WERE THE RAINS ENOUGH?

Overview

Grains closed mixed in an extremely choppy day with the rain over the weekend and more Russia headlines.

The main headline going into the weekend and at last night's market open was how much rain did we get or not get, and was it enough. Corn and beans were surprisingly strong given the rains over the weekend.

We saw some beneficial rain in a few key areas over the weekend, but we also saw plenty of areas that missed out. Such as Illinois, as central Illinois received no rain. With Eastern Iowa and Northern Illinois also missing a majority of the moisture.

Areas that received rain included Northern Indiana, the Dakotas, Minnesota, and some of Iowa. But overall, it was very spotty showers and wasn’t just this massive game changing soak. So overall, there were many major production areas that missed out on most of the needed rain, and the rains were not widespread enough as the crops needed. I am not convinced we got nearly enough rain to change crop conditions or yield potential. I think we are still a very long ways from seeing anywhere near where the USDA has their yield.

Russia news had bulls hopeful over the weekend, as the leader of the Wagner mercenary group had a brief rebellion against Moscow on Friday. However, this was resolved Saturday.

Going forward, weather will continue to be the factor at play. This Friday we will also get the newest USDA report.

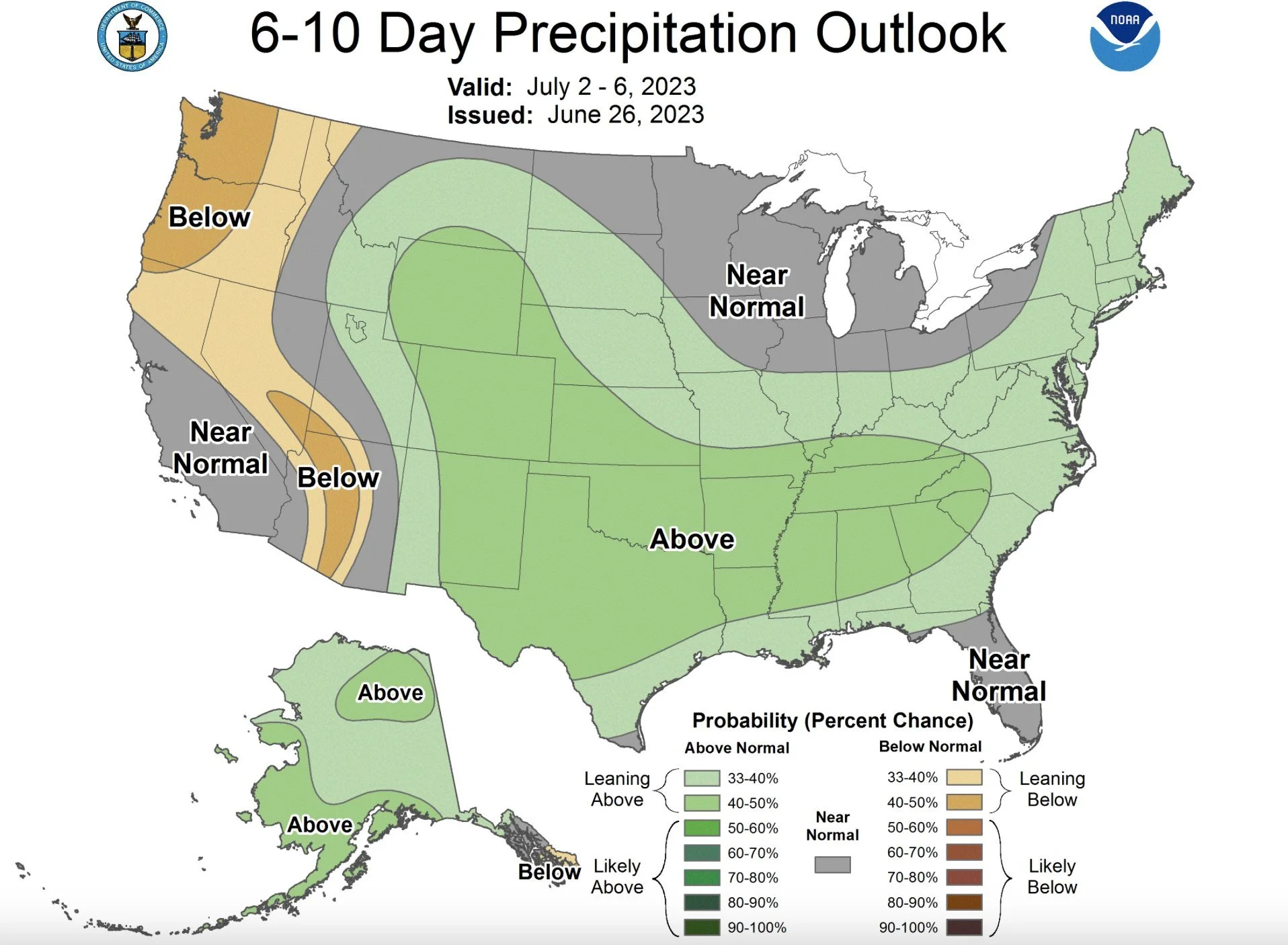

Forecasts are showing some rain, but bulls argue this rain won’t be enough to change crop conditions or yield potential

Crop conditions came in after close today and they were very bullish. As corn conditions dropped another 5% to 50% rated G/E, which was below the trade estimates of 52%. Soybeans dropped another 3% to 51% but were inline with the trade estimates.

*Note: We did not have a Weekly Grain Newsletter yesterday due to it all coming down to how much rain we did or did not receive over the weekend.

Crop Progress & Conditions

Corn 🌽

Rated G/E: 50%

Trade: 52%

Last Week: 55%

Last Year: 67%

Soybeans 🌱

Rated G/E: 51%

Trade: 51%

Last Week: 54%

Last Year: 65%

Spring Wheat 🌾

Rated G/E: 50%

Trade: 51%

Last Week: 51%

Last Year: 59%

Winter Wheat 🌾

Rated G/E: 40%

Trade: 38%

Last Week: 38%

Last Year: 30%

Harvested: 24%

Trade: 29%

Last Week: 15%

Last Year: 39%

Average: 33%

Today's Main Takeaways

Corn

Corn futures opened last night down double digits but somehow managed to open a few cents higher this morning. Ultimately ending the day a hair higher in a big 25 cent trade range to start the week. As neither bulls nor bears can take over with the market being torn between two decisions. Did we get enough rain or not?

