WHEAT SURGES WHILE CORN & BEANS DISAPPOINT

Overview

Grains close mixed following an up and down day full of volatility. As new crop corn and beans close well off their highs, and old crop takes a hit.

The wheat market sees a big rally led by KC and Minneapolis near 50 cent rallies. The strength in wheat was due to a few different global headlines which we will touch on later in today's write up.

Monday we had crop conditions out after close, so today was the first market reaction we got from the numbers. Not quiet the reaction bean bulls had hoped today for with the decrease.

All of the numbers are below but to sum it up, corn conditions improved by 1%. Which was expected, so nothing major there but it does show that the corn crop may be improving. Beans and wheat stole the show however. Beans came in 1% lower than last week, and 2% below what the trade was expecting. The trade was expecting improvements, but instead we saw another decline. Spring wheat came in 2% lower than last week, and 4% below what the trade has been guessing. As they were expecting a 2% increase, when in reality we deteriorated by 2%. Winter wheat harvest is also running behind.

***

In case you missed it, read Sunday's Weekly Newsletter

What's Next For Corn & Beans? - Read Here

Crop Conditions

Corn 🌽

Rated G/E: 51%

Trade: 51%

Last Week: 50%

Last Year: 64%

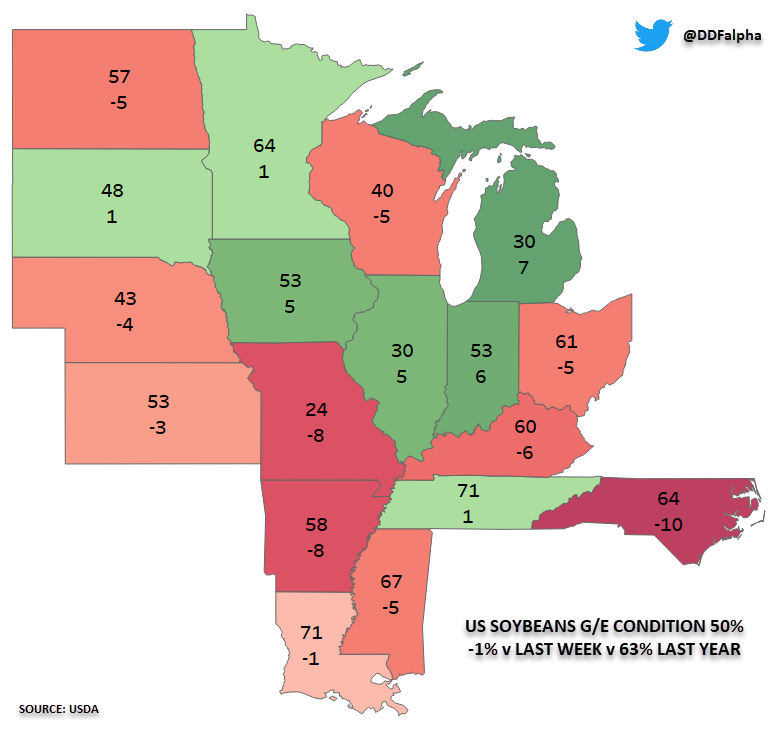

Beans 🌱

Rated G/E: 50%

Trade: 52%

Last Week: 51%

Last Year: 63%

Spring Wheat 🌾

Rated G/E: 48%

Trade: 52%

Last Week: 50%

Last Year: 66%

Winter Wheat 🌾

Harvested: 37%

Trade: 40%

Last Week: 24%

Average: 46%

Today's Main Takeaways

Corn

Corn opened strong but ultimately fell a dime off it's highs ending the day unchanged. As corn just can’t make up it's mind on which direction it wants to go.

As expected, corn conditions did see some slight improvements. As overall ratings jumped by 1% to 51% rated good to excellent. Which is still well below last year's 64%.

Here is a state by state breakdown. Some very clear improvements in the corn belt. The most notable changes being in the 3 I-states.

Illinois: +10% (Rated 36% G/E)

Iowa: +5% (Rated 61% G/E)

Indiana: +5% (Rated 52% G/E)

Despite the improvements, I still wanted to look at how this June shapes up compared to other years when we look at total precipitation.

