YIELDS, DROUGHT, & CHINESE APPETITE

Overview

Grains finish the day mixed. With soybeans leading the way while wheat sees a little bit of profit taking. The market tried to push Chicago lower, but we ultimately bounced over a dime off those lows to only lose a 3 1/2 cents on today's profit taking.

Overall, not a ton of news today.

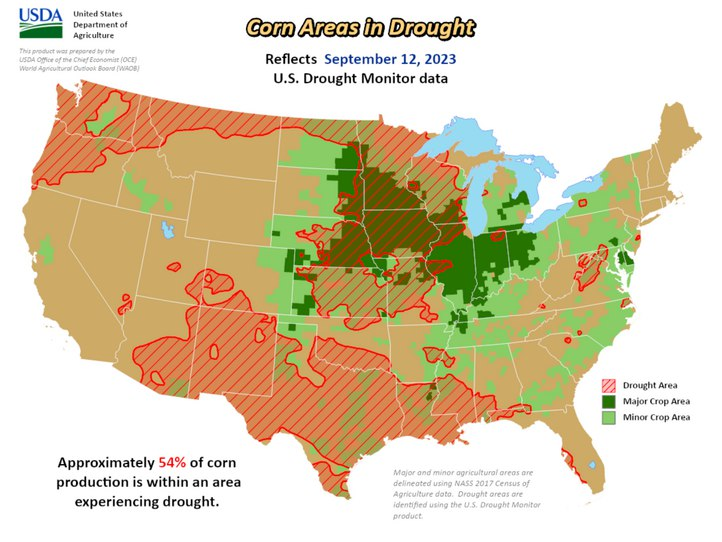

We got the newest drought update. Here is what it showed.

Areas Experiencing Drought (% Weekly Change)

Corn: 54% (+5%)

Beans: 48% (+5)

Spring Wheat: 59% (+3%)

Winter Wheat: 46% (0%)

Cotton: 46% (+2%)

Now does this increase to drought matter anymore? Well, not really. The weather game is essentially over here. We can’t do much more damage than we have and no amount of rain is going to save the crops either. The only weather headline here in the US that matters for now would be if we were to get an early freeze.