Some argue we did, some argue we didn’t. But the surprising strength in corn today indicates to me that we indeed did not get nearly enough. Most expected the markets to be down fairly hard today, but corn managed to close 13 cents off our early lows.

Taking a look outside of the US, China is experiencing some severe dryness. As their corn belt's soil moisture levels are the lowest they've seen in 6 years.

Updated crop conditions came in after close today. As I predicted last week, we saw yet another big decrease across the board. As overall corn ratings came in down another -5% from last week. This was below the trade expectations of 52%.

Keep in mind, the USDA's methodology in how they base crop progress and conditions does indeed include and take into account the rains over the weekend, even Sunday. So the numbers confirm that the rains in areas such as Illinois were a big swing and miss.

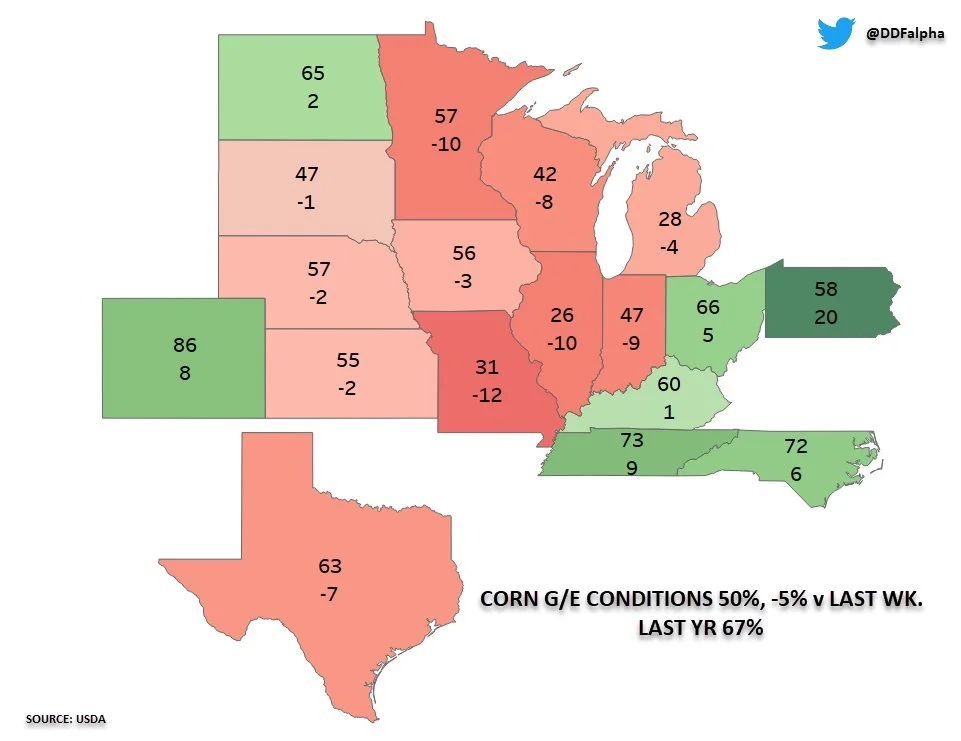

Some Noteworthy Changes:

Illinois -10% (Rated 26% G/E)

Indiana -9% (Rated 47% G/E)

Missouri -12% (Rated 31% G/E)

Minnesota -10% (Rated 57% G/E)

Here is a state by state map from Darin Fessler on Twitter.

