WAR, WEATHER, & WHEAT LIMIT UP

Overview

Grains rally across the board led by limit up action in the wheat market. The main thing today was more war headlines as Russia bombed the Danube river. This was one of two things we mentioned in yesterday's newsletter that could lead to much higher prices. If you missed that, you can check it out here.

The attacks on the Danube are very important because this is the second place where they can ship a lot of exports for Ukraine.

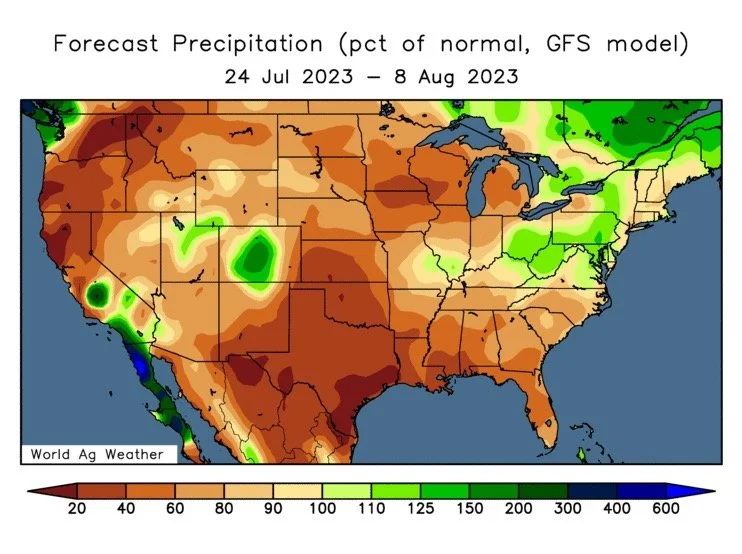

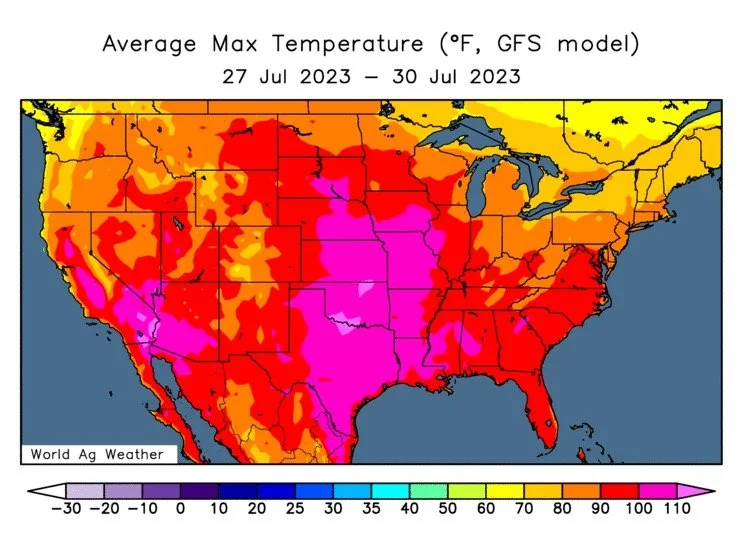

The other factor is weather. Temperatures are still very hot, with little precipitation. This is coming at a critical time frame for corn pollination as well as beans starting to set pods. A little early on the pod setting, but it is getting close.

So the two main factors going on in our markets both remain bullish. We will have to see if we get any further escalation overnight or later this week. If escalation continues, who knows how much more upside we could see. Then we also have the weather to add on top of that for now.

