IS CORN STILL KING?

WEEKLY GRAIN NEWSLETTER

By Jeremey Frost

This is Jeremey Frost with some not so fearless grain marketing plan ideas for www.dailymarketminute.com

Last week reminded me of going to ValleyScare at ValleyFair

What a ride some of our grain markets have had. Last week we saw wheat nearly trade limit up a week ago when the market opened, then we got news that the wheat crop conditions are worse than even the lowest estimate as crop conditions for wheat came in the lowest ever. Then Wednesday and Thursday we saw the market take it on the chin and give up all the gains, as Russia said they would resume participating in the export corridor. When it was all said and done wheat was up nearly 20 cents on the wheat, but it also filled the gaps left on Sunday night.

One has to wonder if Putin has played Chicken Little just a little too much, if we will continue to see the market jump at his request. The present deal is set to expire on November 19th, what does that mean will happen? Will the market shoot up when he says that Russia won’t be renewing any deals? Will it take it on the chin when he says that they will renew? The problem that I see is that eventually Chicken Little was right.

The King (Corn) has been dethroned

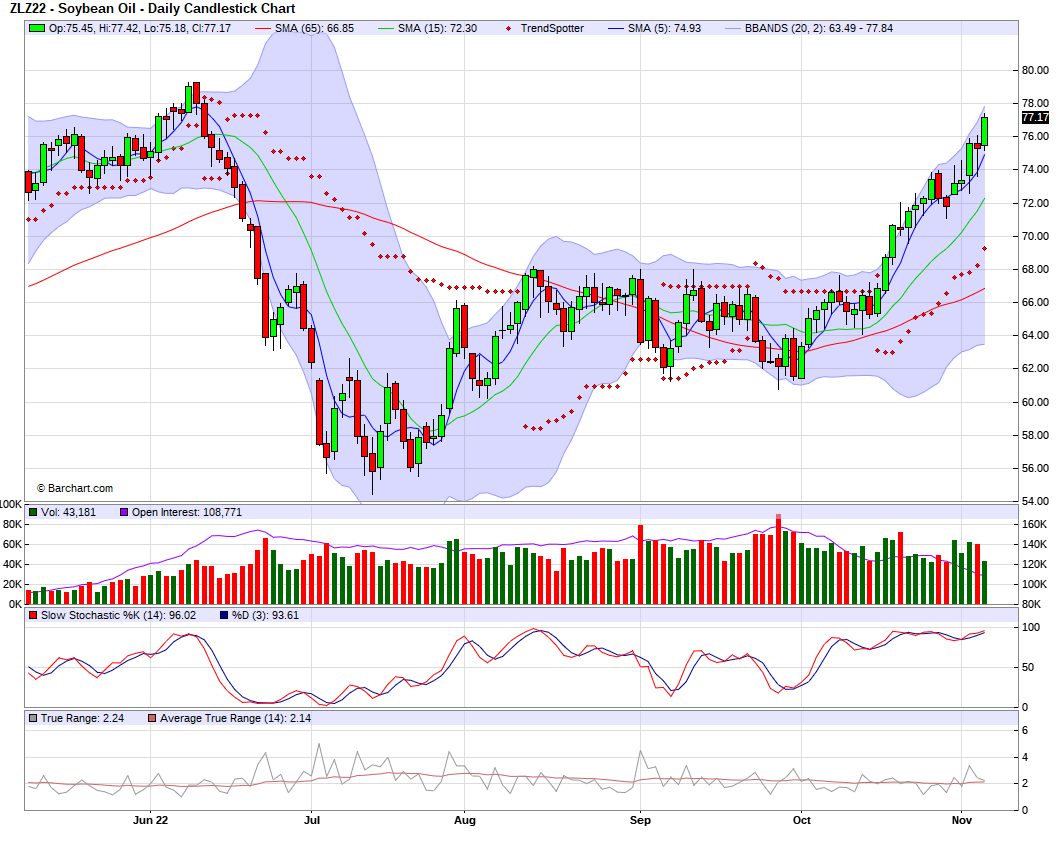

At least temporary, corn has been a follower and not necessarily a willing follower. Last week’s real market mover wasn’t the wheat market. It was the soybean market and in particular it was the soybean oil market. Once thought of as the red-headed step child, soybean oil has been the leader of the grain complex. The difference between soybean oil leading the way and any other grain right now is simply what type of market rally we are in.