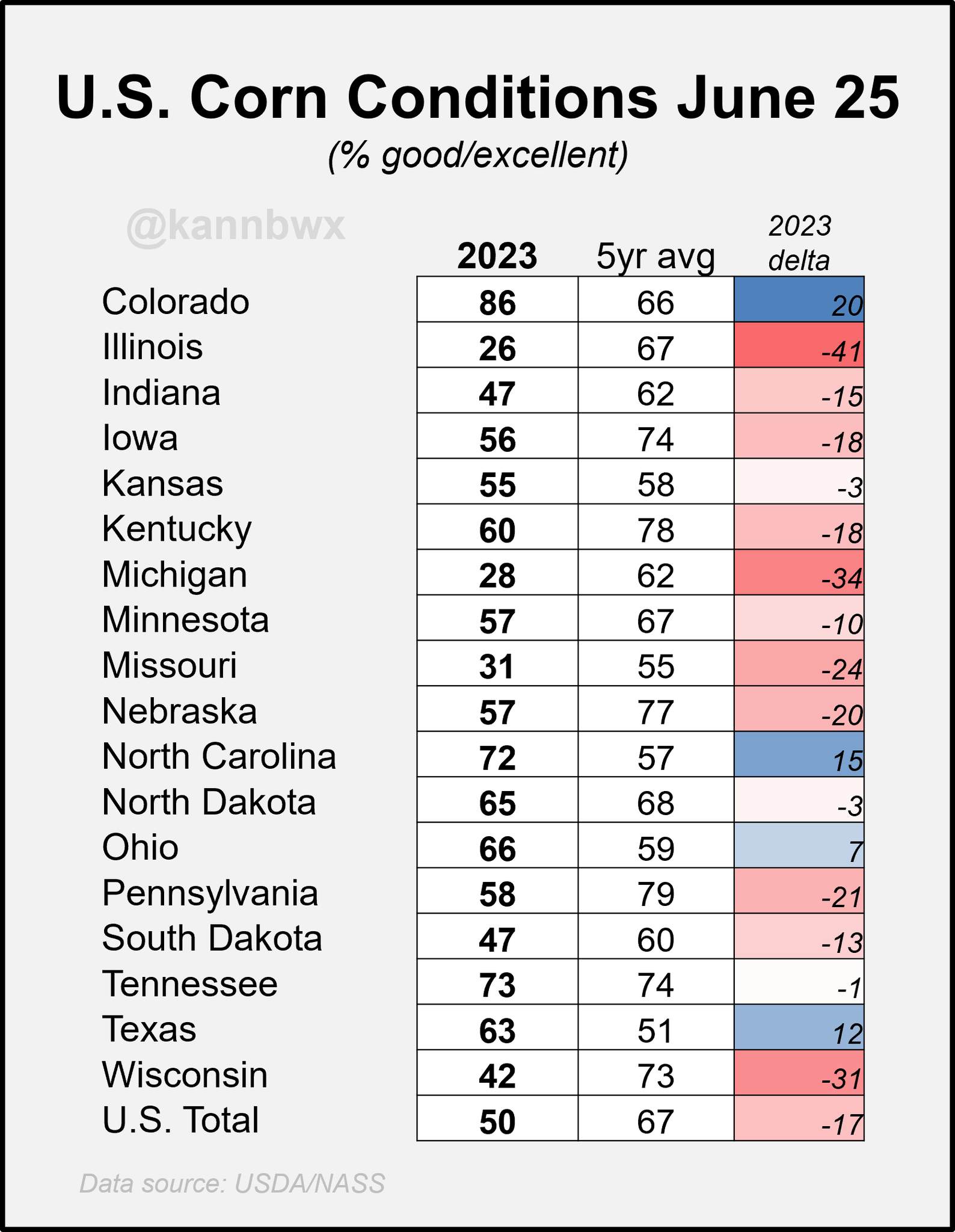

Here are the numbers compared to our 5 year average.

Notice the I-states. Illinois is 41% worse than usual. Nearly every top producing state is far worse.

Chart Credit: Karen Braun

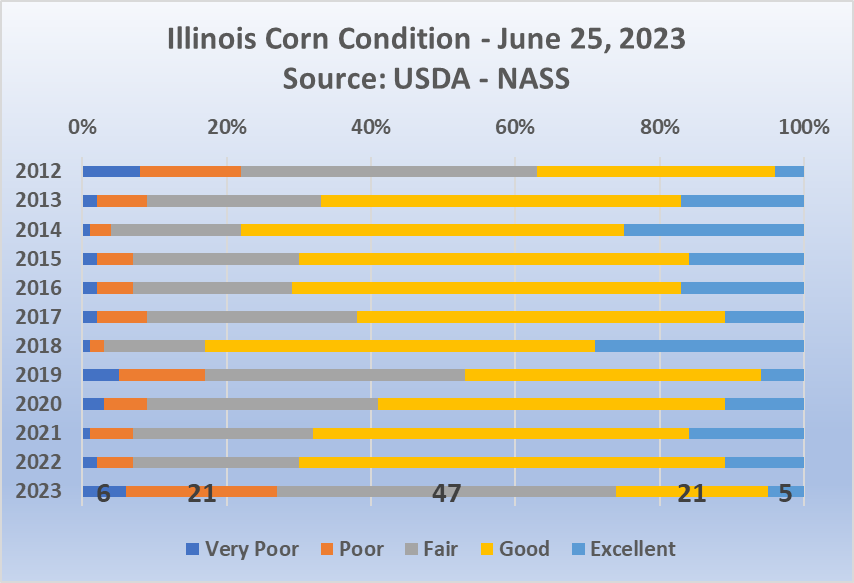

Now let’s take a look at Illinois 's corn condition history.

Again, one of the worst on record. By far the lowest good to excellent rating. With just 26%. For comparison, 2012 was nearly 40% rated good to excellent.

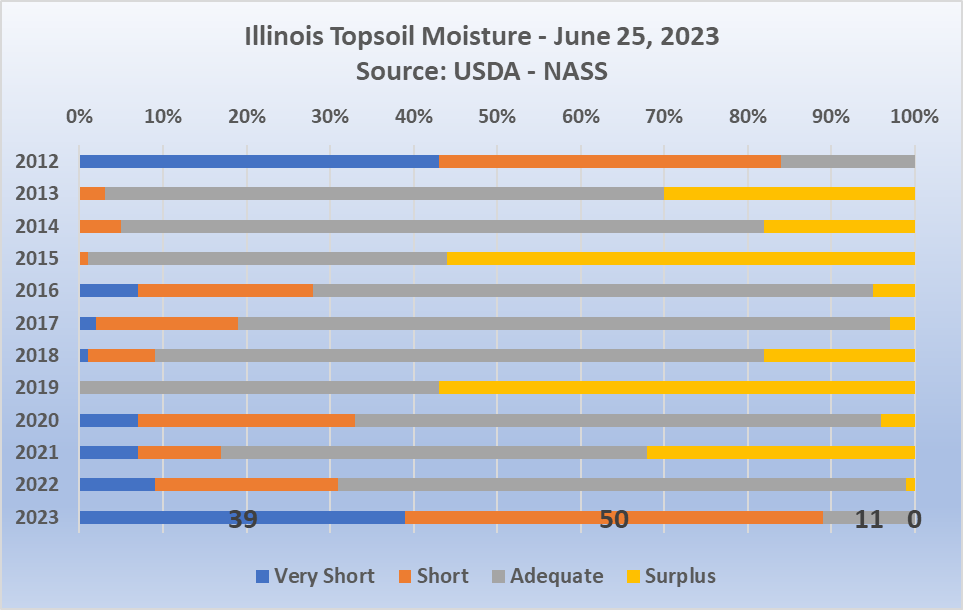

That is another huge decrease from our top producing state of Illinois. Now let’s take a look at their top soil moisture situation.

They are the shortest they have ever been since they starting tracking this metric. Yes, worse then 2012. Sitting at nearly 90% short top soil moisture.

