WEEKLY GRAIN NEWSLETTER

BASIS CONTINUES TO FIRM

By Jeremey Frost

This is Jeremey Frost with some not so fearless grain marketing commentary for www.dailymarketminute.com

First off I need to thank the Veterans that have given me the opportunity to live in the best country in the world. The Veterans have made America Great, thank you!

This picture collage pretty much sums up life. Thank you farmers and thank you Veterans.

The above should remind farmers just how important they are as well as how much control they can have on the journey to becoming price makers.

Welcome to the team!

“Howdy! I am Barry Morris, friends call me Bud. I am a graduate of Texas A&M University with a degree in Agricultural Development. I worked as a grain merchandiser in Texas, Kansas and Arkansas for the last 12 years. Now as a grain and feed broker with Morris Agriculture, I am excited to be joining the team at Daily Market Minute.

I reside in McKinney, Texas with my wife, two children and an old, crotchety blue heeler. My wife believes I can fix, build or smoke anything, but my favorite skill is beekeeping. I manage several apiaries across North Central Texas.”

For those of you in Texas, Oklahoma, Kansas, and Missouri make sure you give Barry a call if you need help moving some grain as he will do his best to give you the best information to help your decision making. Barry’s number is 214-250-3888.

Where do the grain markets go from here?

Let’s just say this, as winter hits where do bears go? Hibernation. And that’s if they don’t get caught in a bear trap that the bulls have been setting. With harvest over, look for the bears to start leaving our markets. Too much uncertainty with Russia and Ukraine, along with tight balance sheets and upcoming weather scares over the next several months will likely leave the bulls in charge. I look for grains to bounce as we close the year out. We have much tighter balance sheets, with less days supply for all three of the major grains than a year ago.