Yes we got meaningful rain, but the corn belt still had one of it’s driest years on record. With parts of Illinois being the driest in over 120 of 131 years.

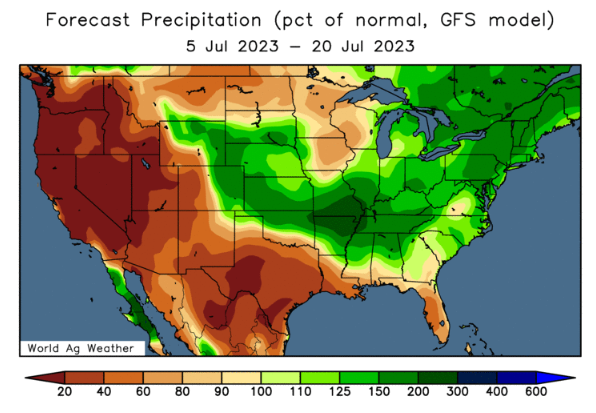

Here is the current weather outlook. A lot of this is likely priced in. But is definitely something to keep your eyes on. These forecasts could lead to some additional pressure to the downside short term.

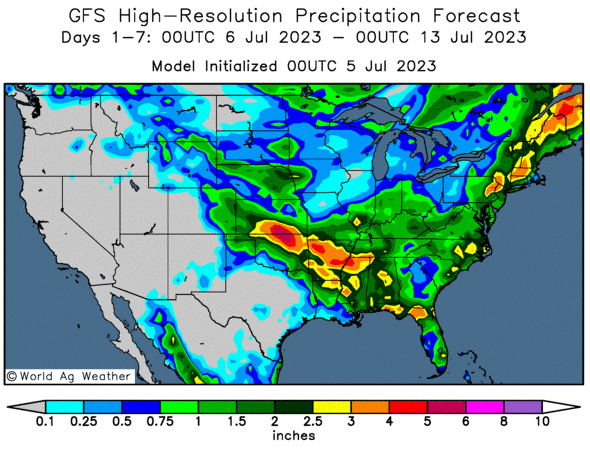

Now here is something else we are watching. The GFS models show a potential dry pocket in Iowa, which could spread into Illinois.

After a 7 day $1.40 sell off I don’t think anyone wants to sell cash grain here. I am not saying we can’t go lower, because of course we can. No one has any idea how the weather will shake out. I actually wouldn’t be surprised to see one more leg down, and close below Monday's lows.

In this morning's audio we talked about a 50% retracement bringing us into that $5.55 to $5.60 range. Which is also right around our 100-day moving average. This is a range we could look to make additional sales. In this morning's audio we also go over possibly owning calls. You can listen to that here.

If we take a look at the charts, yes I think we have the potential to make a quick new low. But we also could have just created a double bottom. Nonetheless, we are very very oversold here on the charts, and I expect us to get a nice rebound in the next few days. My first upside target is $5.25 followed by the $5.50 range.

Corn Dec-23

Soybeans

Beans also opened up very strong following the holiday. At one point we broke 40 cents off our highs, but managed to claw back 17 cents or so. Ultimately ending the day still higher by a penny but 23 cents off our early highs.

Friday we had a very bullish report. Monday we had bullish crop conditions. Yet soybeans struggled to hold on to the momentum, suggesting that a lot of this is already priced in. The lack of momentum was also simply due to some profit taking following the massive rally we just had.

Unlike corn, soybeans conditions fell again. Falling 1% to 50% rated good to excellent. This was a bullish surprise, as the trade was expecting ratings to actually improve by 1% to 52% rated good to excellent. Just like corn, much of the I-states saw some good improvement. Part of the reason we didn’t see a ton of reaction to the decrease in ratings was, firstly a lot of this was already priced in, and secondly, the top 4 producing states all saw improvements.

Some notable changes:

Illinois: +5% (30% rated G/E)

Indiana: +6% (53% rated G/E)

Iowa: +5% (53% rated G/E)

Missouri: -8% (24% rated G/E)

Michigan: -5% (40% rated G/E)

There is nothing wrong with rewarding this recent rally. I don’t mind taking some risk off the table here with prices within 35 cents off their 2023 highs. Is there the potential for more upside? Yes. If the cards get dealt right, there is a ton of potential for beans to make new highs for the year. I think beans even have the potential to see near $15. But you still need to take into consideration what makes the best sense for your operation and remain comfortable no matter what scenario plays out. So if you need to make some sales, make a few. This is also not a terrible area to start looking to grab some puts soon in the coming weeks.