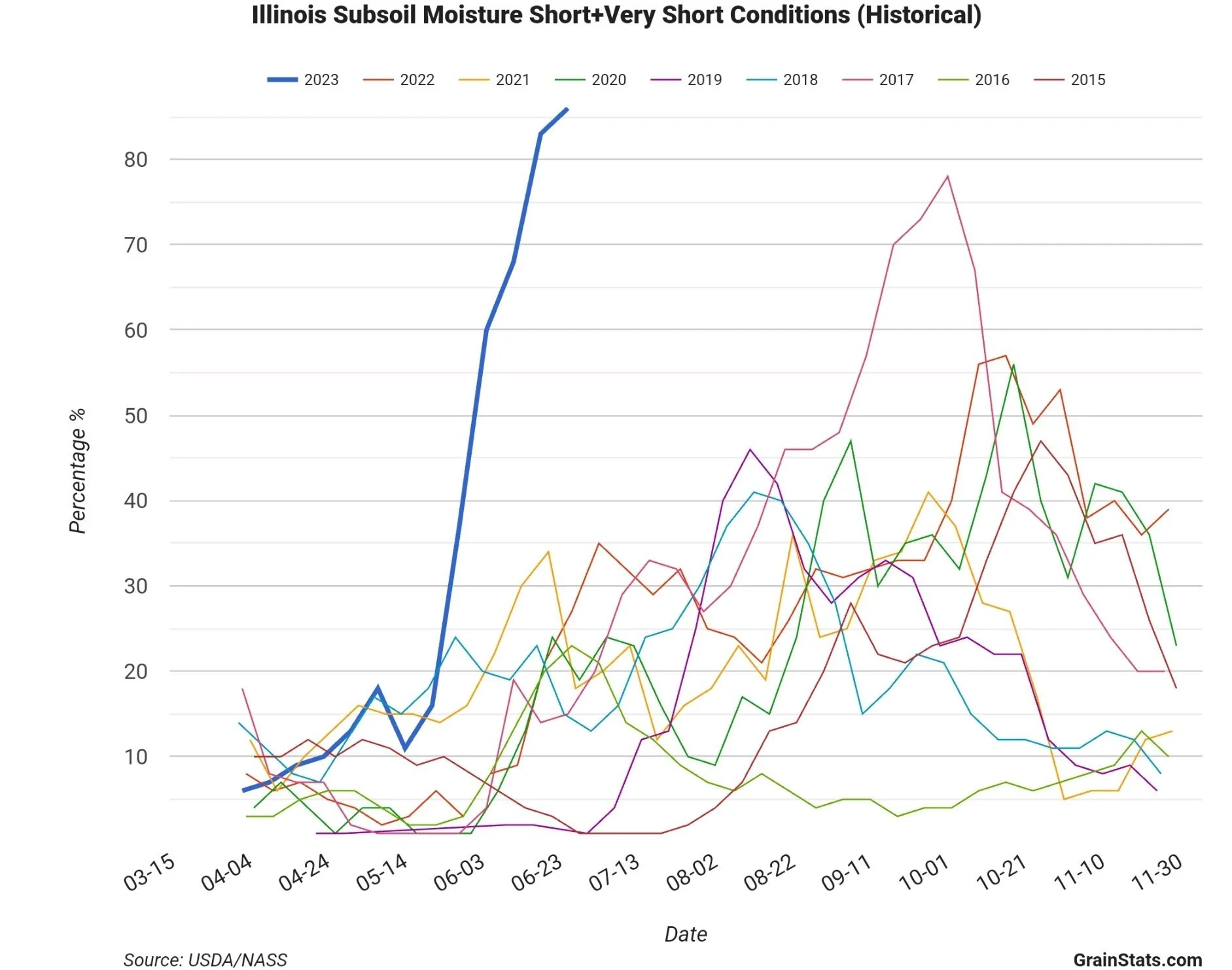

Here is the sub soil moisture situation. Yikes.

Chart Credit: GrainStats

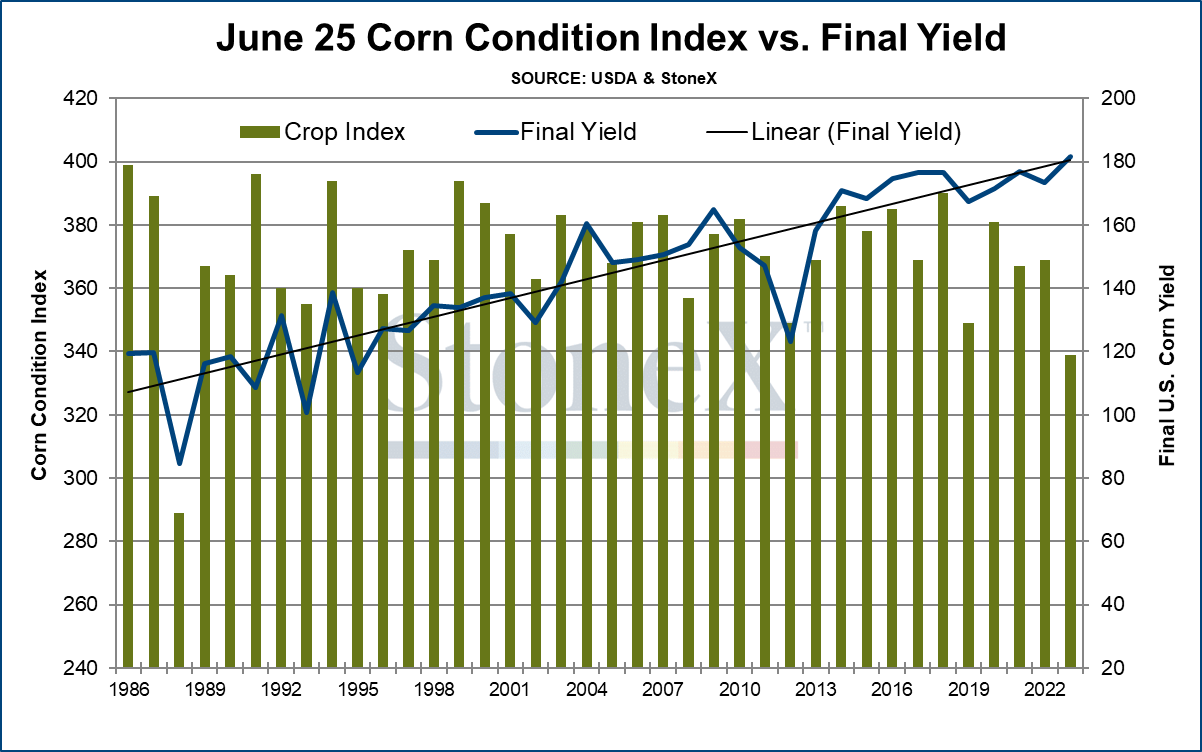

Now let's look at the corn condition index score.

