3-DAY RALLY COMES TO AN END

Overview

Grains mixed here to start Thursday, with corn and wheat futures taking a breather which isn’t too surprising given our recent rally. Overall the markets continued to be supported by optimism that we see an increase in Chinese demand as well as dry forecasts in Argentina.

Weekly export sales delayed until tomorrow with the holidays.

Markets will be closed next Monday, January 2nd.

This is a heads up that we will not have our usual Sunday Weekly Grain Newsletter this Sunday due to the holidays. Updates will continue as normal after next week. Enjoy your holidays.

Below is yesterday's audio commentary in case you missed it

Is $9 Corn & $20 Beans Possible? - Listen Here

For those of you still on a trial, our 50% off holiday sale ends Saturday, December 31st.

Today's Main Takeaways

Corn

Not a ton of movement in the corn market today, as corn traded slightly lower here. Down -3 1/4 cents, trading in a very tight 5 cent range.

Corn saw some weakness today as there was just a lack in fresh bullish news to get the needle moving higher. We also had less traders involved in the markets due to the holiday week.

Weakness today wasn’t anything unexpected either, as we have seen an impressive rally as of recent. In yesterday's update I said I wouldn’t to be too entirely surprised to see prices take a breather here, with the chance of seeing prices correct to the $6.70 or so range which is where the trendline lays.

There is some rumors that China will be buying U.S. corn as before harvest, South America has less supplies, thus leading China to possibly look to the U.S.

Brazil exempted U.S. ethanol from tariffs through March. This actually might be pretty beneficial in adding support to corn as it highlights that Brazil is short corn.

Weekly energy numbers weren’t great. As crude oil stocks increased and ethanol stocks increased to the highest level in late December that they have on record.

