GRAINS MIXED AHEAD OF USDA REPORT

Overview

Grains mixed here today following the long weekend as the trade makes its final adjustments ahead of tomorrow’s USDA WASDE report, scheduled to come out at 11am CT.

Looks like the funds were buying some corn and wheat and selling some beans against it. Funds were likely looking to take some risk off the table ahead of the report.

Export inspections were in line with expectations, but on the light side for corn and heavier side for beans.

We saw Russia threaten to exit the Black Sea agreement.

The big things this week will be the USDA report, U.S. weather, China headlines, and the Russia Black Sea agreement uncertainty.

*Our Biggest Sale Ever Ends Tomorrow. Get all of our stuff for a massive discount before its gone. Every update & audio sent via text and email.

Yesterday's Weekly Grain Newsletter

Read Here

Pre-USDA Report

Tomorrow is the USDA WASDE report and latest crop production reports. In yesterday's write up we said,

"Based on the fact that our quarterly stocks came in lower than estimates there is a good chance that we see our carryout numbers unchanged to lower than the previous month. If they come in higher, the market likely won’t believe them as they probably shouldn’t."

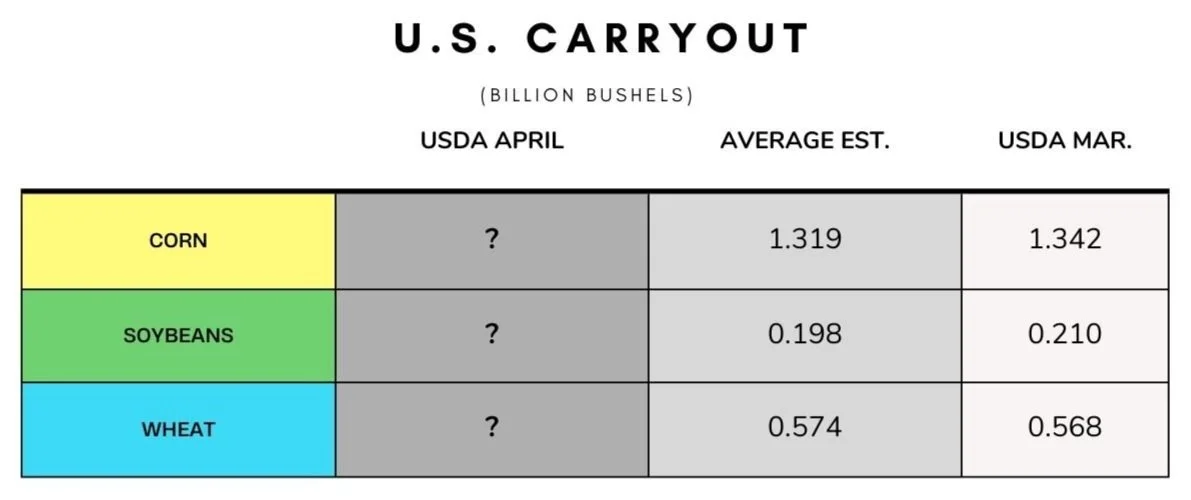

Here are the estimates for tomorrow:

Today's Main Takeaways

Corn

Corn strong here today ahead of tomorrow’s report. Closing up over a dime.

One thing that could pressure corn is the argument that we eventually see the USDA lower their ethanol and export demand. On the other side of things, bulls are saying that the USDA needs to increase its feed and residual numbers. Guess we will have to wait and see what type of adjustments we see tomorrow. The trade isn’t expecting any ground breaking changes tomorrow.

The Van Trump report had this to say about what changes he could see the USDA making; "If anything happens, I have to imagine it will be any of the following... a slight cut in ethanol, a slight cut in exports, or a light increase in feed and residual."

Keep in mind, in tomorrow’s report we will not be seeing any changes to the new crop balance sheet. As these don’t take place until May.

