SHOULD GRAIN BE HIGHER OR LOWER THAN LAST YEAR?

WEEKLY GRAIN NEWSLETTER

By Jeremey Frost

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com

Here we are coming up on the end of January, so I think it is time to take some personal grain marketing inventory.

Some of the things I want to think about are what is the market telling me, what is the fundamental story, what is the technical story, what is the story the funds are telling or want to see, am I where I am supposed to be in terms of grain sold or grain marketing? What is my plan should the markets decide to go straight up or straight down?

But the number one and really most important question that summarizes all of the above is am I comfortable in my grain marketing position with all of the known information and unknown future path for grain prices.

On Friday I had an audio out that called out some advisors for having pocket books lined from those that make money buying grain cheaply. I mentioned how I thought fear selling didn’t make much sense and how it was stupid to be giving grain away making new crop sales.

As many of you know I subscribe to nearly every advisor out there. With my 20 plus years at CHS I have had several great advisors put on marketing seminars that I helped host and I have seen several other advisors in person who I think do a great job. There are also several such as Mark Gold who I have listened to his audio comments nearly every day for 20 plus years. I don’t agree with his philosophy 100%, but I respect and understand his methodology and it is rather simple.

One of the advisor’s that I have started following just the past couple of years has been Roger Wright and Wright on the Market. Last night Roger Had a great write up and it fits well with my thinking that guys should not be fear selling new crop 2023 grain. You can listen to that audio here

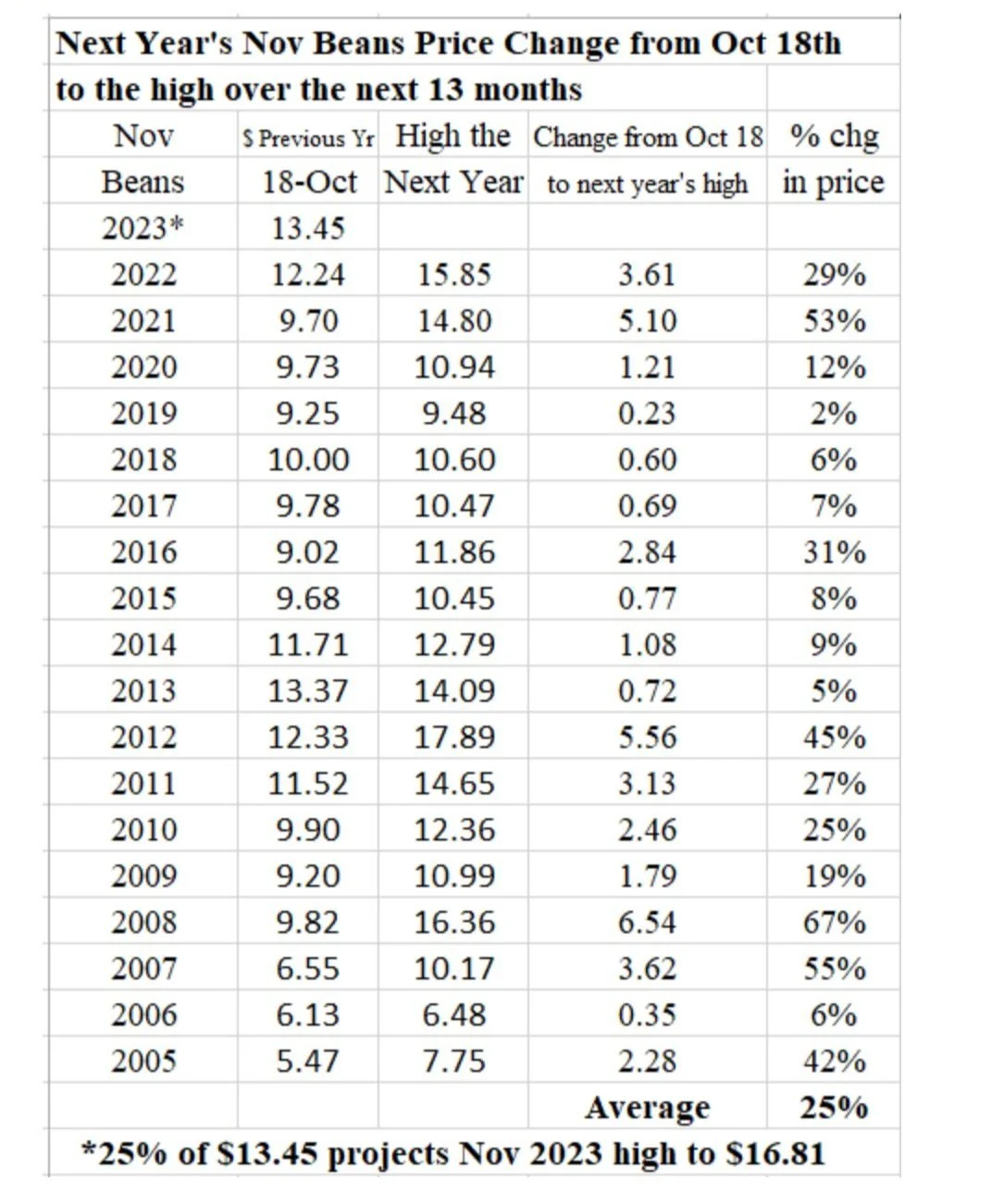

Here is what Roger wrote. “Note that if Nov beans and Dec corn gain the same percentage this crop year as they have gained on average since 2005, November beans will trade to $16.81 this year and December corn will trade to $8.08.”

Followed by these two tables.

When I look at all of the different advisors that I follow, some of whom I respect. Others I think are simply there to promote farmers to sell cheap. Most of them have been rather aggressive lately in making 2023 new crop grain sales.

When I look at the tables above 2013 scares me a little bit I must admit. But for an industry that is so much about averages and locking in profits. How can so many not look at what has happened the past few years. Look at the averages over the past 15-20 years, look at seasonals. Then look at our balance sheet and come up with a conclusion that farmers should be aggressively selling new crop 2023 grain?

I just don’t get it, but maybe I will be wrong. I know very well that there is a chance that some black swan will hit and Mother Nature will be so perfect everywhere. But I can also look at the above and realize that there is 1 year in corn and zero in soybeans where our high hasn’t been above our Oct 18th price. That doesn’t mean it can’t happen this year. But the numbers above don’t get me wanting to sell anything anytime soon.

Why is everyone selling 2023 new crop grain?

The conspiracy theorist in me would say it is a simple play to help the large ABC commercials buy grain cheaper. Anyone remember the Cargill Pro Pricing contracts last year? I don’t think that is exactly the case because large agriculture corporations do make more money the higher the prices are, provided they don’t get on the wrong side of the market. When small grain buyers get on the wrong side of the market they just may go broke and not pay farmers for the grain delivered. When big ones get on the wrong side of the market someone gets fired and they make it off of others via widening margins which is easy to do when prices are higher as farmers don’t seem to mind a penny or two here and there.

The only logical thing that I see for these great grain advisors and grain marketing professionals to be selling 2023 new crop grain is the fact that farmers can lock in profits. I do not have an issue locking in profits, I do have an issue if I don't consider how much one can be leaving on the table.

This is where it comes back to the “are you where you are suppose to be” in terms of grain sales/grain marketing. If you are not where you are suppose to be then get yourself comfortable. There is no price or dollars that can buy one comfort. You as a farmer, as a risk manager have to find your own comfort level which isn’t easy with all of those preaching fear and bullish guys like me calling guys idiots for making fear sales. You have to be able to see clearly through all the smoke and mirrors. You have to find comfort when you make a sale, put on protection, re-own a sale, or when you do nothing. You have to know without much doubt that what you are doing or not doing is exactly what you and your operation should be doing.

I am going to preach all of the reasons I think the market will do what I think it will do, others are going to scream the sky is falling an try to use fear to get you to make sales, while others will tempt you with greed. But at the end of the day it is only you that knows your situation inside and out, it is only you that has a gut feeling on what is right for your operation. So do yourself a favor learn and grow, but still follow that gut feeling that is balanced in a manner that you feel is balanced.

Realizing that 10 different farmers that all have the exact same production, storage, acres….etc. Even with everything the exact same should and will have 10 different marketing approaches based just on small risk management risk reward profile changes that can make 10 different approaches all correct.

One can be buying while the other is selling and there is nothing wrong with that. Just don’t let yourself become complacent and become a follower. Be your own leader. If you need help in your marketing or ever have a question feel free to give me a call 605-295-3100. But remember my advice is going to be coming from my view, which will only be as good as the information you tell me.

