GRAINS RALLY AHEAD OF NEW YEAR

Overview

Grains cap off an already impressive week with a very strong last trading day of the year. Looks like funds didn’t want to hold as many short positions heading into the new year and long weekend.

Markets will be closed Monday, January 2nd.

This is a heads up that we will not have our usual Sunday Weekly Grain Newsletter this Sunday due to the holidays. Updates will continue as normal after next week. Enjoy your holidays.

OUR 50% DISCOUNT ENDS TOMORROW

Today's Main Takeaways

Corn

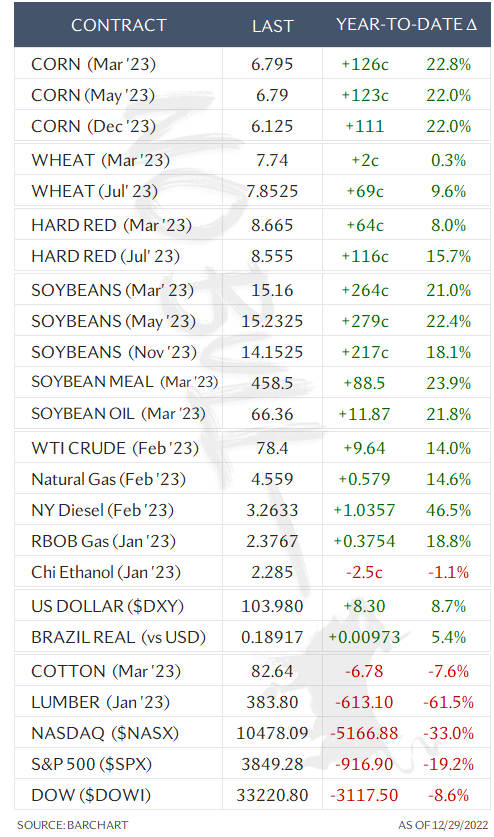

Corn seeing the least movement of the grains today. As soybeans and wheat both trade sharply higher, corn saw some weakness, continuing to trade in a fairly tight range. Ending the day down just a penny. On the short week corn ended +12 1/4 cents higher.

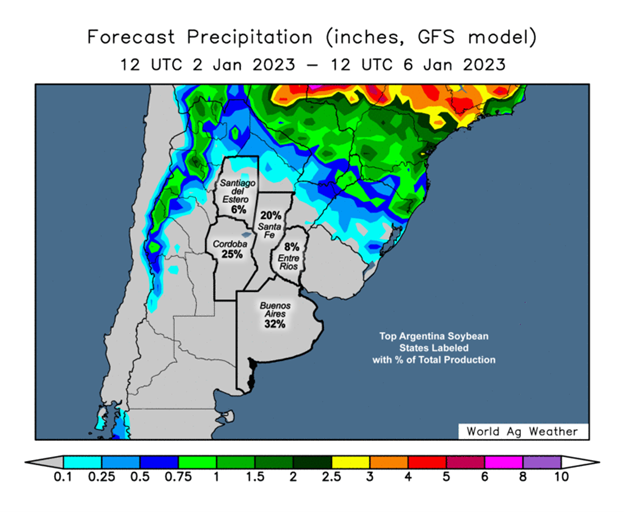

Beunos Aires updated Argentina's planting to 63% complete, an 11% increase from last week. With good/excellent rating of 15% which was unchanged.

There isn’t a ton of fresh headlines surrounding the corn market. I mean we have seen some rumors about China potentially looking to the U.S. to buy some corn as South America has less supplies before harvest. Demand will remain a key factor in either supporting or pressuring the corn market.