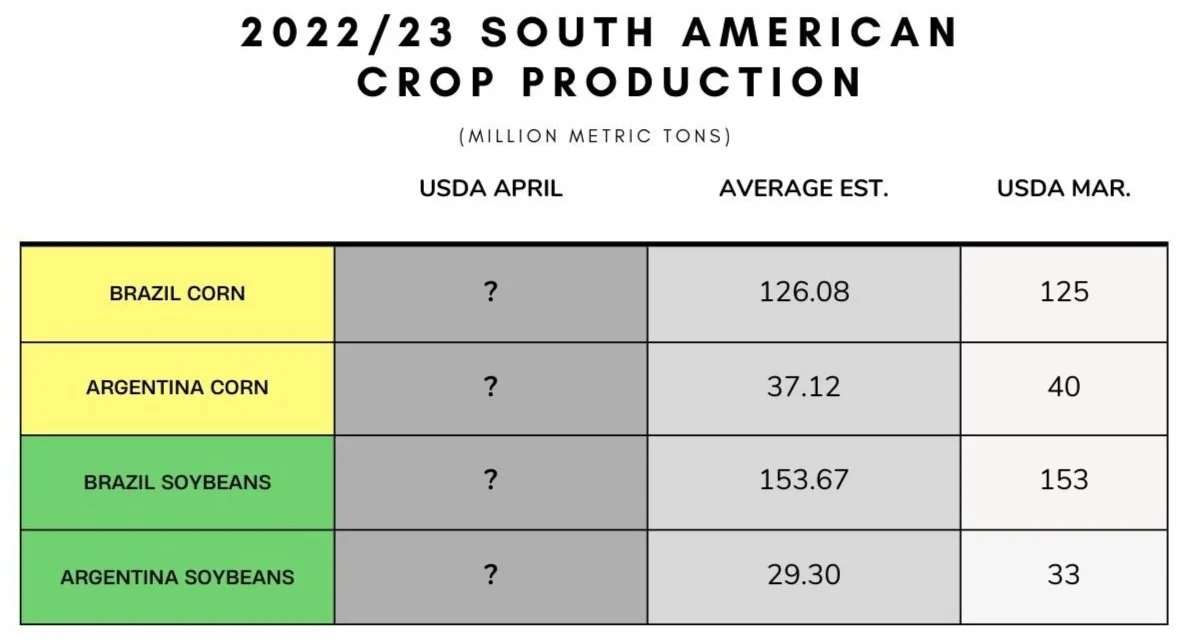

Headlines from South America have been fairly quiet lately. But tomorrow we will again get an update from their crops. The trade is expecting a pretty big cut in Argentina, while perhaps a slight increase to the Brazil crop.

South America Estimates

Argentina: 37 MMT (Down from 40 MMT in March)

Brazil: 126 MMT (Up from 125 MMT in March)

Going forward these South American numbers will start to have less of an impact as the trades focus will shift to U.S. weather.

