WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

Weather markets are now here, and the thing about weather markets is they don’t always move like one thinks they should. It is just as important as the weather is the weather versus the expectations and then even more important than that is the newest forecasts versus the expected forecasts. Bottom line is weather driven markets like the sentence above can be confusing, while lacking rhyme and reasoning.

You have seen and heard me talk for some time that we want to be making grain sales and putting on floors during the seasonal time of the year when it makes sense. That is during planting and growing season.

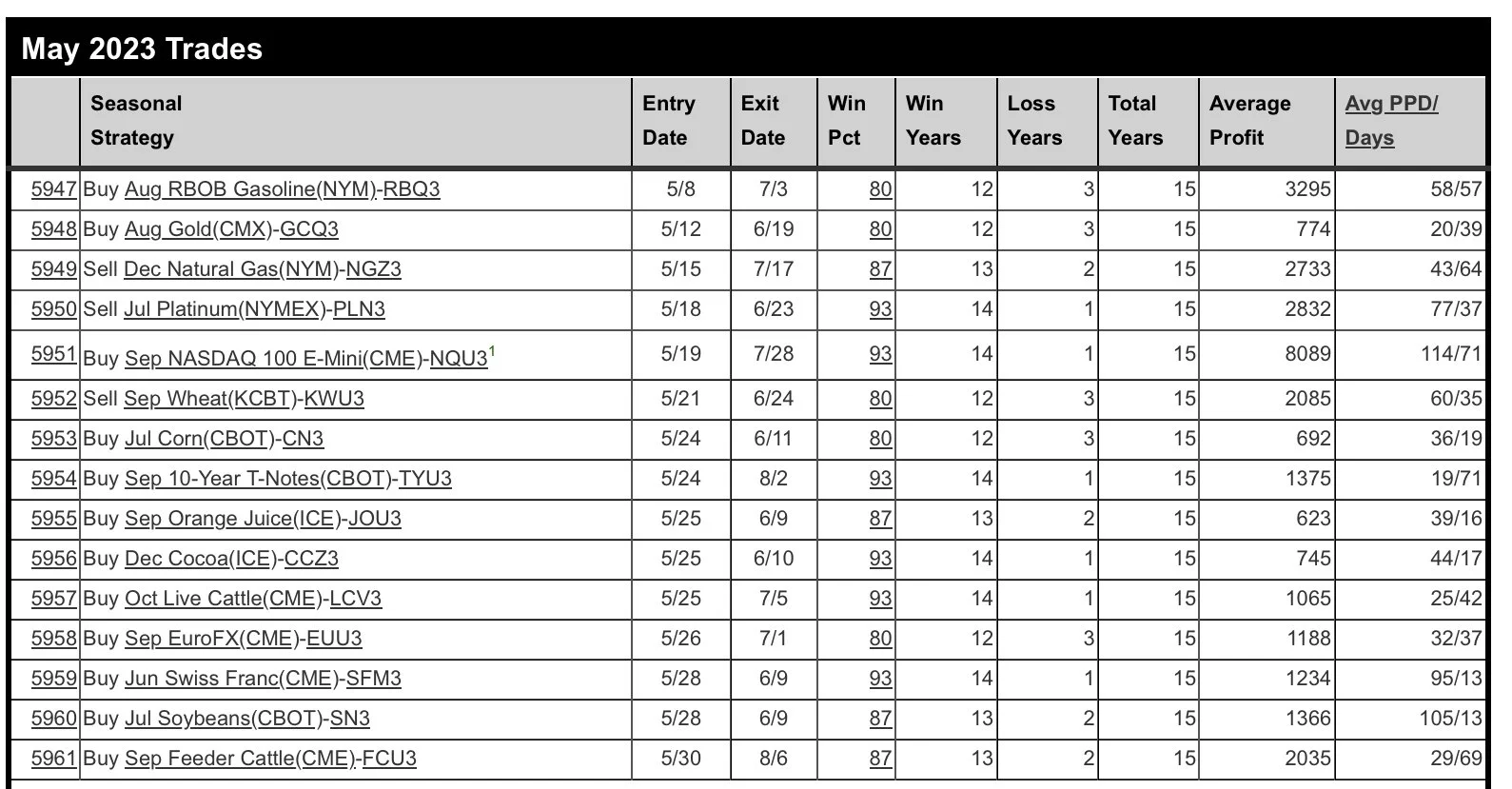

Here is a list of some seasonal trades that MRCI has out there, and the point of sharing this list is that you don’t see tons of soybean and corn trades that come off as winners year after year. Because of the volatility that the growing season, weather, demand, and fundamentals add.

You see some trades in the mentioned grains that our newsletter covers, but the volatility of when and how keep it from being as easy as just saying buy X on X date and sell X on X date.

I guess the bottom line for weather and seasonals is I am trying to communicate that they happen, they almost always happen, but it is not going to be easy enough to pinpoint the day, magnitude, being nor end of a move consistently, hence why we have futures markets.

Now we still want to be watching weather, updated forecasts, seasonals, to help determine proper moves. But we can’t just leave our marketing plan up to weather forecasts and seasononals. We have to have a few other factors that we consider when determining what the proper move is to get one comfortable in their unique situation as for how much grain to sell, protect, or or not price.

Some of those are going to be fundamentals. Such as supply and demand, export sales as a gauge for demand, profit margins that the various buyers of our grains have, such as ethanol margins or soybean crush margins.

The big headline for our fundamentals is the USDA Supply and Demand reports. We will get another one on Tuesday this week. Based on the fact that our quarterly stocks came in lower then estimates there is a good chance that we see our carryout numbers unchanged to lower then the previous month. If they come in higher the market likely won’t believe them as they probably shouldn’t.

