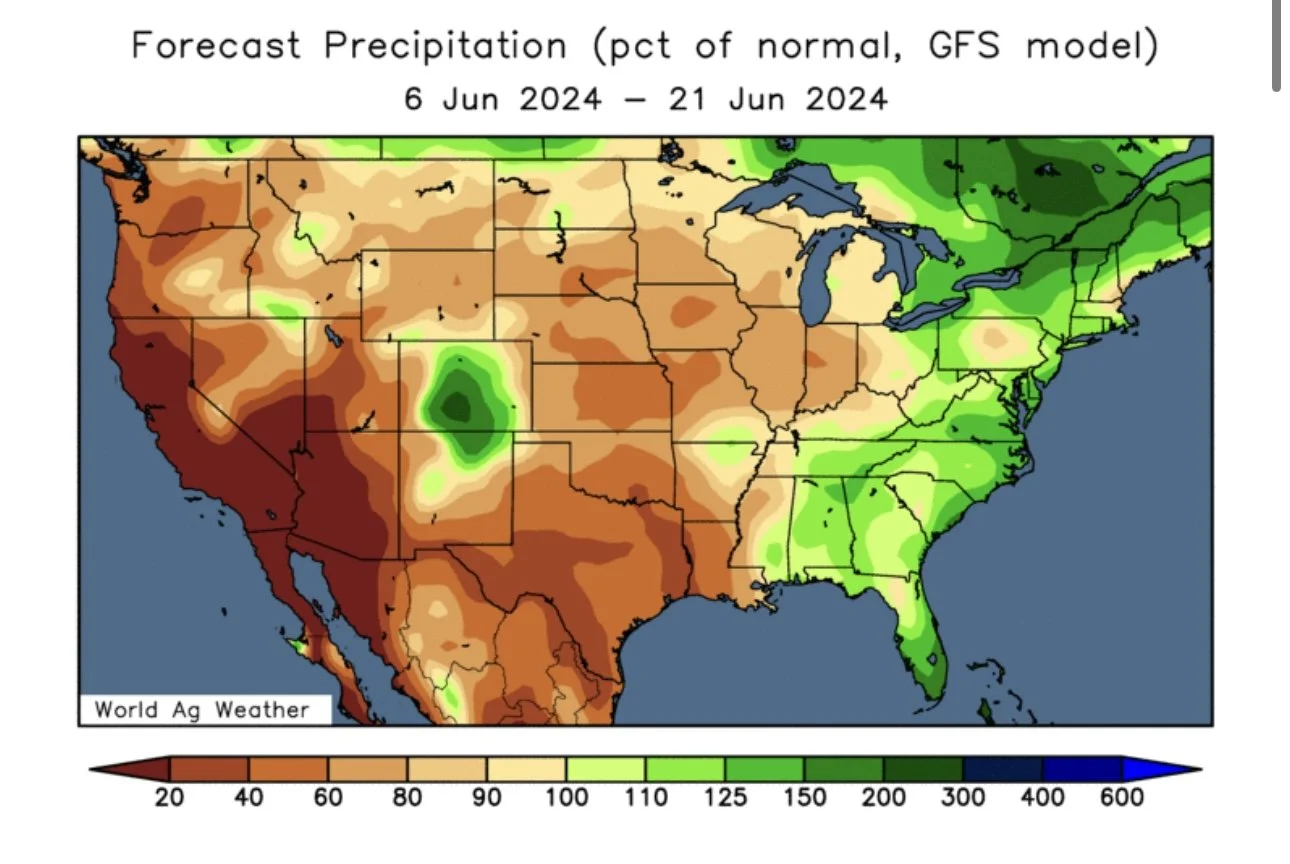

Weather looks dry and cool for most of corn belt next 10 days. But come June 14th, things are looking to heat up FAST. Normally, this 10 day dry forecast would be seen as a concern the past few years, but our subsoil moisture is great so it is not a concern at all here.

Our subsoil moisture is amazing, but hot temps and little rain in the forecasts is going to catch the attention of traders as we get back into a weather market. Too wet early and too hot late are usually not the best recipe either.

