WEATHERING THE STORM: WHAT’S NEXT FOR CORN & BEANS?

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

What just happened?

In today’s lingo perhaps a WTH “what the heck” type acronym would be appropriate when talking about what happened in our markets in the past few weeks.

Well in the past 7 days corn lost the 2nd biggest percentage since the 2008 slide via losing over 21% in the past 7 days. Before that we had nearly everyone starting to jump on the drought bandwagon. Which by the way is still going on in many areas, but the heat wasn’t present enough for the market to care last week.

To summarize what just happened “rain makes grain”. We trade a futures market, meaning what will happen in the future, not a today’s market. If you rewind a couple of weeks we get the crop conditions below estimates, followed by the drought monitor expanding in the corn growing areas, followed by another crop conditions decline below estimates and then we get another drought monitor that expands and should push us higher. But then we fail to follow through to the upside because of some moisture coming in the forecast. Looking back it was a sign when we got the drought monitor, which should have been good news for the price action but we failed to follow up with higher prices.

The momentum shifted and the selling started and really hasn’t let up. Even last week's crop conditions, which declined more than expected, couldn't stop the bleeding. We followed that up with Friday’s USDA report that added a couple million more acres of corn. Leaving the biggest corn-bean spread move I can ever remember with over a dollar a bushel swing in one day between the two.

What did we learn?

First off is markets can have everything priced in that one is reading about, talking about, and thinking about.

Next is that markets make one humble. Very few guessed the highs and very few will guess the lows. Expect the unexpected as they say.

More importantly is if I told you that the corn market will be higher in a month then it was at its highs a couple weeks ago. What would you do?

This is a serious question. If you knew that corn would be higher in a month, what would you do? Would you be able to hold out or would you be tempted to sell on some mini bounce?

This question is asked to help determine one’s risk reward profile. If your answer is that I can’t afford to hold out to see if we can get back to where we are then one probably needs to be more proactive. If your answer is great I knew this sell off was just an attempt to steal grain at cheaper levels. Then your operation has holding power.

My point is not to try to outguess what the next move will be, my point is to make sure you are comfortable with the possibilities and probabilities and to learn what your operation is actually comfortable with.

Looking back it is easy to think that one wishes he would have sold everything at the high. Sold calls, sold futures, bought puts, sold cash grain, did HTA’s. Etc.

But a month from now if we do get a rally will you really have wished you would have pulled the trigger 10 days or so ago? Find a way to balance the possibilities and probabilities with what allows you to sleep best at night knowing those. For some that’s having a hedge account owning courage calls in times like now so that you can make sales when we get the rallies. For others it’s much more complicated depending on your situation, how much you have sold or don’t. What your crop looks like. If you need help please feel free to reach out to me directly at 605-295-3100.

What’s next?

First off let’s look at the soybean market and its fundamentals. We don’t have an updated supply and demand for a little over a week. But what we did get last week was an acre update. Just simple math is 4 million acres at 50 bushels an acre is 200 million bushels less supply then what we had just last week.

So what does that do to prices? Well if we get any weather scare at all we have POTENTIAL to get new all time highs. Will we? I think so because markets have the ability to over do moves. Such as what we have seen to the downside in corn over the past week and a half.

The other thing that is somewhat known is that the USDA will not print a balance sheet that says we have ZERO soybean carryout. They will reduce demand because of the lack of supply. The market's job will be to curb demand. The most logical way to curb demand is simply to go higher.

Below is from Wright on the Markets, it fits very good on what’s next.

When will corn bleeding stop?

I need to keep in mind what I wrote about being humble above and thus realize that markets will and can do whatever they want. My experience does tell me that we are going to make our lows in corn for the next several months in the next few days. Volatility creates more volatility.

The market is expecting an increase in corn crop conditions, the market is expecting moisture to help out the corn crop, the market is expecting the moisture trend to continue to be wet and cool.

As mentioned earlier a couple weeks ago everything was bullish corn, but today everything is bearish. At least on the surface.

