HEDGE PRESSURE

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

(Chart Breakdowns Start at 4:12 min)

LIKE OUR STUFF?

Usually we do not share full updates on social media.

Get access to our daily updates, sell signals, & 1 on 1 tailored market plans.

Futures Prices Close

Overview

Grains lower across the board, led by weakness in wheat.

Like I mentioned yesterday, it looks like the funds are taking somewhat of a pause here.

This rally has been mostly due to short covering. They were record short earlier this year. With prices at their highest levels since June, that means that short positon has been losing since June.

The funds could now be taking a more balanced approach as they are essentially near even. Now of course they could get long, but it will require a bullish factor for them to do so.

We have an upcoming USDA report a week from today.

If we see our highest yield prints of the year, I like our chances that could move higher. (Of course if corn yield jumps to 185, we could go substantially lower).

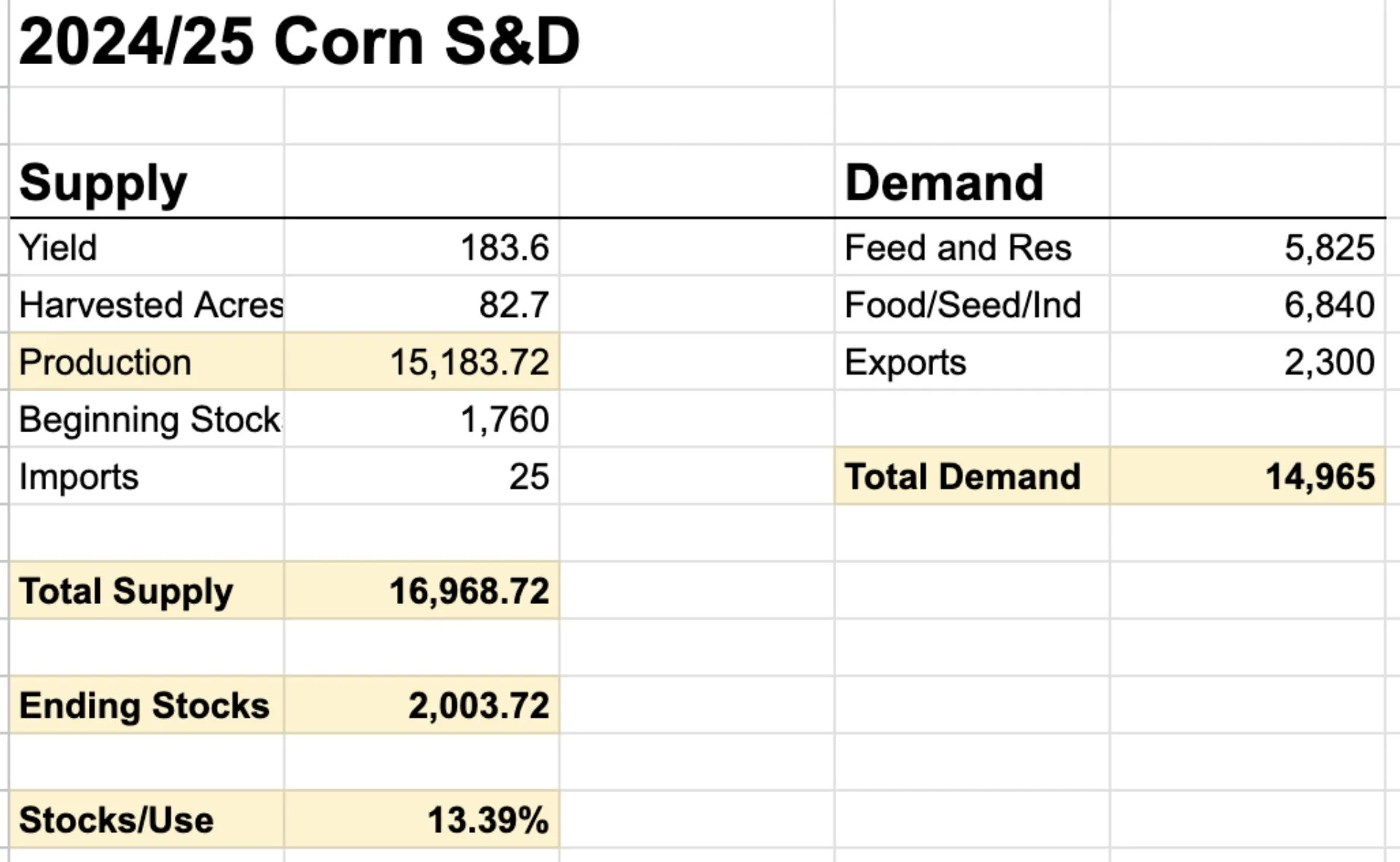

On corn, it's pretty bullish that our yield has continued to climb, while our carryout has continued to fall. This speaks volume on demand.

