YIELD, DROUGHT UPDATE, TIME FOR CALLS?

Overview

Grains end mixed with soybeans getting a slight bounce following their recent sell-off while corn and beans continue to struggle to gain any moment. As wheat led us to the downside, down 12 in Chicago and 19 1/2 in KC.

Corn and beans had a relatively quiet day compared to as of late with the massive volatility we've seen. With a small 10 cent range in corn, and a 19 cent range in beans.

We another sale of beans to China this morning. Export sales this morning were huge for soybeans, 2.74 million metric tons. Was a little surprising to see beans not pick as much momentum as some would have thought, but the weather is still pressuring the beans.

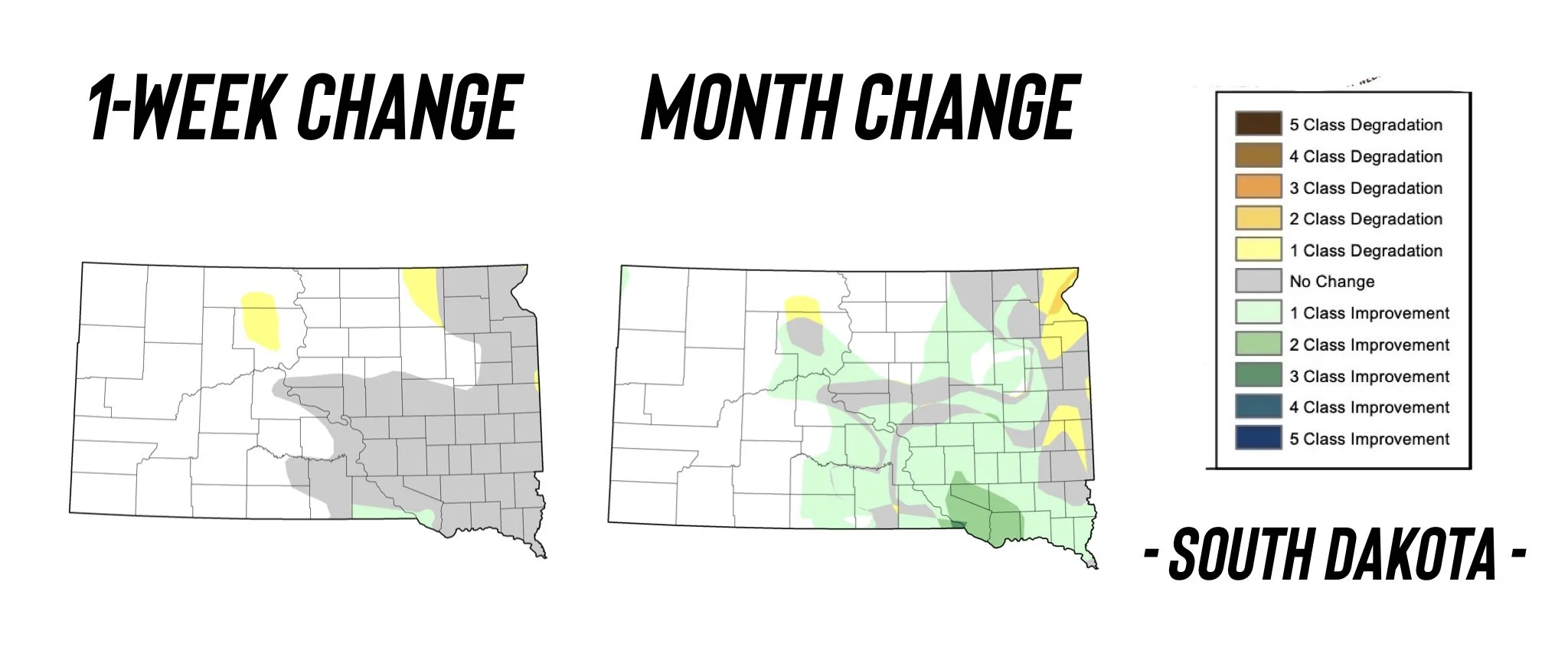

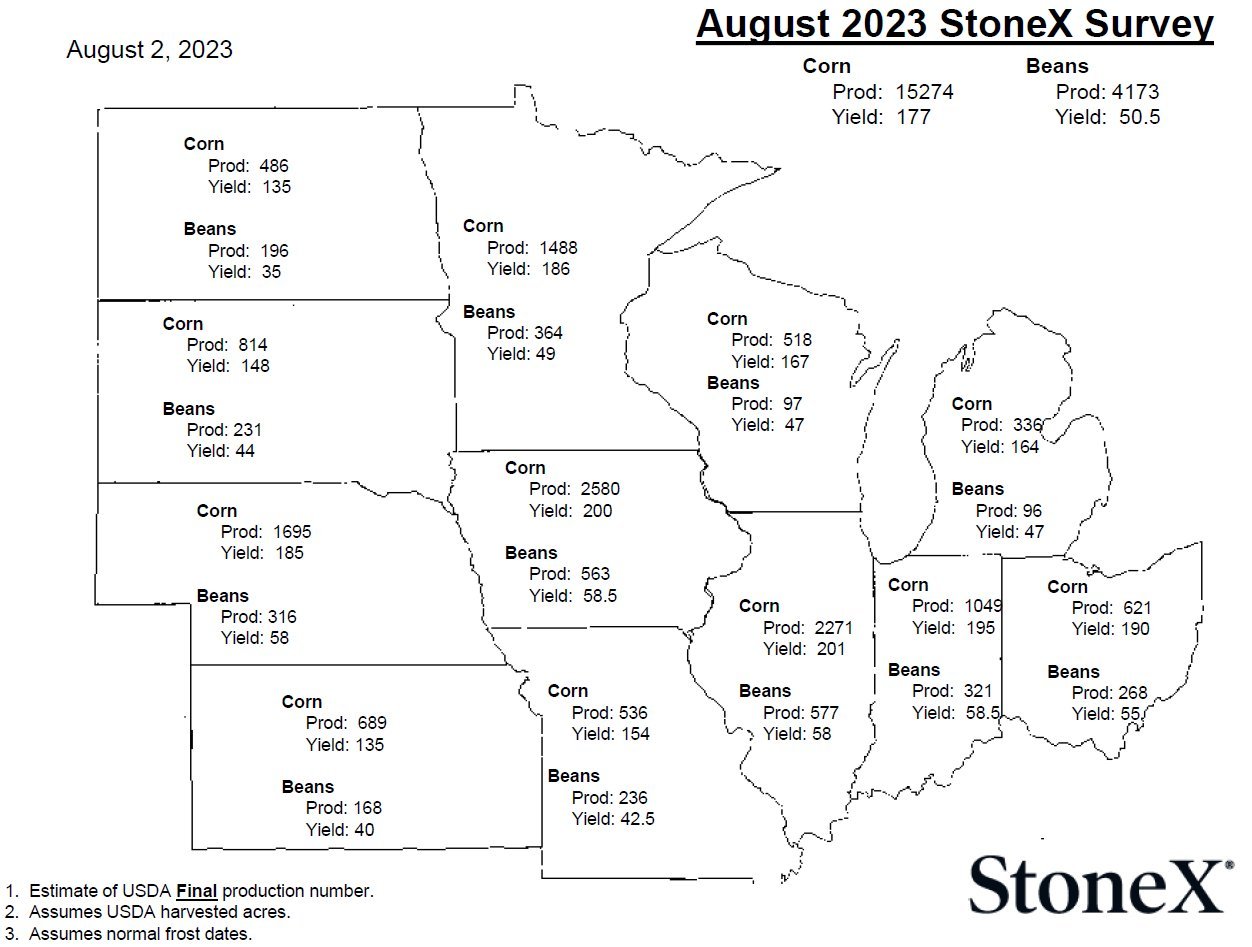

StoneX came out with some yield estimates from a survey. For corn they had 177 bpa compared to the USDA's 177.5 bpa. On the beans they had 50.5 bpa for beans vs the USDA 52 bpa.

The rain and cooler weather are certainly going to help the crop. But I still think the trade is underestimating the amount of damage we have done thus far. To have our bean crop rated at just 52% good to excellent this late in the season is a pretty good indication that we likely won’t even be close to what the USDA seems to think.