Soybean oil rally has been a demand-driven rally, a lack of supply along with crush margins that are super strong off of charts. Here is an article from LinkedIn from Walter Cronin.

The bottom line is that soybean oil, at least in the short term, is King. This King has been ruling with demand, and demand-driven markets are markets that usually last much longer than fear driven markets.

Look for the strong bean oil prices to give support to the sunflower market.

It may take a while with the great sunflower yields in most of the US, but eventually one should look for Hi Oleic sunflowers to show strength behind the strength in bean oil. Bean oil is presently around 77 cents a pound. Historically sunflower prices can track bean oil, and an old adage was ½ of bean oil would be sunflower price. That means sunflowers could have some room to go up. It also means that if we get some price action on the bean oil chart that looks like a top has been made one might want to cross hedge sunflowers via buying bean oil puts. To be clear we don’t have any sell signals happening yet on the bean oil chart. But with recent strength, it shouldn’t surprise one if we see some profit-taking or consolidation in the short term.

If you don’t have much bin space or you need to move sunflowers right away please give Wade a call at 605-870-0091 or Jeremey at 605-295-3100.

Recommendation is to have hedge accounts open, funded, and ready to watch for action where one can call a top in bean oil. It may very well take until next summer before we see the highs, and it could be much higher than even this advisor thinks. But at some point one will want to own some bean oil puts. For those of you that have good sales already made for sunflowers you still should have hedge accounts open, ready to make money on the way down sometime towards summer of 2023.

On tap this week

We have crop conditions and progress on Monday afternoon. That will likely show our wheat crop is still starting off as the worst wheat crop in history. Will it make a difference? If it was the spring the wheat prices would be going nuclear, but right now it isn't going to do much. It is old news and built into the market and we all have seen wheat crops planted in the dust only to have the bins go bust.

Crop progress is going to show that we are on the tail end of harvest. We recommend buyers trying to get ownership on any price breaks, as it will be very tough to buy grain without a rally once harvest is over. You may be able to buy tops of bins, as farmers do their due diligence and core bins to help keep grain in condition.