Corn exports are up +14% vs last year. Yet the USDA is projecting LESS than a +1% increase to our exports. This is how you lower that carryout. Via demand. Record crop or not.

Yes a 2 or 1.9 billion bu carryout is not "bullish". But not long ago all anyone was talking about was the potential for a massive 2.5 billion one.

Long term thinking, we could very easily be looking at less corn acres next year. Perhaps 89 to 90. Then let's say we still get a pretty big crop even at 180 bpa. We already built up all of this demand. Things could tighten up pretty fast.

We will have a record yield. Yet our carryout will shrink YOY due to demand.

The best thing about a demand driven market? They last. Supply driven weather scare ones do not. (Example: last year's rally in June)

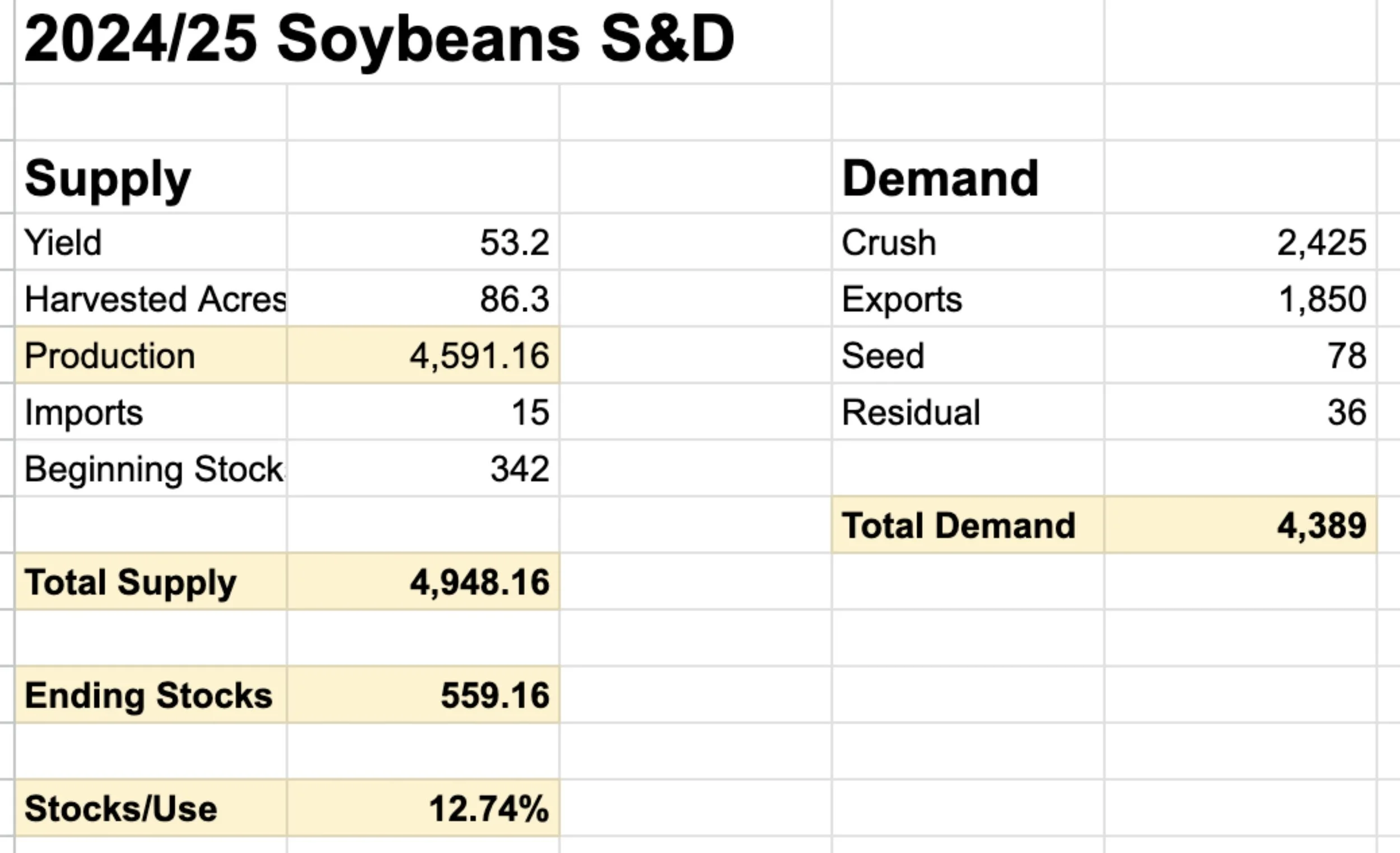

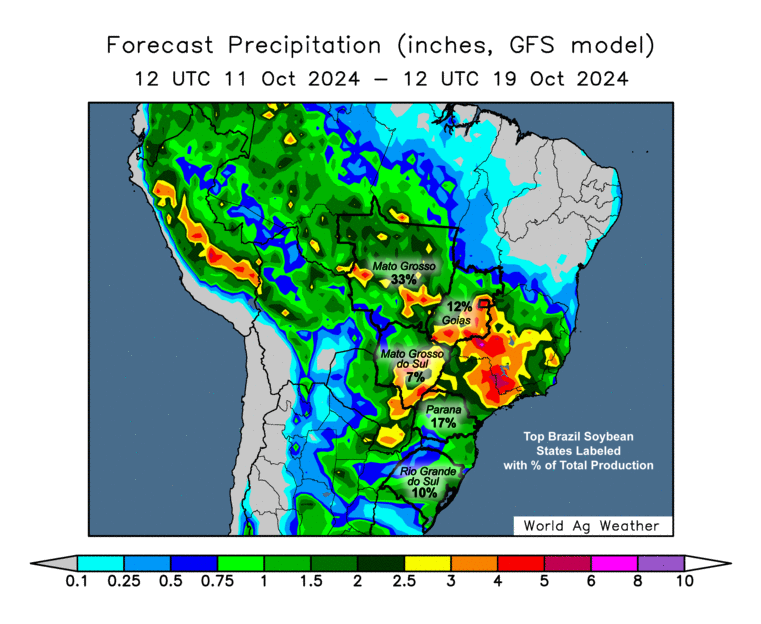

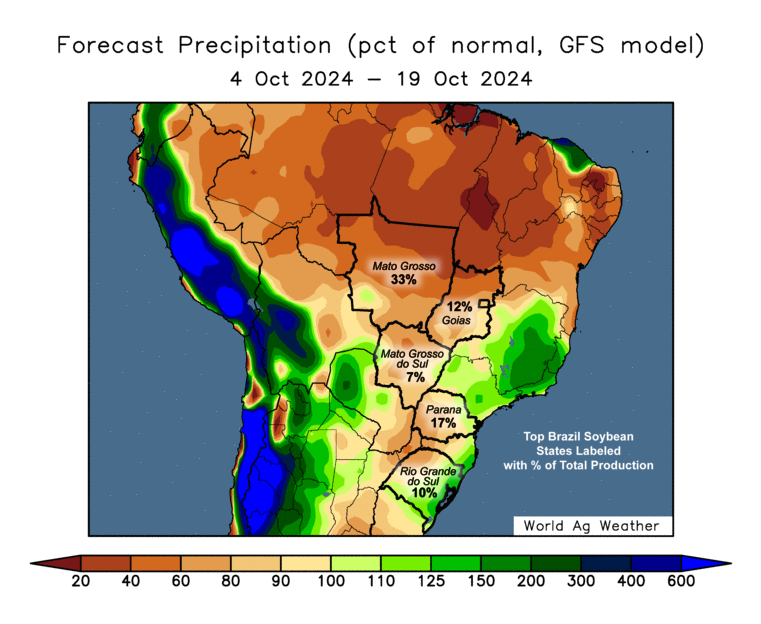

Soybeans are a slightly different story looking long term. Without a story out of Brazil, we will need yield to come down in the US to get a bullish story. If Brazil produces what the USDA says they will, it could be very negative for beans.

Current US Balance Sheets

Keep in mind, Brazil now far outproduces the US in beans. So their growing season is actually probably the same if not more impactful to the markets than the US growing season is.

However, there is definitely an argument to be made that the US is losing bean yield. Personally I think we see yield creep lower. But by how much is the question.

