WEEKLY WRAP

Overview

Grains mixed as beans get a great bounce while the wheat market gives back yesterday’s gains.

Beans were strong to end the week as China canceled Brazillian soybeans. The thought process is that this business will move to the US.

Wheat under some pressure as grain in moving in the Black Sea again after a 3-day pause from Ukraine. Ukraine appears to not be too concerned with the potential drone attacks or mines, as they now deny that they ever stopped shipping out of their ports.

We have rains across the midwest and it is going to be getting cold this weekend. This has some wondering if we see any damage to beans.

The war in Isreal is getting more dicey, slowly gaining more tension.

Mark Gold said: "I still think the war is a powder keg and frankly wouldn't want to be short anything over the weekend."

Not only did the China cancellation support beans, bean meal was strong again, up another +12.9 (+3%) today as its rally continues, making new contract highs. Trading at its highest level since July 27th. Now up +76.0 since the October 9th lows.

Both corn and beans have been mainly pressured by US harvest which is wrapping up soon as well as some "favorable" forecasts in Brazil.

However, I wouldn’t look at the South American forecasts as necessarily favorable. Rain continues to disappear and not fall despite what the forecasts have been calling for.

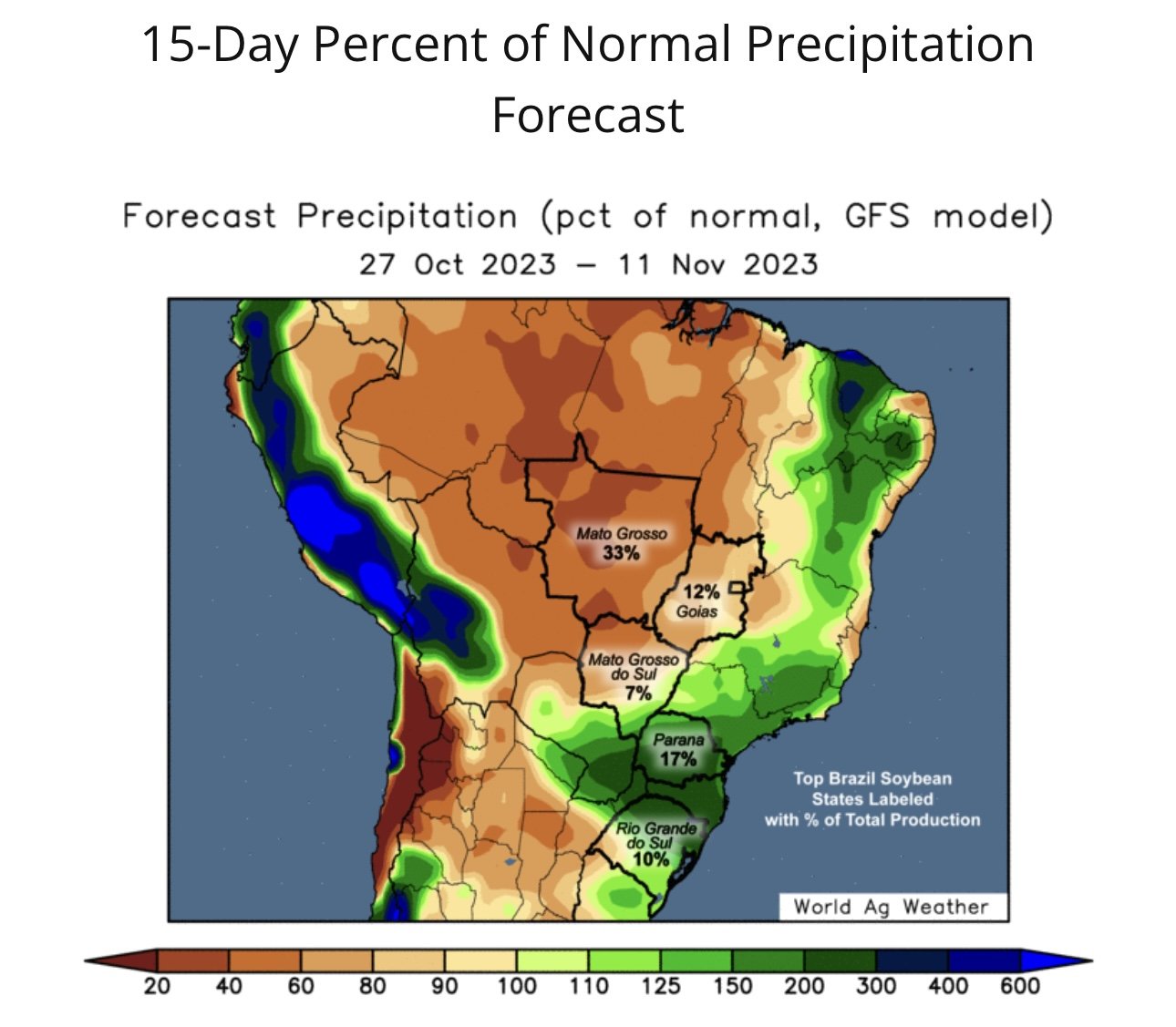

Here are the forecasts:

