USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Soybeans and wheat both higher following yesterdays USDA report.

Corn on the other hand actually closes lower, topping out right at that 200-day MA target we had been mentioning.

Why was corn lower today?

Usually a report this bullish would’ve led to a big rally. But it did not.

It looks like the trade was already pricing in this bump in demand. Hence the recent rally.

If corn carryout would’ve remained unchanged, we likely would have taken it on the chin.

USDA Report

The USDA report was in my opinion friendly for corn and neutral to both wheat and soybeans.

The biggest surprise was of course corn demand. We thought the USDA should acknowledge demand but weren’t sure if they'd kick the can down the road.

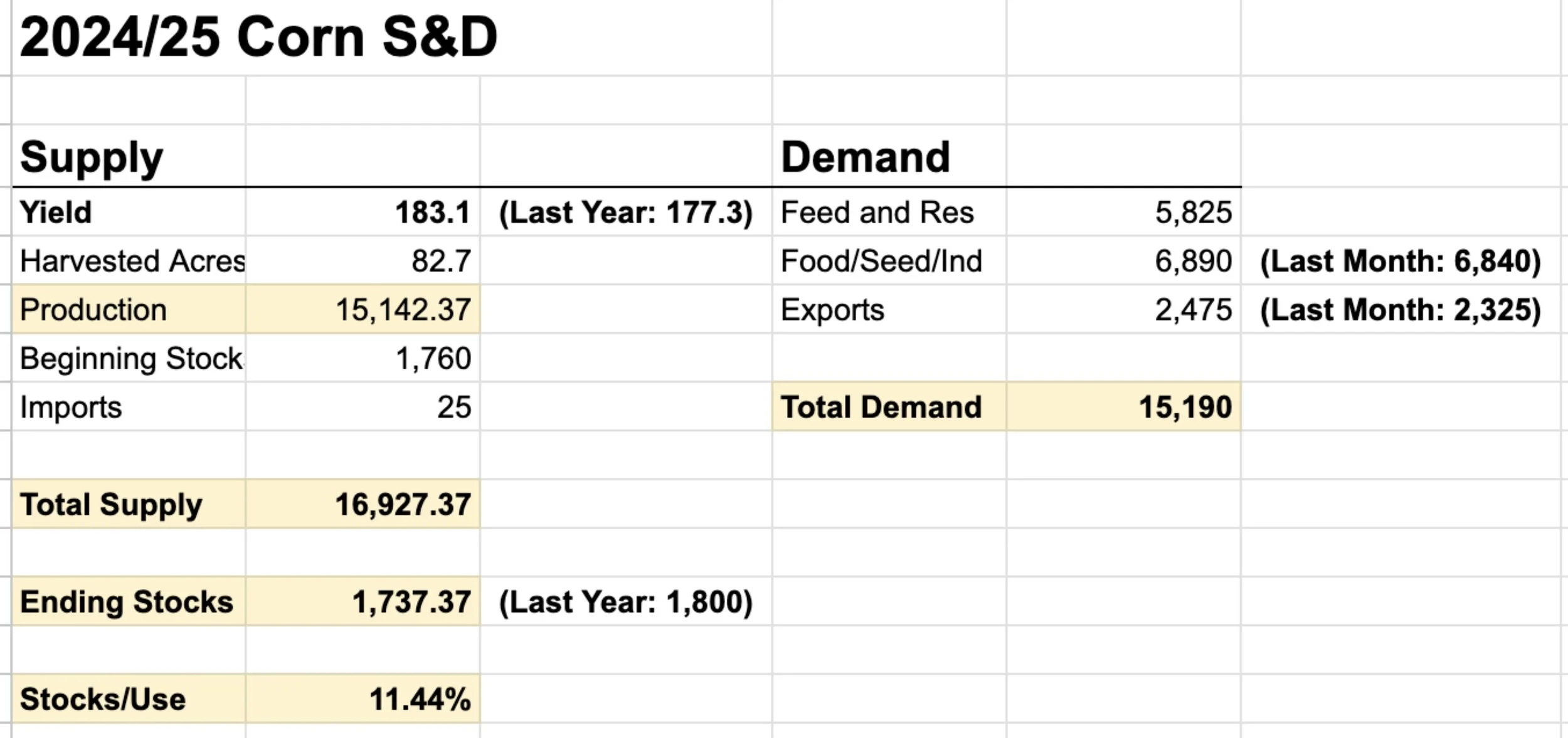

Corn carryout fell from 1.938 to 1.738 billion. A huge -200 million bushel decrease from last month.

