RUSSIA EXITS GRAIN DEAL. BUY THE RUMOR SELL THE FACT

Overview

Grains gapped open higher overnight. The big news was the Black Sea deal, as it did not get extended. This led to wheat and the rest of the grains trading much higher overnight. However, wheat and corn both eventually ran into some heavy selling. Giving away more than their gap higher and closing lower.

Why was this? It was simply due to buy the rumor and sell the fact. As the trade has been anticipating this for quiet some time now.

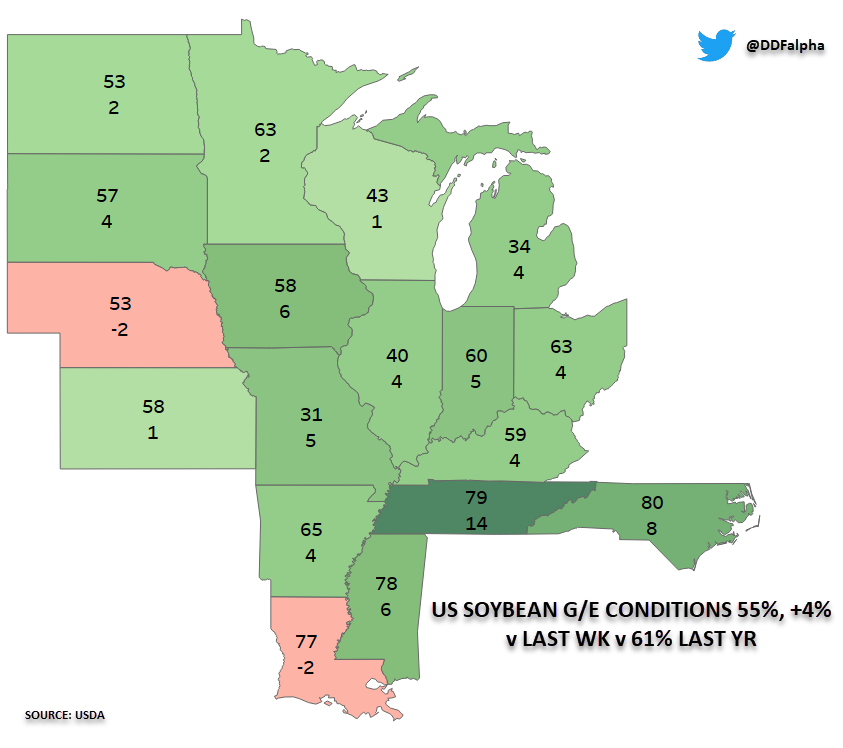

Crop conditions came out after close today. Corn improved as expected. Soybeans improved more than expected. Coming in at 55% good to excellent vs estimates of 53%. Spring wheat also improved more than expected, with 51% vs 47%. Winter wheat harvest continues to run behind.

The western belt is expected to see below average precipitation for the next two weeks, with risks of hot temperatures also still in place. So overall, the weather is looking bullish as we head into the end of July. Based on the forecasts, I think the next week we should see higher prices if they stay that way. Last week I mentioned that I was hearing more and more about late July turning on the heater. Now even though weather is bullish, I wouldn’t be surprised to see beans potentially take it on the chin tomorrow with the unexpected improvement in crop ratings.

Below is the current forecasts.