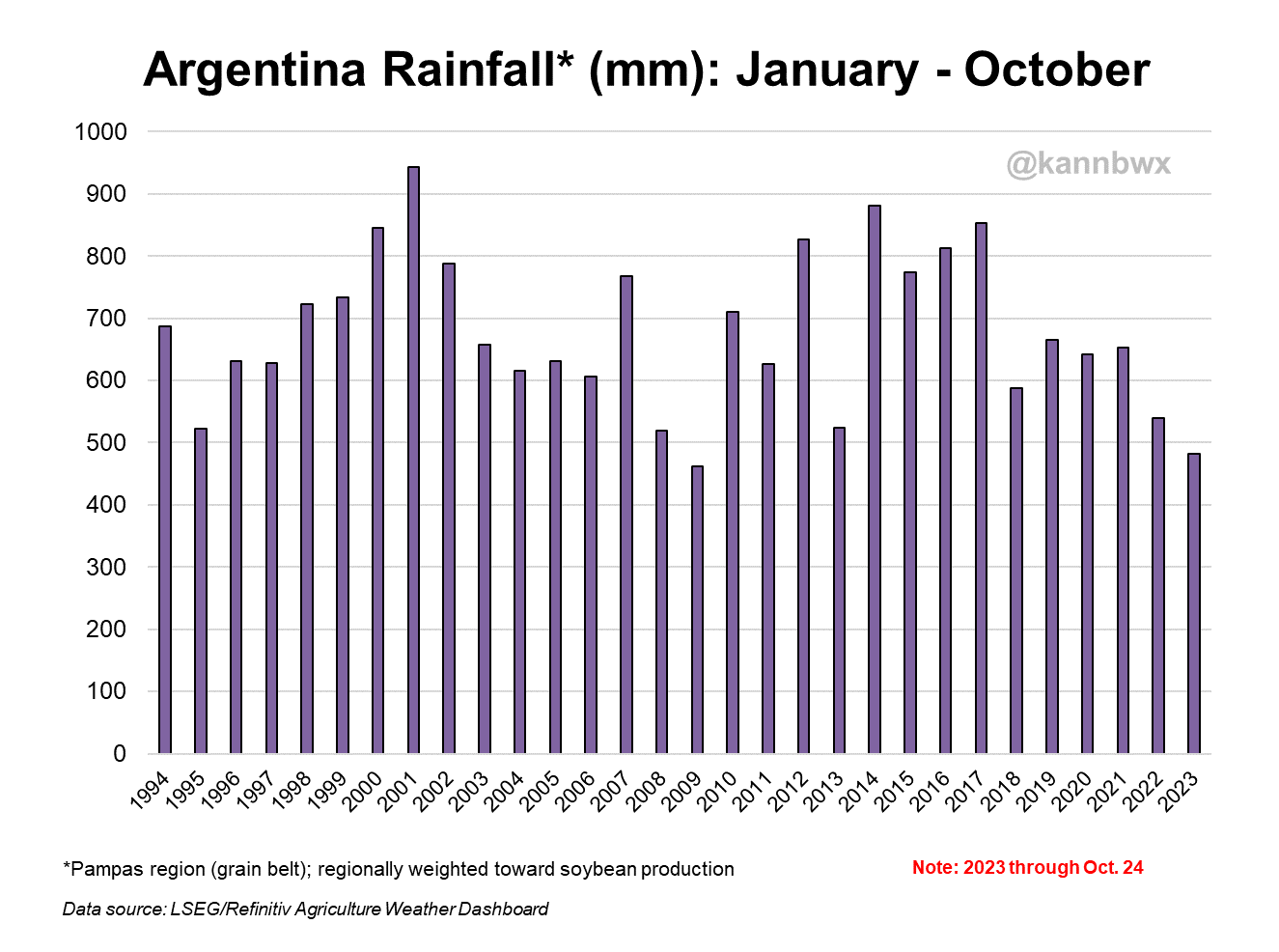

How dry has South America been thus far?

If we look at this chart, 2023 for Argentina has been the 2nd driest year in the past 30 years, only behind 2009 which featured horrible crop outcomes. Their year-to-date rainfall is 30% below average.

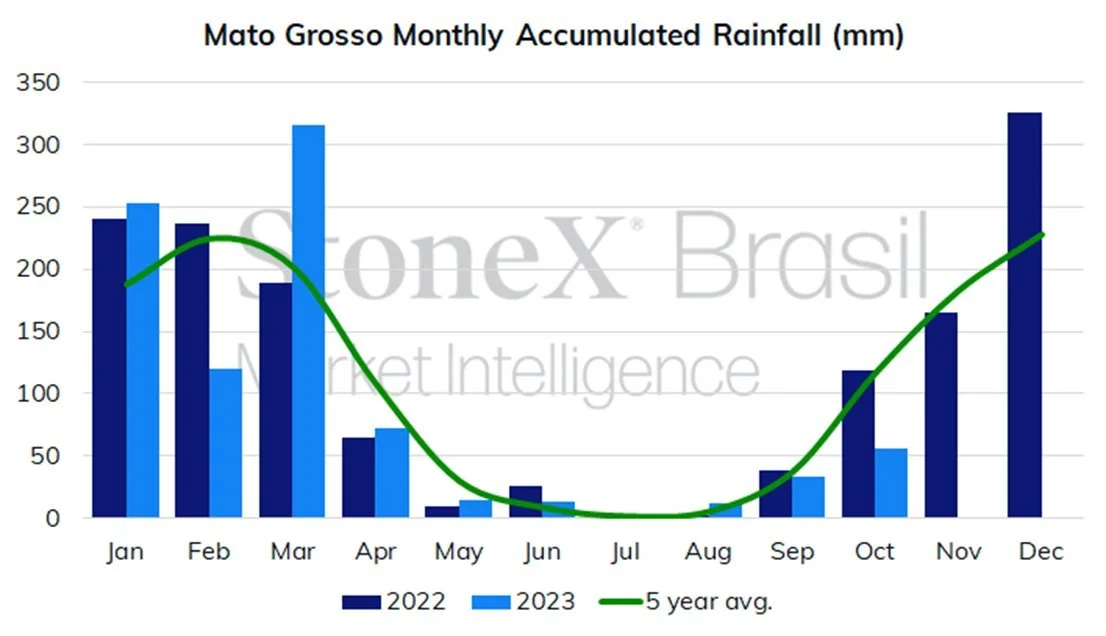

Now let's take a look at Brazil. Where their production comes in at will be more impactful than Argentina's. If we take a look at Mato Grosso (their largest producing area) you will see they have received far less rain than last year as well as the 5 year average.

Taking a look at October, this year is not even half of what it was last year.

So far, this looks like a pretty bullish factor. But of course, November and December will be what it all comes down to.