This was the 2nd lowest all-time for this week. Trailing only 1988.

I think the odds are continuing to increase that we see the USDA make a rather large cut to yield. Perhaps a larger one than the trade is expecting...

I stand by my argument. Zero chance of hitting trendline yield. The trade is probably already estimating a number in the 175 range. I still believe there is a solid chance yield is sub 160.

If you take a look at this chart below. It is pretty clear we are due for a big cut.

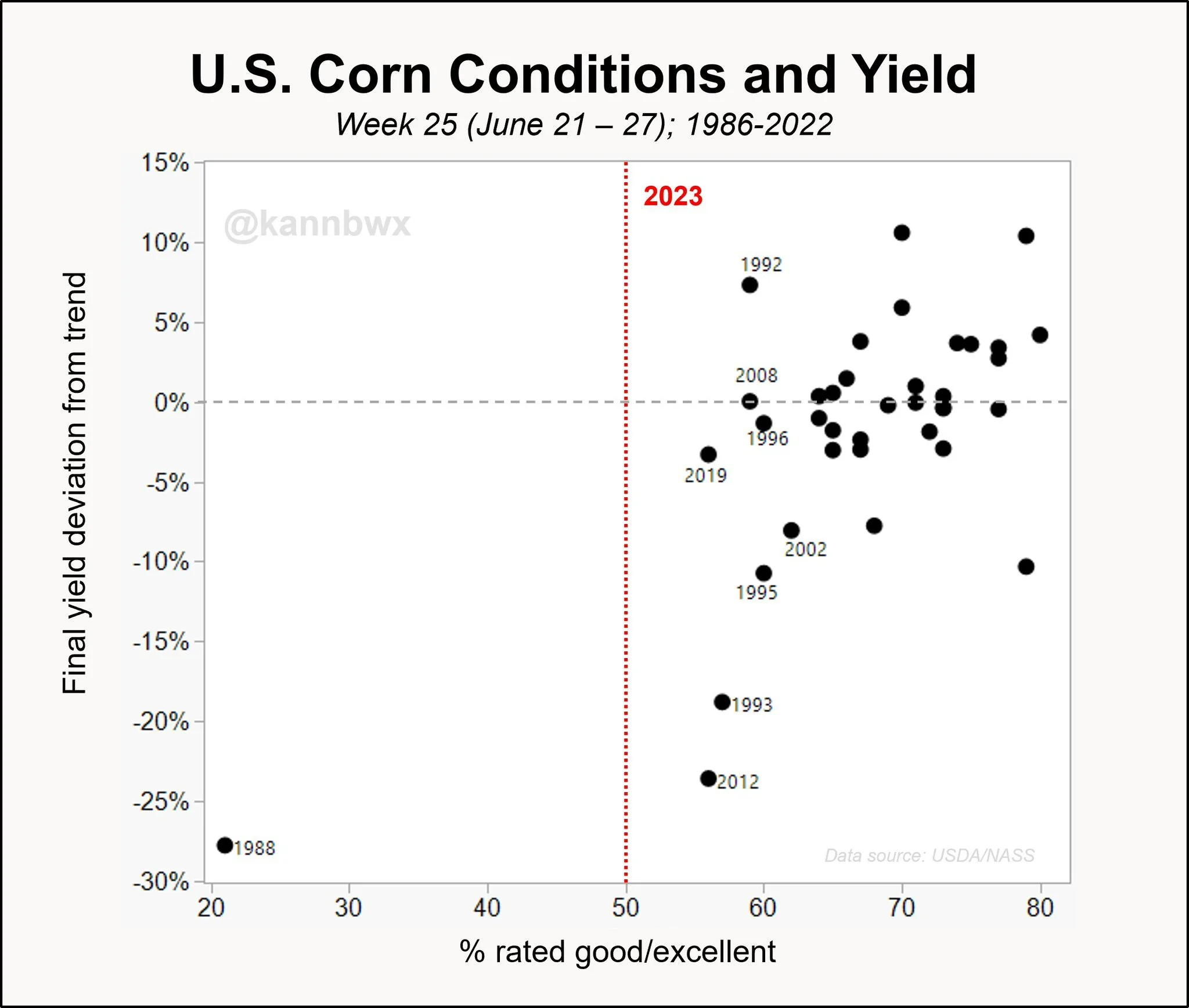

Here is a great chart from Karen Braun on Twitter.

It showcases corn conditions and final yields. As you can see the past 6 out of 8 years in between the 56% to 62% range all fell below trend line yield.

The only two outliers were 2008 and 1992. But this year is a far different situation than those two years. In fact, 2023 is essentially on an island of its own. Again, that 50% rated good to excellent is the worst in 35 years.