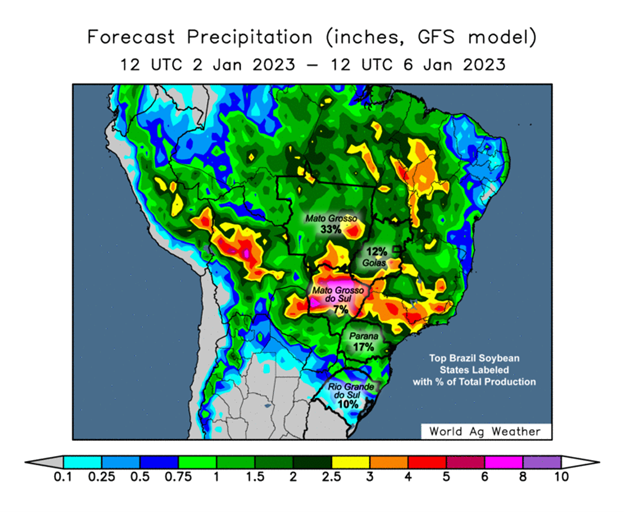

I list all the main factors below, but we of course have our other two main factors being the same as they have been. China & covid, and probably the larger one of the two at least shorter term here is of course South American weather. Brazil still has decent weather so that’s something that has bulls a little nervous, but Argentina on the other hand has some massive problems.

From a technical standpoint the next resistance after $6.80 appears to be $6.90. I've said in the last few updates I could see this recent corn rally take a break and correct 10 cents or so to the $6.70 range. But when it's said and done, bulls want that $7. And I don’t think that's an unreasonable target, as I think there is a solid chance we go to restest that level here sometime soon. Especially if Argentina remains dry and we see some strength in demand.

Ethanol

The delayed ethanol numbers were disappointing. Weekly ethanol production dropped sharply to an average of 963,000 barrels per day. This is the first time in 11 weeks that production has fallen below 1 million. Ethanol stocks rose to 8 month highs.

Biggest Factors

South American Weather

Demand

Exports & Ethanol

Fund Rebalance

USDA report few weeks away

Weekly Change

March-23: +12 1/4 cents

March-23 (6 Month)

Soybeans

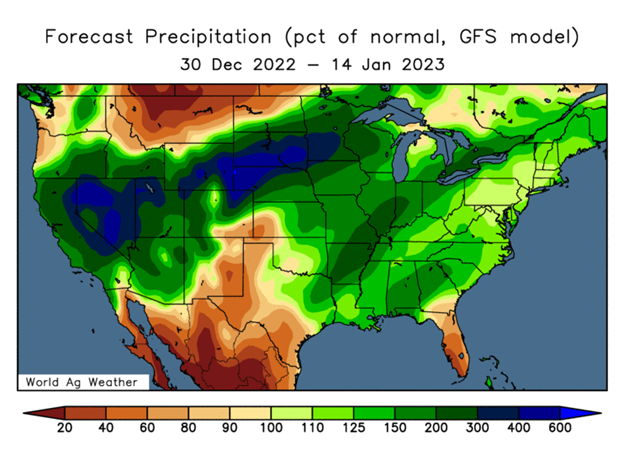

Soybeans traded over +20 cents higher in the overnight session due to Argentina weather. We are getting close to a point where if they don’t get any meaningful rain in the next few weeks we will see acres cut back as it just won't pay to put the beans in the ground at a certain point. Forecast for Argentina is still looking pretty hot and dry which has been the main supportive factor. Soybeans finished the last day of the year +7 3/4 cents higher and were up nearly +40 cents on the short week.

Overnight we saw prices surge with the Argentina forecasts. Hitting a high of $15.37 1/2 before coming back down 13 cents off their highs.

Soymeal again leading the way. Up sharply today (+2.75%), hitting a new contract high overnight which has further added support to the bean market.

Buenos Aires updated Argentina planting at 72% complete, up 12% from last week. With good/excellent ratings of 10% which was a 2% decrease from last week.

We of course have the China situation that will continue to play a role in the future of soybean prices. But ultimately the deciding factor in where we go from here short term will be Argentina and whether they receive any sort of meaningful rain or not.

Outlook for Argentina is dry. They might get some small rains over the weekend. But after that its looking like forecasts turn very hot and dry for the most part. If they don’t get rain I just don’t see a ton of reasons for us not to push a little higher here going into the new year. But of course we will likely see prices see some profit taking here in the next few trading days, but there is still quiet a bit of upside. Soybeans have pushed past every nearby resistance, if things play out right we could see prices climb to the $15.50 - $15.60 range which was our high back in June.

One concern looking long term is the fact that Brazil is still expecting a record crop. Later in this update we will talk about whether you should be selling or not given this recent rally.