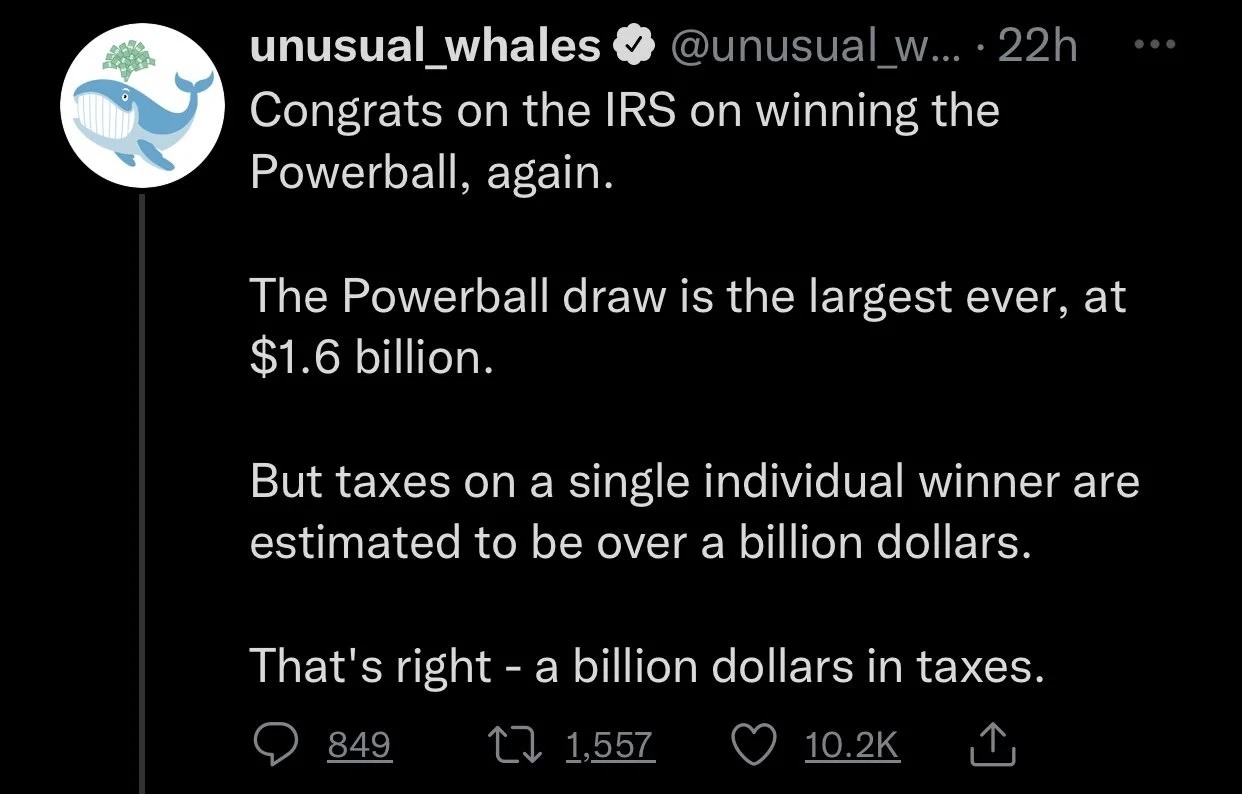

Tuesday will bring the election and this may have huge impacts. But I am going to choose not to outguess that at this time. Just realize this could add volatility, but depending on the results could also add money flow back into commodities.

Wednesday will bring the USDA Supply and Demand report. There is risk that we see the crop sizes increase and most in the market also believe that the USDA could cut demand. Especially for corn exports as we are off to a very slow start. On the flip side, as I have been saying, we can not sell what we do not have. The bottom line is we have some risk that our carryout trend changes. It has been getting smaller and smaller for months. Production has gotten smaller and smaller for months as well. If we see an increase in yields along with a decrease in demand forecasted the market could take it on the chin.

If that happens I want to be in a spot to be ready to buy the break, re-own previously made sales.

