BEANS FALL APART

MARKET UPDATE

Video Version is Subscriber Only

For Full Access: CLICK HERE

(Charts & Main Takeaways at 4:53 min)

Prefer to Listen? Audio Version

Futures Prices Close

Overview

Corn & soybeans lower as beans get hammered while the wheat market was slightly higher.

Soybeans are now -58 cents off their highs from Sep 27th and have given back 50% of the rally.

There were 3 main reasons for soybeans getting hammered:

China stimulus news (or lack there of)

Rains in forecast for Brazil

Harvest pressure

As I mentioned last week, this week was likely going to bring some harvest pressure.

The heavy fund buying was offsetting the harvest pressure, but now the funds are potentially taking a more balanced approach as they have essentially removed their entire short position.

As of October 1st the funds are now only short:

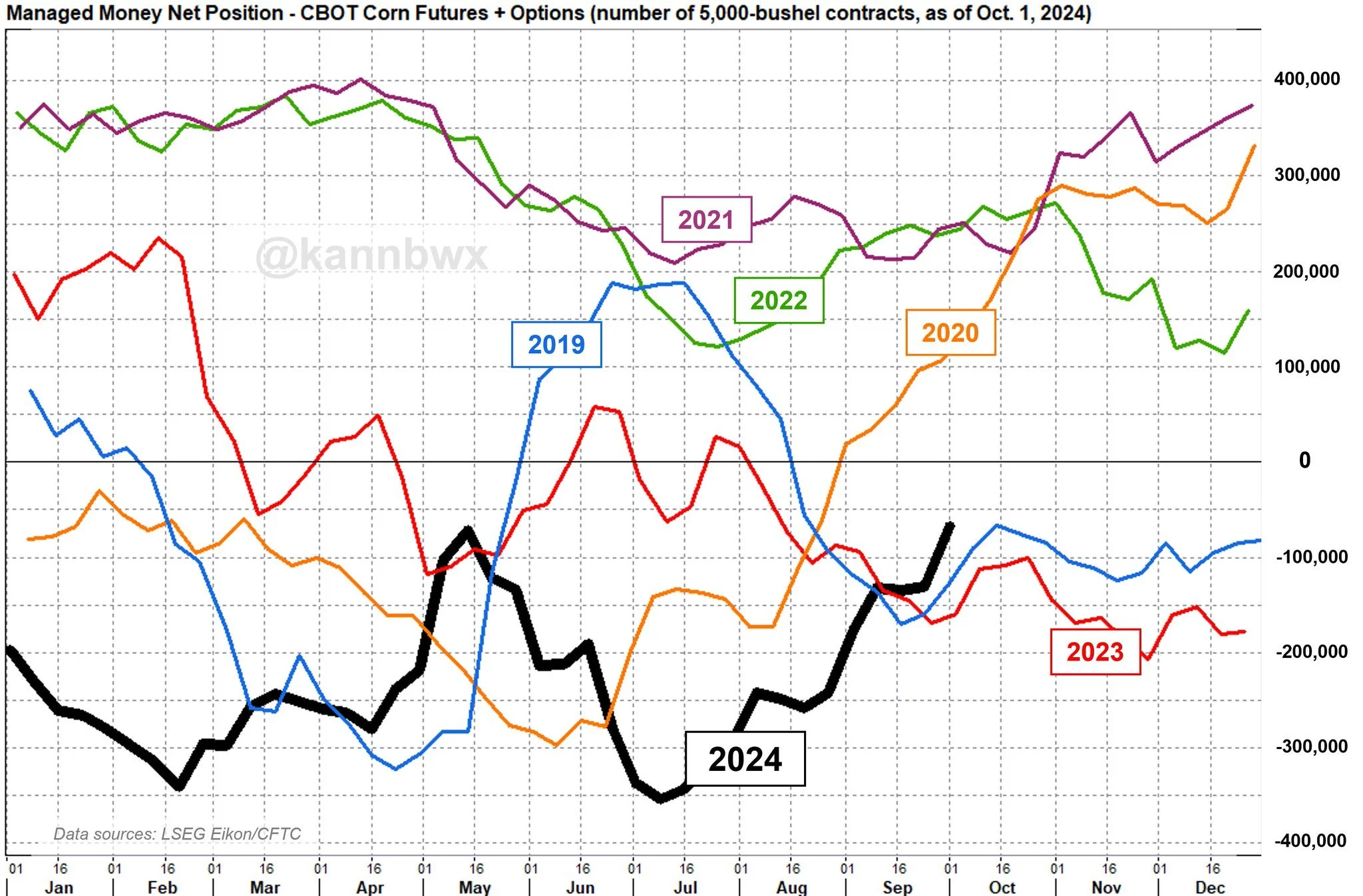

Corn: -72k (-356k record this year)