One day of higher prices doesn’t change a trend and we 1,000% need another day of follow through strength to confirm more upside.

But the biggest thing today that perhaps signals that we might be going higher is the spreads.

Both corn and bean bull spreads made new highs for the move today, as the nearby has been gaining on the deferred.

First take a look at corn. The July-Sep spread went from -11 cents to -5 cents. And is now at less of a carry than where we were at our highs.

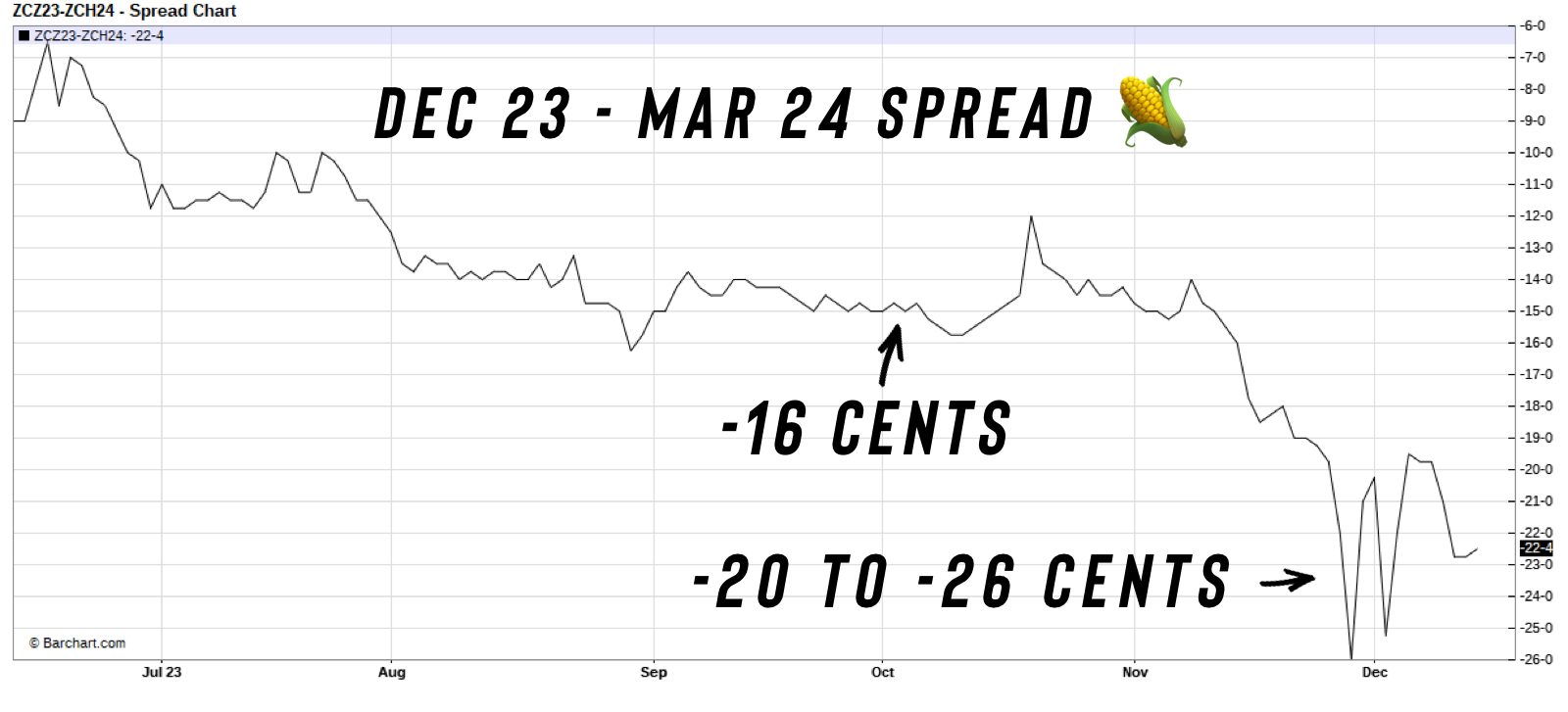

Look at how massive the carrys were.