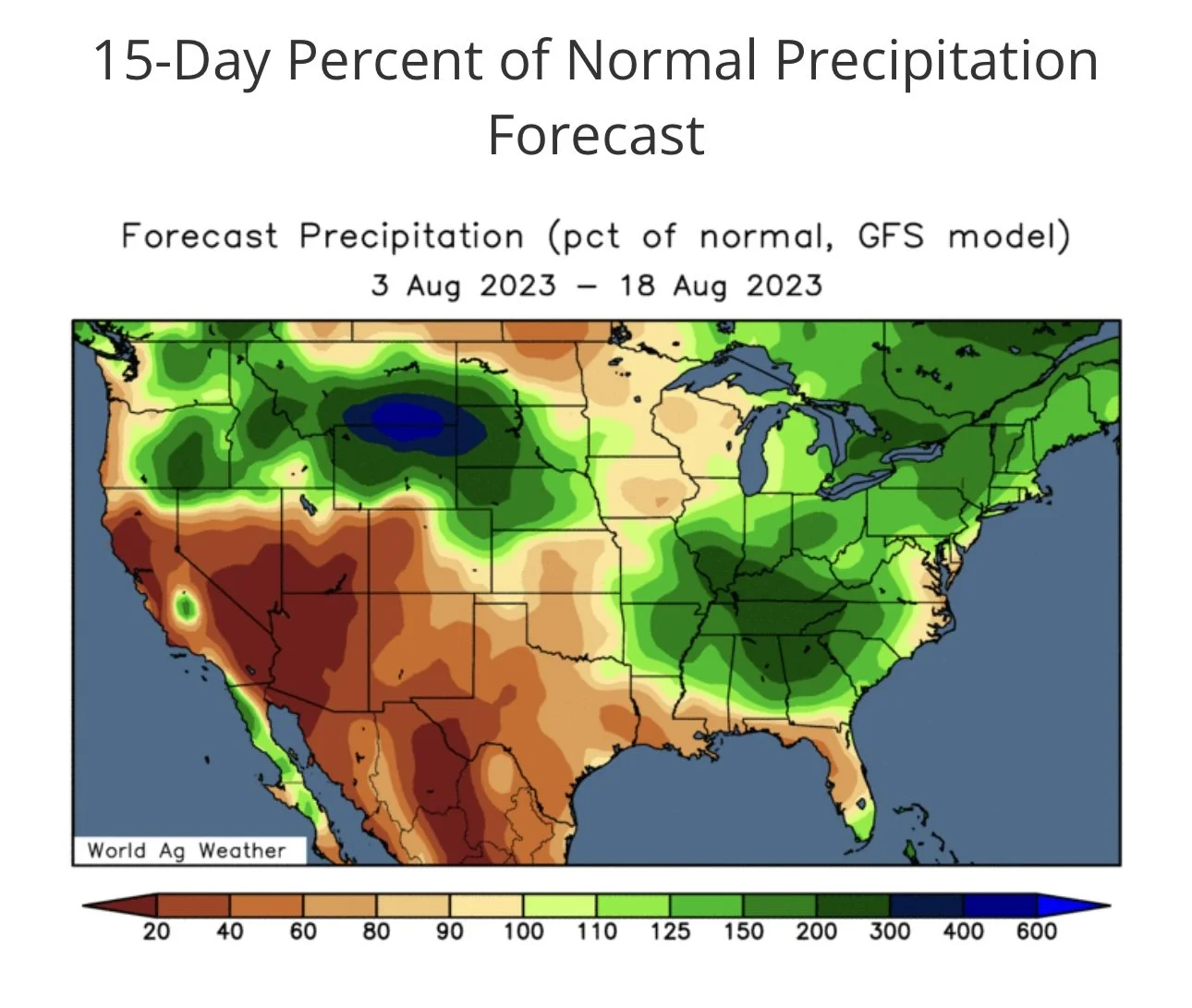

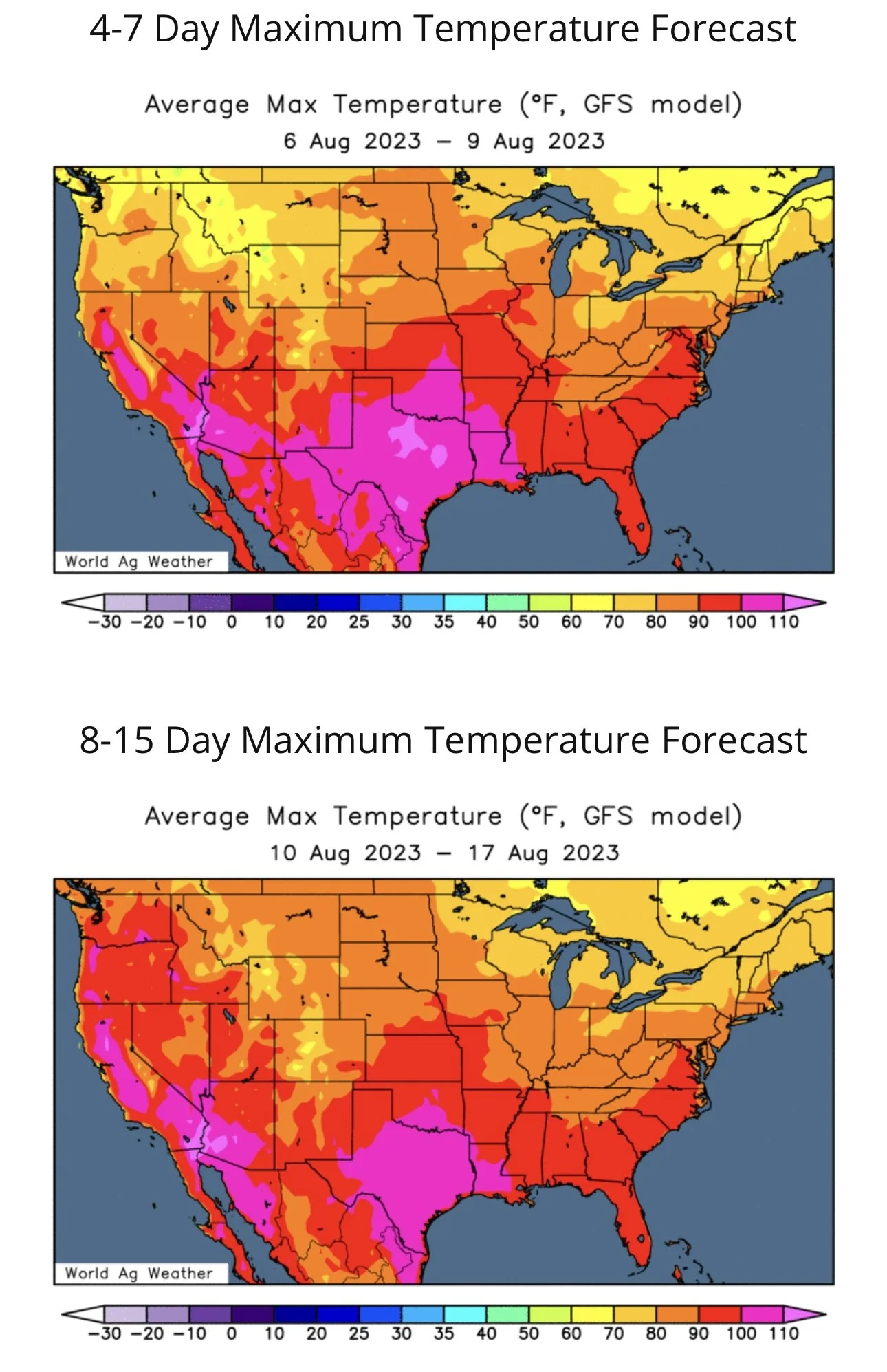

Below is the current forecasts.

Forecasts

Drought Update

The newest drought monitors were on the bearish side. Now these weren’t a game changer, but the midwest had 3% less drought in the D1 category and 6% more in the no drought stress category.