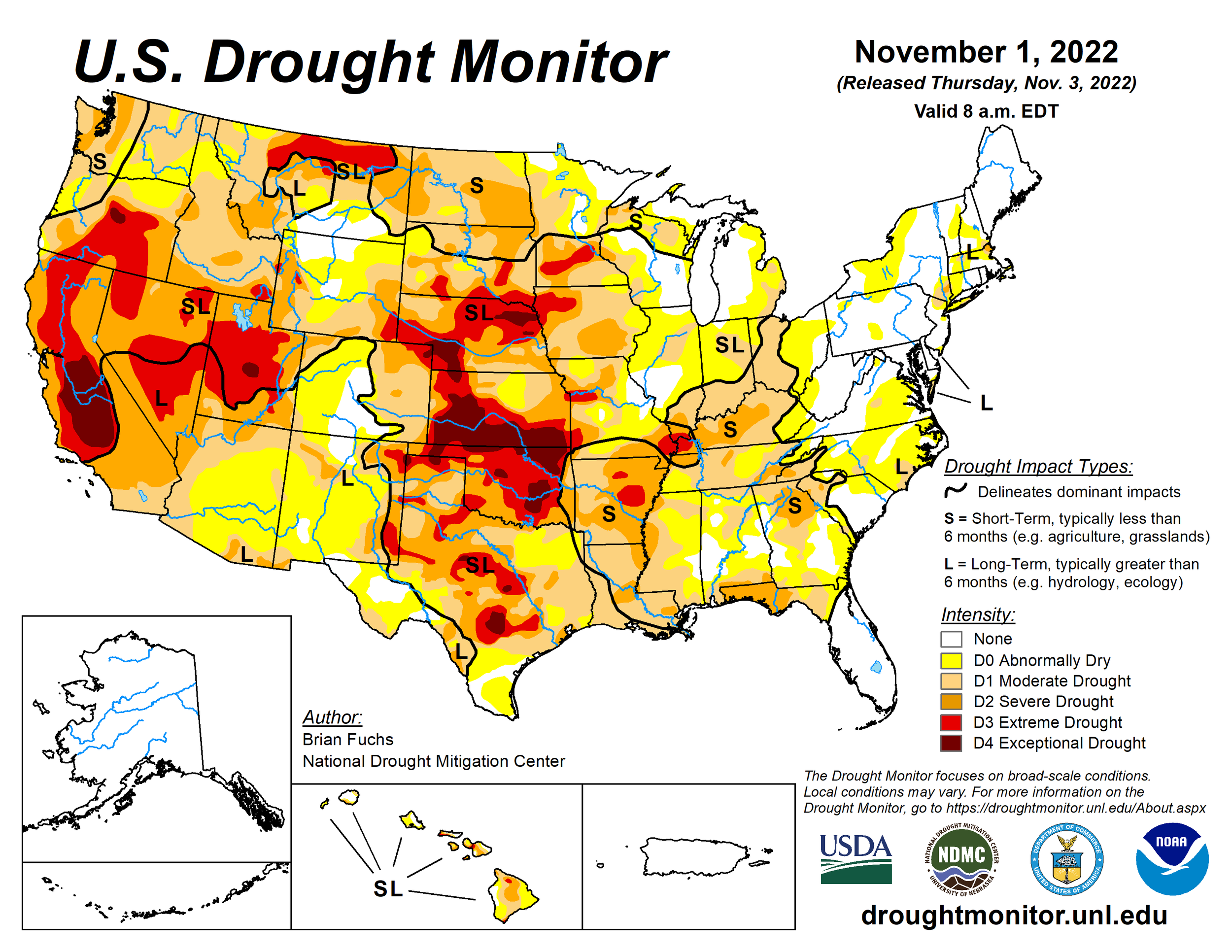

With the choppy price action that corn has had the past week or so, I have to wonder if the trade has priced in a negative report, because headlines have been of slow demand and most estimates are for yields to be near unchanged to higher. I remain in the camp that we see yields lower when it is all said and done with the main reason being the drought area increases we have seen the past several months.

Will the USDA take a wait-and-see approach? I guess we will find out on Wednesday.

Will Corn be King again?

If you look at the basis, it appears that corn will once again take back the lead in the grain markets. Is the basis firm in some many areas because of demand? Or lack of supply? Does it matter?

It may not matter, but historically demand driven markets are better for prices longer term. A portion of why the basis is so firm in many areas is the fact that even with an increase in production on the next USDA report we will still have a billion bushels less in production than we did a year ago. That is a lot of demand that needs to go away. As I have previously mentioned, demand does not slip just because the USDA uses a magical pencil.

Corn Basis Numbers

Del Hereford, TX corn was 2.20 bid versus 2.28 offered. This means that folks down in Texas are getting 9.00 plus for their corn.

Corn delivered into Gruver, TX traded @ +2.18 for November to May delivery.

Corn delivered into Scott City, KS was bid 2.00 over with a 2.18 offer for November-May delivery.

Look for these numbers to continue to support and draw corn from the north and east.

Rumors are that some corn has traded into the south east part of SD at +45 for November-December shipment.

Take a look at how the market dynamic has changed versus our newsletter post a few weeks ago Here

RingNeck Energy in my hometown of Onida, went from nearly a 40 cent carry to only a 20 cent carry. Nearby basis is 15 cents better than it was on October 16th, and LH November is 20 cents better than it was.

Nugen Energy has corn basis for December posted at +30 over versus +10 over posted on the 16th of October for a 20 cent improvement.

Agtegra in Huron SD has improved their posted basis by 35 cents.

Glacial Lakes in Mina has improved their posted corn basis by 45 cents on the nearby market as the structure for their bid has gone from a 27 cent carry to March to a 10 cent cash inverse.