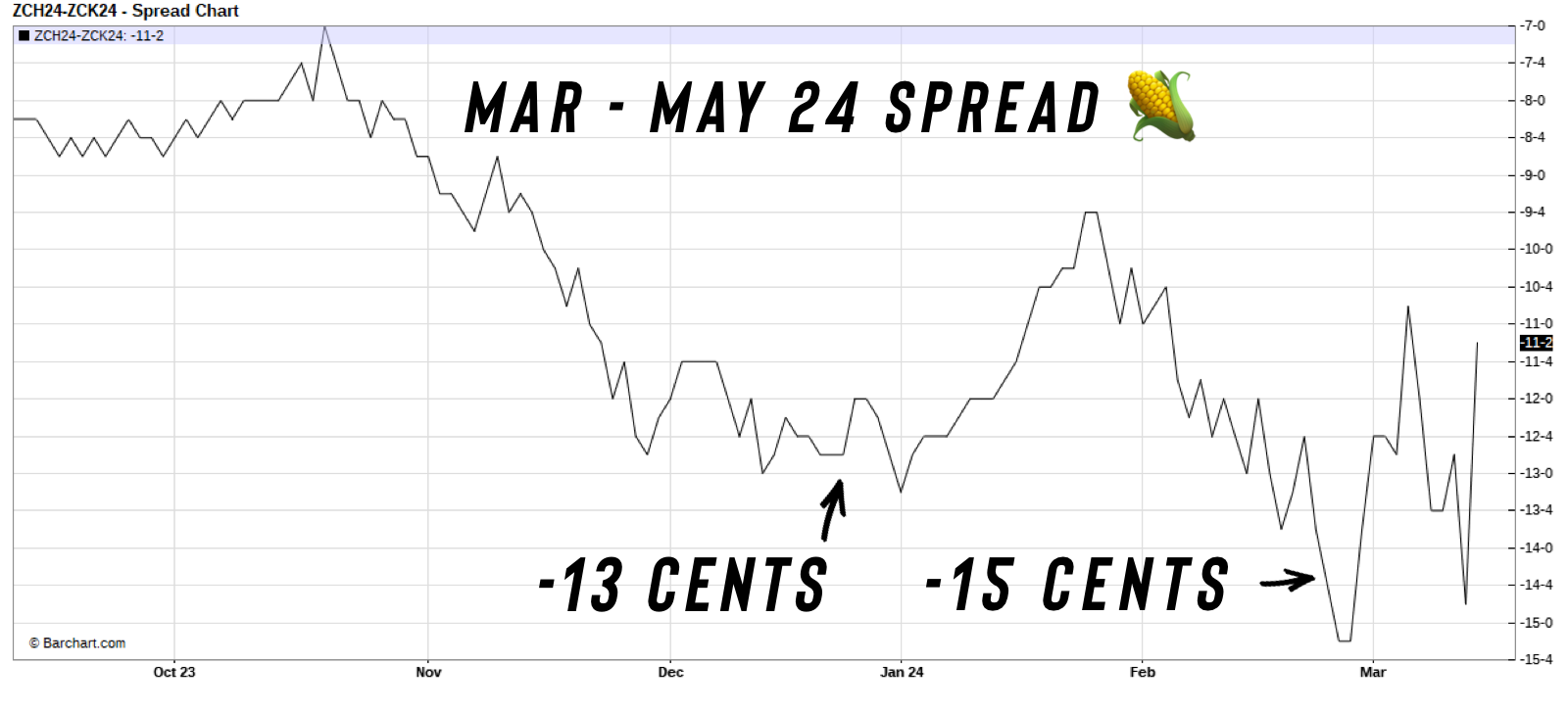

In the March to May spread we had a -15 cent carry.

In Dec 23 to March 24 spread we had up to a -26 cent carry.

Today we have less than a -6 cent carry. The spread was massive, and now it is shrinking. It is not doing what previous months did.

