WHAT DOES ADM THINK ABOUT CHINESE DEMAND

WEEKLY GRAIN NEWSLETTER

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com

Grain Price Action

A rather wild week for the grain markets the past few days. We started off lower leaving some gaps on the charts on Sunday the 22nd, but we followed that up with very strong reversals on the charts that left all of the grains positive for the week.

The price action has added to my bullish attitude and outlook for long term price action. As I mentioned in some of my audio comments in the past week or so we are very close to seeing some breakouts on the charts, we are just a few good days away from really opening up the technical view, which would cause money flow to enter into our markets.

We also have a chance that fundamentals will drive the price action as it feels like our trend on the demand side of things is improving. The export sales in the next month or two will really be very key.

If soybeans continue the pace they have had in exports we will see the USDA have to adjust our export sales higher despite the fact that they lowered them in our January report. Our balance sheet is tight enough that we really don’t have extra soybeans to export.

As for corn it appears our exports might be the only game in the world for a bit. So the next several weeks will be very important for our corn balance sheet. The present pace is well behind even the lowered USDA numbers. But part of that is because the USA has only so much shipping capacity and our export terminals won’t be shipping tons of corn when they are full of soybeans.

What All to Watch

The USDA may be slow to react to changing export sales on both corn and soybeans. So we need to watch spreads, cash basis, and the actual export shipment and sale numbers.