As many of you know I have been in the bull camp for some time, calling for higher prices in 2023. Believing that we have a decent chance to take out previous all time highs in many of our markets. I still believe that is our most likely outcome, but I also realize that there are some risks to that happening. The biggest risk is that money or the funds simply don’t decide to play in the at the ag casino. We need the funds betting, the bigger the bets they place the more volatile we get which opens up the upside that much more, even if it starts with the funds placing short bets like they have been in the wheat market.

So rising interest rates that don’t come back down remain one of the biggest risks that we have to our price action in the future.

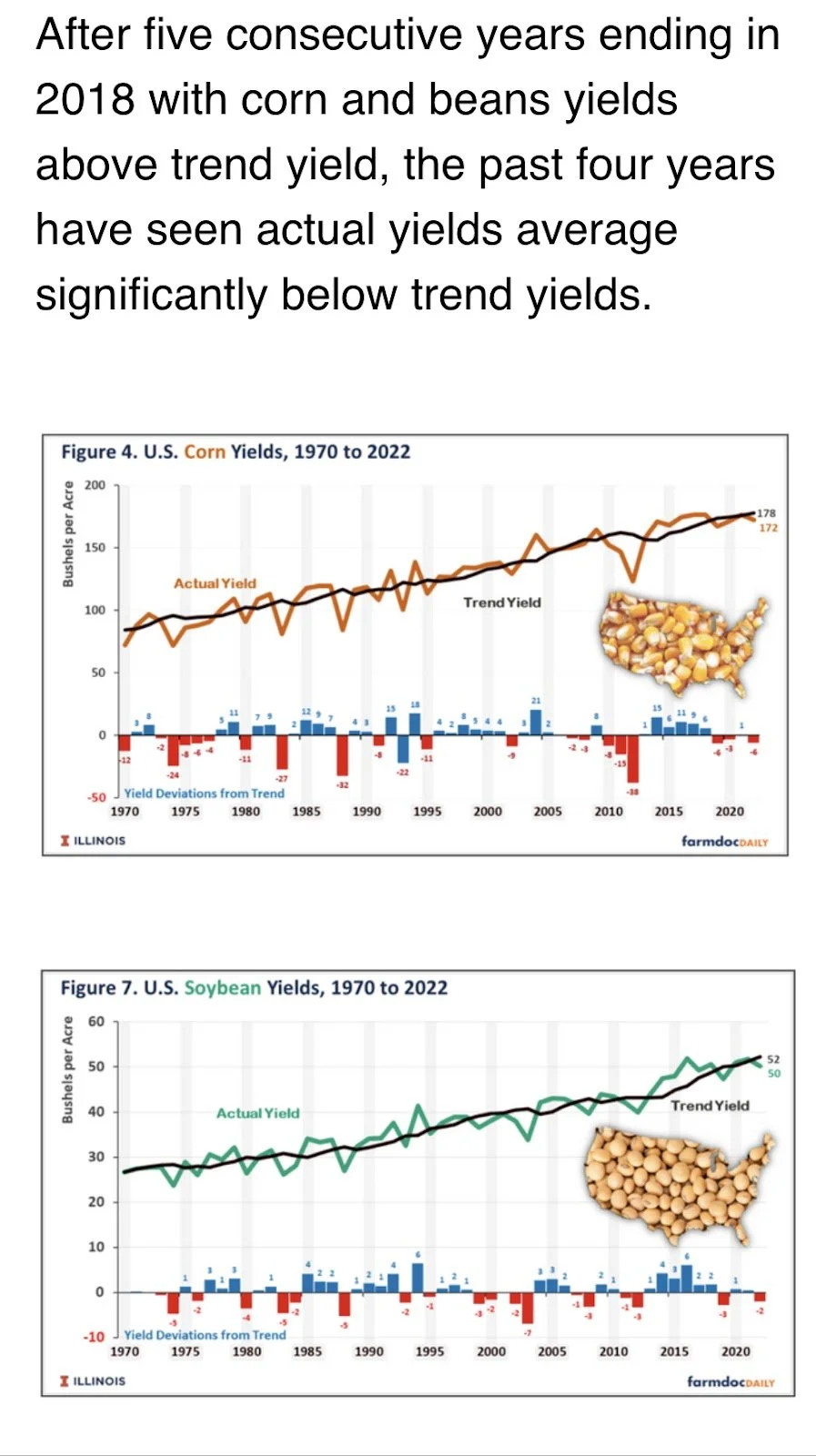

When I take a step back and start looking at the big picture I am reminded that we just don't have enough food to feed a growing world. Here are a few screenshots from Wright on the Market backing up that fact.

This is one of our shorter weekly write ups that you will see, but we are simply waiting patiently for the USDA report later this week and we are expecting to see Mother Nature increase some volatility as we go forward.

And more importantly we don’t want to overwhelm one as we wish you and your family a Happy Easter!

As always, if you ever need anything don’t hesitate to reach out to us at (605)295-3100.

OUR USDA REPORT SALE ENDS IN 2 DAYS

Our biggest sale ever ends Tuesday. Lock in all of our premium content for a massive discount. Receive every single one of our audios and updates via text & email.

Past Updates

4/6/23 - Audio Commentary

WEATHER MARKETS HAVE BEGUN

4/5/23 - Market Update

FUNDS & WEATHER PRESSURE GRAINS

4/4/23 - Audio Commentary

WHY TODAY WAS BULLISH DESPITE LOWER PRICES

4/3/23 - Market Update

BEANS OVER $1 OFF THEIR LOWS

4/2/23 - Weekly Grain Newsletter