MARKETING STYLES, USDA RISK, & FEED NEEDS

AUDIO COMMENTARY

Very choppy action today

USDA report Friday

Bean sitting at support zone (chart below)*

China stimulus factor to watch

Brazil has rain coming. Priced in now?

If you plant SA beans late, 2nd corn is late

Livestock feed needs recommendation

What to do if you bought bean protection

Aggressive marketing style vs hedge 101

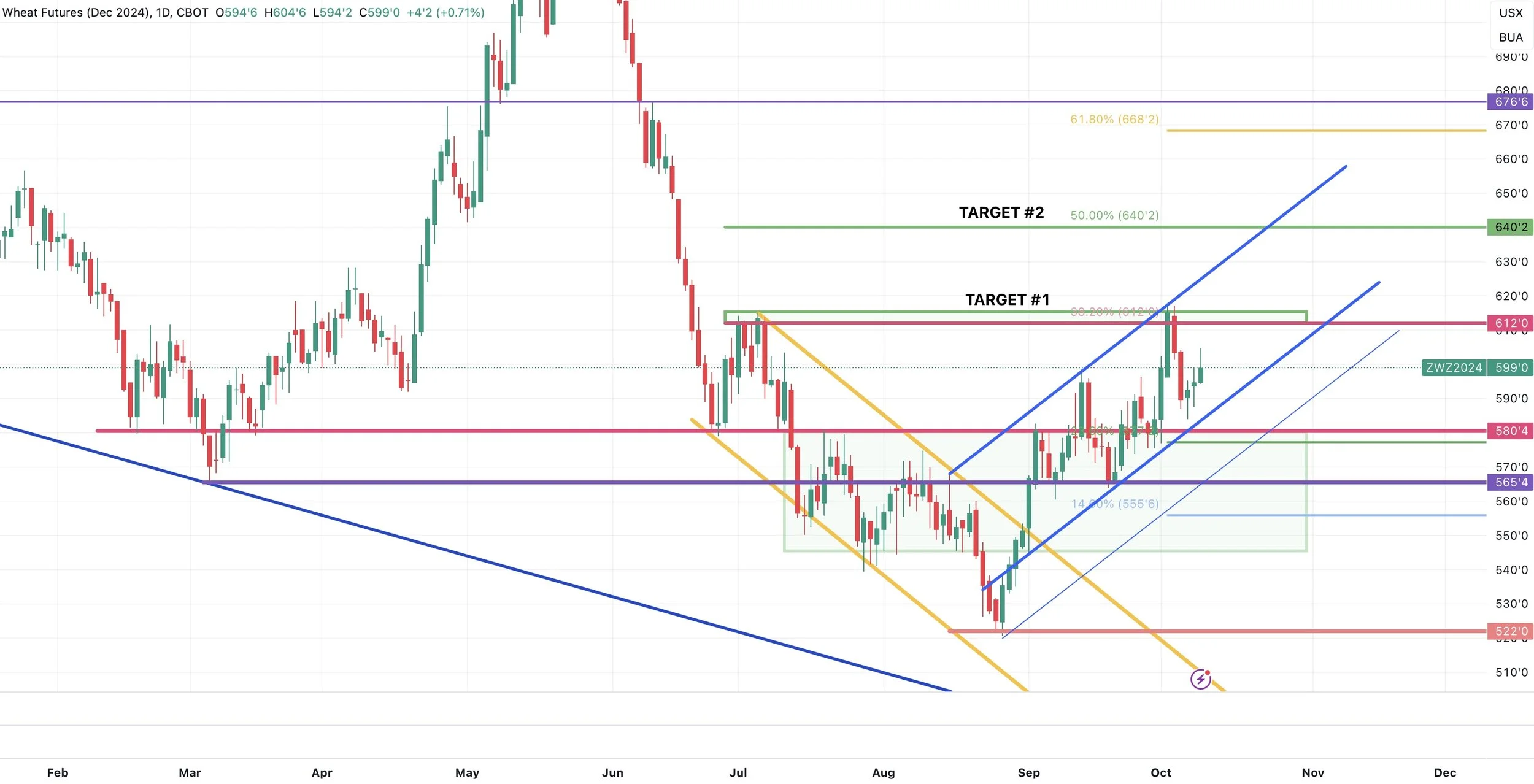

Why I think wheat can go higher

Wheat chart looks friendly (chart below)*

The risk going into the USDA

Nobody is prepared for massive yields

Listen to today’s audio below

You only got to listen to the LAST HALF of today’s 10min audio.

Subscribe if you want full access to every update. Every signal. Completely tailored 1 on 1 plans.

TRY 30 DAYS FREE: CLICK HERE

Want to talk? (605)295-3100

CHARTS

Corn 🌽

Still sitting at some support, right at our late July highs.

If this level fails I still wouldn’t be surprised to see us test the bottom of this channel and that $4.13 area. $4.13 should offer good support. Would really like to see us hold that.

Looking to the upside, if we can take out that recent high it should spark more technical buying. Bringing us to that $4.40 to $4.46 level.

Beans 🌱

The bean chart doesn’t look anywhere as bullish as corn or wheat. But it’s not completely broken despite us breaking below that channel.

Currently sitting in this support zone (green box) between $10.18 to $10.00

We NEED to hold $10.00. If we do not, there is not much support below until we get close to those lows.

Resistance to the upside remains at $10.65-80

Wheat 🌾

This chart looks pretty friendly. Very similar to corn actually, but I like that we already back tested that mid-Sep high and bounced.

Would like to see us hold this channel support.

If we break the channel, we still have heavy support at $5.80

Looking to the upside, if we break those recent highs it should cause more technical buying. The next target is $6.40

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24

BULLISH USDA FOR CORN: RECOMMENDATION

9/27/24

UP-TOBER? SELL SIGNAL, TARGETS, & FACTORS

9/27/24

BEAN SELL SIGNAL

9/26/24

NEW HIGHS BUT CONCERNING CLOSE

9/25/24

HIGHEST CLOSES SINCE JULY. UPSIDE & SALES CONSIDERATION

9/24/24

GREAT START TO THE DAY, AWFUL FINISH

9/23/24

MASSIVE DAY FOR THE GRAINS

9/22/24

EARLY YIELD TALK, DROUGHT, BRAZIL, SEASONAL LOWS & MORE

9/19/24

GRAINS SEE TECHNICAL SELLING

9/18/24

FED DROPS RATES, BRAZIL STORY, 2025 SALES?

9/17/24

TARGETS & WHAT TO DO IF YOU BOUGHT PROTECTION

9/16/24

WAS TODAY HEALTHY CORRECTION BEFORE GRAIN RALLY RESUMES?

9/13/24

CORN & WHEAT BREAK OUT: EVERYTHING YOU NEED TO KNOW

9/12/24

USDA RAISES YIELD BUT REPORT WASN’T ALL THAT BEARISH

9/11/24

USDA TOMORROW. MAKE OR BREAK SPOT ON CHARTS

9/10/24

USDA THURSDAY

9/9/24