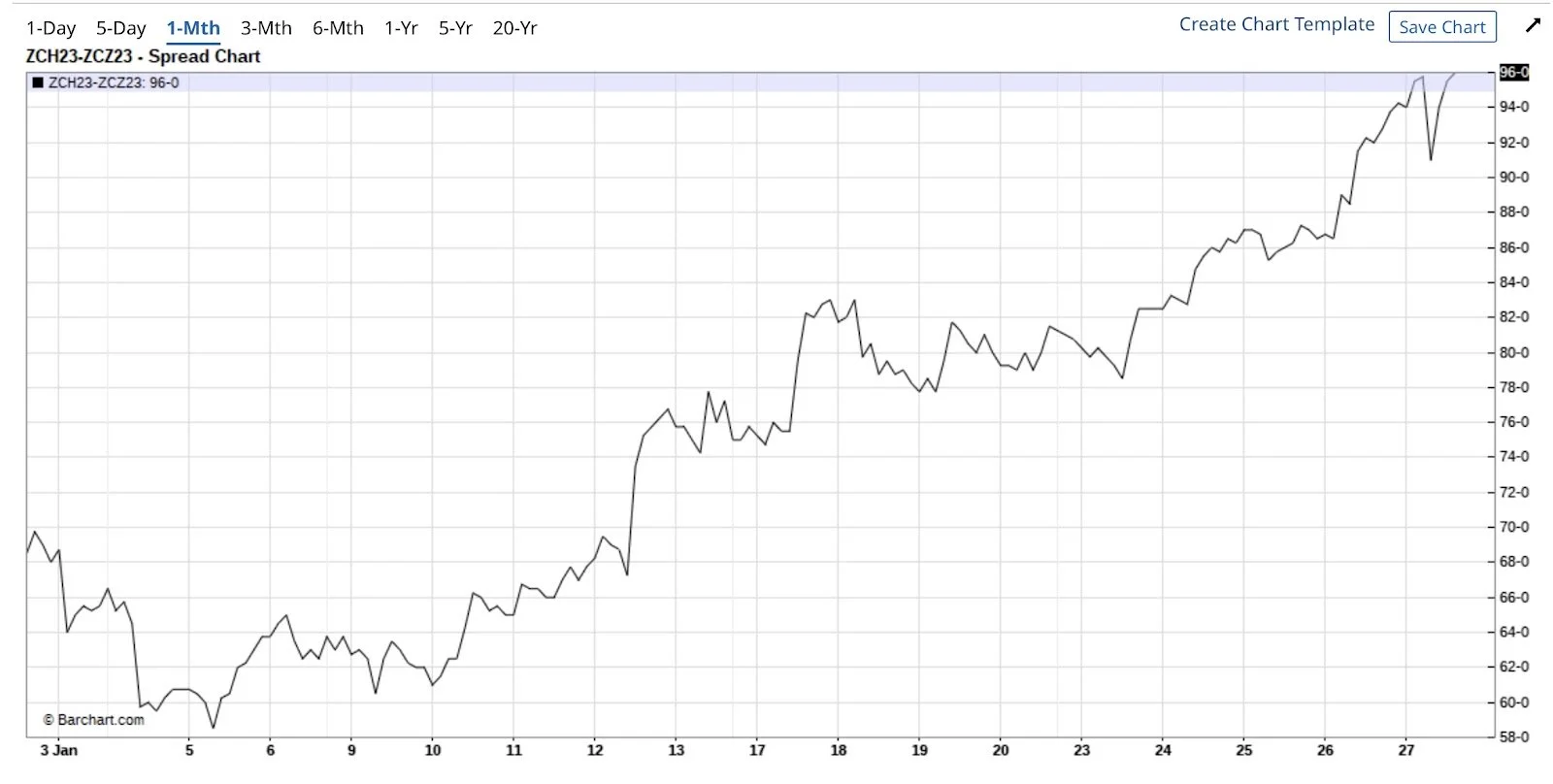

Spread Charts

Here are a couple of spread charts that we want to follow. The first chart is the last 3 months of old crop March Soybeans minus new crop November Soybeans. As you can see, old crop beans have continued to gain a big premium to new crop beans. We did have a little set back on Friday. We will want to watch to see if that is a correction or a trend change. A trend change would signal that Brazil is starting to supply more beans.

This next chart is the last month of old crop March Corn minus new crop December corn. This chart shows a lot of strength.

What did those spread charts tell you?

They told me that we have been gaining upfront demand. That the market is continuing to show more demand upfront by taking the carryout out of the market or via increasing the inverse. According to many of the best advisors and grain merchandisers the spreads show the truest fundamentals of our markets actual supply and demand. So the wider these spreads get the more upside we have, and that by default spills over into more upside for 2023 crop via a tighter starting carry in.

Another Bullish Advisor Perspective

I suggest listening or watching Shawn Hackett on Market to Market https://www.iowapbs.org/shows/mtom.

One of the things he mentions as he talks about wheat was (Shawn Hackett): “I think things are getting worse. We went from a period of hyper worry a year ago to mass complacency today. We had a period where they worked this corridor deal that allowed a lot of that was above ground ending stocks to be coming out of Ukraine ended the supply shortage for a while. But I actually think now they have to sell only what they're producing.”

Shawn Hackett: “We were talking with our largest producers there a week ago, 50% down in acres for the foreseeable future. I think the big shortage issue that the market traded a year ago is coming up later in ‘23. I think it's a big surprise and the market's going to have to put some pricing back on.”

How Much Upside Does Wheat Really Have?

He puts a price target out there that is about a dollar and a half higher than the present price. I think if things come together our upside is much higher, but it is hard to print that or say that because those numbers are so far away and seem unattainable from present levels. I do know that our markets have the ability to overdue price moves. So my opinion is the wheat market will catch fire, it is just a matter of time before someone lights a match that catches the short funds and smokes them out.

India, which is number two in the world for as far as wheat production goes, approved a sale of 3.0 MMT into its domestic market this past week, in an attempt to help stabilize and cure the record high prices they have. Yes the 2nd largest grower of wheat has record high prices. That fact alone gives me some hope for our wheat market. I get more optimistic when I look at the weather that China has had in its wheat growing areas, and even more optimistic when I consider statements that Putin made about having enough wheat for Russia’s needs. Bottom line is if we start to see demand for US wheat, make sure you are not short.

I think wheat has more upside then even I will be willing to print. It is all about emotion and momentum. If emotions get involved in the wheat market we have no ceiling as wheat is tied to hunger more than other commodities. Keep in mind that the past few weeks we have had Russia, India, and Brazil either do things or make statements about food security. I think the world is short of food to feed everyone, especially if we see the Chinese demand to do a boomerang like I think it will.