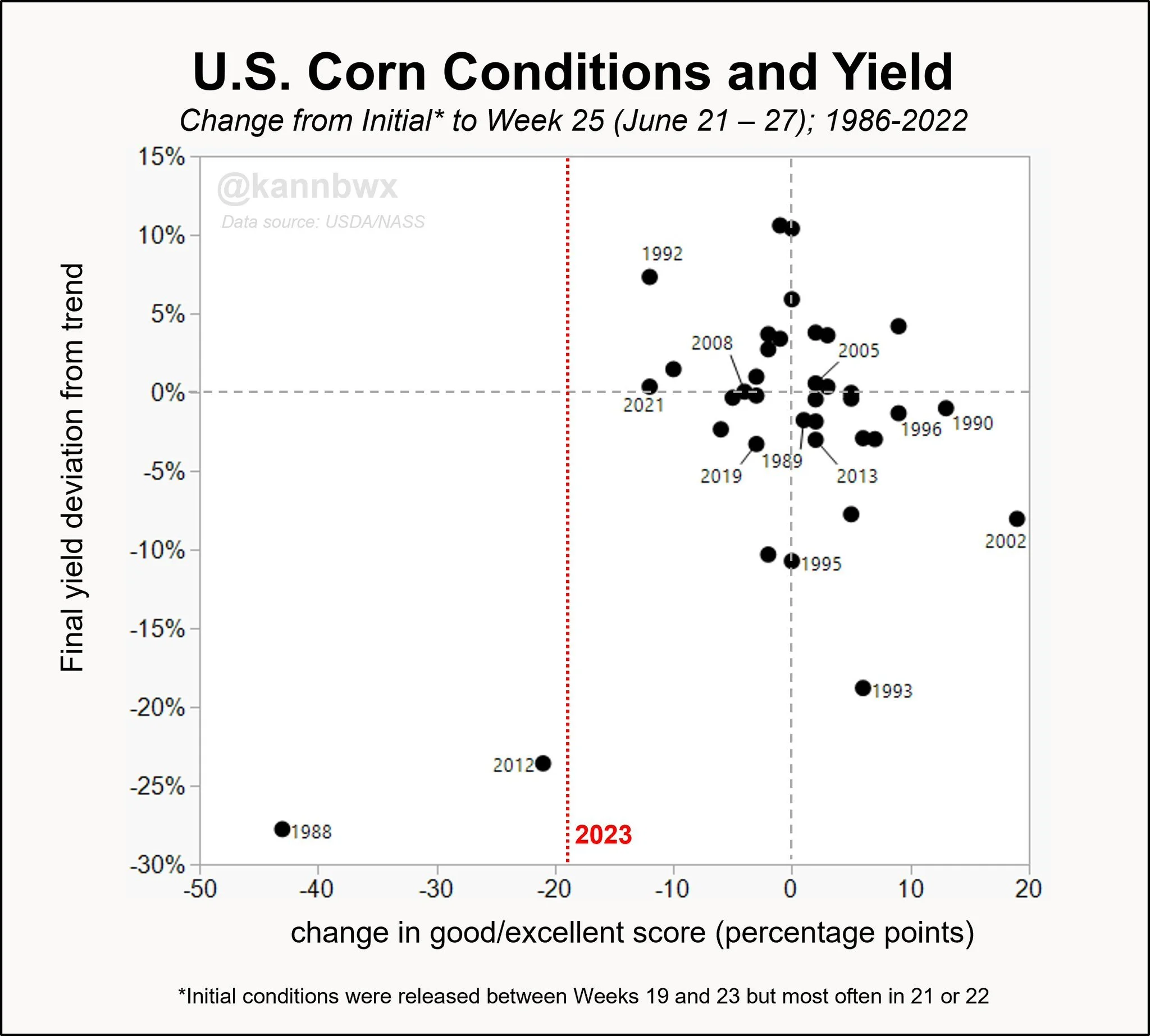

Here is another great chart she put together. This one shows corn conditions change from the initial week vs yield. Notice the two years on an island of their own. 2012 and 2023.

So far this year, corn conditions have fallen 19% from the initial ratings. 2012 had fallen 20%. Keep in mind, this years conditions are still worse than that of 2012, but this chart shows the change from "initial" ratings.

Going forward, bears are talking about some potential rains. But these forecasts have been anything but reliable.