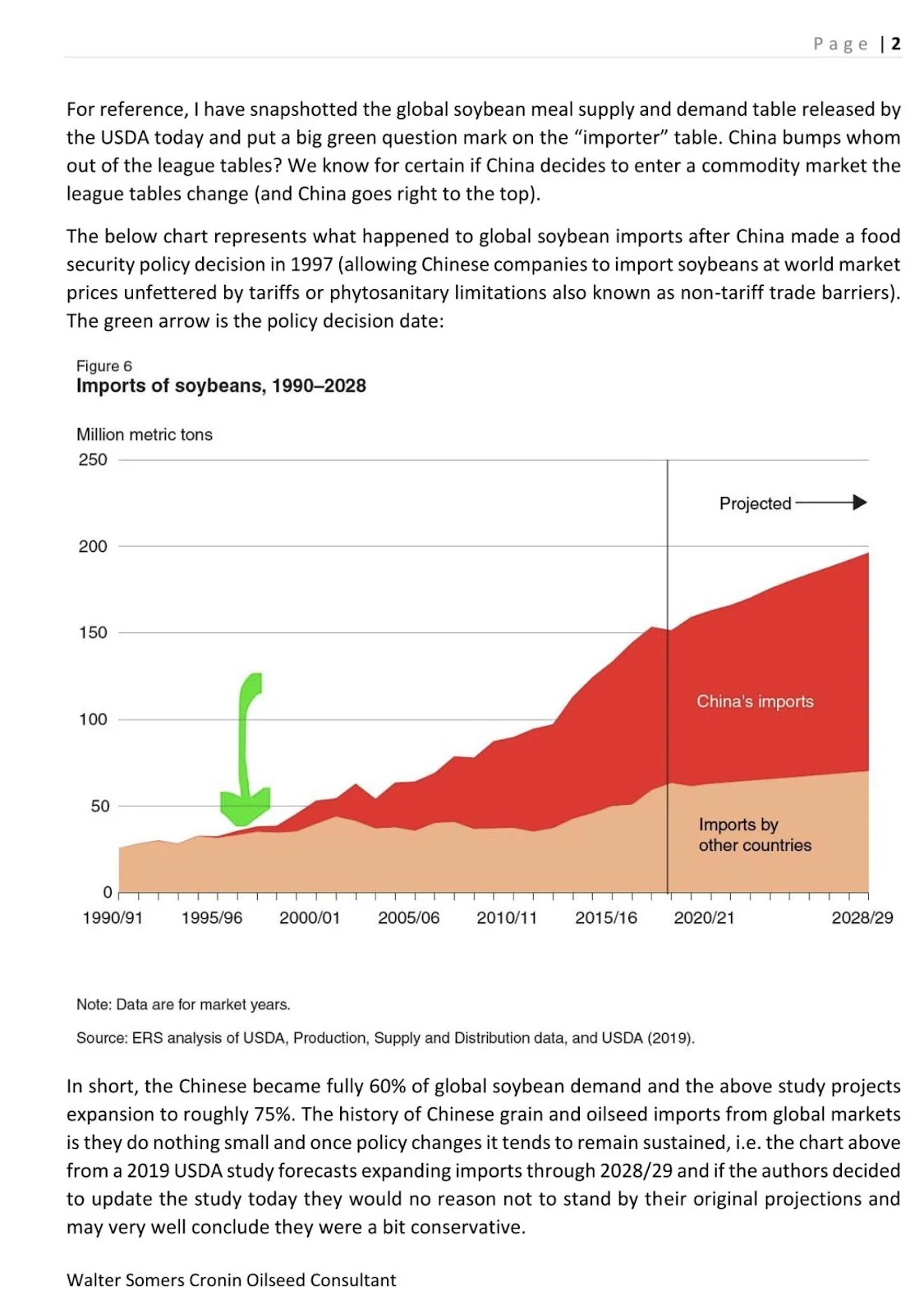

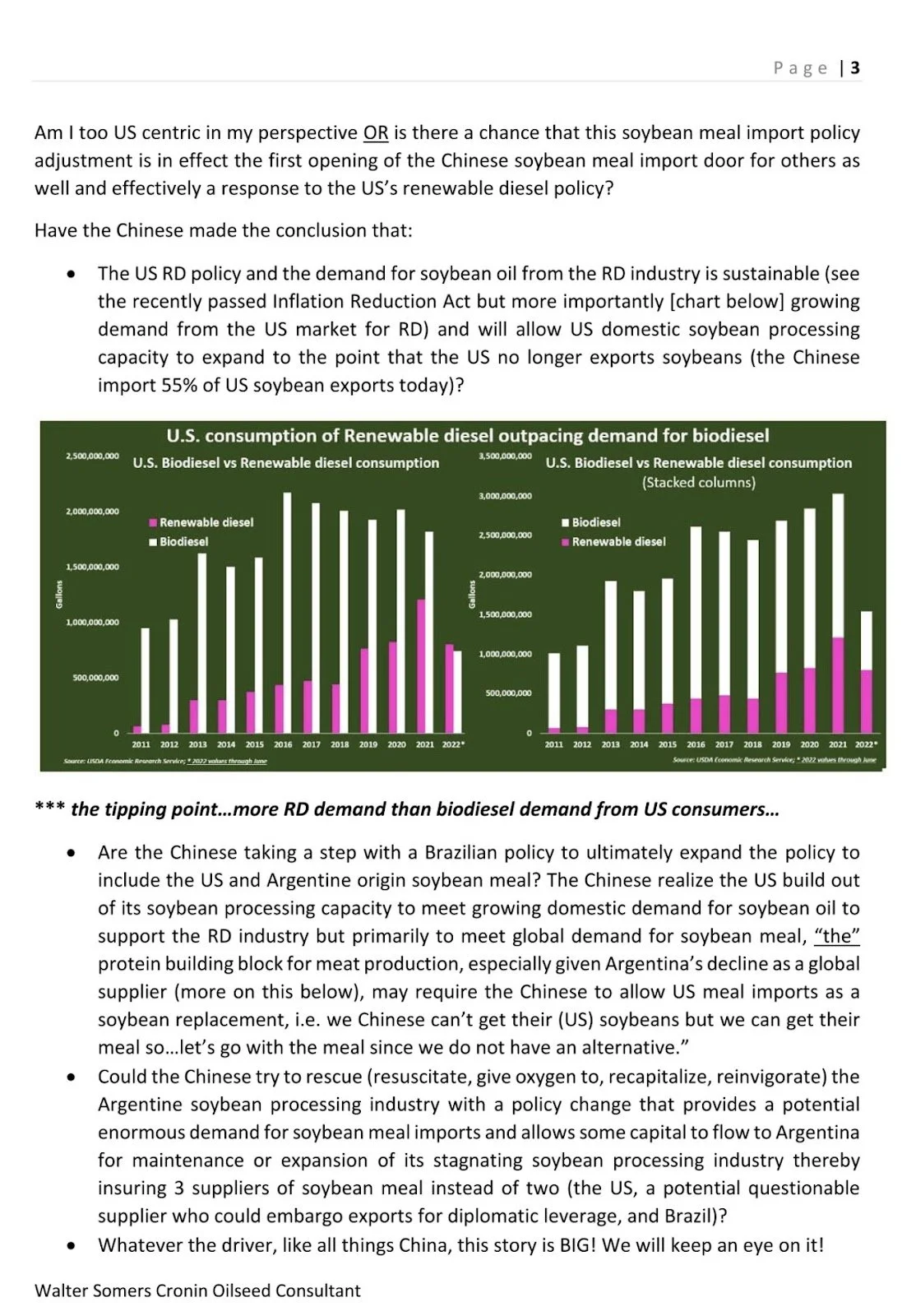

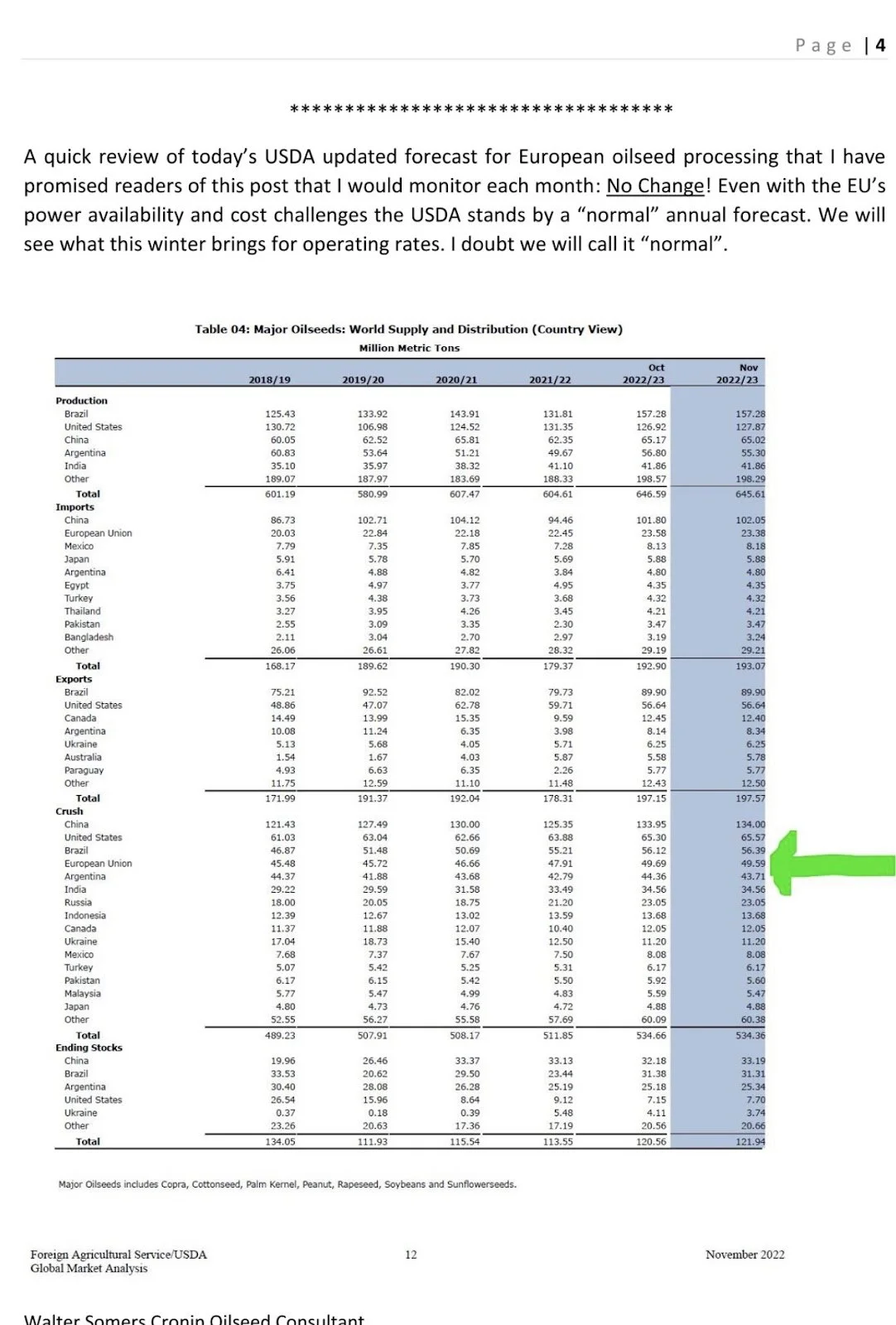

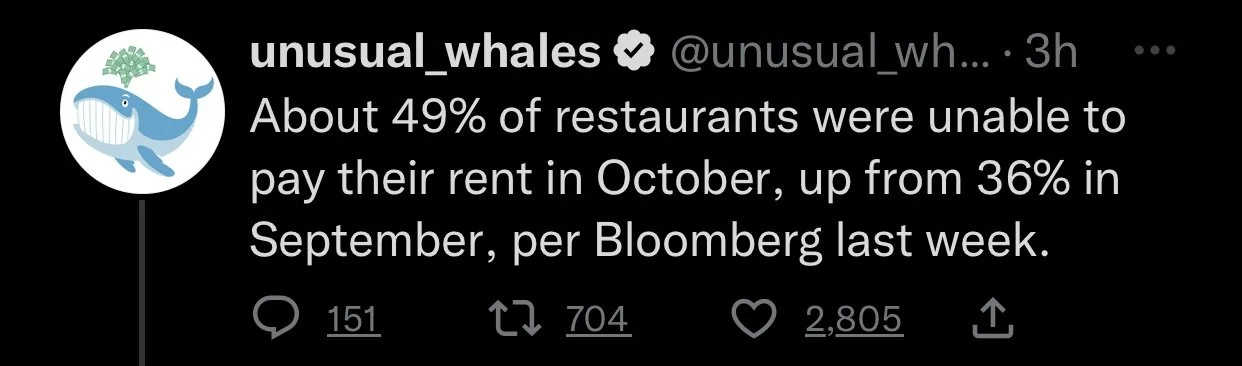

Below is from Walter Cronin from LinkedIn. I think he is on to something very major and that is “world demand for protein meals will consume all the US can produce…….the Chinese may have just announced they are joining” that they will consume all that the US can produce. This is major and is just one more reason why I think we will see new all-time highs for most of the grain markets in 2023.

Take a look for yourself.

The above looks extremely bullish to me. As we are basically about ready to tell China we don’t have enough beans for you. But we will get you some soybean meal. How bullish is it that the US is about to tell its biggest customer that we don’t have enough soybeans to supply you, but you can have our leftover soybean meal.

We have all heard the term “Acre War”, but now we are about ready to have a demand war for the different outputs that soybeans leave, bean meal and bean oil. Bean oil is doing its parts making another new multi month high on Veterans day, breaking out to the upside on the charts.

I am going to include a couple charts in this section of the newsletter, these charts are coming from investing.com. For those of you that have never been to that website, it offers plenty for free. Including live quotes. There are plenty of services out there that offer delayed quotes for the grains but the investing.com app offers free live quotes along with buy and sell signals.

So I am going to show you a couple charts as well as technical buy/sell signals from investing.com and Barchart.com