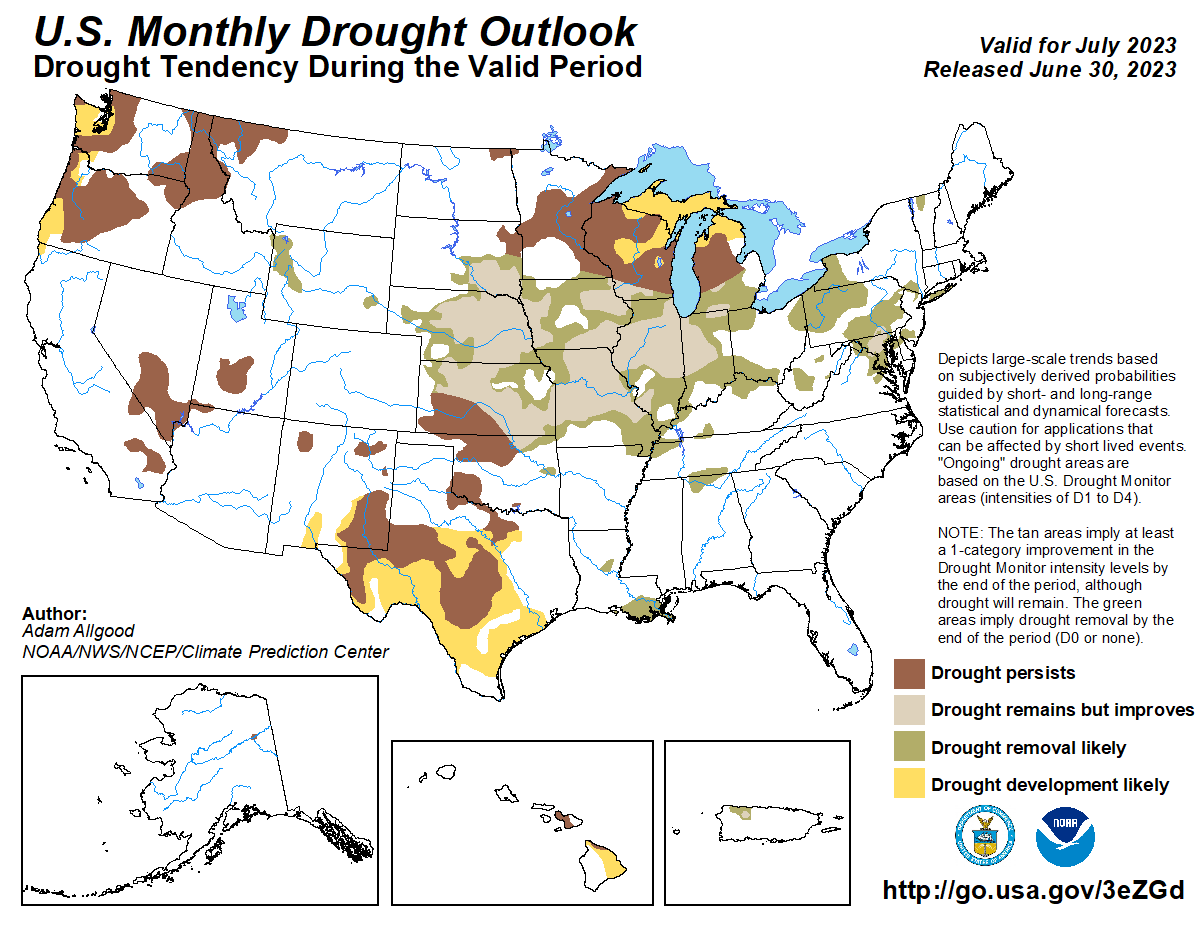

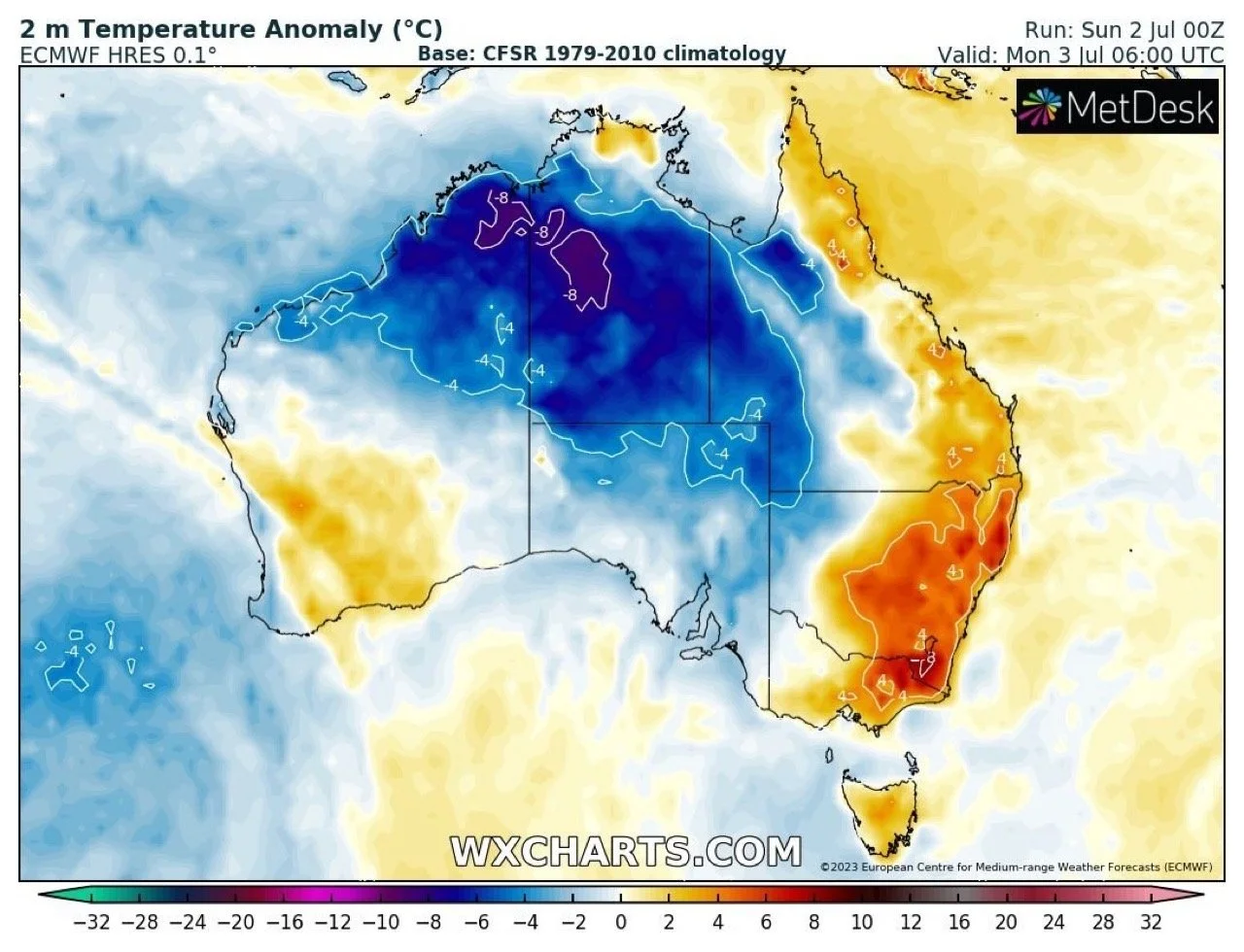

Let’s look at some weather maps.

Looking at this first map the past several days, I have two main points. First off is more green for Illinois, Indiana, Ohio. This started about a week or so ago and it’s the first time for months that it has happened. However Iowa has quickly went from green in the forecast to tan/brown.

This next one is the past 30 days. This is one that when we look at yields for the July USDA updated yields could be very bullish. Especially if the USDA updates yields in the same manner they did in 2012.