When spreads firm, it indicates higher prices. It shows the market has more demand or needs more supply vs than it did back then. If prices were as bearish as they were in a few months ago, that spread would be 10-15 cents instead of 6. So it shows we are finding demand at these levels.

Beans old crop futures were already inverted even though futures had been down 7 days in a row. Now that is a bullish indicator.

We are now at a +33 cent inverse, a larger inverse than when we made our highs.

Usually spreads firm when a market goes up. When they firm up while futures are falling, that is usually a sign that we are done going down.

Spreads are firming. Basis is also firming. This isn’t something you usually see if we are going to get a lot lower prices.

Today's Main Takeaways

Corn

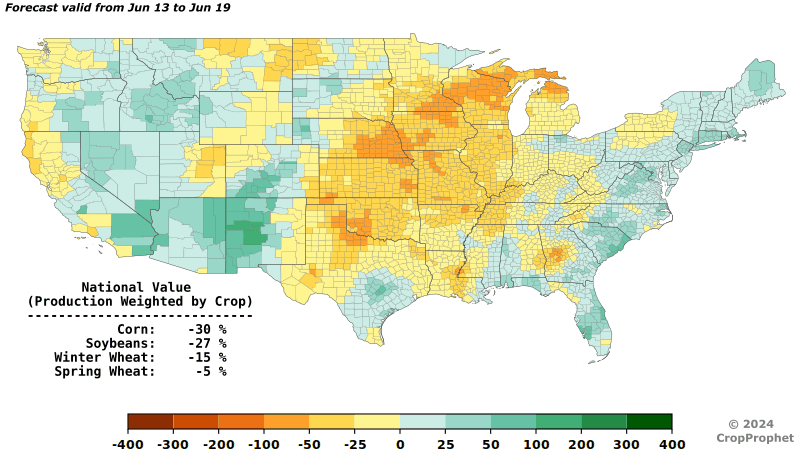

The funds has been selling on the idea that there isn't any risk here to the crop. That the crops right now look fantastic, the ratings were good, and our subsoil moisture is the best in years.

No. There is no immediate weather concern. But as I have been mentioning for months, the outlook for this summer is still very hot. Not the type of heat where you say "It gets hot every year".

The heat cranks up by June 14th.

This still makes me believe we will get another weather scare. Remember, a futures market prices in what "could" happen in the future, not necessarily what actually unfolds. Hence why it is called a futures market. Even the thought of uncertainty for a week or two can cause a rally.

Do NOT expect the USDA to lower yield in this months USDA report. It is too early and they almost never adjust yield in June. They have only done it on severe delayed planting years like 2019. This wasn't 2019.

BIG day on the charts. We took out the past 4 days. We have also took back that trendline we gave away. I like corn higher, but a day is not a trend changer. We need follow through.

It also does not change where your risk is, and as a farmer for most that is to the downside. You have to know how to use tools to keep your upside open while defending your downside.

I see a rally, but rather than gambling, you can capitalize using strategies. You can use a call option to cover the sales you made or will make, or you can get a put here to protect from downside. Some of you even may want to look at cheap courage calls right now to help give you the courage to make a sale if we go higher.

With this sell off, implied volatility dropped. Making options relatively cheaper. Making it cheaper for you to protect yourself from further downside or participate in potential upside.

As we move further into growing season, prices of options will increase as implied volatility increases.

Looking at the chart, we got a potential bear trap on Dec corn. Those stops at $4.59 got hit then reversed. The algos love to do that.

As for targets, I think we could get to $4.65-75 July corn and $5.00 or higher Dec corn. Nearly every single analyst knows we have that $5.03 gap on Dec corn.

If you want to know what your specific operation should be doing, give us a call (605)295-3100.

July Corn

Dec Corn

Soybeans

Outside of the spreads, the other big thing today was the news of Brazil taxing their farmers 20% on a new Government bill yesterday.

This will lead to less farmer selling from them the next 120 days which the plan is approved for. This plan still has to be approved by legislation but it could boost the US bean and corn export potential this summer.