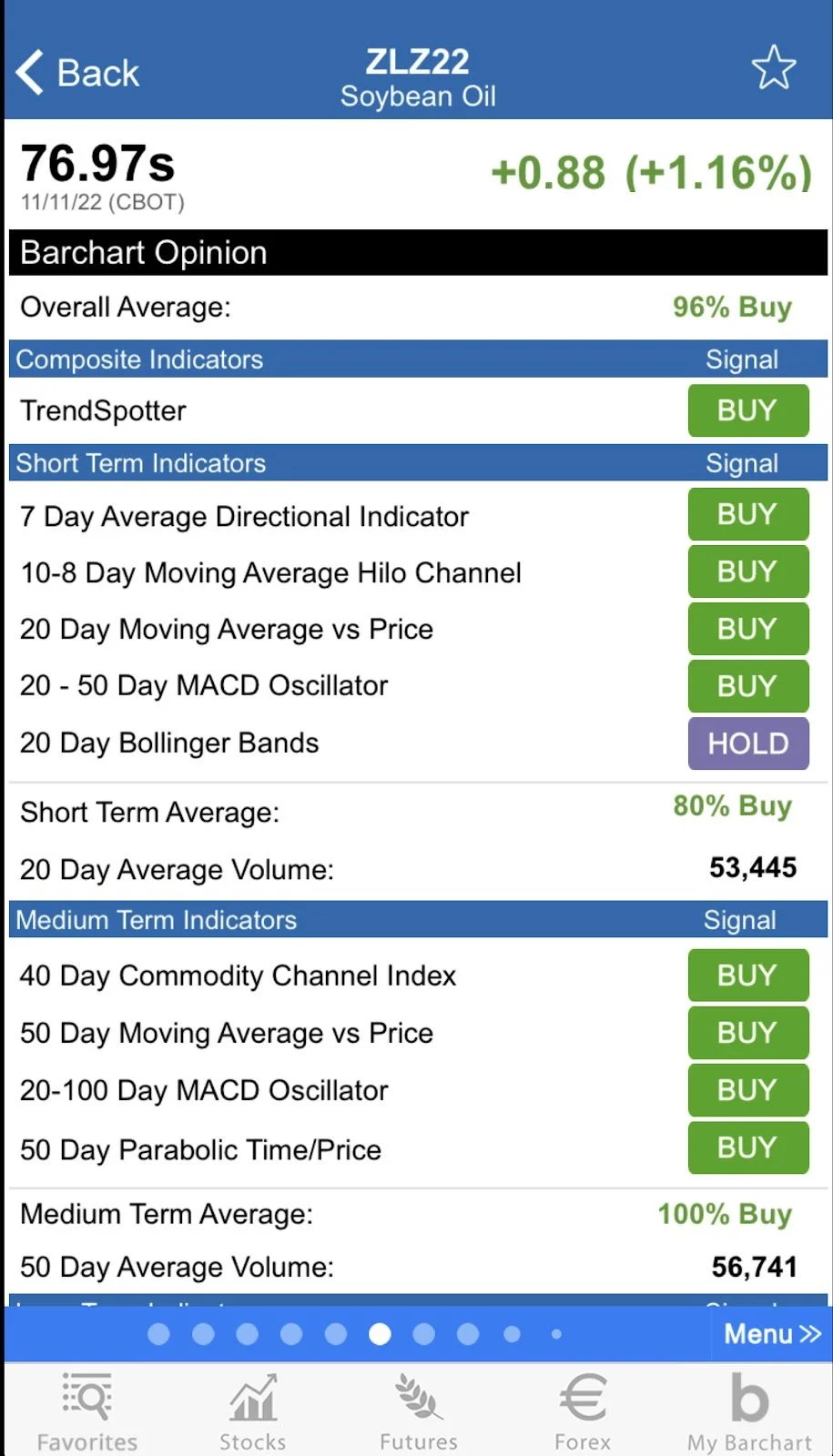

This first chart is a daily soybean oil chart. You can see we had an upside breakout day on Friday, making a new high for the move. This is off of the barchart.com app.

This next chart is a monthly soybean oil chart. This shows how much stronger bean oil is from a historical perspective. Well above 2008 and 2012 levels and within reach of the all-time highs we had just a few months ago.

This next screen show is a technical opinion from the Barchart app. Notice they have soybean at 96% buy.

This new one is still soybean oil, but it is from the investing.com app. It has 11 buy indicators.

The next screen shot is also for soybean oil, and it shows 12 moving averages as buy, and 11 technical indicators as buy signals.

Add the above charts to the fundamental info above and one can see why I am very bullish on the soybean oil market.