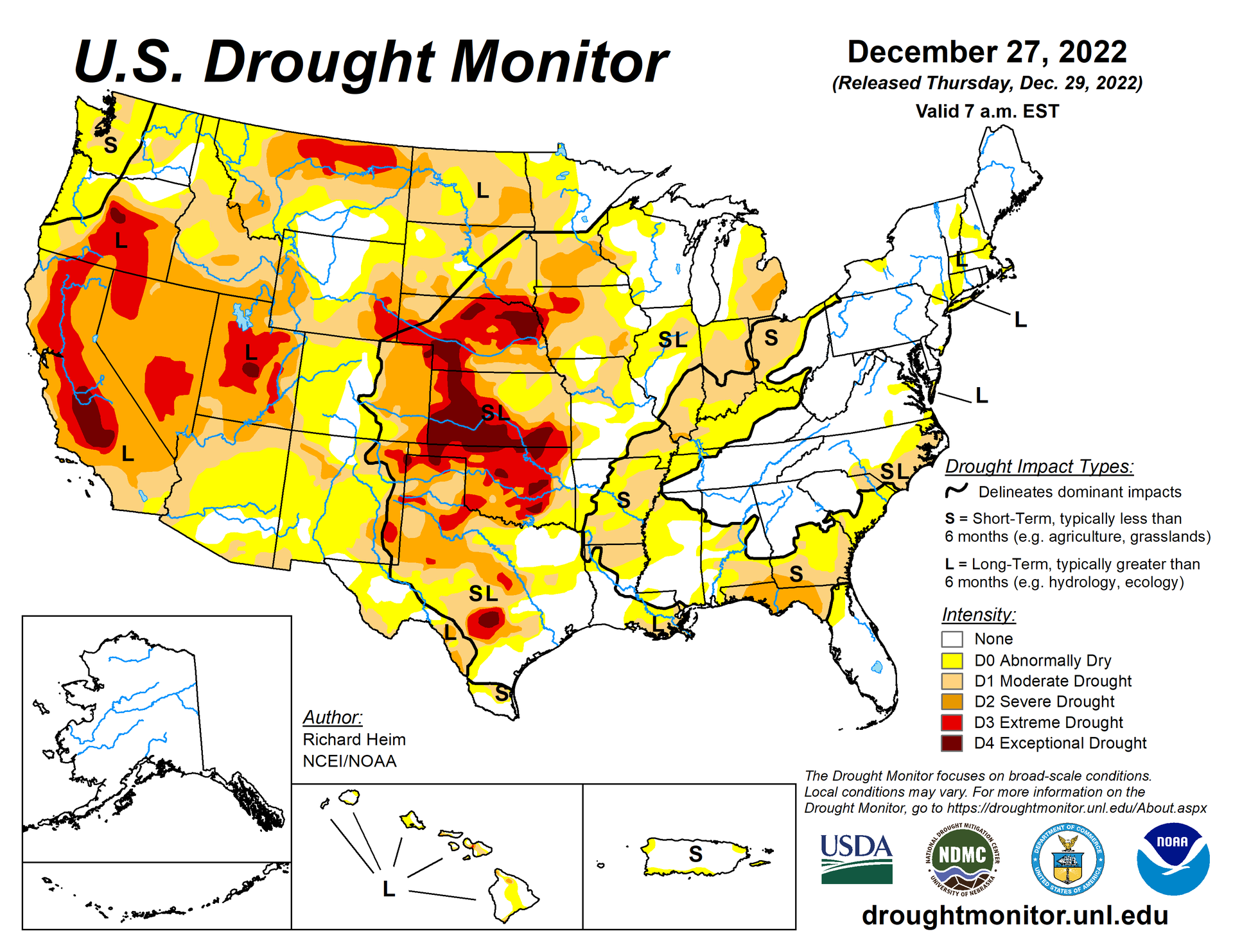

Argentina's corn planting is only at 52% complete. So there is still concerns for the Argentina crop. Similar to soybeans, Argentina weather will continue to be one of the larger factors going forward in the corn market.

The uncertainties in the market remain the same, with the largest two factors being of course South American, but also China and their covid situation. As they are backing off of their restrictions.

Even though I could see prices correcting lower here short term following this rally, it doesn’t take away from the fact that I still have a slight bullish tilt on corn going forward. Ultimately I think we could see a retest of $7 due to a variety of factors.

March-23 (6 Month)

Soybeans

Soybeans seeing a little bit of strength again here today following yesterday's impressive 25 cent rally. Prices still sitting over $15 by a good margin. We will have to wait and see if this rally will be sustained or if we run into some selling.

Meal futures saw sharp gains yesterday along with the soybean futures. As Argentina is the worlds leading meal exporter. With the poor soybean crop in Argentina, this means there will be less meal exporting next year.