What is the market telling me?

Here are a few spread charts

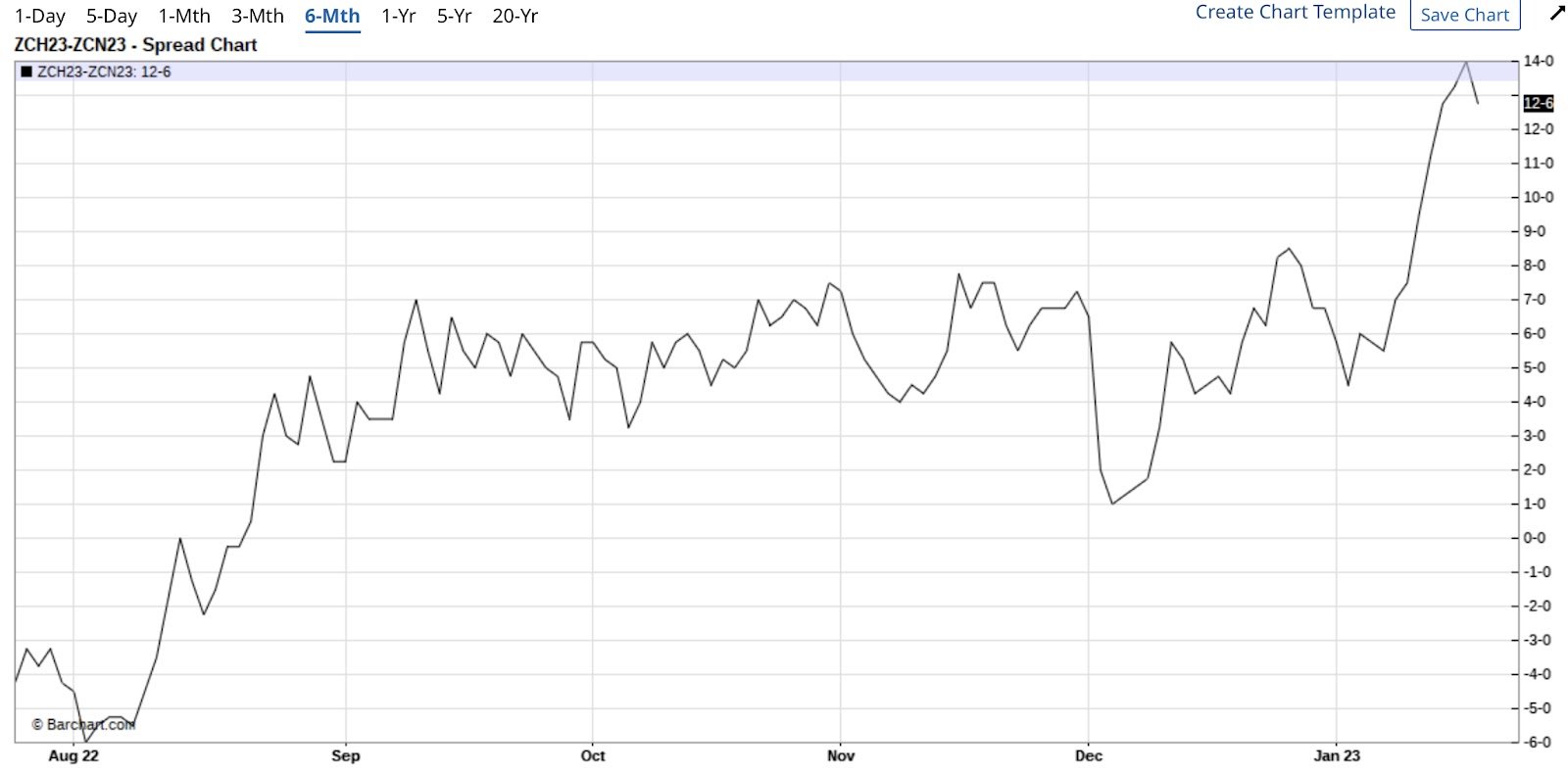

Here is March July corn spread. Notice the recent strength. This is a 6 month chart.

Here is March versus December, old crop versus new crop. 6 month chart, notice the recent strength.

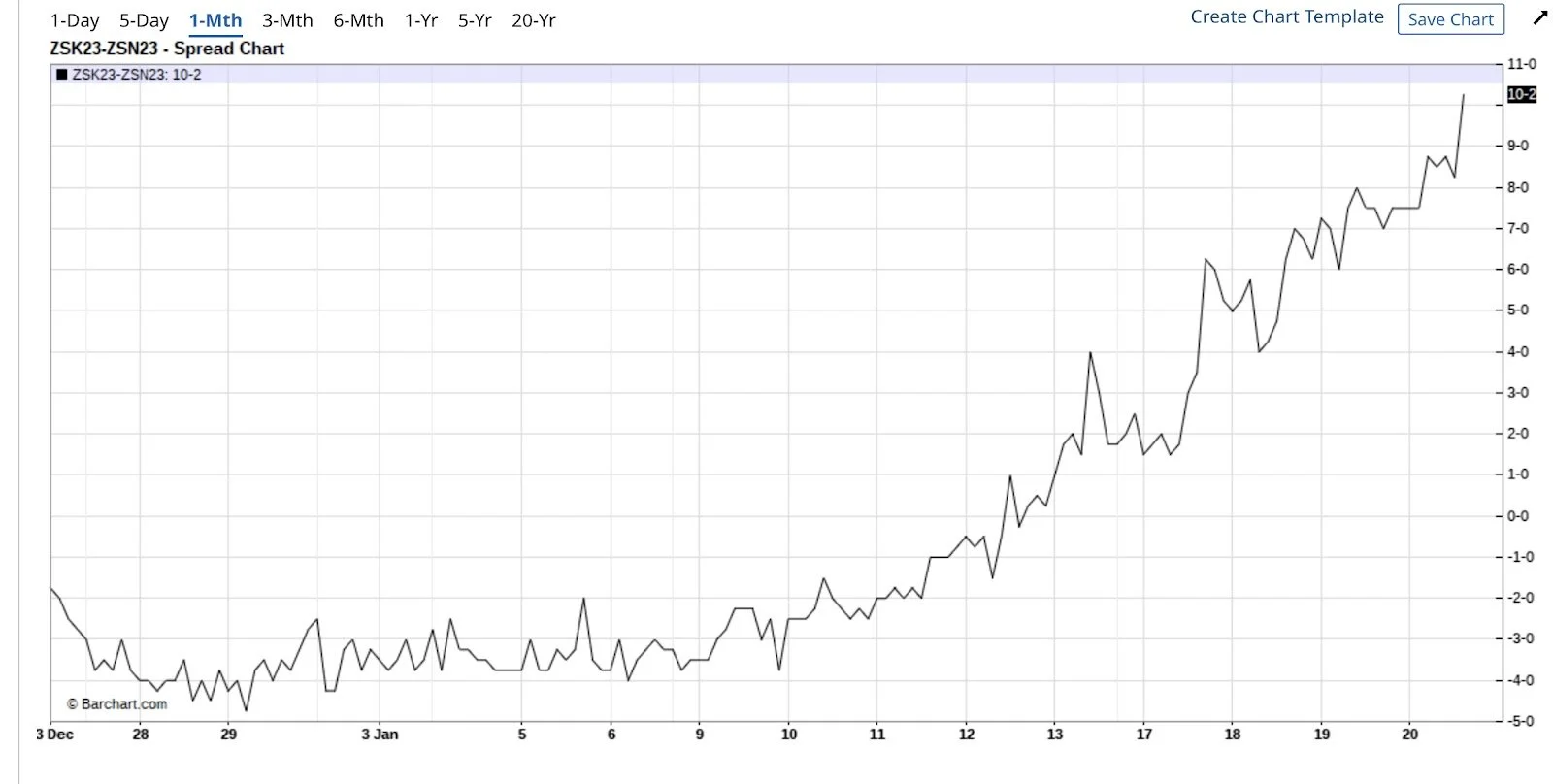

Here is the same spread but only for the last month. Still notice the recent strength.

Here is a soybean May futures to July futures, 1 month chart. Look at the recent strength.

Here are the March soybeans versus. July soybeans. Notice recent strength.