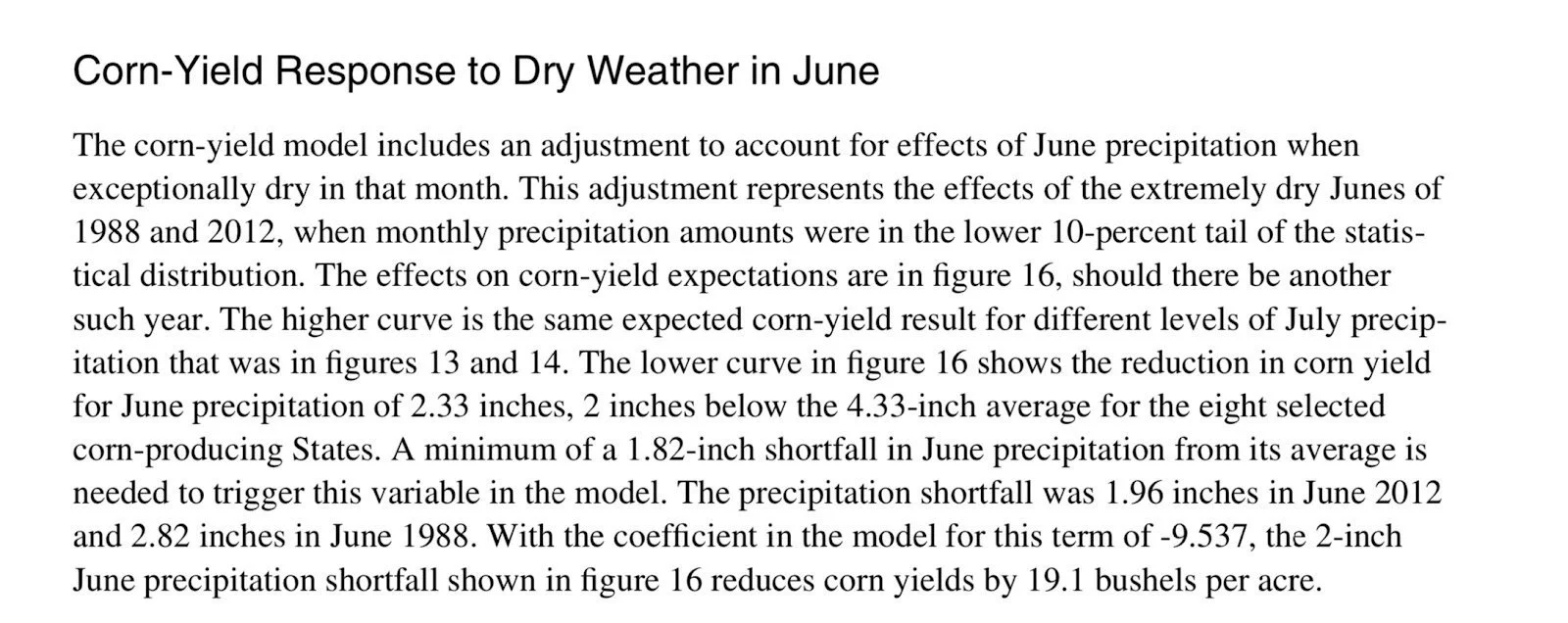

The following screen shots are from:

https://www.ers.usda.gov/webdocs/outlooks/36651/39297_fds-13g-01.pdf?v=737

An article in 2013 with info on how the USDA adjusted yield in 2012.

I only point this out because we have just had a drier June then we did in 2012. If the USDA uses similar methodology when calculating the yield in July as they did back then the market could explode higher. It would make our prices a couple weeks ago look cheap.

Having said this I don’t look for that to happen. The market is trading something in the 175-185 yield range, with most of the market now believing we are better than a year ago.

I don’t believe that we are better than a year ago in terms of yield. I think we have done too much damage. But just because I believe that doesn’t mean that’s how it will shake out.

I do believe that the market should bounce because of the damage done to the crop but Mother Nature holds the cards to determine if we can get a meanful bounce or just stabilization of the prices.