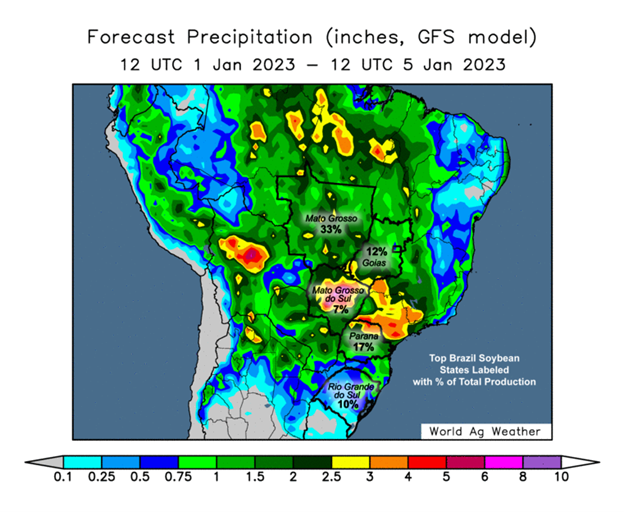

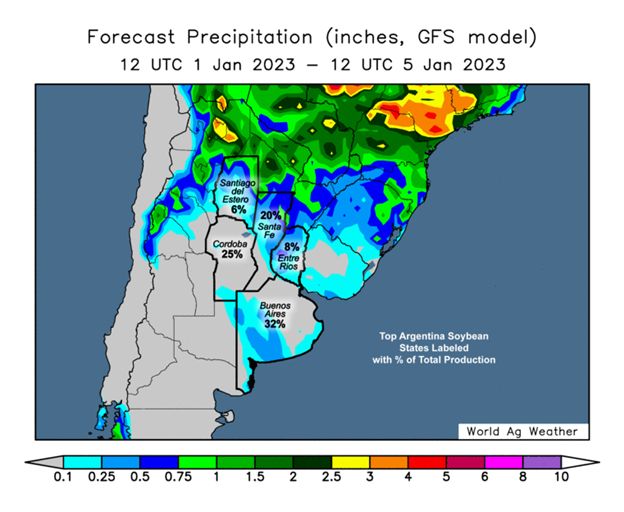

Taking a look at Argentina forecasts which have the focal point in the soybean market. Looks like they might get some rain the next day or two, but temps are still very hot. Seeing temps of over 100 the next week or two. Could see some pressure tomorrow depending how these forecasts shake out.

If Argentina forecasts remain dry and they don't receive any meaningful rain soon and soybean futures can stay elevated over $15. I don't see any reason why we couldn’t see prices continue to trade higher next week. But of course there are many uncertainties, South American weather being the largest.

The other big factor that we mentioned above in the corn section is China. Chinese demand and how their covid situation plays out will be the other thing to keep your eyes on for the soybean market.

With the recent rally, many other advisors have placed sell signals for soybeans. Of course it is never a bad idea to take off some risk, as one should be comfortable in their operation. So we advise you to do whatever makes you comfortable. But there are a few other ways to manage risk in the soybean market. We go over this in more depth in our past two audio updates. You can listen to them below.

Tuesday's Audio

Is it time to sell soybeans? - Listen Here

Yesterday's Audio

Is $9 corn & $20 beans possible? - Listen Here

Soymeal down -2.8 to 458.5

Soy oil up +1.39 to 66.36

Soybeans March-23 (6 Month)

Wheat

Wheat futures started off the morning sharply lower but rebounded nicely from our early lows. Still seeing some losses as Chicago closed down -11 cents, KC down -16, and Minneapolis getting hit the hardest down -20 cents. Chicago closed nearly a dime off its lows of $7.65 1/2 as it closed at $7.74. Minneapolis on the other hand ended the day near its lows, not seeing the same rebound as Chicago.

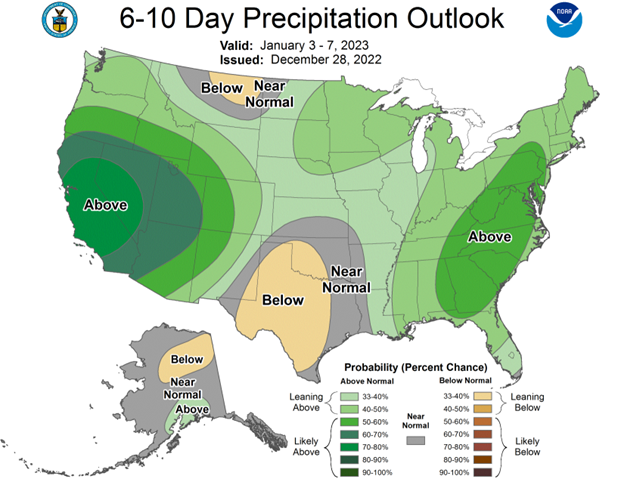

Wheat futures are likely seeing some pressure from the warmer temps across the U.S. following the nation wide snow storms a few short weeks ago. The warmer temps are melting the snow which should give the crops better moisture. But this is also somewhat of a mixed bag. As with the snow melting, yes this gives crops better moisture, but it also removes that layer of protection from a winter kill. Which puts the crops at greater risk of a freeze.

Wheat also pressured by rains across the midwest. As they are talking 3-5 inches of rain east of the Mississippi. Areas like Nebraska and Kansas also expected to get some rain.

The Russian ruble has seen a sharp decline, which makes the Russian wheat cheaper. Prices now at their lowest levels in two months. So these lower prices create further competition which isn't helping the wheat market. This was one of the biggest reasons for the losses in wheat futures today. Wouldn’t be surprised to see export numbers on the light side tomorrow.