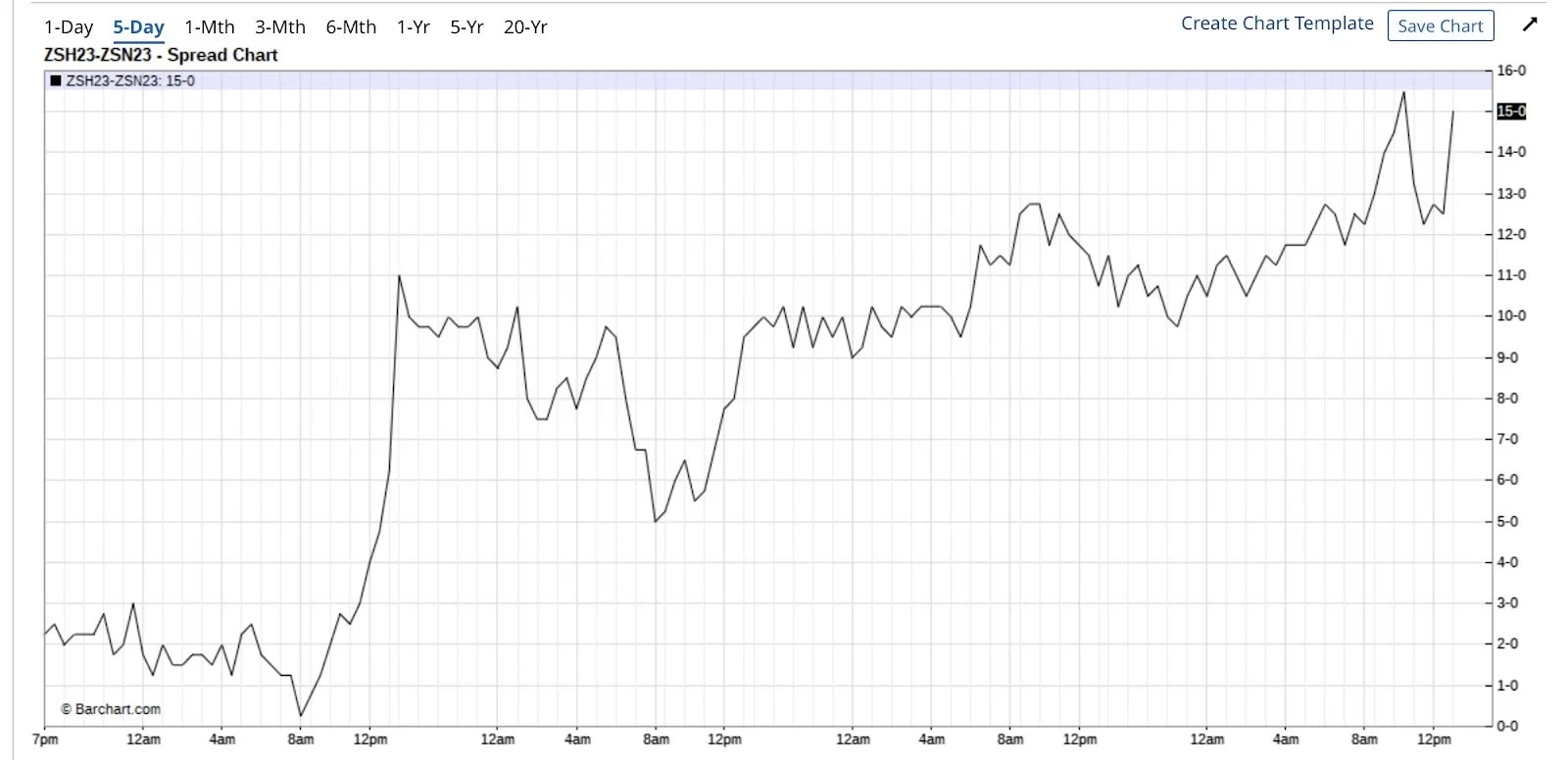

Here is March versus July, just the past 5 sessions.

Here are the last 5 sessions of March soybeans versus new crop Nov soybeans.

Here is the last month in March versus new crop November soybeans. Notice the recent strength.

The bottom line on all of these graphs is even though we struggled to gain the past few sessions. Spreads have stayed firm or even firmed in most cases. That is bullish and would be another reason for me to not be making new crop 2023 grain sales.

For those of you that have made 2023 new crop sales. Do you feel you locked in a good basis if you made a cash sale? How much less of a basis versus nearby did you lock in or sell your cash 2023 grain for?

For me the ability to separate basis, futures, and cash price is a must comfort level that every producer needs to get to. Don’t get me wrong, as your neighbors actually appreciate guys selling a little cheap once in a while to help demand out. But other than helping demand out, what is the point of selling a super cheap basis? No bins and have to?

What does the technical picture look like?

I am going to refer to Wright on the Markets tech guy for that. You can read his complete weekend write up here.

Tech Guy Weekend Comments 1/21/23

From March Wheat comments last Thursday:

"I am still bullish on March wheat despite it not showing much progress this week. Let's see if that 728.75 price holds tonight and tomorrow, or if it doesn't, see if it attracts good buying - I think it will."

On Friday March Wheat tested the 728.75 low by 4 ticks, the buyers showed up as expected, and wheat rallied about +15 cents up to end at 742.75. The net gain on the day was +8.25.

As has been discussed, the next up target is near 800 - it is actually between 800 and 810. I will detail also where and why are the targets above 810. Remember, nodes or bumps/swing points on the left side of a chart create resistance levels as a market rises on the right.

There are 4 up corrections on the left side of the March Wheat chart where the swing highs of these bumps are referred to with a down pointing red arrow on the chart. These areas will create temporary stopping points where backfills will occur.

After March Wheat moves up to 805, I expect a pullback between 775-770. Then another move up should occur, taking prices up to 860 to 890 then another backfill from there to 830 or so with another leg up to about 920.

These are ballpark prices and we will have to wait to see the actual movement. You will see how these estimations are derived on the chart from the bumps and the array of supply/demand lines drawn.

These rough estimations are to highlight that wheat will not go straight up, but rather have some pretty big swings. I have drawn the expected rough price path that March Wheat should travel with blue up and down lines on the right.

In general, a market's movement up on the right generally mirrors that of the path on the left. This probable price action in wheat should offer several trade's (in and out) for the active trader. Here is the chart.

Those highs in the 674 region of March Corn chart on the left which were mentioned yesterday did indeed fuel buying interest today. The red horizontal line labeled "this line" runs across these highs we are talking about. Check out these details on yesterday's corn chart here.

The March Soybean front month spread against all back months is demonstrating bullish divergence. The bean market's demand for product right now has been increasing daily, even during the correction.

Yesterday again, while the March contract lost 8 cents, July lost 10.75, so the March/July spread has continued to widen the inversion. I would imagine that this will turn the flat price back up, but I don't know for sure. Here is what that chart looks like.

This is the updated March - continuation daily chart here. The settlement and last price was a 2.5 cent disparity, which is a few ticks either side from the top of the ascending triangle. We will see what Sunday night brings.

The fund longs increased their position by 28,000 in soybeans and 44,000 in corn during the most recent run up in prices, per the commitment of traders short form (futures only) report yesterday.

Their respective open interest also increased by about those amounts indicating new fund longs entering the markets. This phenomenon is generally considered bullish - the strong money is pushing the trend.”

One of the big reasons I have been promoting the Tech Guy from Wright on the Market is the fact that he has some real technical upside targets listed on his various charts. Some of these numbers are at all time new highs, like I have been saying for months. (For those of you new to www.dailymarketminute.com I have been predicting new all time highs in 2023 for corn and beans since September, I also predicted 15.00 soybeans before the end of 2022.)

My wheat prediction has been wrong, but I am still in the camp that this spring/summer we will see 10.00 plus wheat again and that will open the doors to testing last years highs.