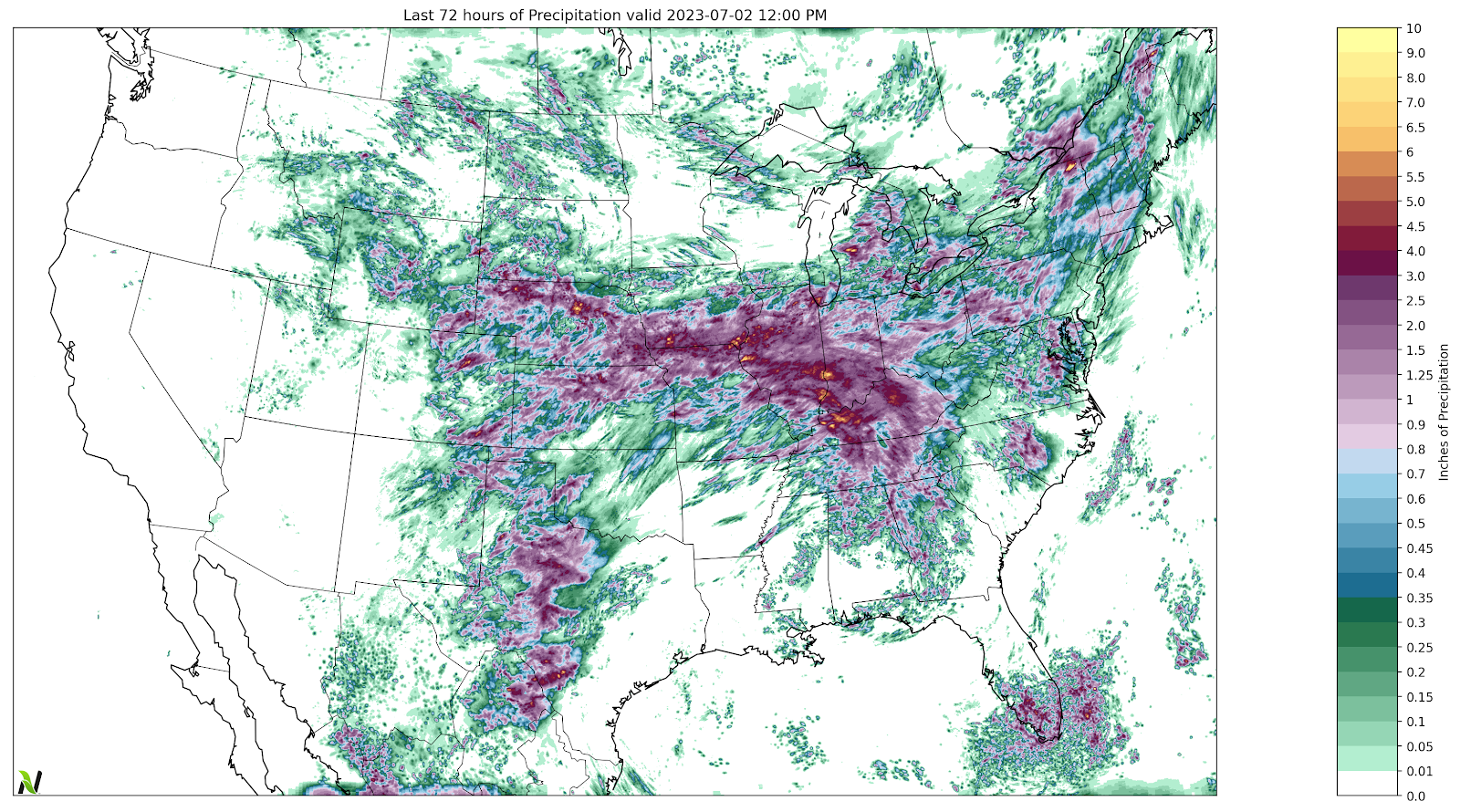

Here is the last 72 hours of moisture.

But here are some better maps showing more of what has actually hit. When you zoom in you notice more of a Swiss cheese type of rain.

Notice the 1.5 inches here, but also notice the areas to the north and south that had less then ½ inch.

Here is another one just notice the variances.

The above are from https://www.cocorahs.org

I think it is by far the best website with real info.