SovEcon raised their 2022-23 wheat production estimates for Russia from 100.9 to 101.2 million metric tons.

Rosario Grains Exchange lowered their Argentina wheat estimate by 300,000 metric tons to 11.5 million, with the worst yields we've seen since 2010.

The $8 mark is the level bulls will be watching as that would be a key level in this reversal from our recent bottom. Most including myself seem to think that if we can just reach that $8 mark, we have plenty of more room to the upside.

I have said this time and time again, but I think wheat probably has the best upside in the markets given our low levels. Now Im not saying we can’t see prices lower here in the next day or even weeks. But looking long term we definitely have the potential to see prices higher from here.

Funds have been in control of the wheat market. But have reduced their massively short position on this recent 50 cent rally. I think funds will continue to liquidate their their short positions in the future. From a technical standpoint, wheat is also nowhere near any massive resistance.

Wright on the Markets had a good write up talking about wheat and managed money. I included it in yesterday's update. Which you can read here

Chicago March-23 (6 month)

KC March-23 (6 month)

MPLS March-23 (6 month)

Fertilizer Price Update

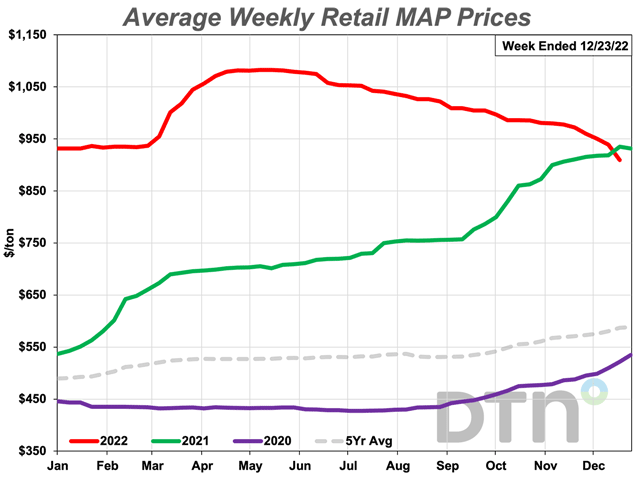

All of this info comes from DTN. You can read their full article here

Average retail price for all 8 fertilizers are now lower compared to last month. As all prices are noticeably lower going into the last week of the year.

With 3 fertilizers being significantly lower compared to last month (A significant change is considered a 5% or more move).

MAP, potash, and urea were all 6% cheaper compared to last month.

MAP had an average price of $909 per ton

Potash $790 per ton. Moving below $800 a ton for the first time since December 2021.

Urea $757 per ton

The 5 remaining fertilizers were slightly cheaper compared to last month.

DAP had an average price of $890 a ton. Moving below $900 for the first time since February 2022.

10-34-0 was $751 per ton

Anhydrous $1,360 per ton

UAN28 $578 per ton

UAN32 $681 per ton

Fertilizer prices compared to last year are now mixed. With 6 being cheaper and 2 being more expensive.