Crop Progress & Ratings

Corn 🌽

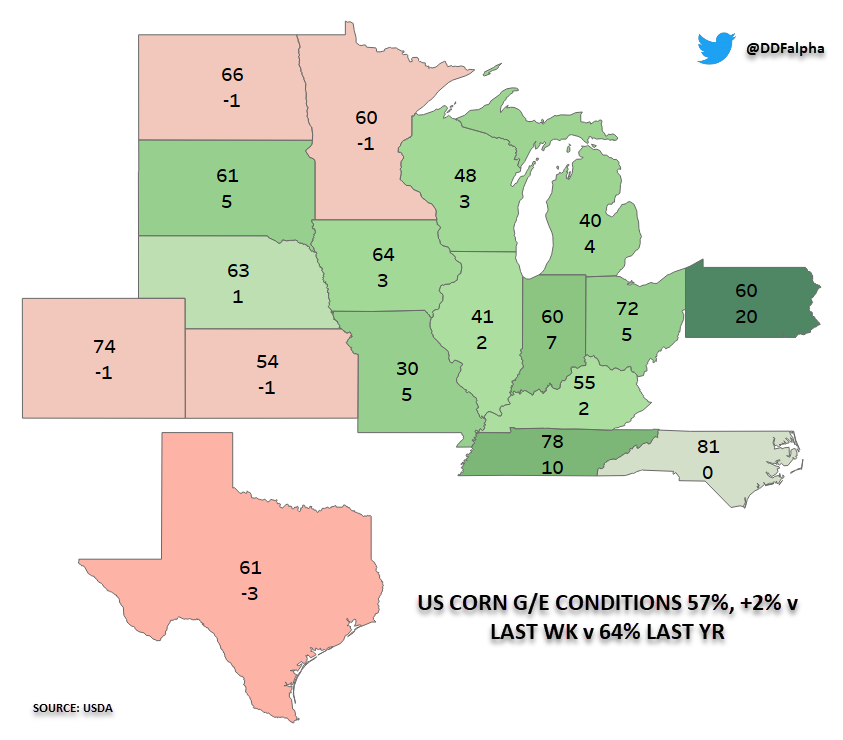

Rated G/E: 57%

Trade: 57%

Last Week: 55%

Last Year: 64%

Soybeans 🌱

Rated G/E: 55%

Trade: 53%

Last Week: 51%

Last Year: 61%

Spring Wheat 🌾

Rated G/E: 51%

Trade: 47%

Last Week: 47%

Last Year: 71%

Winter Wheat 🌾

Harvested: 56%

Trade: 57%

Last Week: 46%

Last Year: 69%

Average: 69%

SAVE $450/YR BEFORE YOUR TRIAL ENDS

Take advantage of our massive offer before its gone and your free trial ends.

Today's Main Takeaways

Corn

Following up a near 20 cent from last week, corn gives back nearly 8 cents today. We gapped higher overnight from the Russia & Ukraine news, but ultimately gave it all back as it was just a case of buy the rumor and sell the fact, as the trade was expecting this for a while.

Before giving back our gains, corn actually posted new highs this morning, at the high corn was up 45 cents from last week's lows. Ultimately, today just felt like a correction day. The weather forecasts are still shifting hotter and drier.

As mentioned, crop conditions saw slight improvements for corn. Improving by 2% to 55% rated good to excellent. However, this was expected and already priced in. So I don’t expect to see much reaction from this. However, soybeans came in far better than estimates so there is a chance beans try to pull down corn if that is the reaction we get tomorrow.

Some Notable Changes

South Dakota: +5% (61%)

Iowa: +3% (64%)

Illinois: +2% (41%)

Indiana: +7% (60%)

Ohio: +5% (72%)