The demand increase came from:

+50 million bushels of ethanol

+150 million bushels of exports

Many weren’t sure if they'd pull the trigger on exports, with some questioning if demand was front ran before Trump. So the USDA must think these sales are here to stay.

Consensus was ethanol needed to be bumped and we got it. So great report for corn as the USDA acknowledged demand.

A 1.74 billion bushel carryout isn’t wildly bullish. But remember, not too long ago there was chatter about the potential for a 2.5 billion one.

As for soybeans & wheat, we didn’t see major changes.

We saw a slight bump to exports in wheat which led to US carryout dropping slightly.

The USDA also dropped China corn imports by -2 MMT to 14 MMT, so the USDA isn’t too confident China will be buying corn.

What's Fair Value for Corn?

A while ago I mentioned in my update that historically a 1 billion bushel carryout in corn roughly equates to $8.00 futures to ration demand.

Where as a 2 billion bushel carryout roughly equates to $4.00 futures.

So 1 billion = $8 and 2 billion = $4

This means that every 100 million bushels of carryout in-between equates to around 40 cents of value.

Before yesterday we had a carryout of 1.9 billion which meant corn's "fair value" was about $4.40

Today corn carryout is at 1.74 billion. Which means we have 250 million bushels less than 2 billion.

That equates to about +$1.00 higher than $4.00 (2 billion bushels) if every 100 million truly equals $0.40 cents of value.

The numbers broke down:

-100 million = $0.40 cents

-100 million = $0.40 cents

-50 million = $0.20 cents

Total: -250 million or $1.00 of value vs a 2 billion bushel carryout and $4.00 futures.

Based on this, one could suggest corn has a true value of about $5.00 as of today.

Black Oil Sunflowers Offers:

We are looking for black oil sunflower offers.

Shoot Jeremey a call or text at (605)295-3100 with any new crop black oil sunflowers you have for sale.

With harvest over now, this is the time where you need to be proactive and have a marketing plan.

So if you'd like to talk through your operation, please feel free to reach out to us. It doesn’t cost you anything.

(605)295-3100

Today's Main Takeaways

Corn

I already went over pretty much everything for corn.

Like I have been saying for a long time, I still think demand will lead corn higher longer term. Which is exactly what we are seeing thus far.

Corn yield is +6 bpa higher than last year, but carryout is now actually lower than last year, (Current: 1.738 / Last Year: 1.80 billion). This is possible due to demand.

Demand driven markets last. Supply driven ones do not.

Short term, I could see us take a breather but we don’t have to. From a technical standpoint we are overbought and due for a small correction.