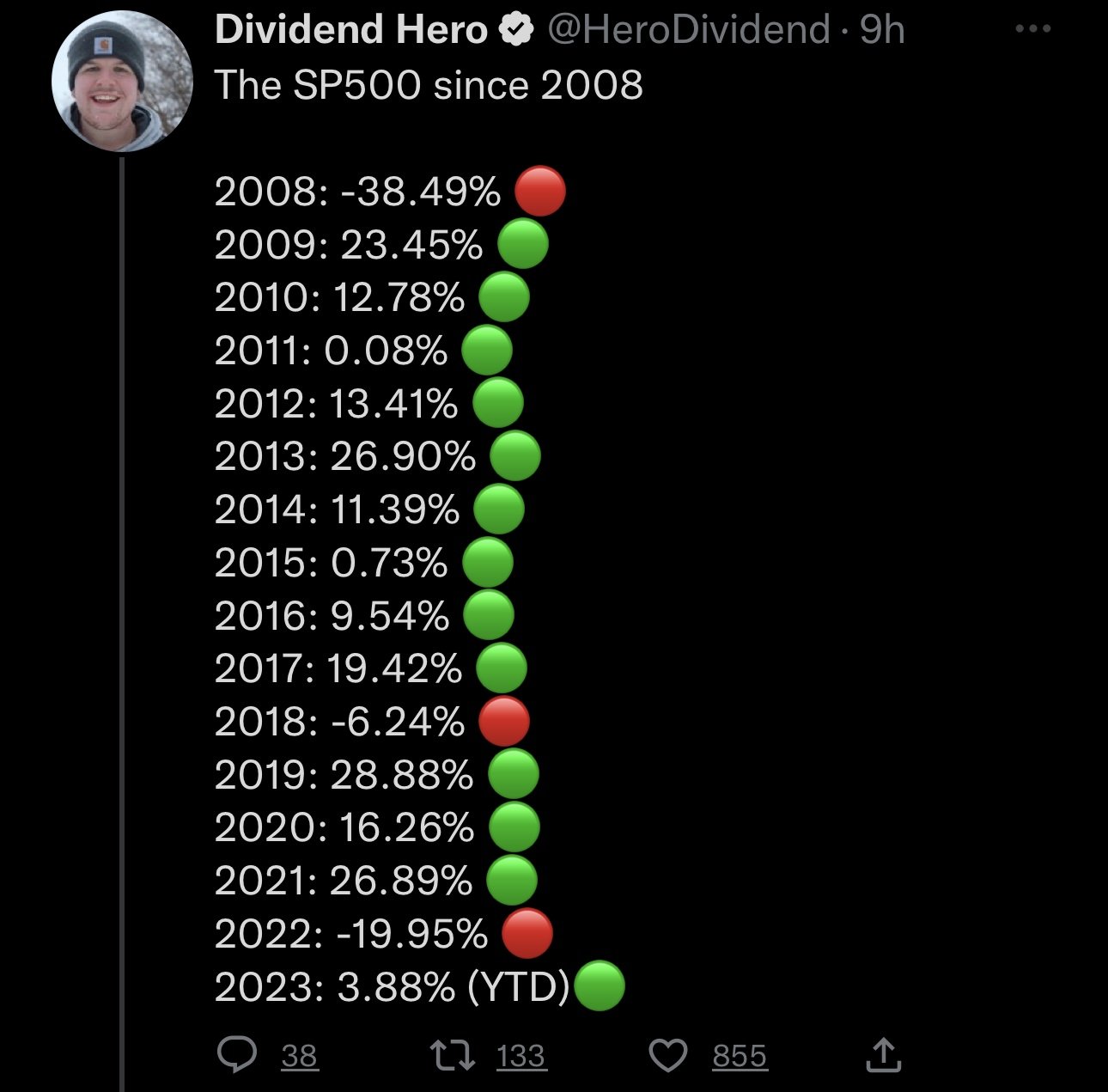

As mentioned, one of the reasons I like to piggyback off of the Tech guy is his technical targets for soybeans and corn. I want farmers to realize yes there is nothing wrong with making profitable sales. But if the funds decide to jump on the bull bandwagon what could happen.

Also think about it in these terms, if farmers have already sold a bunch of 2023 crop early how much pressure will additional selling put on the market when or if we do go higher?

I know several advisors that are 25-50% sold. So who will be left to sell if Mother Nature decides to get dry and hot and we have 2012 type yields in the corn belt? How many more farmers are going to be in a place to sell when maybe they should.

So the fact that a bunch of advisors and elevators have got farmers to fear sell grain early gives me more confidence that we will make new all time highs in 2023. If more farmers would have listened to me and not sold then it would have much less of a chance of happening. But with farmers selling soon it opens the door to much higher prices.

Sometimes the market can’t go up until all of those that think it will have thrown in the towel.

Keep in mind that farmers produce roughly 3 million futures contracts worth of corn every year. 10% of that sold would be 300,000 contracts. As I mentioned in past newsletters farmers pre-selling less would dramatically increase our price. By pre-selling less we naturally become price makers instead of price takers. Buyers either have to buy, find a replacement, or shut the doors. Farmers don’t have to sell, they can build bins. So who has more staying power? Farmers or the buyers?

Fundamental story?

What is the fundamental story that the markets are telling us? If we look at carryout versus a month ago, all three of the grains are tighter. Spreads are firmer, basis is firmer and this week we had exports pick up.

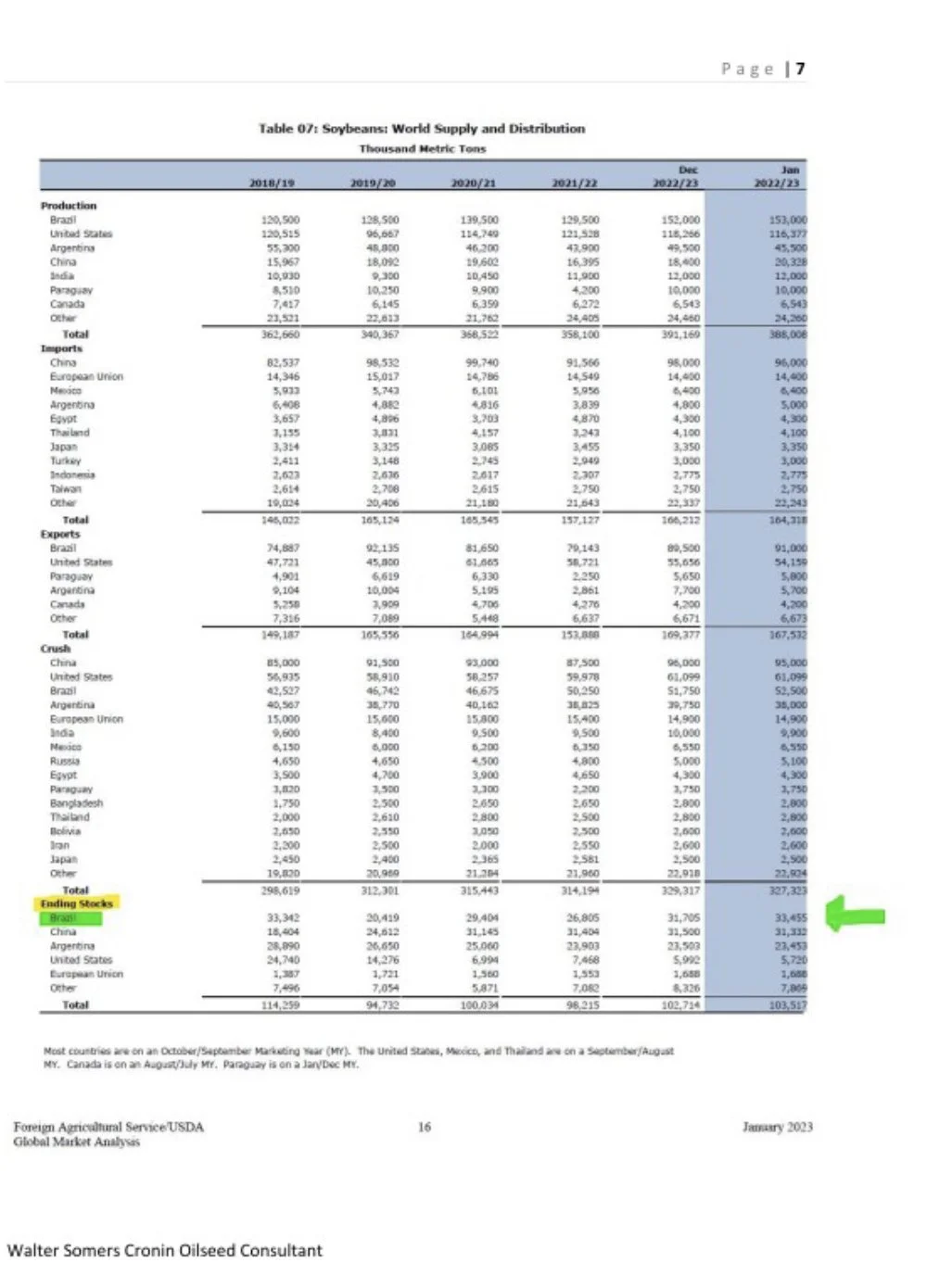

Probably the biggest thing I see fundamentally as positive is the fact that CONAB has Brazil carryout less than a year ago. Despite nearly a billion bushels more soybeans grown. That is one heck of a demand increase.