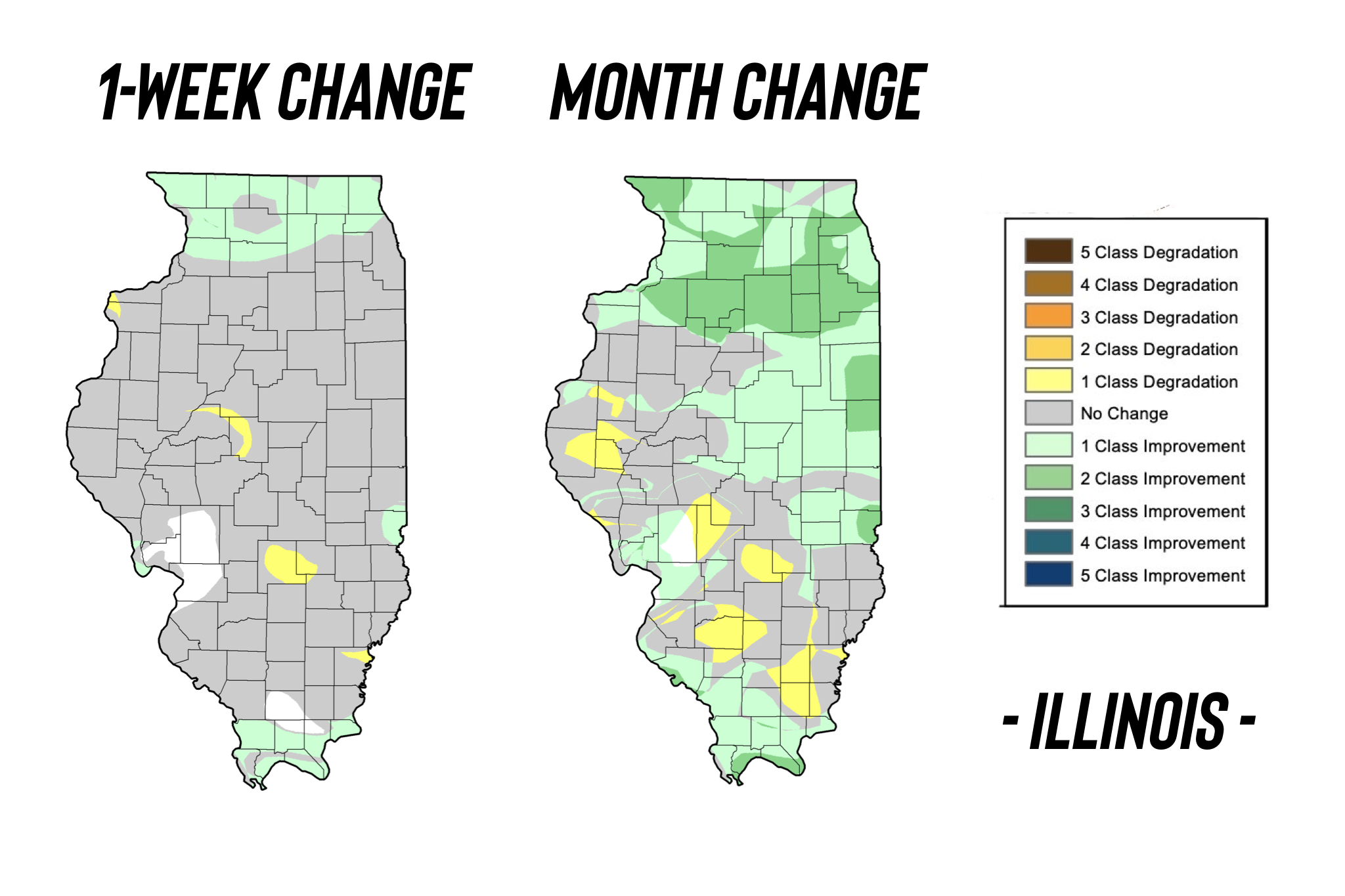

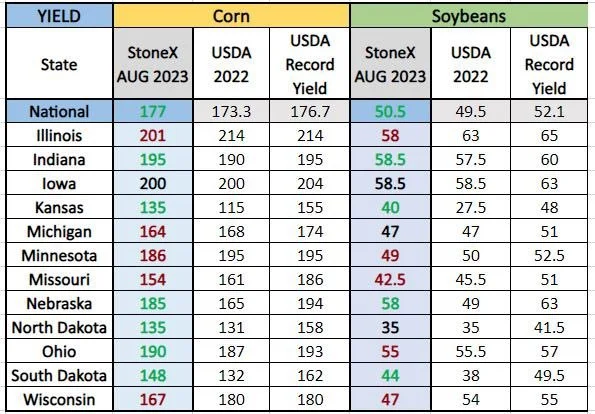

Below is the weekly and month change for the midwest as well as Iowa and Illinois. Illinois saw improvement once again but Iowa saw some decline.