So Does ADM

The below is from Mr Walter Cronin’s LinkedIn feed. In it he had listened to ADM’s earrings call. Take a look for yourself and see what you think about what ADM thinks will be happening to Chinese demand and the agriculture world in general.

Is China going to be the next USA?

If you look at the above notice of the comment of the US consuming about 270 pounds a year of proteins, while China is only at about 170 pounds per year. If China is trying to live the lifestyle that we do, then they have a ways to go. This my friends is rather bullish as is everything else written above.

The fact that the ADM CEO basically said that even once all of the new crush plants are operating we will have more than enough demand for all of the bean meal is different from what all of the advisors have been saying. Most think we will have an abundance of bean meal, but ADM says no we won’t, that our demand will eat it all up and then some. Long term very bullish statements.

I have always respected ADM and done a lot of business with them over the years. Not only are they pro-farmer they are good business people. Don’t get me wrong they still take advantage of the farmers at times but they don’t try to get farmers into Pro-Pricing contracts below the market. They try to make sure farmers are successful because they realize that farmers make or break their company. I don’t think all Ag companies care about farmers like ADM does. I could mention some but here is not the place.

Wright on the Market

The below was from Wright on the Market, it came out Saturday a.m. It aligns very well and is a good short read.

“The real (ree-al) is the currency of Brazil. As its exchange rate strengthens in the world markets, it makes Brazilian exports more expensive, just like every country with a strong currency. And, just like every other country with their currency increasing in value, the market value of their exports must be reduced to be competitive in the world marketplace. Brazil's corn and soybean prices are declining as the exchange rate of the real rises. Farmers are not selling nearly as much of their new crop beans and corn as normal. The stronger real coupled with the farmers being slow to sell anything means Brazil's 2023 export pace is off to a very slow start.

Gosh, who else has beans and corn to export during the next five months? Argentina? It is a little dry there. Ukraine? There are several export problems there.

Every day the rain continues in northern crop areas of Brazil is another day later the safrinha corn crop will be planted and the less it will yield as the dry season starts before the safrinha crop is mature even in a good year. Persistent January & February rains two years ago led to the safrinha crop being 600 million bushels less than the previous year. That 600 million bushels came right off the top of their corn exports. Six hundred million bushels = 51% of the corn expected to be on hand in the USA this coming August 31st (aka carryover). What do you think will happen to the price of corn this summer if the safrinha planting delays continue another two weeks?

One of our clients, Andy, said all the featured speakers at the Top Producer Summit in Nashville this past week were bearish on “everything.” He said the growing negative predictions for the economy and commodity prices this past year are beginning to feel like the Joe Kennedy Story in reverse.

You can read the Joe Kennedy Story at:

https://www.wrightonthemarket.com/post/the-joe-kennedy-story

Every week we issue an analysis of the weekly exports sales. We calculate the current marketing year-to-date sales pace compared to a year ago pace. We also show USDA's projected percentage change for the current marketing year compared to the previous year. This is how one can predict USDA export demand changes on future S&D reports.

Look at them beans on yesterday's export sales report copied below. Soybean export sales year-to-date are running 5.4% more than a year ago (green cell). To the right of that green cell is the USDA's projection of a decline of 7.8%. Actual versus projection is a difference of 13.2%. Thirteen percent of last year's US bean export total is 280 million bushels. If you look at the USDA S&D we sent on January 13th, you will see Uncle Sam projects the US carryover on August 31st will be 220 million. That is just seven months from now. If you did not already know this, you are simply not paying attention.

Think about it; what has to happen to keep the US from running out of soybeans?

Start with: Fasten your seat belt.

LVMH markets 75 prestigious, luxury consumer brands around the world. We are talking about outfits like Tiffany & Co., Christian Dior, Fendi, Givenchy, Marc Jacobs, etc.

The world’s largest buyer of luxury consumer goods is China.

China's Lunar New Year celebration is a big sales week for LVMH companies and this past week was a very good week for them. Independent reporters across China said most of the Chinese wore (covid) masks outside this past week, but hardly anyone wore masks inside and they were spending money like they had been cooped-up for three years. LVMH market managers are gushing with overwhelming joy as the Lunar New Year Celebration winds down this weekend and they were already prodding LVMH to ramp-up production immediately. People will spend a lot of money on food before they spend money on luxury consumer goods.