Below is a screenshot from twitter with a few DTN moisture maps.

But here is why corn has struggled. At what point is it baked into the prices becomes the question.

The bottom line is that the weather is bearish. Is it built into the market? I believe so, I think we go running back up if one of two things happen.

First off is if the USDA adjusts yield and catches the market by surprise. Secondly is if/when we see that heat in the 8-14 extend and expand to the east.

The market has priced in an improvement of the drought.I mentioned above that volatility creates more volatility. I think the same can be said of Mother Nature. The past several months we have set tons of records for heat in areas, dryness in areas. Followed by coldness in areas and moisture in areas.

Here is an example of that happening all around the world. This first one is in China, record high temps.

This next one is showing some record high temps in parts of Australia.

I think Mother Nature will continue to be very wicked. I look for it to make our markets more and more volatile. That should create opportunities for both buyers and sellers.

If you need help capturing some of this volatility please do yourself a favor and utilize options like insurance. To open a hedge account you can click here or give me a call at 605-295-3100.

https://www.dormanaccounts.com/eApp/user/register?brokerid=332

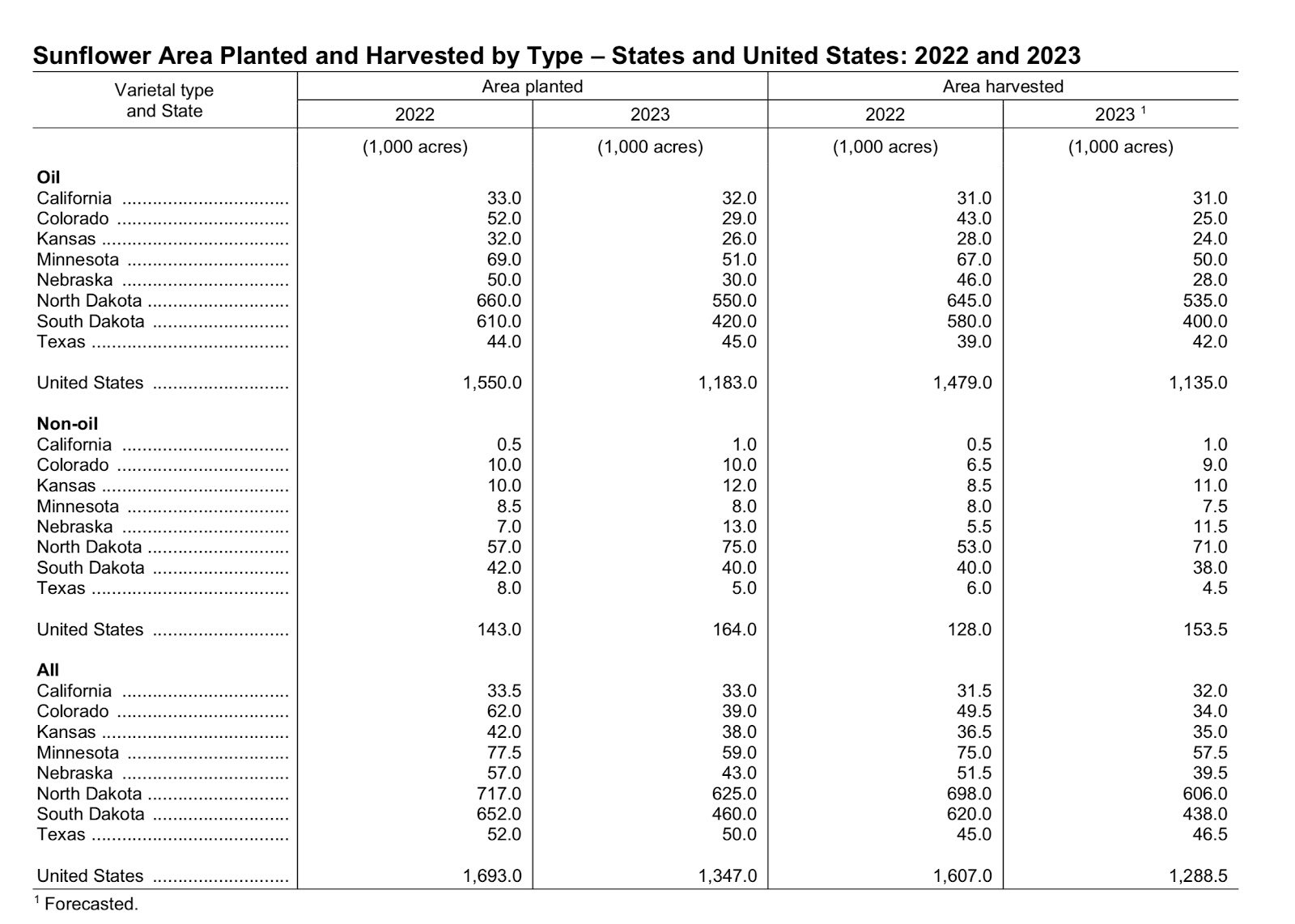

Sunflowers

Sunflower acres were down hard on the report as expected. With bean oil showing plenty of life, look for the sunflower market to find some demand. The thing that we really need for that market to do what it has in years past is to have decent oil content in this year's crop so that the crush and birdseed are having to compete against each other. Without that competition prices will continue to struggle, but if we have some decent oil in the SD sunflower crop it will create that competition that is needed for prices to rally substaintly. Best advice is be patient, but one needs to have plenty of staying power and plenty of bin room because it will likely take into 2024 for sunflower prices to gain back much of what they have lost in the past year.