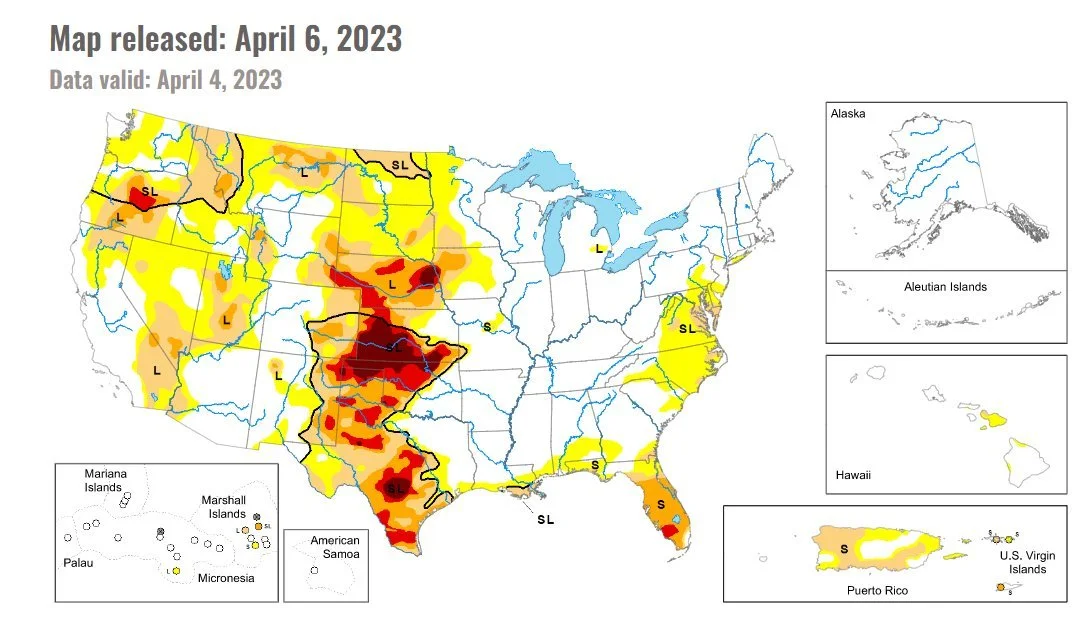

Speaking of weather. On one hand we have overly wet field conditions which could look to add support, but we also have pretty cooperative forecast ahead for the time being. So right now weather is a mixed bag, but there is plenty of potential for some weather worries ahead.

Early this week it's looking pretty warm across the corn belt, but there is some potential for freezes across a large portion of the midwest next week. This warm weather will melt a lot of snow in the Dakota’s and Minnesota areas, so we could see some flooding. Other factors bulls are watching is the Russia & Ukraine war headlines as well as the possibility for some weather problems in Brazil with their second crop.