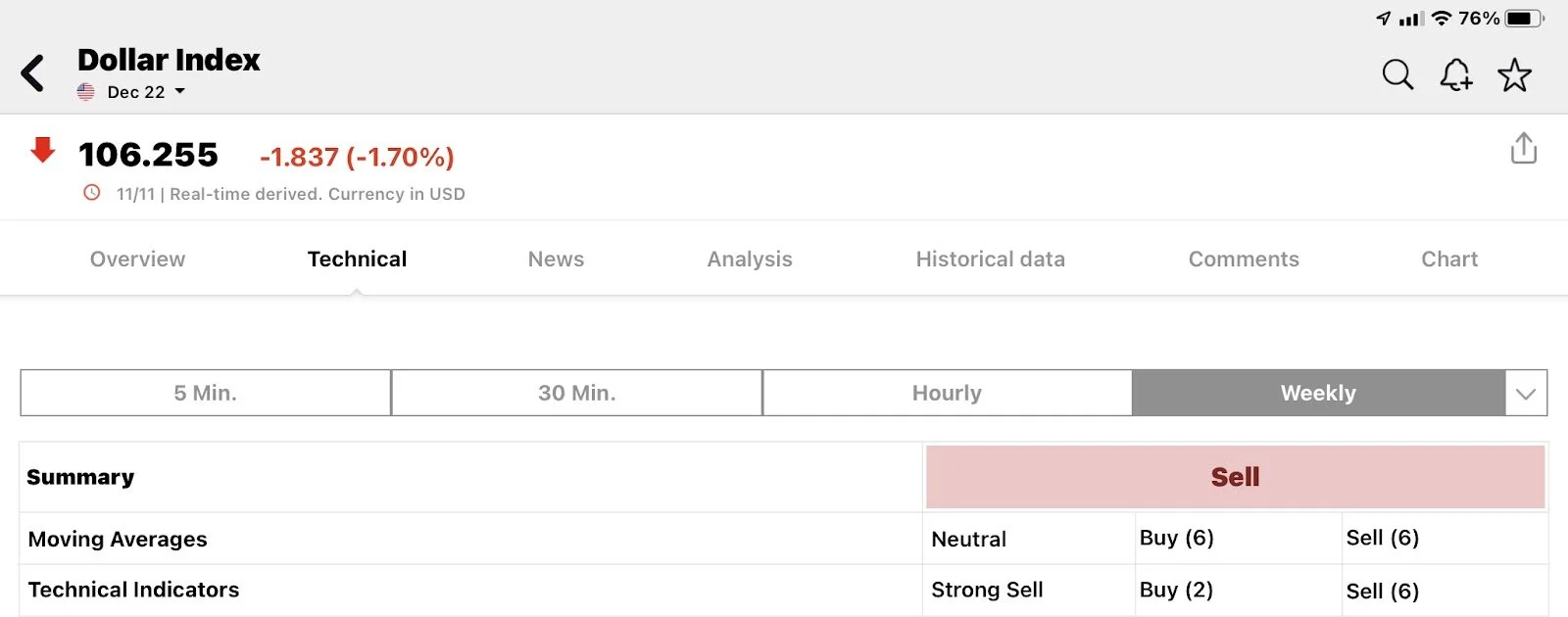

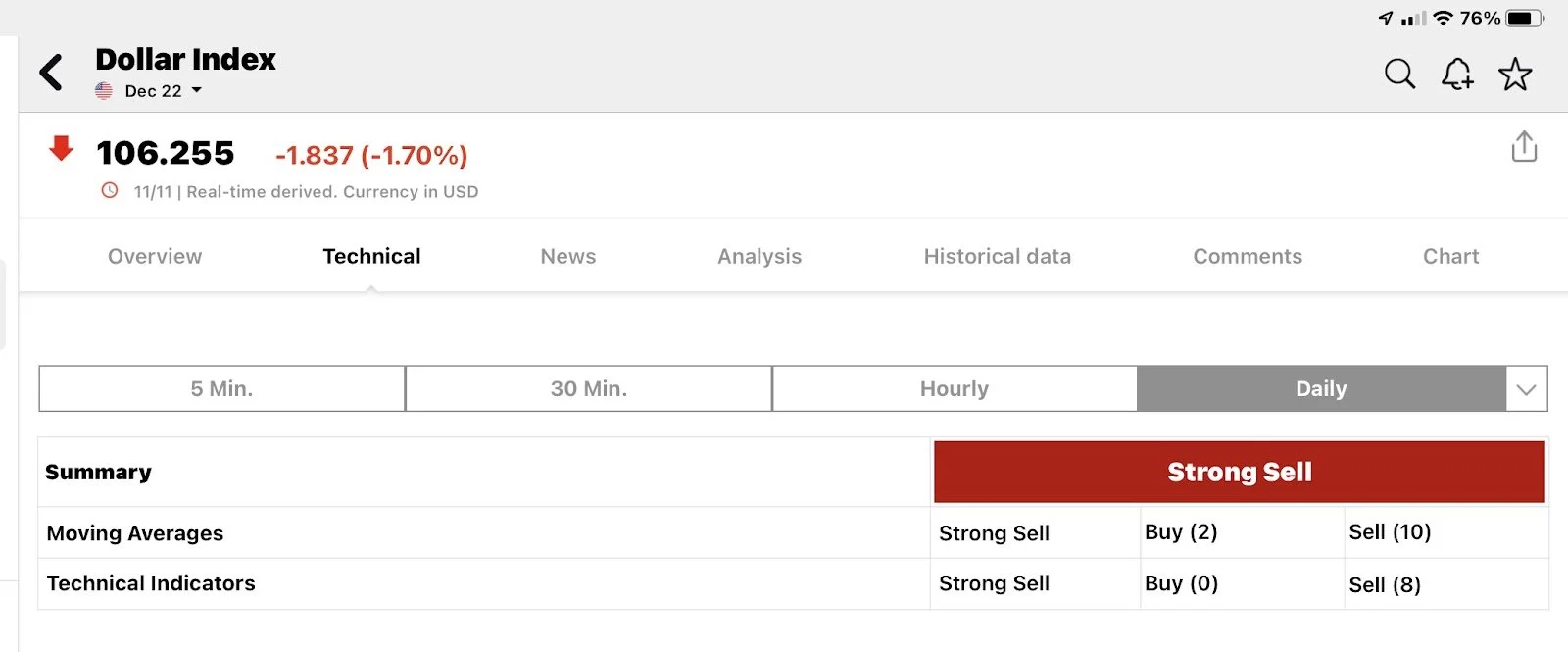

Next is the US Dollar daily chart from investing.com, and this leads to another reason why I am bullish corn, soybeans, and wheat.

You can see we have a multi-month low now.

Here are technical indicators on a weekly basis that have a sell bias.

Next is a daily indicators, moving averages and these have a very strong sell signal.

Ever heard the saying “trend is your friend”, well that’s what all of these technical indicators as well as moving averages are telling us. First off, soybean oil is poised to continue to go higher and next that the US dollar looks like it is going to continue to go lower.

Both of those are very good for US farmers, a word of caution for technical trading is it can be a lagger. The candlestick that the bean oil chart left on Friday would give one a little caution.

Buy recommendation

I watched market to market over the weekend, plus I already subscribe to Roach Ag, and I watch charts for RSI and STOCH, which measure how fast a market moves. If a market has moved too much one direction or the other. All of these indicate buy signals on corn and most wheat contracts. I also noticed Pro Farmer issuing buy signals for livestock feed needs last week. The charts to me look like bulls have set bear traps and I expect wheat and corn to be much higher by Thanksgiving.

So if you have sold corn or wheat, now might not be the worst time in the world to re-own some of it. You have the worst wheat conditions to start off a wheat crop ever. We still have a Russia-Ukraine war that still is happening, granted they have been trying to move as much as possible, but that should be expected. As the choice is to move the grain now or maybe not have an opportunity to ship it later.