Poet in Loomis has had very little changes in the bids in comparison to the other mentioned buyers. The only major change I see is they have strengthened the deferred slots in an attempt to get more coverage.

In the weekly newsletter on October 16th I mentioned that “it is just a matter of time before RingNeck has to improve their basis.”

This will continue, the corn basis for RingNeck Energy is going to continue to get better. As will the corn basis in most areas as harvest finishes up.

Continue becoming price makers instead of price takers

The improvement in corn basis should help show that farmers have much more control then they give themselves credit for. So continue with what some are calling mission impossible and the next time you talk to a buyer, do not take the bid. Give them an offer. These markets are sellers markets for a reason.

If you need more reasoning to offer grain instead of taking a bid, just ask your buyer next time. “Would you consider the market a buyers market or a sellers market?”

If they answer a sellers market, it means that they are offering grain out to the end user, not taking end user prices. So why the heck would a farmer not do the same thing?

Keep in mind that most buyers don’t get paid a bonus for buying higher than the other guy, they most certainly do not get a “good job” when their prices are the highest on the shelf.

Proper Risk Management

Proper risk management is different for every operation, as you all know. Stick with risk management that fits your operation along with your risk-reward profile. If you need help on this take a look at our questionnaire at https://www.dailymarketminute.com/grainmarketingplans

We will then send you a grain marketing plan free based on your answers.

Ag Directory

Make sure you check out our Ag Directory Here

Shoutouts from our Ag Directory this weekend are to..

ROCK TUFF

Dennis Beyers

(605) 287-4123

34240 US HWY 12

Roscoe, SD 57471

PIERRE AUTO PARTS

Address: 1810 N Airport Rd, Pierre, SD 57501

Hours: Monday-Friday 8:30AM-5PM

Phone: (605) 224-1254

BANGHART PROPERTIES

Professional Grain Marketing Services

JEREMEY FROST // GRAIN ADVISOR

(605) 295-3100

jfrost@banghartproperties.com

WADE HARDES // GRAIN ADVISOR

(605) 870-0091

wade@banghartproperties.com

JAN BANGHART // OWNER OF BANGHART PROPERTIES LLC

(605) 354-4975

jan@banghartproperties.com

SERVICES OFFERED

CASH GRAIN BROKER

GRAIN MARKETING PLANS

ON FARM PICK UP

CONNECTED BUYERS AND SELLERS

ADVISE FARMERS

Visit www.banghartproperties.com

Not so Fearless Predictions

I am sticking with my prediction that we will see new all time highs in 2023 for soybeans, corn, KC Wheat, CBOT wheat, and soybean oil. I am adding a local prediction that the posted corn basis at RingNeck Energy will be +25 or better in the spring of 2023. I would print how high I actually think it gets but I don’t want more accusing me of helping run the price up.

A few sunflower buyers don’t like the fact that I have told farmers that I think sunflower prices will once again double. Nor do they like the fact that I am spouting how cheap sunflowers are versus bean oil. Some buyers wished that farmers would not pay attention to how cheap sunflowers are versus bean oil. So it is my job as well as others to try to help the farmer do better. Our loyalty is the farmer.

How Cheap are Sunflowers?

Take a look at the picture below. You will see that on Amazon a 10 pound bag of black oil sunflowers are 39.28 or the equivalent of 399.28 cents per cwt. Local price is bid as cheap as 22.00 per cwt. This brand Audubon Park below is a Global Harvest Foods Brand. Anyone think that Global Harvest buying out the CHS Sunflower birdseed line along with the 3 Performance Seed plants in the past year was a good thing for farmers?

I know several farmers that grow 10 million pounds of sunflowers every year. Present local bids for sunflowers would give one about 2.2-2.7 million or so for 10 million pounds of sunflowers. Not bad.

But if Global Harvest Foods is selling on Amazon per the screenshot above they are getting nearly 40 million.

Black oil sunflowers for birdseed, basically get cleaned and bagged. I wonder what the cost is for that? Actually I know, but I won’t rub more salt into the wounds. I will just say I hope you watch who you are working with. Global Harvest has done a great job of taking out competition. I am pretty sure they were already doing well before they took out more competition. I hope Casey Thompson and the Mills Brothers sleep good at night with the piles of money they get from not paying farmers enough.