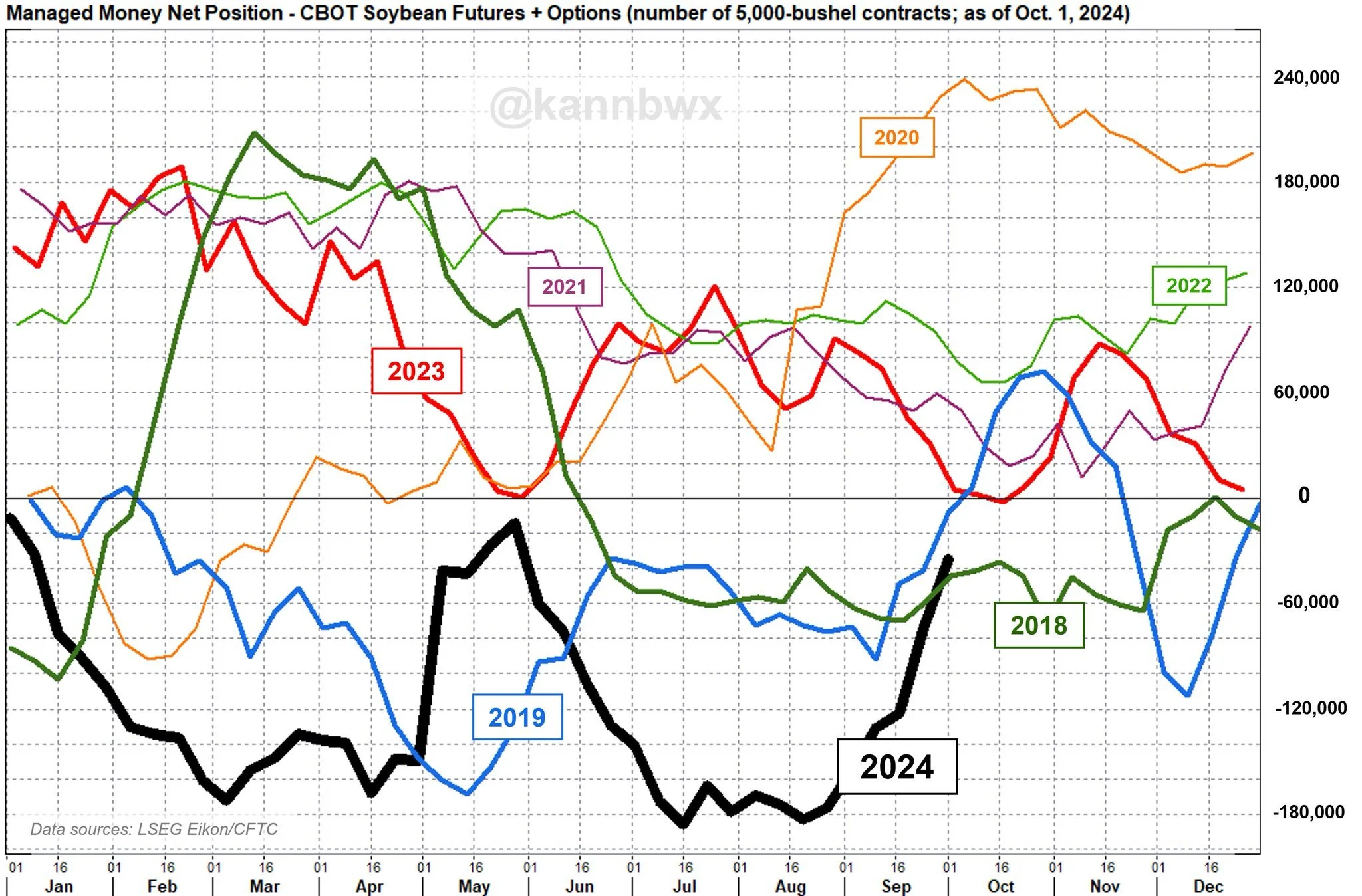

Beans: -32k (-186k record this year)