More Expensive Compared to Last Year

UAN32 is 1% higher

DAP is 3% higher

Cheaper Compared to Last Year

UAN28 is 1% lower

MAP is 2% lower

Potash is 2% lower

10-34-0 is 5% lower

Anhydrous is 5% lower

Urea is 17% lower

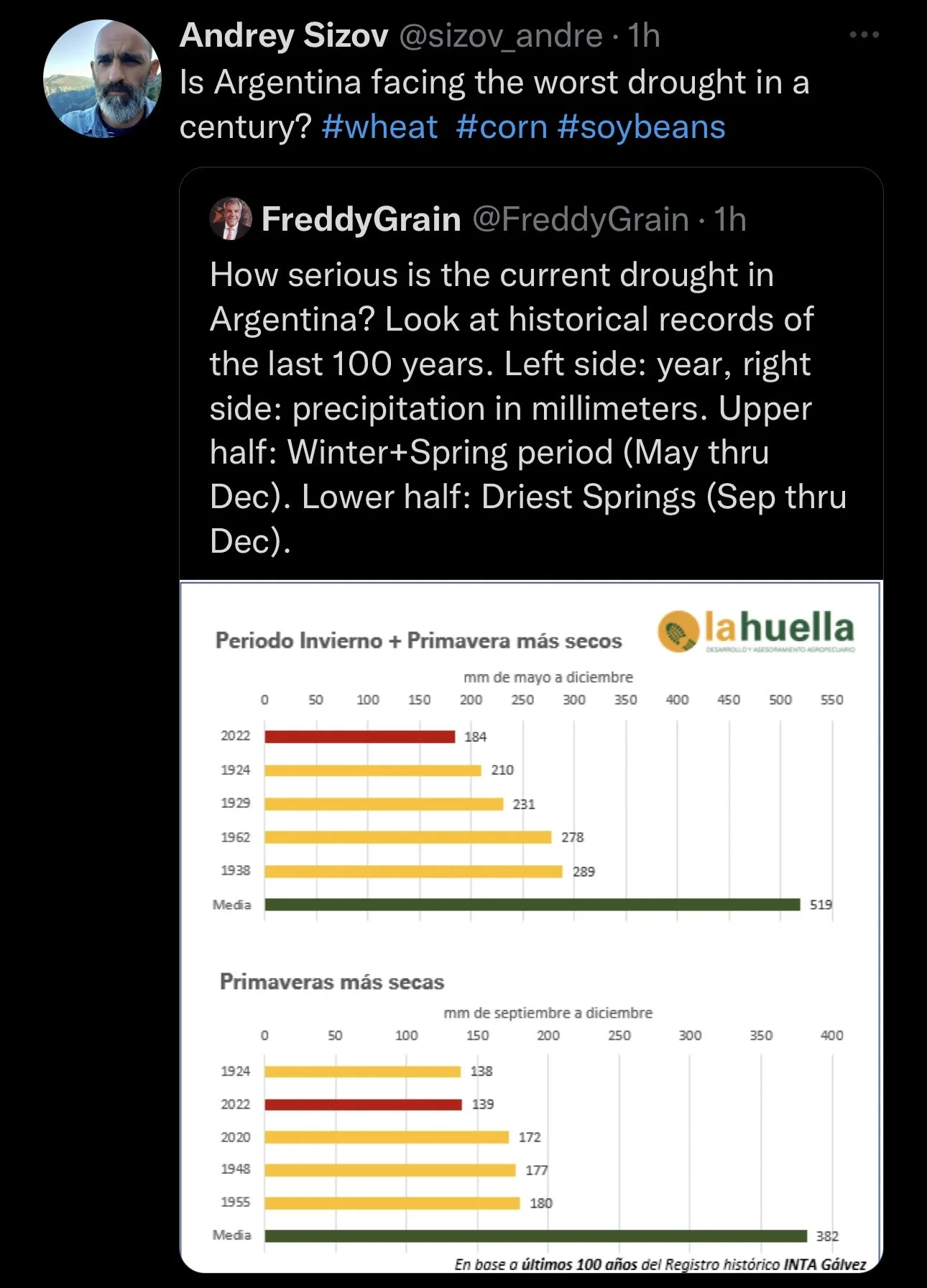

Argentina Drought

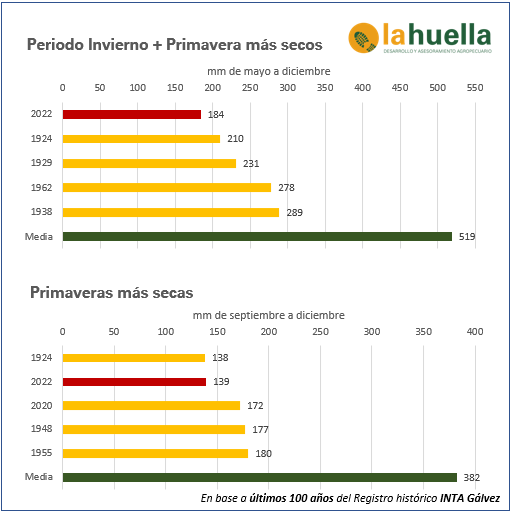

One might ask, how serious is this Argentina drought everyone keeps talking about?

