ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

AUDIO COMMENTARY

Short brief update

All about the election & uncertainty

Very quiet day & little news

Expecting very few changes from USDA

Look for extreme volatility

Election “could” be a non event if priced in

If going to be forced to market soon keep protection

Demand is stout. Will it continue after election?

Idea of interest rate cuts added support

Short term indicators still favor potential bean bounce (Chart below)*

Wheat attempting month long channel breakout. Key spot (Chart below)*

Corn nearing resistance or breakout point. Key spot (Chart below)*

VIDEO CHART UPDATE BELOW*

Listen to today’s audio below

Want to talk? (605)295-3100

Election Sale Ends Tomorrow: CLICK HERE

VIDEO CHART UPDATE

Here is a short video of the charts. You can scroll to read as well if you prefer to read.

CHARTS

Corn 🌽

Corn looks very solid here.

However, we are nearing that downward resistance (blue line).

IF we bust through, it would look very strong and likely bring more upside.

Looking to the downside, we have peak volume support right under us at $4.10, so that should offer good support.

The daily MACD indicator also just flipped bullish, so that is a friendly sign.

Overall, I am optimistically cautious here waiting to see if we can bust that downtrend or if we will reject off of it once again.

Soybeans 🌱

Soybeans look pretty friendly here short term on the charts, as we have quiet a few indicators supporting a bounce here.

First is the MACD. It flipped bullish for the first time since that late August rally (blue line crosses over yellow line). This is a potential friendly sign.

We also have bullish divergence on the RSI (happens when the RSI forms an uptrend but prices form a downtrend) this typically signals a potential reversal.

We are sitting right at this peak volume shelf.

IF we can bust above $10.08, it could be a fast trip up to the next volume shelf and $10.30 area. (if you look at the right hand side we have a volume gap up to $10.35) When there is a volume gap, often times prices will slice right through fast.

So if you are someone who is looking for a target to take risk off the table, my current target is that green box ($10.30 to $10.45) We have the volume gap and $10.44 is our 61.8% retracement to those highs.

(These indicators are not sure-fire things, but they are good signs for a short term pop)

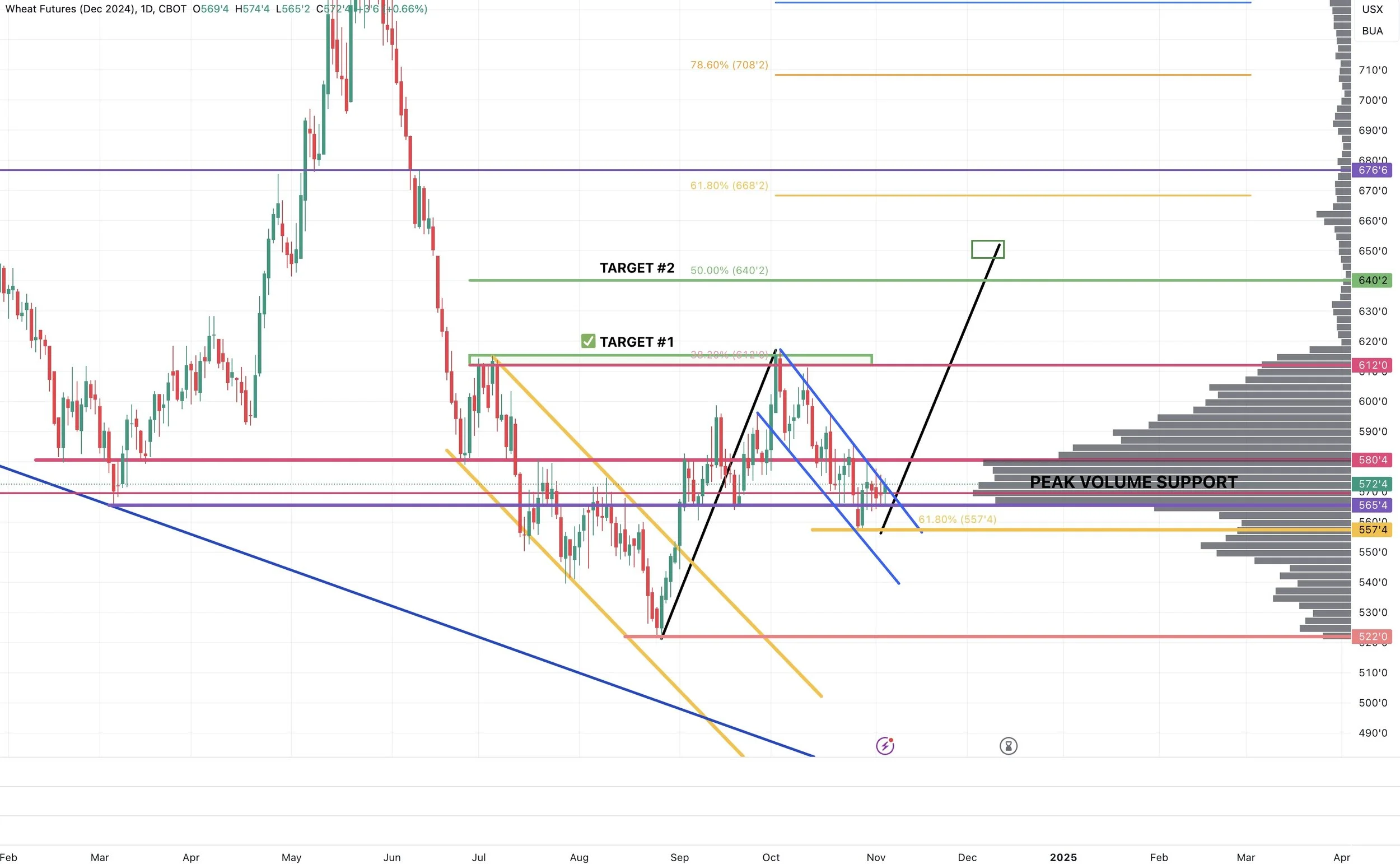

Chicago Wheat 🌾

Here is a close up of wheat. We are very very close to breaking out of this downward channel. Which would be a great sign as we have respected this channel for a month now.

BUT until we do so.. we could just as easily reject off of here like we have a dozen times in the past.

IF we bust out of this channel, the potential bull flag is still in tact.

If you look at the volume shelf on the right, peak volume is $5.65 to $5.80

Another reason why $5.65 is such a good support spot that I really want to see us hold.

If we bust above $5.80, since there is little volume.. we could accelerate somewhat fast.

But first we have to break out of this channel and hold those recent lows of $5.57

KC Wheat 🌾

Pretty much the exact same set up in KC.

Stuck in this channel, hoping we finally bust out to the upside.

$5.61 is the level to hold, if we break down there isn’t much support.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24