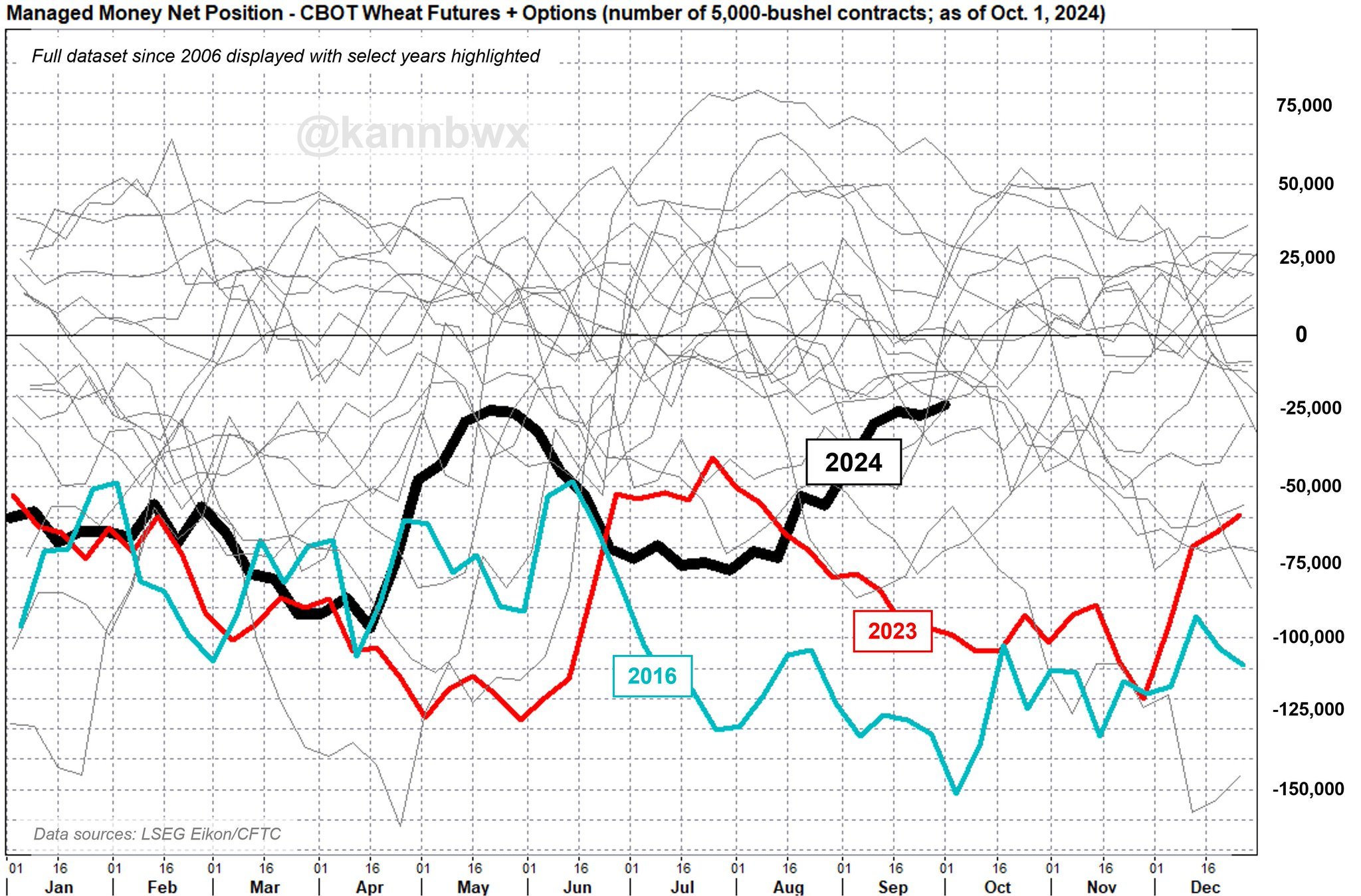

Wheat: -24k

For corn, this is the smallest the short position has been in 14 months. This is the smallest short in beans since May. This is the smallest SRW wheat short since October 2022.