Basis tidbits

As for basis, last week we mentioned that RingNeck energy had gone from a 40 cent carry to only a 20 cent carry, a week later we have them with a 10 cent inverse. What does that tell local farmers? First off, that harvest is basically over. Next it is time for farmers to remember that they have an obligation to work on becoming a price maker. I know for a fact that some local producers sold grain at 20-30 cents better than posted bids, did you get that benefit?

RingNeck marks up another 40 cent basis improvement that SD ethanol plants have had this year.

In my opinion the strength in basis is showing us that we will eventually see a board rally. As a rule of thumb to get grain to market end users firm basis, then firm spreads, and then firm futures.

From Mr. Barry Morris.

Corn 🌽

JFM Del Dodge City, KS 185/195

JFM del Dalhart, TX traded @ +215 today

JFM del Friona could be bought at 215.

Normally the basis spread from Dalhart to Friona is about 20 cents. Oftentimes even wider to afford to haul bushels all the way from Sw KS to Hereford markets. Demand in north plains is stronger or rail is keeping a lid on it. It’s only 2 cents more to send a shuttle to Hereford vs Dalhart. But it costs 60 cents a bushel or more to truck.

Here are other corn basis tidbits

Glacial Lakes in Mina is posting 60 cents better than they had posted a month ago. With rumors that some have traded 20 cents better than the posted bid.

One contact at an unnamed elevator told me that they had bought and sold a lot of corn that they made 50-60 cents a bushel on. I remember times when I was willing to buy corn and handle it for a nickel or less. No wonder some farmers got the buyers to push their posted corn basis by 30 cents. Those that did that were price makers, those that took the posted bid were price takers. Which label do you have?

Locally I think folks are RingNeck energy are going to pay up, as they let way too much corn leave. The local CHS elevator was shipping 25 car units leaving the area all harvest long.

Plus even though the basis has improved by 40-60 cents, bids going south are strong enough to pull corn out of our area. Especially with the salt coming up and trucks starting to loosen up.

If one is looking to move corn please make sure to give Wade a call at 605-295-3100 or myself at 605-295-3100. I don’t think there are many places at all left that have a negative corn basis. If you are selling for a negative basis give one of us a call and we can find a truck market that will pay you fair value instead of trying to steal your corn.

So corn basis has improved, now what.

Look for it to continue to improve, at least until the board decides to rally to new highs. We have a billion bushels of demand to kill and that folks has not happened yet. Look for the corn board to start its price rally next week, I see no reason why we won’t trade north of 7.00 futures by Thanksgiving.

No fear selling allowed

No fear selling is allowed, if you are reading this and paying for this service please do not fear sell, be prepared to buy the dips.

We don’t want to be sellers when the supply is at the highest. That is when we should be buyers.

Sunflower markets are slowly firming.

Buyers are slowly firming bids on sunflowers. Make sure to give me or Wade a call if you have offers. As mentioned we have plenty of trucks looking to pick up products, as buyers are finally realizing that harvest is over and they have done what they always do. Miss the boat. Look for prices to continue to firm, but one has to be a little nervous that we haven't done as well as expected given the bean oil performance.

Make sure you send in samples and get your oil content checked, as well as seed size. If you need help, myself or Wade will send in samples for you.

Spring Wheat basis is Hot on the spot floor!

Make sure you have offers out there should your local elevator happen to get rail cars, and decide to pass on some of that big premium that is happening. This also is opening up some various truck markets for wheat. Let us know if you have offers.

With election week behind us and some races still not known, we will leave you with another couple questions to vote on.

Who controls the Grain Markets more?

The Chinese?

The Russians?

The Funds?

The Farmers?

The Grain Buyers?

Who should control the Grain Markets more?

The Chinese?

The Russians?

The Funds?

The Farmers?

The Grain Buyers?

To Vote Please Click Here

Conspiracy Corner

Watch the Water

Trump - Thanks Gov Noem

HAARP Experiments

A time for Judgement- trucker shortage

From Wright on the Market

“How Money Flows on a Futures Tranaction

This repost from 1,2, & 3 years ago.

Cold, hard cash is the lifeblood of the futures market. Since delivery of the grain is not required, money is the required “commodity” in the absence of the cash commodity.

The cost (commission) to execute a trade at a futures exchange ranges from 59 cents to $150 per 5,000-bushel contract. The typical “full service” commission is $75 per round turn (buy and sell). The commission on mini-contracts (1,000-bushel contracts) is about half as much per contract, but three times more per bushel. The variance in the commission amount is due to brokerage firm policies, the amount of service you request to receive from your brokerage firm and your broker, the quantity of contracts you trade, etc.

Commissions and small regulatory fees are deducted from your brokerage account when incurred, which is when you initiate and close a transaction.

A hedge trader must provide and maintain a money deposit in his trading account to show he has the financial where-with-all to withstand the risk of financial loss of futures trading.

That required deposit is about 25 cents a bushel on corn, 35 cents on wheat, and 50 cents on beans at this time. That required deposit amount is called margin.

The margin money in your brokerage trading account is yours, but it is tied up to “back” your futures trade.

That margin requirement can be changed by the exchange and/or the brokerage firm when the value and the volatility of the commodity changes substantially. That might be two or three times in a “wild” year, or it could be two or three times in one month.

The margin required by the futures exchange is called the “exchange margin” requirement.

The margin required by the brokerage firm is called the “house margin” requirement. A brokerage firm can set house margins at whatever they want. In 1975, the corn initial margin was $5,000 per contract at Merrill Lynch, but $300 per contract at Stotler.

Most agricultural-oriented brokerage firms have house margin requirements the same as exchange minimums.