Biggest Factors

South American Weather

Argentina Rain

Brazil’s expected record crop

China

Demand

Covid headlines

Fund Rebalance

USDA report a few weeks away

Weekly Change

March-23: +39 1/2 cents

Soybeans March-23 (6 Month)

Wheat

Wheat saw the most weakness yesterday, ending our recent rally as they couldn’t manage to add onto the rally. But strength in the wheat market has picked right back up where it left off. Trading much higher today, outweighing the losses that occurred yesterday. With all classes of wheat trading roughly +20 cents higher.

Looks like funds are covering some positions as they still hold an incredibly short position. I mentioned yesterday that I think we see the funds start to liquidate some of their massive short positions here in wheat.

Buenos Aires updated their Argentina harvest at 91.4% complete. Up 13% from last week. With good/excellent crop sitting at just 8%, which is 1% lower than last week.

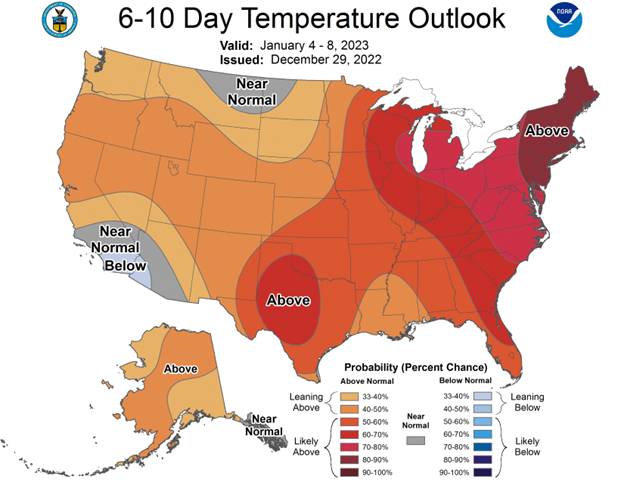

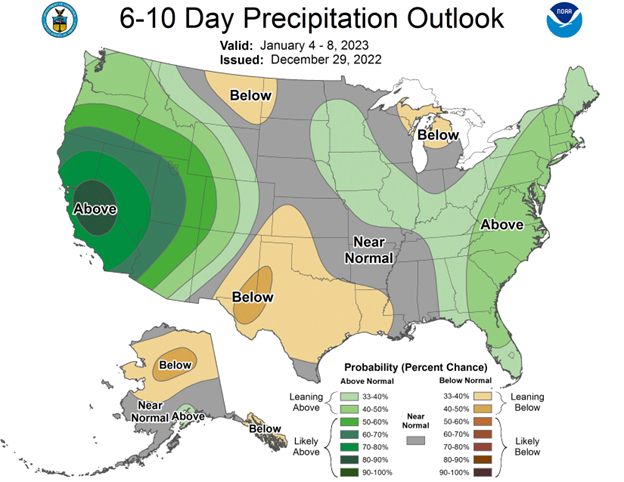

I will list all of the major factors going forward, but winter kill has to be one to note. As with the recent warm temps melting snow across the midwest, this is leaving crops vulnerable to freeze.

I have been saying for the last month that I had a target of $8 for Chicago wheat. That take seemed a little far fetched to some when we were trading below $7.25 at the beginning of the month. But now wheat futures are fastly approaching that target, only 8 cents away. I don’t think prices stop here either. Sure perhaps we take a breather here and there short term. But looking long term, if we can get that $8 break I don't see much reason for prices not to trade higher especially going into the early part of next year. As there are plenty of things that could get the ball rolling and push prices higher into spring or so.

Biggest Factors

Funds. Will they liquidate these short positions.

Winter Kill

U.S. Weather

War Headlines

Russian Ruble & Global Competition

USDA report a few weeks away

U.S. Dollar

Weekly Change

March-23 Chicago: +16 cents

March-23 KC: +13 1/4 cents

March-23 MPLS: +7 cents

Chicago March-23 (6 month)

KC March-23 (6 month)

MPLS March-23 (6 month)

Should You Be Selling?

With our recent rally in the grains, many advisors have starting putting out sell signals across the board advising people to make sales. Including many we follow and respect. Now of course there is nothing wrong with making sales here, as prices are still relatively high and for some of you perhaps it makes the most sense to take some risk off. Our personal opinion is that we are being patient as we believe we will see prices higher next year. So overall what we want to advise you to do is just be comfortable with where you are at in your operation.