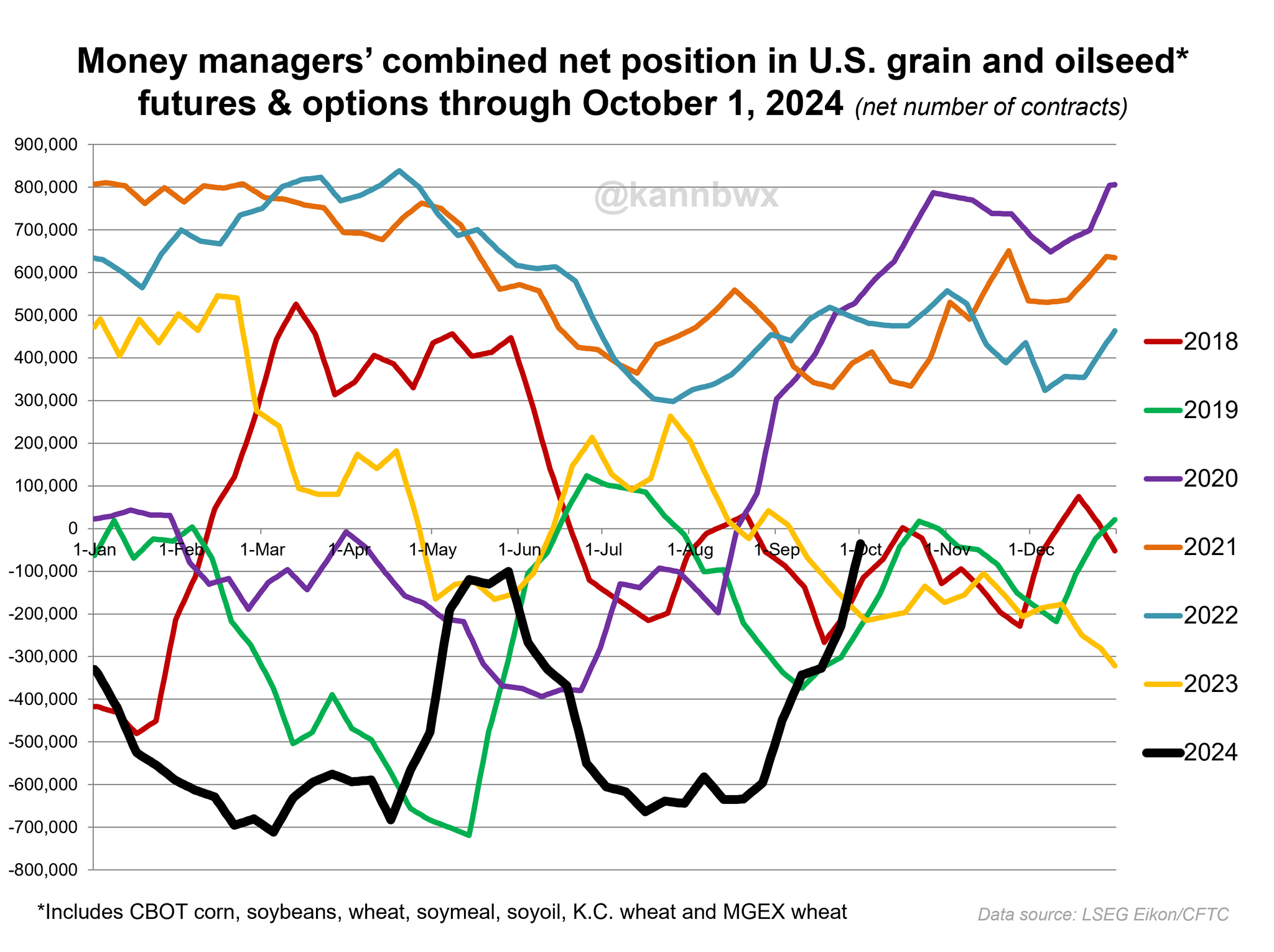

The funds went from record shorts, to almost not bearish at all across the entire ag complex.

All of these charts are courtesy of Karen Braun.

Combined Fund Position

Corn

Beans

Wheat

Now with the funds nearly even, and harvest in full swing, we could very well see more harvest pressure just like I mentioned we probably would see this week.

As the window for harvest is wide open with zero weather problems getting in the way.

Harvest is going to move fast.

Typically, you start to see less harvest pressure when harvest reaches over 50% complete. So we should start seeing less within the next 2 weeks.

Current Harvest Progress:

Corn: 30% (27% avg)

Bean: 47% (34% avg)

2 Week Forecasts

China Stimulus

Despite harvest pressure being there, the #1 reason for the absolute fall apart in soybeans today was China.

Going into last night, the trade was expecting China to release more details on their economy and the entire stimulus deal. But they did not. They provided very little details on it.

So the trade was disappointed that perhaps they are done trying to boost their economy for now. (Although I don’t think this is the last we will hear of it).

It definitely still has the potential to be a very beneficial factor. It could lead to China's economy improving. Which leads to more producer spending. Which leads to greater demand for grains.