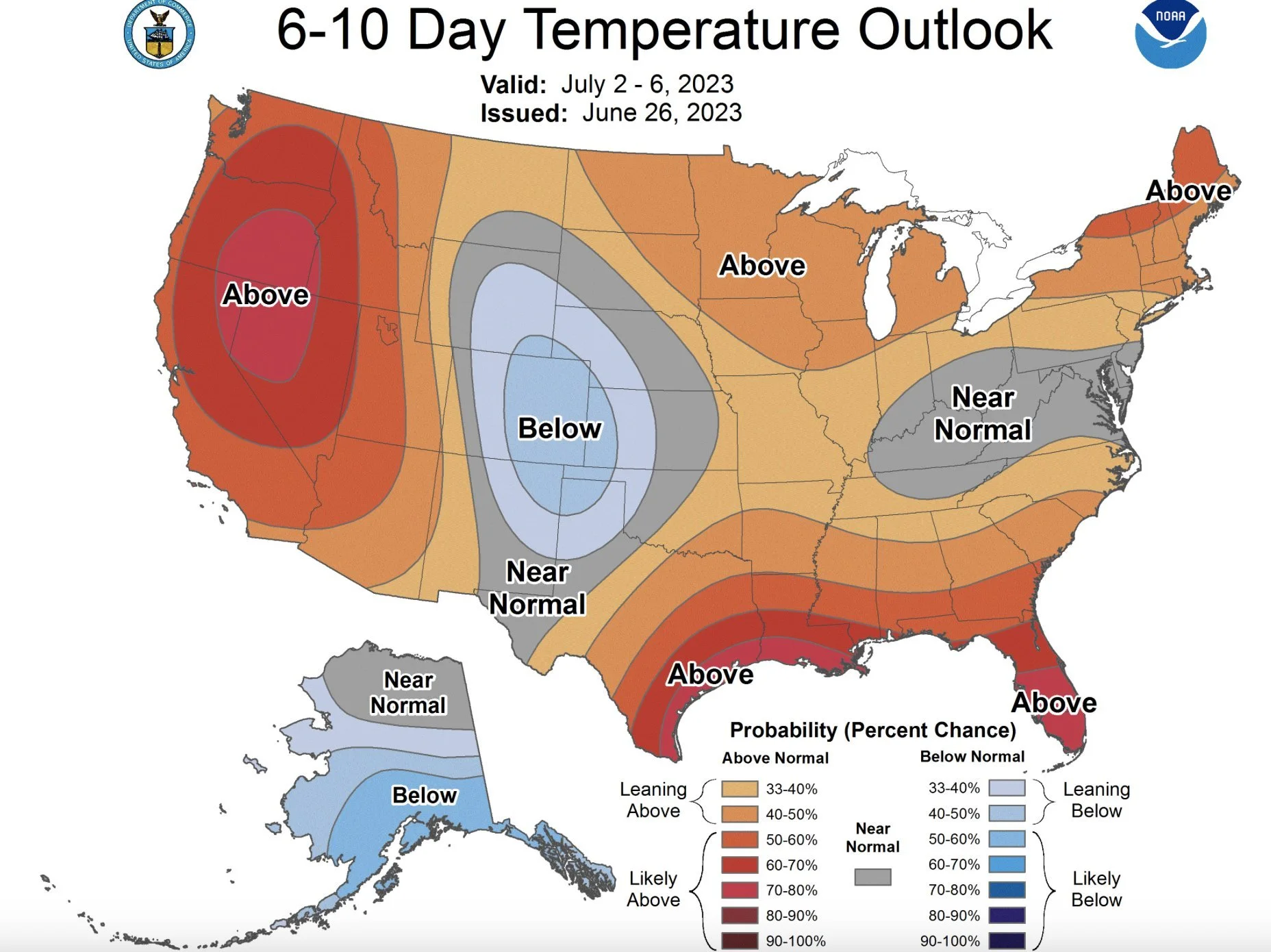

But it will all come down to weather. If it stays hot and these rains miss out again, we could be in for some fireworks following the 4th of July weekend. I think we should be very well supported tomorrow with the terrible crop conditions potentially shocking the trade again, as I still don’t believe the rain we saw will make a huge difference especially in areas such as Illinois.

Sure, some areas saw some improvements. But the showers were very spotty in most areas that did rain. Bottom line is we just didn’t get enough in the right areas that needed it most. So I still think we can go a lot higher until we see a major shift in the weather and game changing rains. The temps are going to start to heat up as we approach July. So even if we see "average" rainfall, it might not be enough when we are already so far behind on precipitation. Will will need some very timely rains. If we don’t get them, be prepared for a rally.

Looking to this weekend, we can expect some heavy volatility as traders prepare for the holiday and the USDA report.

Corn Dec-23

Soybeans

Soybeans were very strong today despite the rains over the weekend. Rallying 13 cents on the day and ending 26 cents off their early lows.

Some people say nothing matters until August, which has some merit. But what happens come August if the crop is already at such a poor level?

Crop conditions that came in today showed soybeans down another -3% to 51% rated good to excellent. Which was right on par with the trades estimates. In comparison, last year we were rated 65% at this time.

Some Notable Changes:

Illinois -8% (Rated 33% G/E)

Missouri -12% (Rated 33% G/E)

Indiana -10% (Rated 33% G/E)

Iowa -8% (Rated 33% G/E)

Wisconsin -7% (Rated 33% G/E)

Kansas -7% (Rated 33% G/E)

Here is state by state breakdowns.

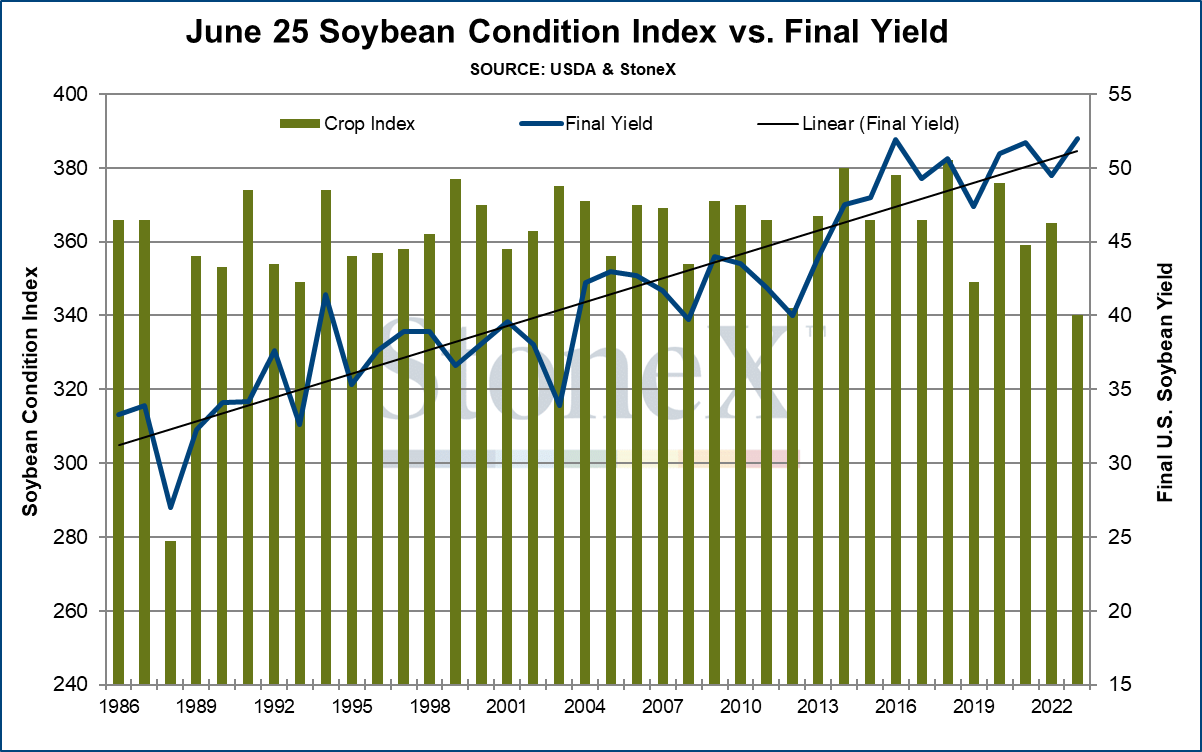

Here is a chart showing this week's conditions vs final yield. This current week's conditions are also the worst since 1988 and 2nd worst on record, although just slightly worse that of 2012.

I think the USDA will have no other chance but to cut yield in July.