If you ever want to talk about your operation and what would make the most sense for you please don’t hesitate to give us a call anytime free of charge. You can call Jeremey at (605)295-3100

Below are our last few audio updates where we also talk about managing risk in the markets.

Is it time to sell soybeans? - Listen Here

Is $9 corn & $20 beans possible? - Listen Here

To go along with the topic on should you be selling, here are two very good write ups from Wright on the Market

You can visit Wright on the Markets website here

Here is his first write up from yesterday;

-

We received about 20 questions and comments yesterday similar to this one:

Where do you see corn and bean markets going? I am looking to sell a little in January just to sell a little on the way up.

Roger’s answer: $8 cash corn and $17.80 cash beans.

So very many of you think you need to sell corn and beans. When we ask why, we get a lot of:

My 2023 operating loan interest rate will be 8%, double what my 2022 OL rate was.

From 1978 to 1990, operating interest rates were 10 to 21%. It will happen again and sooner rather than later the way the government is giving away money. Get your ducks in a row now; learn how to be more efficient with your money:

a) Go to the FSA and get a CCC loan on the grain in your bin. You can borrow money from FSA at an interest rate the same as the government pays, the lowest interest rate in the world. You can save several cents of interest a bushel every month with a CCC loan and you have nine months to sell the grain and pay principal and interest.

b) We realize 4% is highly preferable to 8% interest, but on $6.70 corn, that extra 4% will cost you 2.2 cents a bushel. That is a lot, but basis will improve an average of 4+ cents a month in most areas of the nation into June.

c) If you don’t think the basis will improve in your area or you have to do something, put corn and beans on a basis contract and reduce your interest cost by 70% with a cash advance and benefit from the coming rally in futures. Better yet, reduce your interest cost by 90% and sell the cash grain and buy futures.

d) Or, think outside the box and just sell all of it to reduce your interest cost to zero. And then buy put options next May and June when cash corn is $8+ and cash beans are $17.50+ and make money on the way down you did not make on the way up. You not only will save a lot of interest, you eliminate 100% of the market risk!

You will either pay the interest or do some things you never did before. Now is the time to decide which it will be. Here is more of the comments we receive more frequently every day:

Prices are so high for this time of year I just cannot afford to let these prices get away from me.

Read d) above.

I have time to haul now, but I will not later in the winter and spring.

Read c) and d) above.

I just got to do something! I can’t stand not doing something!

If you do not need the money right now, take the family on a vacation or take up stamp collecting, split firewood and sell it, buy some beef cows (they will double in value in three years plus you get the calves), take the kids to all the museums in the area after you teach them to feed the cows, etc. Get your mind off markets or learn about grain marketing by reading Jon Scheve’s great weekly articles of the past year at

https://www.wrightonthemarket.com/blog/categories/newsletters

Or read about costly grain marketing mistakes of the past 40 years at:

https://www.wrightonthemarket.com/blog/categories/true-tales

Or how to use put options to enhance your cash grain income with very little risk at:

https://www.wrightonthemarket.com/post/how-to-use-put-options-simplified-version

This marketing year carryover is tighter than projected in December a year ago for corn, soybeans, wheat, cotton, sorghum, rice, and sugar. Only barley is projected to have a larger carryover than year ago.

The USDA projected price to be paid to farmers for 2022 corn is $1.25 higher than USDA projected a year ago for 2021 corn. Soybeans, $1.90 higher. Wheat, $2.05 higher. Rice, $3.10 higher. Oats, 65 cents higher. Barley, $1.99 higher. Sorghum, 67 cents higher. Cotton, 6 cents lower, but 19 cents higher than two years ago.

The two most common statements we hear from prospective clients:

I sold way too much too early and it was a big mistake.

I did not sell enough even when I thought the market was at the top.

The two most common statements we hear from first year clients:

I just feel like I have to be selling something in January (even though we say prices are going a lot higher).

Why do they feel they have to sell something? Habit... and a bad one at that!

I did not sell enough when you told me it was the top. Why? Fear of not having a crop and fear the price will go higher.

These guys did not listen when we explained how to lock-in 100% of expected production with no concern of coming-up short bushels or missing the top of the futures price range.

Here is his second write up from today;

-

Roger was asked yesterday by a client:

After reading how high you think corn and beans will go (in yesterday's mailing), should I cancel my orders to sell corn at $7.24 on the March and $15.72 on the March soybeans?