Here is a state by state breakdown

Chart Credit Darrin Fessler

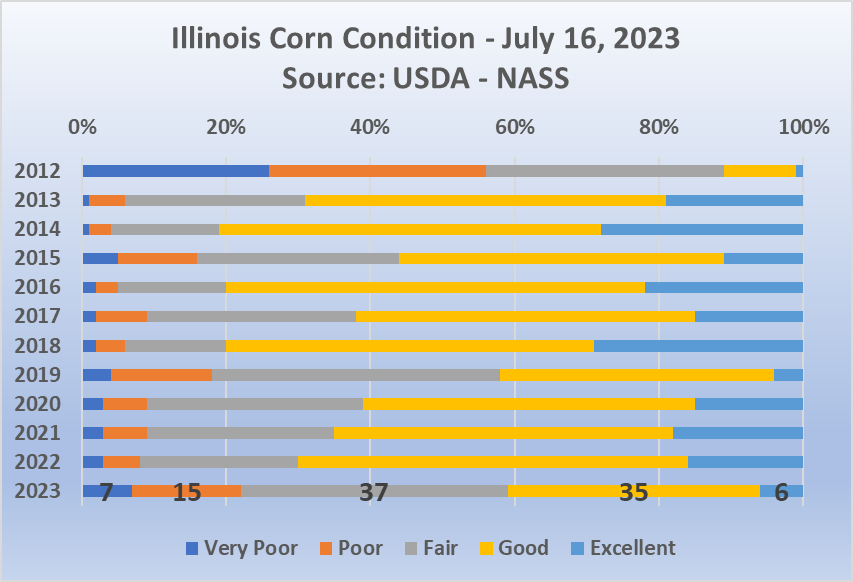

Here is the current corn conditions for Illinois. Clearly not even close to 2012 levels of drought or crop condition anymore. But still one of the worst crops in recent memory.

As mentioned, the forecasts are starting to turn more and more bullish as we look towards the end of the month. Bulls are also pointing to the extreme heat we have seen across the globe. As it seems like every day I open Twitter I see a new headline of somewhere breaking heat records. With areas such as China seeing an all time record heat of 126 degrees.

We also have the macro headlines such as the weakened dollar which remain supportive. However the biggest thing bears continue to look at is demand.