We looked at the corn situation in Illinois. Here is the soybean situation. By far the worst on record. With just a mere 25% sitting good to excellent. The 2nd worst year? 2012, where it was rated roughly 35%.

Outside of US weather, bulls would like to argue that perhaps we see an increase in Chinese appetite. Especially if we see some logistic problems over in Brazil.

Despite the disappointing EPA madates last week that caused a sell off, I still think there is a solid demand story coming for soybeans down the line.

If we can retest our previous highs, there is absolutely nothing wrong with taking some new-crop risk off the table. I still think we have a ton of potential upside, but Mother Nature and the USDA will decide. Keep in mind, soybeans do have some more time than corn does. I still look to corn to lead if we are pushed higher by more weather scares. But looking long term the fundamentals are still very bullish for beans.

Soybeans Nov-23

Wheat

Wheat futures closed mixed as Chicago loses 8 cents, Minneapolis closes a penny lower, while KC ends the day 6 1/2 cents higher.

The Russia news had the wheat market trading double digits higher over night but were unable to hold the steam. As they all closed well off their highs. With Chicago ending over 30 cents off it's high.

Today was disappointing for wheat bulls, especially given that it looked like we were going to rally. But for the month of June, wheat has been the best performing futures market.

Crop conditions today showed winter wheat improving slightly. Coming in at 40% rated good to excellent. Last week was 38% rated good to excellent. The trade was expecting this to be left unchanged. On the other hand, spring wheat conditions came in slightly worse than last week and than the trade was expecting. Coming in at 50% rated good to excellent vs 51% estimates.

Winter wheat harvest was also significantly behind the predictions. Coming in at 24% harvested vs the trades prediction of 29%.

Now for the Russian news. The leader of Wagner had a short rebellion against Moscow. Which had talks going about a potential civil war. The turmoil was resolved fairly shortly but there is still tension and potential for future escalations. One thing to keep in mind with all of this is that the cheap Russian wheat is what has been capping any wheat rallies as of late.

The Van Trump report said,

"If Russia were to run into some type of internal complication that creates a hiccup or kink in logistics of grain transportation the market will look to quickly add more premium related to uncertainties."

To add on to all of the Russian news. We have a ton of global problems that could ultimate support the wheat market. I'm not flat out extremely bullish on wheat, but the potential is there, and I think the wheat market could really be a sleeper moving forward.

We have the crop estimate shrinking in India and and the EU. We have a ton of weather complications out of China. Planting delays in Argentina. Weather concerns in Canada, and fewer acres being planted in Australia. So with all of these potential bullish wild cards still left in the deck, I can’t help but have a bullish optimistic tilt here.

The funds are also still very short the wheat market. We all know what happened last year when they were this short. So there could be some opportunities ahead to see some more short covering.

Things to watch will of course be the Russia headlines, as well as the report Friday. To go along with global weather.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

Rain Fall & Forecasts

From Wright on the Market,

Rainfall inches Monday to Sunday at Karen Braun’s CropWatch locations (25.4 mm per 1 inch):

• SD 3.5"

• E IA 2"

• IN 0.7"

• MN 0.65"

• NE 0.4"

• W IA 0.3"

• W IL 0.3"

• SE IL 0.25"

And weekend rain totals reported to Wright on the Market:

• NE IL 0.8

• Walton, IL 1.16

• Peoria, IL zero

• Masonville, IA 1.0

• Spencer, IA 1.1

• Emmetsburg, IA 1.6 with hail

• McGregor, IA 0.9

• Spencer, IA 0

• Glidden, IA 0.34

• Cornell, WI 0.68

• Foley, MN 0.78

• Jamestown, ND 2.41

• Lake Preston, SD 1.38

• St. Meinrad, Southern IN 0.58

• Bowling Green, OH 0.36

Overall, less rain than expected when the market closed Friday, but most of the Corn Belt has rain in the forecast multiple days this week. We expect this afternoon’s crop conditions report to show a decline in the corn and beans with spring wheat better.

Unless the weather forecast changes at midday, we have probably already made the low for today.

In early May, we sent this to our clients:

"What is unique about 2023 is the Pacific Decadal Oscillation shifted to extreme negative numbers at the same time the La Niña episode and the 22-year sunspot cycle ended.

The location of these masses determine the flow of the jet stream across, not only North America, but also all land masses around the world. The jet stream trail in North America determines where the warm, moist Gulf air meets the cold and dry Artic air, which is where the rain falls. The PDO phase we have at the present will steer the jet stream further north than normal over the Western and Central United States.

A really strong price rally will not develop until at least the middle of June due to drought. But there are so many shorts (net sold futures contracts) in the market, a very nice rally may continue into the middle of June if the weather forecast stays the same."

Last week, the jet stream shifted south from Canada to the Central Midwest and that is why we have more rain. As long as the jet stays where it is now, every day the forecast will include rain for some parts of the Corn Belt. In other words, normal weather. Rain south of the jet stream will be hard to come by. Here is the jet stream as of last night:

Weather

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

6/23/23 - Market Update

HEALTHY CORRECTION OR END OF RALLY?

Read More

6/23/23 - Audio

EXTREME VOLATILITY & WEATHER MARKETS

6/22/23 - Market Update

BEANS PULLBACK & DROUGHT CONTINUES

6/22/23 - Audio

DON’T FEAR THIS VOLATILITY

6/20/23 - Audio

VOLATILE MARKETS

6/19/23 - Audio

CORN SUPPLY RALLY

6/16/23 - Audio

ARE THE GRAINS ABOUT TO GO PARABOLIC

6/15/23 - Audio

2023 IS WORSE THAN 2012

6/15/23 - Audio

CAN CORN BREAK MAGIC LINES?

6/13/23 - Audio

2012 REPEAT OR WORSE

6/12/23 - Market Update

CROP CONDITIONS CONTINUE TO FALL

6/12/23 - Audio

WHY THIS YEAR ISN’T 2013

6/11/23 - Weekly Grain Newsletter

NAVIGATING THE USDA REPORT & DROUGHT