Millet

The millet market is one that is set up to see lower prices and bigger supply create demand.

Acres are up, and we no longer have millet country in a drought. How cheap will it get? I don’t think it will get stupid cheap, but fundamentally more supply should equal lower prices.

Can we bring back the demand that we have lost from the past several years from not having much of a crop? Time is about to tell. I think you will see plenty of elevators trying to buy millet near 10 per cwt at harvest, but I do think we will get demand roaring back and before you know it we could see millet back to the 18-22.00 range.

Other market thoughts

I didn’t touch on it above but last week we had plenty of damage done by the derecho. My experience has always been that a major storm like that does more help than harm, mainly because those storms were needed to raise a crop because of dry weather. I think that is the case in this instance also. Now when you get a weather event when it wasn’t dry perhaps more damage could be done then the good the moisture does?

I read an article that mentioned we had 20-30 bushel damage done from the weather event, but it also mentioned without the moisture we could have seen 40-50 bushels an acre less from dry conditions. Only time will tell how this shakes out, but it is something to watch and it is something that could turn our market around. All of the damage pictures on social media.

The other big unknown is what will the Canadian wildfire smoke do to our crops. I have seen several articles out and the bottom line is I don’t know how it shakes out and what benefits or damages it does to our yields.

Overall most everything I have written about is indicating the bearishness that is out there in our markets. Having more acres, having moisture. But as I mentioned I do think that we have priced this in and done so quickly so I am looking for a bounce as we go into the July USDA report.

One thing I wonder is if China will be coming to the US for corn sometime soon?