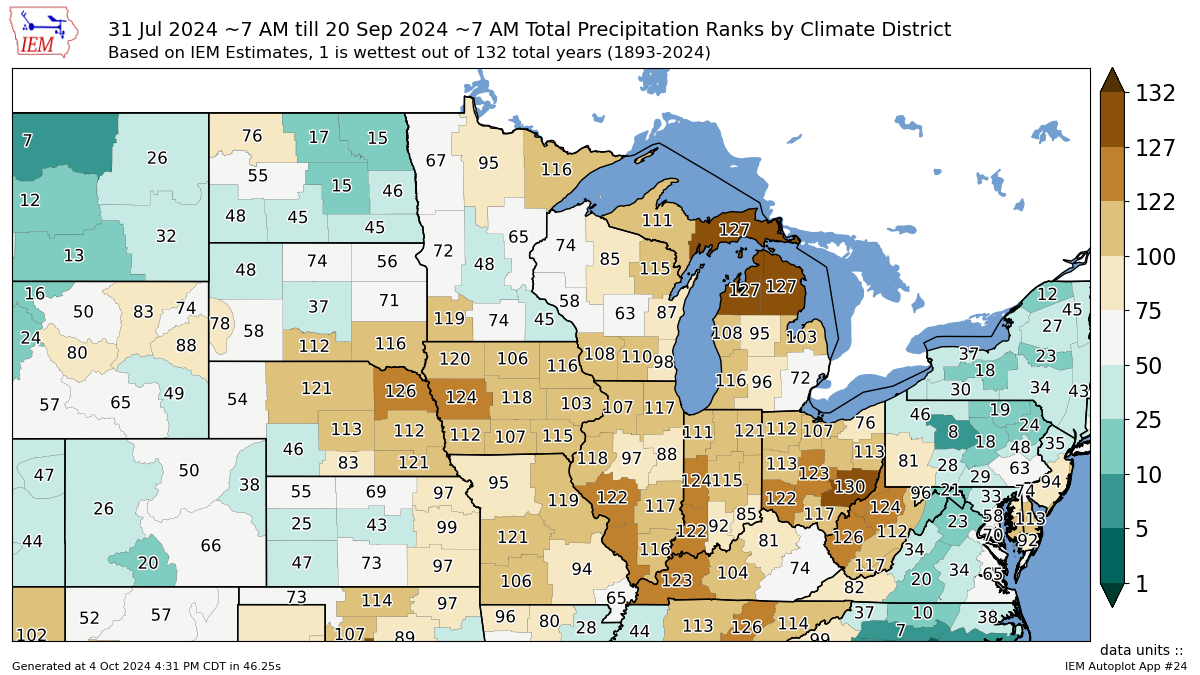

Look at the drought monitor change the past few months.