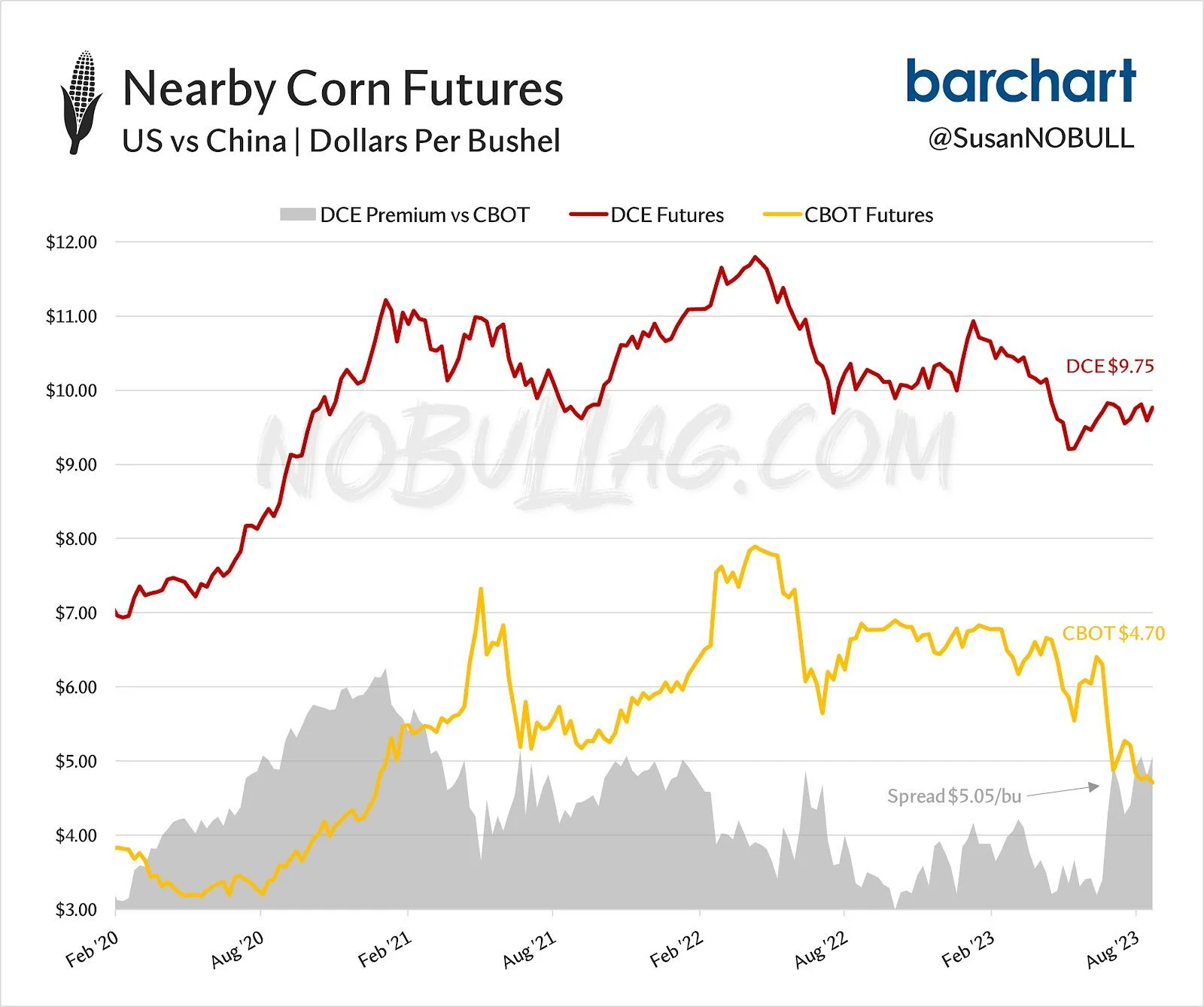

But here is something that does matter. Remember this chart from a few weeks ago from No Bull Ag that shows the spread between China vs US corn had reached over $5.00 a bushel. The largest since fall of 2021.

When we shared this we said: "Don’t tell me China won’t be buying our corn very soon..."

Why point this out? Because China is back in the market for US corn, as they just made their largest weekly purchase since April. With 6.8 million bushels.