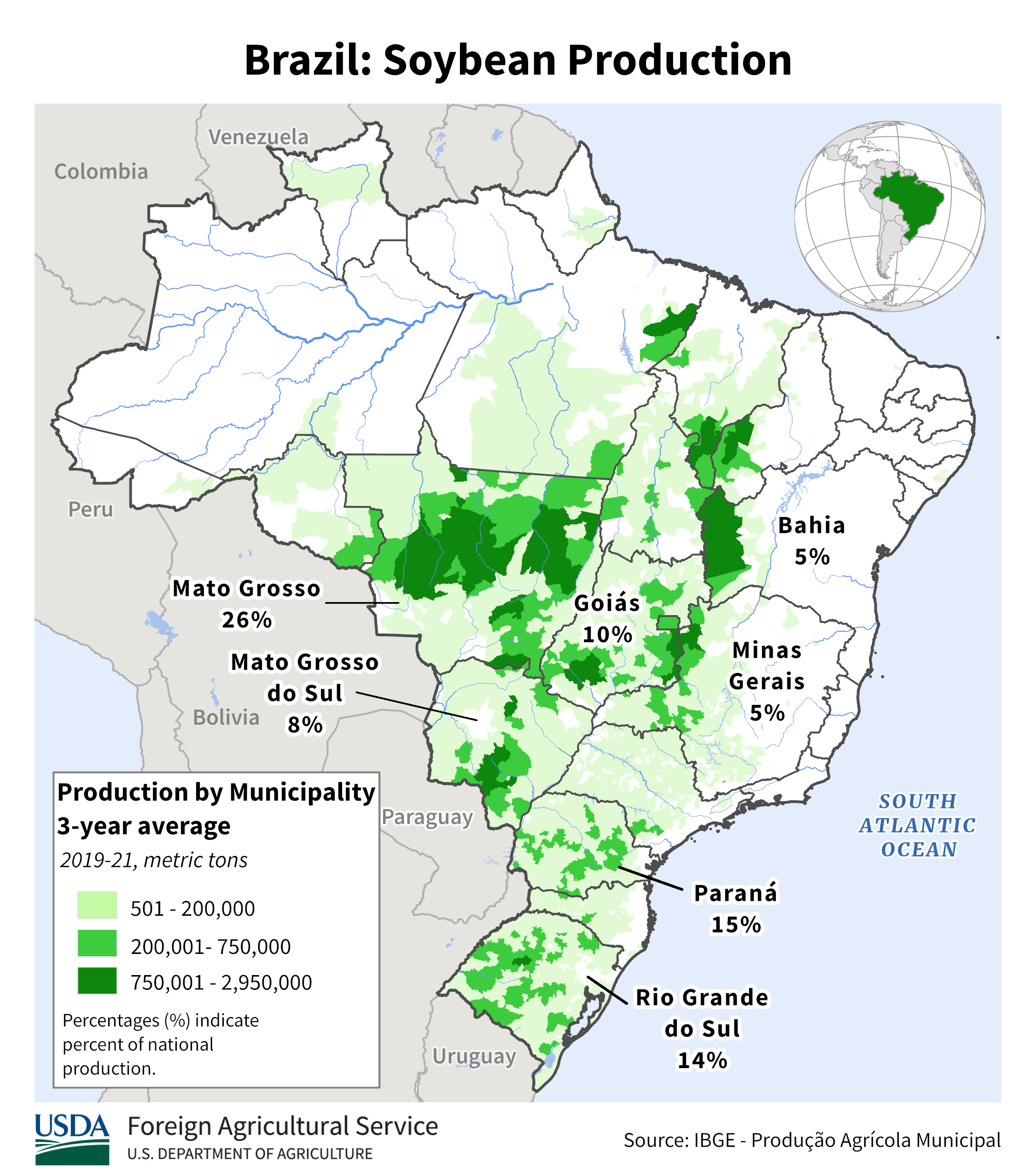

Brazil Rain

The rains in the forecast didn’t help beans.

The next 5 days look dry.