Below are two charts that show the historical records of the last 100 years.

The Top Chart (Periodo Invierno + Primavera mas secos) means Winter + Spring period which is May through December.

The Bottom Chart (Primavera mas secas) means Driest Springs which is September through December.

As you can tell from the chart, 2022 is highlighted in red and is arguably the worst drought on record.

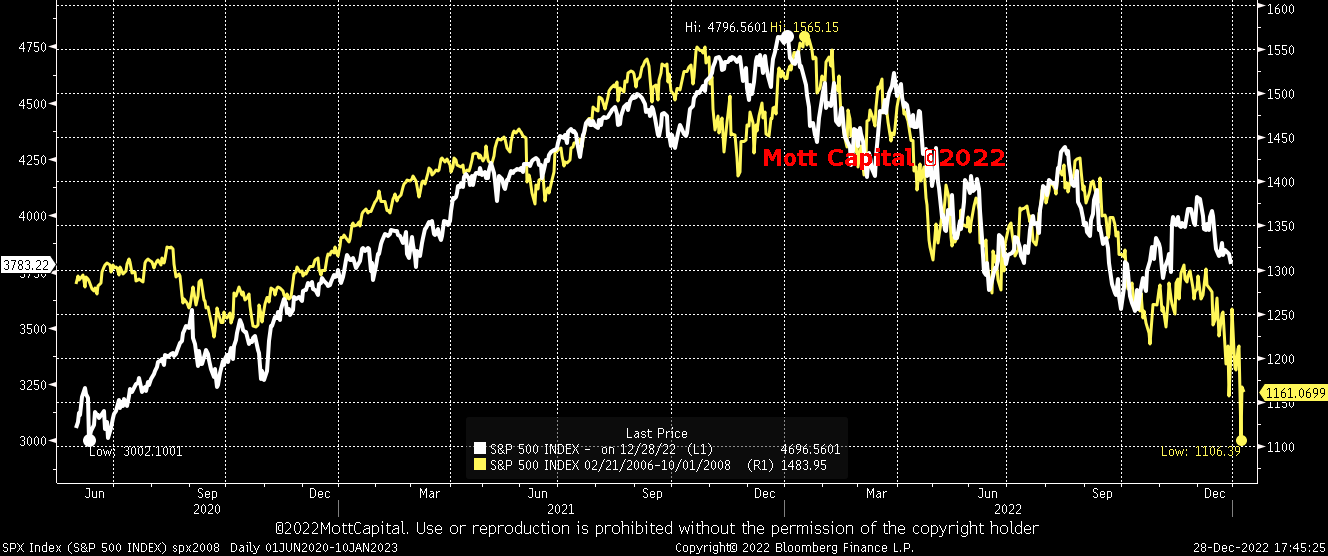

Recession

For months I've said in a few updates that I didn’t think the bottom was in for the stock market. I still hold this opinion. Of course perhaps we did find a bottom. But many big names such as Goldman Sachs and Elon Musk agree that there is greater chance we see the recession worsen in 2023 rather than improve. We already know that the Feds will continue to raise interest rates through out the year.

Something to also note is that 2022 is the worst year collectively for stocks and bonds since 1871.

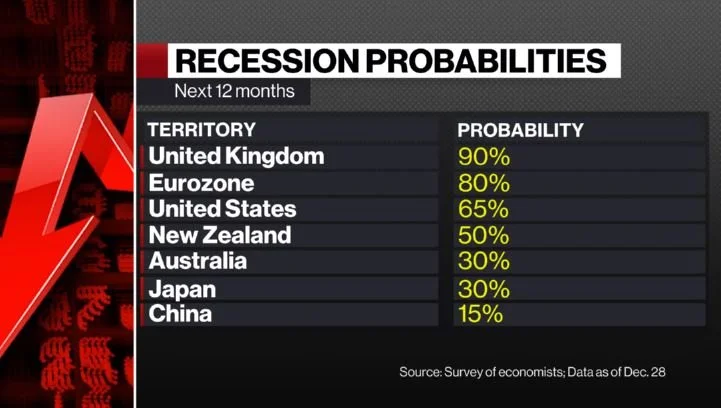

A recent survey from economists gave the U.S. a 65% chance at seeing a recession the next 12 months. We are already in a recession. The only question is, how much worse can it get.