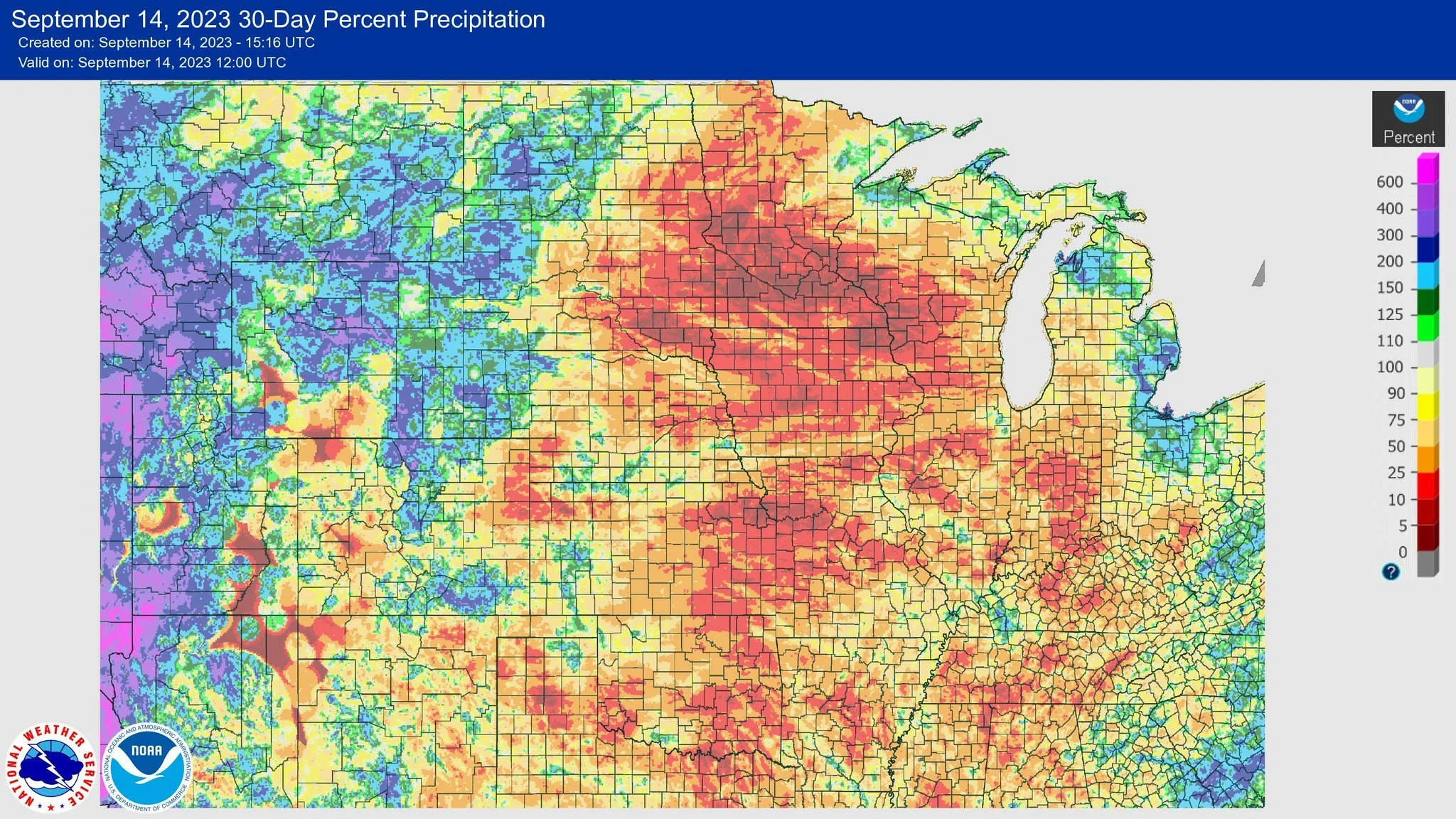

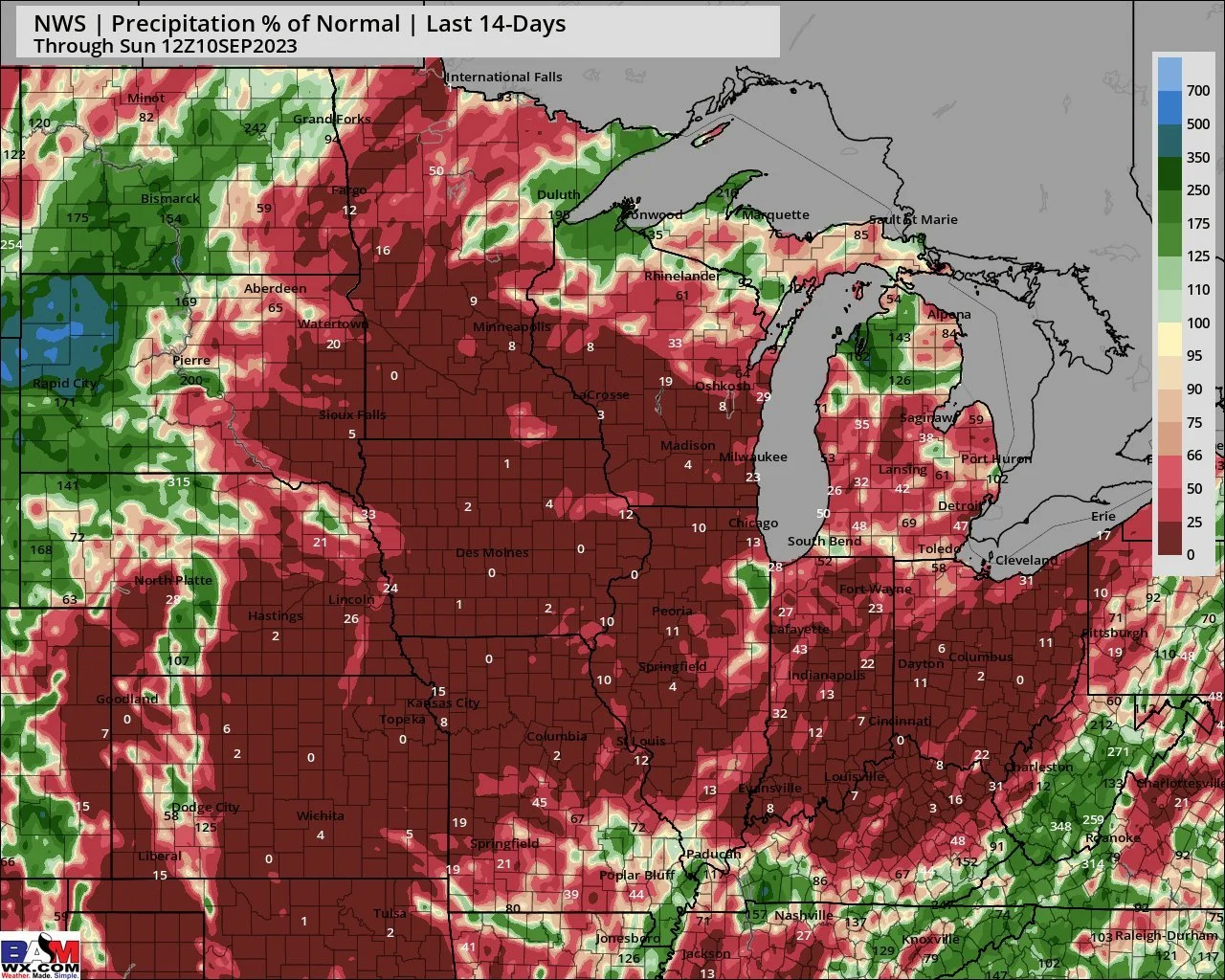

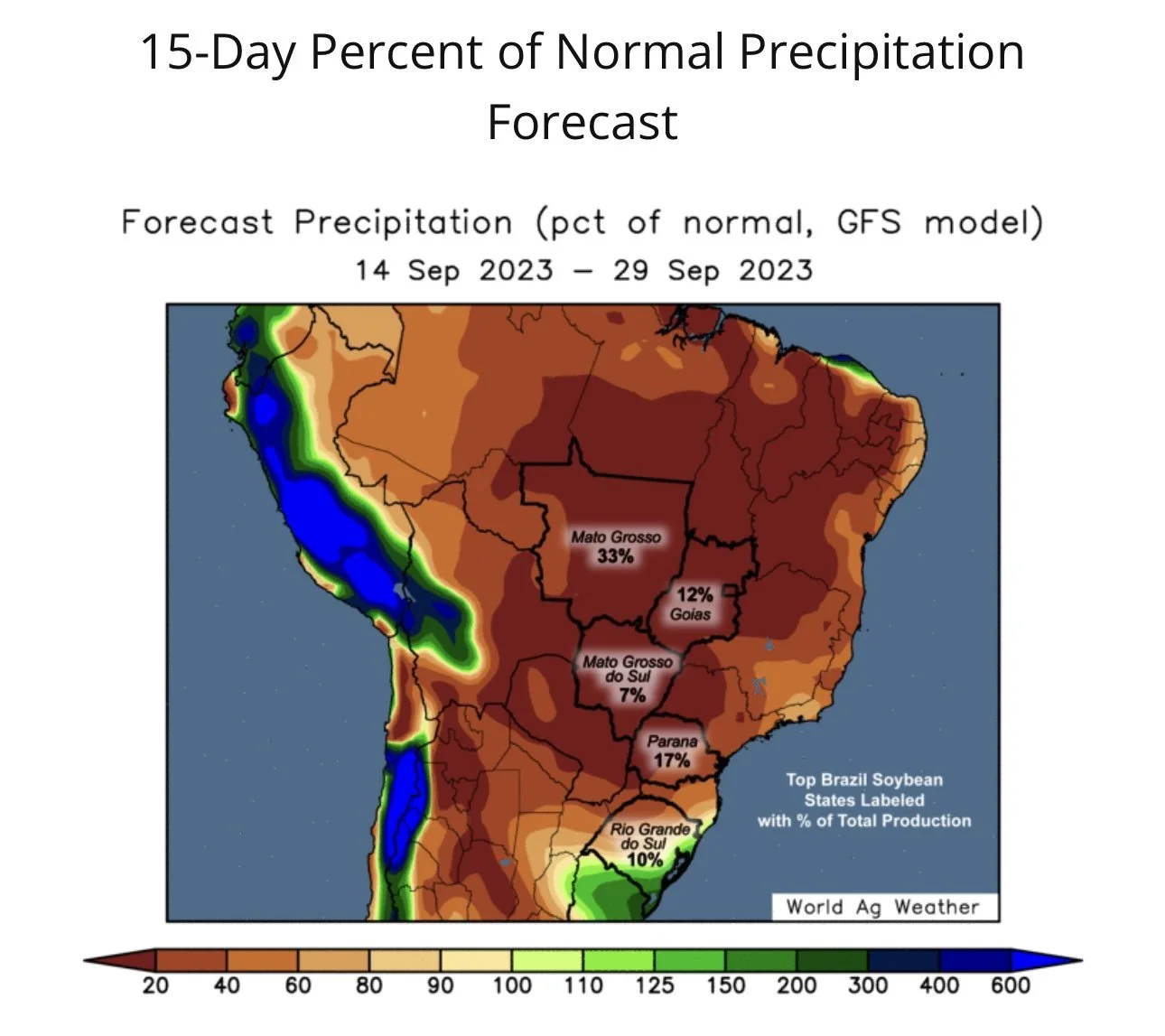

Future weather here might not matter, but our past weather does. Here is the past 30 days and past 14 days of precipitation compared to normal.

These crops took some serious damage. It will take the USDA some time to realize and see the full extend of the damage, but eventually they will.

Yields have dropped month after month. I look for them to continue to do so when the combines start rolling and unravel the whole story.

