GRAINS PRESSURED ACROSS THE BOARD

Overview

Grains and the markets pressured across the board. With wheat getting hit the hardest in the grains. Today’s correction in the grains shouldn’t have been a total surprise given our rally from last Friday, but was still a larger correction than bulls would have liked.

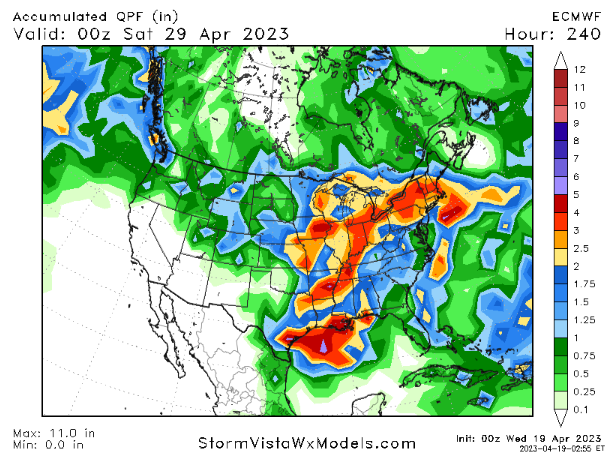

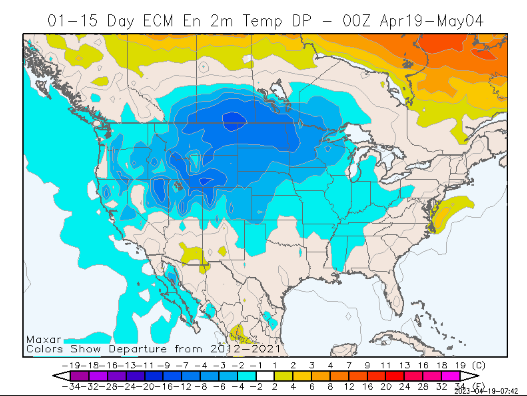

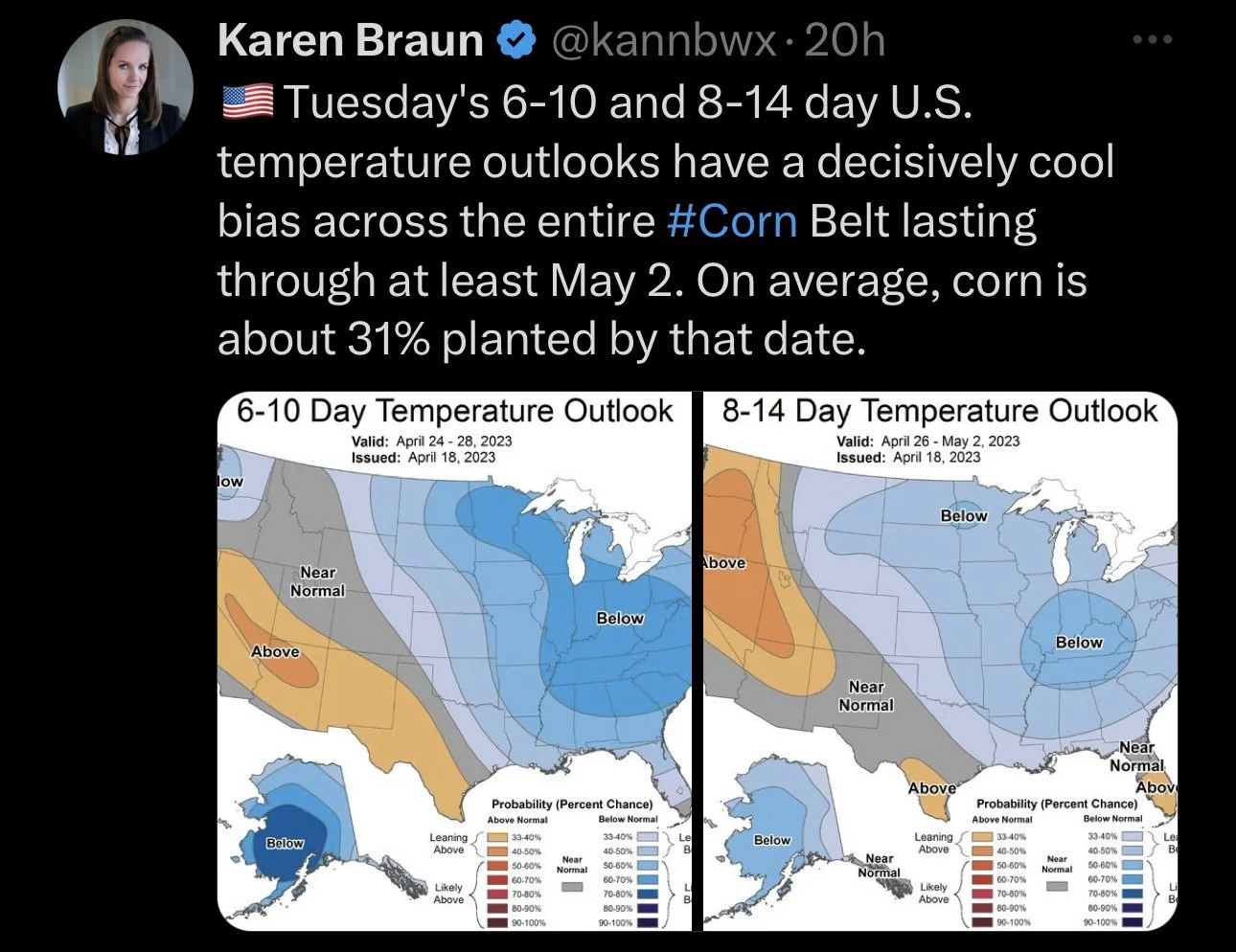

Today’s price action might not agree, but the forecasts are looking bullish, as they are calling for colder wet weather. Which could definitely put planting on a hold for the next week or so. If forecasts stay that way, I think the grains should be well supported.

Basis levels are high and demand is actually strong for the grains. I think on days like today, are days where the funds might be looking to buy breaks in both corn and beans.

Some pressure in the markets came from news that Ukraine will be able to sell grain through Poland. Poland was going to back off on taking any more Ukrainian grain but did eventually take it. Some argue that this might ease Russia into some type of grain agreement.

***

Sunday's Weekly Grain Newsletter

Why We Could See New All-Time Highs

Read Here

ENJOY OUR STUFF? TRY A FREE TRIAL

No obligation. Every single update sent directly to your email and text message.

Today's Main Takeaways

Corn

Corn futures pressured today but see the least losses of the three grains. With May down 5 cents and July down 8 cents.

The main thing bulls are looking at is the forecasts. As they are showing cold weather and rain, which could slow down the fast start to planting we saw last week.

Bulls are also looking at the uncertainties in Ukraine and its grain exports. Currently the situation is a mixed bag. Russia is saying they re allowing inspections, while Ukraine is saying Russia is still complicating things.

One thing bears are looking at that could pressure corn is Chinese looking to buy corn from Brazil. As this indicates a cheaper product.

The forecasts are looking bullish, even though with today’s price action you wouldn’t think so. The acreage debate will be one that could start heating up soon.

We still think we will see higher corn in the coming months, as we expect seasonals to kick in. We will also be looking for more weather premium to be added to our market in the days ahead. On days like today we need to remember that with weather markets, we will see plenty of volatility and our path where we see corn going isn’t going to be a straight shot higher.

Taking a look at the chart, even with today’s losses we still sit in a clear uptrend. Perhaps we do go and test that upward trend line. Bulls would like to retest and surpass our long term moving averages which sit around the $6.50 level.

Corn July-23

Soybeans

Soybeans tried to rally, and were higher at one point. But ultimately also lower today along with the rest of the grains, losing a little over 12 cents on the day.