If you are selling sunflowers make sure you sell them to someone that can actually move them when you want them shipped. Don’t sell them to someone for harvest delivery that is closed on Friday afternoons.

For more info on the sunflower market make sure you listen to my audio commentary from a few weeks ago. Listen Here

Conspiracy Corner

HAARP Experiments

Dry Wells

Refinery Fires

No Farmers, No Food

Check out our all-new Ag Directory

To add value and efficiency the Ag Directory provides a way for users to have a “one-stop” shop in the palm of their hands and not have to search for contacts when they need a trucker, seed, fertilizer, parts, financing, etc.

To get your business listed in our Ag Directory simply

contact me at 605-295-3100.

Commodities Overview by Sebastian Frost

Overview

Grains started off the week sharply higher over the news last weekend that Russia was suspending their grain export deal with Ukraine. However just a few short days later, news broke out that Russia would be resuming the deal, causing grains to sell off and give back a majority of the gains made in the corn and wheat markets. Wheat finished the week higher with the Russia and Ukraine news shaking headlines all week long. We saw energy markets rally, adding support to crude oil and soyoil helping soybeans rally and adding support to the corn market. Going forward to this week, all eyes will be on the USDA Supply & Demand report set to release this Wednesday, November 9th.

Today's Main Takeaways

Corn

Corn started the week off sharply higher with the Black Sea news over the weekend. But then Russia announced they would be resuming the deal, since then corn has been trickling lower giving up all of the gains made from the initial rally. Dec-22 corn closed the week essentially unchanged from last week, finishing +1/4 cent higher on the week at $6.81. We will have to see if corn can break out from its recent choppy trading.

Corn has continued to be pressured by pretty disappointing exports and hasn’t seen great demand at all. With one of the recent exports last week being the worst we have seen in a decade. We also have Brazil gearing up for Brazil imports which likely won't help U.S. export demand. Wednesday's supply and demand report could shake things up.

As for yield, we continue to see numbers all over the board as it remains a large debate. In the last report we saw the USDA lower their estimate from 172.5 down to 171.9 bpa. But then we take a look at other analysts and we are actually seeing many of them raise their estimates higher than what the USDA currently has. Analysts such as IHS and StoneX for example both raised their estimates. IHS raising theirs to 172.9 bpa and StoneX raising theirs to a rather large 174.5 bpa.

If it wasn’t for the massive strength in crude we very well could have seen corn futures even lower this week. But crude has provided an immense amount of support. Hitting its highest levels in a month. Trading over +$3 higher to close the week out Friday, and ending nearly +5% higher on the week. Closing at $92.61. We saw a lot of this strength from Chinas decision to be a little more relaxed on their recent zero-covid policy. If this decision holds true we could hopefully see an increase in demand from China for grains. However, this weekend there was rumors they will still be strictly enforcing this policy. Which is bearish news for crude oil. We will have to wait and see what China decides to do here.

5-Day Change

Dec-22 Corn: +1/4 cent

Dec-22 Corn (6 Month)

Soybeans

Soybeans had an extremely impressive week. Starting off the week higher with the rest of the gains and just continuing to push higher through out the entire week. With Nov-22 beans ending the week over $14.50 and up +64 cents on the week. Friday alone we saw soybeans rally an additional +25 cents.

One of the biggest factors in helping soybeans rally this week was the rally in soyoil. With soyoil hitting the highest levels since summer, trading nearly +7.5% higher on the week. The crazy strength in the energy markets helped push bean oil higher.

Last month the USDA lowered its forecast by -40 million bushels. Given that they just lowered it in the last report, its not looking too entirely likely we see another one made here. As they will likely take a deeper look and digest everything longer before making any additional changes. Estimates for next weeks yield are expected to be unchanged at 49.8 bpa, with an estimate of 212 million bushel carryout, October was 200 million bushels.