China’s economy is, in fact, a major component of the worldwide export demand for grain and soybean. Note China's 9.5% GDP growth in 2011 on the graph below. Do you remember what grain and bean prices were in the 2010 to 2013? If we have $15 beans and $6.50 corn now with China's 2022 GDP just 3%, what will happen when their is GDP 4.5%? Our outlook is China's GDP is going to grow more like 6 to 9% in the next few years. We make that prediction with a lot of confidence.

Remember what Andy said about the attitude of the speakers at the Top Producer Summit... and use the common sense God gave you.”

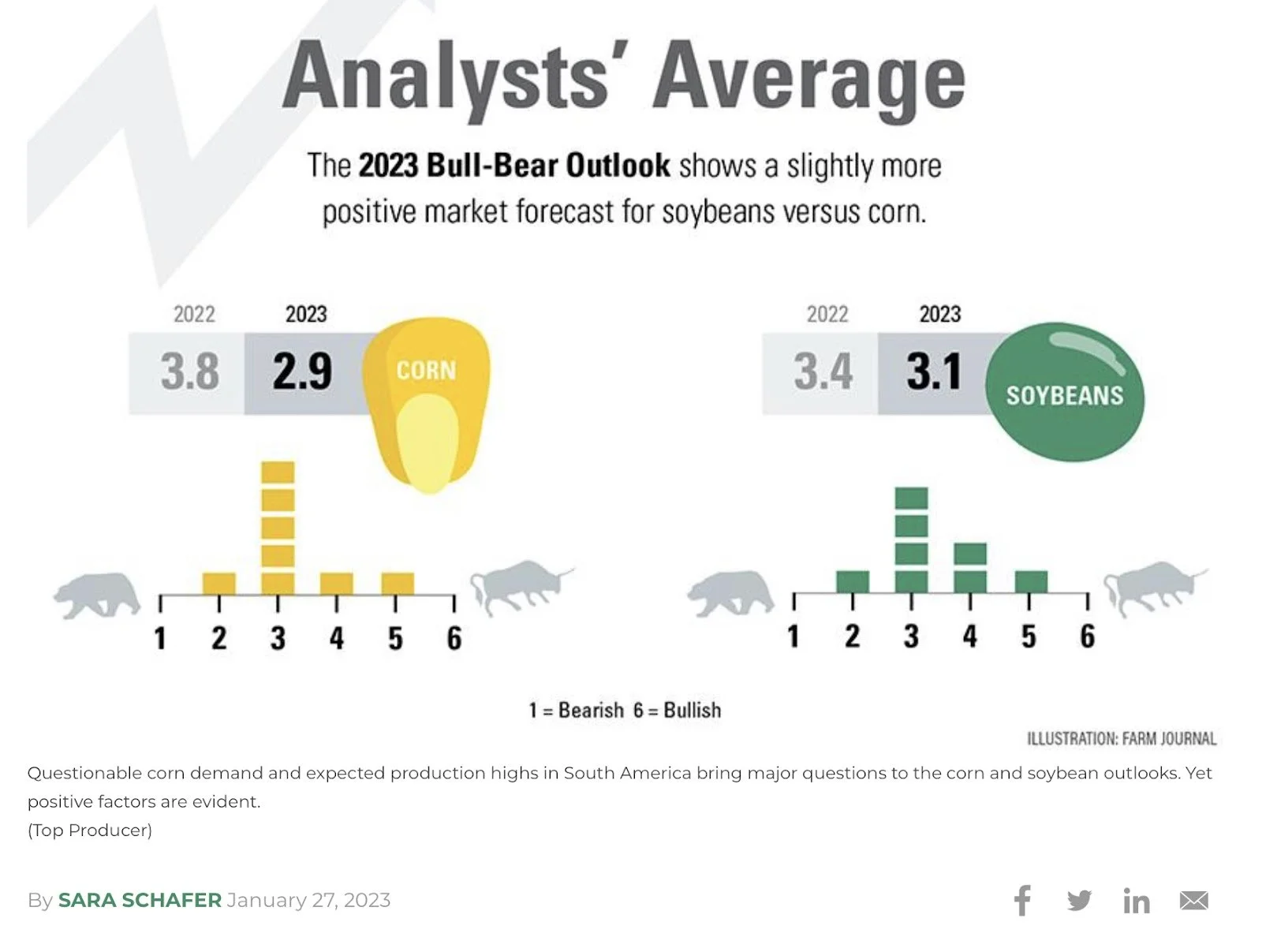

How bearish are the rest of the advisors?