If you want help deciding what to do, or want to learn more about other risk management strategies give Jeremey a call at (605) 295-3100 as every single operation is different with different risk to reward profiles.

I also include an incredible write up from Wright on the Markets that can help you decide what to do and give you some guidance at the end of today's write up. I highly recommend giving it a read as he is one of our most respected other advisor services who always puts the producer first.

Going forward, I think soybeans should be well supported on any breaks. Now we didn’t get the traction bulls had hoped for today. With the extremely bullish report Friday, and the bullish surprise from the crop conditions. Which means a lot of this bullish news is already priced in. So I wouldn’t be too surprised to see some additional profit taking short term and perhaps test that upward support trendline before the next big move higher.

One thing to keep in mind that is included in Wright on the Markets write up is that the seasonal price trend for soybeans is upward until July 15th. So we could be looking to makes sales here soon, within the next 2 weeks or so. Again, I highly recommend reading his full breakdown at the end of today's update.

If we can get a break above Monday's highs, that opens the charts wide open to see more upside. A break above and we look to the $14 level and possible new 2023 highs.

Soybeans Nov-23

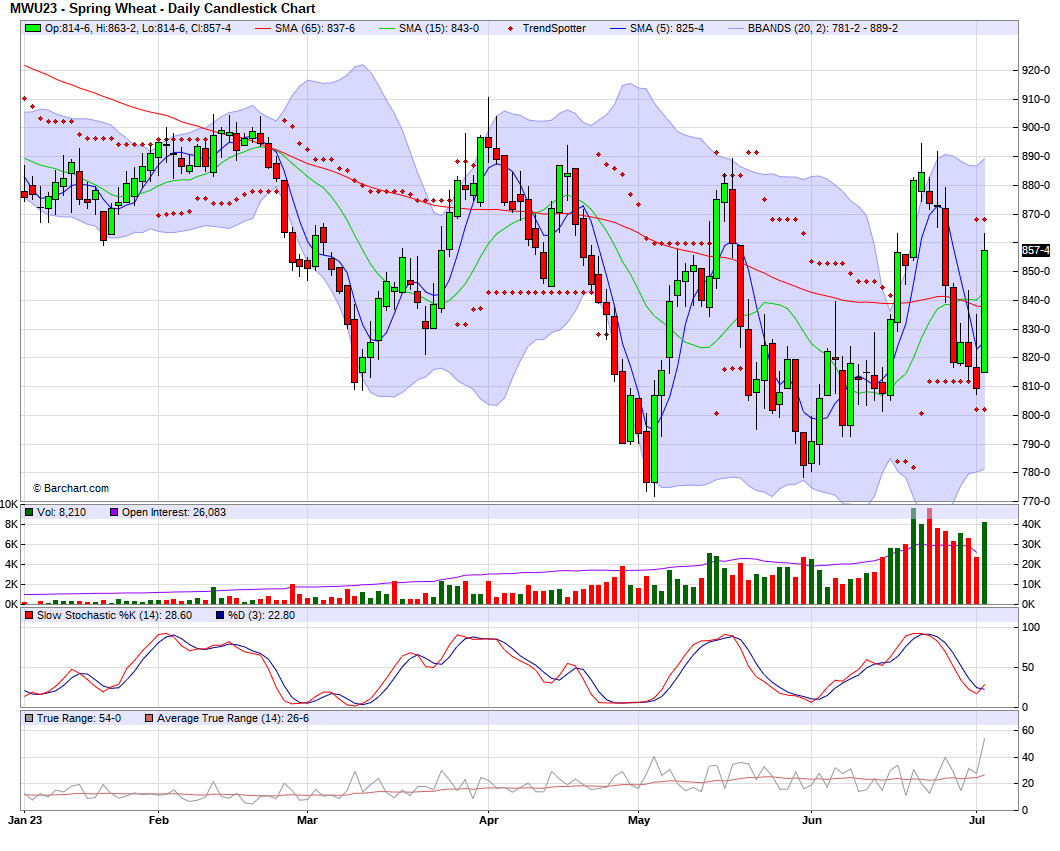

Wheat

The wheat market surges today, following 6 straight days of losses. As wheat futures rally 30 to 50 cents, led by near 50 cent rallies in both KC and Minneapolis.