Corn May-23

Soybeans

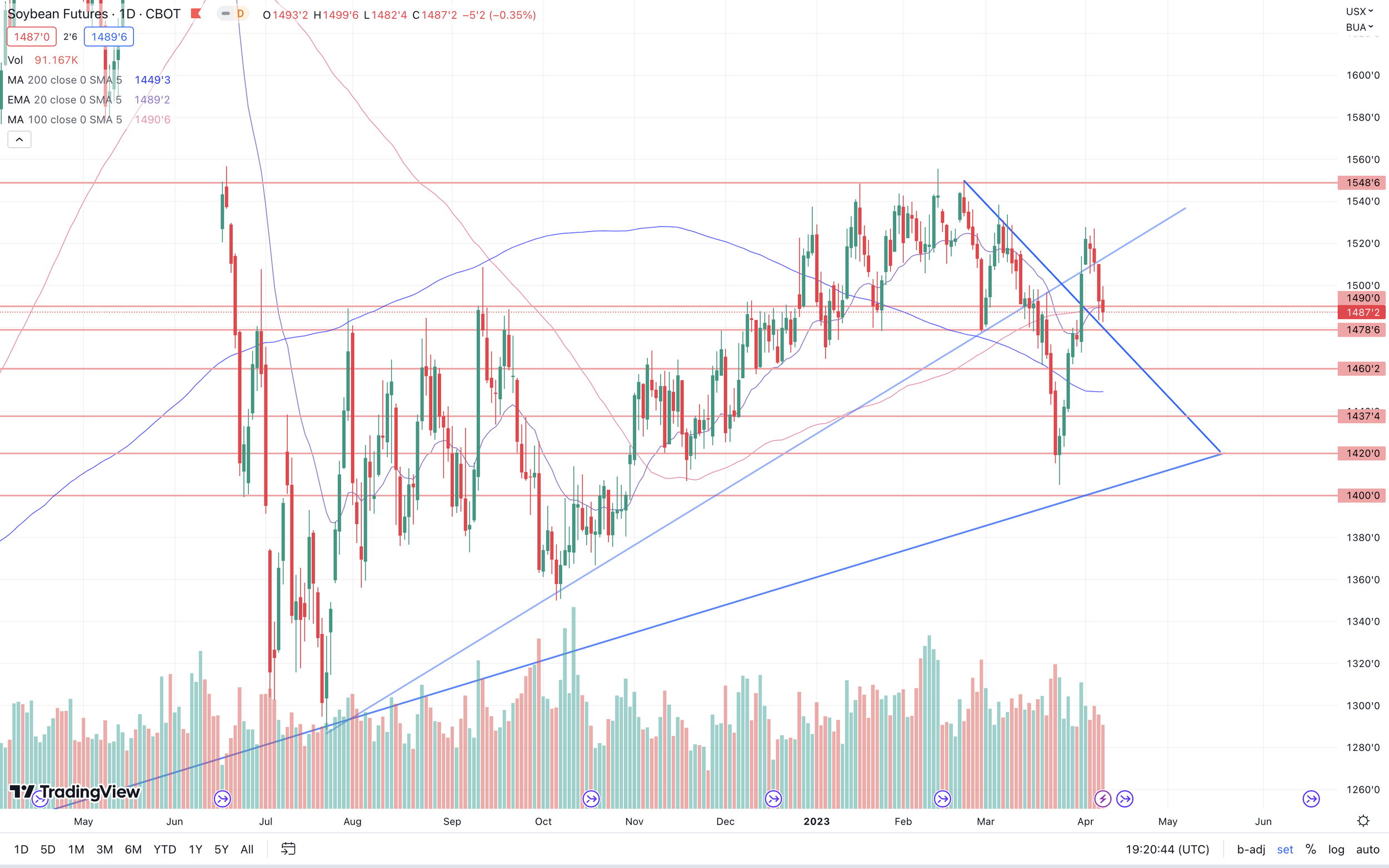

Beans continue to move off their highs, adding to last week's losses here today. Closing down 5 cents today, while finishing 12 cents off their early highs.

Taking a look at tomorrow’s report. There isn’t a ton of major changes expected. The trade is expecting the USDA to lower their U.S. bean carryout from 210 to 198 million bushels. Bulls could argue that we might see a small increase in to exports or a tad higher adjustment made to crush. But we do have a good chance we simply see the USDA take a slow approach and not make any significant changes just yet.

As for the South America numbers. We are again looking at a large cut to Argentina numbers, while the trade is anticipating a small increase to Brazil's numbers.

South America Estimates

Argentina: 29.30 MMT (Down from 33 MMT in March and 44 MMT last year)

Brazil: 153.67 (Up from 153 MMT in March)

There are plenty of individuals who think we ultimately see this Argentina number creep into the 25 range or perhaps even lower. We will have to see just how big of a cut the USDA is willing to make tomorrow.

Soybeans May-23

Wheat

Wheat futures all end the day higher with KC leading the way up 11 1/2 cents. Chicago closed nearly 10 cents off its highs, ending up 3 cents on the day.

Overnight we saw wheat futures strong, with the Black Sea situation seeing some more uncertainty. As we saw Russia threaten to bypass the grain deal and pull out of its current deal and negotiate their own exports with Turkey and Qatar. The Black Sea agreement goes through May 18th.

We have a continuation of the dry and poor crop conditions here in the U.S. looking to add support. We will get an updated version of the crop conditions after close today. Last week we had the overall conditions come in at just 28% rated good to excellent, with 36% rated poor to very poor.

Last week we had Kansas crop conditions come in at just 16% rated good to excellent. Which is a very poor number. To further put this number into perspective, we have to keep in mind just how much of the wheat here in the U.S. comes from Kansas. Kansas typically accounts for 25% of the U.S. winter wheat and around 17% of the total U.S. wheat output.

Taking a look at tomorrow’s report. Not a ton of huge changes are expected. Demand is still something that’s up for debate. Some make the argument that we need to see feed and residual lowered, while others think we need to see exports raised especially if we do see Russia begin limiting exports.

Going forward, bulls such as myself still think there are plenty of wild cards that could eventually flip this thing and lead to the funds causing a reversal. Weather and war being the two biggest factors will the potential to do so.

Taking a look at the chart, May Chicago is still trying to break out of this long term downtrend. We did however potentially create an inverse head and shoulders formation (which is a bullish indicator). Bulls would like to see the funds step in soon and create a reversal.