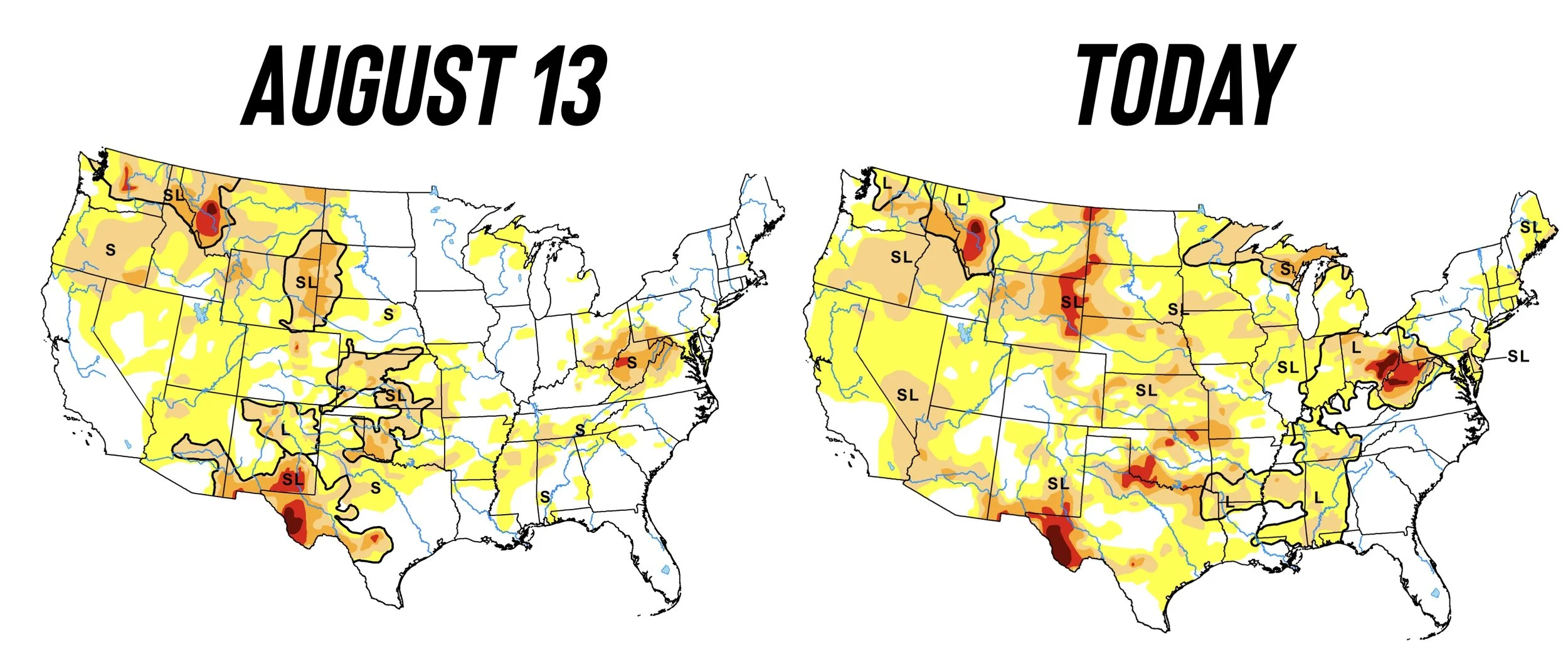

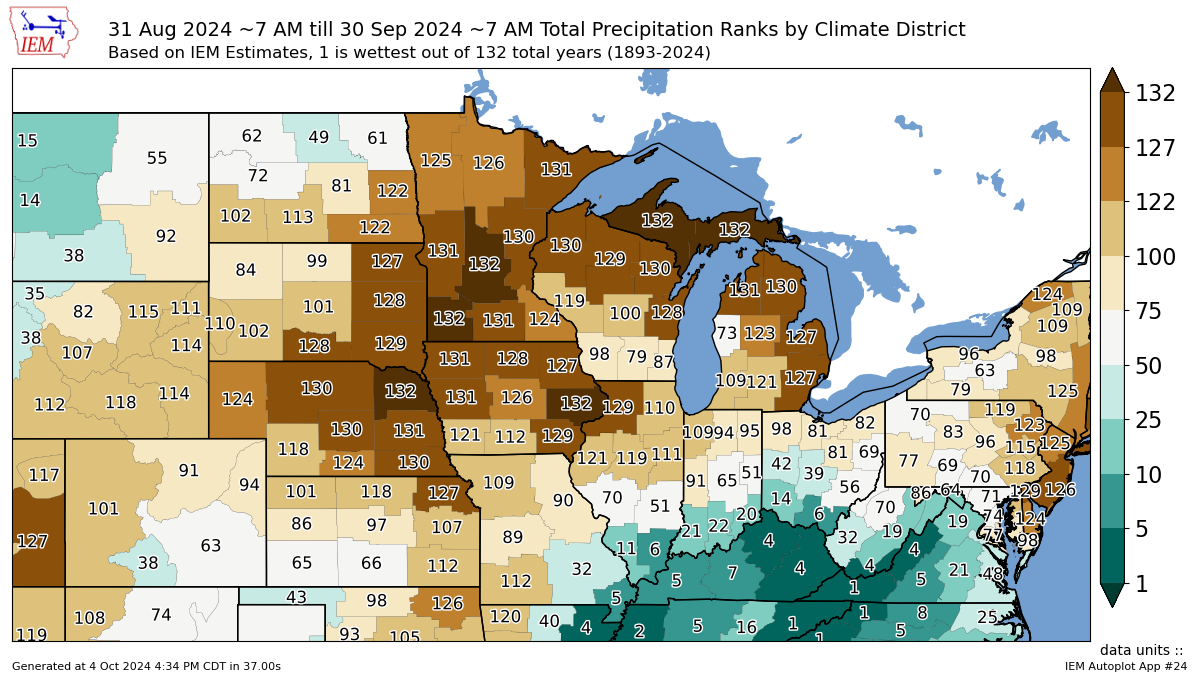

Look at where August & Sep rank on precip all-time.

Not an ideal finish for beans.

Sep Precip Rank

Aug 1 - Sep 20 Precip Rank

One positve beans do have going for them is that we are very competitive on the export markets.

Like I mentioned yesterday. Beans off the Gulf are the cheapest in the WORLD. But this alone isn’t going to be enough. Beans will likely need a South American story of some sorts.