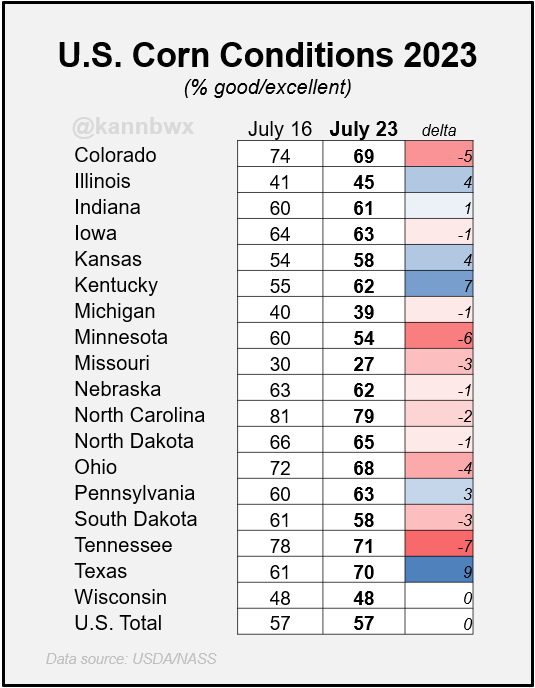

Crop conditions came in lower than expected across the board. Full numbers below. If they came in slightly lower to unchanged this week, I can imagine they will come in even lower next week with the weather we have rolling in.

Audio Commentary

Here is an audio from Jeremey where he goes over a bunch of marketing. Making decisions with wheat. What to do with targets. Waiting for a sign in these markets. Not leaving money on the table. Making money with puts, and more.

Crop Progress & Conditions

Corn 🌽

Rated G/E: 57%

Trade: 58%

Last Week: 57%

Last Year: 61%

Soybeans 🌱

Rated G/E: 54%

Trade: 55%

Last Week: 55%

Last Year: 59%

Spring Wheat 🌾

Rated G/E: 49%

Trade: 51%

Last Week: 51%

Last Year: 69%

Winter Wheat 🌾

Harvested: 68% (2nd slowest behind 1993)

Trade: 70%

Last Week: 56%

Last Year: 76%

Average: 77%

Today's Main Takeaways

Corn

Corn ends the day up 32 cents off the back of weather and war headlines. As we took out our highs from last week, closing at $5.68. We nearly got that full 62% retracement to the $5.73 level we had talking about the last week, as our high for the day was $5.72.

As mentioned, corn conditions were left unchanged, but the trade was expecting improvements. Coming in at 57% rated good to excellent.

Here is the state by state breakdown from Karen Braun.

The weather still looks fairly bullish as the corn belt and the entire US is going through a pretty massive heat wave. (Forecasts in bean section)

Below is a good post from Eric Snodgrass on Twitter with the. He said:

"Heading into this week's Midwest heat wave, I wanted to post the current accumulated stress degree map.

Calculated by adding degrees above 86 degrees for each day.

For example: if today is 95 degrees, 9 SDDs are accumulated.

>140 SDDs could result in corn yield loss"

$5.75 is our target we have had for a few week or two. Now sure, that is an okay spot to make some sales, and it might make sense to put in a floor here. But if wheat decides to go crazy, corn will follow. The biggest thing for that to happen would be if Ukraine attacks Russia in a way that threatens their supplies. I also expect weather to provide support throughout the rest of the month.

Corn Dec-23

Soybeans

Beans follow the rest of the grains higher here today. Ending up 23 cents. We are now within striking distance from contract highs.

Nov beans are now up a whopping 26% and $3 off our of May 31st lows of $11.30.

Beans aren’t as directly effected by the war headlines and corn and wheat. Thus not quiet as much strength today. So today perhaps a little bit of profit taking and unwinding of the spreads, as money looked to move into the wheat market and out of the beans.

Bean conditions fell 1% to 54%, the trade was expecting them to be left unchanged.

Here is a state by state breakdown from Karen Braun.

Weather will be the key thing for beans moving forward. Over the weekend, the rain that actually fell across the country came up short for the most part.

Forecasts for this week are also showing very little chances of rain, with a ton of heat.

We all know beans are made in August, so this weather scare might be a tad early. But we are getting very close for beans setting pods. The weather the next few weeks will be the factor that drives us to $15+ or back down to $13.