As you know I am very bullish longer term. That doesn’t mean that I want to do nothing in marketing if my operations normal game plan is to have some grain marketing done. It simply means that I don’t want to get oversold. I don't want to be too aggressive in making sales. I want to be comfortable with a major upside bias. The fact that so many advisors are bearish means we have a lot of upside when things turn. It makes me uneasy and I have to question why am I so bullish when all these other famous advisors are so bearish. But at the end of the day my research and experience has me standing by the “be patient” call.

Look at the ADM CEO statements above, those are longer term supper bullish. Any of you guys that are talking to your ADM buyers, have they been saying anything nearly as bullish as what the CEO said? I highly doubt it, because their job is to make as much money as possible.

Do you think your grain buyers sound nearly as bearish when they are trying to sell grain to the end users?

If you are thinking about fear or panic selling some new crop grain.

Look at some of the great detail that Wright on the Market has put out lately, look at the Tech Guys technical targets, listen to the Market to Market with Shawn Hacket, research the price targets that farms.com has put out.

Then ask yourself are you comfortable where you are at. Then ask yourself does the one trying to get you to fear sell have your interest in mind or do they have some other motivation.

How bearish was your advisor last year?

Were they right or did you panic and fear sell a little too early? Don’t get me wrong advisors should be promoting good risk management and for most it makes sense to have some sales done. For me I prefer my guys to “be patient” but part of that comes from the fact that I am in an area that farmers are not comfortable pre-selling like those to the east of us are. Plus I am in an area where many farmers have more than a year’s worth of storage and have solid staying power.

The below is from Ag Web. They polled 8 advisors and it tells me that no one is super bullish. That most of them are slightly bearish. Meaning at least they acknowledge some bullish possibilities. But if you read the article you will see that some of these advisors are 50% sold for 2023. The view they had last year at this time wasn’t much different. Last year they were wrong. Time will tell this year.

Bottom line

The bottom line is we recommend being patient in marketing. But we also want to emphasize that grain marketing isn’t one size fits all. Get yourself comfortable for your operation. Just don't get over aggressive via fear selling or panic selling because we have to go down. We can go lower, but we don’t have to go lower. Odds favor a seasonal rally and higher prices in May-June. So we want to make our sales when we are scared to make our sales, when the market feels like it wants to go to the moon, that’s when we want to be aggressive putting in floors and then scale into making grain sales. We will make grain sales when the market gives us a signal to make sales.

Mother Nature

Will Mother Nature be warm and wet or will she get hot and dry? Only time will tell for sure. But it really appears that we are getting more volatile in weather. Just look at the past couple of years. In 2021 we had a drought that had spring wheat in ND and Canada about ½ of normal. In 2022 we had a millet crop that was ½ of normal, Argentina had ½ of a wheat crop. Who is next on Mother Nature’s list? I have seen some that predict we could see a 2023 drought over the corn belt.

If we start off fast in 2023 for planting, just remember what happened in 2012. If that happens and we see China's boomerang of demand happen at the same time. Pray that no one in your area is short because it will hurt your community big time.