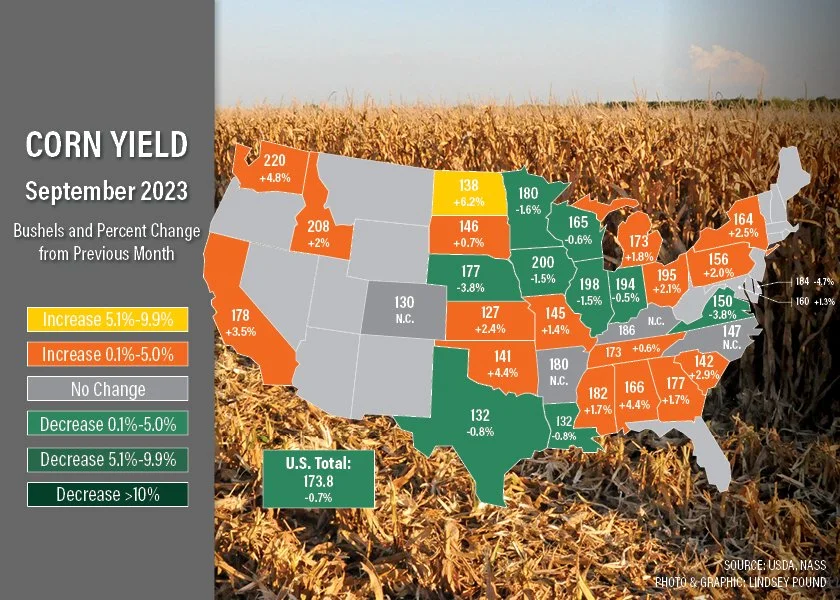

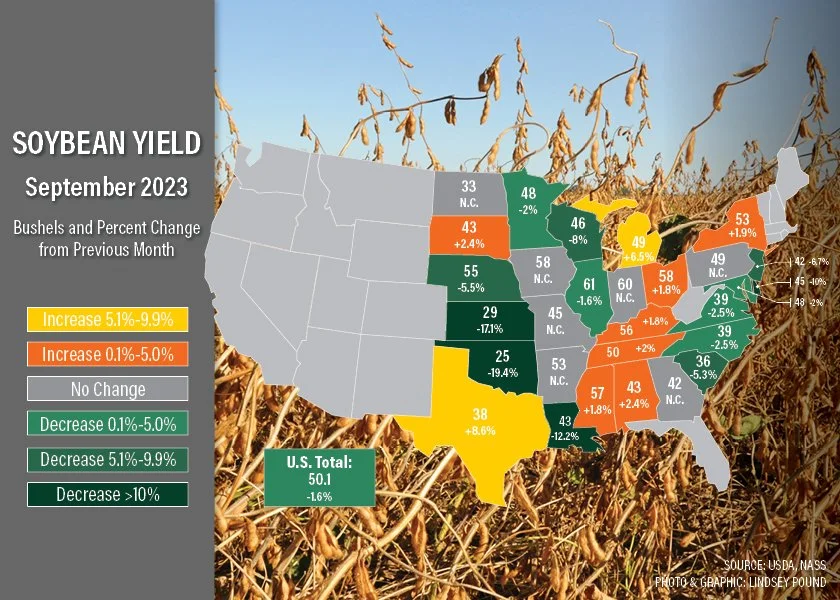

Here was a state by state breakdown from the USDA report. It shows what changes were made to yield in each state.

You can’t tell me that a good portion of the cornbelt and states like Iowa, who just saw the driest second half to August in 131 years, actually improved the past month with the brutal weather we just saw.

A lot of these states will not end up with yields this good.

Today's Main Takeaways

Corn

Corn ends the tight 6 cent trading range day down just 1 3/4 cents.

What impressed me yesterday and today was the fact that we got a pretty bearish report for corn. With the additional 800k acres and yield not falling as much as bulls would have liked. Yet, we were able to close higher yesterday.

This gives me all the more reason to believe we have put in our harvest lows for the year.

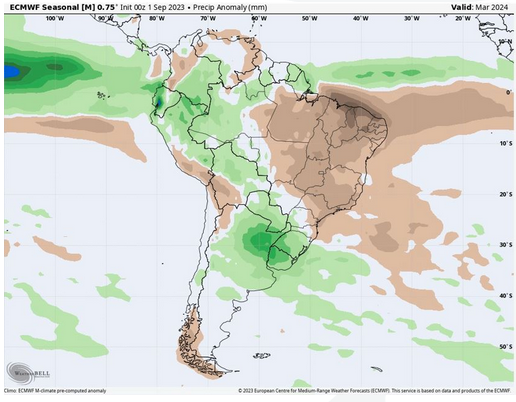

The trade is going to start to talk more and more about South American weather as we make the shift away from US weather headlines.

Everyone is always expecting South America to continue to produce bumper crop after bumper crop. However, an El Nino like this year can cause them serious production concerns, especially for their corn crop.

Seasonally, this is the time we start putting in our lows. I do think a harvest low is in. But I'm not expecting a significant rally until the combines start to roll. When they do, I think we are ultimately sub-170. Yield has continued to fall month after month. Wait until they realize the damage the 2nd half of August brought.

Not only do I think the yield is going to continue to deteriorate from where the USDA has it currently. But I expect demand to start coming back.

Like I mentioned earlier, we were at the biggest spread to China that we have been in 2 years. China was waiting to buy until we are cheap enough. Well, we are cheap enough now. As they made their largest weekly purchase in almost half a year. I expect this to be the start of more Chinese appetite for US corn.

Taking a look at our charts. Bulls need to break that 4-month long bear trendline Bulls also need that $4.73 1/2 low that has been tested 5 separate times to hold. Although I think these levels will hold, if they don’t, our next stop would likely be $4.63. Also notice that we are entering the end of where these two trendlines meet. Might call for a breakout to the upside.

Corn Dec-23

Soybeans

Beans continue to be strong, as we trade higher here today following yesterday's price action where we took out the previous days lows then closed higher.

The soybean fundamental situation remains super bullish both short term and long term. This situation becomes even more bullish if the production some expect us to have, isn't there.

Even some the biggest bears in the Ag community have now turned bullish. A notable one is Darren Frye. He thinks bean yield will be at 46 bpa when it's all said and done. I agree with him.

If beans were to fall that far, even if they fall into the 48 bpa or lower range, they will have to lower our demand. We have said this time and time again, how do you curb demand? The most logical way is higher prices.