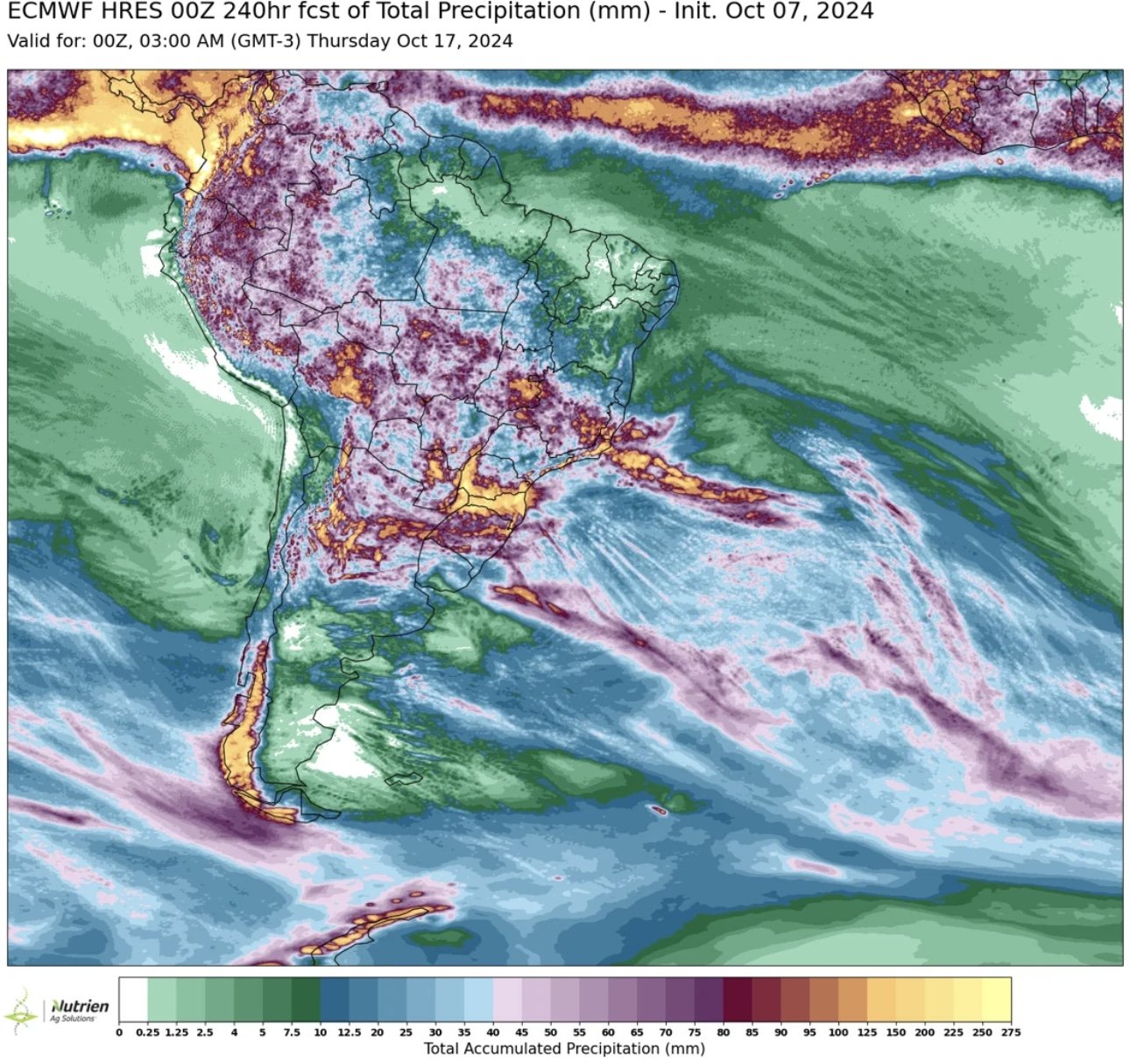

But all forecasts consensually call for rain within the next 10 days.

So it looks like rain will be coming and the bean crop will be planted. So no major concerns as of now.

Right now, bean planting is the slowest in 9 years. Only at 4.5% complete vs 10% last year.