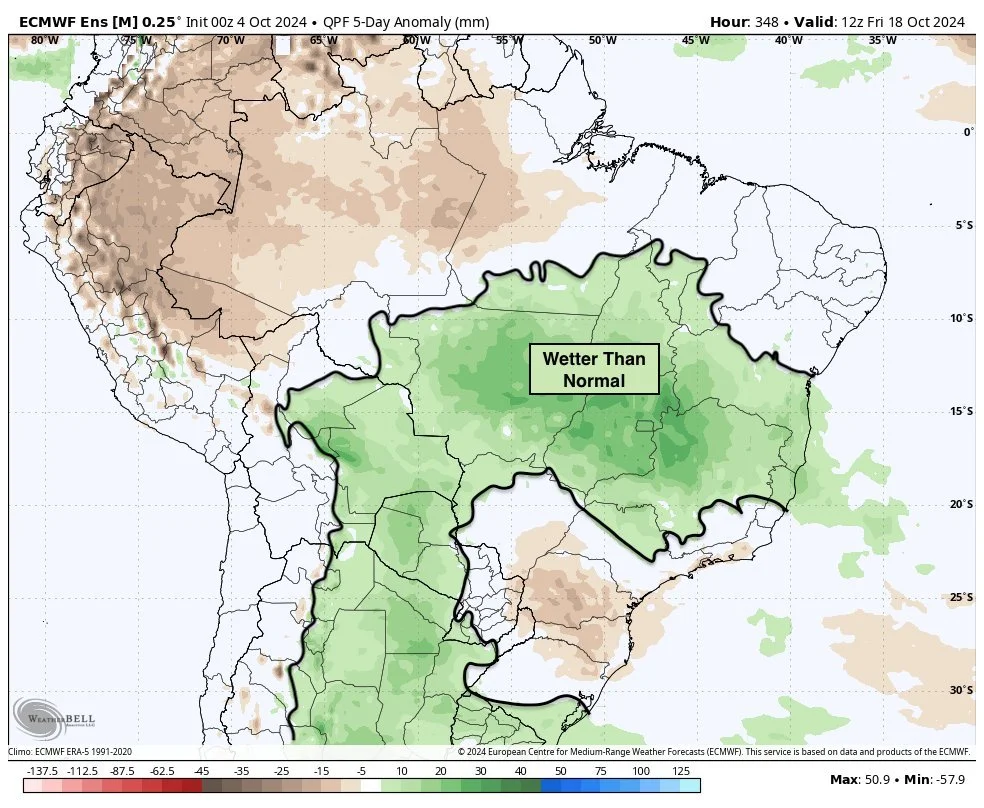

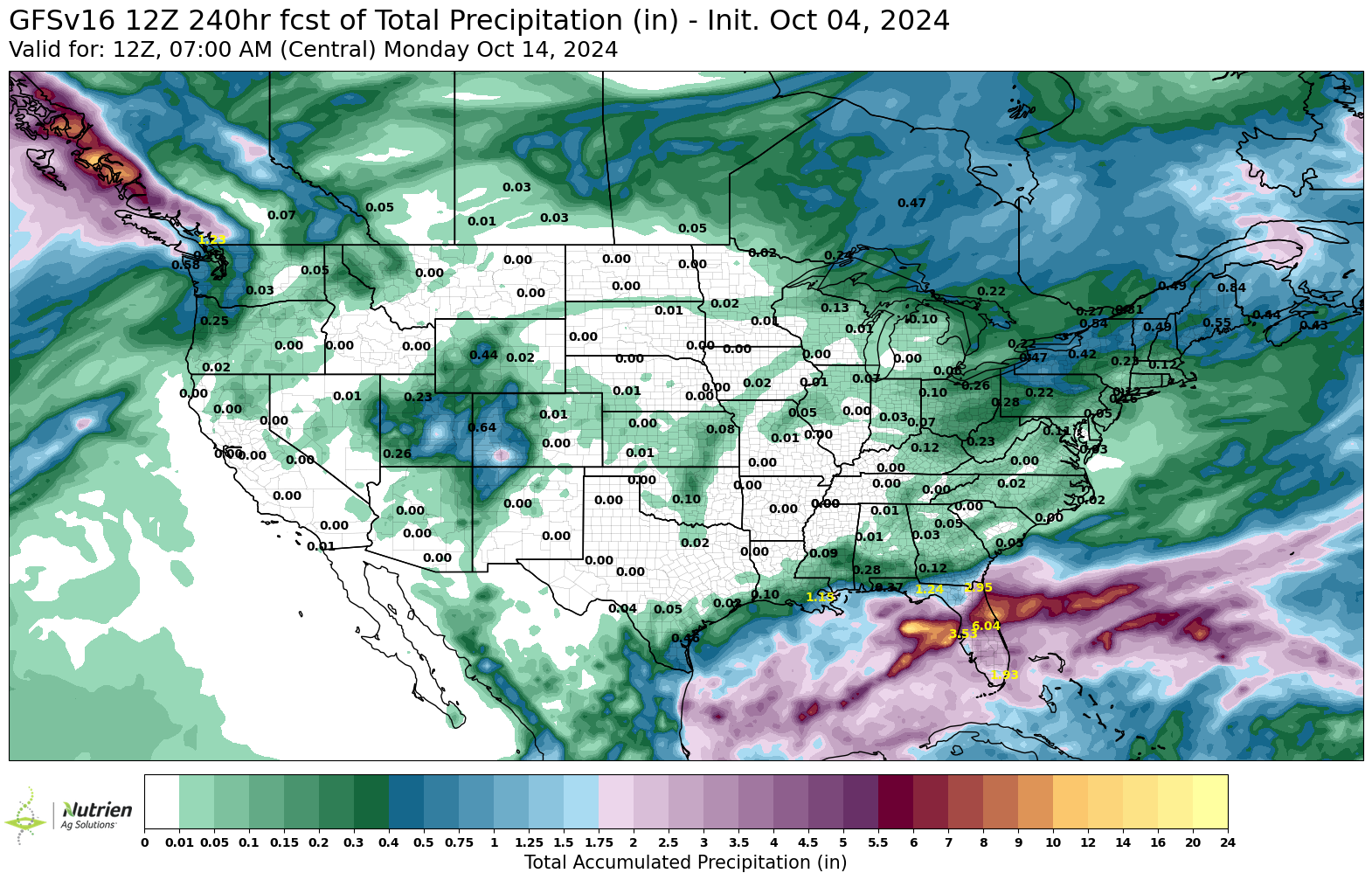

Currently rain is still scheduled within the next 1-2 weeks for Brazil.

Beans have likely given back a good portion of that weather premium already.

Moving forward, this will be the biggest market mover for beans within the next month or so.

Next 2 Weeks

Looking short term, we could definitely run into more hedge pressure here the next week or two if the funds decide to pause.