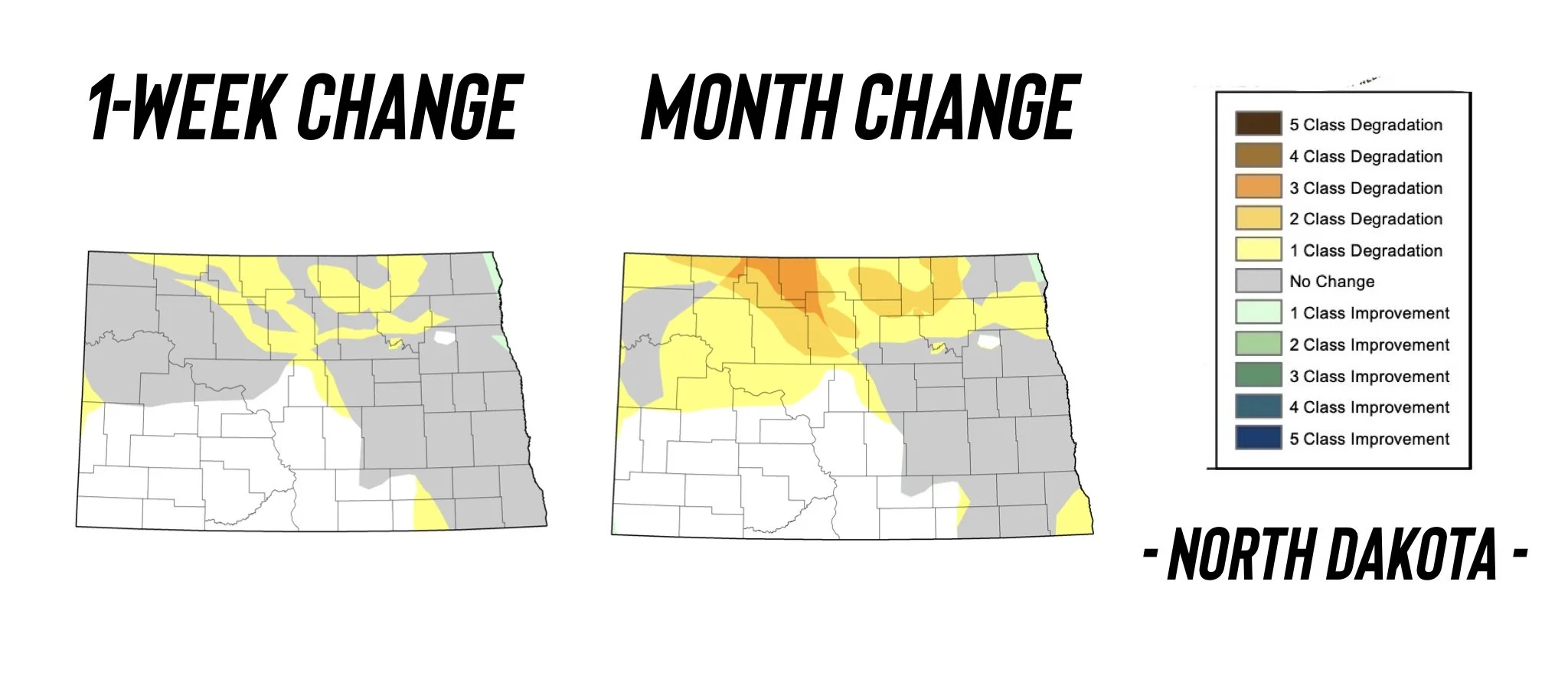

Minnesota, South Dakota, and North Dakota will be a few states that are being closely monitored in terms of potential damage and yield loss.

Here were their drought changes.

Today's Main Takeaways

Corn

Corn posts it's 8th consecutive day of losses, now trading back below $5 and 80 cents off of it's recent highs.

The focus has still been the bearish weather as well as some estimates raising their previous lower yield numbers.

Aside from weather, the macro markets have not helped on this sell off. With the recent surge in the dollar creating headwinds for exports. Exports sales this morning were okay, nothing special. All of this has led to the funds selling.

StoneX Brazil raised its corn production estimate to 139.23 million metric tons. Up 6.23 million metric tons (245 million bushels).

As mentioned, the StoneX survey came out with a 177 bpa yield for corn. A bearish number, and slightly below the USDA's 177.5 they had last month.

Next week we will get the USDA report. There is almost a zero chance that yield comes in unchanged or higher. Could it happen? I suppose it's possible, but not probable.