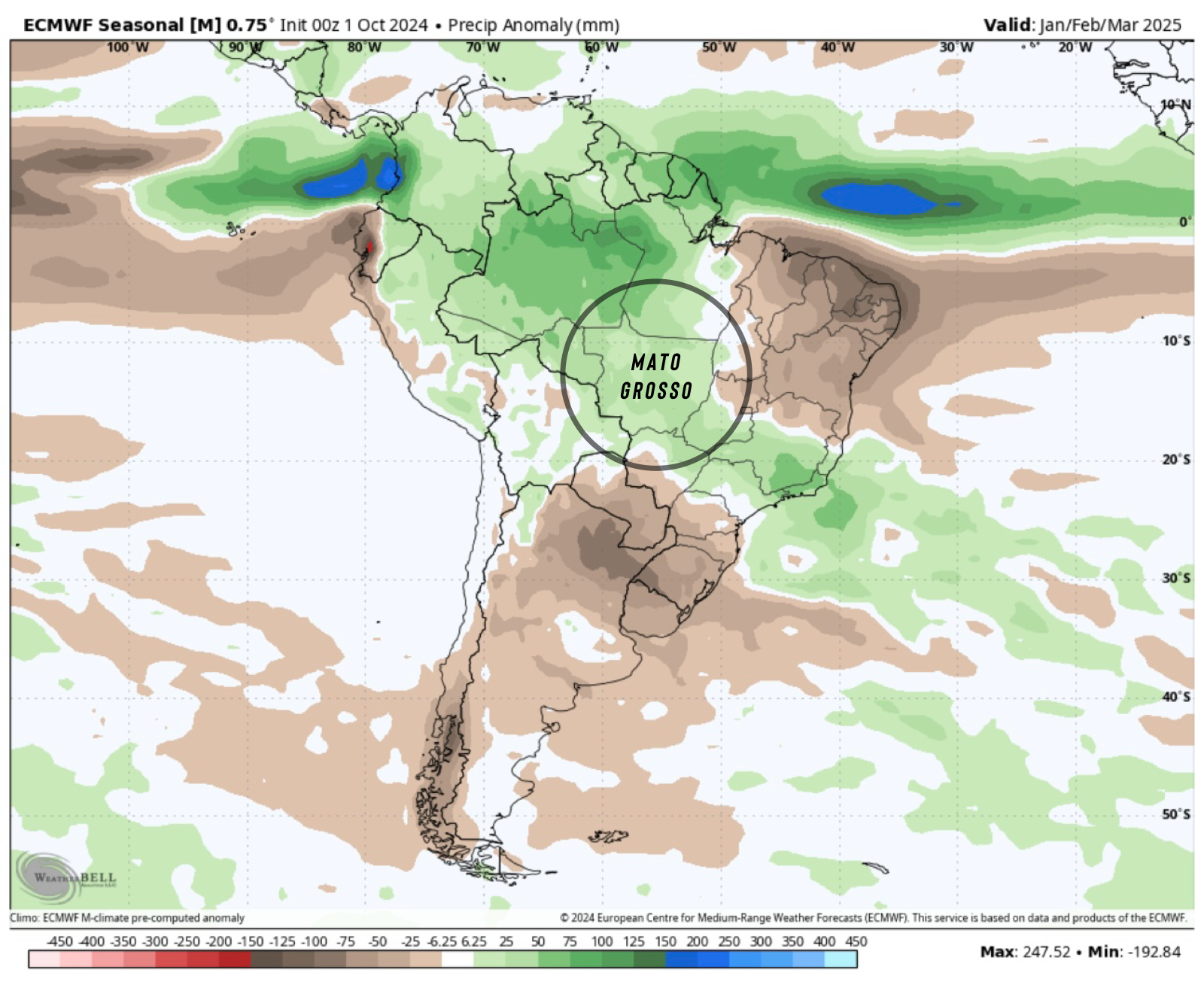

The forecasts also currently suggest wet through mid-November as well as a wetter pattern for Jan-March.

A weather scare is always possible. But the current forecasts don’t suggest so.

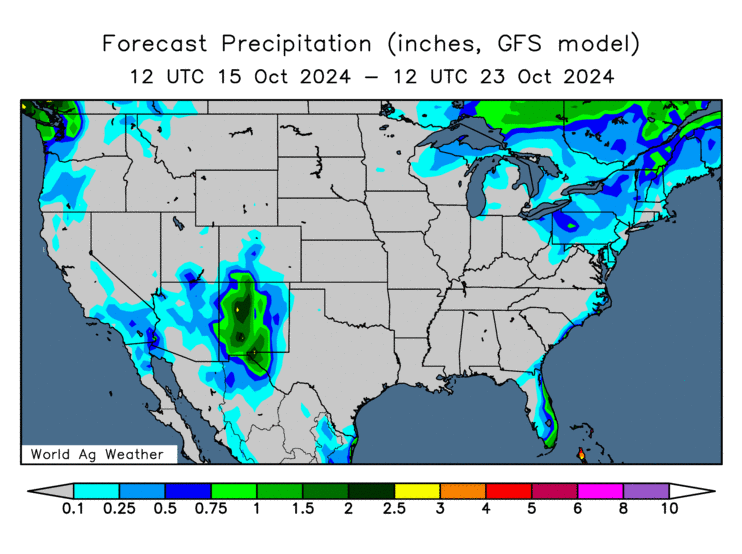

10-Day Rain

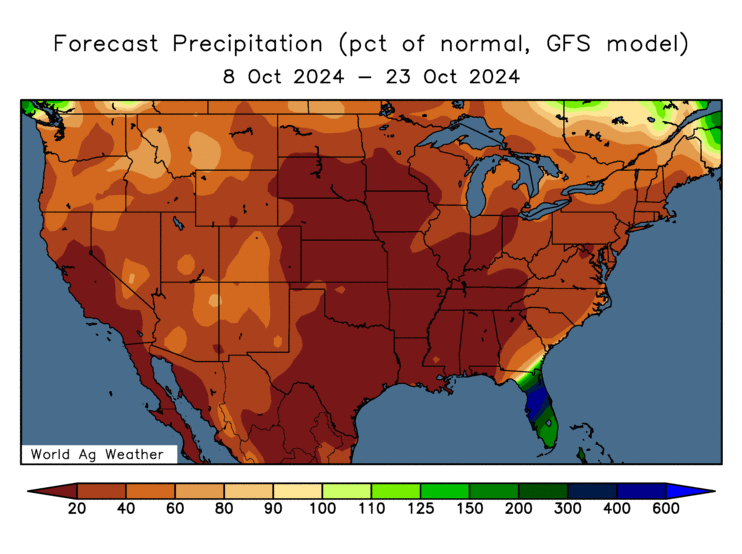

Rain Through Mid-Nov

Rain Through Jan-March

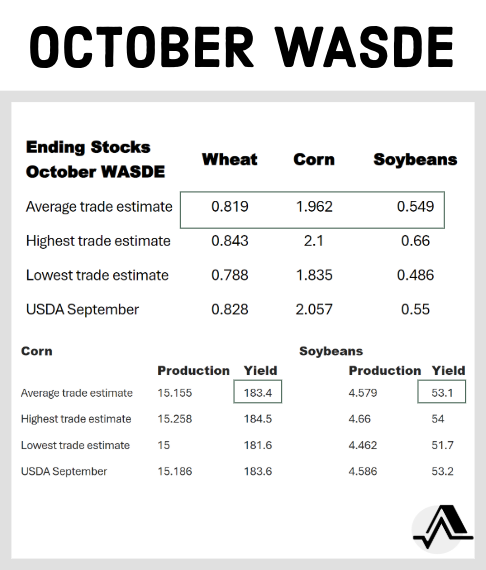

Upcoming USDA Report

The trade is expecting slight cuts to both corn & bean yield.