If you want to set yourself apart from the masses, call a brokerage firm and ask if their house margin is more than the exchange margin. You will blow their socks off! You are not supposed to know those kinds of things!

Definitions:

Initial Margin:

The amount of money which must be deposited into your futures account to initiate a futures position.

Maintenance Margin:

The minimum amount of money required in your brokerage account to maintain a futures position. When the account balance reaches the maintenance margin amount, the account must be restored to the initial margin balance.

Margin Call:

When your broker calls you to add more money to your brokerage account because your account balance is less than the maintenance margin requirement.

For Minneapolis Hard Red Spring Wheat futures, the hedge margin for September, 2019, contract is $1050 per 5,000-bushel contract, but $1365 for speculators. Speculators are futures traders who do not have a cash wheat position to back their futures position.

The maintenance margin for hedgers at the Minneapolis Grain Exchange for Hard Red Spring Wheat is $1050 for both hedgers and speculators.

So, you decide you want to hedge in your own trading account 10,000 bushels of Hard Red Spring Wheat. That will be two 5,000-bushel contracts. The initial margin is $1050 per contract. So, you must deposit $2100 in your brokerage account, which, let’s say is exactly the amount you deposit. You are always encouraged to deposit more than the minimum.

NOW HEAR (READ) THIS:

The price change of the futures is added to or subtracted from every futures trading account every day!

Say What?

Let’s say you short (sell) Minneapolis Hard Red Spring Wheat at $5.88 about noon today. The “settlement” price for each day is determined about 20 to 30 minutes after the close of trading. Let’s say today’s settlement is $5.87.

What happens?

You deposited 21 cents per bushel initial margin in your trading (brokerage) account.

You sold (went short) wheat at $5.88 today.

The market settled at $5.87 today. Are you making money or losing money? If you do not know, go back and read the definition of what “short” means!

The exchange will deduct one cent a bushel from the account of the trader who bought 10,000 bushels of wheat at $5.88 and put one cent a bushel in your trading account because you are short wheat at $5.88 and the settlement was $5.87.

Thus, you now have 22 cents a bushel in your margin (brokerage) account, one cent more than required.

Let’s say tomorrow the price of September Hard Red Spring wheat settles at $5.81, down 6 cents for the day. Six cents will be deducted from the margin account of every trader long September spring wheat and added to every trading account short September spring wheat.

You now have 28 cents in your margin account, but you are only required to have 21 cents. After just two trading days, you have a hedge profit of seven cents on 10,000 bushels… $700!

Let’s say over the next month, September spring wheat works lower and settles at $5.50 sometime in February. Your margin account now has the 21 cents initial margin plus 38 cents of profit (sold at $5.88 minus current price of $5.50), which came from the accounts of those who are long September Spring wheat. So far, so good.

Weather turns nasty in March, and the forecast looks like more bad weather is ahead. The futures begin a rally. Each day the market settles higher, money is deducted from your margin account. Let’s say on April 29, September spring wheat settles above your sold price ($5.88) for the first time. After the deduction for that day, you have less than 21 cents per bushel in your account. Your broker calls you and says, "send money." That is a margin call.

The amount you must send is whatever it takes to bring the margin account back to the initial margin amount as of that day’s settlement.

In this example, the hedge initial margin and the maintenance margin were the same, $1050 per contract. If the initial margin had been $1350 per contract and the maintenance margin $1050 per contract, then you could lose $300 per contract before you received a margin call to bring the balance back to the initial margin of $1350 per contract.

You meet (pay) the margin call and maintain your short position. Let’s say the weather changes for the good of the wheat crop, wheat futures price return to a down trend, and by the end of August it is $5.20. You have 68 cents of profit ($5.88 sold minus $5.20 current price) in your trading account plus the amount of money you deposited to initiate the trade and any additional money you deposited to maintain the position. There was a commission charged the day the trade was initiated, and another commission will be charged when the position is liquidated.

You price the wheat at the elevator and liquidate your hedge the same instant. You tell your broker to send the money you made. If you do not expect to trade for a while, have him send all the money.

Note: as you accumulate more money in your trading account through the market moving in a profitable way for your position, you can withdraw that excess amount. Is that meaningful?

If you hedged 50,000 bushels of beans at $14 in June and the price declines to $11 by mid-August, you will have $150,000 excess funds in your hedge account. If the hedge was at the elevator in the form of an HTA or forward contract, you would not be entitled to that money until you delivered the beans. By the same token, if you sold beans at $14 in your own account and the price went to $17, you would be required to add a total of $150,000 in margin by the time the market reached $17. If the hedge was at the elevator, the merchandiser would be required to meet that $150,000 margin call.

There may be a minimum deposit required to maintain the account active.

Questions?”

Thanks Roger for the good explantion.

You can visit Roger's Wright on the Markets website here

Check out our all-new Ag Directory

To add value and efficiency the Ag Directory provides a way for users to have a “one-stop” shop in the palm of their hands and not have to search for contacts when they need a trucker, seed, fertilizer, parts, financing, etc.

To get your business listed in our Ag Directory simply

contact me at 605-295-3100.

Commodities Overview by Sebastian Frost

Overview

Afer two days of lower prices following the report where we saw the USDA raise yield estimates for corn and soybeans following two months of declined estimates, grains rallied to close out the week on Friday getting that expected bounce that we mentioned after the USDA report Wednesday.

Today's Main Takeaways

Corn

Thursday we saw corn futures hit their lowest levels since August. Friday, corn closed higher but didn’t participate in the big rally that soybeans and wheat had. Closing just 4 3/4 cents higher on the day. With Friday's gains, Dec-22 corn ended -23 cents lower for the week, as it trickled lower for the majority of the week. Prices are now roughly -50 cents off their highs we saw a few short weeks ago.