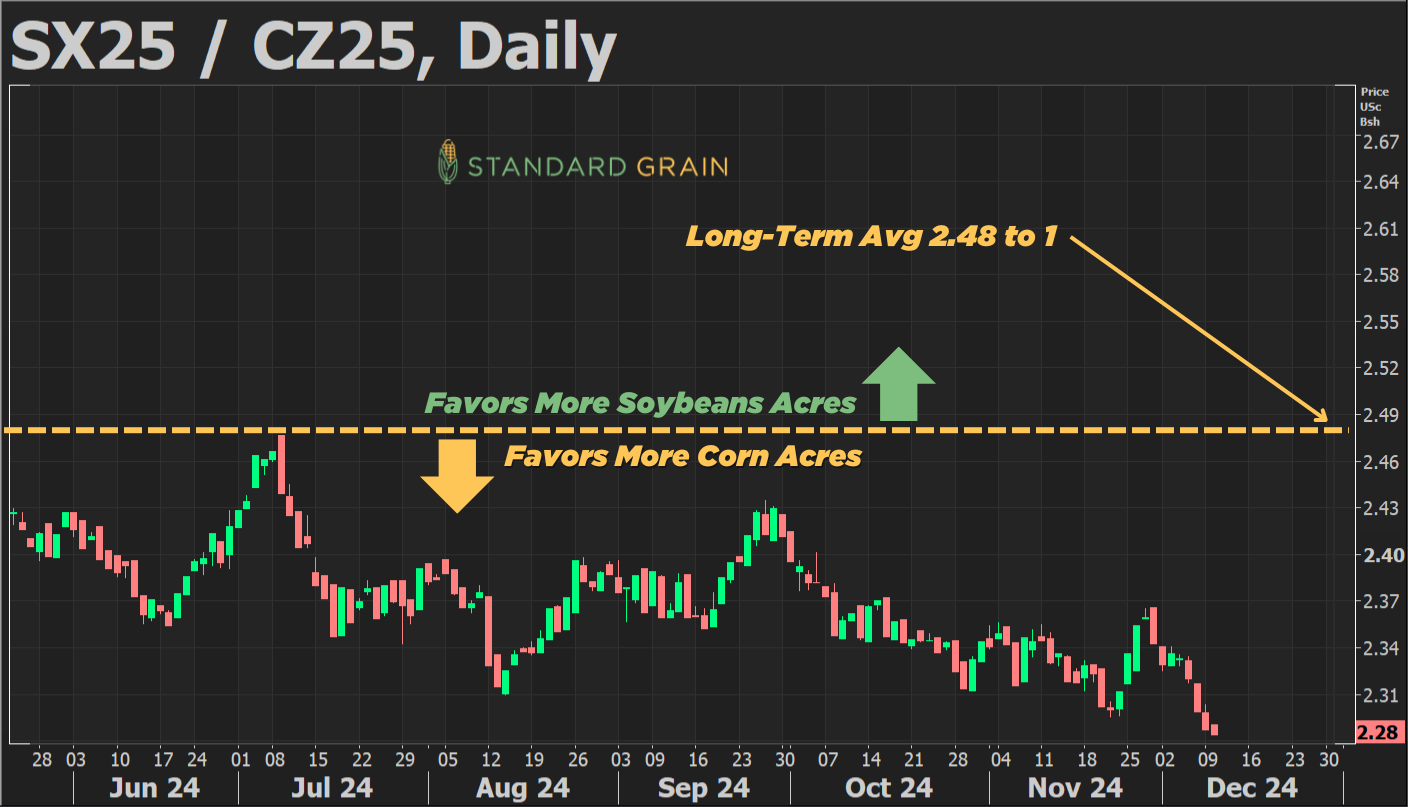

Looking long term, one tailwind we might face next year is more acres switching over to corn from beans due to the poor bean prices.

Here is a good chart from Standard Grain that shows Corn vs Soybean prices. Above that middle line favors more bean acres, below favors more acres.

In Brazil, they are actually getting too much rain. So this could push back soybean harvest and shrink the window for the 2nd corn crop and lead to some late planting.

In case you missed it, today we did alert a sell signal for corn as we hit one of those targets we had been talking about for a while. The 200-day MA.

Here was the signal:

Those of you that have corn to move by the end of February should consider pricing some of that corn that you need to move by the end of February.

If you feel basis in your area will continue to strengthen then we like just buying the $4.50 February corn puts for 10 cents. We would do this on 100% of the corn you have to move by then.

If you feel basis will weaken we would sell the cash corn and re-own with a February $4.50 corn call for 10 cents.

Either strategy creates a futures price floor of $4.40.

Your upside is open through the big USDA report in January. You are locking in a minimum price of nearly +55 cents off the harvest lows.

For those that have to move corn in March or April, we would buy puts on 25% of what you need to move.

If you do not have a hedge account you can call Jeremey at (605)295-3100 or CLICK HERE

For those that do not want to use options, we would sell 33% of what you need to move by the end of February.

Why we alerted the signal:

We hit the 200-day MA which has been a target of ours for a very long time.

I said in past updates that this target is the green light to re-hedge or take risk off the table if you are someone who needs to do.

Right here you can see that the 200-day MA has acted as a major lid on corn futures.

This goes all the way back to 2022 if you followed along when Dec-24 corn was the main contract.

I think we might be able to flip this from resistance to support, but either way this is a huge resistance area.

The last reason is the stochastics.

They are topped out.

This doesn’t mean we have to go lower, but it usually signals that we will lose momentum and could see a correction.

The vertical purple lines mark each time the stochastic topped out.

This also happens to be each time corn put in a local high.

I could very easily see us take a pause here.

Soybeans

The USDA report was a nothing burger for soybeans. No changes at all.

The biggest hurdle is still this monster crop out of Brazil.

Do we get a weather scare or not?

How much of the monster crop is already priced in?

Impossible to know. Either way, the global balance sheet for soybeans is still very bearish.

So there isn’t much reason to get super bullish here.

But perhaps beans will have no choice but to follow corn higher, especially new crop. As there is a chance that corn remains strong and soybeans get some sympathy strength.