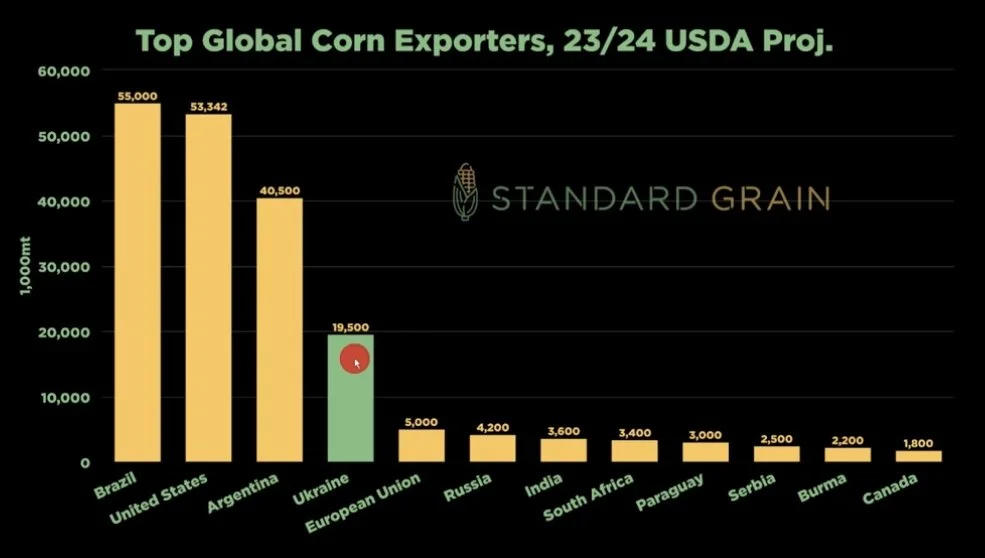

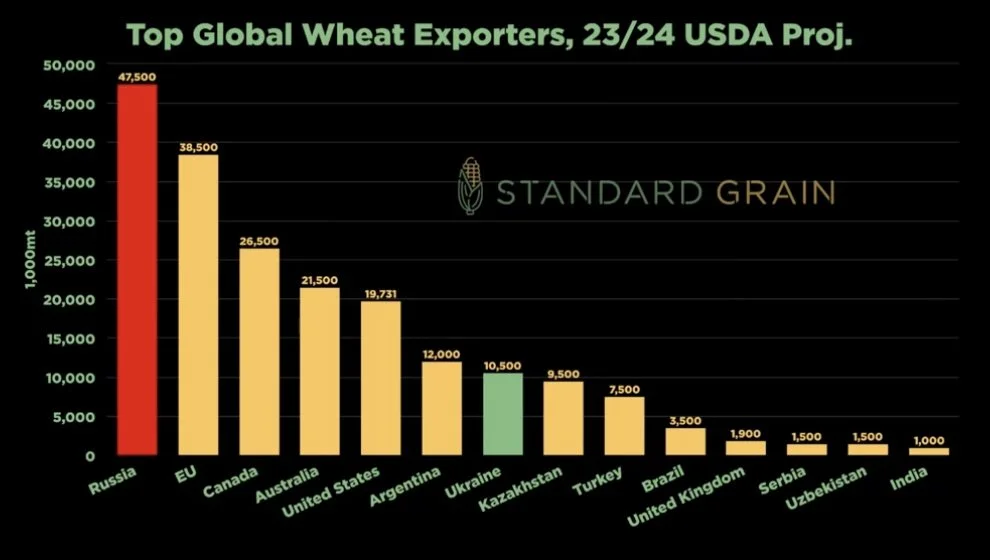

Touching back on the Black Sea deal. This could continue to be a bigger factor and potential wild card for corn. Ukraine is still the 4th leading exporter. What happens if their current export number gets cut in half?

Here is a chart of the top global exporters from Standard Grain.

To close out Friday we made that key weekly reversal we had mentioned, closing above the previous week's high of $5.09 1/2. Is that reversal broken now that corn closed below that today? No its not. The key word there is "weekly". Now if we close lower on the week, then I would say that reversal is broken, but for now, it’s not.

Right now from a technical side, the corn market is simply in recovery mode. We were hit with that massive $1.48 sell off to close out June. So now everyone’s biggest questions are will we bounce? And if so, how high will we go?

Taking a look at some retracement levels. We hit that 25% level at $5.17 overnight, but fell below that. The next big target will be the $5.38 level. Which is the 38% retracement. Personally, I think we have a solid chance to also touch that 50% retracement, which would bring us into that $5.55 range. I'm not wildly optimistic that we hit the 62% retracement of $5.75, but it is a possibility. Our current upside target is still the $5.50 range.

Corn Dec-23

Soybeans

Soybeans are the outlier today, finding some strength while both corn and wheat give back their early gains. Even though we did close a dime off the highs, soybeans added another 7 cents on top of their 50 cent rally from last week. Bulls still have their eyes on $14.

Crop condtions for beans saw some pretty good improvements. As they jumped 4% to 55% rated good to excellent. This was a bearish number as it was more than the trade was anticipating. They had 53% as their estimate.

Some Notable Changes

Iowa: +6% (58%)

Illinois: +4% (40%)

Missouri: +5% (31%)

South Dakota: +4% (57%)

Indiana: +5% (60%)

Here is a state by state breakdown

With crop conditons improving more than expected, we definitely have the possibility to see some pressure tomorrow. But the pressure should be short lived as the weather is still leaning bullish currently.

Below is a chart from Simon Briere on Twitter. It compares 2012 and 2013. This year is a year of it's own. But what's the similarity between those 2 years? We topped out in late August / early September.

This chart further pushes the argument that I personally think soybeans will continue to climb higher into the end of August. However, we all know the crop is made in August. So it will all come down to how hot and dry it is or isn’t. But the current forecasts suggest it will start to get warmer and drier as we approach the end of July.

The continuation of dry conditions in the northern states has bulls suggesting yield is sub 50 bushels per acre vs the USDA's current 52. If we saw that 2 bushel reduction, that would drop new crop production roughly 165 million bushels, which is a pretty large cut, especially when we take into consideration that there is a ton of people that think new crop ending stocks should already be below 200 million.

Weather is going to be the driving factor, higher or lower. Right now it looks supportive, but we all know how quickly things can change. The trade is also going to start to pay more attention to South Americas new crop.

Recommendation

I'm waiting for us to hit $14 and that huge downward trendline we have been battling with for over a year now, which I think has a high possibility to happen.