Many of those farmers are at the cost of production, If you are going to raise taxes you are going to slow down the acreage growth. This is a good thing for the US farmer and should lead to less competition.

Brazil soybeans for Aug CFR China have just become more expensive than PNW for Sep-Oct. This could be important. Demand is poor. And something we desperately need with the worst new crop book of sales in 20 years. Brazil has been able to offer a lot cheaper beans than the US, but perhaps that will start to change with this potential tax situation. There is also rumors that China is looking to buy.

Today we crawled back to $12.00. And with today's rally the chart doesn’t look as awful as it did yesterday. Like corn, we reclaimed that trendline.

Spreads say prices are going higher. Personally I think we still have the potential to see a lot higher prices with an entire growing season ahead. Keep in mind, the carry out situation in beans is tight enough to where if we lose a yield bushels of yield we could certainly run out of beans. But nobody has a crystal ball.

I think we get a seasonal rally and would like to think $13 isn’t completely off the table. But if Mother Nature is kind and demand doesn’t improve, we could be looking at a lot cheaper prices come harvest.

As I mentioned, options are cheaper now. So this provides you the ability to lock in a floor on unpriced bushels or use a call on sold bushels. If you are undersold, I'd lean towards puts. If you are oversold, perhaps look at some calls to re-own if you think prices have upside. Depends on your situation.

Call or text us with questions. (605)295-3100.

Corn typically makes its highs in June. But July can often bring a soybean rally as well due to its later reproductive cycle being later than corn. Which means implied volatility on options can also get more expensive heading into July.

Some Tidbits: Nov futures are higher in mid-July vs Memorial Day 55% of years (before Memorial Day we were $12.19); The USDA's acreage report at the end of the month often tends to surprise. Last year they reported 83.5 million acres. Well below the expectations. In response, the bean market rallied 80 cents and continues higher. Just a reminder how fast these markets can change either direction.

July Beans

Wheat

Wheat lower yet again even with confirmations that the Russian crop is indeed getting smaller.

Wheat is getting pressured from harvest here in the US, as those crops look pretty good. But this was something we already knew about.

Perhaps the funds thought they were too short corn and not short enough wheat.

Russian winter wheat is fire, and a big portion was lost to the frost, but the trade has already priced this in for the most part.

We had good new crop sales and Algeria and Egypt bought 1.4 MMT of wheat in one day which is friendly.

Russia says that are going to have more cuts to their wheat crops. That crop is now down -14 MMT from early April. Ultimately this should help US demand. Right now the US is still not extremely competitive compared to the Black Sea. If we do not get any demand, it really doesn’t matter how small this Russia crop is. It has to lead to demand to push prices.

SovEcon reduced their Russia crop to 80.7 MMT. This is down nearly -2% from their last estimate and down a whopping -14% from their March number.

Last year Russia's crop was 93 MMT. In 2022 it was 104 MMT.

This year it is 80 MMT or perhaps lower. A major change in the global wheat market.

We have not got any news on this, but if Russia came out with an export restriction it would be very friendly. Something to watch out for.

Today we broke -15 cents off our highs. Chicago wheat is now down about -60 cents from it's recent high close. The chart does not look great, but we could be entering a support zone here.

We alerted a wheat sale and or puts for protection when we were trading around $7. Today we are all the way down to $6.40. I do believe we have not seen the last of a Russian wheat headline that leads to rally, but this does not have to happen. This was considered a supply rally, supply rallies often don’t last long. But I wouldn’t be surprised to see another quick run. To do so we will likely need another headline out of Russia.

If you didn’t make any sales and need to play catch up, there still nothing wrong with making a few wheat sales if you are someone who knows you are going to have to move wheat off the combine, needs cash flow etc. Despite being well off the highs now, we are still higher than we have been essentially since last year. Puts are also never a bad idea when you are still sitting over $1.00 off the lows.

For those that followed our wheat sale, we may want to wait a bit but we are entering a spot where it wouldn’t be the worst idea in the world to consider re-owning some of those sales if you believe we have more uspide.

July Chicago

July KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24