When we take a look at these surveys, we need to keep in mind that a lot of the numbers came from buyers, commercials, and elevators as we mentioned in this morning's audio. This is important because more often than not, buyers overstate yield, while farmers understate yield. Because buyers want the price to go down to buy grain as cheap as possible, while producers want to get the best price possible. So overall, these surveys aren't the most reliable thing in the world. So take them with a grain of salt.

Here was the results of the survey.

On the other hand, StoneX also released their yield estimates from their model. Their model showed a yield of 172.5 bpa. Which is nearly 5 bushels an acre less than the USDA currently has and far below what their surveys showed.

Demand is still a concern, and has been the biggest thing putting a lid on corn futures. With next week's USDA report we will have to see what kind of changes they make to the balance sheet side of things, if any.

War is a wild card. If Russia comes out and says they want to resolve this Black Sea deal, corn and wheat would take it on the chin. Not saying that this will happen because nobody knows aside from Putin.

Overall, this move to the downside was over exaggerated and far over done. I noticed a few well respected advisors such as Roach Ag placed buy signals across all of the grains including corn. Then you have others such as Kevin Van Trump who still have a bearish tilt given the improvements in the weather and talk of a large ending stocks number.

Personally, a bounce is certainly coming. However, I actually would not be surprised as at all to see us go and test our recent lows at the $4.81 level as I stated in my update on Monday, before we get a significant bounce.

The move to the downside was overdone, this isn’t a bad spot to consider courage calls on days like today. Although we might have a little more downside ahead of us, days like today are were we want to look to take that opportunity.

Here is a tweet from Brian Wilson, one of the highest respected commodity traders on Twitter and was a pit trader for 25 years. He thinks it's dangerous to be short corn at this level until we see actual yield projections.

Here is a small suggestion from Chris Robinson over at the Robinson report. This adds on to our reason of why we like cheap calls here.

He said,

For those of you who sold corn north of $6.00 and again- north of $5.55 to $5.72 on the last rally?

Take a look at cheap calls.

Why? Simple.

If we have another rally after this USDA you need the calls on BEFORE the move.

That's called a hedge. Waiting to buy calls AFTER a move? is more speculative and is more chasing than hedging.

Upside targets: $5.36, $5.40, and then $5.70.

Corn Dec-23

Soybeans

Beans opened up strong and had a relatively quiet day compared to as of late, finally finding a small amount of strength following their brutal sell off they have endured the past week.

Weather has been the number one factor on this move lower. As forecasts are showing more rains and cooler temps in the forecasts.

This has led to some arguing that perhaps the USDA's 52 bpa yield isn't that far off from being accurate.

I would have to disagree. I wouldn’t put it past the USDA to leave it unchanged to slightly lower. But it would shock me if we didn’t see a cut of some sorts.

To have the current crop conditions rated at just 52% good to excellent this late in the year tells us all we need to know. I expect these to improve next week, but nonetheless it is very hard to even argue that the crop is as good as the USDA says.

We mentioned the StoneX numbers and surveys in our corn section (scroll back up for full numbers). But even the survey which is typically overstated had yield at 50.5 bpa vs the USDA's 52.

However, even their own model has yield at 49.6 bushels an acre. A pretty big change from the USDA's number.

Sure, there is definitely the chance for weather to improve this crop by a wide margin. But we can’t discount just how poor it currently is.

On the demand side of things. This has been a bright spot for beans. Complete opposite compared to corn. Demand has been very solid, with China stepping back into the game. So there is definitely the chance for a bigger demand story to continue developing in the bean market. For beans to keep find some firm footing and go higher from here, demand will certainly have to be there.

If demand isn't there, and forecasts stay as bearish as they are, that wouldn’t be a good look for beans. On the bright side for the weather side of things, these forecasts are now currently priced into our markets.

I expect us to at the very least get a bounce, perhaps into the $13.50 range. But a lot of the next week of price action will come down to pre positioning ahead of the report as well as the report itself.

I still think 52 bpa is far from being close, but who knows how this August weather will shake out and how much improvement we'll see.

Weather, yield estimates, and Chinese appetite will continue to play key roles in where beans go from here.

Another takeaway from Chris Robinson,

For those of you who made cash sales north of $14, if you want to reown those bushels. I like buying calls on a $1.17 sell off when they are sale. You have to have the hedge BEFORE the move. Otherwise it is called chasing, not hedging.