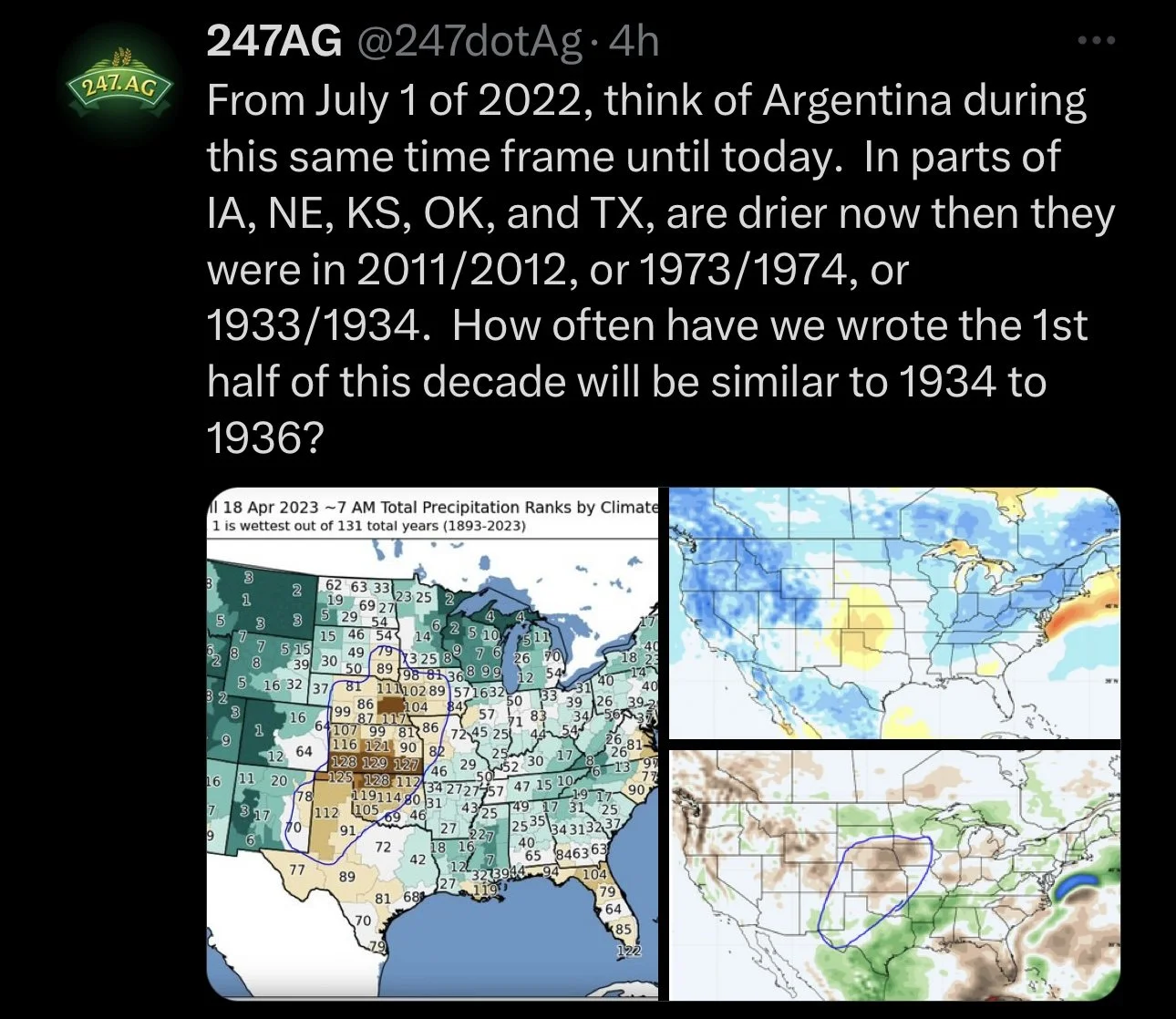

The US Ag Attache in Argentina lowered their soybean production estimate to 23.9 million metric tons. To put this number into perspective, the USDA is currently at 27 million, and this 23.9 would be the lowest in 24 years. With a yield estimate of 23.5 bushels an acre, would be the poorest in nearly 50 years.

Similar to corn, bulls are looking at the weather to provide some support in the days ahead. With cold temps and wet fields look to extend some planting delays, and continue to complicate important growing regions in the north.

To go along with US weather, we also have a continuation of problems in Argentina. Right now a lot of this could already be priced in, but looking long term, one has to imagine what kind of effect this could have down the road months from now. Many still argue this crop will continue to get smaller and smaller, and Argentina might have to look to import upwards of 10 million metric tons of soybeans.

Bears of course counteract this argument and bring up Brazil's massive crop which currently sits around 90% complete. Yes the crop is big. But how much of this crop can they get out of the country without running into logistic problems.

Short term perhaps we see additional pressure. But looking longer term, we have bulls arguing we see an increase in Chinese demand, seasonals say we will go higher into summer, and the fundamentals are bullish.

From Jerry Welch,

"I expect old-crop July soybeans to kiss $16 to $16.50 by Independence Day."

Taking a look at the chart, yesterday we slightly closed out of that short term downtrend from February, but today we closed right back under. Bulls would like to get a clear break out to go and test $15 and perhaps our recent highs.

Soybeans July-23

Wheat

Wheat was heavily pressured across all three classes today. Some pressure came from overnight, as we saw grain-carrying vessels leaving Ukraine resume.

SovEcon increased their 2023 Russian wheat production estimate by 1.5 million metric tons to 86.8 million from last month.

Forecasts are calling for rains in Kansas 10 days out. But these long-term forecasts haven’t panned out as of recently. The next week or so the forecast could completely change. Its tough to agree with anyone being short KC wheat here. There is still probably a lot of tightness in the days ahead.

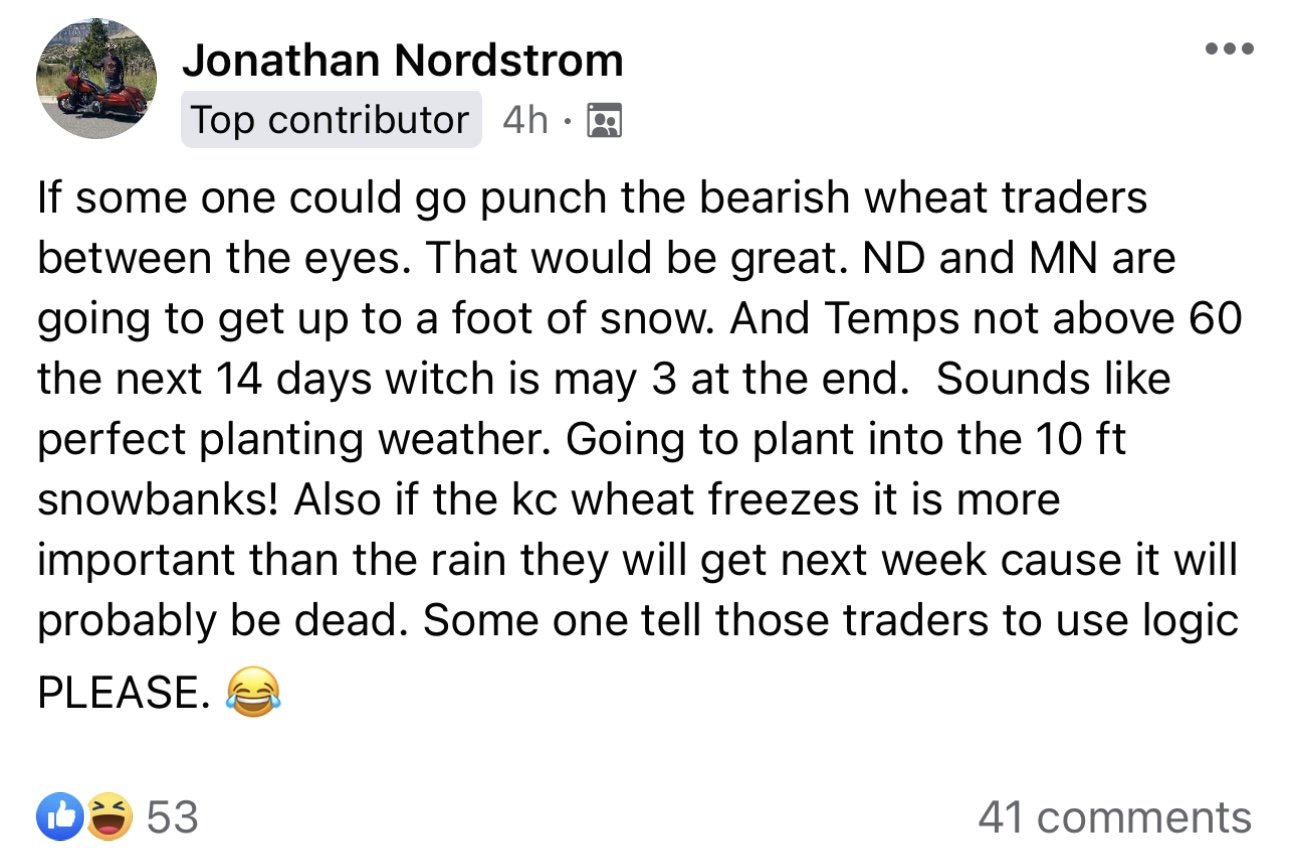

Some bulls are talking about North Dakota and Minnesota getting up to a foot of snow. With temps not reaching 60 degrees until possibly May. Making planting a very difficult task. Bulls are also making the argument that we could see the KC wheat freeze, which could be more important than that rain if they do get it. Short wheat traders could potentially be in for a surprise at some point.

The situation in Ukraine remains a big uncertainty in the markets. I still think there is the chance for some bullish wild cards in the future. Basically, Ukraine is saying that Russia is blocking and complicating their exports. Russia continues to threaten that they have the power to not renew the Black Sea agreement when the time comes if their demands aren't met. It’s clear Russia isn’t too happy with everything.

From Duane Lowry,

"We are going to walk in one morning and find that Russia has pulled out of the grain corridor agreement, because of the West's unwillingness to live up to their agreement. I think this happens before this last extension maturity date."

Taking a look at the chart, we are hovering right at that downtrend from December. Bulls would like to go and test that upper downward trend line to get a breakout and see this inverse head and shoulders come to fruition.

Chicago July-23

KC July-23

MPLS July-23

Will Fertilizer Get Cheaper?

From Wright on the Market,

Written yesterday morning by a client:

"Hi Roger,

I farm Central Minnesota. Very wet here. Never seen this much water sitting in the low areas and that’s saying a lot after 2013, 2014, 2019 and 2022 springs. We went from a 17” snowpack April 5th to nothing April 12th. Very close to record snow here this last winter. Now just flooding, but it will straighten out soon enough.

We use dry fertilizer and we pick it up 21 tons at a time. I have been watching the natural gas price drop as it did a while ago, but the local plants have not seemed to adjust with nitrogen-urea cheaper as you have reported in NOLA. Now I see they are going up via your email this morning. Do you think there is any hope left for price to come lower at the local plant level?

The November 2022 price for this spring’s fertilizer was $10 higher an acre for corn than when I checked February 3rd and again today.

Personally, I am thinking it might only come down after 80% of the crop is planted and the fertilizer plant wants to empty the buildings. Many suppliers, but they all seem to be holding together so far.

Thank you, Tyler."

____

My reply:

Good morning, Tyler,

I think there is a better than 60% chance fertilizer will get cheaper in the coming month or two. Many retailers are sitting on high priced inventory, praying fertilizer prices will get high enough they can sell it at breakeven. Obviously, spring planting will be at least a little late and that will initially decrease fertilizer demand and scare the retailers with high-priced product. Eventually even a minor planting delay will reduce total spring fertilizer demand.

The bigger factor for this spring is most retailers cannot afford to sit on fertilizer another 6 to 12 months. Interest rates are at 30-year highs and fertilizer prices will probably be even cheaper this autumn than now. As you noted, natural gas made a new low just three days ago and that reduces the cost of producing N fertilizer.

National and world fertilizer prices have declined since February. The fact that fertilizer prices have not declined in your area since February confirms your local suppliers bought fertilizer at a high price and are not going to reduce their price to the farmer until after the early spring rush at the earliest.

For my money, I would wait.

Thanks for your business. Roger.

Weather Limiting Planting

From Andy Shissler at S&W Trading,

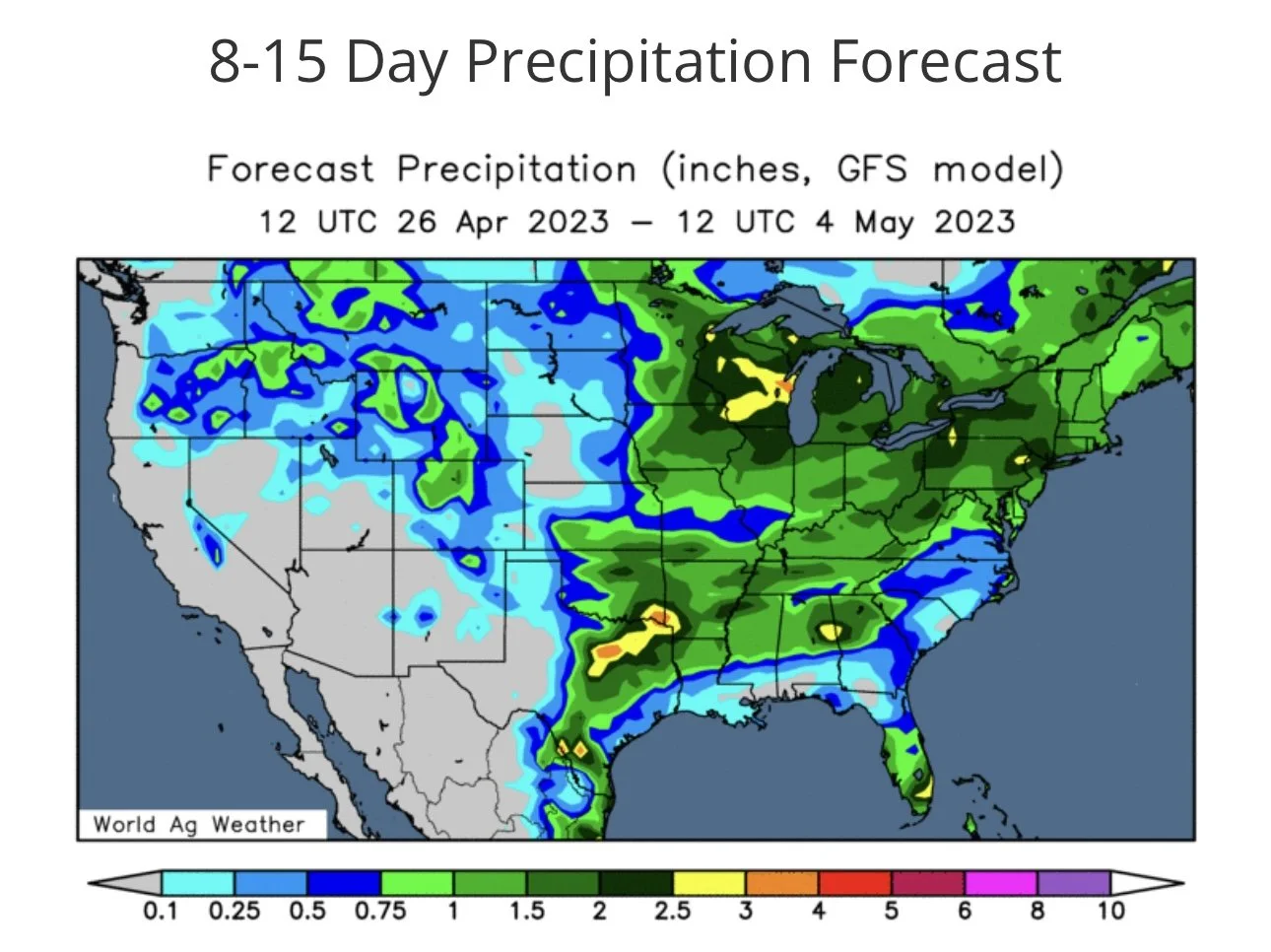

There is currently a storm system and cold front moving through the upper Midwest. Rains will develop all the way into the 21st. Most of the Midwest will see coverage, the exception is Western Kansas, Oklahoma, and Texas.

Another storm system and frost freeze is forecasted for this weekend ont he 22nd to 24th. The weather clears out for a few days and another system is forecasted as a cold front move in producing rains on April 30th to May 1st.

This pattern is very wet and cold, limiting planting in the Northern US to almost nothing.

News out of Ukraine is causing a lower market today, and this is much like we saw last week with a lot of back and forth trading as the market spins its wheels.

The forecast is definitely bullish as cold wet weather will delay planting in the North where the window and growing season is much shorter. Prices are not so good that producers wouldn’t choose to prevent plant crops.

Highlights & News

A CNBC Report said that we have the tightest global supply of rice ever.

Poland said they have reached an agreement to restart transit of Ukrainian grain.

Egypt expects that they will pay 20% more for imported 2023 wheat than they did for 2022 wheat.

The Food Corporation of India reports that India's wheat inventory is at a six year low. Coming in at 8.35 million metric tons, making it only the second time of the last decade that their inventory has fallen below 8.5 million.

The UN reported that India had surpassed China as the most populous country.

Check Out Past Updates

4/18/23 - Audio Commentary

Mother Nature & Seasonal Trends

4/17/23 - Audio & Market Update

Money Flowing Into Grains?

4/16/23 - Weekly Grain Newsletter

Why We Could See New All-Time Highs

4/14/23 - Market Update

Funds Cover Wheat Shorts

4/13/23 - Audio Commentary

Planting - Is It Dry or Wet?

Social Media

U.S. Weather

Source: National Weather Service