Short term, I do think we could get a possible breakout higher.

If we look at the chart, we are close to busting this downward trend from May.

The descending triangle we are trapped in is getting very tight waiting for a breakout to either direction.

If we breakout here, it might be a good opportunity. I am targeting that black downward trendline as my next spot to de-risk if we get there.

We do still need to hold these lows, as if we do not the implied move to the downside still gives us sub $9.00 beans.

The indicators also favor a bounce here.

The MACD flipped bullish the other day. Purple circles are the last 2 times it did so.

The RSI also printed bullish divergence the other day. Both of these usually signal a bounce.

Wheat

Wheat higher for the 4th time in 5 days.

However, not great price action today as we closed -6 cents off the early highs.

In the USDA report we did see the USDA lower US wheat carryout, but not enough to move the market.

From Andrey Sizov Black Sea Guru:

"The issue is the USDA remains too optimistic about Russian exports. The lastest WASDE has 47 MMT vs 48 MMT earlier. SovEcon's forecast is 44.1 MMT."

If this is true, it is friendly. As it means Russia will be selling less cheap wheat on the export market.

Moving forward I still think wheat has plenty of upside potential long term and into next year.

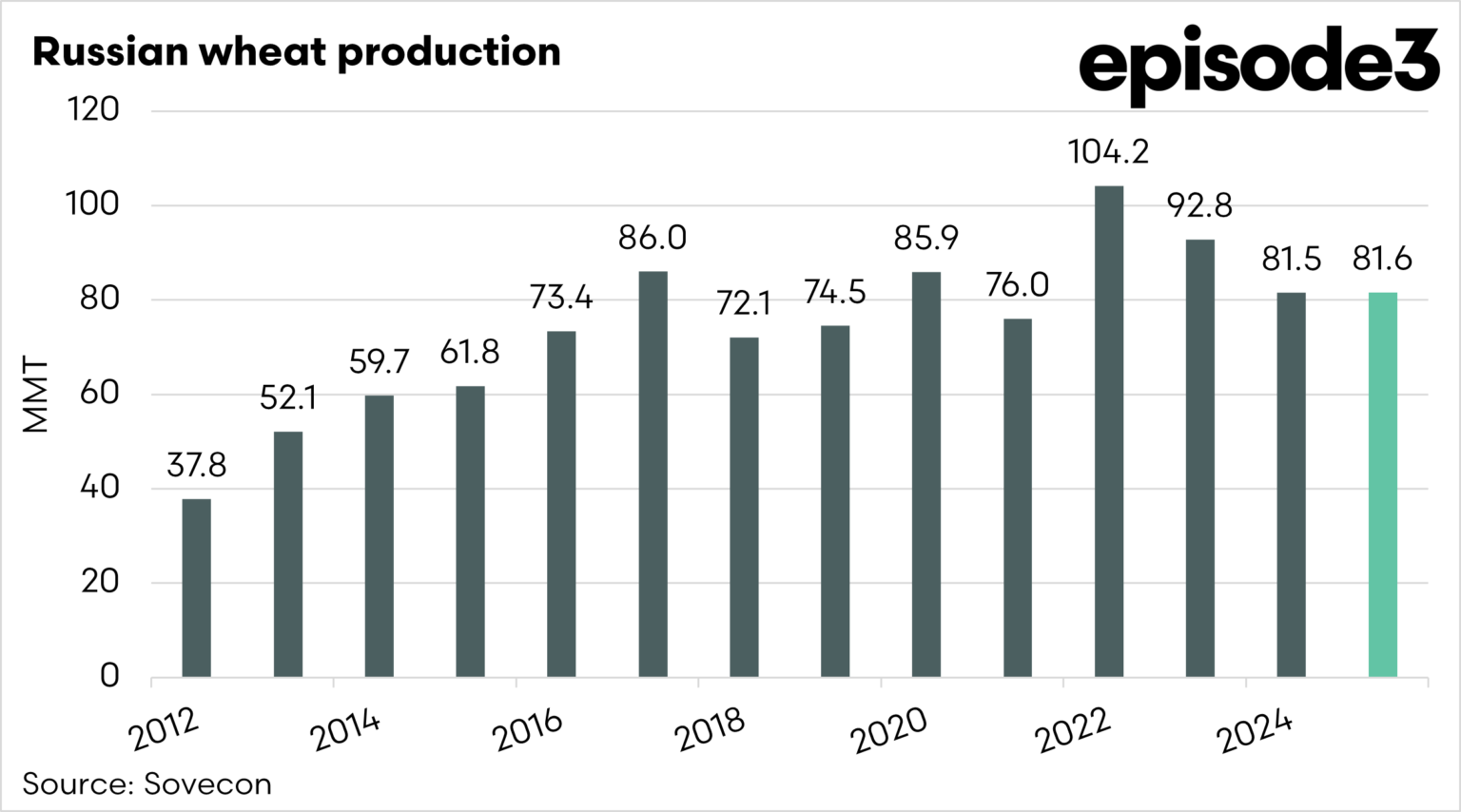

I think the Russia winter wheat crop story could be a big one down the road.

Their winter wheat crop is rated at 37% poor (worst of all-time) vs only 4% last year vs 7.3% on average.

Here is the current estimates for the Russian wheat crop from SovEcon. If this falls below 80 MMT it could be a big deal.

Currently SovEcon has their estimate at 81.6 MMT while most like the USDA have 84-86 MMT.

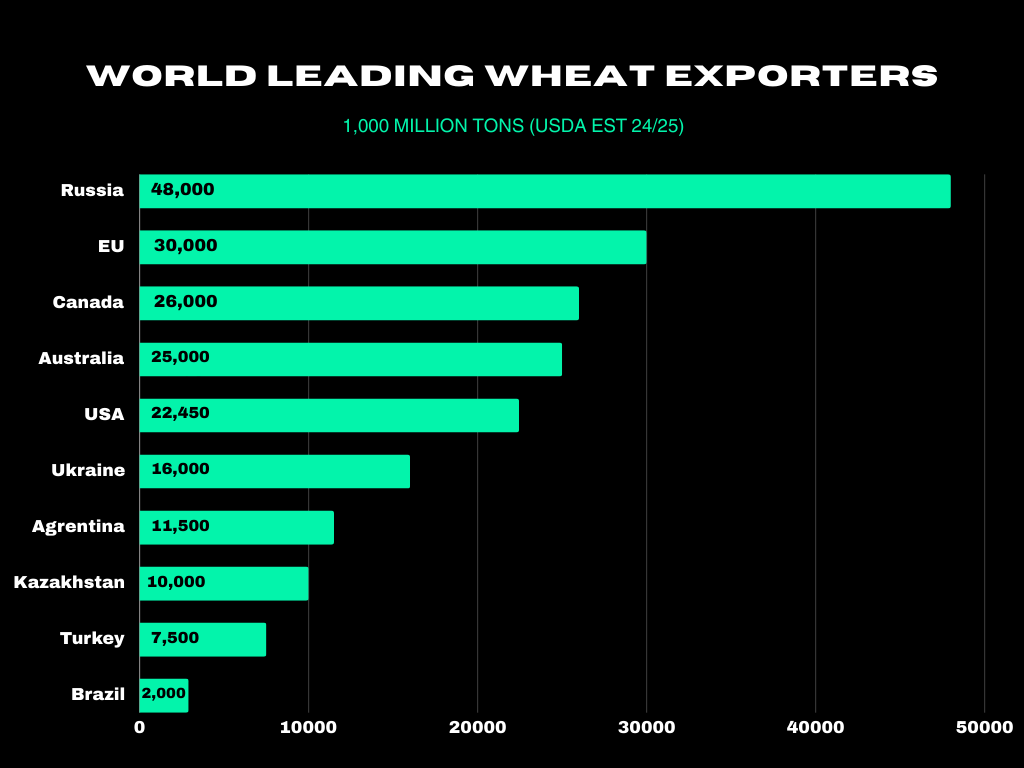

I showed this chart the other day, but look at how big of a chunk Russia has on the world export market.

If their crop has issues, it will be felt on a global scale.

Overall, long term I am optimistic but short term I am still cautious.

We broke out of that downward channel we have been trapped in since October. So that is great news.

But to be confident we are done going down I'd like to see us break above $5.84

KC wheat also looks to be breaking this downward channel.

Still need $5.89 to call a bottom.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24

TARIFF TALK PRESSURE

11/25/24

HOLIDAY TRADE, SEASONALS, TARGETS & DOWNSIDE RISKS

11/22/24

CORN TARGETS & CHINA CONCERNS

11/21/24

BEANS NEAR LOWS. CORN NEAR HIGHS. 2025 SALE THOUGHTS

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24