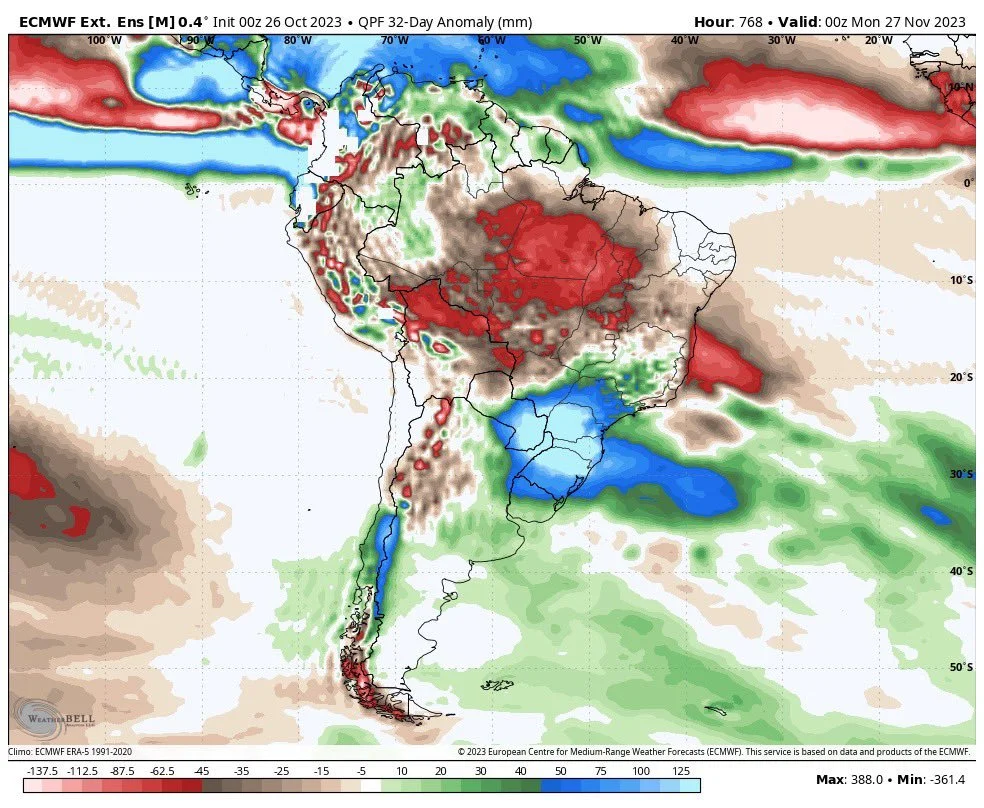

From Darren Frye of Water Street Consulting:

"The next 32 days do not offer much improvement. If this verifies the trade will start talking about 145 instead of 165 for Brazil. Safrinha will be much smaller also."

Weekly Price Changes:

Today's Main Takeaways

Corn

Corn has given back 28 cents from last Friday's highs of $5.09, ending the week at $4.81 1/2. As corn has mainly been stuck between $4.75 and $5.00 for the vast majority of the past 3 months now.

There has just been a risk off mentality this week from the funds who remain heavily short. As we have mentioned time and time again, a major rally will not be easy with a 2 billion bushel carryout.

One thing that could surprise bulls later on is Chinese demand. Bunge's CEO said he believes Chinese demand for corn might surprise to the upside.

Bulls are basically looking for two things to push us higher. First would be a South American weather worry, which is a very realistic possibility as we pointed out earlier. Second would be a surprise in Chinese demand.

Bottom line, I still believe we have printed our harvest lows. But it might be a long marathon to the upside.

I did notice a few other popular advisors had placed buy signals in corn.

The charts don’t look amazing for corn. We need to find a bottom and creep back over $4.90 if we don’t want to test those harvest lows.

-

From Chris Robinson of the Robinson Review,

Levels today as we finish the week.

Corn is stuck in the range. 33 cents for 3 months.

$5.08 to $4.75

Wait for the breakout.

Keep your risk on paper, and keep those options-- both puts and calls--- cheap as can be.

Upside resistance-- $4.85 $4.89 and then $.506, the 50, 20, and 100-day moving averages. Need to sell grain? Keep $5.06 on your radar.