There were a few things supporting the wheat market today.

Firstly, the crop conditions and progress were fairly bullish. As spring wheat ratings came in 4% lower than the trade had been anticipating. The continuation of deterioration despite the rains in the northern plains over the past week indicate that we might have seen some irreversible damage.

Winter wheat harvest is running behind, as rains have hampered harvest. The top producing state of Kansas came in at 46% harvested vs 80% last year. But this report wasn’t the sole reason for the surge in prices today.

The biggest thing was the rise in global prices. As French wheat was up $11 a ton and Russian wheat was up $8 a ton. Russia also apparently dropped the wheat export taxes.

To add on top of that, we have the Russia and Ukraine war situation with the upcoming renewal deadline for the Black Sea agreement. Nearly every source is saying that Russia isn’t going to renew it. We have heard that story before. Russia says they haven’t made a decision, but I would shocked if it didn’t get renewed.

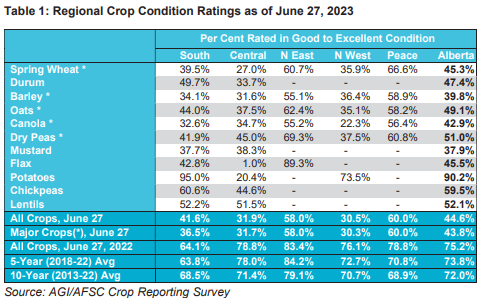

We have touched on this in past updates, but global weather is another big wild card that could support wheat futures.

If we take a look at Canadian durum wheat in Alberta, Canada. It came in only 47% rated good to excellent. A 16% drop over the course of just 14 days.

There are still a significant amount of areas in Canada that are suffering from a deficit in soil moisture. Here is a map showcasing the percent of normal soil moisture.