We really haven’t seen much hedge pressure. As this farmer selling was offset by the heavy buying from the funds.

But with the funds potentially pausing, it opens the door for further hedge pressure especially if the combines are going to be rolling fast. Which they will.

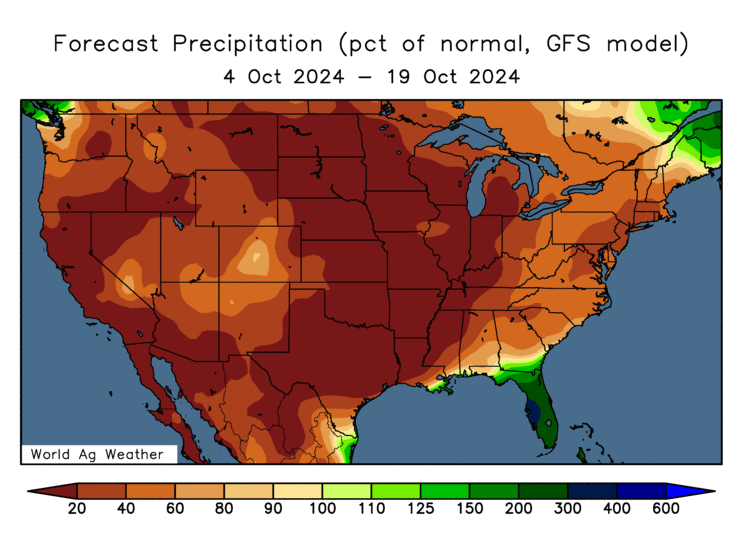

The forecasts are BONE DRY and warm.

Which means harvest will ramp up basically as fast as possible here.

Typically you start seeing less hedge pressure once harvest is 50% complete.

So if we are going to get harvest pressure, it will be the next week or two.

Next 2 Weeks

Now let's take a look at the charts.

Corn 🌽

We ran into resistance at the top of that channel.

This green box is a good area of support. As it was our previous resistance.

If this does not hold, we will likely go test the bottom of the channel which also corresponds with a re-test of that major pink line.

That pink line was our long term old support, and recently turned into resistance until the break out this week. It now turns back to support.

Short term, wouldn’t be surprised to see this if hedge pressure does increase.

Looking longer term, I still think we could see $4.41 to $4.46.

That is our next spot of real resistance.

$4.41 is our 50% retracement to the May highs.

$4.46 is our Feb lows.

I still like keeping protection to the downside. This recent rally makes puts all that more affordable. It makes sense to spend a few cents on a 50 cent rally.

Short term, I think we could see hedge pressure. Long term I still think demand can lead us a little higher.

No one is smart enough to outguess the market. So if you have to move something off the combine in the next month. Keep a floor. Call or text us with questions (605)295-3100.

We go lower? Your puts make you money and offset the loss on the cash side. We go higher? You lose the cost of the put but the price of your cash sale will outweigh the cost of the put.

Does Corn Adjust for Inflation?

Here is a chart from Standard Grain I wanted to include. He said:

"Perhaps corn prices actually have adjusted for COVID related inflation?"

Essentially the thought process here is that maybe our commodities have adjusted for inflation. As you can see, we had major low levels in the 2000's that we never revisited from the pre-ethanol era.

Then we had the post ethanol lows around $3.00. So maybe this is our new post-COVID low levels.

I would like to agree that perhaps this recent low could very well be our long term floor looking forward.

Soybeans 🌱

We broke our $10.42 support.

I would like to see us hold $10.31. That is also the bottom of this channel. A break below the channel wouldn’t very ideal.

If we cannot hold $10.31, the next stop is $10.18. Then $10.00

We do still have a "potential" bull flag set up that brings us to about $11.00

My next target is still $10.97 if we break $10.80

From Jason Britt:

"If soybeans can’t find more of a break than this, I'm going to have to think we are just creating a bull flag vs taking another leg down. Come in with a drier forecast for SA on Sunday/Monday would confirm it and sound us higher into the 10.80 area"

Our sell signal Friday pegged the local high in beans. I still like protecting this level if you did not on the signal.

Wheat 🌾

I didn’t touch on wheat above.

Essentially wheat saw pressure from a stronger dollar. A stronger dollar effects wheat the most and hurts exports.

We also recently had a "war driven" rally. Like I stated on the recent rally, I am always hesitant when we get these. They don’t tend to last.

If this war situation escalates, we could of course go higher, but never going to hold my breathe hoping it does.

So I still like protecting this level if you have not done so yet.

We reached my first $6.12 target and rejected right off of it.

Our next support is the bottom of this channel and that $5.80 level.

That $5.80 level is important. It was our old support several times. It recently became new resistance until we broke through. It is now support once again.

If we can take out $6.12 the next target is $6.40 and our 50% retracement to the May highs.

Same story for KC.

