OUTSIDE UP DAY IN ALL THE GRAINS

AUDIO & MARKET UPDATE

Listen to todays audio here where we go over how to manage your risk on days like today.

Overview

Turnaround Tuesday following corn posting a new contract low today and soybeans breaking below $12 for the first time since June.

However all of the grains, corn, soybeans, and wheat posted outside up days today. This means we took out yesterdays lows before closing above yesterdays highs. Which is typically considered a great sign and potential indication of a reversal.

Today soybeans rallied +33 cents off their lows, taking back roughly half of the recent sell off and are back above $12. Corn posted new contract lows before having it's best day since November after bouncing a dime off the lows and making what is called a "key reversal". While wheat rallied +20 cents off it's lows.

This type of action was something we have been mentioning we could see since last week. That we could see soybeans break below $12 and make a new low fractionally before reversing higher. Because that is what the algos and big money tend to do. Give us head fakes, hit the stops, and push prices just past the point of support and resistance before flipping the tables.

If you haven’t, make sure you go listen to today’s audio above. Essentially we in the audio we go over how you can manage your risk on days like today.

So why the rally?

Some are saying it was a simple technical driven rally. The funds are holding near record shorts and it is the end of the month. So perhaps a large part was profit taking.

However, the biggest headline the bulls are seeing right now is Argentina. The market is finally starting to pay attention.