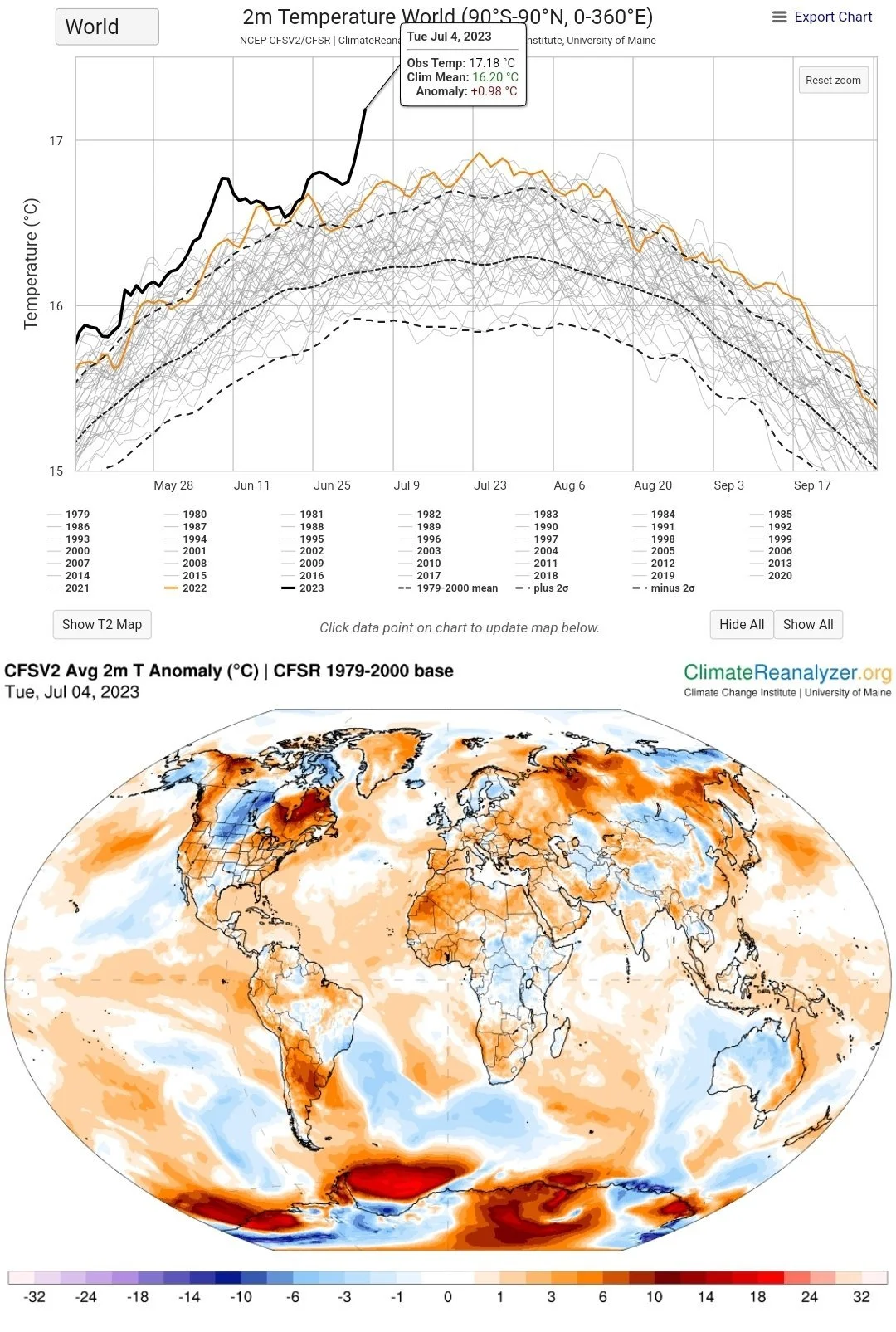

Just a fun fact. The 4th of July, yesterday, was the hottest day globally of all time. As we shattered the record for global surface temperature.

The past two weeks we had mentioned that the wheat market could be a sleeper. The wheat market will continue to be influenced by global prices & competition. Global and domestic weather. And of course war and the grain agreement. We will have to see if the recent increase in global prices can continue to carry us higher, as global competition had been one of the biggest things keeping a lid on any rallies.

Recommendation

This area wouldn’t be a bad place to price in some July hard red winter cash wheat with prices well over $1 off our lows. I think we could possibly see $9, but there is nothing wrong with rewarding this 50 cent rally.

However, we don’t like to give out generic recommendations like most other advisors, as we know every operation is different with different risk/reward profiles. If you want specific advice and recommendations give Jeremey a call at (605) 295-3100 or Wade at (605) 870-0091 and they will ask you a series of questions to be able to help your situation.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

How to Decide When to Price Grain

From Wright on the Market,

Soybean Seasonal Price Up Trend Ends July 15

The age-old problem is to decide when to price your grain. That task should be a two-stage process; basis and futures determine the cash price.

The easy stage is the basis, which is very predictable and the annual range is relatively small compared to the futures price.

The difficult stage is pricing (locking-in) the future price, which is very volatile and some years, very unpredictable. The decision of when and at what price to lock-in futures, whether as a HTA, forward contract or hedge position in one’s own futures account, requires the same decisiveness and sometimes, nerves of steel.

When in doubt, you cannot chicken out on the decision. It is OK to not price futures, but the decision to not price futures should be an intentional decision rather than a non-decision to wait another day.

This is a decision-making tool we highly recommend when the decision is difficult:

1) What is the fundamental outlook?

If the fundamentals are bullish (prices will go higher), that is a reason not to price the futures.

If the fundamentals are bearish (prices will go lower), that is a reason to lock-in (sell) futures.

2) What is the technical outlook?

If the technical picture is bullish, it is a signal not to lock-in the futures.

If the technical picture is bearish, it is a signal to lock-in the futures.

3) What is the seasonal trend?

If the seasonal trend is up, it is a reason not to sell.

If the seasonal trend is down, it is a sell signal.

4) Is the current price profitable?

If you can make a profit at the current price, that is a sell signal.

If you cannot make a profit at the current price, it is a reason to wait to sell.

What is the tie-breaker? Number 4 is the key. If you can make money, price the futures.

If you cannot make money, do not price the futures.

To a large extent, the fundamental and technical picture is like beauty; it is in the eyes of the beholder.