Corn carryout is also expected to fall below 2 billion bushels.

Now you would think this report would be friendly on the carryout side, given that they will be incorporating last report's feed & usage increase.

But the biggest risk is of course if yield increases. Specifically for corn.

Most agree beans probably saw their highest print. But there is still a possibility that corn yield creeps higher.

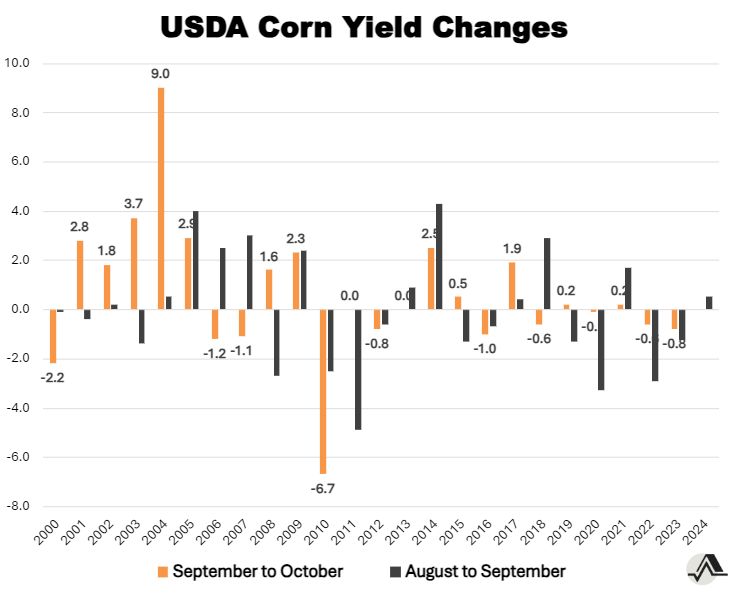

Here is the past yield changes for corn from this report.

We haven’t got a big increase to the upside since 2017.

Today's Main Takeaways

Corn

Short Term Thoughts:

Short term I could still see a little more harvest pressure. As we are only 30% complete.

We also posted an outside down day (took out yesterdays highs, closed below yesterdays lows). This is often a bearish signal and indicates more downside.

I would not be surprised at all to see us test the…………….

The rest of this is subscriber-only…

TRY 30 DAYS FREE: CLICK HERE

IN TODAYS UPDATE

Short vs long term thoughts

Why corn could higher long term

Is the bean rally over?

Chart breakdowns

Risk management

Wheat market breakdown

TRY 30 DAYS FREE

Get full access to our daily updates, sell signals, & 1 on 1 tailored market plans.

On Sep 27th we alerted a bean sell signal. Since then.. beans are down nearly -60 cents. Don’t miss future signals.

TRY 30 DAYS COMPLETELY FREE

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24

BULLISH USDA FOR CORN: RECOMMENDATION

9/27/24

UP-TOBER? SELL SIGNAL, TARGETS, & FACTORS

9/27/24

BEAN SELL SIGNAL

9/26/24

NEW HIGHS BUT CONCERNING CLOSE

9/25/24

HIGHEST CLOSES SINCE JULY. UPSIDE & SALES CONSIDERATION

9/24/24

GREAT START TO THE DAY, AWFUL FINISH

9/23/24

MASSIVE DAY FOR THE GRAINS

9/22/24

EARLY YIELD TALK, DROUGHT, BRAZIL, SEASONAL LOWS & MORE

9/19/24

GRAINS SEE TECHNICAL SELLING

9/18/24

FED DROPS RATES, BRAZIL STORY, 2025 SALES?

9/17/24

TARGETS & WHAT TO DO IF YOU BOUGHT PROTECTION

9/16/24

WAS TODAY HEALTHY CORRECTION BEFORE GRAIN RALLY RESUMES?

9/13/24

CORN & WHEAT BREAK OUT: EVERYTHING YOU NEED TO KNOW

9/12/24

USDA RAISES YIELD BUT REPORT WASN’T ALL THAT BEARISH

9/11/24

USDA TOMORROW. MAKE OR BREAK SPOT ON CHARTS

9/10/24

USDA THURSDAY

9/9/24