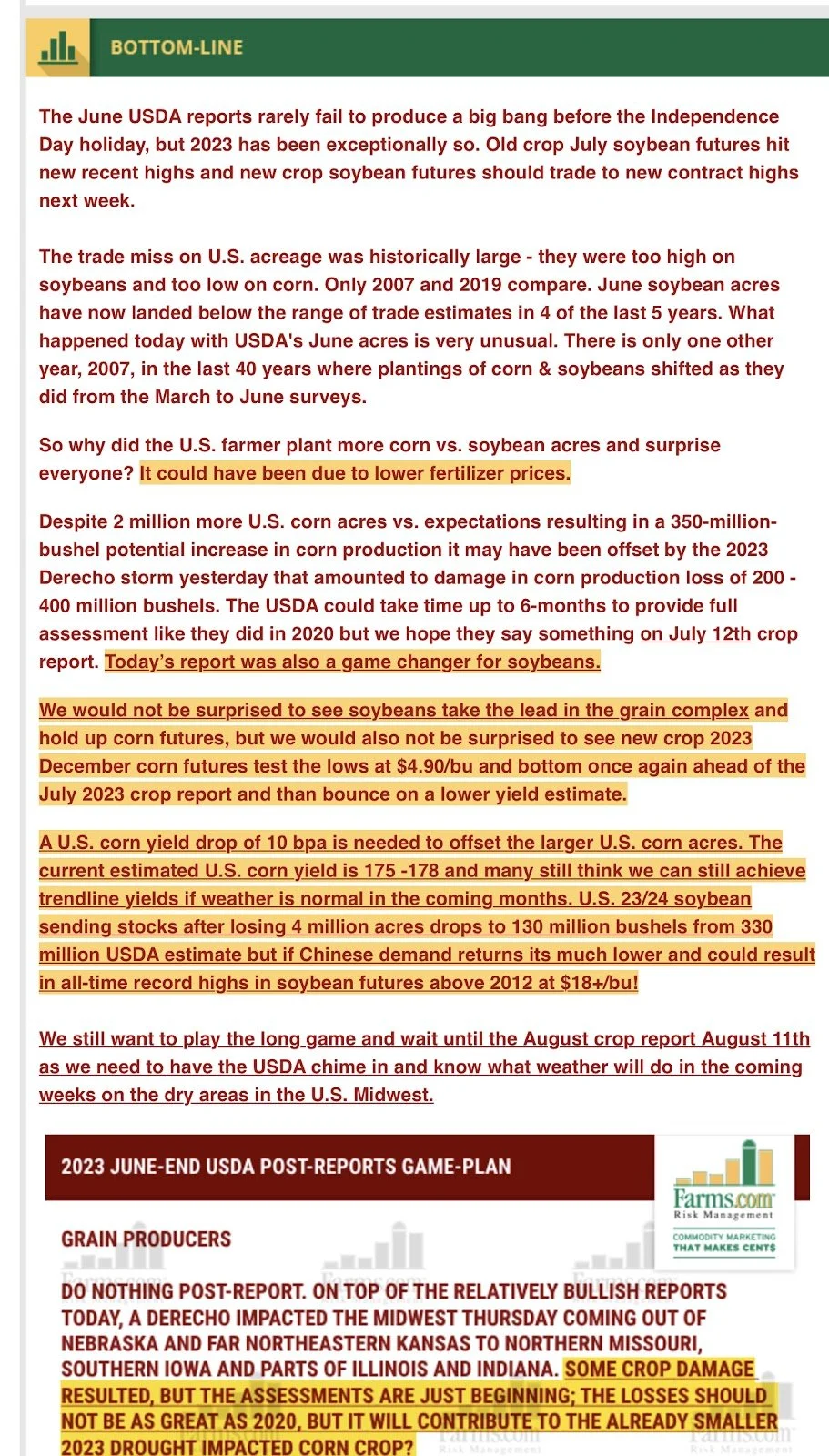

Below is from Farms.com risk management. It helps give hope to the bulls and leaves me comfortable in my marketing plan.

The question remains: are you comfortable in your marketing plan? If you're not, please give me a call 605-295-3100 and I will see what I can do to help you get there.

Check Out Past Updates

WHAT THE USDA REPORT MEANS

Read More →

Jun 30, 2023

MORE DROUGHT & USDA REPORT TOMORROW

Read More →

Jun 29, 2023

WHAT’S NEXT FOR THE GRAINS?

Read More →

Jun 29, 2023

FREE FALL CONTINUES. HOW WILL THIS PLAY OUT?

Read More →

Jun 28, 2023

GRAINS SMACKED DESPITE AWFUL CROP CONDITIONS

Read More →

Jun 27, 2023

DID WEATHER TREND CHANGE?

Read More →

Jun 27, 2023

WERE THE RAINS ENOUGH?

Read More →

Jun 26, 2023

HEALTHY CORRECTION OR END OF RALLY?

Read More →

Jun 23, 2023

EXTREME VOLATILITY & WEATHER MARKETS

Read More →

Jun 23, 2023