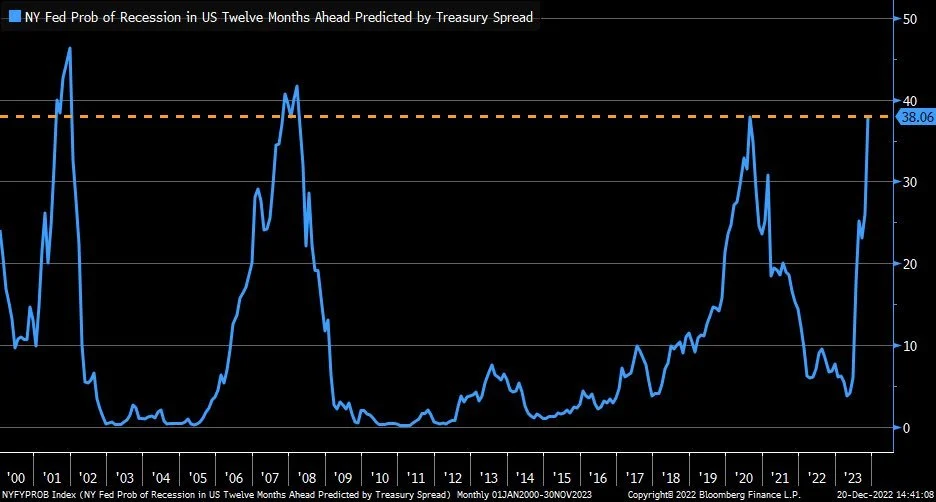

The New York Fed reccession probability scale just surpassed that of 2020 and is nearing the that of 2008.

These are the worst performing stocks in the NASDAQ-100 this year

Tesla (-69%)

Facebook (-65%)

Nvidia (-52%)

Netflix (-52%)

Amazon (-50%)

Google (-39%)