Last month the USDA lowered its soybean yield estimate from 50.5 to 49.8 bushels per acre. Similar to corn, some outside analysts have begun to raise their estimates. With StoneX raising theirs to 50.9 bpa and IHS raising theirs to 50.3 bpa.

Early in the week we saw rumors of China backing off their zero-covid policy. But yesterday we saw China health officials made a statement. Basically saying they will continue to enforce its zero covid policy. If this is what they actually decide to do, it wouldn’t be too entirely unlikely we see soyoil and beans a lot lower this week from their recent high levels. As this news is a bearish headline for demand and the grains as a whole. On the flip side, to see soybeans even higher, we will almost certainly need to see a lot more bullish headlines.

One of the biggest factors going forward for soybeans in the future has to be South American weather, and whether they will see any problems arise due to weather complications.

5-Day Change

Nov-22 Beans: +63 3/4 cents

Jan-23 Beans: +62 cents

Nov-22 Soybeans (6 Month)

Soyoil (6 Month)

Wheat

Wheat of course started off the week soaring roughly 60 cents, but then we saw Russia resume the grain deal which led to wheat giving back a lot of its gains made early in the week. Despite the big sell off the wheat market still managed to trade significantly higher on the week.

With the Russia and Ukraine export deal switching back and forth, it led us to an incredibly volitle week. With a price range of nearly 70 cents. Nobody still knows whats next for the Black Sea agreement. Russia did say they had the ability to still back out of the deal at any moment in time. We will be watching to see is Russia renews the deal, as the deal expires November 19th.

Australia continues to see too much rain, which is causing problems and potentially further degrading their wheat crop. We have already seen analysts starting to lower their estimates.

Friday we saw the U.S. dollar sharply lower which opened a window for grains and wheat to push higher, as the recent strength has been one of the larger factors in the wheat market. We still haven’t seen the dollar break out from its highs we saw back in September, so many are wondering if this is the beginning of the cool off many were hoping for.

Taking a look at the export numbers. U.S. wheat exports had its best September in 9 years at 3+ MMT. However, we have to keep in mind that June and July were some of the worst we have ever seen. With 22/23 total sales still sitting at over 20 year lows.

Looking forward to next week's report, nobody is really looking for any major adjustments to be made. As those usually don't happen until January. Last month we saw yield lowered from 47.5 to 46.5 with acres being lowered down -2 million to 35.5 million. With production being lowered by-133 million bushels. With the fairly large adjustments we saw last month, we will have to see what the USDA does here. Especially given the global situations with Ukraine and Argentina etc. The average estimate for wheat carryout in next weeks report is 578 mbu, in October the USDA had 576 mbu.

Factors remain the same as they have been for a while now. With the obvious Russia & Ukraine situation still being the largest potential factor to swing things. As well as global weather and Argentina, Australia, etc. We still also have the recession fears and a strong U.S. Long term, there is still some potential for wheat, but we will have to wait and see how these other factors pan out for the time being. If there is no new agreement news, and we continue to see weather issues we could still possibly see wheat higher.

5-Day Changes

Dec-22 Chicago: +18 1/2 cents

Dec-22 KC: +28 1/4 cents

Dec-22 MPLS: +9 1/2 cents

Dec-22 Chicago Wheat (6 month)

Dec-22 KC Wheat (6 month)

Dec-22 MPLS Wheat (6 month)

Cattle

Dec live cattle futures ended Friday down -$0.300, down to $152.650. Finishing -$1.350 lower for the week.

Jan feeder cattle ended the week higher +$0.200 to $179.625 and was -$0.750 lower on the week.

Dec Live Cattle (6 month)

Nov Feeder Cattle (6 month)

Crude Oil

Was +4.44 (5.04%) higher Friday to 92.61

Up +4.71 (5.36%) higher on the week

News

U.S. dollar is down over -2% from its week high on Nov. 3

Unemployment rate went from 3.5% to 3.7%

USDA Supply & Demand report out Wednesday]

Credit card debt has hit an all time high of $930 billion. Surpassing the $870 record in 2008.

Social Media

Precipitation Forecasts

2-Day

Weather

Source: National Weather Service