Roger: Are you talking HTA or futures?

Client: Futures.

Roger: No, because when futures reach $7.24 and $15.72, prices will decline 15+ cents on the corn and 30+ cents on the beans. Take your profit and wait for higher prices into May and June.

For those of you who would have answered HTA, should you cancel the orders to sell at $7.24 and $15.72 is more complicated.

First, the markets may never get to $8.50 corn and $17.85 beans. If they do, it will be May or June.

Will your cash flow needs allow you to wait that long?

Do you want to take the chance that Roger is correct on his price projections.

If you are willing to take the chance, do you want to pay interest for another five or six months if you have an operating loan?

If you do sell $7.24 and $17.72 HTA and it turns out to be well below the high, are you willing to buy puts to make money on the way down you did not make on the way up?

You tell us the answer to those questions and we will tell you if you should cancel your HTA orders of $7.24 and $15.72.

Another question yesterday from a client:

Roger, Can u see prices staying or going higher into fall of 2023 if USA has good crop with good rain fall? Than 2024? Low rainfall with average crop in 2023?

Good evening,

Sure, I can see the possibility that fall prices will be higher than they are right now. Do I think that will happen? I had not thought about it because there are so many variables that would have to come together in the right combination to make that happen.

What I expect is the 2023 spring highs will be higher than last spring's highs, possibly as much as 50 cents higher on corn and $1.50 more on beans. I also expect the low of the last half of the calendar 2023 to be higher than the low of the past six months (of 2022). I do not expect the 2023 or 2024 October-November cash corn and bean prices to be higher than they are right now.

If you take the 2022 spot (nearby) futures price daily chart for all of 2022 and add 50 cents to the corn, $1.50 to the beans and 50 cents to the wheat, you will have what I expect prices to be in 2023.

Why?

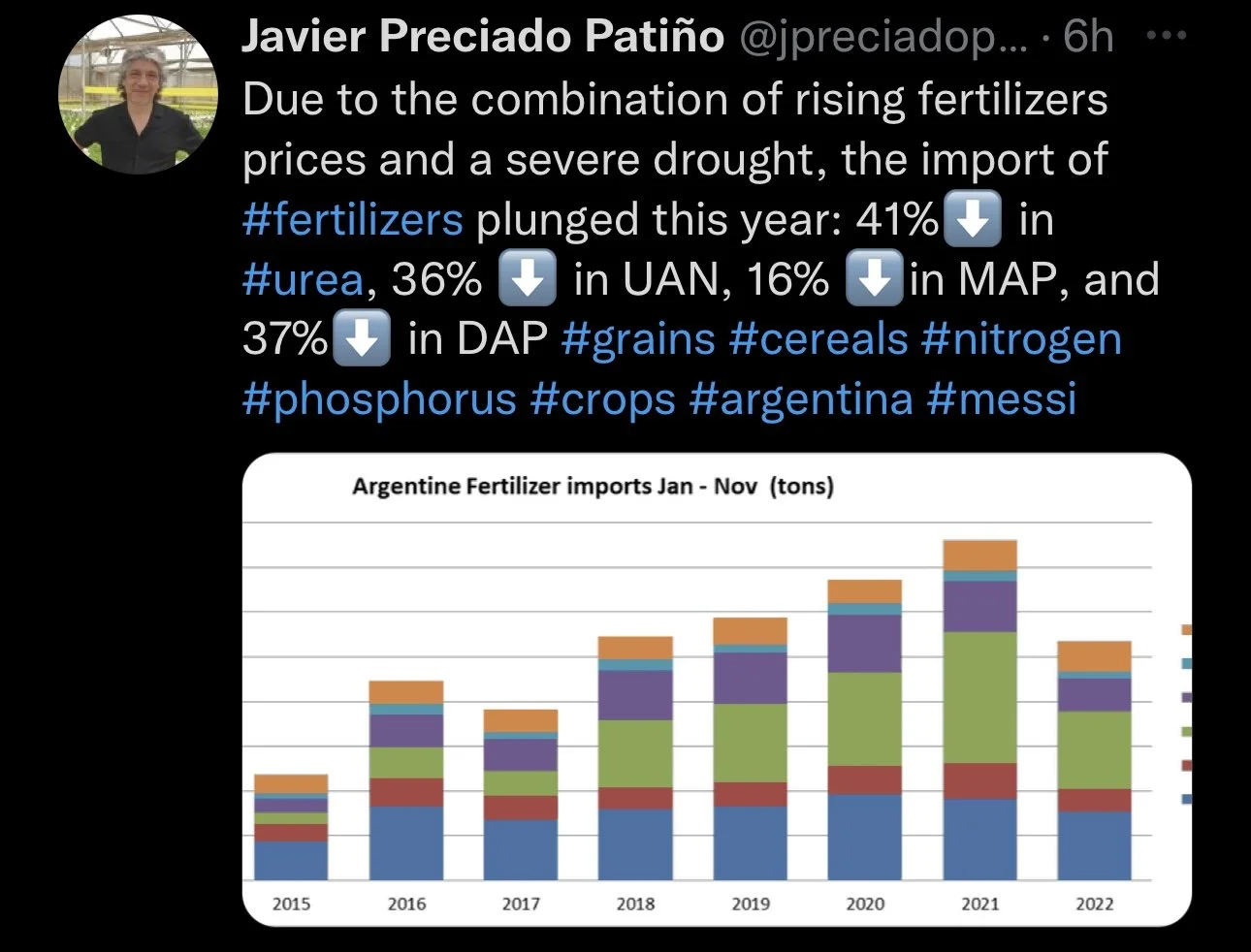

Carryouts are tighter, I expect the economy will be better in 2023 than it was in 2022, there is a war in the area that has the most productive soil in the world (#1 wheat exporter and #4 corn exporter), there is a drought for the third consecutive year in the #3 corn and soybean exporter (Argentina) and their 2023 crop is assured to be way less than normal, the US dollar is in downtrend, which really surprises me, inflation will alone will add 7 to 9% to prices, governments around the world are trying to reduce their "carbon footprint" (fertilizer restrictions, forcibly buying out farmers, covering farm land with solar panels, etc) and many governments restricting exports to keep domestic food prices down.

Lastly, most countries, including the USA, have idiots making the decisions concerning food production and monetary policy. Russia's leader is one of the few world leaders who knows what he is doing when it comes to food production and monetary policy. Russia produced, by far (about 20%), more wheat than ever before in 2022 and the Russia ruble was trashed by sanctions in March (122 rubles per US dollar) and now it takes half as many rubles to buy a US dollar.

As a result of all the above, this evening, spot corn futures are 75 cents higher than a year ago today, spot beans are $1.38 higher, spot hard red winter wheat is 45 cents higher, spot soft red winter wheat is 7 cents higher and hard red spring wheat is 93 cents higher. I really do not think I am going too far out on a limb to predict corn 50 cents higher corn and $1.50 higher beans for the year.

The key factors are how China handles covid and, to a lesser extent, how the rest of the world handles covid, world weather, the expansion or contraction of the war in Eastern Europe, and fertilizer availability.

Yep, I am bullish. Roger

Again I highly recommend checking out Wright on the Markets as his team provides incredible value on a daily basis. You can visit them here

Export Sales

Export sales were mostly in line with expectations. The best surprise was wheat which came in stronger than most had expected especially given the collapse in the Russian Ruble. On the other side of things, soybeans came in pretty disappointing which may have helped lower prices off our overnight highs. Soybeans came in at a marketing year low, but this isn’t anything too surprising as we typically see low numbers at the end of the year. Lastly, corn came in the middle of the trade range.

Corn

0.782 million tons (0.6-0.85 estimate)

Soybeans

0.706 million tons (0.5-0.9 estimate)

Wheat

0.478 million tons (0.2-0.45 estimate)

Other Markets

Crude oil up +1.84 to 80.24

Dow Jones down -300

Dollar Index down -0/356 to 103.230

Cotton up +0.76 to 83.40

Highlights & News

The 3 major U.S. equity indexes are set to finish with their worst performance since 2008.

Yesterday Biden signed a bill for $1.7 trillion in funding to prevent a government shut down. Included in this bill was nearly $50 billion in aid for Ukraine.

The Argentina soybean exchange deal ends today.

Livestock

Live Cattle down -0.950 to 157.900

Feeder Cattle down -0.550 to 186.225

Live Cattle (6 Month)

Feeder Cattle (6 month)

South America Weather

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service