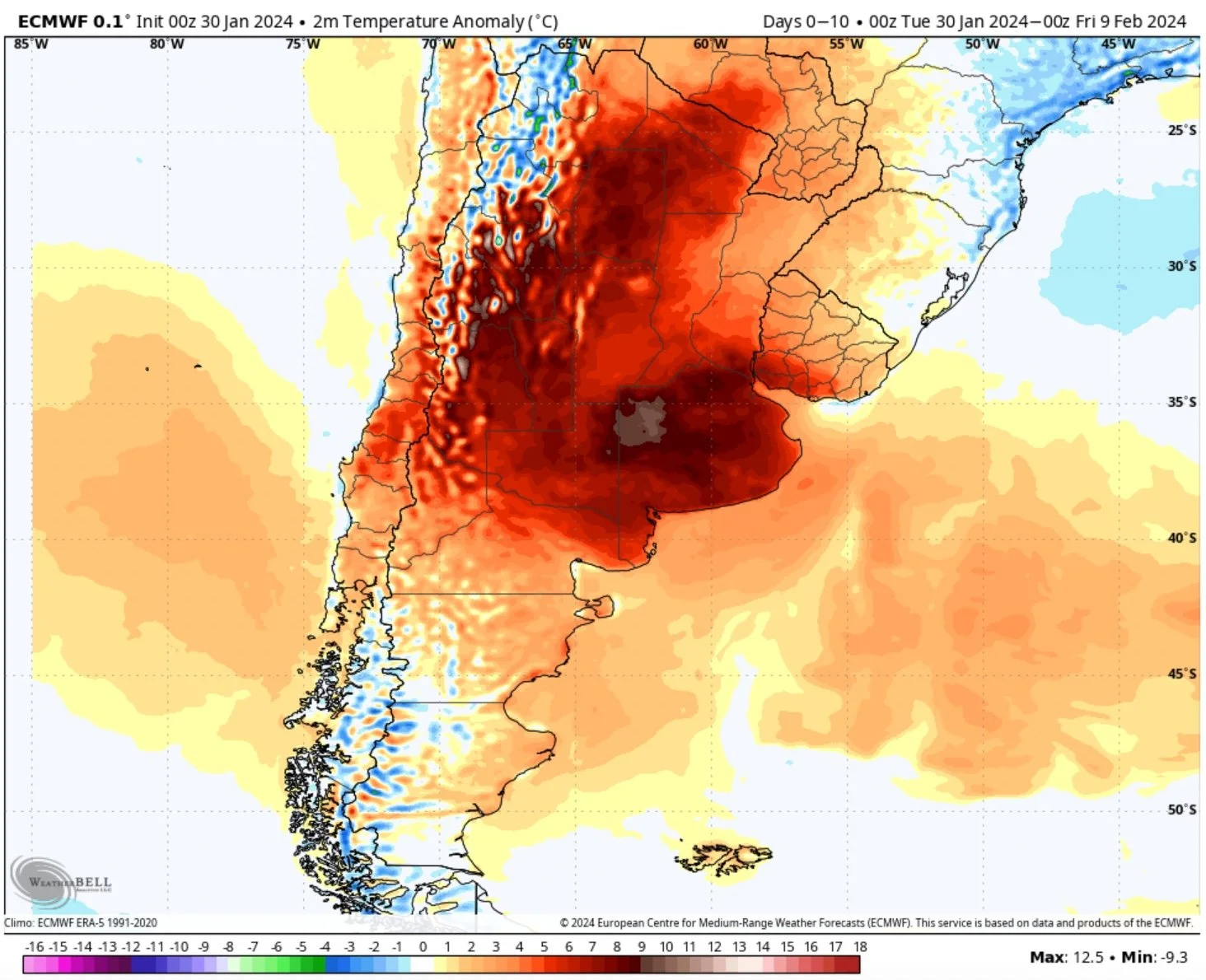

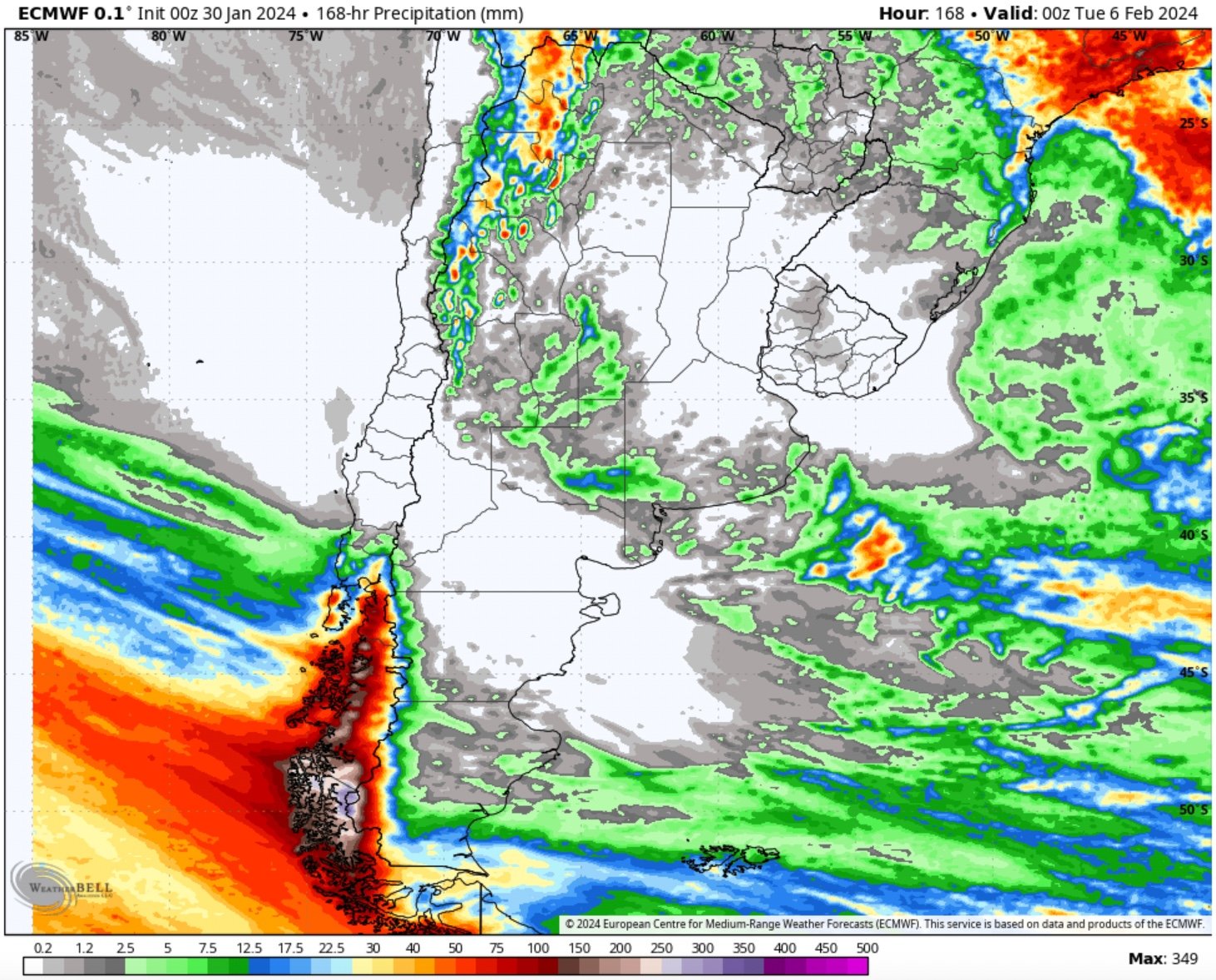

The two week forecasts are calling for scorching temps and the rains seem to disappear. If this continues, it could cause some issues to what most would consider a fantastic crop thus far.

Here is the forecasts:

So was this rally just a case of profit taking or was there more to it?

From Brain Wilson, Options Trader:

"I don't believe this, but if this is just end of month short covering, look at how big of pigs they are to move the market this much on small covering. Ask yourself, how bad do pigs get slaughtered covering 250k contracts of short corn?"

I agree with Brian. If this was simply a case of profit-taking, I don’t think the move would have been quiet this dramatic. But of course, it is certainly possible that this was just "profit taking" given that the funds had a very profitable month with all of their short positions.

Some say the funds need a reason to cover. Which is somewhat true. But at one point do they say enough is enough and the "reason" becomes that they run out of sellers? Guess we will have to see if we get follow through strength.

From Mark Gold of Top Third:

"With the funds short as much corn as they are, you gotta wonder how much is enough. Have we exhausted the bear news?" "If I were a fund, I wouldn’t want to be this short at this time of year."

Now let's jump into the rest of today's update..

Today's Main Takeaways

Corn

Corn posted a fresh new contract low today before following beans and wheat higher.

Why did we rally?

For starters, the funds are holding one of their biggest shorts in corn. Ever. So there was definitely some short covering.

But what spurred the short covering was a combination of some profit taking as well as the heat and dryness in Argentina.

Even though I still think Brazil acres could very well be a lot less than anticipated, the gains in Argentina were what the bears have been looking at. The thought process that these gains will offset the losses in Brazil. Afterall, Argentina is forecasted to have a record crop. So that is what the market is pricing in.

From 247 Ag:

"We need to start watching the Safrinha corn planting progress, which is currently behind by a bit over 6%. Rains can slow it up more. Dry later will affect final yields. The later they plant, the greater the yield loss."

I still think we could be looking at a surprise when it comes to Brazil. However, the biggest risk I still see if the already massive carryout we have here in the US. This is definitely a risk, but there is some talk about less acres being planted this year because spring insurance prices are about to be established with the average daily closing price of the December contract in February. A lower guarantee for insurance could lead to less acres.

Last year we were looking at insurance prices of $5.96 a bushel. It looks like this year we are entering February around $4.70.

With this, don’t be surprised if we don’t see a giant short covering yet. The conspiracists think a lot of times prices are weak in February solely due to trying to keep insurance prices down.

Now even though the bottom might not be in, I do not think we have seen our highs for the year. Which means I think prices are going higher barring any upside shock to US production this year.

I have talked about election years and non election years the past week.

Since 2001, December corn futures have never made their highs in February or March. There has only been 2 years where we made our highs in January, 2001 and 2013.

Here are the list of months where we have made our highs the past two decades.

Jan: 2

Feb: 0

March: 0

April: 2

May: 3

June: 6

July: 3

Aug: 2

Sep: 1

Oct: 0

Nov: 3

Dec: 1

The point is that historically prices will be higher. Could we have made our highs in January? It is possible, as it has happened before. But I'd like to think we follow the historical trend.

So what about our lows?

Here is the list of months we have made our lows:

Jan: 4

Feb: 0

March: 0

April: 1

May: 2

June: 1

July: 1

Aug: 1

Sep: 4

Oct: 0

Nov: 1

Dec: 8

There is no clear pattern to "when" we will make lows. All we know is that we typically trade higher after March. As we have only made our highs 2 times before April.

Bottom line, this is not the time to be making sales. Could be still go lower from here? Yes it is still very possible. If we do continue lower, I have my next support level around $4.30

If you have unpriced bushels and are worried about the downside, consider locking in a floor. But do not overpsend when protecting multi year lows. Calls are still cheap, so some of you may want to consider courage calls. Remember, the purpose of these would be to help you make a sale when we get that weather scare or seasonal rally and to add to your bottom line. We want to do so "before" the rally. If you wait for the rally, that is called chasing, not hedging.

Please give us a call if you have questions. (605)295-3100

Today's price action was great. Most call this a key reversal. However, I am slightly skeptical solely given that it is the end of the month and there is a chance it could just be a case of profit taking. But when the funds have to cover, there is a whopping quarter of a million contracts to unload. I'd like to see us get a few strong days in a row with a break above $4.62.

If we can do that, I don’t think $4.95 to $5 is too unrealistic of an ask. If we can rally back into that range, we want to prepared to take risk of the table for your old crop or establish a higher floor. For a major sustained rally, we will probably have to see a good chunk of the current grain leave farmers hands. There is an old saying that we can’t rally until half of the producers have sold.

I saw a fun fact today that said for 2023 corn, 60% is farmer owned. For 2024 corn, 90% is farmer owned. So we will have to see producers make sales for us to get a major rally. But we don’t want to be in that 50% that sells at the lows before the rally.

Corn March-23

Soybeans

Soybeans rally over +30 cents off their lows after making a new low for the move and after closing below $12 yesterday for the first time since June.

So why were soybeans so much higher following the recent blood bath where we gave away the entire +40 cent rally?

For the most part, this was a technical driven case of short covering. But the bigger picture reason was Argentina.

If dryness in Argentina continues, it could have a very large impact on meal. The trade is keeping in mind what happened last year.

Argentina already has a meal issue. Remember the narrative back in November? It was that Argentina was out of meal. The scenario still hasn’t changed. Last year Argentina only crush 27 million metric tons. The lowest in 20 years.

From Brian Wilson, Options Trader:

"Funds are short meal now we can rally."

Meal was one of the reasons for the drop in beans, as it was looking like an extreme weak link. But now that the funds are short meal, this Argentina headline could cause a rally in meal. IF the heat and dryness continues.

So what are some concerns that bears are pointing at?

Well for starters, there is some talk about "what if Trump is elected" and will this create a trade war with China. I think this is more of just a rumor, but the market trades rumors sometimes. I do not see this as actually being a concern in the future.

Second, we have Brazil basis. It continues to drop. A lot of people are saying this means Brazil has a much bigger crop than most realize. However, we need to keep in mind that basis dropping at harvest is completely normal. Harvest is the time of year where there is the most supply.

Next we had news that the US is actually buying 3 cargeos of Brazilian soybeans. So this could mean 1 of 2 things. Either we are overpriced, or perhaps we simply don’t have soybeans with our already tight old crop situation.

Lastly, there is the fear that China might make cancellations. All they did was delay some of their exports. They have not canceled anything, but the fear is there.

Bottom line, I still don't like making sales here near the bottom of the range. However, if you are someone who is going to be forced to make a decision and has to either sell corn or sell soybeans. It very well might make more sense to sell the beans. The reasons for this are cash flow and risks. Yes, soybeans have so much more possible upside potential than corn. By far. But with potential upside also means potential risks. You have to ask yourself what risks you are comfortable making.

We had an amazing day today., closing +33 cents off the lows. Outside up day and potentially a key reversal higher. Most would consider today's price action a strong technical buy signal. Guess we will see if we get follow through strength. I still see higher prices on the horizon especially if Argentina issues continue, but we need to be aware that there are plenty of risks trying to keep a lid on prices.

If you have unpriced bushels, it's never a bad idea to lock in a floor. Make sure it's cheap. For others, we don’t like chasing a rally, but for some, courage calls could be another strategy to utilize here. Please give us a call if you have questions about either, because there is no decision that all operations should be using at the same time.

Soybeans March-23

Wheat

Wheat market joins the rest of the market higher. Posting an outside up day along with corn and beans.

For wheat, there was no fundamental story or reason for the rally today. It was simply technical and fund buying.

So what's keeping a lid on wheat prices?

The main themes are the same as they have been. Of course Russia still has a stock pile of cheap supply. We just continue to see a lack of export demand.

On top of that, we have non threatening weather, a stronger dollar, and overall disinterest from the funds which has kept a lid on a big rally.

We are suppose to see more moisture in the southern plains which is continuing to increase the thoughts that we could have an above average winter wheat crop.

However, there are still plenty of chances over the course of the next few months to see some winter kill.

But nobody knows that and right now there is some headlines floating around that the wheat crop is currently looking like one of the best in the past decade for this time of year. Again, still way too much time to claim anything just yet. But that's a risk.

KC wheat conditions jumped up to 54% rated good to excellent this week vs December's 43% and last year's 21%.

One thing bulls are keeping an eye on is spring wheat acres. The preliminary estimates came in down -20% from last year.

Long term, as has been the case for a while. I still view wheat as a sleeper. Overall, the wheat charts don’t look too bad. Today we had outside up days but we are still stuck in a choppy range. The chart is different from corn and beans, as it looks more like a chart where the bleeding has maybe stopped and is looking to level off. I still want to see Chicago over $6.38 and KC over $6.71 if we want to get the bulls real excited.

Same risk management goes for wheat as corn and beans. If you are nervous about the downside, consider locking in a floor but make sure it is cheap and please give us a call with questions (605)295-3100.

Mar-24 Chicago

Mar-24 KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

1/29/24

GEO POLITICS, CHINESE, BRAZIL, ALGOS, & BIG MONEY

1/26/24

SOLD RALLIES & HISTORICAL HIGHS

1/25/24

DEVELOPING A GRAIN MARKETING PLAN WITH TECHNICALS

1/24/24

5TH GREEN DAY IN A ROW: WAYS TO OUTPERFORM THE MARKET

1/23/24

GRAINS CONTINUE TO BOUNCE

1/22/24

HAVE MARKETS FOUND A BOTTOM?

1/19/24

FAILED REVERSALS & ELECTION YEAR RALLIES?

1/18/24

UTILIZING TRENDS & TECHNICALS IN YOUR GRAIN MARKETING PLANS

Read More

1/17/24

FUNDS & CHINA

1/16/24

BEANS TRY TO BOUNCE FOLLOWING BEARISH USDA

1/12/24

FULL USDA REPORT BREAKDOWN

1/11/24

USDA REPORT TOMORROW. ARE YOU PREPARED?

1/10/24

PREPARING FOR THE USDA

1/9/24

TURNAROUND TUESDAY & USDA PREVIEW

1/8/24

HOW TO GET COMFORTABLE AHEAD OF USDA REPORT

1/5/24

FIRST WEEK OF NEW YEAR FLOPS

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23