This is also something we talked about in this morning's audio. If you missed it, you can listen here.

Soybeans Nov-23

Wheat

Wheat futures also post their 8th straight day of losses, as they continue to be the funds punching bag and as traders continues to try and outguess what will happen over in Ukraine. Chicago now gave back it's entire mid-July rally, while KC closes at it's lowest levels since early May after just making 9 month highs 6 days ago.

Rumors that Russia wants back in the Black Sea have added some pressure, but these are just rumors. Who knows what is really going on.

Putin and Turkeys president are expected to discuss a revival of the deal. Putin wants the world to see him as this nice guy willing to discuss feeding the starving people of the world. But we all know he probably won’t agree to anything unless major sanctions get lifted.

Below is a tweet from Black Sea guru Andrey Sizov where he tries to make sense of the entire situation.

He said,

"The wheat market shrugged off news about a new attack on Ukrainian Danube terminals. +4% during the night CBOT session….almost -2% at the close. Does it make sense? Probably, no. Let's take a deep dive.

The Danube remains the main export route vital for Ukrainian grain shipments with a monthly capacity of 2.0-2.5 mmt.

Russia attacked the Danube terminals a week ago and then stopped. We thought that maybe they didn’t want to look bad during the well-advertised “Russia-Africa” summit last week.

The alternative scenario was that the Kremlin decided to stay away from the Danube after NATO/Romania warnings. After the attack this week, we now know that it’s not the case anymore.

We believe that there is a chance of more Danube attacks in the not-too-distant future. It seems that air defense in the region remains weak (and the drones are cheap). Kyiv needs to boost its anti-drone defense ASAP.

So far, Russian attacks had limited impact on grain flow from the Danube. There is still a huge waiting line of ships in the region. Freight rates are on the rise though, after the first attack they jumped from ~$30/mt to ~$40/mt. Will we see a further increase in freight or the majority of vessel owners will stop to send their ships there? Could be both.

What about Big Odesa terminals reopening and the “grain deal” restart? It doesn’t seem to be on the cards in the near-term future, especially after the Erdogan-Putin call yesterday. Ankara after the call: the presidents will meet shortly in Turkey. Moscow: the place and the date of the meeting are to be worked out. It seems that the tensions are gradually rising here.

So what the hell happened yesterday? Just fresh funds’ shorts. The funds have been selling wheat at a record-high pace recently (around 30K during three sessions this week only) and they seem to believe that the chance of the Black Sea disruption is negligible. They could be wrong."

***

He thinks there is a good chance we see more Danube attacks in the near future. He also says the grain deal getting restarted isn’t a likely scenario.

The surge in the dollar hasn’t helped the US export business, but one could make the argument that if we continue to see production issues in Canada, Australia, among others we could see some increase in US buying.

In next week's USDA report we will be getting the first real guesses at the the spring wheat numbers and adjustments to winter wheat. Expect heavy volatility to continue with all of the wild cards still at play.

We still have some spring wheat harvest issues so that will definitely be something to keep your eyes on. Will have the potential to support Minneapolis futures.

Are we close to putting in a bottom for wheat? Well that depends on a ton of factors that no one has the answer to. There are however more potential bullish factors than bearish ones at play currently. For Chicago and KC wheat, this is also a time of the year where we seasonally start to go higher.

Although I do expect a bounce, from a technical standpoint I also wouldn't be too surprised to see both Chicago and KC test their lows unless we get some headline or if the funds decide to step in here. For Chicago that would be the $6 range (27 cents lower). For KC that would be the $7.35 range (32 cents lower).

Will have to see if the USDA provides any surprises, which it could.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

8/3/23 - Audio

BUYING RECOMMENDATIONS

8/2/23 - Audio

WEATHER & WAR VOLATILITY CONTINUES

8/1/23 - Weekly Grain Newsletter

WHEN WILL THE BLEEDING STOP?

7/31/23 - Market Update

WEATHER HAMMERS THE GRAINS

7/30/23 - Weekly Grain Newsletter

HOW MUCH DAMAGE WAS DONE FROM RECENT HEAT?

7/28/23 - Audio

DO CURRENT PRICES HAVE ENOUGH WEATHER & WAR PREMIUM BUILT IN?

7/27/23 - Market Update

GRAINS FADE OFF EARLY HIGHS

7/26/23 - Audio