However, the $13.80 to $14 range might be a great spot to take some risk off the table trickle in some new crop sales and if you have any old crop left. Everyone has different risk to reward profiles, but some would have you sold at 40% to 50% of expected production for new crop. But we like you focusing on your individual comfort level. Even at these levels, there is nothing wrong with making a few sales.

Keep in mind, not too long ago we traded $11.30 and are now $2.50 cents off those lows. If you don’t want to make a sale, consider looking at puts soon. We just want to to look to reward this rally one way or another.

I do still think we have a possibility to see $15 later this year, but that is in the hands of Mother Nature and how this August weather pans out.

Soybeans Nov-23

Wheat

The wheat market finishes the day lower following an up and down day as we finally saw confirmation that Russia would not be extending the Black Sea agreement.

Intially this has wheat futures trading double digits higher overnight, but we ultimately lost all of those gains and ended 6 to 8 cents lower in Chicago and Minneapolis, and 14 cents lower in KC.

We failed to hold on to the gains again due to today being a case of buy the rumor and sell the fact. The market was expecting this deal to fall apart.

Crop conditions for spring wheat came in far better than the trade expecting. As spring wheat jumped 4% to 51% rated good to excellent. The trade was expecting this number to be left uchanged.

So some pressure tomorrow wouldn’t be surprising, but we will have to see how the trade reacts to both this as well as the Black Sea situation tomorrow.

Winter wheat harvest remains slower than average, as we are currently 13% behind our usual pace.

The thing with Ukraines exports being halted is that they are now only the 7th leading exporter. Before the invasion, they were 4th, as their exports have been cut by more than half. So fundamentally, the trade just isn't thinking that the halting of their exports is as huge of a deal now as it once was.

Now if for some reason Russian exports were halted, that would be a huge deal, as they are the worlds leading exporter, exporting nearly 25% of the worlds wheat.

Here is a look at the worlds leading exporters from Standard Grain.

As mentioned, the forecasts look supportive across all of the grains including wheat. It will be interesting to see how the market digests everything tomorrow and the rest of the week.

We have the Black Sea deal that ended. Crop conditions improved more than expected. Forecasts are looking and hot dry. Tomorrow, we could see some pressure, but if these warmer and dry forecasts hold through out the week I think we could be well supported.

From Wright on the Market,

"USDA says China's wheat crop is 1.6% larger than a year ago, but China says it's wheat production is 0.9% less than a yea ago, the first decline in seven years due to too much rain. Acres were up but yields were down 13%."

One chart I wanted to look at is the Minneapolis chart.

That $9 level has been our ceiling for over a year now. Even on today's run up before the selling that is the mark we touched. So with prices $1 off of their lows from June, if we crawl into that $9 range it might not be a bad idea to feather in a few sales even though yes we do have the potential to go quiet a bit higher if we can crack $9. But there is nothing wrong with rewarding the rally.

MPLS Sep-23

Overall, I still think there are a few more bullish wild cards than there are bearish ones currently in the deck for the wheat market.

Chicago Sep-23

KC Sep-23

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Some Past Updates

7/16/23 - Weekly Grain Newsletter

MANAGING THESE VOLATILE MARKETS

7/14/23 - Market Update

WHEAT RALLIES & CORN MAKES KEY REVERSAL

7/13/23 - Market Update

GRAINS BOUNCE BACK AFTER BEARISH REPORT

7/13/23 - Audio

DROUGHT & DOLLAR ERASE YESTERDAY’S LOSSES

7/12/23 - Audio & Report Recap

FULL USDA REPORT BREAKDOWN

7/11/23 - Audio

WHAT TO EXPECT IN TOMORROW’S REPORT

7/10/23 - Market Update

CORN & BEANS STRONG AHEAD OF REPORT

7/9/23 - Weekly Grain Newsletter

ARE YOU COMFORTABLE WITH WHAT’S ABOUT TO HAPPEN?

7/7/23 - Market Update

GRAINS SLIDE WITH FAVORABLE FORECASTS

7/6/23 - Audio