We finally broke out of that brutal downtrend from May of 2022. Beans are now 24 cents away from making new contract highs. Why would we stop here? Bulls next target is $14.48

I still recommend making old crop sales if you have any left, and if you need to, there is nothing wrong with making some new crop ones as well. If we go higher, you can grab some puts and make money on the way down. If we go lower, well you timed it perfectly. We still see us hitting $15 by early August unless we get some above-average rain. I have said this time and time again, but we need to remember that we were $3 lower not too ago. If you need help with a hedge account or have specific questions shoot us a text or call anytime at (605)295-3100.

Soybeans Nov-23

Wheat

Wheat leads the grains higher here today following the Russia attacks we mentioned. As Chicago wheat closes limit up, KC wheat nearly does (up 58 cents) and Minneapolis follows up 49 cents.

Tomorrow, we will have expanded trading limits to 90 cents for both Chicago and KC wheat tomorrow. Something to keep in mind. If we get more headlines, who is to say we don’t trade limit again tomorrow or the next day?

On a side note, conditions came in bullish again fro spring wheat. Coming in 2% below the trade estimates and from last week. Coming in at 49% rated good to excellent.

The funds are still short Chicago, as the funds had been it's bully for however long now. With the funds short, it will give Chicago all the more power to go higher if we get more headlines. So we look for Chicago to lead short term.

For those of you that read yesterday's newsletter. We said that wheat had the chance to take out it's highs it had the past 12 months if 1 of 2 things happened overseas.

The first was attacks on Danube river. Which happened today.

The second was if Ukraine attacks in a way that disrupts the shipment of Russian wheat. As Russia has nearly 50 million metric tons of wheat to ship.

If that second scenario happened, there is no telling how high we could go. Nobody can predict this war. But we do know that if these scenarios do happen, wheat could be going much higher, very fast.

Not a lot of people have been talking about the possibility for us to see a repeat of last year. That has been something we have mentioned for months on this continuation of slowly lower prices. We didn’t know when it would happen, but we always said it was a possibility.

With this, if we do continue to take off, the wheat market will provide such a huge opportunity. For those that are nervous, or uncomfortable. If you need to take some risk off with this rally then do so. I don’t mind the idea of making some KC sales. I did notice a few other advisors had placed sell signals in both Chicago and KC. We still think there is a chance for things to get even more exciting, but we want you to be as comfortable and profitable as possible. So do what makes sense for you. As always shoot us a call or text if you have any questions. Jeremey had a great audio above that includes what you should be doing with marketing here, how we will know when the rally is over and more. So make sure you give it a listen if you haven’t.

Taking a look at the charts, Chicago is testing this area for the second time. This is also the first time since November of 2022, where Sep closed over the 200-day moving average. While KC on the other hand finally got a break out from its recent range. Minneapolis also broke that magical $9 resistance finally.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

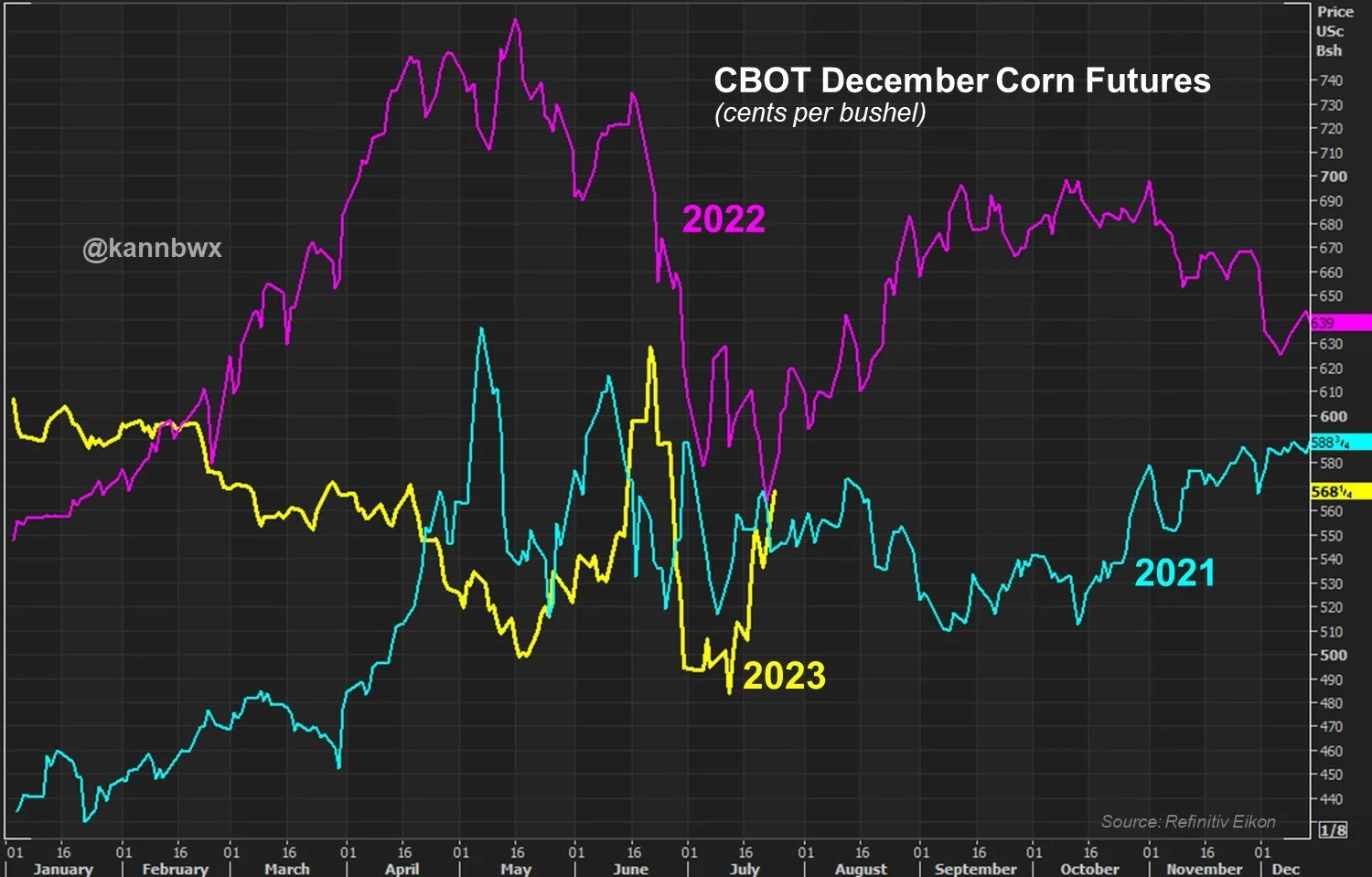

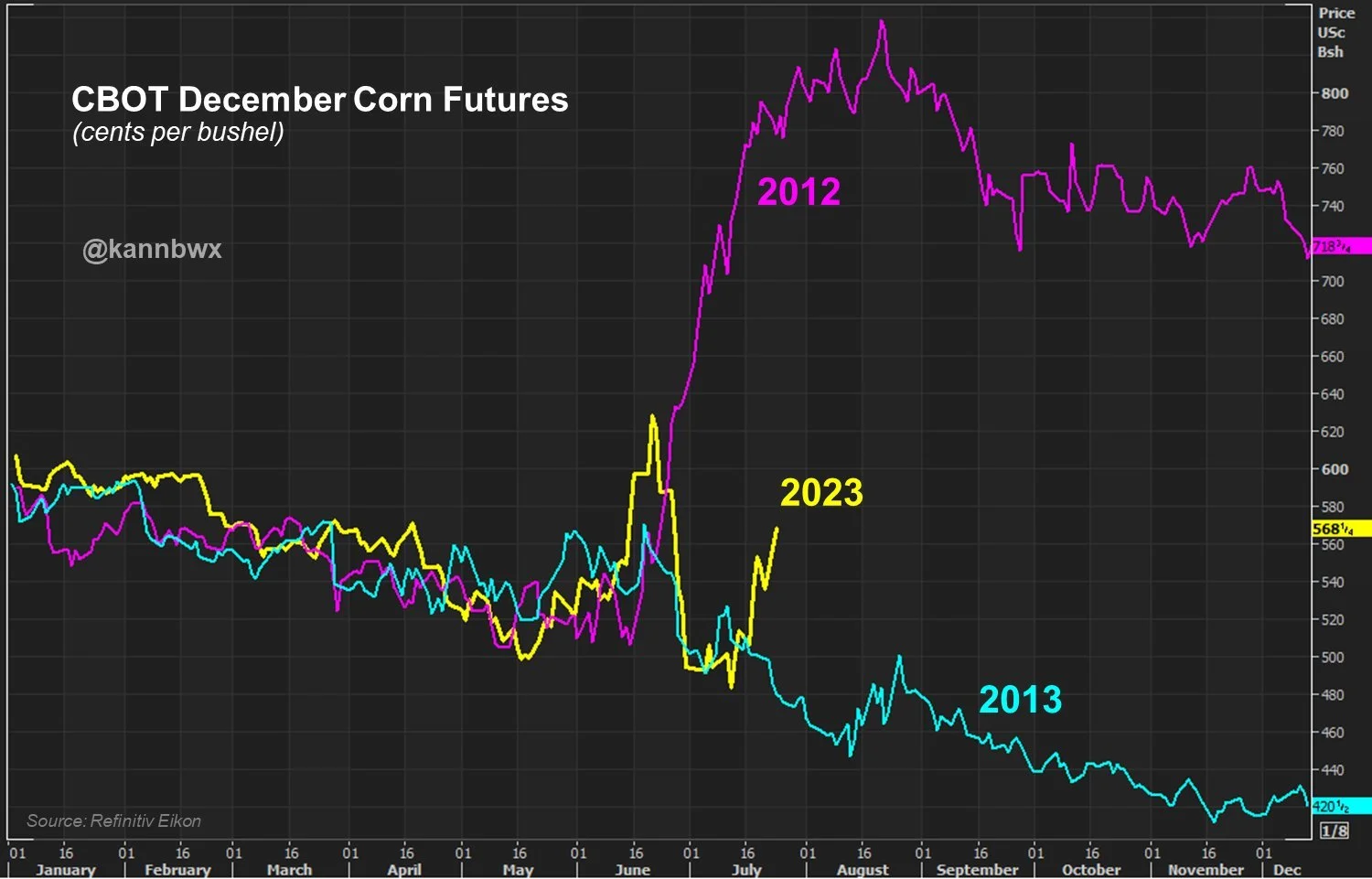

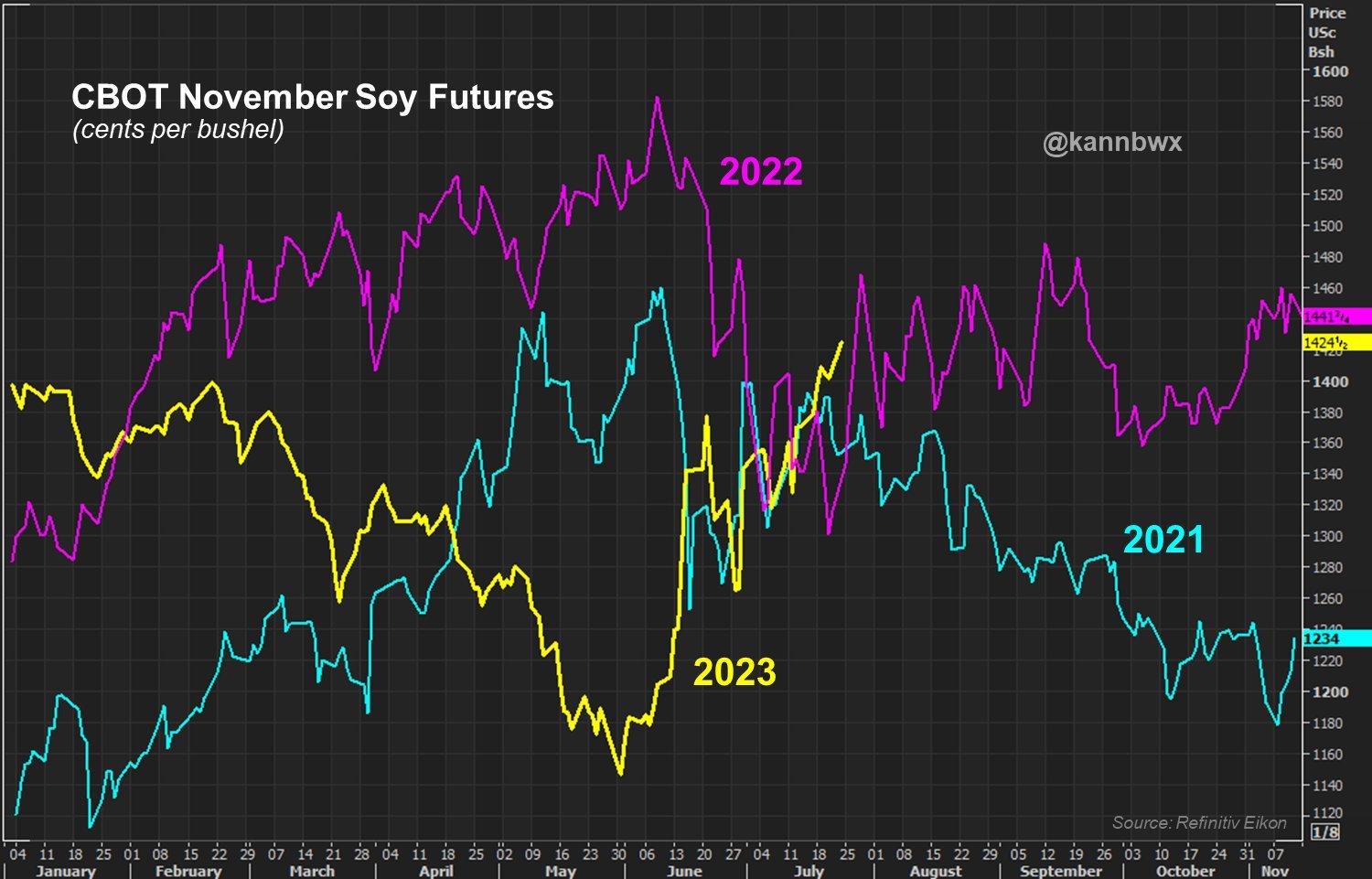

History Price Comparisons

Below are a few charts from Karen Braun on Twitter. I just found them interesting graphics.

The first is corn for 2023, 2022, and 2021.

The second is 2023 vs 2012 and 2013.

This year is clearly a year of its own.

Here is one for soybeans comparing 2023, 2022, and 2021.

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

7/24/23 - Audio

WAR & WEATHER SURGE GRAINS

7/23/23 - Weekly Grain Newsletter

ARE THE HIGHS IN?

7/21/23 - Market Update

RALLY TAKES A BREATHER

7/20/23 - Audio

BEING COMFORTABLE NO MATTER HOW THIS SHAKES OUT

7/19/23 - Market Update & Audio

THE RALLY CONTINUES

7/18/23 - Audio

WEATHER & WAR

7/17/23 - Market Update

RUSSIA EXITS GRAIN DEAL. BUY THE RUMOR SELL THE FACT

7/16/23 - Weekly Grain Newsletter

MANAGING THESE VOLATILE MARKETS

7/14/23 - Market Update