Here are a few charts comparing the S&P 500 from 2022 vs 2008

Chart credit to @MichaelMOTTCM and @SuburbanDrone on Twitter respectively

Other Markets

Crude oil down -0.65 to 78.31

Dow Jones up +350

Dollar Index down -0.582 to 103.600

Cotton down -0.62 to 82.64

Highlights & News

The U.S. is requiring visitors from China to have a negative covid test

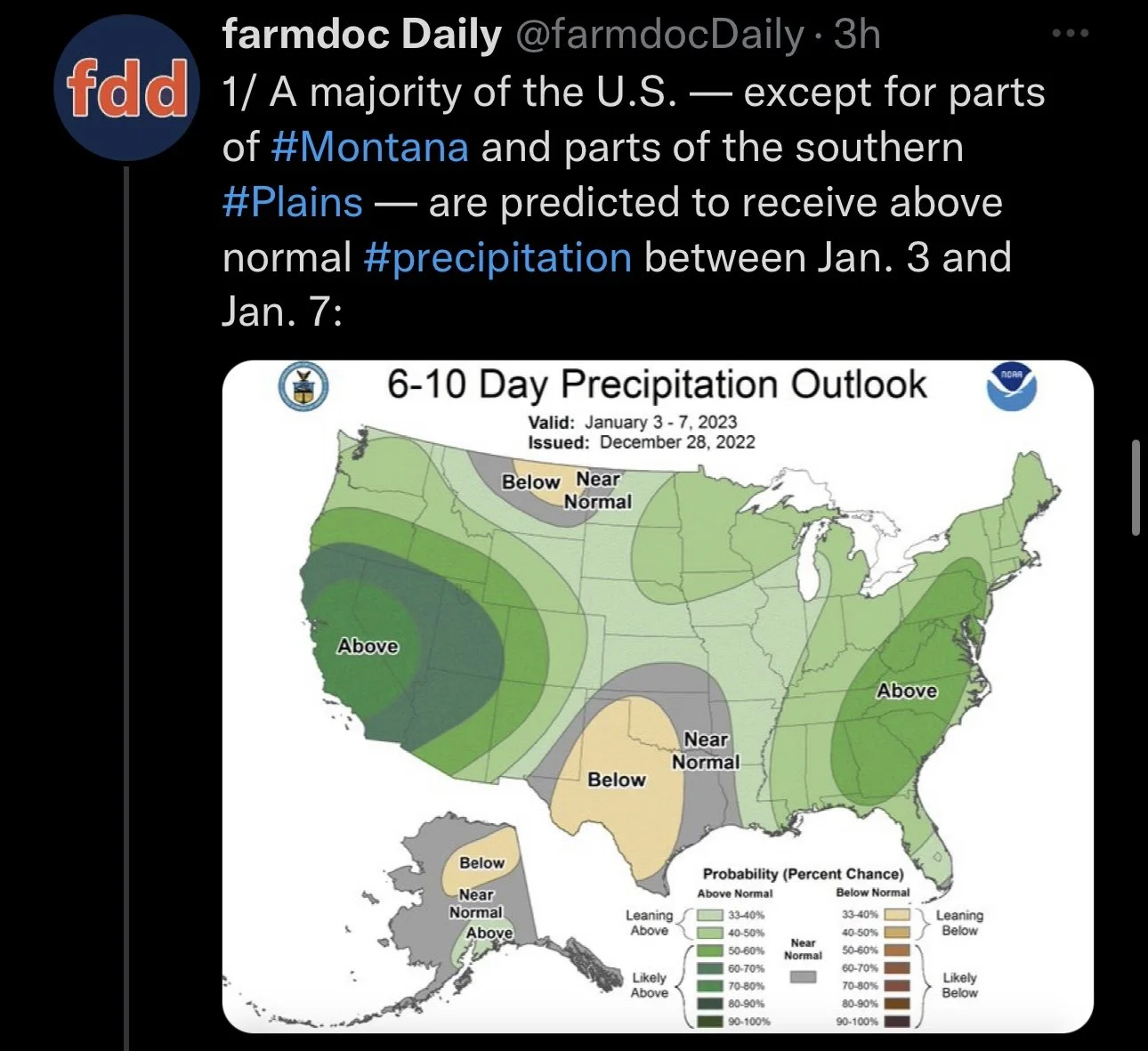

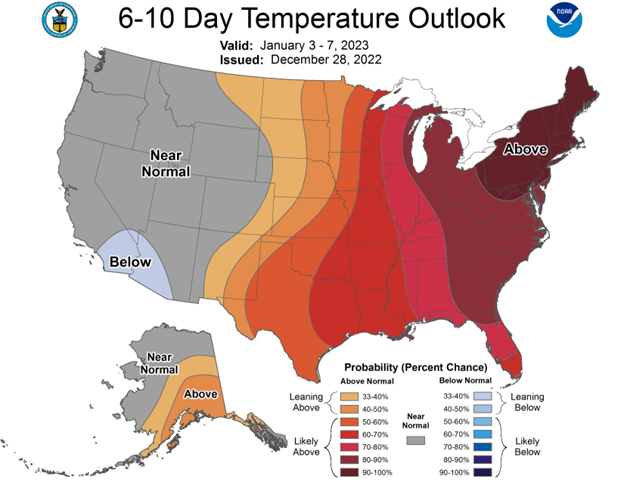

Temps across the midwest have warmed up significantly from our recently brutal cold temps. The eastern part of the states have an above normal temp forecast for the first week of the new year.

Argentina's Ag Ministry reported 2021-22 farmer soybeans sales were 79% despite the exchange rate deal. The exchange rate deal expires Dec. 31st.

Jobless claims come in as expected.

Indonesia will be delaying their restriction on palm oil exports from January 1st to February 1st.

Livestock

Live Cattle up +1.050 to 158.850

Feeder Cattle up +0.575 to 186.775

Live Cattle (6 Month)

Feeder Cattle (6 month)

South America Weather

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service