That’s a true demand story, one that needs to be watched.

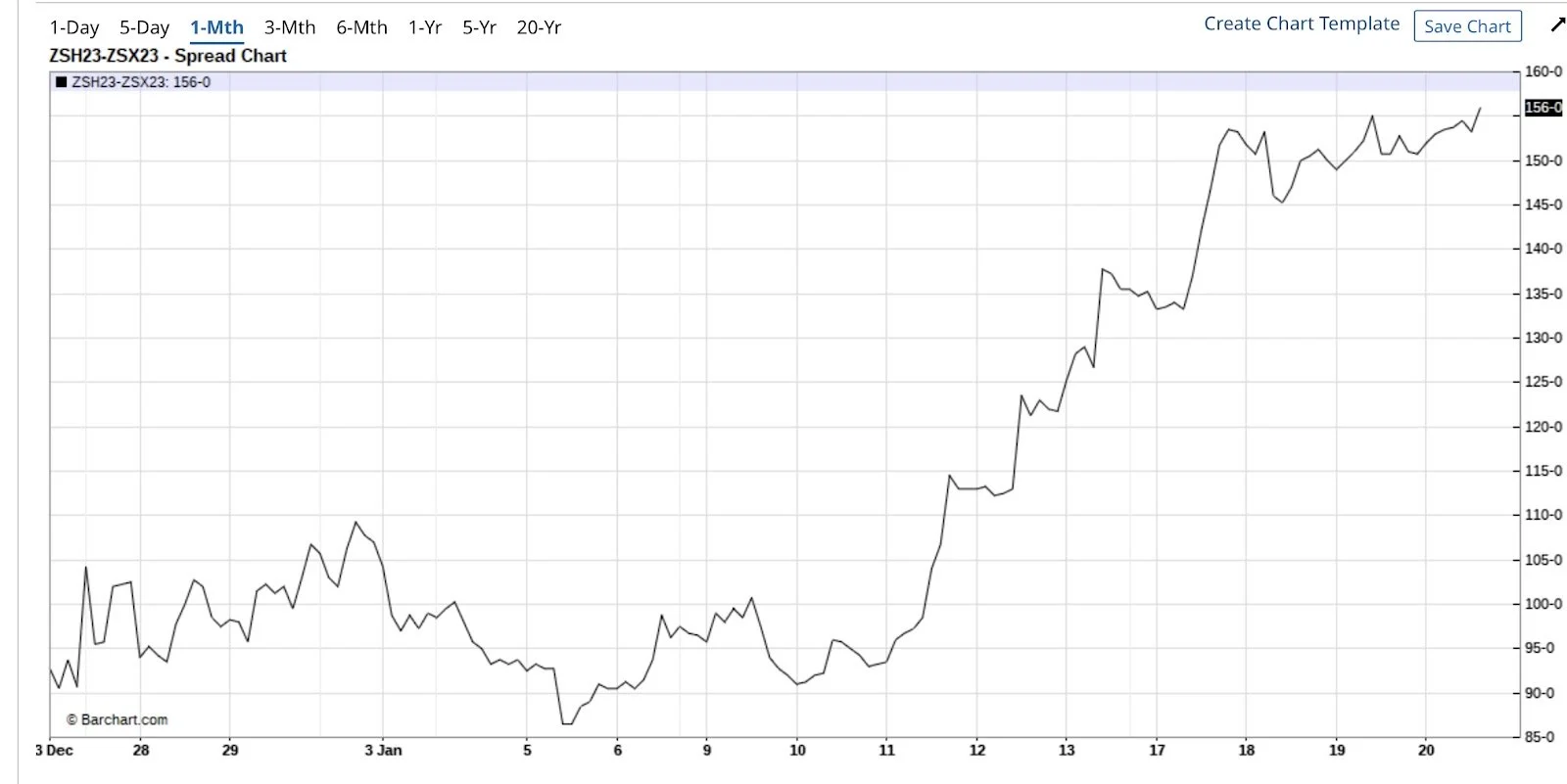

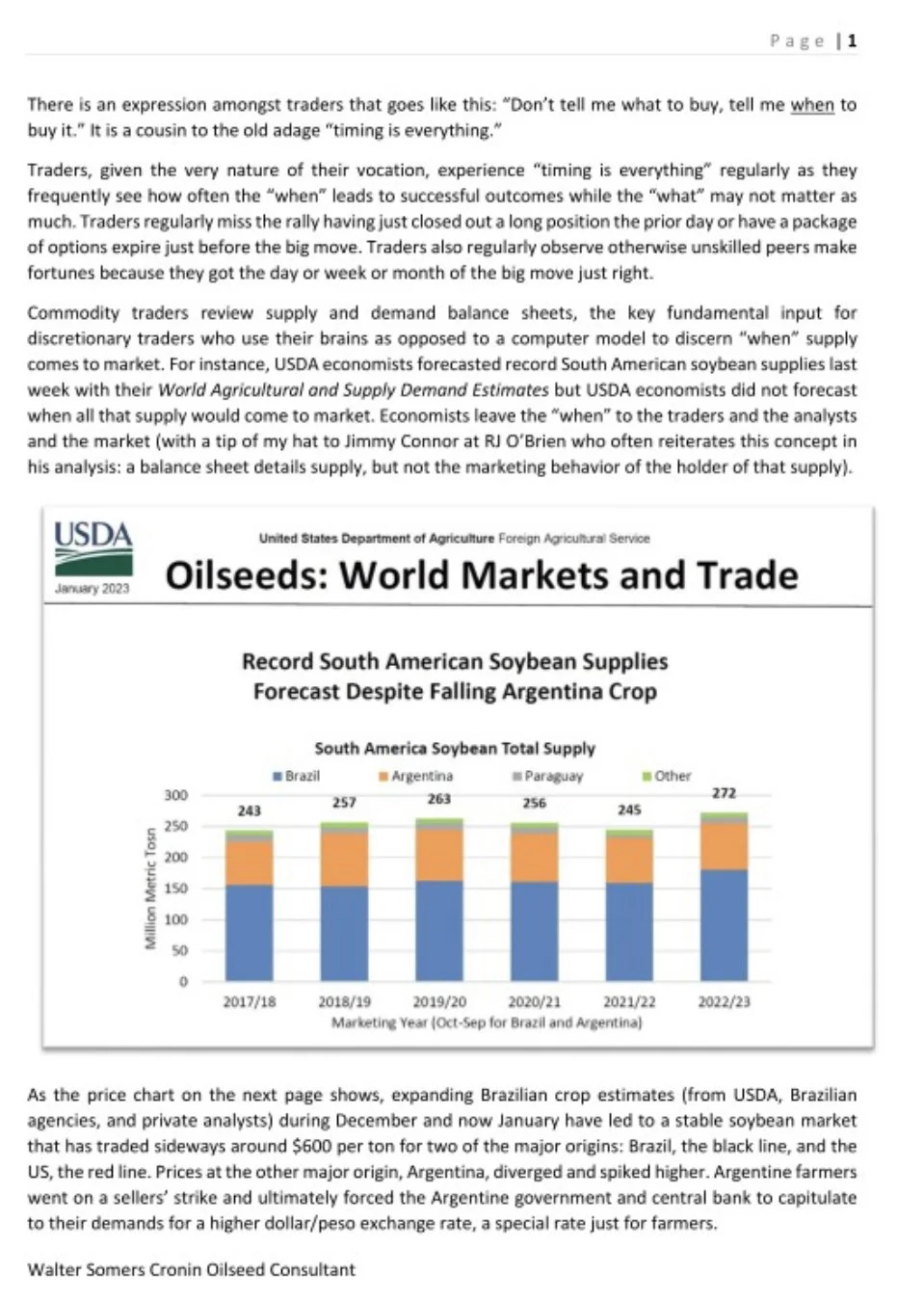

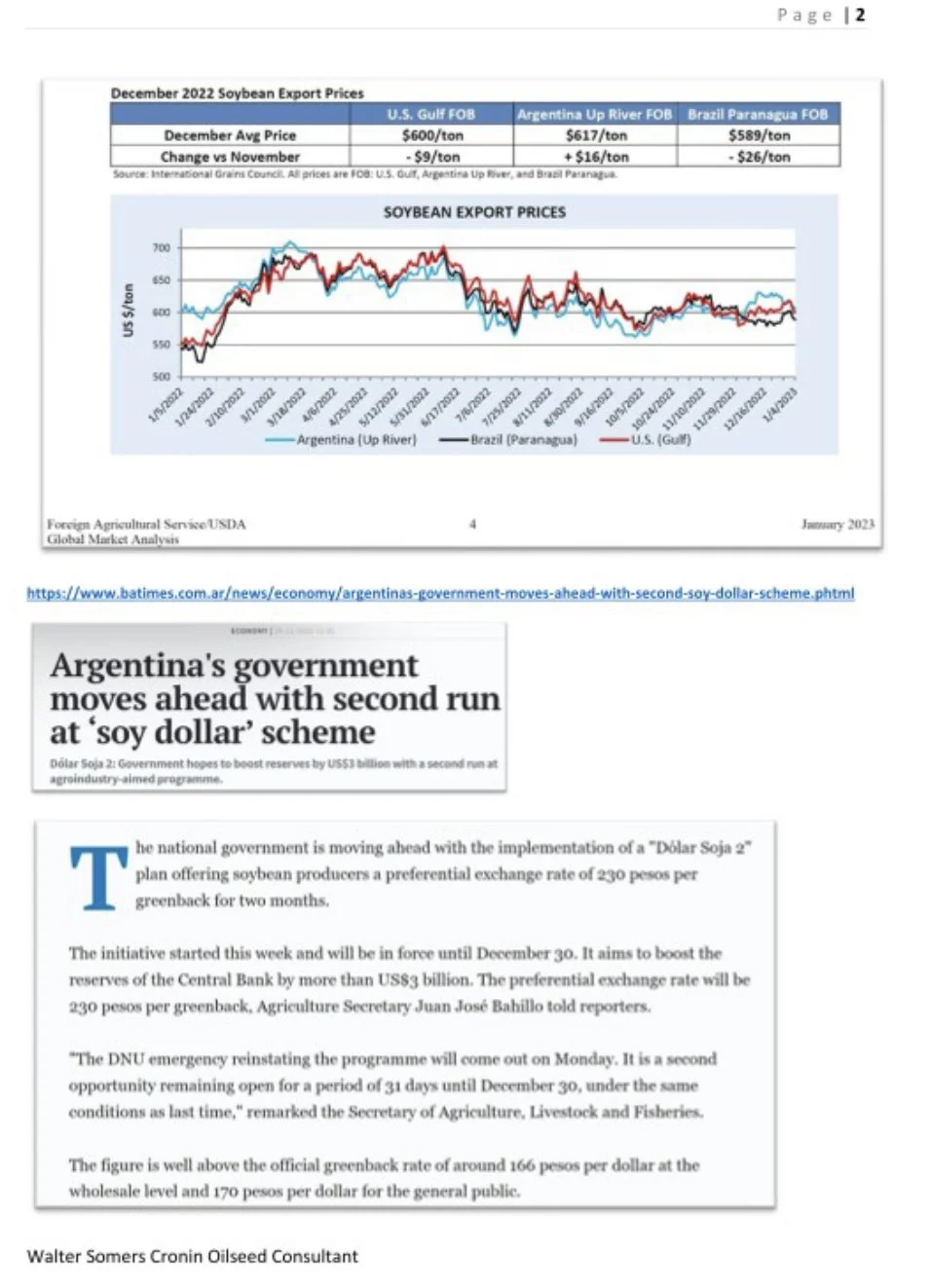

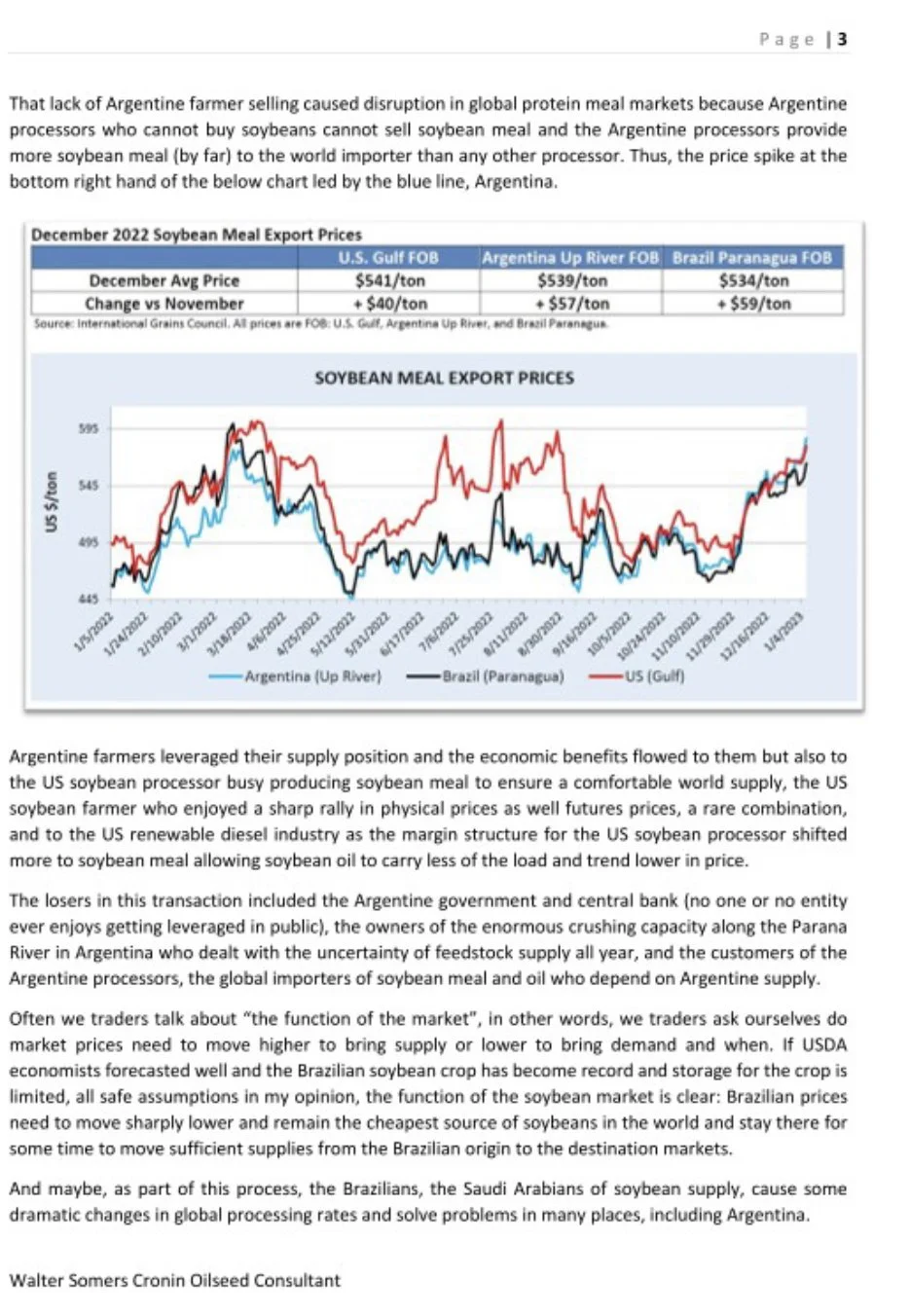

Walter Cronin write up, from LinkedIn.

Below is a write up from Walter Cronin. He makes some good points. His main point in Brazil needs to get cheap enough to help supply both Argentina and the US crush plants. But that doesn’t mean that our soybeans have to go down. Also keep in mind what CONAB said last week that Brazil needs to increase carryovers for both beans and corn substailly for food security. Similar to what Putin said last week. Mark both of those down as game changer potential.