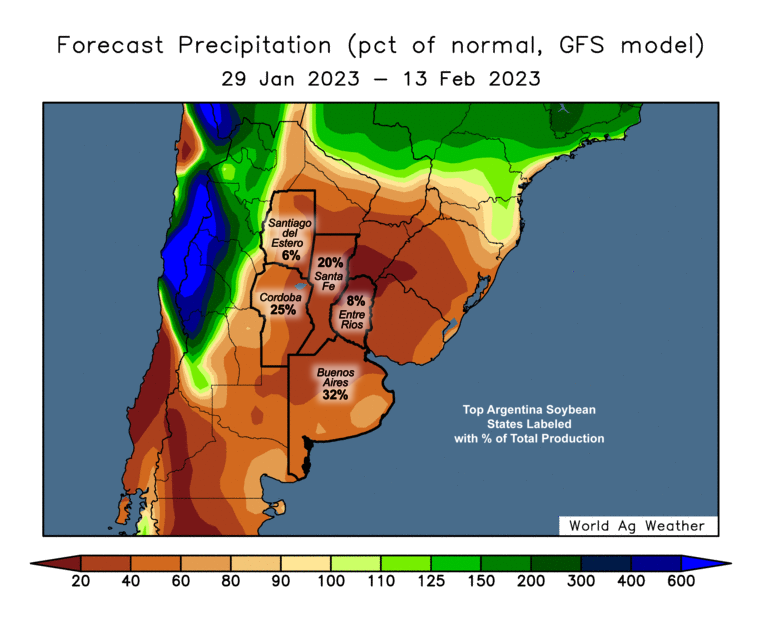

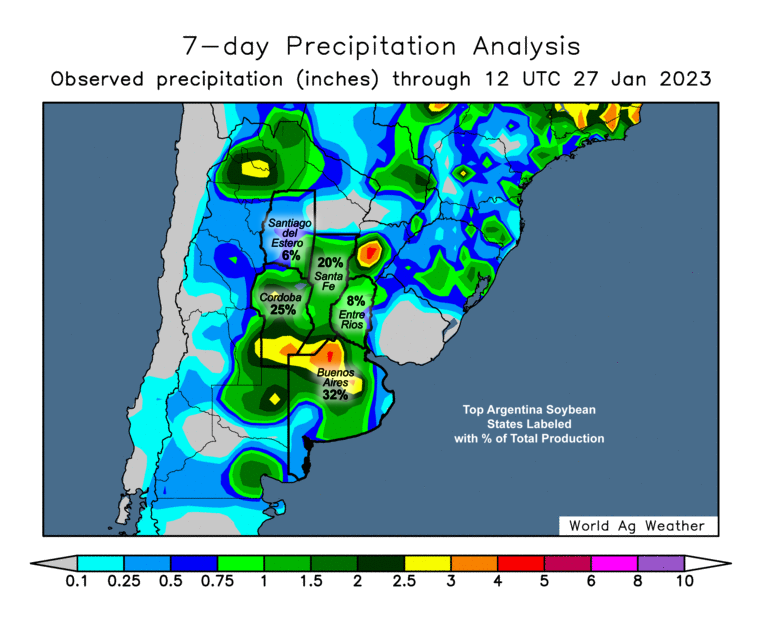

SAM Weather

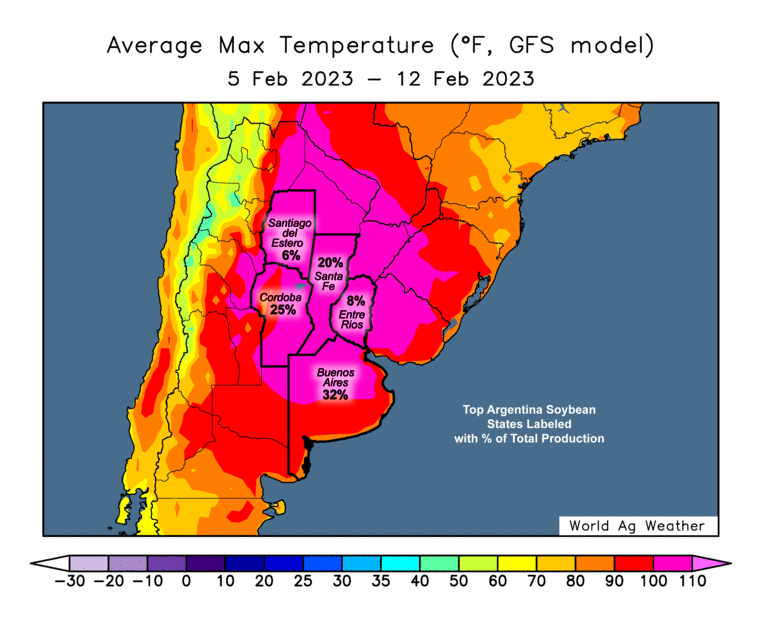

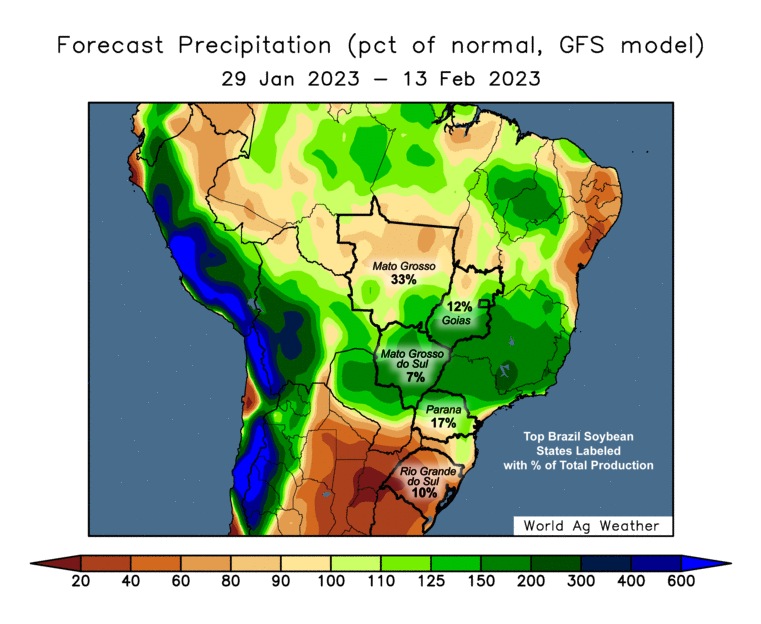

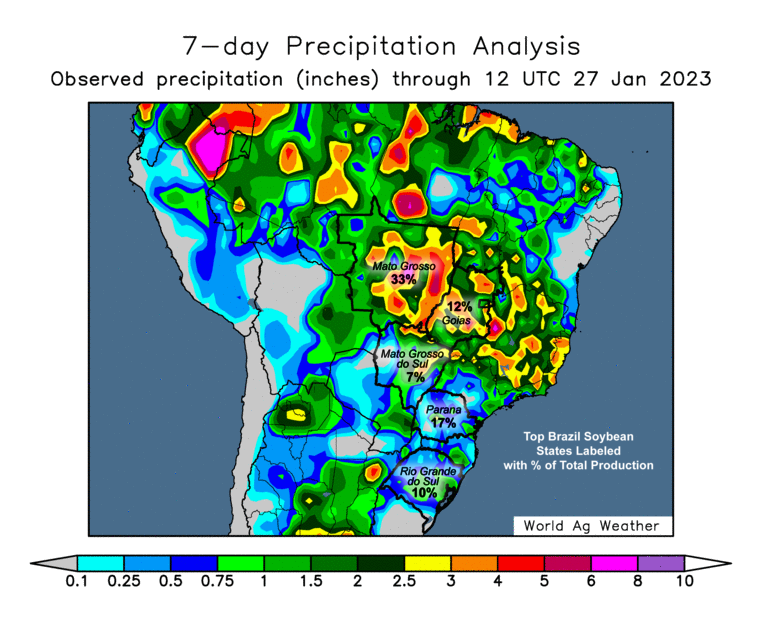

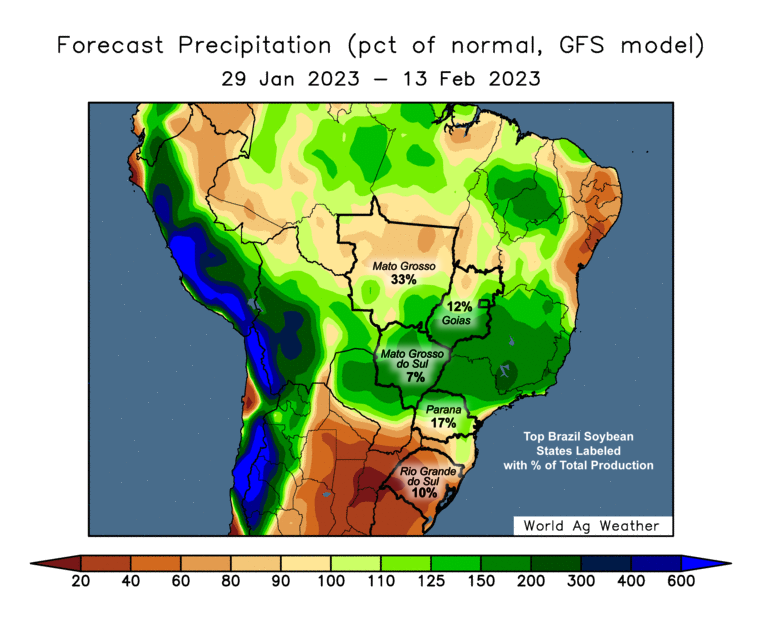

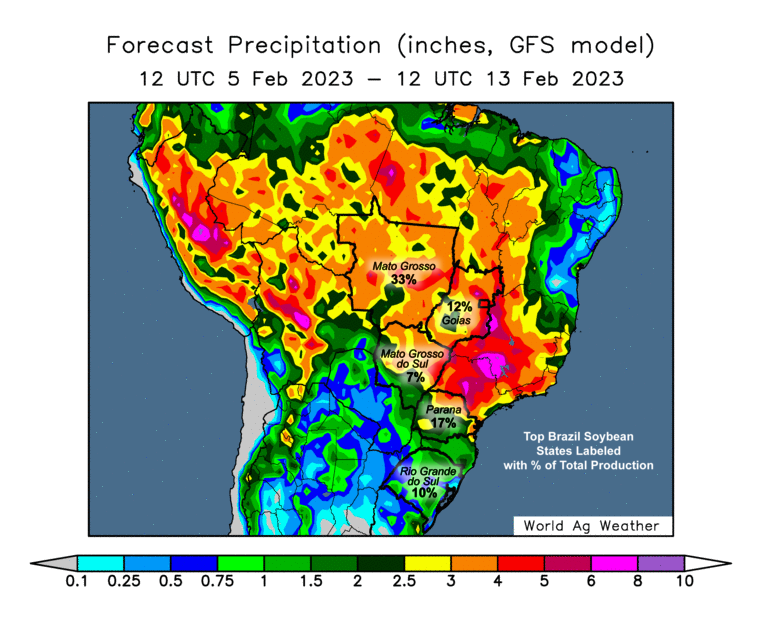

South American weather looks to have resumed drought in Argentina and wetness in Brazil where they attempt to harvest. Check out various weather maps here.

Charts

Corn 🌽

Soybeans 🌱

Wheat 🌾

Market Factors

South American weather

How much rain Argy gets. How much that rain benefits the crop. Is the damage too little too late.

Brazil harvest. They are expecting a record bean crop. Will the heavy rains continue and cause harvest delays.

China

China is still recovering from their whole covid situation. Will we see improved Chinese appetite for US exports.

Funds

The funds are still long corn and beans, and short wheat. Do we see funds switch it up.

War

We have on ongoing war between two of the worlds leading exporters of wheat. Can’t help but think this continues to support markets.

U.S. Weather

The warm temps the past few weeks took away a lot of snow cover across growing regions. This opens the door to potential winter kill.

U.S. Dollar

The dollar has been on a down fall the past few months. Does it continue to fall or will it see a bounce.

Demand & Exports

Important Upcoming Dates

This Monday, January 30th

Monthly wheat conditions update

Will show how much damage was done in growing states here in the U.S. from our December storms.

This Tuesday, January 31st

U.S. exports & inspections

Bulls would like to continue to see strong business from corn.

Fed FMOC metting

Expected to be a quarter-point hike. December we saw half a point, and saw multiple 75 point hikes before that.

This Wednesday, February 1st

NASS December Grain & Oilseed Crushings

February 8th

WASDE 11:00am CT