Corn Dec-23

Soybeans

Soybeans cap off the week with a near 20 cent rally, clawing back about half of what we had lost from last Friday's highs of $13.18. Closing just shy of $13 at $12.97.

The bulls got two main headlines to chew on. The less impactful one is the potential freeze and damage to bean crops in the US over the weekend. The second and more impactful one is that we saw cancellations of Brazil beans to China. The rumors are that this business will be switched over to the US. A great headline for US demand. Like we have said in the past, we don’t see demand anywhere just yet.

It also seems like Brazil is seeing some big delays and backlogs, which could also push more business towards the US.

Bottom line, there are plenty of bullish wild cards left in the deck that have the ability to push beans much higher. If yields at home come up short. If South America runs into production issues. If demand continues to grow. The upside for +$14 beans is there.

At the same time, beans do have a lot of downside if none of these catalysts happen. Although I do believe we will be in for much higher prices, that doesn’t mean you shouldn’t ask yourself what makes the best sense for your operation. If you have made sales or are selling beans into what I believe will be a rally, consider re-owning. If you are behind on sales, look at putting in a floor to protect yourself for the possible downside. At the end of the day, it is impossible to out-predict the markets, but you can manage your risk as well as possible either way the market goes.

*Note: November options expired today. Will be shifting to the January contracts.

Recommendation: Nov. Bean Basis Contracts

For those of you that have basis contracts against the November futures, we recommend that instead of rolling you sell and re-own with futures in a hedge account.

From my experience, if you didn’t get grain priced before the expiration deadline on a basis contract and you have the option to roll to the next month, you should price the grain and re-own with futures.

If your new to using basis contacts you want to make sure not to fall into the trap of rolling into a carry market. Many times elevators advertise basis contacts instead of making cash sales. This is true basis contracts have a time to be used, but if you find yourself in the situation where you are now forced to roll or price, you have reached the time when it no longer makes sense to utilize a basis contract.

The time to utilize basis contacts is when one has an inverted market, when you have a carry market such as November to January soybeans, when you roll all of the sudden your basis isn’t as good as it was.

Let's take an example of one having a zero basis contract. If you are forced to roll or sell, your zero basis now becomes -22 under the January futures. Which in it self isn’t the worst thing ever. But let's say via the buyer allowing you to roll you decide not be proactive enough and find yourself at the end of December being told to either price or roll.

If that was today you would then see a basis of -36 under.. Your zero basis contract doesn’t sound quiet as good now.

What happens if you decide to treat the basis contract like a bin that you forgot about. If you roll again and roll out to July now your zero basis is -57 under if your buyer is not charging you much for roll fees. But for most of you your zero under basis contract is not closer to -65 to – 70.

So our number one reason that we want to price out all basis contracts once the grain is delivered and re-own with futures or option strategies is that farmers who typically roll basis contracts end up falling into a grain marketing trap and end up rolling and rolling, until eventually they become a price taker. Via having a basis contact that is delivered without the futures priced one tends to be complacent on marketing.

So to be clear our recommendation isn’t to sell the beans and close the book on your 2023 soybean marketing. Our recommendation is to price the basis contract and simultaneously buy futures in a deferred month that aligns with your grain marketing plan strategy.

Buy futures? Why would I buy futures some will say. Others will comment isn’t buying futures Texas hedging.

My response is that once basis contracts are fulfilled farmers are already long futures, they just no longer have control nor do they have the cash for the soybeans.

What happens when a buyer does a basis contract with a farmer typically looks something like this. Farmer sells 100,000 bushels of soybeans at a zero basis. Elevator sells 100,000 bushels of soybeans to an end user. At the same time the elevator then buys long November futures. When the farmers prices the basis contract the elevator then sells the 100,000 futures of November futures.

If the farmer choose to roll the contract, the buyer sells his long futures and buys the month he rolls the contract to.

So as the markets go up and down the elevator watches the hedge account go up and down. At www.dailymarketminute.com we turn farmers into price makers instead of price takers. Via pricing basis contracts when delivered farmers become just a little closer to being a price maker with these couple benefits that you will experience.