Chicago March-23

KC March-23

MPLS March-23

Wheat Supply

From Wright on the Markets on Friday

May Kansas City wheat futures notched an all-time record premium of $1.91 per bushel over Chicago May wheat Thursday. In fact, a new high in that spread has been made every day since last Thursday. The old record was set in 2011. Two years ago today, May Chicago wheat was 60¢ higher than the May KC wheat.

It is time to get a perspective on how out of whack this wheat market is.

Take a look:

March 2008 Hard Red Spring Wheat traded to $25 on February 25th, 2008 and $14.12 May 17th, 2022, and $8.72 yesterday. The February 2008 hard red spring wheat carryover was a 50-day supply; a year ago it was a 101 day supply; now it is an 83-day supply.

March 2008 Hard Red Winter Wheat traded to $13.85 on February 27th, 2008 and $13.79 last May 17th, 2022, and $8.64 yesterday. The February 2008 hard red winter wheat carryover was a 44-day supply; a year ago it was a 163 day supply; now it is 156-day supply.

March 2008 Soft Red Winter Wheat traded to $12.61 on February 28th, 2008 and $12.84 May 17th, 2022, and $6.75 yesterday. The February 2008 soft red winter wheat carryover was a 26-day supply; a year ago it was a 123 day supply; now it is a 110-day supply.

The US all wheat carryover in February 2008 was a 42-day supply, meaning the bushels left over at the end of the marketing year would meet the needs of the USA for 42 days into the new crop marketing year. A year ago, the all wheat carryover was a 130 day supply; now the all wheat carryover is a 109 day supply.

Profiting In Sideways Market - Straddles

From Jon Scheve at Wright on the Market

The market will be focused on the weather in the Dakotas as we move forward. While the rest of the country will have good weather for planting, it will come down to how many prevent plant acres there are in the northern part of the corn belt at the end of May.

Market Action

On January 18th when May corn was trading at $6.80, I suspected corn prices would likely be range bound or slightly higher at the end of March. Therefore, I placed a trade to maximize some profit potential if that happened. On 10% of my 2022 production, I sold a $6.80 April straddle (i.e., sold both the $6.80 April put and the $6.80 April call which are based upon May futures) which allowed me to collect a net positive value of over 41 cents.

What Does This Mean?

If the value of May corn on March 24th is:

Above $7.21 – I will sell futures at $6.80, but I keep all of the 41 cents collected on the trade, so it would be like selling $7.21 futures.

Below $6.39 – I give back all of the 41 cents collected from the trade, and I start to lose on this trade penny for penny below this value.

Between $6.39 and $7.21 – I keep some of the 41-cent profit I collected when I placed the trade. The closer the price is to $6.80, the more I keep from the trade.

Why Did You Make This Trade?

I was comfortable with all potential outcomes.

Prices go up - I would be happy selling 10% of my crop at $7.21.

Prices go down - Based on the previous several months, it seemed unlikely corn would trade to the lower end of this range. Plus, it was only 10% of my production, and I had already collected profit on this type of trade over the last four months. Therefore, the downside risk seemed limited.

Prices stay sideways - I would collect additional profits to add to later sales, which seemed the most likely scenario.

What Happened?

On March 24th, a few hours before the options expired and May corn was trading at $6.42, I bought back the $6.80 puts for nearly 39 cents. There was almost zero chance the calls would be exercised that day, so I left them on, and they expired worthless. After commissions, I collected almost 1 cent of profit on this trade that I could apply to my final prices (i.e., the 41 cents originally collected, less the 39 cents to buy back the put options, and less just over the 1 cent commission)

Bottomline:

This is the fifth straddle trade where I collected a profit in the last five months. While I would have liked to collect more profit on it, two weeks prior to the straddle’s expiration the trade was losing more than 30 cents. So, I am happy the market rallied and allowed me to walk away with a tiny profit.

With this trade, I have made $1.59 per bushel profit on 10% of my production (or the equivalent of nearly 16 cents on 100% of my production), while the market has remained mostly sideways the past 5 months.