I have been talking about the possibility to see $15 beans for months. The cloest we've got this year was in July with highs of $14.35. That $15 or even higher price range is still very much in the realm of serious possibilities. If when the combines start to roll, and this crop isn’t as good as they think, we simply can’t afford to lose bushels on an already tight situation.

There are some producers who are saying yield is 5-10% less than it was a few weeks ago. If we take the USDA's 50 bpa yield and knock 5% off of it, we get 47.5 bpa. Soybeans can’t afford to lose another 2 to 4 bushels.

The bio fuel situation is another one which could very easily push beans much higher later in the year into next year.

You need to keep in mind that often times it is hard for beans to continue a rally into harvest. So if you need to make some sales then by all means do what you have to do. If you need specific advise shoot us a call at 605-295-3100. I do think we have a solid chance to trade $15 when these combines start rolling and if South America runs into production hiccups. Which is also another likely scenario given their El Nino. So I think we are in for higher prices, but the downside is there. So if you are nervous about that downside or not comfortable and feel like you need to reward the rally, give us a call and we will go through different strategies tailored to what you need.

Soybeans Nov-23

Wheat

Wheat trades lower here today with some profit taking and the dollar continuing to be a headache as it continues to trade higher.

The world wheat situation is friendly. The report two days ago was bullish. This is the 4th or 5th year in a row where the world is consuming more wheat than it's producing. We are as tight as we've been in over a decade when you look at the major exporting countries.

Nobody want our wheat today, and yes, Russia has a big crop. So I don’t expect wheat to just see this major rally relatively soon. But when we take a bigger picture look at the wheat situation we will have a ton of reasons to rally.

We have problems in Canada, who's wheat production is forecasted down over 13% from last year.

Australia's absolutely brutal dryness and heat from their recent El Niño.

World stocks to use are down over 7% from 2020.

Crops being reduced in Argentina, the UK, and the EU.

Not to mention the war situation hanging over our heads ready to escalate at any moment.

My point is that the wheat situation is finally turning around and will continue to be a big sleeper in our markets. All of these problems don’t make a huge difference today, but just wait, because they will.

From Jeff Peterson of Heartland Farm Partners:

"KC wheat has the potential to move back into the low to mid $8 range with the instability of the global picture"

Yesterday we said that Chicago wheat had put in it's lows for the year and perhaps throughout next year. We look for those lows of $5.70 before the USDA report to hold and slowly grind higher until wheat gets that major reason to really rally.

Chicago Dec-23

KC Dec-23

MPLS Dec-23

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

9/13/23 - Audio Commentary

$10 WHEAT/$6 CORN/$15 BEANS BY THE END OF THE YEAR?

Read More

9/12/23 - Audio & Report Recap

BEARISH REPORT, BUT SETS THE STAGE FOR HIGHER PRICES

9/11/23 - Audio Commentary

CHEAP PRICES CURE CHEAP PRICES

9/10/23 - Weekly Grain Newsletter

PREPARING FOR THE USDA REPORT

9/8/23 - Audio Commentary

WILL USDA REPORT BOOM OR BUST?

Read More

9/7/23 - Market Update

BEANS GIVE BACK GAINS, TRADE PREPARES FOR USDA

9/6/23 - Audio Commentary

BE PATIENT MAKING SALES AT HARVEST TIME

9/5/23 - Market Update

WEATHER IMPROVING, BUT DAMAGE WAS DONE

9/1/23 - Audio Commentary

HOW MUCH DAMAGE WAS DONE & WHAT IS MARKET EXPECTING

Read More

8/31/23 - Audio Commentary

THIS CROP HAS MORE DAMAGE THAN MOST REALIZE. DON’T PANIC SELL

8/30/23 - Audio Commentary

THIS VOLATILITY ISN’T GOING ANYWHERE

8/28/23 - Market Update

WEATHER REMAINS BULLISH BUT CROP CONDITIONS DISAPPOINT

Read More

8/27/23 - Weekly Grain Newsletter

ECON 101 APPLIED TO GRAIN SALES

Read More

8/25/23 - Market Update

BEANS CONTINUE BULL RUN

Read More

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio