PATIENCE & SEASONAL OPPORTUNITIES IN THE MARKET

AUDIO COMMENTARY

Outside markets & recession fears

Wetter KC forecasts. Will they actually develop?

Old crop is tight, basis & spreads are firm which is positive

Expect volatile markets to continue

What to expect from our seasonals

What if we don’t meet USDA numbers

Reasons we could go higher

Opportunities & risk management

Listen to today's audio below

Enjoy Our Stuff? Try Our Free Trial

Try 30-days. Get all of our updates and audio sent via text message & email.

Overview

Grains continue to their sell off from yesterday, with a little bit of a risk off day has nearly all of the markets trading lower. There is some concerns that the Feds will continue to raise interest rates, which has some suggesting we see the US fall further into a recession later this year.

Export sales came in lousy for the most part which didn’t help with the selling today. With old crop corn and beans falling below expectations, while new crop corn was slightly above. The rest were in line with the estimates.

Poland and Romania have agreed to allow Ukranian grains to be imported which was a bearish headline as well.

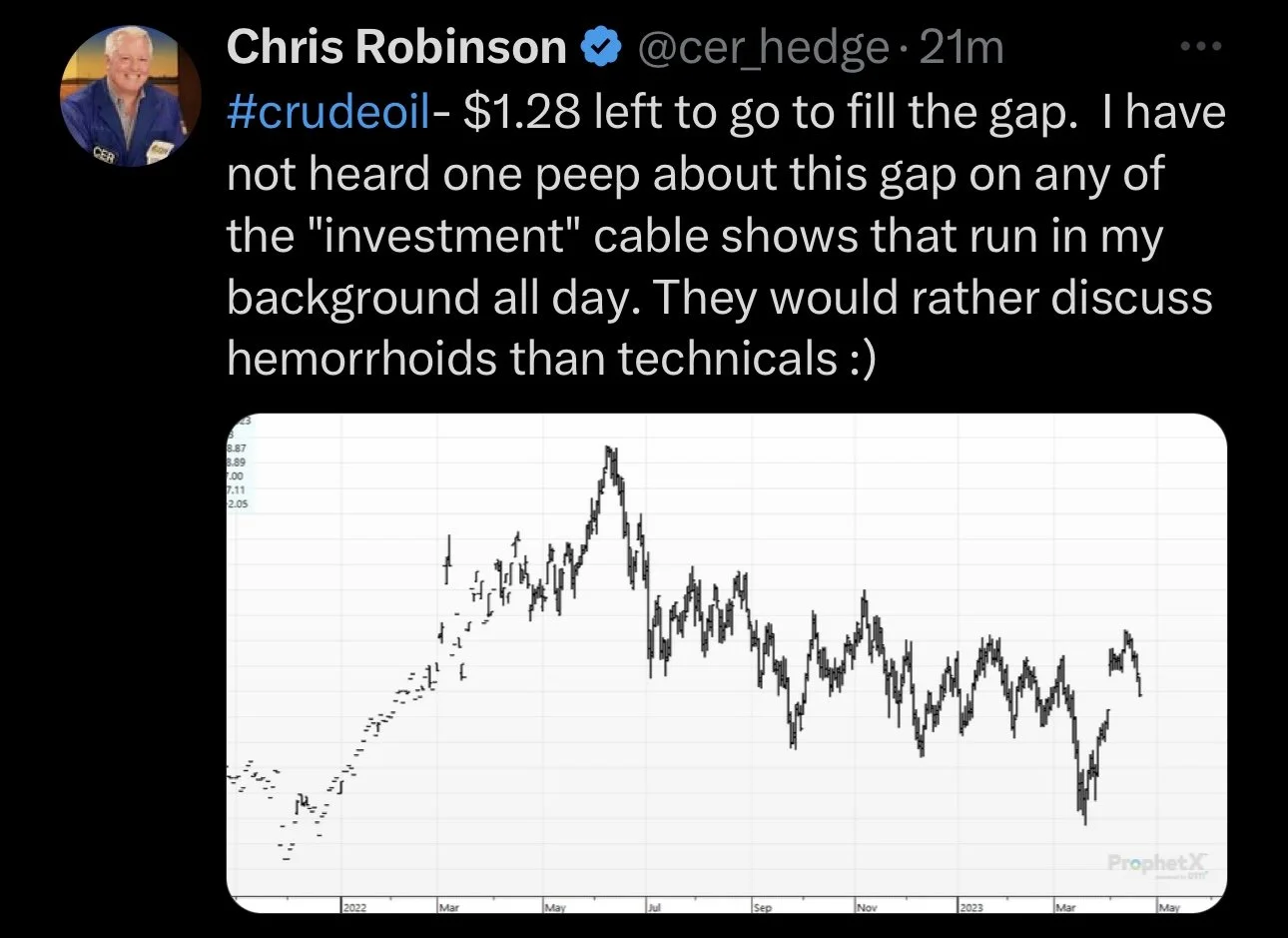

Outside markets also added pressure, with crude getting hit again, down nearly $2.

***

Sunday's Weekly Grain Newsletter

Why We Could See New All-Time Highs

Read Here

Today's Main Takeaways

Corn

Corn trading lower for the second day in a row, down a dime. The main thing pressuring corn here today was really just an influence from the outside markets in a risk off day.

The Feds are causing some concerns in the market, as some think we might be in for more interest rate hikes which has led to further recession concerns. The +10% inflation in the UK is making some think the Feds might stay aggressive than recent forecasts had suggested. We also have had recent weakness in crude oil and some revived strength in the dollar which have weighed on corn and the grains.

We also had news that Poland and Romania have agreed to allow Ukrainian grains to be imported which is a slightly bearish headline as well. The grain corridor headlines are a bit mixed. Some argue that Russia might start to be a little more cooperative while some argue we might wake up one morning and see some crazy headlines that Russia is pulling out of the agreement.

Export sales for old crop corn also came in very disappointing. Falling below expectations. New crop corn export sales did however come in decent, coming in slightly above the trade estimates.

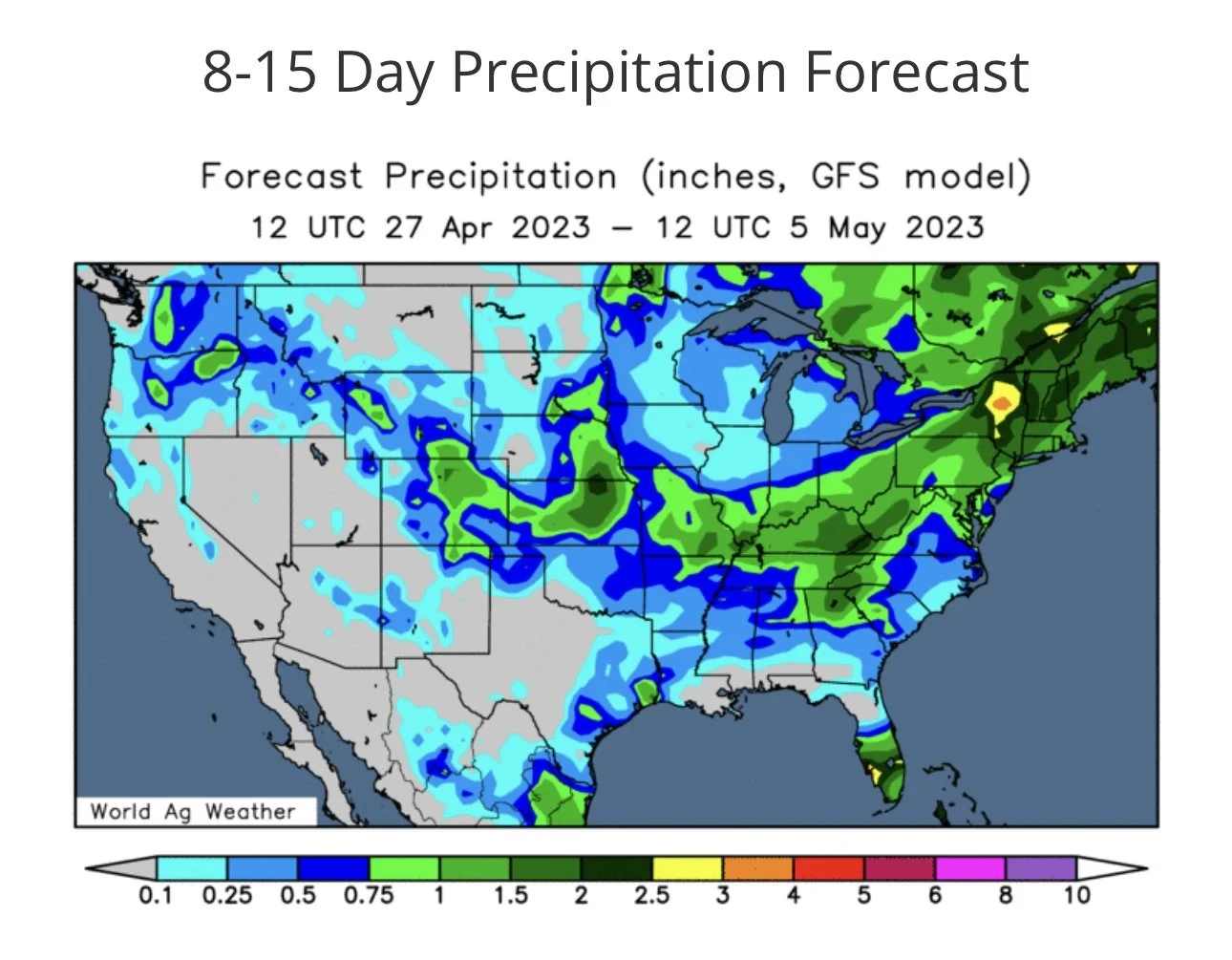

Looking at the weather, looks like there could be some freezing temps in important growing regions. Which has the potential to do some damage. If these forecasts stay true one would assume we see corn well supported.

We got off to a hot start in planting with last week's nice weather. But the forecasts are looking much cooler and wet as we close out the month heading into May. So this will likely delay what had been a fast but brief start. Fast forward to early May, and we might be running behind. The trade typically looks for around 80% of planting to be done by the third week in May. Last week we saw numbers come in at 8%.

I think this sell off here was a tad over done. Most expect to see some planting delays in the near future, and with the not so favorable weather I think we see corn rebound from these levels and follow our seasonals higher.

Taking a look at the chart, we still remain in an uptrend. If we don’t find support here we might have to look at the $6.20 level. Upside target is the $6.45 to $6.50 range and our long term moving averages.

Corn July-23

Soybeans

Soybeans lower again here today, adding to yesterday’s losses. But really this sell off hasn't been all that terrible. Sure we are 30 cents or so off our highs, but we are also 80 cents off our lows.

Export sales this morning were terrible, with some of the worst numbers for beans in recent memory. With just 100,000 tons of export sales. Estimates were 250k to 425k.

The main thing pressuring beans right now is that Brazil still has lower prices especially to China. They continue to find problems with their storage as their harvest winds down, which pressures farmers into selling and pressuring the bean export prices in Brazil. So the big crop and cheap prices from Brazil are the biggest thing bears look at when talking about beans.

Taking a look at South America, there hasn't been much changes as off late. Brazil still has a big crop while Argentina's continues to suffer. Now how all of this will impact things months from now remains a story to be told. There could definitely be the chance for some logistic issues of actually getting Brazil's massive crop out of the country down the road. There isn't much to say regarding Argentina, we all know how historically poor their crop is, though some will argue the crop has stabilized. But really it doesn't matter if it has stabilized here or not, given how terrible it already is.

From Wright on the Market,

Brazil’s bean basis continues to weaken due to oversupply and cash beans there are about $3 less per bushel than US beans. It still takes about three months to get a shipload of Brazil’s bean delivered.

Beans continue to find still resistance at $15, as we go and test that support of $14.68. We still remain in that upward channel. Bulls would like to break this short term downtrend from February.

Soybeans July-23

Wheat

Wheat lower here today with some macro headlines, weather, and Russia adding pressure. With KC wheat seeing the most pressure, possibly due to their forecasts showing rain next week.

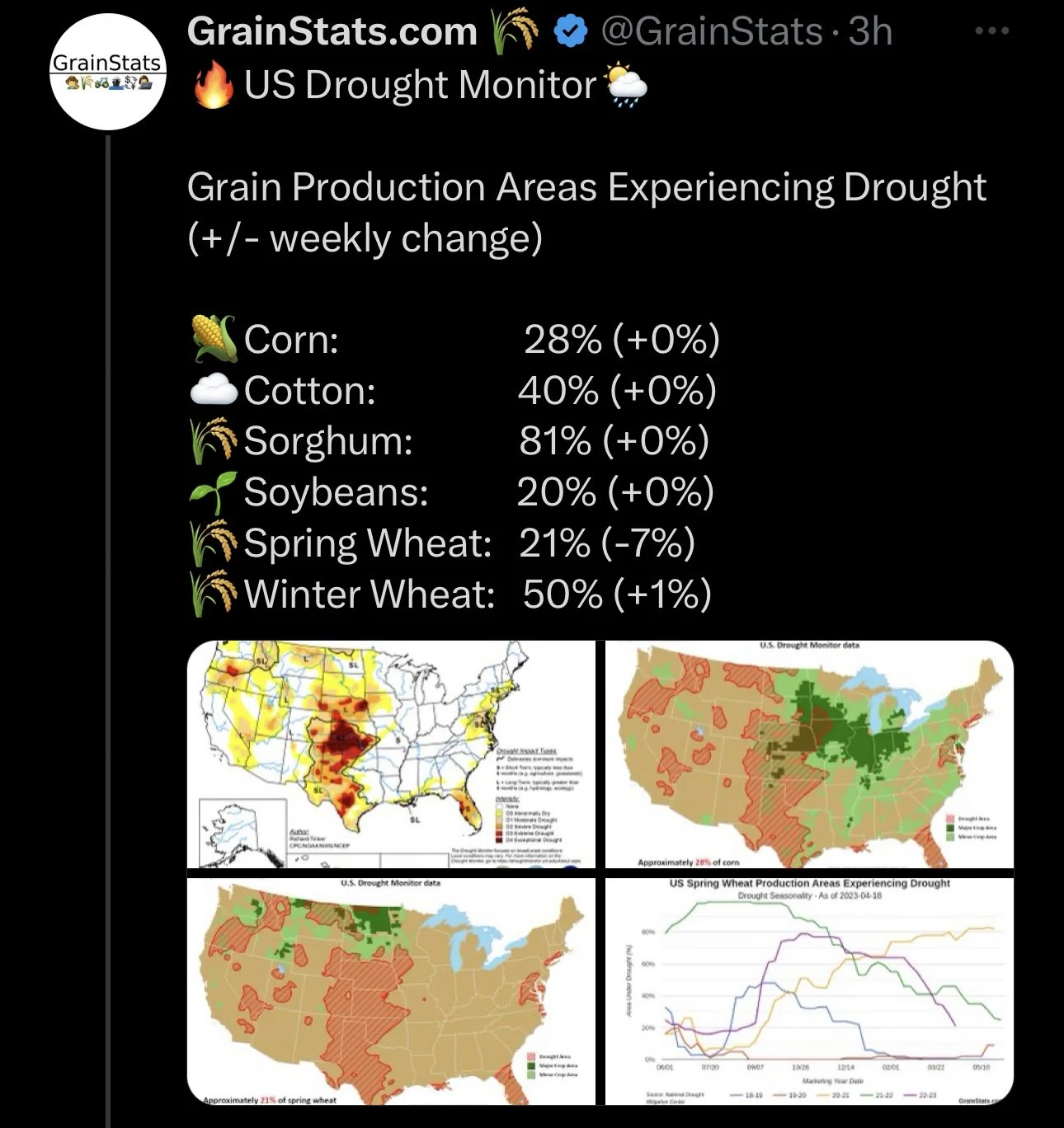

Wheat continues to drag lower despite the fundamentals being bullish. We have US winter wheat conditions at all-time lows, and have forecasts showing possible freeze over the weekend.

We mentioned this previously, but the economy uncertainties and recent strength in the dollar have also weighed on the wheat markets.

Ukraine has been allowed to resume their vessel inspections by Russia, which had been halted over the past few days. There is some talk from bears that perhaps we do see Russia start being more cooperative.

We saw the Russian Ag minister in a meeting say that their wheat crop could only be 78 million tons. Which is an interesting number, as most private groups were using a numbers closer to 85 or so.

Bulls are looking at some pretty cold temps that could soon impact and already vulnerable crop. As we have some potential freezes across a large part of the US wheat growing regions.

Taking a look at the weather for KC wheat crop, they are looking at some decent rains next week in the forecasts. But the weather is getting a lot colder. Seeing KC wheat break 60 cents of so off it’s highs just doesn't make much sense at all taking into consideration just how bad the crop really is.

Going forward, I thought our lows were in a few weeks ago. But here we are, trading back near those lows. Bulls just can’t catch a rally to break out this downtrend. I still think we definitely have the possibility for more weather or war wild cards to catch bears and the funds caught off guard down the road. Keep in mind the funds are still very short Chicago wheat. I still have the wonder just what happens when they decide to flip things over. Will this happen relatively soon? Nobody really knows. Nonetheless wheat is going to trade the 3 W's. Weather, wealth, and war.

Chicago July-23

KC July-23

MPLS July-23

Seasonals & The Bottom Line

From Farms.com Risk Management

Seasonally new crop corn futures will rally into the spring following the USDA March Planting Intentions report 10 out of 15 years, & gain on average $0.95 a bushel and exceed the high in March. So, at a minimum farmers should be setting their old at $7.00 -$7.50 and new crop future targets at $6.50 -$7.00 a bushel or better in corn over the next 2 months.

With new crop 23/24 futures there is a seasonal that says if history repeats itself whatever the high was on new crop 23/24 futures from Jan. 1 to Jan. 30 it will be revisited sometime again in 2023 but on average will be 15% higher (could be higher or lower than the average). The high was $6.11 for corn, so a 15% higher close sometime thereafter would be $7.05 for Dec 23 corn futures.

The corn U.S. fundamentals remain tight despite expectations for higher 2023 acreage, but we remain hostage to the funds fear over recession which is overblown. A recession can destroy demand and do it for the funds so why put more money to work. The USDA, demand or weather will need to give them an excuse to buy as the macro picture may not as we run out of time.

Check Out Past Updates

4/19/23 - Market Update

Grains Pressured Across the Board

Read More

4/18/23 - Audio Commentary

Mother Nature & Seasonal Trends

4/17/23 - Audio & Market Update

Money Flowing Into Grains?

4/16/23 - Weekly Grain Newsletter

Why We Could See New All-Time Highs

4/14/23 - Market Update

Funds Cover Wheat Shorts

4/13/23 - Audio Commentary

Planting - Is It Dry or Wet?

Social Media

U.S. Weather

Source: National Weather Service