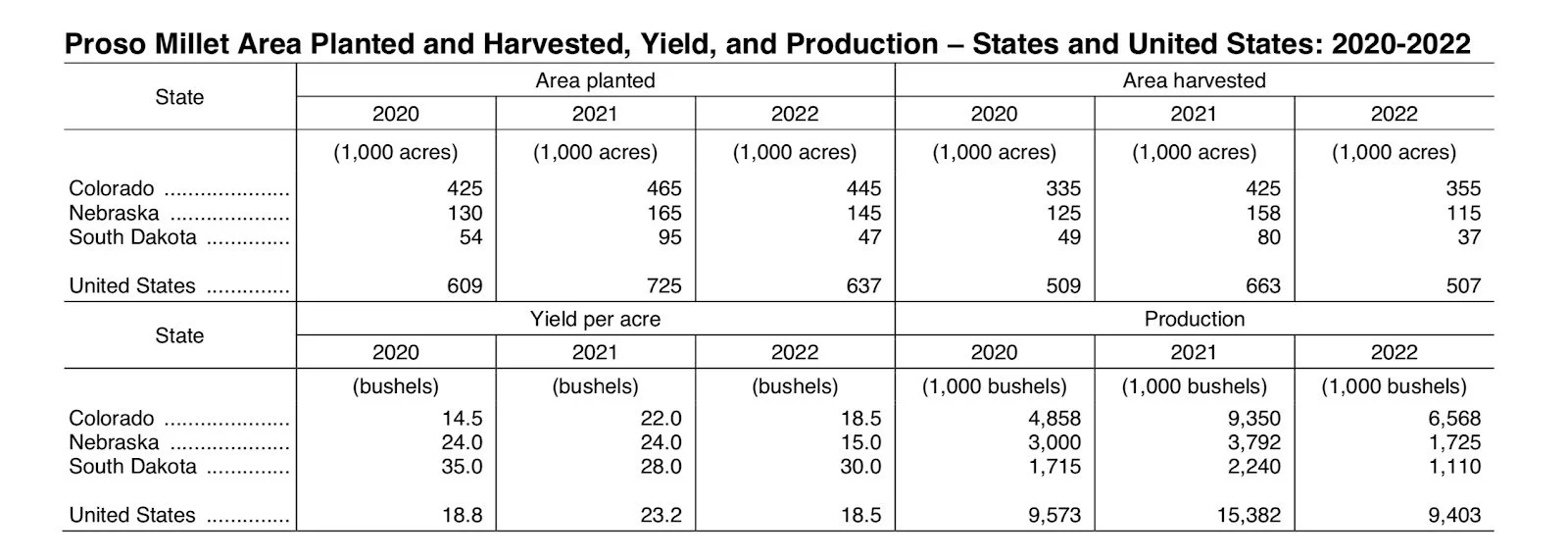

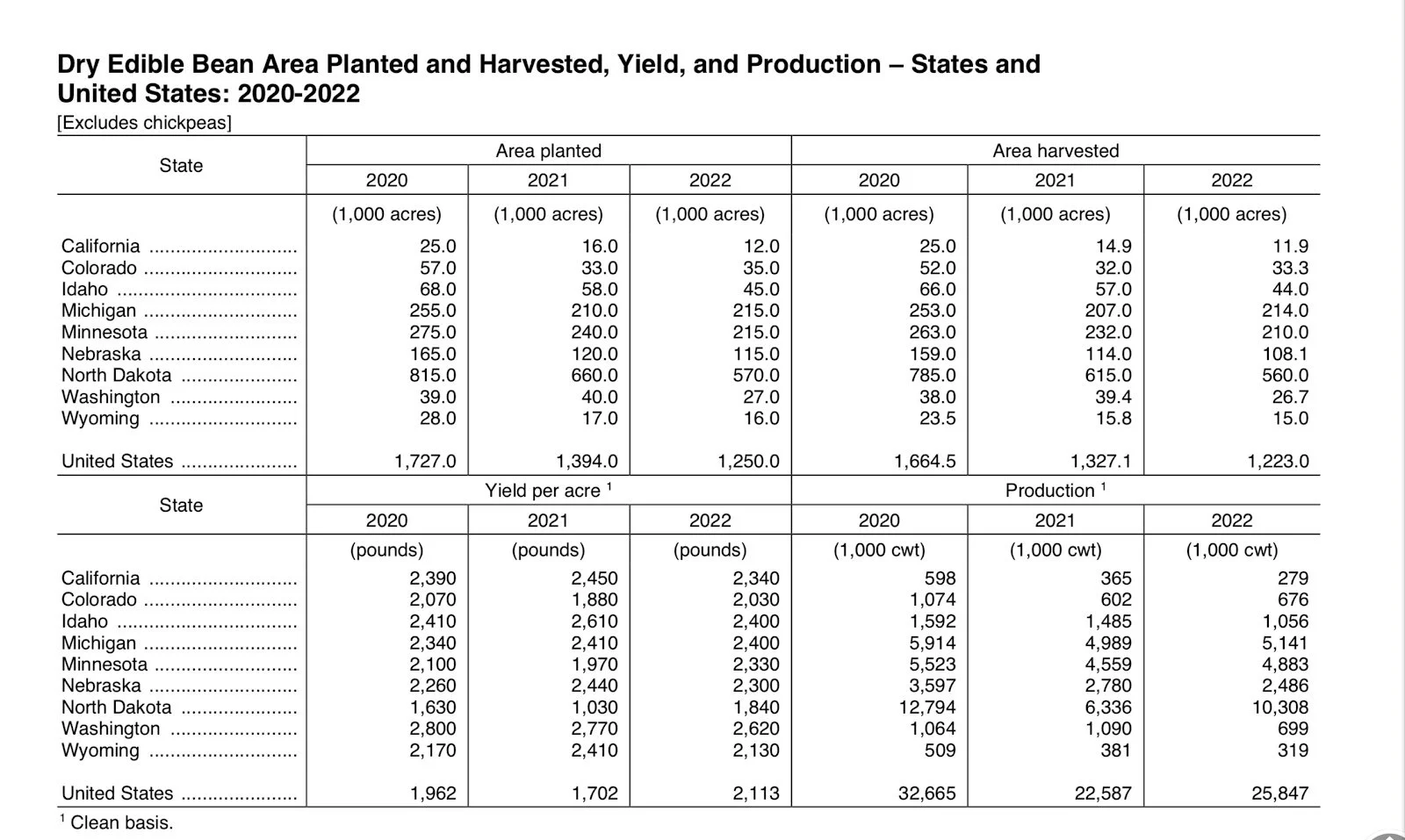

Millet and Sunflowers - etc

Here are a couple of snippets from last week’s USDA report.

Here are sunflower production, no real surprises here. Bottom line is if we can see any export business we could go screaming higher, if not we likely do not double from our harvest low like we have the previous few years. The one thing that sunflowers have going for them is the fact that farmers are price makers in sunflowers more than other grains/oilseeds.

But demand is a big question mark and the next few months will show how much staying power farmers have or don’t have.

For millet you will notice production is below two years ago when millet went screaming higher. The question is now can we find demand? If we can find demand, the sky will be the price limit, but presently it feels like the market doesn’t have enough demand.

Will corn ever have a 2012 type yield repeat?

Here is the big question, can 2012 type of yield versus trend line yield ever happen? If it does how many will go broke?

Is it possible that 2023 will see the 2022 drought move over the corn belt?

Commodity Overview by Sebastian Frost

Overview

Grains ended the week mixed. With soybeans seeing more weakness and wheat seeing some support. Soybeans by far had the most rough week, losing over -20 cents following our big rally last week.

Wetter Argentina forecasts were the main reason we saw heavy pressure in the soybean market. Argentina rain and drought will continue to be a dominating factor in the soybean market. Looks like they may have got some over the weekend.

With the Argentina rains over the weekend and wet forecasts I can’t help but think we open the week seeing pressure in both corn and beans. But there might be some opportunity for wheat.

If you missed it, listen to Friday's audio. Why you shouldn’t be making 2023 sales - Listen Here

Weekly Changes

March-23 Corn: +1 1/4 cents

March-23 Soybeans: -21 1/4 cents

March-23 Chicago Wheat: -2 1/4 cents

March-23 KC Wheat: +4 1/4 cents

March-23 MPLS Wheat: +3 1/2 cents

Today's Main Takeaways

Corn

Corn finished off the week Friday trading a hair lower, despite the amazing export numbers we saw.

A lot of focus for corn currently is the wet forecasts in Argentina, but we do continue to see production estimates lowered. As Buenos Aires cut their estimate by another 5.5 million MMT from 50 to 44.5 million. There is some strong belief that we continue to see these estimates drop even further rain or not. The USDA for starters has their estimate far higher at 52 million. While Dr. Cordonnier has his estimate at 44 million.

Overall there just isn’t a ton of fresh bullish news to get the markets moving higher. Add that to the Argentina rains and it makes me a tad nervous here short term. As there isn't a ton to look at from the demand side of the story right now either.

For prices to be further supported, we are likely going to need a bigger demand story. War and problems in South America are other factors that would help us push higher.

Despite me having a slight bullish tilt for corn, I do think we have the chance to see prices start of the week slightly lower with the Argentina rains. But that doesn’t take away from the fact that I see more upside in the future.

Highlights

Despite Argy rains, corn estimates continue to be lowered.

Buenos Aires recently cut their Argy estimate from 50 to 44.5 million metric tons, which is a sizeable cut. They also noted that this number could drop even further, perhaps 6 to 7 million more.