First off if an elevator sell soybeans to an end user, they get paid for them. Via not pricing the basis contract we allow the elevator to utilize cash flow as the elevator takes your money puts it into their bank account and then buys futures in a hedge account.

Benefit of pricing basis contacts as delivered if not prior. $$$$$$ CASH FLOW. Why would you let the elevator use your money? Are they really that nice of a company? Do you like paying interest expenses while someone else uses your money?

An even bigger benefit of pricing your basis contracts as delivered if not prior to delivery is what it does to your grain marketing style, when you open a hedge account. It makes you much more proactive. Because instead of watch soybeans go up, and then go down, and then go up, etc. You now get a call from someone like me saying that need to send in a margin call because the market has went down. Or I call you up and say that your trade has made you X number of dollars and I talk you into taking profits on some or all of your long futures position.

And for a few lucky ones that historically sell right before the market goes up, now find themselves selling after the market goes up. Then rebuying when the market goes back down. All of the sudden they magically start to buy low and sell high. The pressure that the hedge account does from worries associated with margin calls now acts as a benefit in making the farmer much more proactive.

The next thing that typically happens is the farmer slowly starts utilizing options and future spreads to help create even more flexibility and comfort in the volatility associated with grain future markets.

If you don’t agree with my logic on why one needs to price basis contracts once delivered and re-own with futures. Ask yourself do any elevators ever do basis contracts with end users whereas they don’t price the futures prior to delivery or as the grain is delivered?

If you want to become a price maker you need to do what buyers do. Farmers are much bigger in operation size then 20 years ago. Farmers grain marketing styles should be similar to what elevators and end users utilize. If the buyer doesn’t utilize the grain pricing tool, neither should you. Because if you are utilizing a tool such as rolling basis contracts after delivered or something such as delayed price you remain a price taker.

Become a price maker today and take the little edge that the buyers have added, back.

If you need help opening a hedge account to help you become a price maker call Wade at 605-870-0091 or Jeremy at 605-295-3100

You can also open one here.

Soybeans Nov-23

Wheat

Chicago wheat clawed back 60 cents from it's 2 year lows. But since then we have chopped around in this recent range and struggle to find any follow through buying. As KC wheat on the other hand continues to fall, making another new low today.

The wheat market is the same old story. We have some war headlines here and there. One day they add support, the next day they add pressure.

We have Ukraine pause their grain moving through the black sea only to start moving grain again. They actually came out and said they never stopped.

Nonetheless, it is going to remain a factor. Still has the possibility to be a bullish wild card, but I'm not holding my breath in hopes of another war rally.

The war in Israel isn’t a direct market mover, but things are heating up over there.

The story for wheat is still a long term one. We have the global weather issues. We have the world consuming more wheat than it is producing for however many years in a row now.

Potential is there. Just a matter of when.

From National Farmers (nationalfarmers.com),

December wheat continues to hold $5.75 but fails to stay over $6, major bottoms appear to be in place.

A break above $6 holds the key to higher prices. If we can get above it should cause more buying and upside. We don’t love making sales here, but if you are selling bushels here I like the idea of re-owning and keeping that upside open. Because the upside in wheat is there, it just might take some time.

Chicago Dec-23

KC Dec-23

Check Out Past Updates

10/26/23

SEPARATING THE FUTURES & BASIS COMPONENT TO BECOME A PRICE MAKER

10/25/23

LONG TERM UPSIDE & BEING PATIENT

10/24/23

TECHNICAL SELLING, SA WEATHER, & MANAGING RISK

10/23/23

IS THIS CORRECTION A HEAD FAKE?

Read More

10/20/23

BIG WEEKEND CORRECTION

10/19/23

CORN BREAKS $5. IS WHEAT NEXT? - SOYBEAN RECCOMENDATION

10/18/23

BEANS BREAK $13. IS CORN NEXT?

10/17/23

DID BEANS CONFIRM REVERSAL?

10/16/23

CHOPPY BORING TRADE

10/13/23

POST USDA REPORT CORRECTION

10/12/23

BULLISH REACTION TO USDA REPORT

10/11/23

CAN THE USDA GIVE US A BULLISH SURPRISE?