These trade examples illustrate how selling straddles in sideways markets can be a great way to increase profits. However, this month showed why they must be done carefully. Farmers need to fully understand and be willing to accept all potential final outcomes if prices go up, down or sideways before placing these types of trades. They are not perfect and certainly do not work every time.

Jon Scheve

Superior Feed Ingredients, LLC

OUR BIGGEST SALE EVER ENDS TOMORROW

We are offering our biggest sale to date until tomorrow’s USDA Report. Get all of our stuff for a massive discount before its gone. Every update & audio is sent via text and email.

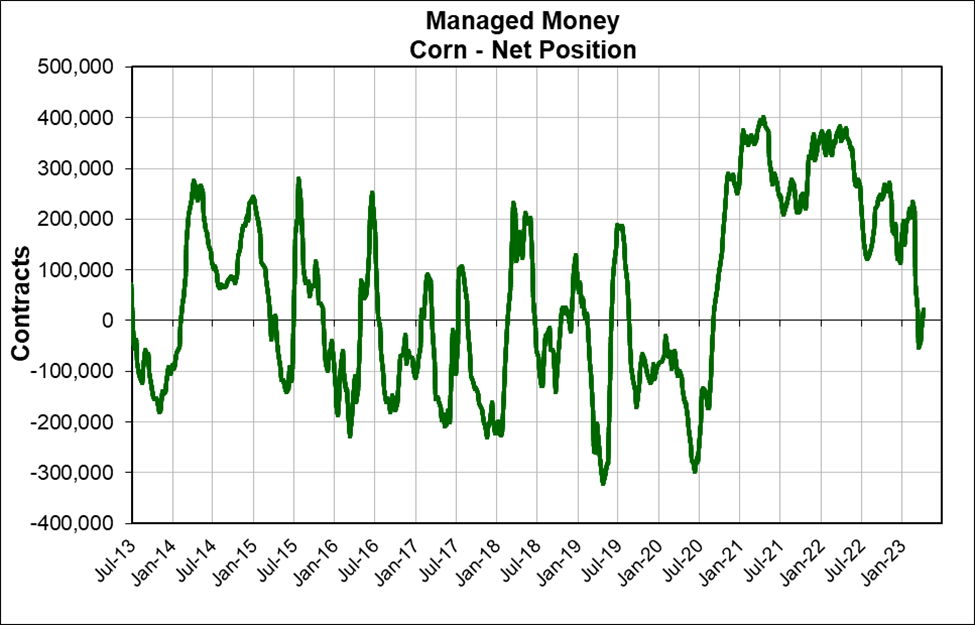

Commitment of Traders

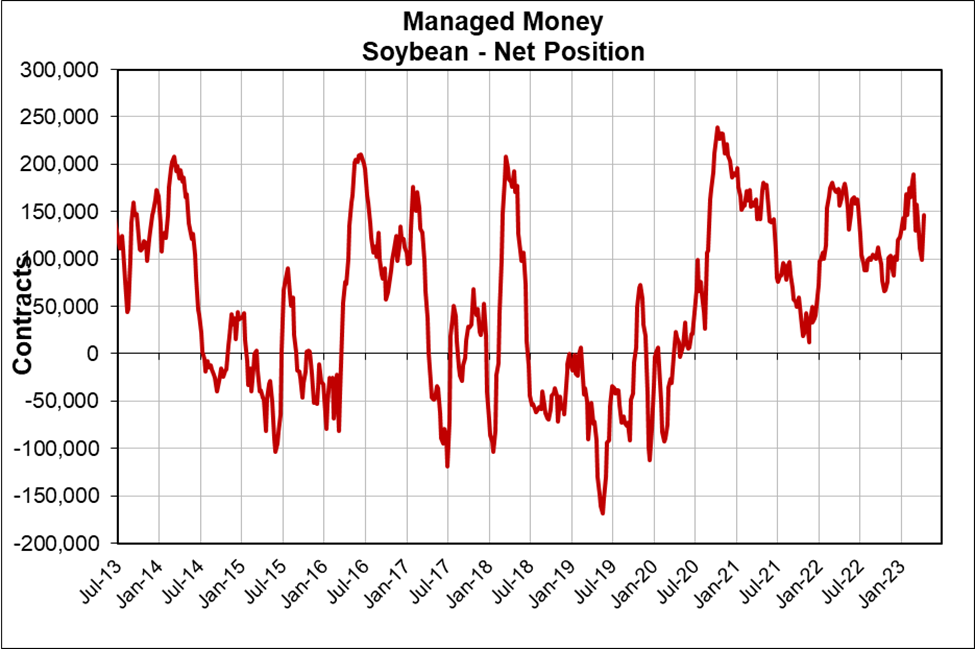

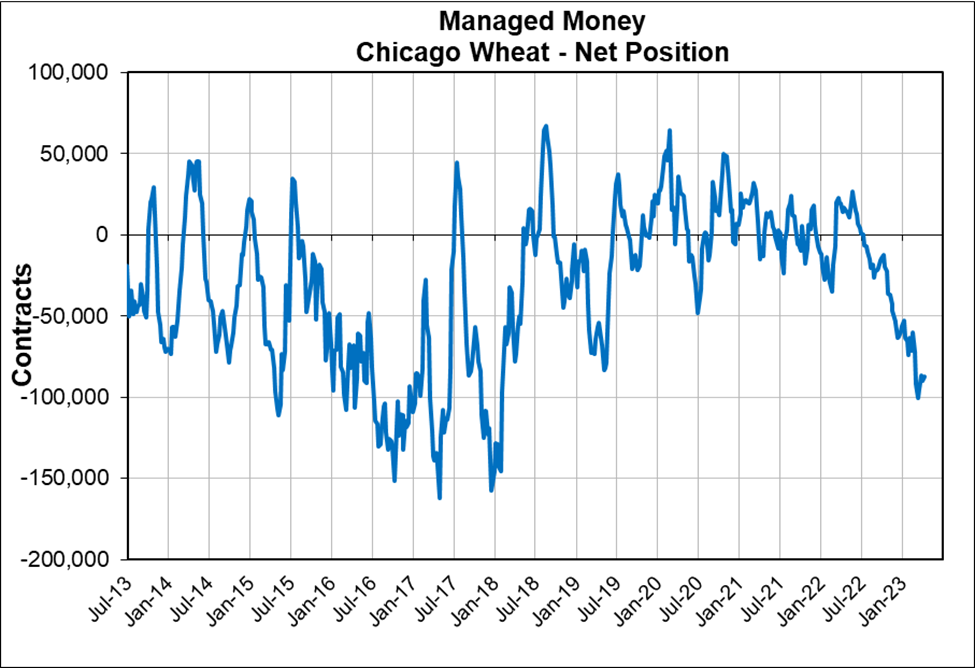

Through the week ending last Tuesday, the funds were buyers across the board. Actually going from net sellers to net buyers in corn following 3 weeks of being net sellers, while adding to their already sizable long bean position. Funds were also small buyers of wheat, but still short around 87,000 contracts.

Positions (As of April 4th)

Corn: Net long 21k contracts

Beans: Net long 146k contracts

Chicago Wheat: Net short -87k contracts

Chart Credit Roach Ag

Other Highlights & News

On Friday, we saw Russia threaten to bypass the Black Sea grain deal unless obstacles to its ag exports were removed.

Poland halts Ukraine grain imports.

China is angry that Taiwan's President met with U.S. House Speaker Kevin MacCarthy while in the U.S.

Check Out Past Updates

4/9/23

WEEKLY GRAIN NEWSLETTER

4/6/23 - Audio

WEATHER MARKETS HAVE BEGUN

4/5/23 - Market Update

FUNDS & WEATHER PRESSURE GRAINS

4/4/23 - Audio

WHY TODAY WAS BULLISH DESPITE LOWER PRICES

4/3/23 - Market Update

BEANS OVER $1 OFF THEIR LOWS

4/2/23 - Weekly Grain Newsletter

HOW THE USDA REPORT WAS A GAME CHANGER

Social Media

U.S. Weather

Source: National Weather Service