USDA remains far above this estimate at 52 million.

Dr. Cordonnier has the lowest estimate at 44 million.

Weekly export sales were well above expectations at 44.6 million bushels, with a range of 10 to 31 million.

Yesterday there were rumors of an Egypt corn purchase from Ukraine at 336 per metric tons, which is slightly below US offers of 338-345.

Weekly ethanol production numbers were at 1,008 thousand barrels. Up 943 from last week.

Ethanol stocks dropped 0.4 million barrels and was the lowest stocks number over the last 6 weeks.

Ethanol production is back up over +1 million barrels a day.

Exports coming out of Ukraine and brazil remain competitive compared to the US.

Main Factors

Argentina weather

Funds

Demand

War

Seasonal tendencies

Corn March-23

Soybeans

Soybeans capped off the week Friday with some more losses, adding onto an already pretty disappointing week. Ultimately losing over -20 cents on the week. Soybeans now nearing that $15 range again.

Obviously we all know about Argentina. They have an incredibly poor crop which has been the fuel to these recent rallies. But just as easy as their drought can push prices higher, rain can push them lower.

Over the weekend there is reports of 1-3 inches of rain covering a big portion of Argentinas crops. With some even more expected rain later in the week.

If they did indeed get plentiful rain, one could expect soybeans to see more pressure and start off the week lower. But looking longer term, the real question is just how bad is the crop, and do these rains even matter.

The two largest factors right now are #1 Argentina weather & #2 China. There are so many question marks surrounding China. But ultimately, if their situation can improve that would be beneficial. But that's something we just don’t know.

Fundamentally, if Argentina gets all this rain, soybeans don’t have a ton else going for them. We just don’t have that one major thing to support prices here for the time being. But there are two things that could help push prices higher. The first being if we see the China situation improve and see their appetite for US beans increase. The other is Brazil. They are expecting a massive crop which everyone already knows about. But their harvest is currently 7-10 days or so behind. We will have to see if this continues to be a bigger problem, as right now it doesn’t seem to be a very big point of concern.

Highlights

Early yield reports in Brazil point to above average yields.

Pretty good export sales, coming in at 36.2 million bushels, at the high end of the estimate range.

China covid uncertainty has put some pressure om ocean freight values and demand expectations.

Weather forecasts showing decent chance of rain in Argentina the next couple weeks.

Argentina crop conditions came in at their lowest its ever been, at just 3% rated good to excellent.

Main Factors

Argentina weather. Rain is expected. But is it too late or just in time?

China covid & economy. Will their situation improve or worsen?

Will we see some problems with Brazils harvest.

Brazil is still expecting record large crop.

Funds

They hold record long position in soy meal.

Seasonal tendencies

Soybeans March-23

Wheat

Wheat was the strongest of the grains on Friday, as KC wheat rallied +16 cents. For the week wheat was mixed, with Chicago slightly lower on the week and KC and MPLS both higher.

Overall, we haven’t seen a ton of change in the wheat market. The number one problem wheat is facing is the simple fact that the US remains outpriced by other countries around the globe as countries have abundant and cheap supplies.

With the global competition, we also have countries like Russia whom have plenty of supply and are expecting record crops. But, with Putins recent talk about restricting exports, it makes you question if Russia supposedly record crop is being overplayed. Perhaps its not quiet as large as some think.

War, wealth, and weather will continue to remain the influencing factors in the wheat market. The war looks so far from over, so there is still possibilities for this to create some bullish headlines. As for wealth, the funds are still incredibly short wheat. I don’t really see them continuing to add on to their short position here. I think once wheat breaks out of its down trend they step back in as buyers, helping further support the wheat market.

Bulls such as myself took a beating the last few months of the year aside from December. But I still think there is a solid chance the lows are in and we see higher prices in the coming months.

Highlights

Strong export sales from wheat as well. Coming in at 17.4 million bushels.

Russia's Ag Minister reported that they plan on exporting 55-60 metric tons of grain for 2022/23.

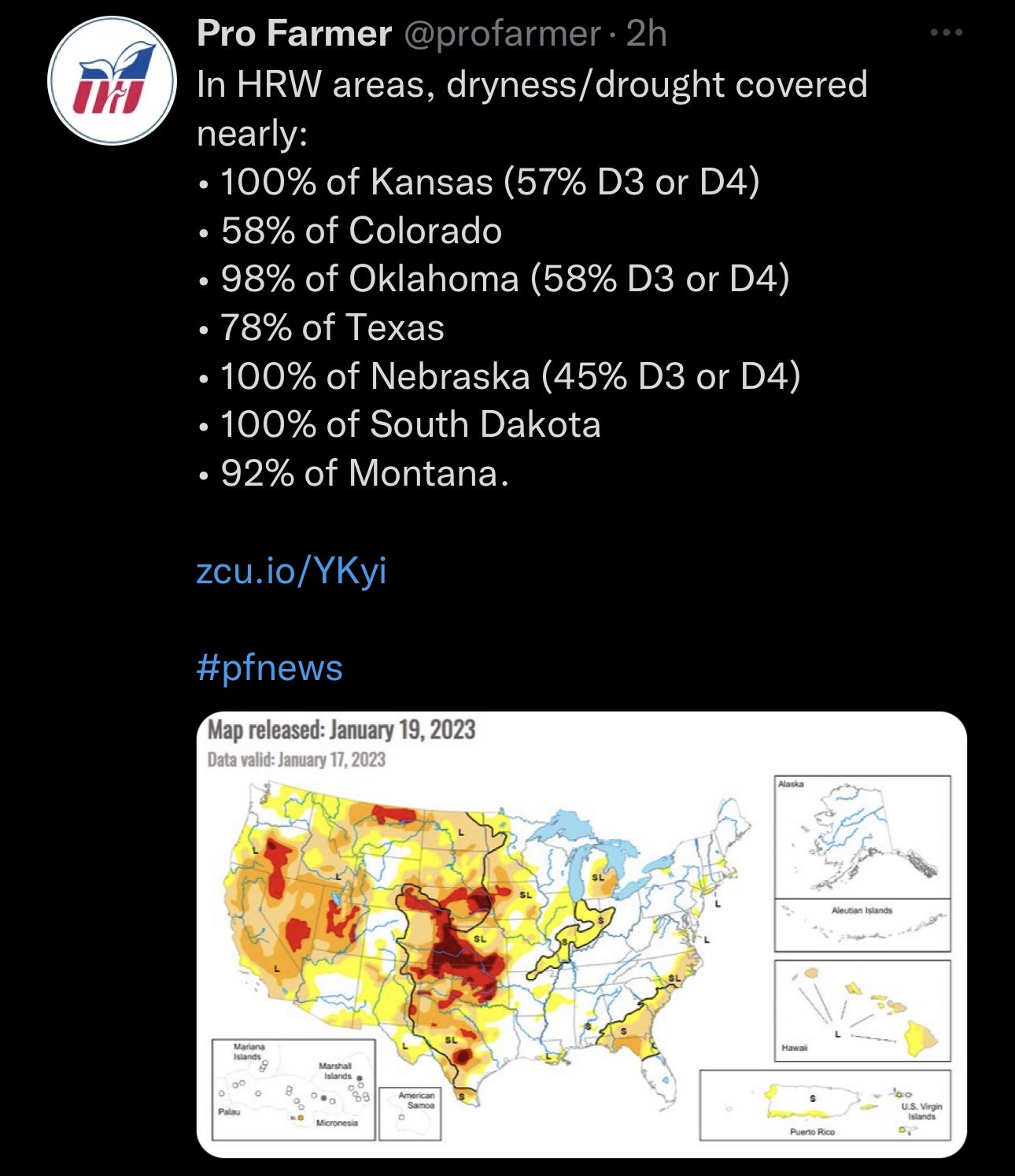

The recent rains have reduced the drought here in the US.

Russia's wheat exports in January are roughly 1.2 million less than they were in December.

There is a large backup of ships off the coast of Turkey that are having problems getting Ukraine exports loaded and inspected.

Main Factors

Global competition. US is still over priced relatively to other countries.

US Weather. Moisture in the southern plains.

Funds are short. Do we see them step back in as buyers.

War. Still far from over, but how well can these headlines support wheat. What decisions will Putin make.

Seasonal tendencies

US dollar, will it continue lower.

Chicago March-23

KC March-23

MPLS March-23

South America Weather

Argentina 8-15 Precipitation

Argentina 8-15 Max Temp

Brazil 8-15 Precipitation

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service