Our support is the bottom of this channel and $5.83

A clean break above $6.17 and the next target is $6.50

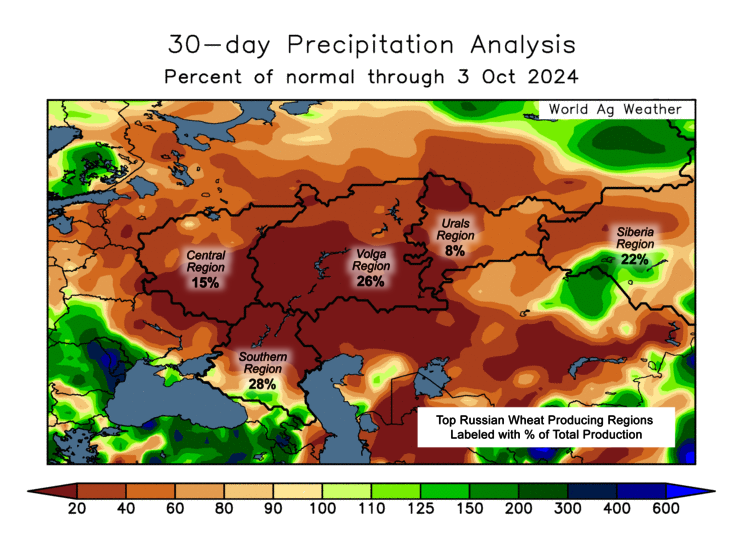

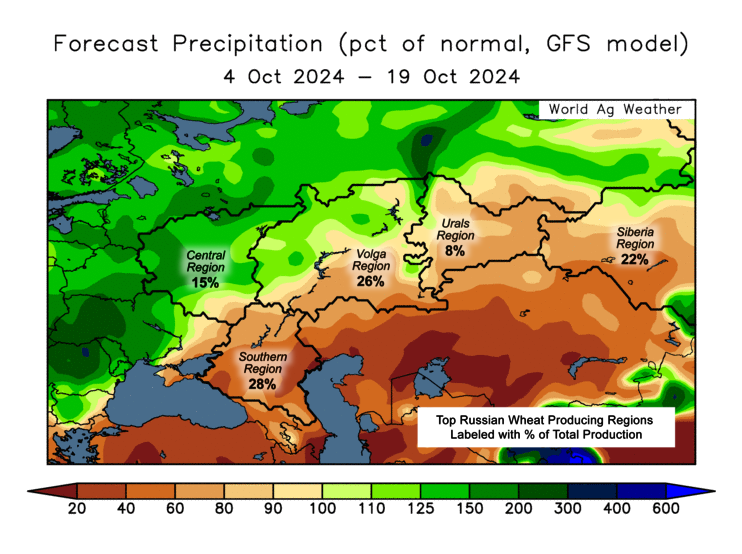

Russia weather is going to be one the biggest things moving forward for wheat.

Russia is the world's #1 exporter & producer of wheat.

Russia's exports are down -10% from last year.

They are just wrapping up planting so it is still a little early for a major impact, but it has been extremely dry. If it continues to stay dry, the wheat market will likely react.

Long term we also have the fact that global wheat stocks continue to shrink. But short term we could definitely give back some of this geopolitical premium.

Past 30 Days

Next 2 Weeks

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24

BULLISH USDA FOR CORN: RECOMMENDATION

9/27/24

UP-TOBER? SELL SIGNAL, TARGETS, & FACTORS

9/27/24

BEAN SELL SIGNAL

9/26/24

NEW HIGHS BUT CONCERNING CLOSE

9/25/24

HIGHEST CLOSES SINCE JULY. UPSIDE & SALES CONSIDERATION

9/24/24

GREAT START TO THE DAY, AWFUL FINISH

9/23/24

MASSIVE DAY FOR THE GRAINS

9/22/24

EARLY YIELD TALK, DROUGHT, BRAZIL, SEASONAL LOWS & MORE

9/19/24

GRAINS SEE TECHNICAL SELLING

9/18/24

FED DROPS RATES, BRAZIL STORY, 2025 SALES?

9/17/24

TARGETS & WHAT TO DO IF YOU BOUGHT PROTECTION

9/16/24

WAS TODAY HEALTHY CORRECTION BEFORE GRAIN RALLY RESUMES?

9/13/24

CORN & WHEAT BREAK OUT: EVERYTHING YOU NEED TO KNOW

9/12/24

USDA RAISES YIELD BUT REPORT WASN’T ALL THAT BEARISH

9/11/24

USDA TOMORROW. MAKE OR BREAK SPOT ON CHARTS

9/10/24

USDA THURSDAY

9/9/24

LOWS ARE IN UNLESS SOMETHING FUNDAMENTALLY CHANGES?

9/6/24

GRAINS WEAK. OUTSIDE DOWN DAY ON CHARTS

9/5/24

GRAINS GET HEALTHY CORRECTION. GETTING READY TO PROTECT DOWNSIDE

9/4/24