Argentina raised their 2023 corn export quota by 100% to 20 MMT for their 2023 crop.

We have the obvious concerns regarding demand and exports for corn. With exports having their worst weeks in a decade. Taking a look at this weeks USDA report, we saw the USDA raise yield as well as a higher ending stock estimate which didn’t help corn prices.

On the other side of things, we have a chance to see global production trimmed if weather winds up not cooperating. As well as globally the possibility of producers switching to planting less corn.

With corn hitting their lowest levels since August, we are nearing a vital support level for corn futures. Currently the 100-day moving average is sitting right around $6.50 which acts as nearby support. Would be very beneficial for corn to hold this level if we want to see higher prices. Personally I think we have a lot of upside here from corn, so hopefully we can see corn futures start to find support and rebound.

5-Day Change

Dec-22 Corn: -23 cents

Dec-22 Corn (6 Month)

Soybeans

Soybeans ended Friday with a great rebound following the losses incurred Thursday, making up for most of the losses we saw. Nov-22 soybeans ended the week +4 cents higher on the week, with Jan-23 beans -12 cents lower on the week.

Similar to corn, exports this week came in on the disappointing side. We also are seeing Argentina get more rainfall. To go along with the problems in China putting a damper on demand. But the bigger issue soybeans are facing currently is South American weather. As weather outlook right now is looking good. With Brazil already expecting a massive crop. If weather stays fair and Brazil winds up having the size of crop that's being talked about, that will likely put a ton of pressure on soybeans in the future.

Overall, the soybean market has a ton factors that could swing things. But with these factors comes risk. Of course, South America forecasts could change, and we could see soybeans rally even further in the future, but for right now that's a tough bet to place.

Main factors to look out for the soybean market will be South America head winds, Brazil's large crop and weather, Argentina's crop and whether they continue to receive beneficial rain, and Chinese headlines.

Taking a look back at Thursday's report we saw the USDA raise soybean yield estimates by 0.4 bpa up to 50.2 bpa which was in the middle of the trade estimate range. We also saw the USDA raise ending stocks by +20 million bushels, and production raised by +33 million. Interestingly, exports were left unchanged.

5-Day Change

Nov-22 Beans: +4 cents

Jan-23 Beans: -12 1/4 cents

Nov-22 Soybeans (6 Month)

Wheat

Wheat closed Friday out with a nice small rally to recuperate some of its early week losses, and the wheat market ended -9 to -34 cents lower on the week. With Chicago getting hit the hardest this week.

Taking a look at the USDA report earlier this week, it wasn’t too crazy as expected. Most are expecting larger changes come January.

The recent collapse in the U.S. dollar has been a beneficial factor for the wheat market, but not as much as one would like. As Thursday when we saw stocks rally, and the dollar sharply lower, wheat was still lower as well despite the other stocks and equity markets seeing a rally.

Globally, we are continuing to see estimates for Argentina's crop continue to be lowered. If the crop keeps seeing problems and we continue to see estimates lowered even further than they already have been, this is definitely a bullish factor to look out for.

Argentinas government said their wheat crop is at 11.8 million metric tons. To put this number into perspective the USDA currently has their estimate at 15.5 million.. The USDA will almost certainly lower this.

As for the Russia and Ukraine situation, we haven’t seen a ton of new updates. So the entire situation remains a mixed bag. We still have the potential for headlines to swing things either which way. Currently the Russia and Ukraine export deal is expected to expire next week, so we will have to keep a look out for what Russia decides to do there and whether they renew the deal or not.

Looking forward, given where prices sit, I think wheat has the potential to see higher prices in the future. But of course, there is plenty of unpredictable factors that go into where we see the markets go next.

5-Day Changes

Dec-22 Chicago: -34 cents

Dec-22 KC: -9 3/4 cents

Dec-22 MPLS: -8 3/4 cents

Dec-22 Chicago Wheat (6 month)

Dec-22 KC Wheat (6 month)

Dec-22 MPLS Wheat (6 month)

Inflation & Stocks

Thursday we saw the CPI come in at 7.7% which was lower than the expected 7.9%. This news led to a major rally in the stock and equity markets including the Dow Jones rallying over 1,000 points. To close out the week, the NASDAQ rallied 9.4% the last two days, its largest two day gain since 2008.

So has inflation really peaked?

For starters, we have to recognize just how historically high the 7.7% interest rate is. Sure it wasn’t as high as expected, which led to many believing this is the start of the end of the recession. Yes, CPI might be trending lower, but it is still the highest we have seen in 4 decades. But personally I don't think that's the case. Every bear market has a bull run. After this rally, reality will set in and things will return to how they have been since the beginning of the recession. It would be foolish to think this two day rally is the end of the recession. As the average recession lasts far over a year.

Taking a look at history, every +5% rally we saw amidst a bear market, eventually led to lower prices despite the amazing rally. Below is a chart comparing 2008 vs 2022 S&P 500.

Jason Furman, an economist at Harvard University who was also a top economic advisor for former president Barack Obama stated "This was good news, but I wouldn’t change my view on the world based on one data point." As well as "One should feel better about inflation than yesterday, but not much better." So from what the vast majority of people are thinking is, this was a good step in the right direction, but the battle against the recession and inflation is far from over.

Additionally, if we look at the top 20 performing days for the NASDAQ going back to 1971, of those largest moves, 16 of them were during bear markets.

Cattle

Dec live cattle futures ended Friday down -$1.55, down to $151.525. Finishing -$0.125 lower for the week.

Jan feeder cattle ended the week lower -$3.125 to $178.575 and was -$1.050 lower on the week.

Dec Live Cattle (6 month)

Nov Feeder Cattle (6 month)

Social Media