On any given day, one can find a hundred technicians that will say the market is going down and another hundred that will say the price is going up.

The same is true of analysis based upon the fundamentals.

Therefore, you must do the work yourself, which means spending 5 to 10 hours a week to gather the information to form your own opinion.

The alternative is to pay someone to do the research for you and transmit that information to you in words you can understand.

But it is not enough for the “expert” to say “sell” or “don’t sell.” Never take anyone’s word for it. It is not their grain! It is your grain!

Make that person tell you why! What are the reasons the recommendation is whatever it is and do those reasons make sense to you? If the reasons do not make sense to you, they are not good reasons.

The key for your decision to sell or not to sell based upon some other person's recommendation is: Does the analyst’s reasoning make sense to YOU!

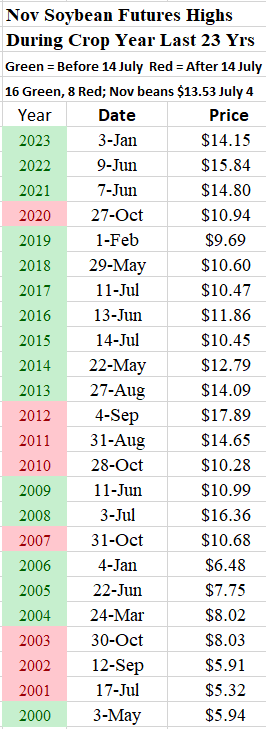

The seasonal price trend for beans turns down July 15th. Roger is expecting to recommend a sale for soybeans in the coming 10 to 15 days. Here is the market plan:

The good news is with all the market tools now available, there is always a “Plan B” opportunity. That was not true just a few decades ago because the marketing tools simply were not available back in the day.

HTA 100% of expected production with a merchandiser who will allow you to roll undelivered bushels to 2024 crop year. If you cannot get a merchandiser to do that for you, contract all the beans your nerves can stand and buy puts in your own account to cover the rest of expected production. Most of you would be surprised what your merchandiser will do for you if you just ask.

If the futures price goes substantially higher after you price the HTA, buy soybean put options with expiration date 3 to 6 months out. Right now, it looks like November beans in the $14.00= area is reasonable HTA expectation over the next two weeks, in which case the first put would be in the range of a $13.60 November put option for 30¢ followed by a $14.00 November put at 30¢.

If you can lock-in a profitable HTA price, and the price goes higher, the puts will allow you to make the money on the way down you did not make on the way up. The HTA will eliminate the down side risk at a minimum cost.

Now, take a close look at November soybean price history. If you do not think this information is very important, you need to change your attitude about marketing.

Fertilizer Update from DTN

UAN28 prices dropped below $400 for the first time since September 2021.

Six of the eight major fertilizers were lower in price compared to last month.

Anhydrous was 5% less expensive than last month with an average price of $753 per ton.

The other five fertilizers that were lower in price were down just slightly from last month.

MAP $829 a ton

Urea $616 a ton

10-34-0 $731 a ton

UAN28 $396 a ton

UAN32 $468 a ton

UAN28 dropped below the $400-per-ton level for the first time since the fourth week of September 2021.

That week, the nitrogen fertilizer's average price was $388 per ton.

Of the remaining two fertilizers, DAP's average price was up $1 from last month at $825 per ton and Potash's average price was unchanged at $620.

This info is from DTN. Read the full article Here

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

7/5/23 - Audio

THE HEAVY VOLATILITY CONTINUES

7/3/23 - Audio

ARE THE MARKETS GOING TO BLOW UP OR FIZZLE

7/2/23 - Weekly Grain Newsletter

WEATHERING THE STORM: WHAT’S NEXT FOR CORN & BEANS?

6/30/23 - Audio & Report Recap

WHAT THE USDA REPORT MEANS

6/29/23 - Market Update

MORE DROUGHT & USDA REPORT TOMORROW

6/29/23 - Audio

WHAT’S NEXT FOR THE GRAINS?

6/28/23 - Audio

FREE FALL CONTINUES. HOW WILL THIS PLAY OUT?

6/27/23 - Audio

GRAINS SMACKED DESPITE AWFUL CROP CONDITIONS

6/27/23 - Audio